Quick Answer: To Buy Netflix Shares in the UK, You’ll Need to:

- Select a broker that offers access to US stocks.

- Create and fund your brokerage account.

- Search for Netflix using the ticker symbol ‘NFLX’.

- Place a buy order for the desired number of shares.

Confirm and finalise your purchase. - Monitor your investment to manage potential risks and returns.

Featured Partner - Etoro

- 5,000+ Tradable Assets

- Beginner Friendly Platform

- Copy Trading Feature

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

Introduction To Netflix

Investing in popular companies like Netflix has become increasingly accessible, even for those residing in the UK. With the rise of online brokerage platforms, buying shares of international giants is no longer a complex process reserved for seasoned investors. This guide will walk you through the essential steps to purchase Netflix shares from the UK, ensuring you are well-prepared and informed before making your investment. Whether you are a beginner or an experienced investor, this comprehensive guide will provide valuable insights to help you navigate the process smoothly.

Understanding Netflix Shares

What Are Netflix Shares?

Netflix shares represent a portion of ownership in Netflix, Inc., a leading global streaming entertainment service. When you purchase Netflix shares, you essentially buy a small piece of the company, making you a shareholder. Shareholders have the potential to benefit from the company’s growth and profitability through increases in the share price and dividends, if the company decides to distribute them.

Why Invest in Netflix?

Investing in Netflix can be an attractive option for several reasons:

Strong Market Position: Netflix is a leader in the streaming industry with a vast and growing subscriber base worldwide.

Innovative Content: The company continually invests in original content, which helps attract and retain subscribers.

Global Expansion: Netflix is expanding its services into new markets, potentially increasing its revenue and profitability.

Technological Advancements: Netflix’s use of data and technology to personalise user experience enhances customer satisfaction and loyalty.

Understanding the potential risks and rewards of investing in Netflix is crucial before making any financial commitment. As with any investment, thorough research and analysis are essential to make informed decisions.

Preparing to Buy Netflix Shares

Research and Analysis

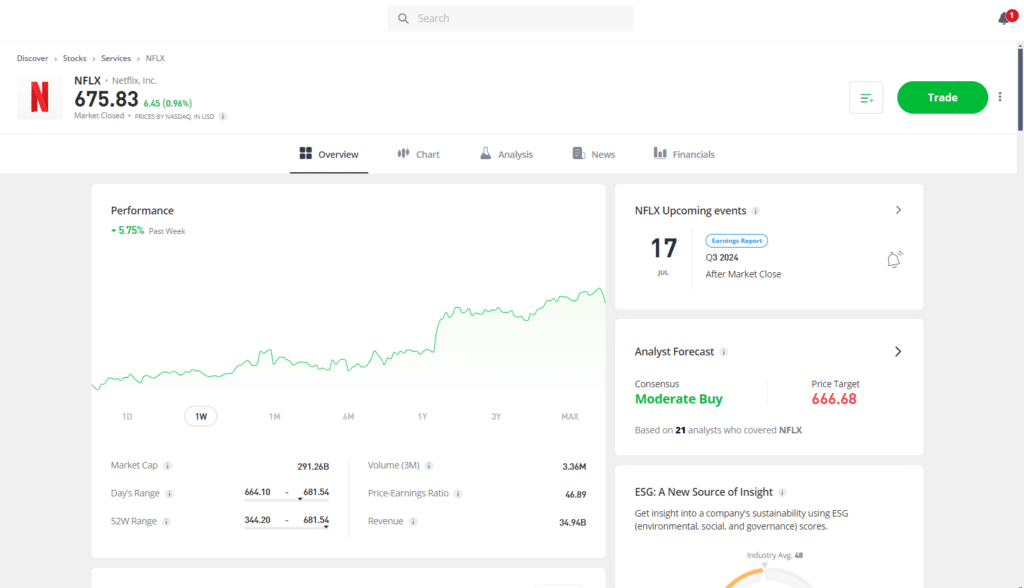

Before investing in Netflix shares, conducting thorough research and analysis is essential. Start by understanding the company’s financial health, including revenue, profit margins, and debt levels. Reviewing Netflix’s annual reports, earnings calls, and financial statements can provide valuable insights into its performance and future prospects. Additionally, keep an eye on market trends, industry news, and competitor actions, as these factors can significantly impact Netflix’s stock price. Analysing the company’s business model, growth strategy, and competitive advantages will help you make an informed investment decision.

Setting Your Investment Budget

Deciding how much money you are willing to invest in Netflix shares is a critical step. Your investment budget should align with your overall financial goals and risk tolerance. Consider your current financial situation, future expenses, and investment horizon. It’s essential to only invest money you can afford to lose, as stock markets can be volatile. Diversifying your investments across different assets and sectors can also help manage risk. Setting a clear investment budget and sticking to it will ensure you maintain financial stability while pursuing potential returns from your Netflix investment.

