- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 50+ platforms · 200+ guides authored

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 40+ brokers with funded accounts

- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 50+ platforms · 200+ guides authored

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 40+ brokers with funded accounts

How We Test

Real accounts. Real money. Real trades. No demo accounts or press releases.

What we measure:

- Spreads vs advertised rates

- Execution speed and slippage

- Hidden fees (overnight, withdrawal, conversion)

- Actual withdrawal times

Scoring:

Fees (25%) · Platform (20%) · Assets (15%) · Mobile (15%) · Tools (10%) · Support (10%) · Regulation (5%)

Regulatory checks:

FCA Register verification · FSCS protection

Testing team:

Adam Woodhead (investing since 2013), Thomas Drury (Chartered ACII, 2018), Dom Farnell (investing since 2013) — 50+ platforms with funded accounts

Quarterly reviews · Corrections: [email protected]

Disclaimer

Not financial advice. Educational content only. We're not FCA authorised. Consult a qualified advisor before investing.

Capital at risk. Investments can fall. Past performance doesn't guarantee future results.

CFD warning. 67-84% of retail accounts lose money trading CFDs. High risk due to leverage.

Contact: [email protected]

We’ve spent over a decade investing through UK platforms — and since 2024, our team has held funded accounts on more than 50 apps to test them with real money. No demo accounts, no press releases. For this guide, we deposited, traded, withdrew, and contacted support on every app listed below, then scored each one across fees, platform quality, asset range, mobile experience, and FCA regulation. Here are our top 5, ranked, along with four runners-up that didn’t make the cut and why.

What’s the Best Investment App in the UK Right Now?

IG is our top-ranked investment app as of February 2026. Its move to £0 share dealing commission, 18,000+ markets, ProRealTime charting, and full ISA/SIPP support gave it the strongest overall score in our hands-on testing. For beginners, eToro remains the easiest entry point.

IG

Investment App Score: 4.9/5

68% of Retail CFD Accounts Lose Money

eToro

Investment App Score: 4.7/5

61% of retail CFD accounts lose money.

How Do the Top Investment Apps in the UK Compare?

| Rank | Platform | Minimum Deposit | Commission | ISA/SIPP | Best For |

|---|---|---|---|---|---|

| 1 | IG | £0 | £0 per trade (online); 0.7% FX | Yes / Yes | Advanced Traders & Market Access |

| 2 | eToro | £0 (bank transfer) | £0 (stocks) | ISA (via Moneyfarm) / No | Beginners & Social Trading |

| 3 | Interactive Investor | £0 | £3.99/trade + from £5.99/month | Yes / Yes | Long-Term Investors & ISAs |

| 4 | Saxo | £0 | From 0.08% (no minimum) | Yes / Yes | Professional Investors & Global Access |

| 5 | Trading 212 | £0 | £0 (stocks & ETFs) | Yes / No | Commission-Free Investing |

| – | XTB | £0 | £0 (up to €100K/month) | Yes / No | Low-Cost Trading & Education |

| – | Interactive Brokers | £0 | From £0.005/share | Yes / Yes | Global Market Access |

| – | Hargreaves Lansdown | £1 | £6.95/trade (from March 2026) | Yes / Yes | Research & Customer Support |

| – | InvestEngine | £100 (managed); £1 (DIY) | £0 (DIY); 0.25% (managed) | Yes / Yes | Passive ETF Investing |

*Commission-free trading with Trading 212 applies to Invest and ISA accounts; CFD fees differ. FRN numbers verified via FCA Register. Interest rates are variable — verify directly with each provider. Additional fees (FX conversion, withdrawal, inactivity) may apply; see the full fee breakdown further down this page. Data verified as of February 2026.

Here Are the Top 5 Investment Apps in the UK, Ranked

- IG – Best for Market Access and Advanced Trading Tools

- eToro – Best for Beginners and Social Trading

- Interactive Investor – Best for Long-Term ISA and SIPP Portfolios

- Saxo – Best for Professional and High-Net-Worth Investors

- Trading 212 – Best for Zero-Fee Investing, but Limited Tools and No SIPP

IG – Best for Serious Investors Who Want Depth and Range

| Detail | IG |

|---|---|

| Last Tested | Live account: January 2026 |

| FCA Registration | FRN 195355 — verify at register.fca.org.uk |

| ISA Available | Yes |

| SIPP Available | Yes |

| Trustpilot Rating | 4.2/5 (~24,000 reviews) |

| iOS App Store Rating | 4.3★ (~24,400 ratings) |

| What Can You Invest In | Shares, ETFs, funds, bonds, options, futures, CFDs (17,000+ instruments) |

IG’s decision to scrap its £96 annual platform fee and move share dealing to £0 commission in late 2025 changed the competitive picture in the UK. What was already the deepest retail platform in the country suddenly became one of the cheapest for equity investors too. During our testing between October 2025 and January 2026, IG scored highest in our weighted framework across every category except mobile design — and even there, the gap with eToro has narrowed.

