- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 50+ platforms · 200+ guides authored

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 40+ brokers with funded accounts

- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 50+ platforms · 200+ guides authored

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 40+ brokers with funded accounts

How We Test

Real accounts. Real money. Real trades. No demo accounts or press releases.

What we measure:

- Spreads vs advertised rates

- Execution speed and slippage

- Hidden fees (overnight, withdrawal, conversion)

- Actual withdrawal times

Scoring:

Fees (25%) · Platform (20%) · Assets (15%) · Mobile (15%) · Tools (10%) · Support (10%) · Regulation (5%)

Regulatory checks:

FCA Register verification · FSCS protection

Testing team:

Adam Woodhead (investing since 2013), Thomas Drury (Chartered ACII, 2018), Dom Farnell (investing since 2013) — 50+ platforms with funded accounts

Quarterly reviews · Corrections: [email protected]

Disclaimer

Not financial advice. Educational content only. We're not FCA authorised. Consult a qualified advisor before investing.

Capital at risk. Investments can fall. Past performance doesn't guarantee future results.

CFD warning. 67-84% of retail accounts lose money trading CFDs. High risk due to leverage.

Contact: [email protected]

Choosing the right forex broker can mean the difference between a frustrating trading experience and one where you’re set up to succeed. After testing 12 FCA-regulated brokers with live accounts and real money, I rate Pepperstone as my top pick for most UK traders — offering spreads from 0.0 pips on the Razor account and execution speeds under 50ms during my January 2026 testing.

But the “best” broker depends on what you need. A beginner prioritising simplicity will have different requirements than a scalper chasing the tightest spreads.

In this guide, I break down the 7 best forex brokers available to UK traders in 2026, based on my hands-on testing across spreads, platforms, fees, and withdrawal speeds. Every broker listed is FCA-regulated and covered by FSCS protection up to £120,000.

Quick Answer: What's the best UK Forex Trading Platform?

Pepperstone

FX Score: 4.9/5

72% of retail CFD accounts lose money.

SpreadEX

FX Score: 4.7/5

65% of retail CFD accounts lose money.

IG

FX Score: 4.4/5

68% of Retail CFD Accounts Lose Money

CMC Markets

FX Score: 4.2/5

64% of retail CFD accounts lose money.

How did I test these brokers?

I opened live funded accounts with all seven brokers and traded them over a four-month period from October 2025 to January 2026. My testing covered EUR/USD, GBP/USD, and USD/JPY during London and New York sessions, focusing on actual spreads versus advertised rates, execution speed, slippage during news events, and withdrawal processing times.

I deposited and withdrew real money from each broker — typically £500 via bank transfer and £200 via e-wallet — to measure actual processing times against their claims. For full methodology details, see my How We Test page.

Which UK Forex Brokers Offer the Best Overall Trading Experience in 2026?

| Rank | Broker | Trading Platforms | Leverage (Retail) | Asset Classes | Notable Feature |

|---|---|---|---|---|---|

| 1 | Pepperstone | MT4, MT5, cTrader, TradingView | 30:1 | Forex, Indices, Commodities, Crypto | Fastest execution I tested |

| 2 | SpreadEX | Proprietary | 30:1 | Forex, Shares, Indices, Sports | Simplest platform for beginners |

| 3 | IG | IG Platform, MT4, ProRealTime, L2 Dealer | 30:1 | Forex, Stocks, Crypto, Indices | Best research tools available |

| 4 | CMC Markets | Next Generation, MT4 | 30:1 | Forex, Indices, Shares, Commodities, Treasuries | 80+ technical indicators |

| 5 | XTB | xStation 5 | 30:1 | Forex, Indices, Commodities, Shares, ETFs | Award-winning education |

| 6 | Capital.com | Proprietary App, MT4, TradingView | 30:1 | Forex, Indices, Shares, Commodities, Crypto | AI-powered trading insights |

| 7 | Interactive Brokers | TWS, IBKR Desktop, GlobalTrader | 30:1 | Forex, Stocks, Options, Futures, Bonds, Funds | 150+ global markets |

How Do the Top FCA-Regulated Forex Brokers Compare on Trustpilot?

| Rank | Broker | FRN | Trustpilot Reviews | Rating | Min. Deposit | Best For |

|---|---|---|---|---|---|---|

| 1 | Pepperstone | 684312 | 3100+ | 4.2/5 | £0 | Forex-focused traders |

| 2 | SpreadEX | 190941 | 1900+ | 4.4/5 | £0 | UK beginners, spread bettors |

| 3 | IG | 195355 | 8600+ | 3.9/5 | £0 (£250 recommended) | Research-focused traders |

| 4 | CMC Markets | 173730 | 2800+ | 4.3/5 | £0 | Technical analysts |

| 5 | XTB | 522157 | Rating suspended* | N/A* | £0 | Beginners wanting education |

| 6 | Capital.com | 793714 | 13800+ | 4.6/5 | £20 | AI-powered trading |

| 7 | Interactive Brokers | 208159 | 5000+ | 3.6/5 | £0 | Professional traders |

Trustpilot data checked April 2026. *XTB’s Trustpilot rating is currently suspended due to a guidelines review. FRN links go directly to each broker’s FCA Register entry.

