Compare UK Brokers with Confidence

Discover why we're the UK's #1 online resource for in-depth broker reviews and comparisons. Use our expertise to choose the right platform for you.

Award-Winning Brokers

Our experts have reviewed and ranked the top brokers for UK traders

Capital.com

Award-winning mobile trading app with AI-powered insights, commission-free trading* on 5,000+ markets including stocks, forex, indices, and commodities. FCA-regulated (UK), with additional oversight from CySEC, ASIC, and SCB. *Other fees may apply.

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 60% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work and whether you can afford to take the high risk of losing your money.

Pepperstone

Award-winning forex and CFD broker with ultra-fast execution, tight spreads, and access to TradingView, MT4, MT5, and cTrader platforms.

75.2% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

SpreadEx

UK specialist spread betting & CFD provider with competitive spreads, fast execution, and extensive range of markets including financials and sports.

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 64.5% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider.

CMC Markets

Award-winning UK broker with advanced Next Generation platform, offering over 12,000 instruments including shares, indices, forex, and commodities with competitive spreads.

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 67% of retail investor accounts lose money when trading spread bets and CFDs with this provider.

eToro

Leading social trading platform with excellent range of assets including stocks, crypto, ETFs and copy trading features.

51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Our Most Extensive Guides

In-depth reviews and comparisons of the UK's leading investment platforms, trading apps, and crypto exchanges — tested with real accounts by our editorial team.

Best AI Trading Robots in the UK

Best CFD Broker UK

Best Crypto Apps in the UK

Best Crypto Exchanges UK

Best Day Trading Platforms in the UK

Best Investment Apps in the UK

Best Investment Platforms in the UK

Best Options Trading Platform UK

Best Spread Betting Platform UK

Best Stock Trading Apps UK

Best Trading Platforms UK

eToro Promo UK – Claim Up to £500 in Free Stocks

Independent Research You Can Actually Trust

We open real accounts, deposit real money, and test every platform ourselves. Our Financial Intelligence Reports document actual spreads, verify FCA registration, and provide specific, timestamped data—not recycled marketing claims.

Learn about our methodologyMoney, Business & Investing — Out Loud

Weekly episodes breaking down the stories, strategies and decisions that shape how people build wealth. Hosted by Isiah and the TIC team — real talk, no fluff.