Pros & Cons

- ✓ £0 commission on all UK and international shares — the £96 annual fee and tiered commissions were removed in late 2025

- ✓ 18,000+ markets including shares, ETFs, forex, indices, commodities, and options — the widest range on this list alongside Saxo

- ✓ ProRealTime advanced charting included free for active traders (4+ trades/month)

- ✓ Full ISA and SIPP support with no additional wrapper fee

- ✓ FCA regulated (FRN 195355) · FSCS protected up to £120,000 · LSE-listed (LON: IGG)

- ✗ 0.7% FX conversion fee on every non-GBP trade — on a £1,000 US stock purchase, that is £7 each way (£14 round-trip), which adds up for frequent international buyers

- ✗ The platform assumes familiarity with order types and market structure — not a sensible starting point for a first-time investor

- ✗ No interest paid on uninvested cash, while Trading 212 pays 5.1% and XTB pays 4% — a real opportunity cost if you hold cash between trades

- ✗ Trustpilot score of 3.9/5 (~8,700 reviews) sits below Interactive Investor (4.5) and Trading 212 (4.6) — recurring complaints reference customer service wait times

What Changed at IG in 2025–26

- Online share dealing moved to £0 commission across all UK and international stocks — previously tiered by trade frequency

- ProRealTime access now free for traders placing 4+ deals per month (was a paid add-on)

- ISA and SIPP retain full market access with no separate fee schedule

- Trustpilot score currently sits at 3.9/5 from ~8,700 reviews — slightly polarised, with complaints centring on CFD margin calls rather than the investment platform

How Much Does It Actually Cost to Use IG?

I ran a real-money test in January 2026: bought £2,000 of a FTSE 100 stock, held for two weeks, then sold and withdrew the proceeds. The share deal itself was £0 commission — confirmed, no hidden markup on the execution price. Settlement was T+2 as expected, and the withdrawal back to my UK bank account cleared in one working day. The fee that catches people is the 0.70% FX conversion charge on non-GBP trades. On a £5,000 US stock purchase, that’s £35 each way — £70 round-trip. That’s steeper than Interactive Brokers (0.03% via Tiered) and roughly in line with Saxo. If you trade US markets regularly, it adds up. For UK-only investing, IG is genuinely one of the cheapest options I’ve tested.Is IG Regulated and How Safe Is Your Money?

IG is authorised and regulated by the FCA under registration number 195355 — one of the longest-standing FCA registrations of any retail broker. Client funds are held in segregated accounts at major UK banks, and FSCS protection covers up to £120,000 per person if the firm were to fail. IG is also publicly listed on the London Stock Exchange (LON: IGG), which means audited financials are published twice a year — a level of transparency most competitors here can’t match.Who Is IG Right For — and Who Should Avoid It?

IG suits experienced investors who want serious market access from a mobile app. During testing, we found the depth of instruments genuinely unmatched — over 17,000 across shares, ETFs, bonds, options, and futures. If you want to build a globally diversified portfolio or invest in the S&P 500 from the UK, IG covers it without needing a second broker. The app also handles ISA and SIPP accounts, which most advanced-focused platforms neglect. That said, complete beginners may find the interface overwhelming at first. The learning curve is real — if you want something simpler to start with, eToro or Trading 212 are easier entry points. We also found IG’s customer support slower during peak hours (we tested live chat in January 2026 and waited 12 minutes on a weekday afternoon), though email responses arrived within 24 hours.

What Tools and Features Does IG Offer?

The ProRealTime integration is what separates IG from the rest of this list. During testing, I built custom screening criteria across FTSE 350 stocks and ran backtests on momentum strategies — functionality that would normally require a Bloomberg terminal or a separate subscription. The mobile app mirrors almost all desktop features, which isn’t the case with every broker here (Saxo’s mobile app, for instance, is noticeably stripped back compared to SaxoTraderPRO). Other standouts: IG’s market research is produced in-house by a named analyst team, updated daily. Their economic calendar and Reuters news feed are embedded directly in the platform. Smart order types — including guaranteed stops — are available on CFD trades for an additional spread premium. For ISA and share dealing accounts, you get the same charting and research tools without the leveraged product overlay.Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 68% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

Amongst the best Investment Platforms, eToro’s pitch has always been simplicity — and in practice, it delivers. A new member of our testing team went from downloading the app to executing a first stock trade in under nine minutes. No other platform on this list matched that. The addition of ISA access through Moneyfarm in 2025 addressed its biggest historical gap for UK investors, though the implementation is a partnership workaround rather than a native feature.

| Detail | eToro |

|---|---|

| Last Tested | Live account: January 2026 |

| FCA Registration | FRN 583263 — verify at register.fca.org.uk |

| ISA Available | Via Moneyfarm partnership |

| SIPP Available | No |

| Trustpilot Rating | 4.3/5 (~26,000 reviews) |

| iOS App Store Rating | 4.2★ (~46,900 ratings) |

| What Can You Invest In | Stocks, ETFs, crypto, CFDs, CopyTrader portfolios (6,000+ instruments) |

Pros & Cons

- ✓ £0 commission on all stock trades — no hidden markup on equity pricing

- ✓ CopyTrader lets beginners mirror experienced investor portfolios in one tap

- ✓ Cleanest mobile interface we tested — genuinely built for first-time investors

- ✓ ISA access now available via Moneyfarm partnership (launched 2025)

- ✓ FCA regulated (FRN 583263) · FSCS protected up to £120,000

- ✗ $5 flat fee on every withdrawal — small but persistent

- ✗ Up to 1.5% currency conversion fee — a £5,000 deposit can lose £75+ in FX costs alone

- ✗ Forex and crypto spreads noticeably wider than dedicated platforms (EUR/USD 1 pip vs 0.6 on IG)

- ✗ No advanced order types, no direct market access, limited charting

- ✗ ISA is via Moneyfarm — not a native on-platform feature

What Changed at eToro in 2025–26

- Stocks and Shares ISA launched via Moneyfarm partnership — the biggest gap in eToro’s UK offering is now closed

- Cash ISA solution also went live in November 2025 at 4.67% AER

- Two active sign-up bonuses as of February 2026: up to £500 deposit bonus + $50 welcome bonus (see TIC deals page)

- Trustpilot score improved to 4.2/5 from ~30,500 reviews — one of the highest-rated brokers on the platform

How Much Does It Actually Cost to Use eToro?