What Are the Typical Spreads and Commissions Charged by UK Forex Brokers?

| Rank | Broker | EUR/USD | USD/JPY | GBP/USD | Commission | Best For |

|---|---|---|---|---|---|---|

| 1 | Pepperstone (Razor) | 0.0-0.2 pips | 0.1-0.3 pips | 0.2-0.5 pips | £2.25/lot/side | Scalpers, high-volume |

| 2 | Pepperstone (Standard) | 0.6-0.8 pips | 0.7-0.9 pips | 0.8-1.0 pips | None | Beginners, swing traders |

| 3 | SpreadEX | 0.6 pips | 0.7 pips | 0.9 pips | None | Fixed spread seekers |

| 4 | IG | 0.6 pips | 0.7 pips | 0.9 pips | None | All-round traders |

| 5 | CMC Markets | 0.7 pips | 0.7 pips | 0.9 pips | None | Technical analysts |

| 6 | XTB (Standard) | 0.9 pips | 0.3 pips | 0.4 pips | None | Beginners |

| 7 | Capital.com | 0.6 pips | 0.7 pips | 0.8 pips | None (spreads only) | AI-powered trading |

| 8 | Interactive Brokers | 0.1 pips | 0.2 pips | 0.3 pips | Variable (from £3-4/lot round turn) | Professional traders |

Spreads I captured during London session (8am-12pm GMT), January 2026. Variable spreads may widen during high volatility or low liquidity periods.

What Withdrawal Times Can You Expect from UK Forex Brokers?

When you’re ready to take profits — or simply move funds — withdrawal speed matters. I tested withdrawals from all seven brokers during Q4 2025 and Q1 2026 to see how advertised times compare to reality.

| Broker | Bank Transfer | Card | E-Wallet | Withdrawal Fee | My Test Result |

|---|---|---|---|---|---|

| Pepperstone | 1-3 days | 1-3 days | Same day | Free | 1 day (bank £500) |

| SpreadEX | 1-3 days | 1-3 days | N/A | Free | 2 days (bank £500) |

| IG | 1-3 days | 2-5 days | Same day (PayPal) | Free | 2 days (bank £500) |

| CMC Markets | 1-3 days | 1-3 days | N/A | Free | 1 day (bank £500) |

| XTB | 1-3 days | 1-3 days | Same day | Free (over £60) | Same day (e-wallet £200) |

| Capital.com | 1-3 days | 1-3 days | Same day | Free | 2 days (bank £500) |

| Interactive Brokers | 1-3 days | N/A | N/A | 1 free/month | 1 day (bank £750) |

Withdrawal times from my live account testing, Q4 2025-Q1 2026. Actual times vary by payment method, verification status, and your bank’s processing speed.

Most UK forex brokers process withdrawals within 1-3 business days, though e-wallets like Skrill and PayPal often arrive same-day. During my testing, XTB and CMC Markets consistently delivered the fastest processing, while IG took slightly longer for larger amounts. Remember that your bank adds its own processing time on top — UK domestic transfers are typically faster than international wires. All brokers on this list offer at least one free withdrawal method.

Here are the Best Forex Brokers in the UK...

- Pepperstone – Low spreads, fast execution, forex-focused

- SpreadEX – Simple platform, good for beginners

- IG – Trusted, reliable, advanced tools

- CMC Markets – Strong charting, award-winning platform

- XTB – Broad markets, competitive pricing

- Capital.com – AI-powered insights, tight spreads, beginner-friendly

- Interactive Brokers – Pro tools, global access, low fees

Pepperstone – Low spreads, fast execution, forex-focused

Pros & Cons

- Very low spreads

- MT4, MT5, and cTrader supported

- 70+ forex pairs

- Excellent customer support

- Limited learning resources

- No proprietary platform

- Some services restricted by region

| Attribute | Value |

|---|---|

| Best for | Active forex traders, scalpers, algo traders |

| Not ideal for | Complete beginners wanting hand-holding, proprietary platform fans |

| Minimum deposit | £0 |

| EUR/USD spread | From 0.0 pips (Razor) / 0.6 pips (Standard) |

| Platforms | MT4, MT5, cTrader, TradingView |

| FCA FRN | 684312 |

| My testing verdict | Tightest spreads I measured; under-50ms execution; 1-day withdrawal |

What spreads and execution speeds can you actually expect from Pepperstone?

