Is XTB a Good Broker? 2025 Review

Thomas Drury

Co-Founder

Seasoned finance professional with 10+ years' experience. Chartered status holder. Proficient in CFDs, ISAs, and crypto investing. Passionate about helping others achieve financial goals.

Twitter ProfileAuthor Bio

Dom Farnell

Co-Founder

Dom, a Co-Founder at TIC, is an avid investor and experienced blogger who specialises in financial markets and wealth management. He strives to help people make smart investment decisions through clear and engaging content.

Twitter ProfileAuthor Bio

Fact Checked

How we test

At The Investors Centre, we pride ourselves on our rigorous fact-checking process. To delve deeper into our meticulous testing procedures and discover how we ensure accuracy and reliability, visit our dedicated page on how we test.

Risk Warning

The information provided in this article is for educational and informational purposes only and does not constitute financial or investment advice.

Some of the links on this website are affiliate links, meaning we may earn a commission if you click through and make a purchase or investment, at no extra cost to you. This helps support our website and allows us to continue providing quality content.

Updated 26/03/2025

When I first started looking for a trading platform, I wanted something that was reliable, easy to use, and packed with the right features. That’s when I came across XTB. It is a well-known broker with a solid reputation, but I wanted to see for myself whether it lived up to the hype. After spending time trading on the platform, testing its investment options, security measures, and customer support, I’ve got a pretty good sense of what it does well and where it could improve. In this post, I’ll share my personal experience with XTB so you can get a real, no-nonsense take on whether it’s the right broker for you.

Quick Answer: Is XTB a Good Broker for Beginners?

Yes, XTB is highly suitable for beginners. Its intuitive xStation platform, comprehensive demo account, and educational resources like the Trading Academy make it an excellent choice. While there’s a learning curve for advanced features, XTB’s tools provide a strong foundation for new traders.

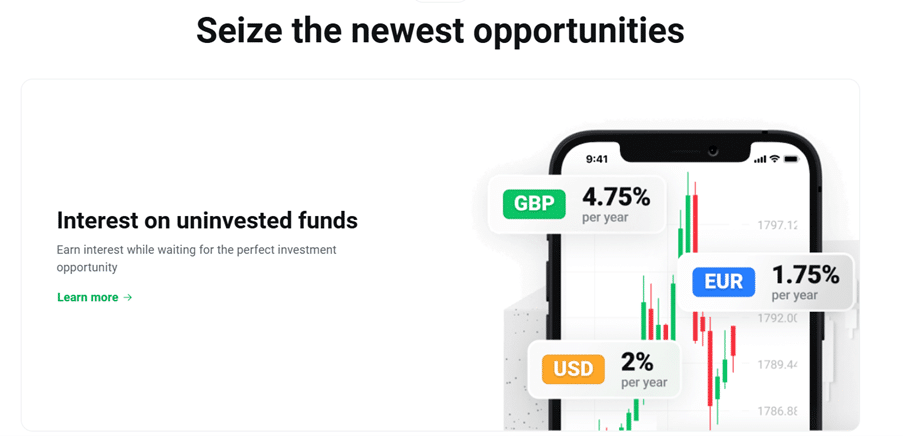

Featured Platform: XTB

- Low Trading Costs

- User-Friendly Platform

- Interest on Cash

73% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Why Are New Traders Drawn to XTB?

I first came across XTB while looking for a platform that could bridge the gap between beginner-friendly simplicity and professional-level tools. Many platforms I tried before felt either too basic or too advanced. XTB stood out because of its balance: the xStation platform looked modern and straightforward, and reviews highlighted its educational support.

One of the first features I appreciated was the demo account. It allowed me to experiment with real-time markets using virtual funds, which gave me the confidence to start trading without the fear of losing money. Another feature that caught my attention was the Trading Academy, packed with structured lessons for new traders.

