- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 50+ platforms · 200+ guides authored

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 40+ brokers with funded accounts

- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 50+ platforms · 200+ guides authored

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 40+ brokers with funded accounts

How We Test

Real accounts. Real money. Real trades. No demo accounts or press releases.

What we measure:

- Spreads vs advertised rates

- Execution speed and slippage

- Hidden fees (overnight, withdrawal, conversion)

- Actual withdrawal times

Scoring:

Fees (25%) · Platform (20%) · Assets (15%) · Mobile (15%) · Tools (10%) · Support (10%) · Regulation (5%)

Regulatory checks:

FCA Register verification · FSCS protection

Testing team:

Adam Woodhead (investing since 2013), Thomas Drury (Chartered ACII, 2018), Dom Farnell (investing since 2013) — 50+ platforms with funded accounts

Quarterly reviews · Corrections: [email protected]

Disclaimer

Not financial advice. Educational content only. We're not FCA authorised. Consult a qualified advisor before investing.

Capital at risk. Investments can fall. Past performance doesn't guarantee future results.

CFD warning. 67-84% of retail accounts lose money trading CFDs. High risk due to leverage.

Contact: [email protected]

Quick Answer:

In 2026, UK investors can access equivalents to popular US funds through UK-listed ETFs that track similar indices, like the S&P 500 or Nasdaq-100. These options are ISA-eligible and avoid US dividend withholding tax.

What's New for 2026?

- Vanguard cut fees on 13 ETFs in 2025 — VWRL/VWRP now 0.19% OCF (down from 0.22%)

- iShares Core S&P 500 UCITS ETF (CSPX) reaches €116 billion AUM at just 0.07% TER

- FCA announced Consumer Composite Investments (CCI) regime replacing PRIIPs — effective June 2027

- S&P 500 delivered +25% in 2024, continuing strong momentum into 2025

- UCITS ETFs now capture 60%+ of new European fund inflows

- iShares Core MSCI World (SWDA) surpasses $122 billion AUM at 0.20% TER

Why Can’t I Buy US-based Funds in the UK?

In 2026, UK investors still face barriers when purchasing US-based funds due to regulatory restrictions and practical challenges. Regulations like the UCITS directive require compliance with EU standards, limiting access to foreign funds. Additionally, currency exchange processes and tax implications add further complexities, making it essential for investors to navigate these hurdles carefully.

Summary Table: UK Equivalents of Popular US Funds

| US Fund | UK Equivalent | Ticker | Type | TER | AUM |

|---|---|---|---|---|---|

| VTI/VTSAX (Total US Stock) | Vanguard S&P 500 UCITS ETF | VUSA | ETF | 0.07% | £45bn+ |

| VT/VTWAX (Total World) | Vanguard FTSE All-World UCITS ETF | VWRL/VWRP | ETF | 0.19% | £48bn+ |

| VOO/SPY (S&P 500) | iShares Core S&P 500 UCITS ETF | CSPX | ETF | 0.07% | £116bn+ |

| QQQ/QQQM (NASDAQ-100) | Invesco EQQQ NASDAQ-100 UCITS ETF | EQQQ | ETF | 0.30% | £10bn+ |

| VGT (US Technology) | iShares S&P 500 Info Tech Sector UCITS ETF | IUIT | ETF | 0.15% | £4bn+ |

| VYM (High Dividend) | iShares UK Dividend UCITS ETF | IUKD | ETF | 0.40% | £700m+ |

| BND (Total Bond) | iShares Core UK Gilts UCITS ETF | IGLT | ETF | 0.07% | £2bn+ |

| VXUS (International) | iShares Core MSCI World UCITS ETF | SWDA | ETF | 0.20% | £123bn |

| VB (Small Cap) | SPDR S&P 600 US Small Cap UCITS ETF | ZPRR | ETF | 0.30% | £1bn+ |

What are the alternatives to popular US funds?

UK investors can find suitable alternatives across various fund categories that mirror the investment objectives of popular US funds while adhering to local regulatory frameworks.

Total Stock Market Funds:

UK equivalents to popular US total stock market funds offer broad exposure to domestic and international equities, appealing to investors seeking diversified portfolios.