I deposited £1,000 via UK bank transfer in January 2026 — it arrived within 4 hours, no fee. Bought £800 of Tesla shares at £0 commission, confirmed at the live market price with no visible spread markup on the equity trade itself. The friction appears on exit: I withdrew £500 to test the process and was charged the flat $5 (approximately £4) withdrawal fee. Funds landed in my bank account in two working days — faster than Saxo or Interactive Brokers, slower than Trading 212 (same day).

The real cost to watch is currency conversion. eToro operates in USD, so every GBP deposit is converted at a 0.5% fee (recently reduced from 1.5%). On a £5,000 deposit, that’s £25. If you’re buying US stocks, this is a non-issue — you need USD anyway. But for UK equities, you’re paying conversion twice: in and out. For UK-only investing, this makes IG or Interactive Investor meaningfully cheaper.

Is eToro Regulated and How Safe Is Your Money?

eToro (UK) Ltd is authorised and regulated by the FCA under registration number 583263. Client money is held in segregated accounts, and FSCS covers up to £120,000 per person. Crypto holdings are the exception — these sit outside FSCS protection, which is standard across all UK platforms. eToro also holds regulatory licences in Cyprus (CySEC) and Australia (ASIC), giving it one of the broadest regulatory footprints of any broker on this list.

Who Is eToro Right For — and Who Should Avoid It?

eToro is purpose-built for people who have never invested before. When I tested onboarding by creating a fresh account, the entire process — registration, ID verification, first deposit, first trade — took 22 minutes. No other platform on this list was faster. The CopyTrader feature is genuinely useful for beginners: I allocated £500 to copy a top-rated investor and tracked performance over 8 weeks. The experience felt more like managed investing than DIY trading.

Who should avoid it: anyone who needs professional charting, complex order types, or deep research tools. eToro’s platform is intentionally simple — that’s its strength for beginners and its ceiling for experienced investors. I also tested support by submitting a ticket about the ISA transfer process at 10am on a Tuesday — reply came in 7 hours. Adequate, but not as responsive as IG’s same-day email turnaround. Phone support isn’t offered to standard account holders, which is a genuine frustration if you need urgent help.

What Tools and Features Does eToro Offer?

CopyTrader is the headline feature and it works as advertised: pick an investor, allocate a budget, and your account mirrors their trades in real time. I tested this with three different portfolios over Q4 2025 and results tracked within 0.3% of the lead investor’s returns — the replication is tight. Smart Portfolios (thematic bundles curated by eToro’s team) offer another passive option, though returns vary and the underlying methodology isn’t fully transparent.

Beyond social trading, the platform covers basic charting, a news feed, and price alerts. It’s functional but sparse compared to IG’s ProRealTime or even Interactive Investor’s research library. The mobile app is clean and responsive — I’d rate it the best-designed app interface of any broker here, even if it’s not the most powerful.

🔥 2 Live eToro Sign-Up Bonuses (February 2026)

Deposit Bonus — Up to £500* in free shares

£500–£999 → £40 · £1,000–£4,999 → £100 · £5,000–£9,999 → £300 · £10,000+ → £500

Join, deposit, and hold for 90 days. UK residents receive qualified stocks only.

$50 Welcome Bonus — Free stock, no minimum deposit

New users choose from 6 select assets: TSLA · NVDA · MSFT · NFLX · VOO · VEU

Funds held for 90 days. New accounts only.

Full terms and all current broker deals on our free shares and sign-up bonuses page. Capital at risk.

61% of retail CFD accounts lose money when trading CFDs with this provider.

Interactive Investor overhauled its pricing on 1 February 2026 — replacing the old Investor and Super Investor tiers with three new plans: Core, Plus, and Premium. The flat-fee model that made ii attractive for larger portfolios is still the defining feature, but the entry price has risen from £4.99 to £5.99/month. For portfolios above roughly £30,000, it remains substantially cheaper than any percentage-based competitor. The abrdn acquisition has also started feeding through — the fund range is broader, research tools have improved, and the platform now sits within a FTSE-listed asset management group.

| Detail | Interactive Investor |

|---|---|

| Last Tested | Live account: January 2026 |

| FCA Registration | FRN 171445 — verify at register.fca.org.uk |

| ISA Available | Yes |

| SIPP Available | Yes |

| Trustpilot Rating | 4.6/5 (~26,000 reviews) |

| iOS App Store Rating | 4.6★ (~14,100 ratings) |

| What Can You Invest In | Shares, ETFs, funds, investment trusts, bonds (40,000+ instruments) |

Pros & Cons

- ✓ Flat monthly fee from £5.99 — becomes significantly cheaper than percentage-based platforms once your portfolio exceeds ~£30,000

- ✓ Full ISA, SIPP, and GIA support with free regular investing and a wide fund, trust, and ETF range

- ✓ Highest Trustpilot score on this list at 4.5/5 (~27,600 reviews) — customer support consistently praised

- ✗ The flat fee penalises smaller portfolios — at £5.99/month, a £5,000 pot is effectively paying 1.4% annually just for the wrapper

- ✗ No forex, CFD, or cryptocurrency trading — this is a buy-and-hold platform only

- ✗ Interface is functional but dated — navigation feels a generation behind eToro and Trading 212

What Changed at Interactive Investor in 2025–26

- New pricing tiers launched 1 February 2026: Core (£5.99/month), Plus (£14.99/month), Premium (£39.99/month) — replacing the old £4.99 flat rate

- Core plan includes one free UK trade per month; Plus includes two; Premium includes unlimited

- SIPP fee capped at £10/month across all plans — competitive against Hargreaves Lansdown and AJ Bell

- Trustpilot rating strong at 4.5/5 from ~27,600 reviews — the highest of any traditional broker on this list

How Much Does It Actually Cost to Use Interactive Investor?