The xStation platform was also incredibly intuitive. From a clean dashboard that displayed essential metrics to tools that explained market movements, everything seemed designed to reduce the overwhelm beginners typically feel.

What really impressed me, though, was how XTB combined these beginner-friendly tools with features that made me feel like I could grow into an advanced trader over time. It wasn’t just about starting—it felt like a platform that could support my entire trading journey.

Key Features That Attracted Me to XTB

| Feature | Why It’s Beginner-Friendly |

|---|---|

| Demo Account | Risk-free environment to practice trading |

| Trading Academy | Step-by-step lessons tailored for new traders |

| xStation Platform | Clean, intuitive design for easy navigation and quick learning |

What Features Make XTB Beginner-Friendly?

User-Friendly xStation Platform

One of XTB’s most impressive features for beginners is its xStation platform. It’s designed to make trading feel less intimidating while still offering all the tools you need. Unlike platforms that bombard you with charts and technical indicators, xStation presents the essentials in an organised way.

For example, the dashboard shows real-time market data, your open trades, and a simple search bar to explore instruments. As a beginner, I found it easy to place trades without worrying about making mistakes due to complex layouts. Features like the one-click trading tool helped me act quickly, especially when practicing day trading strategies.

The platform also provides built-in tutorials and explanations for key tools, making it easier to learn as you go. Even better, xStation is consistent across desktop and mobile, so you can transition between devices without confusion. Its simplicity was a game-changer for me as a new trader.

Customer Service and User Support

Good customer support can make or break a trading experience, and in my time using XTB, I’ve found their customer service to be genuinely solid. They offer support through live chat, email, and phone, which is great because I like having options depending on how urgent my question is.

What stands out to me is how responsive and knowledgeable their team is—I’ve had queries about platform features and account management, and they’ve always been quick to help.

Another big plus is that their support is multilingual and available 24/5, which aligns well with global trading hours. As someone who appreciates a bit of extra guidance, I also find their educational resources and dedicated account managers really helpful, especially for beginners who might need a little more direction. It’s reassuring to know that if I ever run into an issue, I won’t be left waiting for answers.

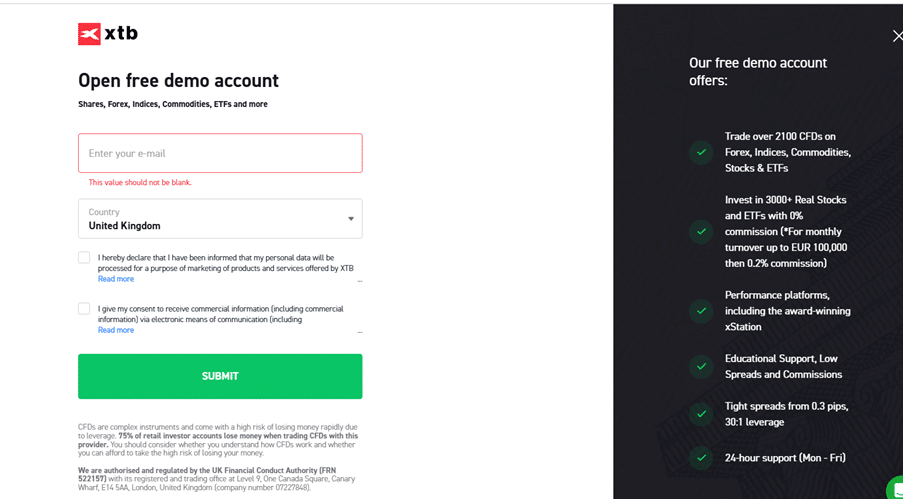

Comprehensive Demo Account

XTB’s demo account is one of the best tools for beginners. It gives you access to the full xStation platform with virtual funds, allowing you to explore trading in real-time conditions without financial risk. When I first started, this feature was invaluable.

