Profile

Co-Founder

Thomas brings extensive experience in financial analysis and investment research. With a strong background in both institutional and retail investment sectors, Thomas ensures all content meets the highest standards of accuracy and relevance.

Follow on Twitter Connect on LinkedIn"Every piece of investment advice should be grounded in solid research and practical application. My role is to ensure our content provides real value to investors at every level."

My Favourite Writes:

Profile

Co-Founder

Dom is an experienced retail investor, learning his craft in what he likes to call the "hard way". Through many of these lessons he has crafted himself a sound investment strategy that has enabled him to make investing into a business not just a hobby.

Follow on Twitter"Financial clarity and integrity are the cornerstones of everything we do. We're here to ensure that your investment journey is built on a solid financial understanding and a sound strategic foundation."

My Favourite Writes:

Profile

Co-Founder

Adam is a passionate investor who created The Investors Centre (TIC) to combine his professional skills with his love for investment.

Follow on Twitter"Investment is about more than just numbers; it's about strategy, research, and the willingness to adapt."

My Favourite Writes:

How We Test

Our Commitment to Accuracy

At The Investors Centre, we maintain the highest standards of accuracy and reliability in all our investment education content. Every article undergoes rigorous fact-checking and review processes.

Our Testing & Verification Process

- Primary Research: We gather data directly from official sources including company reports, regulatory filings, and government databases.

- Platform Testing: Our team personally tests and evaluates investment platforms, creating accounts and documenting real user experiences.

- Expert Analysis: Content is reviewed by experienced investors and financial professionals within our team.

- Data Verification: All statistics, figures, and claims are cross-referenced with multiple authoritative sources.

- Regular Updates: We review and update content quarterly to ensure information remains current and accurate.

Review Standards

- Independence: We maintain editorial independence and disclose any potential conflicts of interest.

- Transparency: Our testing methodology and evaluation criteria are clearly documented.

- Objectivity: Reviews are based on measurable criteria and standardized testing procedures.

Corrections Policy

If errors are identified, we correct them promptly and note significant updates at the bottom of articles. Readers can report inaccuracies to our editorial team at info@theinvestorscentre.co.uk

Last Review Date

This article was last fact-checked and updated on: September 16, 2025

Disclaimer

Educational Purpose Only

All content on The Investors Centre is provided for educational and informational purposes only. It should not be construed as personalised investment advice, financial advice, or a recommendation to buy, sell, or hold any investment or security.

No Financial Advice

We are not authorised by the Financial Conduct Authority (FCA) to provide investment advice. Content on this website does not constitute financial advice, and you should not rely on it as such. Always consult with a qualified financial advisor or professional before making investment decisions.

Investment Risks

Investing carries inherent risks, including the potential loss of principal. Past performance does not guarantee future results. The value of investments can go down as well as up, and you may not get back the amount originally invested.

Accuracy & Completeness

While we strive to provide accurate and up-to-date information, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability of the information contained on this website.

Third-Party Content & Links

This website may contain links to third-party websites and references to third-party products or services. We do not endorse, control, or assume responsibility for any third-party content, privacy policies, or practices. Users access third-party sites at their own risk.

Affiliate Disclosure

Some links on this site may be affiliate links. If you click on these links and make a purchase or sign up for a service, we may receive a commission at no additional cost to you. This does not influence our editorial content or reviews.

Personal Responsibility

Any action you take upon the information on this website is strictly at your own risk. We will not be liable for any losses or damages in connection with the use of our website or the information provided.

Regulatory Notice

Investment products and services featured on this website may not be available in all jurisdictions or to all persons. Users are responsible for complying with local laws and regulations.

Contact Information

For questions about this disclaimer or our content, please contact:

Email: info@theinvestorscentre.co.uk

Last Updated

This disclaimer was last updated on: August 2025

Quick Answer: How Do I Short The Dollar?

Shorting the dollar means profiting if the USD falls in value. Traders borrow dollars, sell them, and aim to buy them back cheaper. Popular methods include forex trading, inverse ETFs, and CFDs, each offering different risk levels, leverage options, and access for UK investors.

What it Means to Short the USD?

Shorting USD involves selling the currency when you expect it to weaken. If the dollar declines, you can buy it back at a lower price, securing a profit. This strategy is used by hedgers, speculators, and traders seeking diversification or protection from dollar strength.

What are the Key Methods to Bet Against the Dollar?

Traders can short the dollar via forex pairs like EUR/USD, by purchasing inverse ETFs, or using CFDs. Each method provides exposure to USD movements, with forex offering direct market access, ETFs simplifying the process, and CFDs allowing leverage but adding higher risk.