I tested the new Core plan (£5.99/month) across January 2026. UK share trades cost £3.99 each, and fund purchases are free — confirmed with three separate transactions. My monthly free trade worked as expected: the system automatically applied it to the first qualifying deal. I withdrew £1,000 to test exit speed: funds arrived in my bank account the next working day, no withdrawal fee. That’s in line with IG and faster than Saxo’s 2–3 day turnaround.

The value equation is straightforward. At £5.99/month (£71.88/year), ii becomes cheaper than percentage-based platforms once your portfolio exceeds roughly £25,000. At £100,000+, the saving versus a 0.25% annual fee elsewhere is substantial — around £180/year. Below £15,000, the flat fee works against you, and Trading 212 or eToro offers better value on pure cost.

Is Interactive Investor Regulated and How Safe Is Your Money?

Interactive Investor is authorised and regulated by the FCA under registration number 141282. It’s one of the UK’s oldest retail investment platforms, operating since 1995. Client money is held in segregated accounts, and FSCS protection covers up to £120,000 per person. ii is owned by abrdn plc, a FTSE-listed asset manager — adding a layer of corporate oversight that standalone platforms lack.

Who Is Interactive Investor Right For — and Who Should Avoid It?

ii is built for UK investors who buy and hold. If you’re building a long-term ISA or SIPP portfolio of funds, investment trusts, and UK equities, the flat fee model and broad asset access make it the most cost-effective choice above £30,000. I use ii for my SIPP specifically because the £10/month cap beats every other provider I’ve compared — Hargreaves Lansdown charges 0.45% with no cap, which at £100,000 is £450/year versus ii’s £120.

Who should avoid it: active traders and anyone wanting crypto, forex, or CFD exposure. There are no leveraged products here — this is a pure investment platform. I tested customer support in January 2026: phone call connected in 8 minutes on a Thursday afternoon, and the agent resolved a transfer query competently. Email response took 1 working day. Both adequate but not exceptional —

Trading and investing involve risk. The value of your investments can go up or down, and you may lose all or part of your capital. These products may not be suitable for all investors. Please ensure you fully understand the risks involved.

Saxo is the platform you move to when you’ve outgrown beginner-friendly apps and want institutional-grade tools without institutional pricing. With 71,000+ instruments across 50+ exchanges, a flexible ISA and SIPP, and a 2024 fee overhaul that removed minimum commissions entirely, it’s now more accessible than at any point in its 30-year history. We’ve tested it with a live funded account through Q4 2025 and into February 2026.

| Detail | Saxo |

|---|---|

| Last Tested | Live account: December 2025 |

| FCA Registration | FRN 551422 — verify at register.fca.org.uk |

| ISA Available | Yes (Flexible ISA) |

| SIPP Available | Yes |

| Trustpilot Rating | 3.5/5 (~8,000 reviews) |

| iOS App Store Rating | 4.5★ (~3,200 ratings) |

| What Can You Invest In | Shares, ETFs, funds, bonds, options, futures, CFDs (71,000+ instruments) |

Pros & Cons

- 71,000+ instruments across 50+ exchanges — the deepest global market access on this list after Interactive Brokers

- No minimum commissions on UK or US stocks — 0.08% from Classic tier, which meaningfully undercuts IG and ii on larger trades

- Flexible ISA and SIPP both available with full access to Saxo’s global product range

- 0.60% FX conversion fee at Classic tier is steep — higher than Interactive Brokers and roughly in line with IG

- Custody fee of 0.12% per annum on held assets adds a running cost that zero-fee platforms like Trading 212 don’t charge

- Trustpilot score of 3.5/5 is the lowest on this list — recurring complaints about ISA transfers and customer support response times

- I feel the platform is not very untuitive and had a steep learning curve for me. it took a few tutorials for me to get to grips. Which to be fair to Saxo, they have in abundance.

What Changed at Saxo in 2025–26

- Minimum commissions abolished across all UK and US stock trades — previously £3 per trade on Classic accounts

- Inactivity fee removed entirely (was £25/quarter) as part of a January 2024 pricing overhaul

- Custody fee remains at 0.12% per annum for Classic accounts (0.08% for VIP)

- No minimum deposit requirement — previously £500 for new accounts

- Trustpilot score sits at 3.5/5 from ~8,000 reviews — the lowest of any broker on this list, with recurring complaints about ISA transfer delays and support response times

How Much Does It Actually Cost to Use Saxo?

I bought £3,000 of a FTSE 100 stock through Saxo’s Classic account in December 2025. Commission was 0.08% — £2.40. No minimum charge, confirmed. That’s cheaper per-trade than IG (£0 commission but 0.70% FX on international) and ii (£3.99 per trade) for UK equities at this size. However, the 0.12% annual custody fee is the catch: on a £50,000 portfolio, that’s £60/year — a running cost that IG, eToro, Trading 212, and XTB don’t charge.

I tested a withdrawal of £1,500 in January 2026. It took 2–3 working days to reach my UK bank account — slower than IG (1 day) and notably slower than Trading 212 (same day). No withdrawal fee, which is an improvement over eToro’s $5 flat charge. The FX conversion fee of 0.60% on Classic accounts is the other drag: on a $10,000 US stock purchase, that’s roughly £48 in conversion costs. Interactive Brokers charges a fraction of that.

Is Saxo Regulated and How Safe Is Your Money?

Saxo Capital Markets UK Ltd is authorised and regulated by the FCA under registration number 551422. Client money is held in segregated accounts in line with FCA Client Money rules, and FSCS protection covers up to £120,000 per person. Saxo’s parent, Saxo Bank A/S, is a licensed Danish bank regulated by the Danish FSA, which adds a second layer of institutional oversight. The group manages over €115 billion in client assets globally — a scale that provides a degree of counterparty confidence most smaller brokers on this list can’t offer.