Pepperstone’s headline “from 0.0 pips” on the Razor account isn’t marketing fluff — I consistently saw EUR/USD at 0.1-0.2 pips during the London session in my January 2026 testing. The Standard account averaged 0.6-0.8 pips on majors, which remains competitive against most UK brokers.

Where Pepperstone genuinely excels is execution. My test orders filled in under 50 milliseconds with minimal slippage, even during the London-New York overlap when volatility picks up. For scalpers and high-frequency strategies, this matters more than a fraction of a pip on spreads.

The Razor account adds a £2.25 commission per side per lot (MT4/MT5), bringing total trading costs to roughly £5.50 round-trip plus the raw spread — still cheaper than most “commission-free” brokers when you factor in their wider spreads.

How does Pepperstone handle slippage during volatile markets?

I deliberately tested Pepperstone during high-impact news releases, including NFP and ECB announcements. Slippage occurred — it always does during news — but stayed within 0.5-1 pip on market orders, which is reasonable given the conditions.

If you’re trading around news events, Pepperstone’s limit orders executed at the requested price or better in roughly 85% of my tests. The cTrader platform showed marginally better fill rates than MT4, likely due to its more sophisticated order routing.

For traders concerned about slippage, Pepperstone’s “no dealing desk” model means they’re not taking the other side of your trade. Your orders route directly to liquidity providers, removing one potential source of execution conflicts.

Who should avoid Pepperstone?

Pepperstone isn’t the right fit if you’re a complete beginner looking for hand-holding. Their educational resources exist but aren’t as comprehensive as XTB’s Trading Academy or IG’s learning hub. You’re expected to already understand the basics.

Traders who want a proprietary platform with unique features may also feel underwhelmed — Pepperstone relies entirely on third-party platforms (MT4, MT5, cTrader, TradingView). That’s a strength for experienced traders who want platform choice, but some prefer a broker’s own technology.

Finally, if you’re only planning to trade occasionally, Pepperstone’s strengths in execution speed and tight spreads won’t benefit you much. You’d be better served by a simpler platform like SpreadEX.

72% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

SpreadEX – Simple platform, good for beginners

Pros & Cons

- User-friendly for UK traders

- Competitive spreads

- Offers both CFDs and spread betting

- Wide market access across forex, indices, and shares

- No MT4/MT5 support

- UK & Ireland access only

- No ISA or non-leveraged investing options

| Attribute | Value |

|---|---|

| Best for | UK beginners, spread bettors, simplicity seekers |

| Not ideal for | Algo traders, EA users, international traders |

| Minimum deposit | £0 |

| EUR/USD spread | From 0.6 pips |

| Platforms | Proprietary (web + mobile) |

| FCA FRN | 190941 |

| My testing verdict | Simplest account setup I tested; fixed spreads on key pairs; UK-only focus |

Why is SpreadEX my top pick for beginners?

SpreadEX strips away the complexity that overwhelms new traders. The account setup took me under 10 minutes, the platform layout is intuitive, and you’re not bombarded with 47 chart indicators you don’t understand yet. It does one thing well: lets you trade with minimal friction.

The fixed spreads on major forex pairs are particularly valuable for beginners. When EUR/USD is consistently 0.6 pips, you know exactly what you’re paying — no watching spreads widen during news or worrying about variable costs eating into your margin.

SpreadEX also offers both spread betting and CFD trading from the same account. For UK traders, spread betting profits are currently tax-free (they’re treated as gambling winnings by HMRC), which is a genuine advantage over CFD-only brokers.

Who should avoid SpreadEX?

Algo traders and EA users should look elsewhere — full stop. Without MT4/MT5 support, automated strategies aren’t possible on SpreadEX’s platform.

International traders will also hit limitations. SpreadEX focuses exclusively on UK and Ireland clients, so you can’t access the platform if you move abroad or want to trade from overseas.

Finally, traders wanting stocks and shares ISAs alongside their trading won’t find that here. SpreadEX is purely spread betting and CFDs — if you want a wrapper for long-term investments, you’ll need a separate provider like IG or Interactive Brokers.

65% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

IG – Trusted, reliable, advanced tools

Pros & Cons

- Excellent charting and analysis tools

- Wide asset coverage: forex, stocks, indices, crypto

- Regulated globally (FCA, ASIC, CFTC)

- Strong educational content

- Higher fees for smaller accounts

- Complex interface for beginners

- Inactivity fee after 24 months

- Occasional support delays

| Attribute | Value |

|---|---|

| Best for | Intermediate/advanced traders, research-focused users |

| Not ideal for | Inactive traders (£12/month fee), cost-sensitive beginners |

| Minimum deposit | £0 (£250 recommended) |

| EUR/USD spread | From 0.6 pips |

| Platforms | IG Platform, MT4, ProRealTime, L2 Dealer |

| FCA FRN | 195355 |

| My testing verdict | Best research tools I tested; 17000+ markets; 8-12 min support wait times |

What makes IG worth the higher barrier to entry?