Step-by-Step: How to Short the Dollar

Step 1: Choose Your Strategy

Selecting the right strategy depends on your risk tolerance, experience, and access. Forex offers direct currency exposure, CFDs provide leverage but higher risk, and inverse ETFs simplify shorting for beginners. Each method requires understanding mechanics, costs, and how USD movements affect potential returns.

Should I Use Forex, CFDs, or Inverse ETFs?

Forex suits experienced traders who can monitor markets closely. CFDs appeal to those seeking high leverage but need caution. Inverse ETFs are beginner-friendly, traded like stocks, and limit exposure. Consider your goals, available capital, and risk appetite before committing to a method.

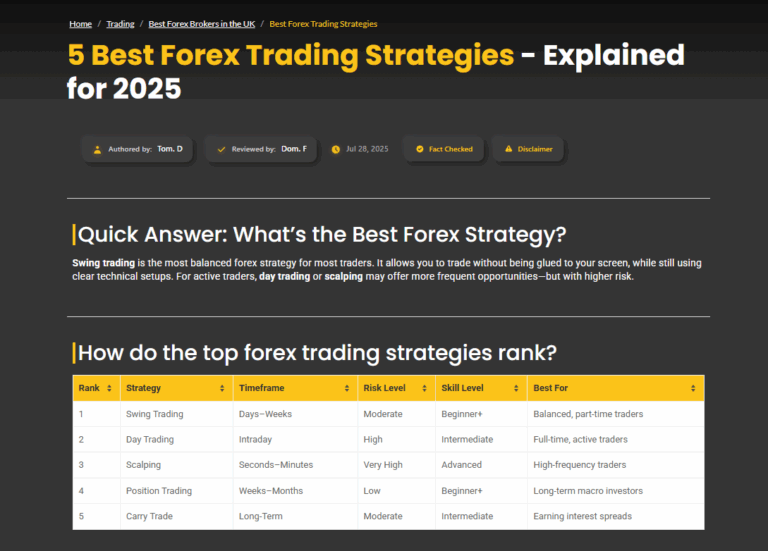

| Method | Skill Level | Leverage Available | Risk Level | Holding Period | Cost Considerations | Best Suited For |

|---|---|---|---|---|---|---|

| Forex Pairs | Intermediate | High (up to 30:1 or more) | High | Short to medium-term | Spread + overnight swap fees | Active traders who monitor news and charts |

| Inverse ETFs | Beginner | None | Medium | Short to medium-term | Management fees + decay over time | Passive investors or swing traders using brokerage accounts |

| CFDs | Advanced | Very high (up to 500:1 with some brokers) | High | Intra-day to short-term | Spreads, commissions, overnight fees | Experienced traders looking to capitalise on volatility |

Step 2: Pick a Trading Platform

Choosing the right platform ensures access to the instruments you need, competitive spreads, and reliable execution. A strong platform supports research, risk management tools, and educational resources, making your shorting process smoother and safer, particularly when dealing with leveraged or complex products.

What Makes a Platform Safe and Reliable?

Safety depends on FCA regulation, segregated client funds, and platform security. Reliability comes from fast execution, low slippage, and transparent fees. Check reviews, customer support quality, and available trading tools. A secure, regulated broker reduces operational risks while supporting your USD shorting strategy.

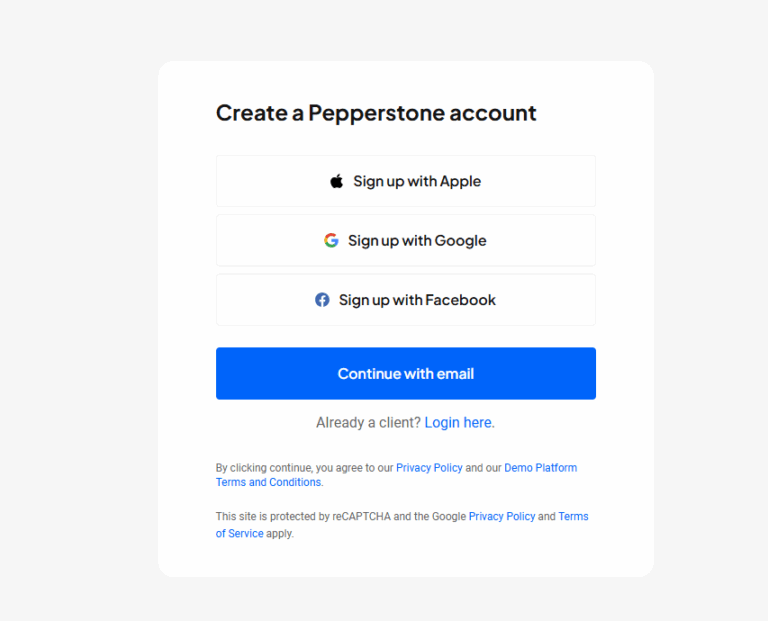

Step 3: Set Up Your Account

Before trading, complete verification, fund your account, and establish risk limits. Proper setup includes identity checks, bank transfers or card funding, and activating two-factor authentication. Defining maximum trade sizes or stop-loss levels ensures disciplined trading and protects capital from unexpected USD swings.

