7 Best Options Brokers UK (2025)

Thomas Drury

Co-Founder

Seasoned finance professional with 10+ years' experience. Chartered status holder. Proficient in CFDs, ISAs, and crypto investing. Passionate about helping others achieve financial goals.

Twitter ProfileAuthor Bio

Dom Farnell

Co-Founder

Dom, a Co-Founder at TIC, is an avid investor and experienced blogger who specialises in financial markets and wealth management. He strives to help people make smart investment decisions through clear and engaging content.

Twitter ProfileAuthor Bio

Fact Checked

How we test

At The Investors Centre, we pride ourselves on our rigorous fact-checking process. To delve deeper into our meticulous testing procedures and discover how we ensure accuracy and reliability, visit our dedicated page on how we test.

Risk Warning

Please bear in mind that trading involves the risk of capital loss. 51% to 84% of retail investor accounts lose money when trading CFDs with the providers below. You should consider whether you can afford to take the high risk of losing your money.

Last Updated 14/04/2025

If you’ve ever wished you could profit from a market move without actually owning the underlying asset, then welcome to the world of options trading. Options give you the right—but not the obligation—to buy or sell an asset at a specific price, within a set time frame. So discover our handpicked selection of reputable, regulated brokers for 2025, each rigorously tested with real funds. All brokers are available to traders in the United Kingdom.

1

IG

Options Trading Score: 4.9/5

71% of Retail CFD Accounts Lose Money

SpreadEX

Options Trading Score: 4.8/5

81% of retail CFD accounts lose money.

XTB

Options Trading Score: 4.7/5

73% of Retail CFD Accounts Lose Money

4

AvaTrade

Options Trading Score: 4.5/5

76% of retail CFD accounts lose money.

Quick Answer: What is the best platform for Options Trading in the UK?

In 2025, IG stands out as the top choice for Options trading in the UK, known for its user-friendly platform combined with advanced features. Another platform with advanced technical tools, Spreadex, offers a superior range of options and sophisticated functionalities, catering well to experienced traders.

Here are the top 7 Options Brokers in the UK

- IG – Overall Platform, Versatile and Reliable

- Spreadex – Intermediate Traders, Comprehensive Features

- XTB – Fast Execution, Free Market Analysis, User-Friendly Interface

- AvaTrade – Beginners, Easy to Use

- Saxo – Advanced Analytical Tools, Professional-Grade Platform

- Interactive Brokers – Low Trading Costs, Wide Market Access

- Plus500 – CFD Options Trading, Intuitive and Efficient

What Is Options Trading?

When you buy an option, you’re buying the right (not the obligation) to either buy (a call option) or sell (a put option) an underlying asset at a set price, within a certain period.

You’re not buying the stock or asset—you’re just buying the right to act on it. That’s what gives options so much flexibility, but also where things can get a bit technical.

In the UK, you can trade both UK and international options—most commonly on big-name stocks and indices like the FTSE 100, or currency pairs like GBP/USD. Personally, I started with US options on companies like Apple and Tesla through an FCA-regulated broker. They’re more liquid, have tighter spreads, and tend to offer better educational support.

The difference between direct options trading (like Interactive Brokers or IG) and CFD-based options exposure (such as eToro or Plus500). With direct options, you’re trading listed contracts—actual calls and puts. With CFDs, you’re speculating on the price of an option, but you’re not trading the contract itself. Both have pros and cons, but direct options give you more control over strategy building.

Is Trading Options Legal In The UK?

Yes—options trading is perfectly legal in the UK as long as you’re using a broker authorised by the Financial Conduct Authority (FCA). There is risk involved —but with the right platform and a bit of education, it is quite manageable.

What Are the Best Options Trading Platforms in the UK?

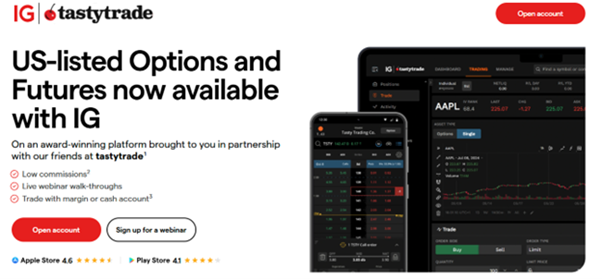

IG - Overall Platform, Versatile and Reliable

IG offers access to a wide range of global options markets through a powerful, regulated platform. It’s well-known for its advanced trading tools, reliable execution, and top-tier educational support. For traders serious about options, it ticks nearly every box.