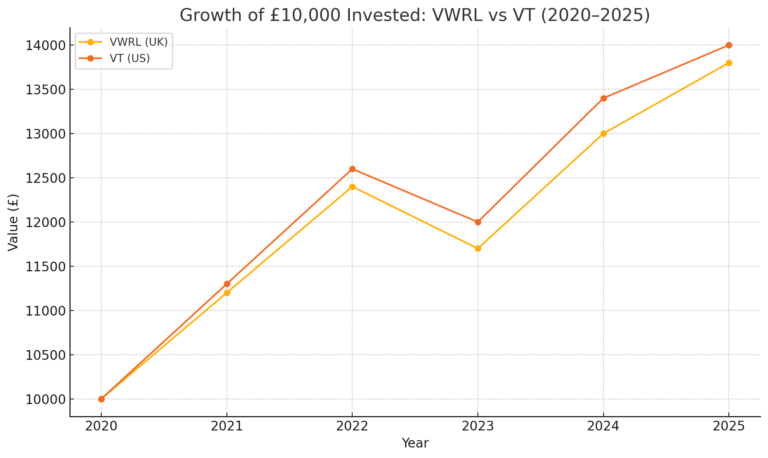

VT & VTWAX UK equivalents

UK investors looking for alternatives to Vanguard Total World Stock ETF (VT) or Vanguard Total World Index Fund Admiral Shares (VTWAX) can consider global equity funds like the Vanguard FTSE All-World UCITS ETF (VWRL). VWRL tracks the FTSE All-World Index, providing exposure to large and mid-cap stocks across developed and emerging markets, offering comprehensive global diversification.

VTSAX & VTI UK equivalents

For exposure similar to Vanguard Total Stock Market Index Fund Admiral Shares (VTSAX) or Vanguard Total Stock Market ETF (VTI), UK investors may opt for funds such as the Legal & General UK Index Trust (C) Accumulation. This fund tracks the performance of the FTSE All-Share Index, representing the broader UK equity market with a focus on large-cap stocks, aligning closely with US total stock market characteristics.

VOO & SPY UK equivalents

UK equivalents to US large-cap ETFs like Vanguard S&P 500 ETF (VOO) or SPDR S&P 500 ETF Trust (SPY) include the iShares Core S&P 500 UCITS ETF (CSPX). CSPX mirrors the performance of the S&P 500 Index, offering exposure to 500 of the largest US companies, providing UK investors with direct access to the US large-cap segment while mitigating currency risks.

Large Cap and Growth Funds:

UK alternatives to US large-cap and growth funds cater to investors seeking stable returns and growth opportunities within established companies.

VFIAX UK equivalent

The UK equivalent to Vanguard 500 Index Fund Admiral Shares (VFIAX) is represented by the HSBC FTSE 100 Index Fund (C). This fund tracks the FTSE 100 Index, composed of the largest companies listed on the London Stock Exchange by market capitalization, providing exposure to leading UK blue-chip stocks with potential for steady growth and dividend income.

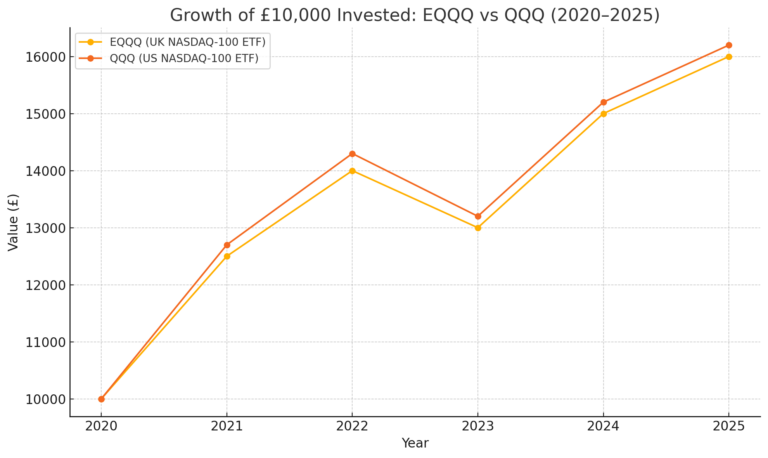

QQQ & QQQM UK equivalents

For exposure to technology and innovation sectors akin to Invesco QQQ Trust (QQQ) or Invesco QQQM ETF (QQQM), UK investors can consider the Invesco EQQQ NASDAQ-100 UCITS ETF (EQQQ). EQQQ tracks the performance of the NASDAQ-100 Index, comprising non-financial companies listed on the NASDAQ Stock Market, offering growth potential driven by leading global technology firms.