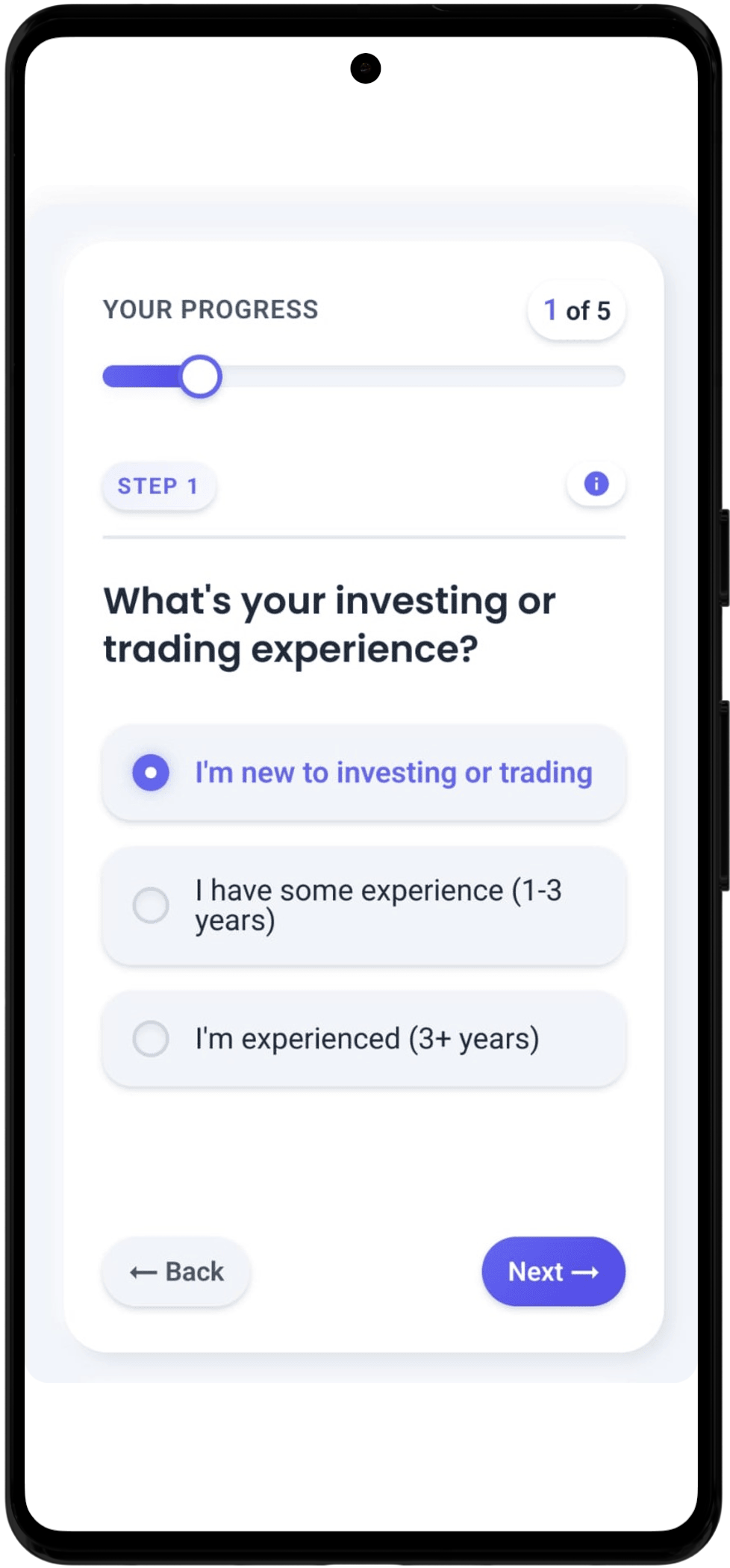

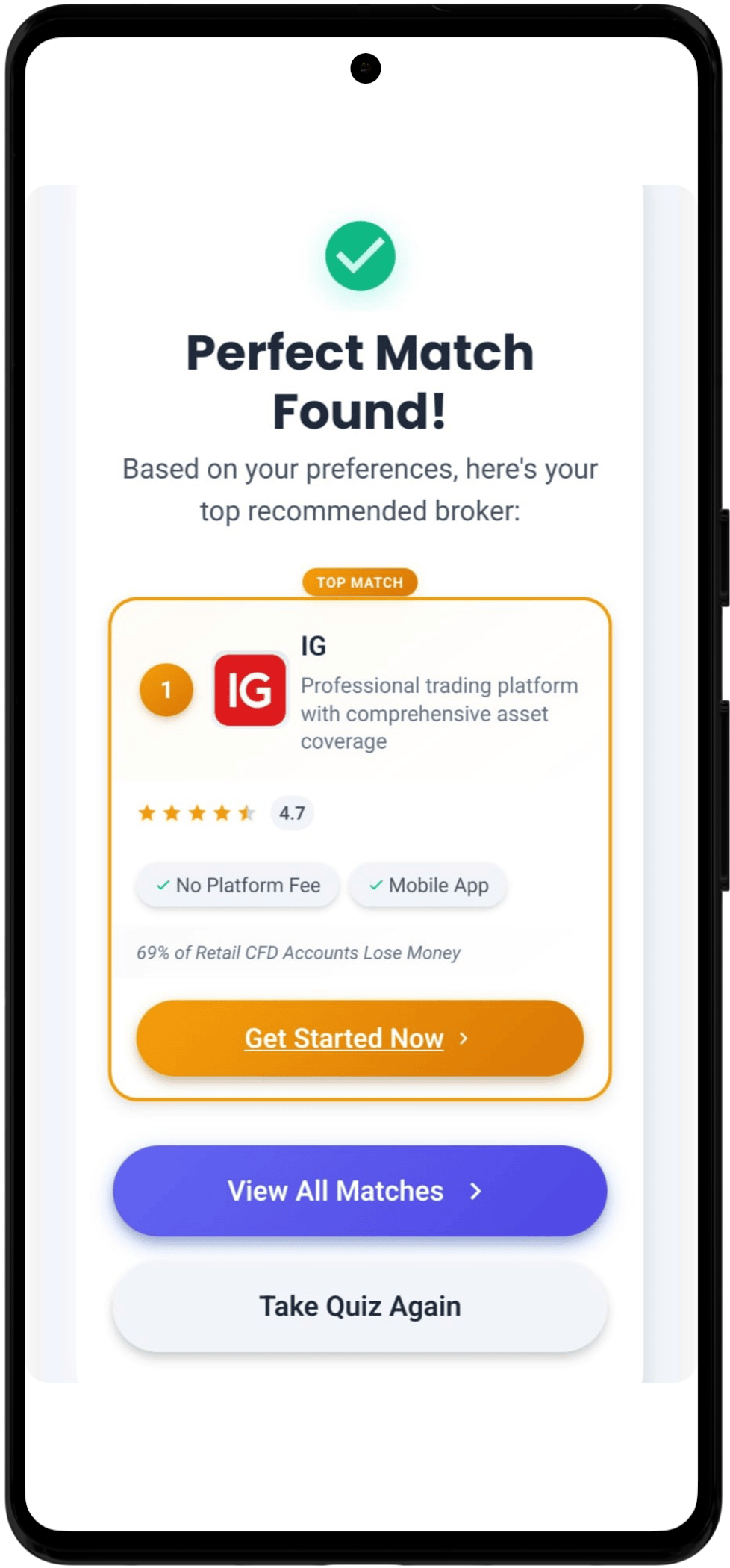

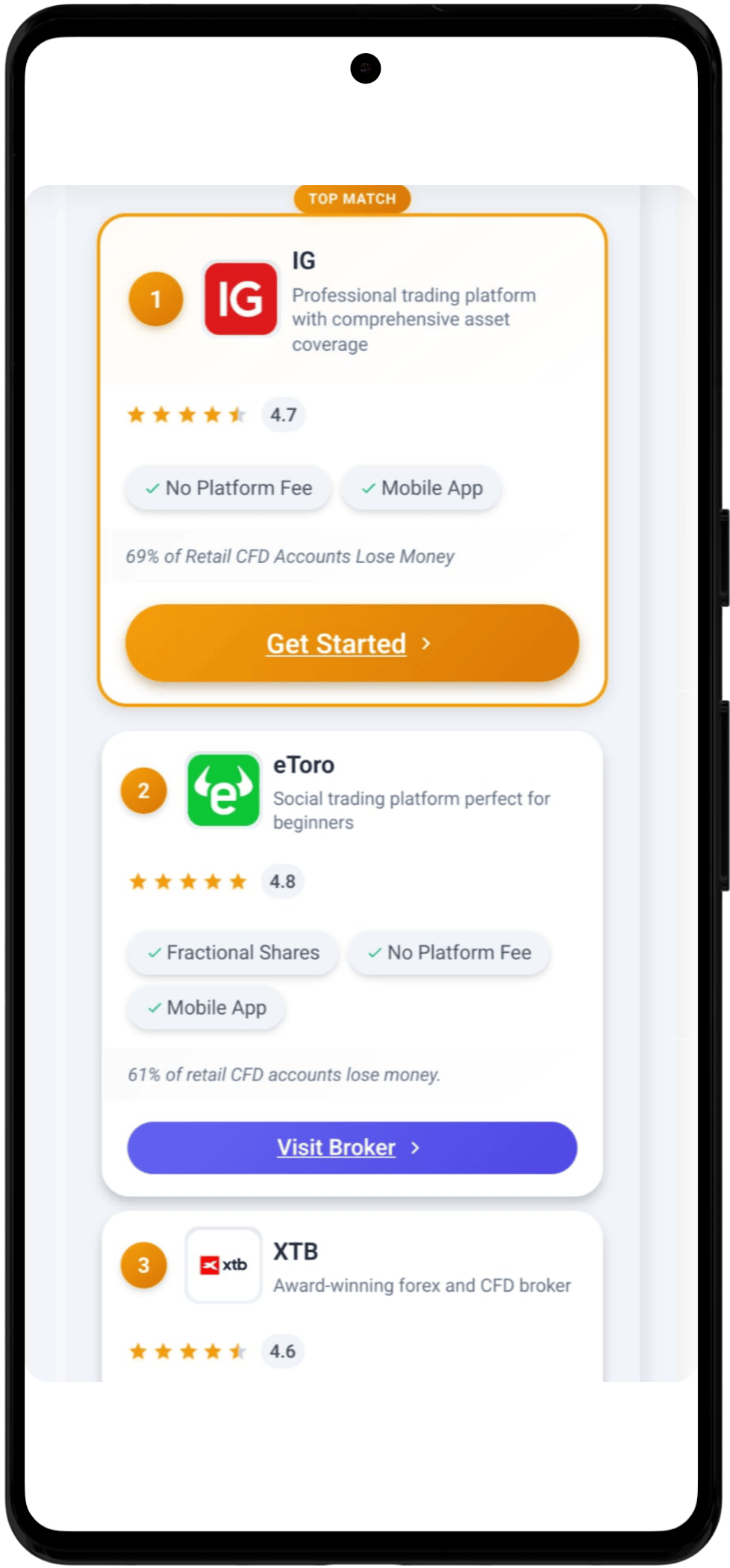

Compare Our Trusted Brokers in Seconds

Find the perfect platform for your needs. Our comparison tool shows real fees, features, and performance data to help you make the right choice.

- ✓ Compare fees, features & performance instantly

- ✓ Get personalized recommendations based on your needs

- ✓ 100% free, unbiased, and transparent

Your Guide to UK Investment Platforms

We provide comprehensive, unbiased reviews and comparisons of investment platforms, ISAs, and SIPPs to help you make informed financial decisions.

As Featured In

Unbiased Reviews of Popular Brands & Platforms

We evaluate each platform across various categories, assigning points based on qualitative factors. These points are then translated into star ratings.

Learn About Our Testing Process

How We Help UK Investors Compare Platforms

We provide detailed information and analysis of UK investment platforms. Our independent research helps you understand fees, features, and services so you can make your own informed decisions.