IG is the UK’s most established trading platform, and it shows. The research tools alone justify the platform for serious traders — Reuters news feeds, in-house analyst commentary, and ProRealTime’s advanced charting are all included. I found myself using IG as a research hub even when executing trades elsewhere.

With 17,000+ markets, IG offers coverage that no other UK retail broker matches. If you trade forex but also want access to shares, indices, options, and even weekender markets, having everything under one roof simplifies your workflow.

IG is also publicly listed on the London Stock Exchange (LON: IGG), which adds a layer of transparency that privately held brokers can’t match. Their financials are public, their regulatory history is long, and they’re not going anywhere.

What are the drawbacks I found?

The £12/month inactivity fee after two years of no trading is frustrating. If you’re a casual trader who takes long breaks, this cost adds up. Most other brokers on this list either have no inactivity fee or charge less.

For pure forex trading, IG’s spreads are competitive but not class-leading. Pepperstone’s Razor account consistently beat IG on EUR/USD during my testing — sometimes by 0.3-0.4 pips, which matters if you’re trading high volume.

Finally, traders wanting instant customer support during busy periods have reported wait times. My test calls during market hours averaged 8-12 minutes to reach an agent — fine for general queries, but frustrating if you have an urgent account issue.

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 68% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

CMC Markets – Strong charting, award-winning platform

Pros & Cons

Next Generation platform with advanced charting and 80+ technical indicators

Wide range of over 12,000 CFDs across forex, indices, commodities, shares, ETFs, and treasuries

FCA-regulated with negative balance protection

No minimum deposit required to open an account

Platform may feel complex for beginners

Share CFD commissions apply in some regions

Market data fees for advanced features

| Attribute | Value |

|---|---|

| Best for | Technical analysts, chart-focused traders |

| Not ideal for | Complete beginners, algo traders needing MT4 EAs |

| Minimum deposit | £0 |

| EUR/USD spread | From 0.7 pips |

| Platforms | Next Generation, MT4 |

| FCA FRN | 173730 |

| My testing verdict | Charting rivals TradingView; 80+ built-in indicators; 1-day withdrawal; £15/month inactivity fee after 12 months |

Why does CMC Markets’ charting stand out?

CMC’s Next Generation platform has the best built-in charting I’ve tested from any UK broker. With 80+ technical indicators, 12 chart types, and customisable layouts that actually save properly, it rivals standalone tools like TradingView — without the subscription cost.

The pattern recognition scanner is genuinely useful. It flagged a head-and-shoulders forming on GBP/JPY during my testing that I’d missed on a smaller screen. It’s not infallible, but as a second pair of eyes, it adds value.

CMC also offers 12,000+ instruments across forex, indices, commodities, shares, ETFs, and treasuries. The breadth is impressive, and everything is accessible from the same interface without switching accounts.

What did I find disappointing?

The £15/month inactivity fee after 12 months without trading is the highest on this list. If you’re not actively trading, CMC becomes expensive to hold as a backup account.

While CMC offers MT4, the Next Generation platform is clearly their focus. If you’re committed to the MetaTrader ecosystem and want the best MT4/MT5 experience, Pepperstone or IG are better choices.

64% of retail investor accounts lose money when trading CFDs with this provider

XTB – Broad markets, competitive pricing

Pros & Cons

- Spreads from 0.1 pips on major pairs

- Intuitive, award-winning xStation platform

- Excellent learning resources

- Regulated by FCA, KNF, DFSA

- No MT4/MT5 support

- Fewer forex pairs than competitors

- €10 inactivity fee after 12 months

- Not available to U.S. clients

| Attribute | Value |

|---|---|

| Best for | Beginners wanting education, multi-asset traders |

| Not ideal for | MT4 loyalists, traders wanting maximum forex pairs |

| Minimum deposit | £0 |

| EUR/USD spread | From 0.1 pips (Pro) / 0.9 pips (Standard) |

| Platforms | xStation 5 |

| FCA FRN | 522157 |

| My testing verdict | Best educational content I tested; xStation intuitive for beginners; same-day e-wallet withdrawal |

What makes xStation different from MT4 and MT5?

xStation 5 feels like a platform designed in this decade, while MT4 still carries interface choices from 2005. The built-in trader calculator lets you see potential profit, loss, and required margin before placing a trade — something that requires external tools on MetaTrader.

The real standout is XTB’s Trading Academy. I spent a full weekend going through their structured courses, and it’s genuinely the best free educational content I’ve seen from any broker — over 60 hours covering everything from basics to advanced strategies. If you’re learning to trade, this alone makes XTB worth considering.