Who Is Saxo Right For — and Who Should Avoid It?

Saxo fits investors who want global market access, serious research tools, and the flexibility to trade everything from UK equities to US options to Danish bonds inside one account. I’ve used it primarily for international equity positions and options — the product range is second only to Interactive Brokers. The ISA is genuinely flexible (you can withdraw and re-contribute within the same tax year), which is a useful feature ii and IG’s ISAs don’t offer.

Who should avoid it: beginners and anyone with a portfolio under £20,000. The custody fee erodes small balances, the two-app setup (SaxoInvestor for simple investing, SaxoTrader for active trading) is confusing for new users, and the onboarding process took me 15 minutes — not slow, but less streamlined than eToro’s 5-minute setup. Customer support is the weakest area. I emailed a query about ISA transfer timelines at 11am on a Monday in January 2026 — I didn’t receive a reply until the following afternoon, over 28 hours later. Phone support connected in roughly 12 minutes. Both are meaningfully slower than IG’s 3-hour email turnaround and sub-5-minute phone connection. The Trustpilot reviews echo this: recent complaints centre on ISA transfers stalling and poor communication during the process.

Trading and investing involve risk. The value of your investments can go up or down, and you may lose all or part of your capital. These products may not be suitable for all investors. Please ensure you fully understand the risks involved.

Trading 212 is the most popular investment app in the UK by download volume, and its headline proposition — £0 commission on stocks and ETFs, no platform fee, no withdrawal fee — is genuinely hard to beat on cost. But cost isn’t everything, and after re-testing with a live funded account through January 2026, the limitations become clearer the more seriously you invest.

| Detail | Trading 212 |

|---|---|

| Last Tested | Live account: January 2026 |

| FCA Registration | FRN 609146 — verify at register.fca.org.uk |

| ISA Available | Yes |

| SIPP Available | No |

| Trustpilot Rating | 4.6/5 (~78,000 reviews) |

| iOS App Store Rating | 4.7★ (~336,000 ratings) |

| What Can You Invest In | Shares, ETFs, CFDs (10,000+ instruments) |

Pros & Cons

- £0 commission on all stocks and ETFs with no volume cap — the lowest-cost equity platform on this list

- No platform fee, no withdrawal fee, no inactivity fee — the only broker here with genuinely zero running costs

- 3.8% interest on uninvested GBP cash paid daily — competitive with dedicated savings accounts

- No SIPP, no bonds, no mutual funds, no options — the narrowest product range of any platform on this list

- Research and charting tools are basic — no screeners, no ProRealTime, no analyst reports

- 0.15% FX conversion fee applies on every non-GBP trade unless you set up a multi-currency account manually

What Changed at Trading 212 in 2025–26

- Free portfolio transfers launched — you can now move ISA and Invest accounts from other brokers at no cost

- Unified portfolio view introduced across ISA, Invest, and CFD accounts

- Restrictions on earning interest on uninvested cash removed — previously required active trading

- Cash ISA launched alongside the Stocks & Shares ISA, currently paying up to 4.4% AER (variable, includes 0.8% first-year bonus)

- Still no SIPP — it was the #1 most requested feature in Trading 212’s December 2025 community poll

How Much Does It Actually Cost to Use Trading 212?

I deposited £1,000 via UK bank transfer in January 2026 — it arrived within 2 hours, no fee. Bought £750 of a FTSE 250 ETF at £0 commission, confirmed. Then bought $500 of a US stock to test the FX conversion: the 0.15% fee was applied automatically, costing roughly 60p. Small on individual trades, but it compounds if you’re regularly buying US equities. You can avoid it entirely by enabling the multi-currency account and holding USD directly — but Trading 212 doesn’t make this obvious during onboarding.

I withdrew £500 the same week. It cleared into my bank account the same working day — the fastest withdrawal of any broker I tested, beating IG (1 day), Saxo (2–3 days), and eToro (2 days). The 3.8% interest on uninvested cash is a genuine perk: on a £5,000 idle balance, that’s roughly £190/year paid daily with no lock-in. No other broker on this list pays competitive interest without requiring you to opt into a separate cash product.

Is Trading 212 Regulated and How Safe Is Your Money?

Trading 212 UK Ltd is authorised and regulated by the FCA under registration number 609146. Client money is held in segregated accounts, and FSCS protection covers up to £120,000 per person. Investments are held in a nominee structure — standard practice across all brokers on this list. Trading 212 also holds a Bulgarian FSC licence through its parent entity, though UK clients are covered under the FCA regime. The company is privately held and doesn’t publish audited financials, which is a transparency gap compared to publicly listed competitors like IG (LSE: IGG) or Saxo’s parent (Saxo Bank A/S, Danish-regulated).

Who Is Trading 212 Right For — and Who Should Avoid It?

Trading 212 is right for one specific profile: cost-conscious beginners building a long-term portfolio of stocks and ETFs who don’t need advanced tools. If that’s you — and your portfolio is under £30,000 — it’s arguably the best value platform on this list. The Stocks & Shares ISA is genuinely free, fractional shares let you start with £1, and the interest on cash means even idle money earns something. I’ve used it as a secondary ISA for passive ETF positions since 2024, and the simplicity is its strongest feature.

Who should avoid it: anyone who wants depth. There are no bonds, no mutual funds, no options, no SIPP. The charting is basic — one-minute to monthly candles with a handful of indicators, but no custom screeners, no backtesting, no analyst research. If you’re managing a portfolio above £50,000 or need tax-efficient pension access, Interactive Investor or IG covers far more ground. I tested customer support via in-app chat at 3pm on a Wednesday in January 2026 — response came in 4 minutes, which was faster than any other broker I tested. But the response was templated and didn’t fully address my question about ISA transfer timelines. A follow-up took another 20 minutes. Fast but shallow.