Choosing a Brokerage Platform

Types of Brokerage Accounts

There are various types of brokerage accounts available for buying Netflix shares. The most common options include:

Standard Brokerage Account: Offers flexibility to buy and sell stocks, including Netflix shares, without restrictions. However, taxes on capital gains and dividends apply.

Stocks and Shares ISA: A tax-efficient account allowing UK investors to buy and hold shares, including Netflix, without paying capital gains or dividend taxes up to a certain limit.

Self-Invested Personal Pension (SIPP): A retirement account that provides tax relief on contributions. You can buy Netflix shares within a SIPP, but funds are typically locked until retirement age.

Factors to Consider When Choosing a Broker

Selecting the right brokerage platform is crucial for a smooth investing experience. Consider the following factors when choosing a broker:

Fees and Commissions: Compare the fees charged for buying, selling, and holding shares. Look for platforms with competitive pricing structures to maximise your investment returns.

User Interface and Tools: A user-friendly interface and robust tools for research, analysis, and trading can enhance your investing experience. Ensure the platform provides real-time data, educational resources, and customer support.

Regulation and Security: Choose a broker regulated by the Financial Conduct Authority (FCA) in the UK. This ensures your investments are protected and the platform adheres to strict regulatory standards.

Investment Options: Ensure the platform offers access to international stocks, including Netflix shares. Additionally, check if they provide other investment options such as ETFs, mutual funds, and bonds for diversification.

Opening a Brokerage Account

Step-by-Step Guide

Opening a brokerage account involves a few straightforward steps:

Choose a Broker: Select a brokerage platform that meets your needs based on the factors mentioned earlier.

Complete the Application: Fill out the online application form, providing personal details such as your name, address, and National Insurance number.

Verification: Submit identification documents, such as a passport or driving license, and proof of address, like a utility bill or bank statement, to verify your identity.

Fund Your Account: Deposit funds into your brokerage account using a bank transfer, debit card, or other accepted payment methods.

Verification and Funding Your Account

Once your application is approved, you’ll need to verify your identity and fund your account before you can start buying Netflix shares. Most brokers require you to upload scanned copies or photos of your identification documents and proof of address. Verification typically takes a few days. After your account is verified, you can transfer funds into your account. Some brokers may offer instant funding options, while others might take a few business days for the transfer to complete. Ensuring your account is fully funded and ready will enable you to act quickly when you decide to purchase Netflix shares.

Buying Netflix Shares

Placing a Trade

Once your brokerage account is funded, you are ready to buy Netflix shares. Here’s a step-by-step guide to placing a trade:

Log into Your Brokerage Account: Access your account through the broker’s website or mobile app.

Search for Netflix: Use the search function to find Netflix shares, typically listed as “NFLX” on the stock exchange.

Select the Stock: Click on Netflix from the search results to open the trading page.

Choose the Number of Shares: Decide how many shares you want to buy. You can also specify the amount of money you wish to invest, and the platform will calculate the number of shares based on the current price.

Place Your Order: Choose the type of order (e.g., market order, limit order) and review the details. A market order buys the shares at the current market price, while a limit order buys the shares at a specified price or better.

Confirm the Trade: Review your order details and confirm the trade. Once the order is executed, you will own Netflix shares.

Order Types and Execution

Understanding different order types is crucial for effective trading:

Market Order: Executes immediately at the current market price. This is the simplest and fastest way to buy shares.

Limit Order: Executes only at your specified price or better. This allows you to control the price you pay but may result in the order not being filled if the price doesn’t reach your target.

Stop Order: Becomes a market order once the stock reaches a specified price, known as the stop price. This can help limit losses or protect profits.

Stop-Limit Order: Combines elements of stop orders and limit orders. Once the stop price is reached, the order becomes a limit order and will only execute at the specified limit price or better.

Managing Your Investment

Monitoring Your Shares

After purchasing Netflix shares, it’s essential to monitor your investment regularly. Keep track of the company’s performance, industry trends, and overall market conditions. Use the tools and resources provided by your brokerage platform to stay informed. Set up alerts for significant price movements or news related to Netflix. Regularly reviewing your investment helps you make timely decisions, such as buying more shares, holding, or selling, based on your financial goals and market conditions.

Understanding Dividends and Returns

While Netflix does not currently pay dividends, understanding how dividends work is essential for any investor. Dividends are regular payments made by companies to their shareholders out of their profits. Instead of dividends, investors in Netflix rely on capital appreciation, meaning the increase in the share price over time, for their returns. Keep an eye on Netflix’s financial health and strategic decisions, as these factors can significantly impact the stock’s performance and your potential returns.