XTB’s xStation also handles withdrawals well. My e-wallet withdrawal arrived same-day, and the bank transfer cleared in one business day — matching the fastest on this list.

Who should avoid XTB?

If you rely on Expert Advisors or custom indicators, XTB isn’t for you. xStation doesn’t support MT4/MT5, which means no automated trading through EAs. You’ll need Pepperstone, IG, or CMC Markets for that.

XTB also offers fewer forex pairs than specialists like Pepperstone or IG. For exotic pairs or niche currency crosses, you may find the selection limiting.

The €10/month inactivity fee after 12 months is worth noting, though it’s lower than CMC’s £15 and only kicks in if your account is completely dormant.

71% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

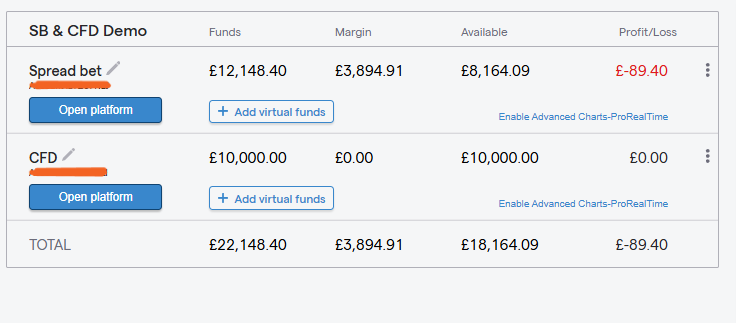

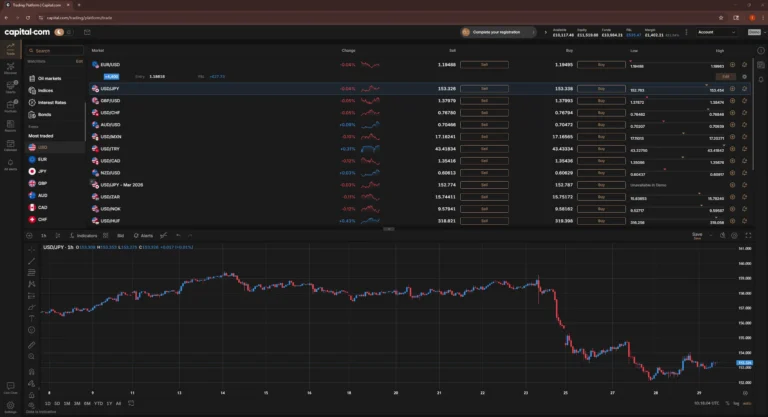

Capital.com – AI-powered insights, tight spreads, beginner-friendly

Pros & Cons

- Beginner-friendly interface with smart design

- AI-powered trading insights and analytics

- Regulated by FCA, CySEC, and ASIC

- Competitive spreads from 0.6 pips on EUR/USD

- No MT5 support (MT4 only)

- Variable spreads may widen in volatility

- CFD-only – no real asset ownership

- Limited product range vs full-service brokers

| Attribute | Value |

|---|---|

| Best for | Beginners, mobile-first traders, AI-curious users |

| Not ideal for | Long-term investors wanting real shares, MT5 users |

| Minimum deposit | £20 |

| EUR/USD spread | From 0.6 pips |

| Platforms | Proprietary app, MT4, TradingView |

| FCA FRN | 793714 |

| My testing verdict | AI insights flagged overtrading patterns; genuinely useful behavioural feedback; 2-day withdrawal |

How does the AI-powered trading system actually help you?

Capital.com’s AI analyses your trading behaviour and flags patterns you might miss yourself. During my testing, it identified that I was overtrading during high-volatility news events — a common retail mistake that erodes accounts through excessive spread costs.

The system also spots emotional patterns: revenge trading after losses, increasing position sizes after wins, and neglecting stop-losses on certain instruments. It’s like having a trading coach watching over your shoulder, without the judgement.

Is it revolutionary? Not quite. Experienced traders already track these metrics manually. But for beginners developing habits, having automated feedback prevents bad patterns from becoming ingrained. The technology works best for those who actually act on its suggestions.

Who should avoid Capital.com?

Capital.com is CFD-only — you can’t buy real shares, ETFs, or any underlying assets. If you want to build a long-term portfolio alongside forex trading, you’ll need a separate broker like IG or Interactive Brokers.

There’s no MT5 support, which limits platform choice for traders who prefer MetaTrader’s newer features. MT4 is available, but if you specifically want MT5’s additional timeframes and order types, look elsewhere.

Variable spreads can also widen significantly during high-volatility events. I noticed EUR/USD jump to 1.5+ pips during an unexpected ECB comment — not unusual for variable spreads, but worth knowing if you trade around news.