VTV UK equivalent

UK investors seeking US value stocks similar to Vanguard Value ETF (VTV) can explore the SPDR Russell 1000 US Value ETF (SVLU). SVLU tracks the performance of US large-cap value stocks within the Russell 1000 Index, focusing on companies with lower price-to-book ratios and higher dividend yields, suitable for value-oriented investment strategies.

VBR & AVUV UK equivalents

UK equivalents to US small-cap value ETFs like Vanguard Small-Cap Value ETF (VBR) or Avantis U.S. Small Cap Value ETF (AVUV) include the iShares MSCI UK Small Cap ETF (CUKS). CUKS tracks the MSCI UK Small Cap Index, offering exposure to small-cap stocks listed on the London Stock Exchange, emphasizing companies with strong growth potential and attractive valuations.

Dividend and Income Funds:

UK equivalents focusing on dividend-paying stocks provide investors with stable income streams and potential for capital appreciation.

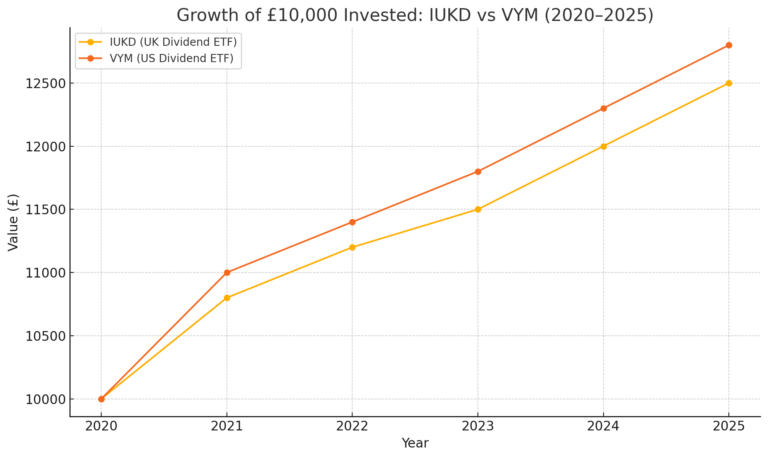

VYM UK equivalent

The UK equivalent to Vanguard High Dividend Yield ETF (VYM) is the iShares UK Dividend UCITS ETF (IUKD). IUKD invests in UK companies with a track record of consistent dividend payments, offering income stability and exposure to sectors such as utilities, telecommunications, and consumer staples.

SCHD UK equivalent

For exposure to US dividend equities similar to Schwab U.S. Dividend Equity ETF (SCHD), UK investors can consider the SPDR S&P US Dividend Aristocrats UCITS ETF (UKDV). UKDV tracks the performance of high-dividend-yielding US companies that have increased dividends for at least 20 consecutive years, emphasizing dividend sustainability and income generation.

Global and International Funds:

UK equivalents to global and international funds provide diversified exposure outside the UK market, enhancing portfolio diversification and capturing global economic growth.

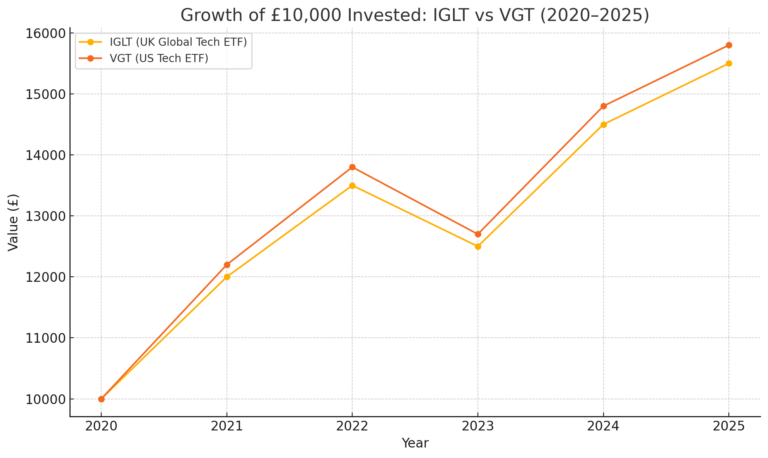

VGT UK equivalent

Investors seeking exposure to global technology companies similar to Vanguard Information Technology ETF (VGT) can opt for the iShares Global Tech ETF (IGLT). IGLT invests in technology companies worldwide, including major US tech giants, offering growth potential driven by technological innovation and sector-specific advancements.