I used the demo account to practice trading forex pairs like EUR/USD and commodities like gold. What I appreciated most was how the demo mimicked live market conditions—it wasn’t just a stripped-down version of the platform. This allowed me to test strategies like setting stop-loss orders and using leverage without any pressure.

The demo account also helped me understand XTB’s fee structure and market spreads, so I was better prepared when transitioning to live trading. The ability to practice as long as I wanted, without a time limit, was another major advantage compared to other platforms I tried.

Benefits of XTB’s Demo Account

| Feature | Benefit for Beginners |

|---|---|

| Virtual Funds | Practice trading without risking real money |

| Real-Time Conditions | Gain experience in live market environments |

| Unlimited Access | No pressure to transition to live trading too quickly |

For any beginner, XTB’s demo account is a low-risk way to build confidence and develop skills.

Educational Content and Tools

XTB’s educational resources, particularly the Trading Academy, are incredibly helpful for beginners. The Academy offers structured lessons on trading fundamentals, market analysis, and risk management. These lessons are presented in a step-by-step format, making them easy to follow even for someone completely new to trading.

I remember one lesson on technical indicators that completely changed how I approached chart analysis. It broke down concepts like moving averages and RSI in simple terms, helping me understand how to spot potential trends.

Beyond the Trading Academy, XTB also provides daily market analysis and webinars. These resources kept me informed about market trends and helped me feel more confident in placing trades. The platform’s tools, like economic calendars and sentiment analysis, were also valuable for understanding market dynamics as a beginner.

XTB’s educational content isn’t just theoretical—it’s actionable, helping you apply what you learn directly on the platform.

Investment Options at XTB

When I first started exploring investment platforms, I was looking for one that offered a good mix of options without overwhelming me. That’s where XTB stood out. It provides access to a wide range of financial instruments. I’ve broken them down into their different asset classes, including recommendations for each type of Trader:

| Asset Class | Best For |

|---|---|

| Stocks | Long-term investors, dividend seekers, those who want to own shares in individual companies. |

| ETFs (Exchange-Traded Funds) | Beginners, diversified investors, those looking for lower-risk exposure to multiple assets. |

| Forex (Currency Trading) | Active traders, those interested in short-term trading, people who follow global economic trends. |

| CFDs (Contracts for Difference) | High-risk traders, those looking to trade with leverage, short-term speculators. |

| Commodities (Gold, Oil, etc.) | Hedge seekers, long-term investors, traders looking for safe-haven assets. |

| Cryptocurrencies | Risk-tolerant investors, those interested in emerging markets and digital assets. |

| Indices (S&P 500, NASDAQ, etc.) | Passive investors, those looking for exposure to an entire market rather than individual stocks. |

| Bonds | Conservative investors, those looking for stable returns and lower volatility. |

I personally appreciate the ability to trade thousands of global markets, and in some regions, XTB even offers commission-free stock and ETF trading, which is a huge plus. If you are a trader who is into leveraged trading, XTB also has CFDs on various asset classes, allowing you to speculate on price movements without actually owning the asset. Whether you are looking to build a long-term portfolio or take advantage of short-term market movements, XTB gives you the flexibility to trade the way that suits you best.

Safety, Security and Regulation at XTB

When it comes to choosing a broker, safety and regulation are non-negotiable for me. That is one of the reasons I trust XTB—it is regulated by some of the most respected financial authorities, including the FCA in the UK, CySEC in Cyprus, and the KNF in Poland.

This means they have to stick to strict rules designed to protect traders like you and me. One thing I really appreciate is that XTB keeps client funds in segregated accounts, so my money is never mixed with the company’s finances. Plus, with negative balance protection in place, I know I can’t lose more than I deposit, which adds an extra layer of security. On top of that, XTB takes cybersecurity seriously, using advanced encryption to keep personal and financial data safe. Knowing that my funds and information are well-protected gives me peace of mind when trading.

What Challenges Might Beginners Face with XTB?