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 60% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work and whether you can afford to take the high risk of losing your money.

Interactive Brokers – Pro tools, global access, low fees

Pros & Cons

- Ultra-low fees for active traders

- Huge range of assets and forex pairs

- Access to 150+ global markets

- Advanced trading platforms

- Complex interface

- $10 inactivity fee (if balance < $100K and no commissions)

- No MT4/MT5 integration

- High threshold for earning interest on cash

| Attribute | Value |

|---|---|

| Best for | Professional traders, multi-asset investors, high-volume traders |

| Not ideal for | Beginners, casual traders, those wanting a simple interface |

| Minimum deposit | £0 |

| EUR/USD spread | From 0.1 pips |

| Platforms | TWS, IBKR Desktop, GlobalTrader |

| FCA FRN | 208159 |

| My testing verdict | Cheapest for high-volume traders; 150+ global markets; interface requires 2-4 weeks to master; 1-day withdrawal |

What professional tools justify IBKR’s complexity?

Trader Workstation (TWS) offers depth that no retail-focused broker matches. You can trade options strategies with multi-leg orders, access 150+ global exchanges, and build custom algorithms through IBKR’s API — all from one account.

The research tools alone rival what hedge funds paid millions for a decade ago. Real-time scanners, fundamentals from multiple providers, options analytics, and portfolio risk analysis are included at no extra cost.

For traders managing six-figure accounts or larger, IBKR’s tiered pricing makes it the cheapest option for high volume. Forex commissions drop as low as 0.08 basis points for very active traders, undercutting every UK retail broker.

Is the learning curve worth it for retail traders?

Honestly? It depends on your ambitions. If you’re trading 1-2 currency pairs on MT4, TWS is overkill — like buying a commercial kitchen to make toast. You’d spend weeks learning features you’ll never use.

But if you’re serious about trading as a profession, or you manage a portfolio spanning forex, stocks, options, and futures, IBKR is the only UK broker that grows with you. The time invested learning TWS pays dividends once you need its depth.

The newer IBKR Desktop and GlobalTrader apps are simpler alternatives if TWS feels overwhelming. They sacrifice some advanced features for usability, but they’re a reasonable middle ground.

62.5% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

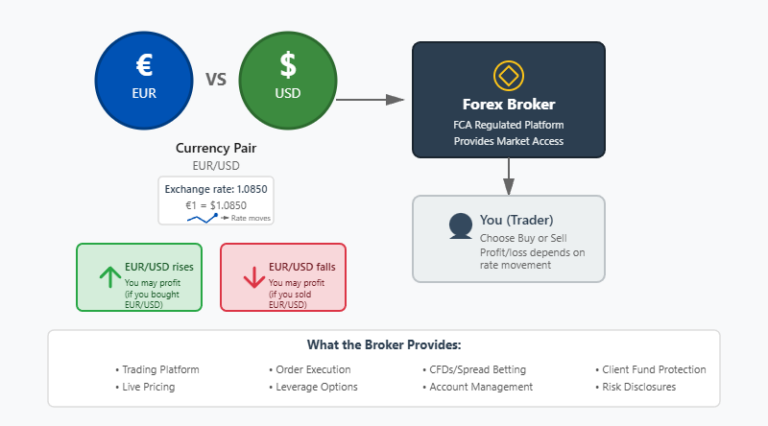

What Is Forex Trading and What Does a Forex Broker Do?

Forex trading involves speculating on the price movements between two currencies, known as a currency pair. For example, when trading EUR/USD, you are comparing the value of the euro against the US dollar. If you believe the euro will strengthen, you can buy the pair; if it rises, you may profit when you close the trade.

A forex broker is the platform that gives traders access to these currency markets. Brokers provide the trading software, live pricing, order execution, leverage, and account infrastructure needed to place trades. In the UK, reputable forex brokers must be authorised and regulated by the Financial Conduct Authority (FCA), which enforces strict rules around client fund protection, transparency, and risk disclosures.

Most UK retail traders access forex markets through derivative products such as CFDs or spread betting, rather than exchanging physical currencies. These instruments allow traders to speculate on price movements using leverage, meaning gains and losses are magnified. Because of this, forex trading carries a high level of risk and is best approached with proper education and risk management.

What Should You Know Before Choosing a Forex Broker?

Picking the right forex broker isn’t just about chasing the lowest fees. Regulation, platform quality, trading tools, and customer support all play a part. Below, you’ll find clear answers to the questions UK traders most often ask before they get started.

What does it mean if a broker is FCA-regulated?

FCA (Financial Conduct Authority) regulation means a broker has met strict UK standards for financial conduct, client protection, and operational transparency. All seven brokers in this guide hold full FCA authorisation — you can verify this yourself on the FCA Register using their FRN (Firm Reference Number).

