Quick Answer: To Buy Alibaba Shares in the UK, You’ll Need to:

- Select a broker that offers access to US stocks.

- Create and fund your brokerage account.

- Search for Alibaba using the ticker symbol ‘BABA’.

- Place a buy order for the desired number of shares.

- Confirm and finalise your purchase.

- Monitor your investment to manage potential risks and returns.

Featured Partner - Etoro

- 5,000+ Tradable Assets

- Beginner Friendly Platform

- Copy Trading Feature

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

Introduction To Alibaba

Investing in Alibaba, one of the world’s largest e-commerce and technology companies, can be an attractive option for many investors in the UK. With its diverse business model and significant presence in China, Alibaba offers potential growth opportunities. This guide will walk you through the steps necessary to purchase Alibaba shares from the UK, covering everything from choosing a brokerage to understanding the tax implications.

Understanding Alibaba

Company Overview

Alibaba Group Holding Limited, founded in 1999 by Jack Ma, is a Chinese multinational conglomerate specializing in e-commerce, retail, internet, and technology. It operates various businesses, including Taobao, Tmall, and Alibaba.com, serving millions of users and businesses globally. Alibaba’s business model encompasses online and mobile commerce, cloud computing, digital media, and entertainment, making it a dominant player in the tech industry.

Why Invest in Alibaba?

Investing in Alibaba can be compelling for several reasons:

Growth Potential: Alibaba has shown consistent revenue growth, driven by its expanding e-commerce operations and increasing cloud computing services.

Market Leadership: As a leader in the Chinese market, Alibaba benefits from a large and growing consumer base.

Diversification: Alibaba’s business interests span multiple sectors, providing a diversified revenue stream.

Innovation: The company continually invests in new technologies and innovations, keeping it at the forefront of the tech industry.

By understanding Alibaba’s background and the reasons to consider investing, you can make a more informed decision about including Alibaba shares in your investment portfolio.

Steps to Buy Alibaba Shares

Choose a Brokerage

The first step in purchasing Alibaba shares is to select a brokerage that allows you to buy and sell international stocks. There are several types of brokerages to consider:

Types of Brokerages

- Full-Service Brokerages: These offer a wide range of services, including investment advice, portfolio management, and a variety of financial products. They typically charge higher fees but provide comprehensive support.

- Discount Brokerages: These provide the basic services needed to buy and sell shares, often with lower fees and commissions. They are a cost-effective choice for investors who prefer to manage their own investments.

- Online Brokerages: These platforms allow you to trade stocks online with ease and convenience. They often offer lower fees and user-friendly interfaces, making them a popular choice for both novice and experienced investors.

Factors to Consider

When choosing a brokerage, consider the following factors:

- Fees and Commissions: Compare the cost of buying and selling shares across different brokerages.

- Account Types: Ensure the brokerage offers the type of account you need, such as individual or joint accounts, ISA or SIPP.

- Trading Platform: Evaluate the usability and features of the brokerage’s trading platform.

- Customer Support: Look for brokerages with reliable customer service to assist you when needed.

- Regulation and Security: Choose a brokerage that is regulated by the Financial Conduct Authority (FCA) to ensure your investments are protected.

Open an Account

Once you have selected a brokerage, the next step is to open an account. This process typically involves the following steps:

Necessary Documentation

To open an account, you will need to provide various documents to verify your identity and address. These may include:

- Proof of Identity: Such as a passport or driver’s license.

- Proof of Address: Such as a utility bill or bank statement.

- National Insurance Number: Required for tax purposes.

Account Verification

After submitting your documentation, the brokerage will verify your information. This process can take a few days, depending on the brokerage. Once your account is verified, you will receive confirmation and instructions on how to proceed with funding your account and starting your investments.

Fund Your Account

With your brokerage account open and verified, the next step is to fund your account. This involves transferring money from your bank account to your brokerage account. Here’s how you can do it:

Payment Methods

Most brokerages offer several payment methods to fund your account, including:

- Bank Transfer: A direct transfer from your bank account to your brokerage account.

- Debit/Credit Card: Some brokerages accept payments via debit or credit cards.

- Electronic Wallets: A few brokerages may support funding through electronic wallets like PayPal.

Currency Exchange Considerations

Since Alibaba shares are traded in US dollars, UK investors need to consider currency exchange rates and potential fees. Some brokerages offer competitive exchange rates and lower fees for converting GBP to USD. It’s essential to understand these costs as they can impact your overall investment.