Tax Implications

UK Tax on Dividends and Capital Gains

Investing in shares has tax implications in the UK. Here are the key points to consider:

Dividends: Any dividends received from your investments are subject to income tax. The first £500 of dividend income is tax-free under the dividend allowance. Beyond this allowance, dividends are taxed at different rates depending on your income tax band.

Capital Gains: When you sell your Netflix shares for a profit, the gains are subject to Capital Gains Tax (CGT). Each individual has an annual CGT allowance (£3000 for the 2024/25 tax year). Gains above this allowance are taxed at 10% for basic-rate taxpayers and 20% for higher-rate taxpayers.

How to Report Your Investments

You need to report your dividend income and capital gains to HM Revenue and Customs (HMRC). Here’s how to do it:

Self-Assessment Tax Return: If your dividend income exceeds the allowance or you have significant capital gains, you will need to file a self-assessment tax return.

Record-Keeping: Keep detailed records of your share purchases, sales, dividend receipts, and any associated costs. This information is crucial for accurately calculating and reporting your tax liability.

Online Reporting: You can report your taxes online through the HMRC website. Ensure you meet all deadlines to avoid penalties and interest charges.

Conclusion

Summary of Steps

Investing in Netflix shares from the UK involves several steps. Start by conducting thorough research and analysis to understand the company’s potential. Set a clear investment budget that aligns with your financial goals and risk tolerance. Choose a reputable brokerage platform that meets your needs, and open a brokerage account by completing the necessary application and verification processes. Once your account is funded, place a trade to buy Netflix shares. Monitor your investment regularly and understand the tax implications associated with your holdings.

Final Tips and Considerations

Stay Informed: Continuously educate yourself about the stock market, investment strategies, and Netflix’s business performance. Staying informed will help you make better investment decisions.

Diversify: Avoid putting all your money into a single stock. Diversifying your portfolio across different assets and sectors can reduce risk and improve your overall investment returns.

Long-Term Perspective: Investing in stocks is typically more rewarding when viewed as a long-term endeavor. Patience and a long-term perspective can help you weather market volatility and achieve your financial goals. Seek Professional Advice: If you are unsure about any aspect of investing or managing your taxes, consider seeking advice from a financial advisor or tax professional. Their expertise can provide valuable guidance tailored to your specific situation.

By following these steps and considerations, you can confidently navigate the process of buying Netflix shares in the UK and build a solid foundation for your investment journey.

Additional Resources

Here are three reputable sources to back up your article on how to buy Netflix shares in the UK:

Finder UK: This site provides a comprehensive guide on how to buy Netflix shares, including the steps to open a brokerage account, fund it, and place a buy order for Netflix shares. It also offers advice on selecting a broker that provides access to US stocks, such as Netflix.

Koody: Koody details various methods of investing in Netflix shares, from direct stock purchases to investing through mutual funds and ETFs. It also highlights the importance of using a regulated broker and discusses the tax implications of such investments.

Buyshares.co.uk: This guide outlines the steps to purchase Netflix shares, from opening an account with a regulated broker to funding your account and executing a trade. It also includes information on different brokers and the fees associated with buying US stocks.

FAQs

No, you cannot buy Netflix shares directly from the company. You need to use a brokerage platform that allows you to purchase shares of publicly traded companies like Netflix. These platforms act as intermediaries, facilitating the buying and selling of shares on the stock market.

Yes, most brokerage platforms charge fees for buying and selling shares. These fees can include transaction fees, commissions, and account maintenance fees. It’s essential to review the fee structure of your chosen brokerage platform to understand the costs involved and how they might impact your investment returns.

The minimum amount required to invest in Netflix shares depends on the brokerage platform you use. Some platforms may have a minimum deposit requirement, while others might allow you to invest with any amount. Additionally, the cost of one share of Netflix will determine the minimum investment if you plan to buy a whole share. Some platforms also offer fractional shares, allowing you to invest smaller amounts.

You can track the performance of your Netflix shares through your brokerage platform, which typically provides real-time data and portfolio tracking tools. Additionally, financial news websites, stock market apps, and business news channels offer updates on stock prices and market trends. Setting up alerts for significant price movements or news related to Netflix can also help you stay informed.

Investing in Netflix shares, like any stock investment, carries certain risks. These include market volatility, changes in the competitive landscape, regulatory impacts, and fluctuations in the company’s performance. It’s important to conduct thorough research and diversify your investments to mitigate these risks. Remember that past performance is not indicative of future results, and investing in stocks always involves the potential for loss.

Gain Access to Our #1 Recommended Investment Platform in the UK

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.