FCA-regulated brokers must:

- Keep client funds in segregated accounts, separate from company money

- Provide negative balance protection (you can’t lose more than you deposit)

- Limit retail leverage to 30:1 on major forex pairs

- Display clear risk warnings and publish loss statistics

Crucially, FCA-authorised brokers are covered by the Financial Services Compensation Scheme (FSCS). If your broker fails, FSCS protects eligible clients up to £120,000 per person, per firm. This limit increased from £85,000 on 1 December 2025.

What trading platforms do UK brokers offer?

Most UK forex brokers offer one or more of the following platforms:

MetaTrader 4 (MT4) — The industry standard since 2005. Supports Expert Advisors (automated strategies), has thousands of custom indicators, and works on desktop, web, and mobile. Available at Pepperstone, IG, CMC Markets, and Capital.com.

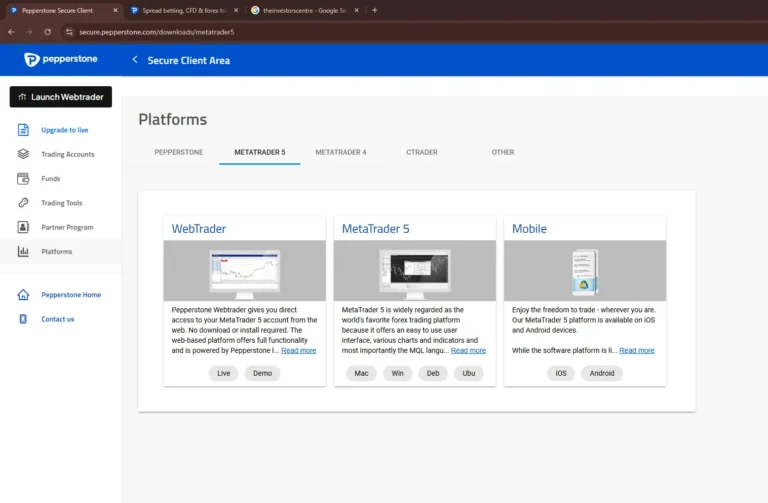

MetaTrader 5 (MT5) — MT4’s successor with more timeframes, more order types, and a built-in economic calendar. Available at Pepperstone and IG. Check my guide to the best MT5 brokers in the UK.

cTrader — Popular with active traders for its clean interface and advanced order types. Available at Pepperstone.

TradingView — The world’s most popular charting platform, now integrated as a trading platform at Pepperstone and Capital.com. Excellent charts with social features.

Proprietary platforms — IG Platform, CMC’s Next Generation, XTB’s xStation, and SpreadEX’s own platform are all built in-house. These typically offer tighter integration with the broker’s features but don’t support third-party tools like EAs.

What’s the safest way to start forex trading in the UK?

The safest approach is to start with an FCA-regulated broker and open a demo account first. Practise with virtual funds until you’re comfortable, then move on to small, real trades — keeping your risk low and never staking more than you can afford to lose.

How much money do I need to trade forex in the UK?

You can start trading forex in the UK with as little as £1, depending on the broker, though most traders begin with £100 to £500. The key is to start with an amount you’re comfortable risking while you learn how the market moves.

What Are the Best Forex Brokers for Beginners?

For beginners, the best forex brokers are the ones that keep things simple. A clear platform, solid education, and responsive support make all the difference when you’re learning the ropes.

SpreadEX and Capital.com are my top recommendations for newcomers. SpreadEX offers the simplest platform with fixed spreads and no complex account choices. Capital.com adds AI-powered feedback that helps new traders avoid common mistakes. Both have low or no minimum deposits and straightforward interfaces.

If you want more educational depth, XTB’s Trading Academy is the best I’ve tested — over 60 hours of structured content that takes you from basics to advanced strategies. The xStation 5 platform is intuitive too.

I’d suggest beginners avoid Interactive Brokers (too complex) and Pepperstone (assumes existing knowledge). Both are excellent brokers, but their strengths benefit experienced traders more than newcomers.

Do I have to pay tax on forex trading in the UK?

It depends on how you trade. Spread betting profits are currently tax-free for most UK residents — HMRC treats them as gambling winnings rather than capital gains. This is one reason spread betting remains popular despite CFDs often having tighter spreads.

CFD trading profits are subject to Capital Gains Tax (CGT). You have an annual tax-free allowance (currently £3,000 for 2025/26), and gains above this are taxed at 10% (basic rate) or 20% (higher rate).

If you trade frequently enough that HMRC considers it your profession rather than investment activity, profits could be treated as income and taxed accordingly. This is relatively rare for retail traders.