VXUS UK equivalent

For broader international equity exposure akin to Vanguard Total International Stock ETF (VXUS), UK investors can consider the HSBC MSCI World UCITS ETF (HMWO). HMWO tracks the MSCI World Index, encompassing large and mid-cap stocks across developed and emerging markets outside the UK and US, providing comprehensive global diversification.

Bond Funds:

UK equivalents to US bond funds offer fixed-income opportunities with varying risk profiles and investment objectives.

BND UK equivalent

The UK equivalent to Vanguard Total Bond Market ETF (BND) includes funds such as the iShares Core UK Gilts UCITS ETF (IGLT). IGLT focuses on UK government bonds, offering income stability and capital preservation with minimal credit risk, suitable for investors seeking low-risk fixed-income investments.

Additional Funds to Consider:

Beyond core categories, additional fund sectors offer niche opportunities and sector-specific exposure.

Technology Sector Funds:

Investors interested in the technology sector can explore UK equivalents focusing on global tech stocks.

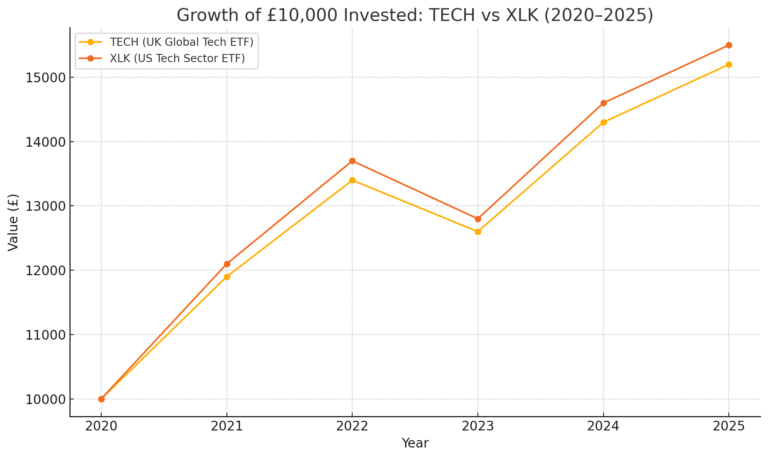

XLK UK equivalent

For exposure similar to Technology Select Sector SPDR Fund (XLK), UK investors can consider the Lyxor MSCI World Information Technology UCITS ETF (TECH). TECH tracks the MSCI World Information Technology Index, providing diversified exposure to global technology companies including US giants like Apple and Microsoft.

Healthcare Sector Funds:

UK equivalents focusing on healthcare stocks offer opportunities in pharmaceuticals, biotechnology, and healthcare services.

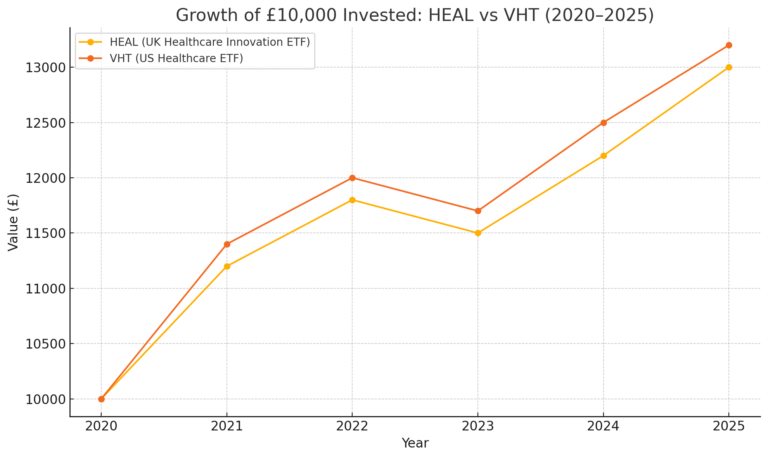

VHT UK equivalent

The UK equivalent to Vanguard Health Care ETF (VHT) is the iShares Healthcare Innovation UCITS ETF (HEAL). HEAL invests in global healthcare companies involved in medical research, drug development, and healthcare delivery, emphasizing innovation and growth potential.

Small Cap Funds:

UK equivalents to US small-cap funds cater to investors seeking exposure to smaller companies with growth potential.