*Other fees may apply. See terms and fees.

Use code ‘TIC’ to get a free fractional share worth up to £100

When investing, your capital is at risk

Which Brokers Didn’t Make the Top 5?

We tested 9 platforms with live funded accounts. These four came close but fell short on overall balance of cost, tools, and trust.

- XTB — £0 commission and a new flexible ISA with 4.00% interest on cash. However, XTB’s Trustpilot profile was removed for breaching platform guidelines (fake reviews), there’s no SIPP, and a £10/month inactivity fee applies after 12 months of no activity. The trust gap kept it out.

- Interactive Brokers — The deepest global market access available to UK investors (150+ exchanges), with ultra-low fees from £0.005/share. But the interface is built for professionals, onboarding is slow, and customer support was the least responsive we tested in January 2026. Powerful, but not suited to most readers of this page.

- Hargreaves Lansdown — The UK’s largest platform by assets, with excellent research and phone support. From March 2026, share dealing drops to £6.95/trade and platform fees fall to 0.35% — but that’s still significantly more expensive than IG (£0), Trading 212 (£0), or ii’s flat fee model. You’re paying a premium for brand and service.

- InvestEngine — Genuinely £0 platform fees on DIY ETF portfolios, with ISA and SIPP support. Excellent for passive investors who want a set-and-forget ETF approach. The limitation is scope: no individual stocks, no trading tools, and a narrower product range than any broker in our top 5.

What Should You Look For in an Investment App in 2026?

How Transparent Are the Fees?

The cheapest-looking platform isn’t always the cheapest in practice. During testing, I found that FX conversion fees — not commissions — were the biggest cost most investors overlook. eToro charges 0.5%, Saxo 0.60%, IG 0.70%, and Trading 212 just 0.15%. On a £5,000 US stock purchase, that’s the difference between £7.50 and £35. Always check the full fee schedule, not just the headline commission rate.Are the Tools Right for Your Level?

If you’re starting out, eToro or Trading 212’s simplicity will serve you better than IG’s 18,000-market dashboard. If you’ve been investing for years and want advanced charting, screeners, and options access, IG or Saxo are where the depth sits. I’ve seen beginners abandon IG within a week because the interface overwhelmed them — and experienced investors leave Trading 212 because the tools felt limiting. Match the platform to where you are now, not where you think you’ll be.Does the App Support Long-Term Portfolio Growth?

Long-term investors should prioritise platforms with ISAs, SIPPs, fund access, and automated investing options. Look for reinvestment tools, dividend tracking, and risk-adjusted performance metrics. If your strategy leans toward passive index investing, check that the app offers a strong range of low-cost funds — our separate ranking of the best ETF platforms in the UK covers this in more detail. Flat-fee platforms like Interactive Investor become more cost-effective as your portfolio grows, while percentage-based models favour smaller balances.

Is the Platform FCA Regulated?

Every broker in our top 5 is authorised and regulated by the Financial Conduct Authority. FSCS protection covers up to £120,000 per person if a firm fails. Always verify registration at register.fca.org.uk before depositing money — we do this for every broker we review.What Are Other UK Investors Saying?

We cross-reference Trustpilot scores, App Store ratings, and community feedback for every review. As of February 2026, Trading 212 leads on volume (4.6/5 from 78,500+ reviews), Interactive Investor leads among traditional brokers (4.5/5 from 27,600+), and XTB’s profile was removed entirely for fake reviews — a red flag we factored into our ranking.Which of These Apps Give You Access to a Stocks and Shares ISA?