While XTB’s xStation platform is intuitive, beginners may initially feel overwhelmed by the range of tools and features. As someone new to trading, I remember logging in and being greeted by multiple tabs for instruments, charts, indicators, and analysis. It was exciting but also intimidating at first.

One challenge I faced was figuring out which tools I needed as a beginner versus those better suited for advanced traders. For example, the economic calendar was helpful, but advanced indicators like Fibonacci retracements felt unnecessary at the start.

To simplify the experience, I recommend starting with XTB’s demo account. It allows you to explore the platform at your own pace without the pressure of real money on the line. Additionally, focus on basic tools like price charts and stop-loss orders before diving into advanced features. The platform’s built-in tutorials are also a great way to learn the ropes.

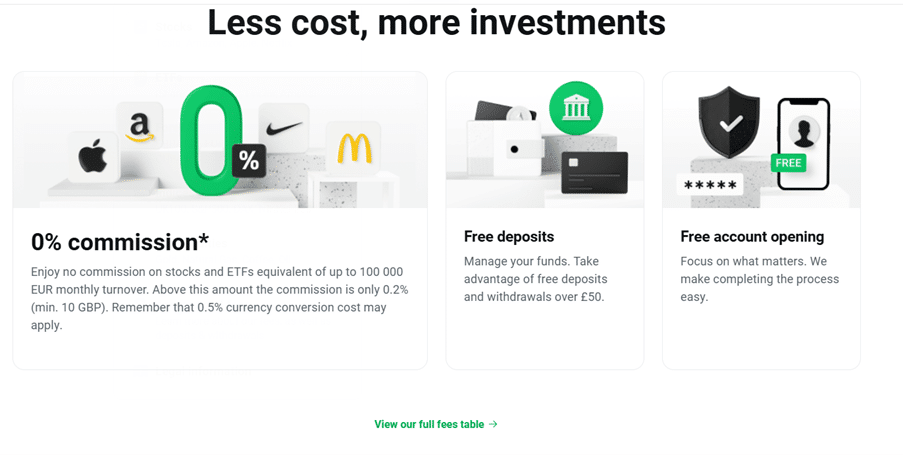

Is XTB’s Fee Structure Beginner-Friendly?

XTB’s fee structure is generally beginner-friendly, but understanding it is key to managing costs. The platform doesn’t charge commissions on standard accounts for forex or CFDs, which is excellent for new traders. However, spreads can vary depending on the instrument and market conditions.

Overnight financing fees (also known as swap rates) apply to positions held overnight, which could catch beginners off guard. When I started, I learned to close most of my trades within the day to avoid these costs. By focusing on short-term trades, beginners can keep fees manageable while learning how spreads and swaps work.

Overview of XTB’s Fees

| Fee Type | Details | Impact on Beginners |

|---|---|---|

| Spread | No commission; spreads depend on the market | Manageable for frequent day trades |

| Overnight Fees | Applies to positions held overnight | Avoid by closing trades daily |

| Deposit/Withdrawal Fees | Free for most methods | Beginner-friendly |

How Does XTB Compare to Other Platforms for Beginners?

What XTB Offers That Others Don’t

Compared to platforms like IG and eToro, XTB excels in its balance of beginner accessibility and professional-grade tools. Its xStation platform is one of the most user-friendly trading platforms I’ve used, offering a modern design and robust features like advanced charting, sentiment indicators, and one-click trading—all in one place.

One feature that stands out is XTB’s detailed market analysis tools, which provide insights into trends and help traders make informed decisions. IG offers similar tools but often feels more segmented, while eToro focuses more on social trading, which may not appeal to everyone.

Another strength of XTB is its low fees on forex and CFD trades. Unlike IG, XTB charges no commissions on standard accounts, which can be a big cost-saver for beginners. The ability to access a wide range of markets, including forex, indices, and commodities, also makes XTB versatile and scalable as your trading skills improve.