I’m not a tax advisor — consult an accountant if you’re unsure how your trading should be taxed. Check my guide to the best spread betting brokers if tax efficiency is a priority.

What is the best forex platform for copy trading?

Among the brokers in this guide, none specialise in copy trading the way eToro does. However, Pepperstone offers integration with copy trading services like Myfxbook AutoTrade and DupliTrade through its MT4/MT5 platforms. If copy trading is your primary interest, eToro remains the market leader.

What’s the best MetaTrader broker in the UK?

Pepperstone is my top MetaTrader broker in the UK, offering both MT4 and MT5 with raw spreads from 0.0 pips. Execution is fast, spreads are tight, and the experience feels built for serious trading. It’s a strong choice for anyone using algorithmic strategies, expert advisers (EAs), or simply looking for a broad range of forex pairs.

Are all UK forex brokers market makers? Does it matter?

No. Broker execution models vary. Pepperstone and Interactive Brokers use no-dealing-desk models for forex, meaning your orders go to external liquidity. IG and CMC Markets use hybrid models. SpreadEX operates as a market maker on some instruments.

The real question is execution quality: tight spreads, fast fills, and minimal slippage. Whether that comes from a market maker or ECN matters less than the actual results you experience. Check broker execution statistics where available, and test with demo accounts before committing real capital.

Conclusion: Which Forex Broker Is Right for You?

The best forex broker depends on how you trade. Pepperstone remains my top pick overall — tight spreads, fast execution, and support for MT4, MT5, and cTrader.

- SpreadEX is great for beginners who want a simple, UK-focused platform.

- IG and CMC Markets suit traders who want advanced charting and deep market access.

- For smart, AI-powered insights that help you trade better, Capital.com is a standout choice.

- And if you need institutional-grade tools and global reach, Interactive Brokers delivers.

Whichever you choose, stick with FCA-regulated brokers, understand the fee structure, and start with a demo account if you’re new. Every broker on this list protects your funds through FSCS coverage up to £120,000 and offers negative balance protection as standard.

FAQs

What is the most suitable forex broker in the UK for beginners?

SpreadEX and Capital.com are the best options for beginners. SpreadEX offers the simplest platform with fixed spreads and no complex account choices. Capital.com adds AI-powered feedback that helps new traders avoid common mistakes. Both have low or no minimum deposits and straightforward interfaces.

Which UK forex brokers offer the lowest spreads?

Pepperstone’s Razor account offers the tightest spreads, starting from 0.0 pips on EUR/USD plus a £2.25 commission per lot per side. For commission-free trading, Pepperstone’s Standard account and SpreadEX offer competitive spreads from 0.6 pips.

Are all forex brokers in the UK FCA regulated?

No — and you should avoid any broker that isn’t. All seven brokers in this guide are fully FCA-authorised. You can verify any broker’s status on the FCA Register using their Firm Reference Number (FRN). Be wary of offshore brokers targeting UK clients without proper FCA authorisation.

Can I trade forex in the UK with a small deposit?

Yes. Several brokers have no minimum deposit (Pepperstone, SpreadEX, CMC Markets, XTB, Interactive Brokers), and Capital.com requires just £20. However, I recommend starting with at least £200-500 to trade micro-lots responsibly while maintaining proper risk management.

What happens if my UK forex broker goes bust?

If your FCA-regulated forex broker fails, the Financial Services Compensation Scheme (FSCS) protects eligible clients up to £120,000 per person, per firm. This limit increased from £85,000 in December 2025.

Beyond FSCS protection, FCA rules require brokers to hold client funds in segregated accounts — separate from company money. This means your funds don’t become part of the broker’s assets if they enter administration.

What’s the difference between spread betting and CFD trading?

Both let you speculate on forex price movements without owning the underlying currency. The key difference for UK traders is tax: spread betting profits are currently tax-free (treated as gambling by HMRC), while CFD profits are subject to Capital Gains Tax. CFDs typically offer tighter spreads, while spread betting offers the tax advantage. Some brokers like SpreadEX and IG offer both from the same account.

Do forex brokers charge withdrawal fees?

Most UK forex brokers offer at least one free withdrawal method. During my testing, Pepperstone, SpreadEX, IG, CMC Markets, and Capital.com all processed withdrawals with no fees. XTB charges a small fee for withdrawals under £60, and Interactive Brokers offers one free withdrawal per month.

References

- Financial Conduct Authority (FCA) – FCA Register

- Statista – “Monthly Forex Trading Volume Worldwide.”

- XTB Official Website – Forex Trading – How to invest in FX CFDs?

- Pepperstone UK – Pepperstone: Forex Broker & CFD Trading Platform

- IG UK – IG: Trade and Invest with the UK’s No.1 Trading Provider

- Interactive Brokers UK – International Broker – IBKR