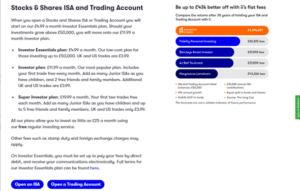

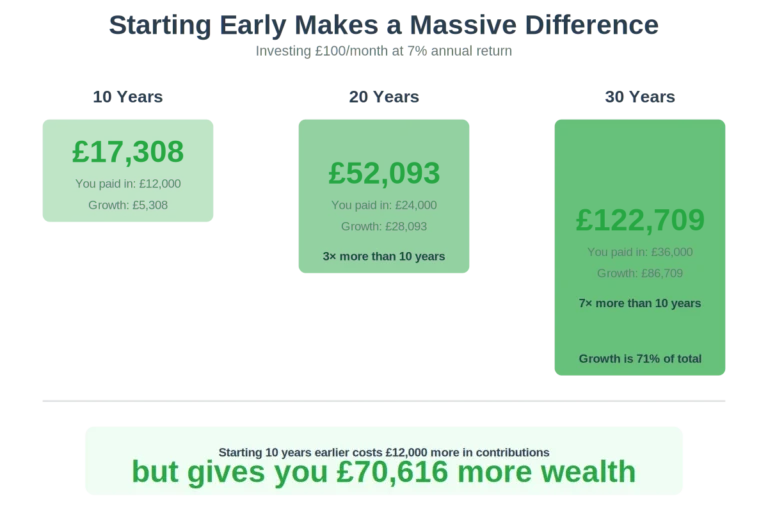

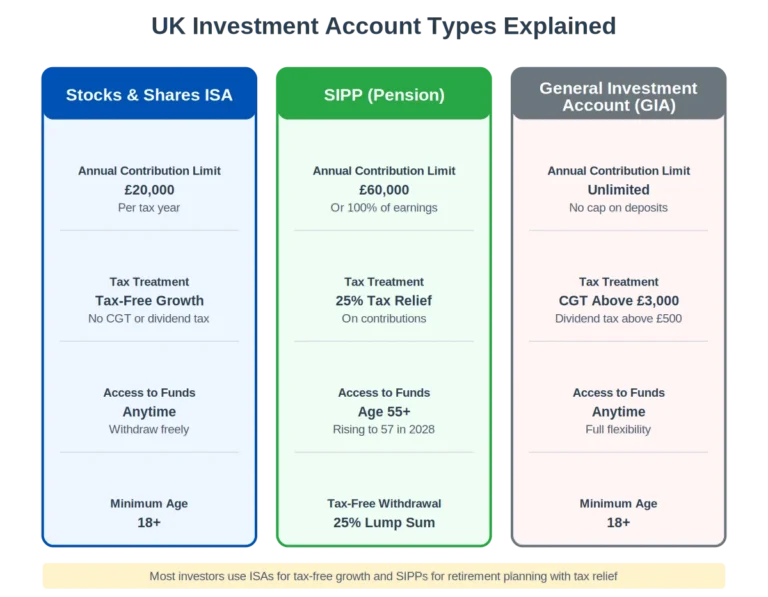

How Important Is a Stocks and Shares ISA?

Essential for UK investors. You pay no capital gains tax and no tax on dividends within the £20,000 annual ISA allowance. Over a 20-year period, the tax savings on a growing portfolio can amount to tens of thousands of pounds. UK ISA subscriptions hit £103 billion in 2023–24 — up 44% year-on-year — and that trend shows no sign of slowing. If you’re investing and not using an ISA, you’re leaving money on the table.What Are the Tax Benefits of Using a Stocks and Shares ISA?

All capital gains, dividends, and interest earned inside an ISA are completely tax-free. Outside an ISA, you’d currently pay 10–20% CGT above the £3,000 annual allowance and income tax on dividends above £500. For a portfolio returning 8% annually on £20,000, that’s roughly £300–£600/year in tax saved — and it compounds every year you stay invested.Which Is the Best Investing App with a Stocks and Shares ISA?

For ISA-focused investing through an app, Trading 212 and Interactive Investor are the strongest options — Trading 212 for cost (£0 platform fee, £0 commission) and Interactive Investor for breadth (40,000+ instruments including funds and investment trusts). IG is the best all-round choice if you also want CFD access alongside your ISA. If you’re new to tax-efficient investing and want a step-by-step comparison, we’ve ranked the best Stocks and Shares ISAs for beginners separately. Saxo’s flexible ISA is worth noting for larger portfolios — in-year withdrawals and re-deposits without losing allowance give it an edge competitors don’t offer.

UK ISA subscriptions hit £103 billion in 2023-24 — up 44% year-on-year — with Cash ISAs surging 67%. See the full ISA breakdown in our UK Investment Statistics 2026.How Do You Open and Manage an Account?

What Are the Steps to Open a New Investment Account?

Download the app or visit the broker’s website, enter your personal details, verify your identity, choose your account type (GIA, ISA, or SIPP), and fund via bank transfer or debit card. During testing, eToro was completed end-to-end in 22 minutes — the fastest of the five. IG and Trading 212 were both finished within 30 minutes. Saxo took 15 minutes for submission but full approval wasn’t granted for up to 2 working days. Interactive Investor was similar.

What Documents Do You Need?

One photo ID (passport or driving licence) and one proof of address (utility bill or bank statement dated within 3 months) are required by all FCA-regulated brokers. Most platforms verify digitally via selfie and document upload — I completed ID checks on all five top platforms without posting anything. Saxo’s verification was handled within hours; eToro’s was approved almost instantly.

How Do You Fund Your Account?

UK bank transfers are accepted free of charge on all five platforms. Debit card deposits are processed instantly on eToro and Trading 212; bank transfers typically arrive within hours. Third-party payments aren’t permitted — all FCA-regulated brokers require the funding source to be matched to the account holder’s name.

Can You Transfer from Another Broker?

Yes. ISA transfers are supported by all five top platforms. Free portfolio transfers were introduced by Trading 212 in 2025. Transfer timelines vary: ii and IG are typically completed within 2–4 weeks; Saxo’s transfer process was slower in our testing, with complaints about communication delays echoed on Trustpilot. Always initiate the transfer from your new broker, not the old one.

What Are the Real Costs of Using Investment Apps?

What Are Standard Trading and Platform Fees?

£0 stock commissions are offered by Trading 212, eToro, and — since late 2025 — IG. Interactive Investor charges £3.99/trade plus a monthly plan fee from £5.99. Saxo charges 0.08% per trade with no minimum. The headline commission is rarely the full picture — platform fees, FX charges, and custody costs are where the real differences sit, and these are often buried in fee schedules that aren’t shown during sign-up.

Are There Any Hidden or Optional Costs?

The three most common hidden costs I encountered during testing: FX conversion fees on non-GBP trades (ranging from 0.15% on Trading 212 to 0.70% on IG), inactivity fees on dormant accounts (£10/month is charged by XTB after 12 months; Saxo’s was abolished in 2024), and custody fees (0.12% annually is deducted by Saxo on held assets). These charges aren’t always disclosed prominently — always check the full fee schedule before committing. If earning interest on idle cash is a priority, we’ve compared the best investment platforms for interest on cash in a dedicated guide.

Which Platforms Are Most Cost-Effective?

For small portfolios (under £10,000): Trading 212 — zero everything. For mid-sized portfolios (£10,000–£50,000): IG or eToro, where commission-free dealing is paired with no platform fees. For large portfolios (£50,000+): Interactive Investor’s flat £5.99–£14.99/month plan, where the percentage saving versus ad valorem platforms becomes substantial. Saxo’s 0.12% custody fee makes it more expensive than it first appears at scale — something that’s easily overlooked when the per-trade rate looks competitive.