Pros & Cons

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 71% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

- Access to global stocks, indices, and commodities

- Professional-grade platform with strong charting tools

- Extensive educational resources (via IG Academy)

- Excellent trade execution and platform reliability

- Some options fees may be higher vs. competitors

- £250 minimum deposit may deter casual traders

- Feature-rich platform may overwhelm beginners

- Customer support can be slow during busy periods

What Do Our Experts Say?

IG combines robust tools, deep market access, and top-tier education—ideal for committed UK options traders.

Why I'd use it for Options Trading:

IG offers Direct Market Access (DMA), advanced order types, and real-time options analytics—all backed by FCA regulation. I also found their dedicated options section in IG Academy to be one of the best learning tools out there.

Spreadex - Intermediate Traders, Comprehensive Features

Spreadex is a UK-based platform that specialises in spread betting and CFDs, offering a flexible trading environment across forex, indices, commodities, and shares. It’s designed more for active traders than long-term investors, and it delivers on usability, market access, and cost-efficiency.

Pros & Cons

81% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

- Wide range of markets for spread betting and CFDs

- All-in-one platform with a user-friendly interface

- Low trading costs and competitive spreads

- Strong customer service with personalised support

- No ISAs or non-leveraged investment accounts

- Limited international access (mostly UK & Ireland)

- Doesn’t support MT4/MT5 (but does offer TradingView integration)

What do our Experts Say?

Spreadex is a solid pick for intermediate UK traders who want simplicity, flexibility, and competitive pricing in one place.

Why I'd use it for Options Trading:

Spreadex gives me access to diversified spread betting opportunities across key asset classes, and I’ve found the platform intuitive and responsive. The personalised support has been a bonus when I’ve needed help fine-tuning my approach or navigating the markets.

XTB - Fast Execution, Free Market Analysis, User-Friendly Interface

XTB delivers where it counts—fast execution, competitive spreads, and a clean, intuitive trading platform. The xStation 5 interface is especially useful for options traders who want quick, efficient access without the complexity of pro-level platforms. Add in free market analysis and personal support, and it’s a solid all-rounder.

Pros & Cons

73% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

- Fast execution—key for options trading timing

- User-friendly xStation 5 platform

- Tight spreads help reduce costs

- Personal account managers and responsive support

- Fewer options products vs. larger brokers

- Missing some advanced features for pros

- Options education could be more robust

- Occasional downtime during maintenance windows

What do our Experts Say?

XTB strikes a strong balance between ease of use and performance—great for traders who want fast execution without a steep learning curve.

Why I'd use it for Options Trading:

I like that XTB simplifies the options trading process without dumbing it down. The analysis tools are solid, and having a personal account manager has helped me stay on track with strategy and execution—especially when I was still refining my approach.

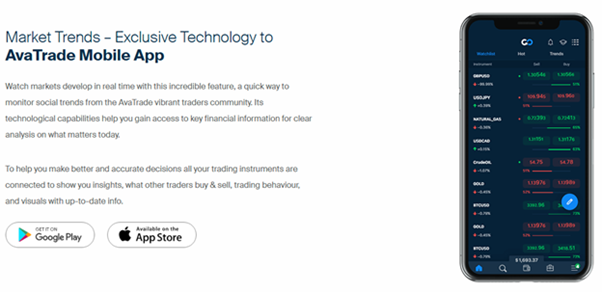

AvaTrade - Beginners, Easy to Use

AvaTrade is a user-friendly broker that stands out for its dedicated AvaOptions platform, offering a clean interface and useful tools for trading both forex and options. It’s especially well-suited for beginners, with solid educational content and risk management features built right in.

Pros & Cons

76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

- Strong education hub to build trading knowledge

- AvaOptions offers combined forex and options trading

- Automated trading features available

- Fully regulated and secure

- Spreads are a bit wider than some rivals

- Inactivity fees apply

- Limited instruments in some regions

- Withdrawals can be slower than average

What do our Experts Say?

AvaTrade is a great starting point for beginners—simple, supportive, and backed by a regulated, secure platform.