Verification, Funding, and Risk Limits

Most brokers require KYC verification. Fund accounts using bank transfers, cards, or e-wallets. Set risk limits per trade and for total exposure. Define stop-loss levels and consider leverage carefully. A structured setup reduces the chance of costly mistakes when shorting the dollar.

Step 4: Place Your Short Position

Entering a short position involves analysing market conditions, selecting the amount to sell, and timing the entry. Correct position sizing ensures risk is manageable, while understanding spreads, fees, and leverage helps prevent losses from small USD fluctuations or volatile price swings.

Understanding Entry Points and Position Sizing

Identify key technical or fundamental signals before entering. Determine trade size based on account balance and risk tolerance. Avoid over-leveraging. Entry points should reflect market trends, support, and resistance levels, while position sizing prevents large losses during unexpected USD moves.

Step 5: Monitor Your Trade

Active monitoring is critical. Track price movements, news, and economic releases that impact the USD. Adjust stop-loss orders if necessary and watch leverage effects. Continuous oversight helps protect profits, reduce losses, and allows for timely decisions when shorting the dollar in volatile markets.

Tracking Market Moves and Using Stop-Loss Orders

Use charts, economic calendars, and alerts to monitor USD movements. Set stop-loss and take-profit levels. Review your positions regularly, adjusting for volatility or news events. Consistent monitoring ensures your short position aligns with risk management rules and market conditions.

Step 6: Close or Adjust Your Position

Deciding when to exit is as important as entry. You can close the position to secure profits or adjust stops to protect gains. Timely actions reduce exposure, manage risk, and capitalize on market trends, preventing minor USD reversals from eroding potential returns.

Managing Risk and Taking Profits

Review price targets, economic news, and technical signals before exiting. Partial closes or trailing stops can lock in profits. Adjust your position based on market behaviour, keeping risk-reward ratios in mind. Effective exit strategies prevent losses and maximize gains when shorting USD.

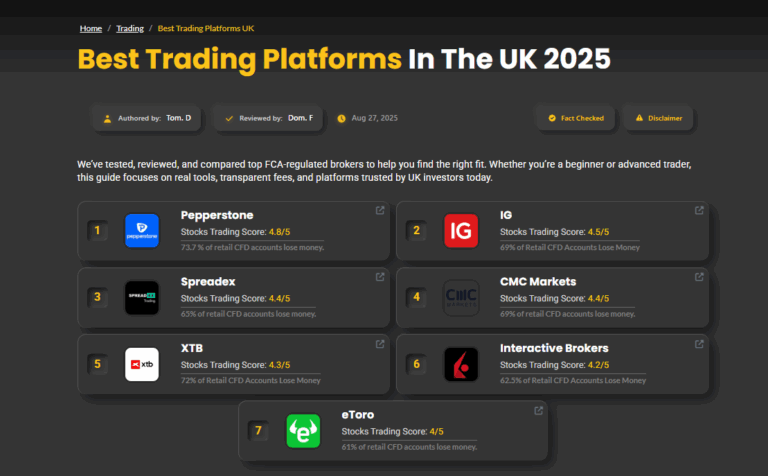

Which Platforms Should I Use to Short the Dollar?

Choosing the right platform is critical when shorting USD. Traders need FCA-regulated brokers offering forex, CFDs, or inverse ETFs, reliable execution, risk management tools, and educational resources. Pepperstone, SpreadEX, and IG are top options, each with unique strengths and limitations.

Top Platforms for Shorting the USD in 2025

Here are a few I’ve used (or still use) and recommend for anyone looking to short the dollar this year. Each has its own strengths depending on your style and experience level:

| Platform | Instruments Supported | Regulation | Minimum Deposit | Key Features & Fees | Best Suited For |

|---|---|---|---|---|---|

| Pepperstone | Forex, CFDs (incl. commodities, USD) | FCA (UK), ASIC (AU) | $0 | Low spreads, fast execution, multiple platforms (MT4/MT5/cTrader), strong UK regulation | Forex/day traders and cost-conscious traders |

| IG | Forex, CFDs (including USD Index) | FCA (UK), ASIC (AU) | $0–$300 | Competitive spreads, advanced charting, deep liquidity, wide USD instrument access | All levels — from beginners to pros |

| eToro | CFDs, Forex, Copy Trading | FCA (UK), CySEC (EU) | $50–$200 | User-friendly interface, copy trading, zero commissions on stock CFDs | Beginners and intermediate traders |

| Interactive Brokers | Forex, ETFs (e.g. UDN), Futures | FCA, SEC, CFTC (US) | $0–$1,000 | Low-cost structure, professional-grade tools, global market access | Professionals and experienced traders |

| XTB | Forex, CFDs on USD pairs/indexes | FCA (UK), KNF (Poland) | $0 | Tight spreads, fast execution, strong educational resources, no deposit minimum | Active short-term traders and scalpers |

| SpreadEx | Forex, CFDs, Spread Betting (USD) | FCA (UK) | £1 | Spread betting & CFD support, competitive spreads, browser-based platform, UK focus | UK-based traders seeking simplicity & flexibility |