Where Other Platforms Might Be Easier

While XTB is a well-rounded platform, some alternatives may feel easier for absolute beginners. For instance, eToro’s social trading allows users to copy experienced traders, making it less intimidating for those without much knowledge. Similarly, Plus500’s simplified interface focuses only on essential features, which can be less overwhelming.

However, these platforms often lack depth. I found that while eToro was beginner-friendly, its social trading approach didn’t teach me the skills I wanted to develop. XTB, on the other hand, provided a platform where I could grow from a novice to a more advanced trader.

Tips for Beginners Using XTB

Start with the Demo Account

XTB’s demo account is a must-use for beginners. With access to the full xStation platform and virtual funds, it’s the perfect place to test strategies and explore markets without risk. I spent several weeks practicing on the demo account before transitioning to live trading, which helped me avoid costly mistakes. Use it to familiarise yourself with XTB’s interface and develop confidence in placing trades.

Focus on Key Markets

When starting with XTB, focus on just one or two markets, like forex or indices. Forex pairs such as EUR/USD are particularly beginner-friendly because of their liquidity and smaller spreads. This approach allows you to build expertise in a specific area before diversifying into other instruments. I began with forex, gradually expanding into commodities like gold once I felt more confident navigating the platform.

Use XTB’s Educational Tools

XTB’s Trading Academy and analysis tools are invaluable for beginners. From structured lessons to webinars, these resources provide a strong foundation in trading basics. I recommend spending time with their tutorials on risk management and technical analysis, which helped me understand key trading concepts and apply them effectively on the platform. These tools are essential for learning and growth.

Should Beginners Choose XTB?

XTB is an excellent platform for beginners, combining simplicity with powerful features that support both learning and growth. The intuitive xStation platform ensures a seamless experience for new traders, with easy navigation and tools like one-click trading and customisable charts. The demo account provides a risk-free environment to practice trading in real-time markets, and the Trading Academy offers structured lessons and webinars to build foundational knowledge.

However, some beginners might initially feel overwhelmed by the range of features, and understanding the fee structure (especially overnight fees) takes some time. That said, with proper use of the demo account and educational resources, these challenges are manageable.

Based on my experience, I highly recommend XTB. It offers the perfect balance of ease and depth, making it suitable for new traders while also supporting their transition to more advanced trading strategies as they gain confidence and skill.

Trade Smarter, not Harder

- Low Trading Costs

- User-Friendly Platform

- Interest on Cash

73% of Retail CFD Accounts Lose Money

FAQs

Is XTB good for beginner traders?

Yes, XTB is an excellent choice for beginner traders. Its intuitive xStation platform, demo account, and comprehensive educational resources make it accessible for those new to trading.

How does XTB's demo account work for beginners?

XTB’s demo account offers virtual funds in a real-time trading environment. It allows beginners to practice strategies, understand market dynamics, and explore platform features risk-free.

What educational resources does XTB offer for beginners?

XTB provides a robust Trading Academy with structured lessons, live webinars, market analysis, and tutorials. These resources are designed to help beginners build a solid trading foundation.

Are XTB’s fees beginner-friendly?

Yes, XTB’s fees are beginner-friendly. The platform charges no commission on standard accounts for forex and CFDs, but beginners should be aware of spreads and overnight fees.

What are the best markets for beginners to trade on XTB?

Forex and major indices are ideal for beginners on XTB. Instruments like EUR/USD offer high liquidity and small spreads, making them easier for new traders to understand and trade.

You May Also Like:

References:

- XTB Official Site – XTB – Investing, Savings, Trading | XTB.

- Financial Conduct Authority (FCA) – Consumers | FCA

- XTB Online Investing Reviews – Trustpilot: Read Customer Service reviews and ratings – TrustPilot

- XTB Support Fees and Costs – Terms & Fees As transparent as possible – Terms & Fees

- Low Trading Costs

- Our Recommended Platform for UK

- User-friendly Platform

- Interest on Cash

- Wide Range of Assets

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.