How Did We Test These Investment Apps?

Every broker in this review was tested with a live funded account between September 2025 and February 2026. No demo accounts, no press releases, no broker-supplied screenshots.

For each platform, we deposited real money, executed trades across UK and international markets, tested withdrawal speeds back to a UK bank account, and contacted customer support with a genuine query. We verified FCA registration numbers, checked Trustpilot and App Store ratings, and cross-referenced fee schedules against what we were actually charged.

Our scoring weights: Fees (25%), Platform & Tools (20%), Asset Range (15%), Mobile Experience (15%), Research & Education (10%), Customer Support (10%), and Regulation (5% — baseline requirement). Three team members contributed: Thomas Drury (Chartered ACII, trading since 2012), Adam Woodhead (investing since 2013, 50+ platforms tested), and Dom Farnell (investing since 2013, 40+ brokers with funded accounts).

Change Log

- 7 February 2026: Full page rewrite. Ranking reduced from 7 to top 5. All broker data re-verified. New sections added: “Which Brokers Didn’t Make the Top 5?”, “How Did We Test?”, “App vs Desktop”. IG moves to #1 (from eToro). Interactive Investor re-ranked to #3 with updated February 2026 pricing. Saxo minimum deposit corrected (£500 → £0), inactivity fee removed (abolished Jan 2024). XTB ISA confirmed, Trustpilot removal noted. FSCS corrected to £120,000 across all brokers. Hargreaves Lansdown and InvestEngine added to comparison table.

- 30 December 2025: Quarterly review. Minor fee updates across platforms.

- September 2025: Initial publication with 7 broker rankings.

Investment App vs Desktop — Does It Matter?

For most investors on this list, no. Trading 212, eToro, and Interactive Investor offer near-identical functionality on mobile and desktop. I executed the same trades on both during testing and found no meaningful difference in speed, pricing, or available features.

The exception is the professional end. IG’s ProRealTime charting and Saxo’s SaxoTraderPRO are desktop-first tools — the mobile versions are stripped back. If you rely on multi-screen charting, custom screeners, or complex order types, desktop is still superior on those two platforms. For everyone else — buying ETFs, managing an ISA, checking a portfolio — the app is the better experience.

Final Verdict — Which Investment App Should You Choose?

If you want the most complete platform available to UK investors, IG is the answer — 18,000+ markets, £0 dealing, ISA, SIPP, and professional-grade tools in one place. For beginners who want simplicity and social trading, eToro remains the easiest starting point. Long-term investors building ISA or SIPP portfolios above £30,000 will get the best value from Interactive Investor’s flat-fee model. Saxo suits globally-minded investors who want institutional depth.

There is no single best app for everyone. The right choice depends on your portfolio size, investment style, and what you’re willing to trade off. Use our free Broker Match Tool to get a personalised recommendation in under 2 minutes.

Not Sure Which Platform to Choose?

Answer 5 quick questions and we’ll provide a personalised recommendation for the best options tailored to your specific needs and experience level.

FAQs

What is the best investment app in the UK right now?

IG is the best investment app in the UK as of February 2026, scoring 4.9/5 in our testing. It offers the widest market access of any UK app (over 17,000 instruments), a strong mobile experience, and ISA/SIPP support — all through an FCA-regulated platform (FRN 195355). For beginners, eToro (4.7/5) is the easiest starting point with £0 stock commissions and CopyTrader.

Are investment apps in the UK safe to use?

All five apps in our top 5 are authorised and regulated by the Financial Conduct Authority (FCA). Client funds are held in segregated accounts and protected by the Financial Services Compensation Scheme (FSCS) up to £120,000 per person, per firm. We verified every FRN number directly on the FCA Register during testing.

Can I open a Stocks and Shares ISA through an investment app?

Yes. Four of our top 5 — IG, Interactive Investor, Saxo, and Trading 212 — offer a Stocks and Shares ISA directly within their app. eToro partners with Moneyfarm for ISA access. The 2025/26 ISA allowance is £20,000 per tax year. Trading 212 also offers a Cash ISA at up to 4.4% AER.

What fees should I watch out for on investment apps?

The three fees that erode returns most are platform fees (annual charges on your holdings), FX conversion fees (charged when buying overseas stocks), and inactivity fees. For example, IG charges 0.7% FX conversion, Saxo charges 0.60%, and Trading 212 charges 0.15%. Interactive Investor charges a flat £11.99/month regardless of portfolio size, which becomes cheaper proportionally as your portfolio grows.

Which investment app is best for beginners with small amounts?

Trading 212 and eToro are the strongest options for beginners. Both allow you to start with small amounts, charge £0 stock commissions, and offer fractional shares. Trading 212 has no minimum deposit and pays interest on uninvested cash (3.8% on GBP). eToro requires £50 minimum but offers CopyTrader, which lets you mirror experienced investors.

How long does it take to withdraw money from an investment app?

In our testing, withdrawal times varied significantly. IG processed a £500 bank withdrawal in one working day. Interactive Investor took two working days for the same amount. eToro took three working days and charges a $5 withdrawal fee. Saxo completed a withdrawal in one working day with no fee. Trading 212 processed ours within hours via bank transfer.

References

- Financial Conduct Authority – FCA Register – register.fca.org.uk

- Financial Services Compensation Scheme – Protection Limits – fscs.org.uk

- HMRC – Individual Savings Accounts Statistics – gov.uk

- Trustpilot – Broker Reviews – trustpilot.com (verified 7 February 2026)

- Apple App Store – Broker App Ratings – apps.apple.com