Why I'd use it for Options Trading:

AvaOptions is a great platform for blending spot and options trading. I like the risk tools and portfolio simulations—it’s helped me test ideas before committing real capital. And for anyone just starting out, the education support is genuinely useful.

Saxo - Advanced Analytical Tools, Professional-Grade Platform

Saxo Bank offers one of the most sophisticated trading platforms on the market, built with professional and high-net-worth traders in mind. From deep global options access to robust analytical tools, it’s a platform that rewards experience and strategic thinking.

Pros & Cons

64% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

- Broad global access to options across markets

- Powerful analytical and strategy-building tools

- Industry-leading market research and insights

- Premium customer service and support

- Steep learning curve for beginners

- Higher fees on some trades

- Not ideal for smaller accounts or casual traders

What do our Experts Say?

Saxo is best suited for experienced traders who want full control, deep research, and premium execution.

Why I'd use it for Options Trading:

When I’m running complex strategies or trading across multiple markets, Saxo’s tools are unmatched. The platform offers deep analytics, custom strategies, and a level of market visibility that few others provide. It’s built for serious trading.

Interactive Brokers - Low Trading Costs, Wide Market Access

Interactive Brokers is a global powerhouse, known for razor-thin commissions and access to just about every options market out there. It’s packed with advanced tools, making it ideal for active or professional traders who want complete control over strategy and execution.

Pros & Cons

62.5% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

- Ultra-low commissions on options trades

- Huge range of products: equities, indices, futures

- Pro-level platforms like Trader Workstation (TWS)

- Excellent research and risk management tools

- Platform can feel overwhelming for new users

- Market data fees can stack up monthly

- Customer support may lag during busy periods

- Desktop interface isn’t the most intuitive

What do our Experts Say?

IBKR is perfect for experienced traders who need deep tools, low fees, and access to global options markets.

Why I'd use it for Options Trading:

IBKR’s tools are second to none. I use Risk Navigator to map out potential portfolio outcomes and the Options Strategy Lab to quickly build and test multi-leg trades. If you’re serious about options, this is a platform that lets you trade like a pro.

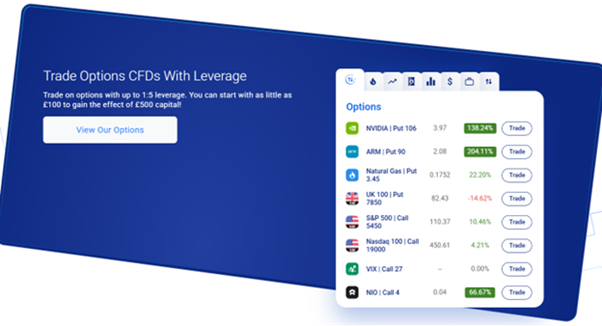

Plus500 - CFD Options Trading, Intuitive and Efficient

Plus500 offers an easy-to-use platform for trading CFDs on options, making it accessible for beginners and casual traders. While it doesn’t support direct options contracts, the interface is clean, and its built-in risk management tools are a standout feature.

Pros & Cons

80% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

- Intuitive interface that’s easy to learn

- Built-in tools like stop-loss and guaranteed stop

- Competitive spreads on option CFDs

- Broad market access via CFD format

- No direct options trading—CFDs only

- Limited tools for advanced strategies

- Educational content could be better

- Support quality can vary

What do our Experts Say?

Plus500 is a simple, low-barrier entry point for traders wanting CFD-style exposure to options—no complex setups required.

Why I'd use it for Options Trading:

When I’m looking for a quick way to gain options exposure without building complex strategies, Plus500 makes it easy. The platform’s simplicity, paired with effective risk tools, is perfect for straightforward directional trades.