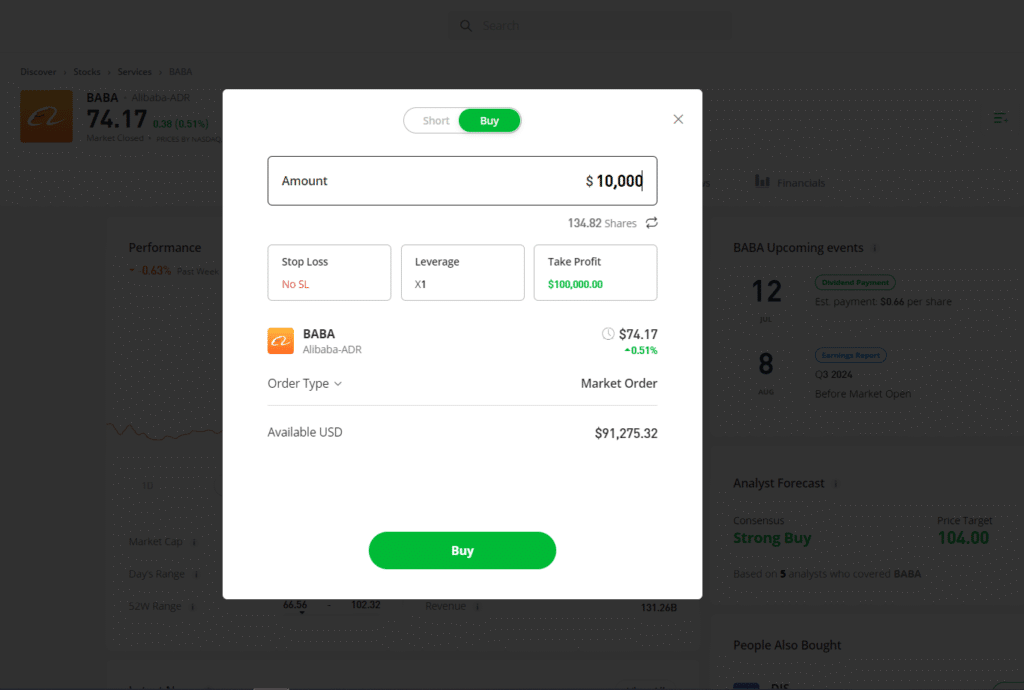

Place an Order

Once your account is funded, you can place an order to buy Alibaba shares. There are different types of orders you can use:

Market Orders vs. Limit Orders

- Market Orders: This type of order buys shares immediately at the current market price. It is straightforward but doesn’t guarantee the price you pay.

- Limit Orders: This type of order allows you to specify the maximum price you are willing to pay for the shares. The order will only be executed if the shares are available at or below your specified price.

Order Execution Time

The time it takes to execute your order can vary. Market orders are usually executed quickly, while limit orders may take longer depending on market conditions and the price you set. Ensure you understand the process and timing of order execution with your chosen brokerage.

Monitor and Manage Your Investment

After purchasing Alibaba shares, it’s important to monitor and manage your investment regularly to ensure it aligns with your financial goals.

Using Trading Platforms

Your brokerage’s trading platform will provide tools and features to help you track the performance of your shares. Utilize these tools to stay informed about market trends, news, and updates related to Alibaba.

Setting Up Alerts

Many trading platforms allow you to set up alerts for specific price movements, news updates, and other significant events. These alerts can help you stay proactive and make timely decisions about your investments.

Tax Implications for UK Investors

Capital Gains Tax

In the UK, profits made from selling shares are subject to Capital Gains Tax (CGT). However, you are entitled to an annual CGT allowance, which means only gains above this threshold are taxed. It’s crucial to keep records of your transactions to calculate your capital gains accurately.

Dividend Tax

If Alibaba pays dividends, UK investors need to be aware of the Dividend Tax. Dividends received from your shares are subject to taxation, but there is a tax-free dividend allowance each year. Dividends above this allowance are taxed at different rates depending on your income tax bracket.

Tax-Efficient Investment Options

To minimize your tax liability, consider using tax-efficient investment accounts such as:

Stocks and Shares ISA: This allows you to invest up to a certain amount each year without paying tax on capital gains or dividends.

Self-Invested Personal Pension (SIPP): Contributions to a SIPP can provide tax relief, and investments grow free of capital gains and dividend tax.

Consulting with a tax advisor can help you understand the tax implications of your investments and optimize your tax strategy.

Risks and Considerations

Market Volatility

The stock market can be volatile, and Alibaba shares are no exception. Factors such as economic conditions, geopolitical events, and changes in market sentiment can cause fluctuations in the share price. It’s essential to be prepared for this volatility and invest only what you can afford to lose.

Regulatory Risks

As a Chinese company listed on a US stock exchange, Alibaba faces regulatory scrutiny from both Chinese and US authorities. Changes in regulations or tensions between these countries can impact the company’s operations and share price. Stay informed about regulatory developments to understand their potential impact.

Economic Factors

Alibaba’s performance is influenced by the economic environment in China and globally. Economic downturns, changes in consumer spending, and shifts in trade policies can affect the company’s revenue and profitability. Diversifying your investment portfolio can help mitigate some of these risks.

Conclusion

Buying Alibaba shares in the UK involves several steps, from choosing a suitable brokerage to managing your investments effectively. By understanding the process and considering factors such as fees, tax implications, and potential risks, you can make informed decisions and build a successful investment strategy. Stay informed, be proactive, and regularly review your investment to ensure it aligns with your financial goals.

FAQs

No, Alibaba shares are not listed on the London Stock Exchange. You can buy Alibaba shares through brokerages that offer access to international markets, specifically the New York Stock Exchange where Alibaba is listed.

There are no specific restrictions on UK investors buying Alibaba shares, but you must comply with the regulations of the brokerage you choose and any applicable UK and US tax laws.

The minimum amount needed depends on the current share price of Alibaba and the minimum investment requirement set by your chosen brokerage. Some brokerages allow fractional share purchases, enabling you to invest smaller amounts.

You can track the performance of your Alibaba shares using the trading platform provided by your brokerage. Most platforms offer real-time price updates, performance charts, and news related to the company.

Yes, many brokerages offer dividend reinvestment plans (DRIPs) that allow you to automatically reinvest dividends received from Alibaba shares into additional shares of the company, helping you grow your investment over time.

Gain Access to Our #1 Recommended Investment Platform in the UK

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.