Why Would Traders Short the Dollar?

Shorting the dollar is not just speculation—it can manage risk and exploit market conditions. Traders hedge currency exposure, anticipate USD weakness, or capitalize on volatility. Understanding motivations ensures strategies align with investment goals, risk tolerance, and broader economic trends impacting the greenback.

Hedging Against Currency Risk

Traders anticipating a weaker USD can profit by shorting it. This involves analysing economic indicators, interest rates, and geopolitical events. By betting on dollar declines, speculators aim to earn returns from currency depreciation, using forex, ETFs, or derivatives to implement their strategies efficiently.

Speculating on a Weakening USD

Traders anticipating a weaker USD can profit by shorting it. This involves analysing economic indicators, interest rates, and geopolitical events. By betting on dollar declines, speculators aim to earn returns from currency depreciation, using forex, ETFs, or derivatives to implement their strategies efficiently.

What Are the Risks of Shorting the Dollar?

Unlimited Loss Potential – Unlike buying an asset, where losses are capped at your initial investment, shorting exposes you to theoretically unlimited losses if the dollar rises instead of falls.

Margin Calls & Leverage Risk – Short positions are typically taken on margin, meaning sudden price spikes can trigger margin calls and force you to close out at a heavy loss.

Interest Rate & Policy Shifts – U.S. Federal Reserve decisions on interest rates, monetary tightening, or unexpected policy changes can strengthen the dollar and move sharply against your trade.

Safe-Haven Demand – In times of global uncertainty or crises, investors flock to the U.S. dollar as a safe-haven asset, which can quickly drive the dollar higher and squeeze short sellers.

High Volatility & Short Squeezes – Sudden reversals, unexpected economic data, or market interventions can fuel extreme volatility, creating a short squeeze that forces traders to cover positions at higher prices.

Final Thoughts: Should You Short the Dollar?

Shorting the dollar can be a strategic move for UK traders looking to hedge or profit from USD weakness. As of 17th September 2025, technical indicators and macroeconomic trends suggest potential opportunities. Always combine market analysis, risk management, and hedging strategies to protect your portfolio.

Seamless Trading Across Platforms

- Low Spreads and Fast Execution

- Multiple Account Types

- Advanced Trading Platforms

73.7% of retail investor accounts lose money when trading spread bets and CFDs with this provider.

FAQs

How can I short the US dollar as a beginner?

If you’re just starting out, the simplest way to short the US dollar is by using an inverse ETF like UDN through a regular brokerage account. It doesn’t require leverage or advanced trading skills. Just be aware of management fees and the potential for decay over longer periods.

Is shorting the dollar risky?

Yes — like any speculative strategy, shorting the dollar carries risk. Market reversals, economic surprises, and leverage can quickly turn a profitable trade into a loss. That’s why I always recommend using stop-losses, sizing positions carefully, and trading with a clear plan.

What is the best forex pair to short the dollar?

One of the most popular forex pairs for shorting the dollar is EUR/USD. Going long on this pair effectively means you’re betting on the euro to rise and the US dollar to fall. Other good options include GBP/USD and AUD/USD, depending on your macro view.

Can I short the US dollar with a CFD broker?

Absolutely. CFD brokers like IG and XTB allow you to short USD via currency pairs (like USD/JPY) or even through the US Dollar Index (DXY). Just be cautious with leverage — it magnifies both gains and losses.

Is now a good time to short the dollar in 2025?

Many traders are watching the dollar closely in 2025 as the Fed hints at rate cuts and inflation eases. While some see this as a shorting opportunity, always remember that this isn’t financial advice — it’s essential to do your own analysis and risk management.

References

- Federal Reserve – Monetary Policy Statements

- Investopedia – How to Short a Currency

- Bloomberg – Dollar Index News & Analysis

- Invesco – UDN ETF Overview

- IG Group – What is Forex Trading?

- eToro – Understanding CFD Trading

- Trading Economics – United States Interest Rate

- XTB – Economic Calendar & Sentiment Tools

- Interactive Brokers – Product Listings (Forex, ETFs, Futures)