How Do These Options Brokers Compare?

| Rank | Broker | % Retail Accounts Losing Money | Regulatory Authority | Minimum Deposit | Options Markets Available | Demo Account | Account Types | Spread Costs |

|---|---|---|---|---|---|---|---|---|

| #1 | IG | 69% | FCA (UK), ASIC (AU), MAS (SG) | £250 | Yes | Yes | Standard, ISA | CFDs, Spread Betting, Shares (variable) |

| #2 | Spreadex | 82% | FCA (UK) | £0 | Yes | Yes | Standard, Professional | Varies by market |

| #3 | XTB | 77% | FCA (UK), KNF (Poland) | £250 | Yes | Yes | Standard, Islamic | CFDs only (variable) |

| #4 | AvaTrade | 71% | FCA (UK), ASIC (AU), CBI (Ireland), BVI FSC | $100 | Yes | Yes | Standard, Spread Betting, Islamic | CFDs only (variable) |

| #5 | Saxo | 80% | FCA (UK), MAS (SG), FINRA (US) | Varies by region | Yes | Yes | Classic, Platinum, VIP | Variable (ECN accounts often lower) |

| #6 | Interactive Brokers | 62.5% | FCA (UK), FINRA (US), SFC (HK), MAS (SG) | $100 (Lite), $10,000 (Std) | Yes | Yes | Individual, Joint, IRA, LLC | Variable (volume-based commissions) |

| #7 | Plus500 | 80% | FCA (UK), ASIC (AU) | $100 | Limited | Yes | Standard | CFDs only (variable) |

What Types of Options Can You Trade in the UK?

When I first started exploring options, I was surprised by just how many different types are available to UK traders. It’s not just about betting on stocks going up or down—you’ve got choices depending on your asset class and strategy:

Equity Options. You can trade options on both UK-listed stocks and major US companies, like Apple, Microsoft, or BP. US equity options are usually more liquid and come with better pricing. That said, if you’re more focused on local markets, UK stock options are available through brokers like IG and Saxo.

Index options such as the FTSE 100 and S&P 500. These are great if you want broader exposure without picking individual stocks. I’ve used them a few times to hedge during choppy markets.

Forex options are another option (no pun intended)—particularly pairs like GBP/USD or EUR/USD. These are typically available on more advanced platforms.

Some brokers even offer ETF and commodity options, although access is more limited. If you’re trading through a UK broker with global reach, like Interactive Brokers, you’ll usually have more of these choices.

CFD-based options, like those offered by eToro or Plus500. You don’t own the actual contract—you’re just trading on the price movement. They’re simpler to get into, but less flexible if you want to build complex strategies.

Some platforms will require margin accounts for options trading, and many will ask for approval based on your trading experience. So always check the platform’s requirements before signing up.

Why Are People in the UK Still Trading Options?

I’ve been trading options for a few years now, and while it definitely comes with a learning curve, I can say that the flexibility and risk management possibilities are what really sold me on it. In the UK, I’ve noticed a growing number of investors starting to explore options—especially those looking to hedge existing positions or earn income from sideways markets.

What Should You Look for in an Options Trading Platform?

After testing out a whole bunch of platforms, I’ve narrowed down a solid checklist of what really matters when it comes to trading options—especially from a UK perspective.

Key Platform Features to Prioritise

FCA regulation – This will help with peace of mind when it comes to fund protection and dispute resolution.

Next: transparency around fees. Some brokers charge per contract; others work on spreads. I always look for platforms that clearly lay out what you’re paying—and ideally, offer a breakdown before you hit “confirm.”

Then, the toolkit. At a minimum, I want access to an options chain, Greek calculators, and some strategy builder or volatility charting. These features help you avoid flying blind.

The platform also has to be easy to use. A slick desktop interface and a fast, responsive mobile app are crucial. I do a lot of my trading on the go, and a laggy app can ruin a trade.

Lastly, I check for order types and risk controls—like stop-loss, take-profit, and limit orders. The more control I have over execution, the better.

How To Match the Platform to Your Experience Level

If you’re just starting out, look for platforms with a clean layout, good educational content, and — a demo account. IG, for example, has one of the best educational hubs I’ve used.

For more experienced traders, you’ll probably want multi-leg strategy support, tiered pricing, and access to international markets. Interactive Brokers ticks most of those boxes, but keep in mind that the learning curve is steep.

And in 2025, always keep an eye out for a responsive mobile app. Whether I’m entering a trade or just monitoring my positions, a fast app with full-feature access can make all the difference.

| Platform | Best for |

|---|---|

| IG | Overall Platform, Versatile and Reliable |

| SpreadEx | Intermediate Traders, Comprehensive Features |

| XTB | Fast Execution, Free Market Analysis, User-Friendly Interface |

| AvaTrade | Beginners, Easy to Use |

| Saxo | Advanced Analytical Tools, Professional-Grade Platform |

| Interactive Brokers | Low Trading Costs, Wide Market Access |

| Plus500 | CFD Options Trading, Intuitive and Efficient |

What Option Trading Fees Should I Expect?