Our 4-Pillar Research Process

Every platform undergoes the same comprehensive analysis to provide you with comparable information

Cost Analysis

We document all fees and charges, including platform fees, trading costs, and any hidden charges across different account types

Platform Testing

We test each platform's functionality, user interface, mobile apps, and customer service to report on the actual user experience

Feature Comparison

We catalogue available investments, tools, research resources, and account types to help you understand what's offered

Regulation Check

We verify FCA authorisation status, FSCS protection coverage, and document security measures for your information

See Our Research In Action

Explore our comprehensive platform reviews to see how we apply our research methodology. Each review provides detailed analysis of fees, features, and services to help you make informed investment decisions.

Browse Platform ReviewsGet In Touch

Have questions about trading platforms or need personalized guidance? Our expert team is here to help you make informed investment decisions.

Send Us a Message

info@theinvestorscentre.co.uk

Great Whelnetham, Bury St Edmunds,

IP30 0UN, United Kingdom

Find Us

Why Choose Us?

Frequently Asked Questions

Learn more about The Investors Centre and how we help UK investors find the right platform

What is The Investors Centre?

The Investors Centre is an independent UK financial comparison website operated by TIC Investments Ltd (Companies House number 15242358). We test investment platforms, trading brokers, and cryptocurrency exchanges with real money, publishing in-depth reviews and educational guides to help UK investors make informed decisions.

We are not a broker, financial advisor, or investment firm. We do not manage funds, accept deposits, or provide personalised financial advice. Our comparison service is free for all users.

Is The Investors Centre the same as The Investment Center on the FCA warning list?

No. The Investors Centre (TIC Investments Ltd, company number 15242358) is a completely separate organisation from "The Investment Center" that appears on the Financial Conduct Authority (FCA) warning list. We have no business, legal, or operational connection to that entity whatsoever.

We are a financial comparison and education website — we do not provide investment advice, manage client funds, accept deposits, or operate as a broker or financial services provider. You can verify our company registration at any time on the Companies House website. For full details, visit our Company Information page.

Is The Investors Centre affiliated with Computershare Investor Centre?

No. The Investors Centre (TIC Investments Ltd) is not affiliated with Computershare Investor Centre (Computershare's online shareholder management portal) or with The Investors Center, Inc., a US-based company. These are entirely different organisations with no business, legal, or operational relationship to us. Any similarity in names is coincidental.

How does The Investors Centre evaluate trading platforms?

We follow a structured review process that examines key factors including:

- Regulatory status and FCA compliance

- Fee structures, spreads, and hidden costs

- Platform usability, features, and mobile apps

- Customer service responsiveness and withdrawal speeds

Our editorial team opens real-money accounts with each broker, deposits our own capital, carries out test trades, and records observations across different asset classes. This hands-on process allows us to create comparative reviews that reflect the actual user experience rather than marketing claims.

Please note: our reviews are intended for informational purposes only and should not be taken as investment advice or a guarantee of platform performance.

How does The Investors Centre maintain editorial independence?

The Investors Centre is funded through an affiliate model — if a user clicks through to a broker via one of our links and opens an account, we may receive a commission. However, our reviews are written without input from commercial partners. Affiliate relationships do not determine our ratings, scoring, or editorial conclusions.

We maintain a strict "No-Buy" promise: if a broker fails our security checks, hides fees, or blocks withdrawals during testing, they do not make our rankings regardless of commercial terms offered. We have rejected partnerships with over 20 unregulated platforms to protect our readers.

Is The Investors Centre a legitimate company?

Yes. The Investors Centre is the trading name of TIC Investments Ltd, a company registered in the United Kingdom with Companies House under company number 15242358. Our registered office is at Unit Gf4, Eagle House, Great Whelnetham, Bury St Edmunds, IP30 0UN, United Kingdom.

The company is co-founded and directed by Thomas Drury (ACII), Adam Woodhead, and Dom Farnell. You can verify our registration directly on the Companies House website.

Does The Investors Centre provide financial advice?

No. The Investors Centre does not provide personal financial advice, manage investment funds, accept client deposits, or operate as a broker or financial services provider. Our content is strictly educational and informational — we are a comparison and review website that helps readers research platforms independently.

We always recommend consulting a qualified financial advisor before making investment decisions.

How can I verify I am on the real Investors Centre website?

Our official websites are theinvestorscentre.co.uk (for UK readers) and theinvestorscentre.com (for international readers). Both are owned and operated by TIC Investments Ltd (company number 15242358). Check that the URL in your browser matches one of these domains and that the site uses HTTPS encryption.

If you are contacted by anyone claiming to be from "The Investment Center" requesting direct investment or fund transfers, that is not us. We never solicit investments, request fund transfers, or promise guaranteed returns.