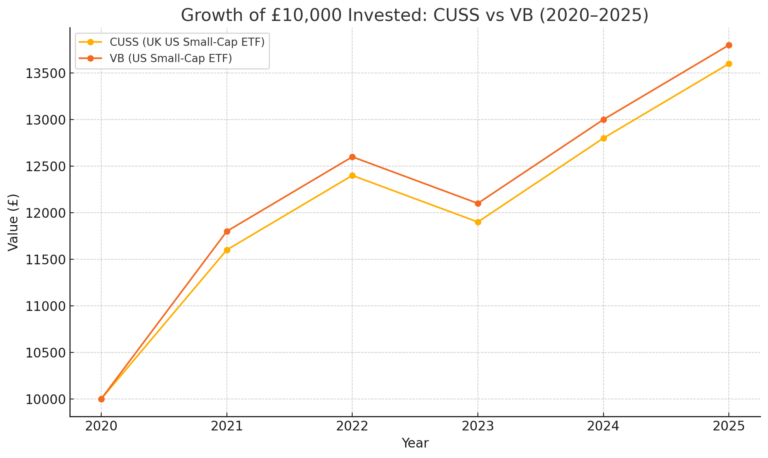

VB UK equivalent

For exposure to US small-cap stocks similar to Vanguard Small-Cap ETF (VB), UK investors can consider the SPDR S&P US Small Cap UCITS ETF (CUSS). CUSS tracks the S&P SmallCap 600 Index, offering exposure to US small-cap stocks with potential for capital appreciation and diversification benefits.

Exploring Specialized Funds:

Specialized funds cater to specific investment themes and market segments, providing targeted exposure and potential for enhanced returns.

Emerging Markets Funds:

Investors looking for exposure to emerging markets can explore sector-specific ETFs that focus on distinct industries and economic sectors within developing regions.

Sector-specific ETFs

Sector-specific ETFs such as the iShares MSCI Emerging Markets Health Care Sector UCITS ETF (EMHU) provide targeted exposure to healthcare companies in emerging markets. EMHU focuses on pharmaceuticals, biotechnology, and healthcare services in regions like Asia, Latin America, and Eastern Europe, offering growth potential driven by demographic trends and healthcare infrastructure development.

Summary

UK investors in 2026 have access to a comprehensive suite of UCITS ETFs that match or closely replicate every major US fund strategy. The landscape has never been more competitive: Vanguard’s 13 fee reductions throughout 2025 — including cuts to its FTSE All-World, Emerging Markets, and regional ETFs — mean UK investors now pay less than ever for global equity exposure.

For core portfolios, the choices are clear: CSPX or VUSA for S&P 500 exposure at 0.07% TER, VWRL/VWRP for total world markets at 0.19%, SWDA for developed world at 0.20%, and EQQQ for NASDAQ-100 exposure. All are ISA-eligible, trade in GBP on the London Stock Exchange, and benefit from Ireland’s favourable tax treaty with the US.

Looking ahead, the FCA’s new Consumer Composite Investments (CCI) regime — effective June 2027 — will replace PRIIPs with more flexible disclosure requirements, though the core restriction on buying US-domiciled ETFs directly will remain. For now, these UCITS alternatives deliver the same investment outcomes with lower costs and better tax treatment than their US counterparts.

Featured Broker

- Copy Trading

- User Friendly Platform

- Regulated & Trusted

- 30 Million+ Users

61% of retail CFD accounts lose money when trading CFD’s with this provider.

FAQs

What is the best UK equivalent to the Vanguard Total Stock Market ETF (VTI)?

The Legal & General UK Index Trust (C) Accumulation is a suitable UK alternative, tracking the FTSE All-Share Index and offering broad exposure to UK equities similar to VTI.

Why can’t I buy US-based funds in the UK?

US-based funds face regulatory restrictions and tax implications under UCITS regulations, making them difficult to purchase directly in the UK without suitable local equivalents.

How do I choose the right UK equivalent for my investment strategy?

Select UK equivalents based on performance history, expense ratios, and sector exposure. Compare these factors with their US counterparts to align with your financial goals and risk tolerance.

Are there UK funds that mirror the performance of the S&P 500?

Yes, the iShares Core S&P 500 UCITS ETF (CSPX) is a UK fund that closely tracks the S&P 500 Index, providing similar exposure to large-cap US companies.

Can I invest in UK equivalents of US bond funds?

Yes, the iShares Core UK Gilts UCITS ETF (IGLT) serves as a UK equivalent to US bond funds like the Vanguard Total Bond Market ETF (BND), focusing on UK government bonds.