Fees can really sneak up on you in options trading, so I always make a point of knowing exactly what I’m being charged before placing a trade. Here’s what I usually look out for:

- Commissions – Most platforms charge per trade or per contract. It’s not always a dealbreaker, but it adds up fast if you’re trading frequently.

- Spreads – The tighter the spread, the cheaper the trade. I pay close attention to this—especially on less liquid contracts.

- Contract Fees – Some brokers charge a small fee for every contract you trade. Doesn’t sound like much, but do a multi-leg strategy and it can get pricey.

- Exercise or Assignment Fees – If I hold to expiry and the option gets exercised or assigned, there’s sometimes an extra charge.

- Platform Fees – A few brokers charge monthly fees for access to advanced tools or real-time data. I try to avoid these unless the tools are genuinely worth it.

Pro Tip: Always check the fine print. And if you’re a high-volume trader, don’t be afraid to ask for better rates—I’ve done it, and it pays off.

| Rank | Platform | Commission | Strategy Tools | Mobile App | Demo Available | Account Approval Needed |

|---|---|---|---|---|---|---|

| #1 | IG | £0.10–£0.30 | Yes | Yes | Yes | Basic KYC |

| #2 | Spreadex | Spread-based | Yes | Yes | Yes | Basic KYC |

| #3 | XTB | Spread-based | Limited | Yes | Yes | Basic KYC |

| #4 | AvaTrade | Commission-free (spread only) | Limited | Yes | Yes | Basic KYC |

| #5 | Saxo Markets | £1.00+ | Yes | Yes | No | Yes |

| #6 | Interactive Brokers (IBKR) | $0.15–$0.65 | Yes (advanced) | Yes | Yes | Tiered approval process |

| #7 | Plus500 | Spread-based | No | Yes | Yes | Basic KYC |

What Are the Risks of Trading Options?

I’ll be honest—options trading isn’t for the faint of heart. It can be incredibly rewarding, but there are definitely risks, especially if you’re diving in without a plan. Here are some of the common risks:

The first big one? Leverage. Options give you a lot of exposure for a relatively small investment. That’s great when the trade works in your favour, but it can backfire fast. I’ve seen losses mount quickly on trades where I was too aggressive with position sizing.

Then there’s time decay. Options lose value as they approach expiry, especially if the market isn’t moving much. I used to underestimate this, thinking I just needed to be directionally right. Turns out, timing matters just as much.

Volatility traps are another issue—an option might look cheap, but if volatility spikes or drops suddenly, your pricing can go out the window. And don’t get me started on complex strategies like iron condors or straddles unless you’ve really done your homework.

How Do I Manage Risk When Trading Options?

I’ve learned to treat every trade like it could be my worst—because sometimes, it is. That’s why risk management tools aren’t optional for me—they’re the foundation of everything I do.

Here’s what I focus on:

- Stop-loss orders are my safety net. I always set a clear exit before entering a trade. If it turns against me, I’d rather take a small hit than spiral into a big loss.

- Position sizing matters. I stick to risking no more than 2–3% of my capital on any one trade—it helps manage leverage and avoid big drawdowns.

- I spread trades across assets and strategies to manage currency risk, liquidity issues, and overexposure.

- I use defined risk strategies like spreads and protective puts to control downside, especially when holding stock.

- Time decay is a constant factor—especially in short-dated trades—so I always keep an eye on the expiration date and implied volatility to time my entries better.

- I avoid surprises by understanding margin interest costs and ensuring I have negative balance protection in place—just in case the market moves faster than I can react.

- And let’s not forget counterparty risk—I stick with regulated brokers to reduce that kind of exposure.

Ultimately, I trade only with money I can afford to lose. The plan is simple: manage risk, stay flexible, and keep learning. That’s what’s kept me in the game over the long run.

Is Options Trading Right for You? Here are the Pros and Cons:

| Pros | Cons |

|---|---|

| Flexible Strategies – I can profit in up, down, or sideways markets. | Steep Learning Curve – It took me a while to fully grasp the mechanics. |

| Defined Risk – With the right setup (like spreads), I know my max loss going in. | Time Decay – If I’m not careful with expiry dates, time can eat away at profits. |

| Leverage – I control more exposure with less capital. | Leverage Cuts Both Ways – Small moves can mean big losses, fast. |

| Great for Hedging – I use puts to protect my stock positions during volatility. | Not Beginner-Friendly – It’s easy to jump in too fast without fully understanding the risks. |

| Low Upfront Costs – Buying options is cheaper than buying the stock outright. | Overtrading Temptation – With so many strategies, it’s easy to get carried away. |

| Advanced Tools Available – Platforms like IG and IBKR offer amazing strategy builders. | Fees Can Stack Up – Contract costs, commissions, and spreads can eat into returns. |

Where Can I Practice Trading Options?

I used demo accounts for months, tracking every trade in a journal to see what worked (and what didn’t). It helped me build confidence without burning cash.

Bottom line? Options trading is a skill—and like any skill, it takes time, practice, and a lot of patience to get it right.

Final Thoughts: Which is the best Options Trading Platform?

Here are the top 3 Options Trading Platforms in the UK:

#1 IG – Overall Platform, Versatile and Reliable

#2 Spreadex – Intermediate Traders, Comprehensive Features

#3 XTB – Fast Execution, Free Market Analysis, User-Friendly Interface

If you’re just starting out, I’d recommend starting with IG or even eToro (though eToro offers options via CFDs, not direct contracts). IG has one of the cleanest platforms I’ve used, plus their educational content is top-notch.

For more advanced traders who want access to global markets and low commissions, Interactive Brokers is hard to beat. I use them for multi-leg strategies and more complex trades.

Finally, Saxo Markets is ideal for professionals or high-net-worth traders who need speed, execution quality, and in-depth research tools. I’ve tested it—it’s slick, but the higher fees and deposit minimums make it more suited to serious investors.

To conclude, Options trading has become one of my go-to strategies, but it took time, practice, and plenty of mistakes to get there. If you’re willing to learn and manage risk properly, it can be a powerful addition to your trading toolkit. But don’t rush it—start small, keep it simple, and build confidence as you go.

FAQs

Yes, options trading is legal in the UK—as long as you’re using a regulated broker authorised by the Financial Conduct Authority (FCA). I always stick with FCA-regulated platforms for safety and peace of mind.

Most platforms require you to apply for an options-enabled account. Depending on the broker, this might mean passing a quick suitability check or proving your trading experience.

You can get started with as little as £100 on some platforms, but I’d recommend having a bit more to allow for proper position sizing and risk management. I started small and scaled up as I got more comfortable.

CFDs let you speculate on the price of an option, but you don’t own the options contract. With direct options trading, you can use advanced strategies like spreads, collars, or covered calls. I prefer trading the real thing when possible.

In my experience, IG is a great starting point—clean interface, strong education, and FCA-regulated. AvaTrade and Spreadex are also solid picks if you’re just getting started.

It can be high-risk—especially with leverage, time decay, and implied volatility in play. But using defined risk strategies, stop-loss orders, and only trading what you can afford to lose makes it more manageable.

Yes—some platforms support algorithmic trading or offer built-in strategy builders. I use these tools for backtesting and simplifying complex trades, but I always monitor my positions.

Top 5 Options Brokers

1

IG

71% of retail investor accounts lose money when trading spread bets and CFDs with this provider.

2

SpreadEx

81% of retail investor accounts lose money when trading CFDs with this provider.

3

XTB

73% of Retail CFD Accounts Lose Money

4

AvaTrade

76% of retail investor accounts lose money when trading CFDs with this provider.

5

Saxo

64% of retail investor accounts lose money when trading CFDs with this provider.

References

- Financial Conduct Authority (FCA) – https://www.fca.org.uk

- IG Academy – Options Trading Education

- Interactive Brokers – Options Trading Overview

- Saxo Markets – Derivatives & Options Trading

- HM Revenue & Customs (HMRC) – Capital Gains Tax

- SpreadEx – Options Trading Guide | Financial Spread Betting

- eToro UK – CFD Trading Guide

Featured Blogs

81% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

- Spread betting & CFDs

- UK-based, FCA regulated

- No minimum deposit

- Free market analysis tools

- Desktop & mobile trading