Quick Answer: To buy NVIDIA shares, you’ll need to:

- Research NVIDIA: Learn its performance and market position to assess its potential.

- Decide Investment Amount: Determine what fits your budget.

- Choose a Broker: Pick one that is reputable and offers NASDAQ stocks.

- Buy NVIDIA Shares: Open an account, deposit funds, and make your purchase.

eToro

eToro redefines investing with its intuitive platform and social trading network. Connect with millions of traders worldwide, learn from the best, and trade confidently across diverse asset classes. Experience innovation and opportunity in one place, making investing accessible and empowering for all.

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

Introduction to NVIDIA

Welcome to our comprehensive guide on “How to Buy NVIDIA Stocks & Shares,” where we dive into the intricacies of investing in one of the most dynamic and innovative technology companies in the market today. Whether you’re a seasoned investor or new to the market, understanding how to buy NVIDIA stock is crucial in navigating the investment landscape. NVIDIA’s prominence in the technology sector, driven by its advancements in graphics processing units (GPUs) and accelerated computing, makes NVIDIA stock a potentially lucrative addition to your investment portfolio. This blog will provide you with step-by-step instructions, key considerations, and strategic insights on how to buy NVIDIA stock, ensuring you’re well-equipped to make informed decisions in your investment journey. Join us as we explore the exciting world of NVIDIA investments, from opening your first brokerage account to making your first purchase of NVIDIA stock.

NVIDIA Corporation, established in 1993 by Jensen Huang, Chris Malachowsky, and Curtis Priem, has grown from a small startup into a global leader in graphics processing technology and artificial intelligence (AI). Initially focused on developing graphics chips for gaming PCs, NVIDIA has significantly expanded its reach and now plays a pivotal role in various computing-intensive sectors.

History and Growth

The company’s journey began with the invention of the GPU (Graphics Processing Unit) in 1999, which revolutionized 3D gaming by offloading complex graphics calculations from the CPU. This innovation not only transformed the gaming industry but also laid the groundwork for NVIDIA’s expansion into other areas. Over the years, NVIDIA has diversified its product lineup to include GPUs for professional visualization, mobile computing, and more recently, deep learning and AI—fields where its technology has become indispensable for powering complex computations and data analysis.

Product Range

NVIDIA’s product range is broad and diversified, catering to different market segments:

GeForce Series:

Aimed at gamers, the GeForce series of GPUs are designed to deliver high-performance graphics and smooth gameplay experiences. They are widely recognized in the gaming community for their quality and reliability.

Quadro Series:

Targeted towards professionals in design, animation, and video editing, Quadro GPUs offer precision and power for complex simulations, large data computations, and intricate designs.

Tesla and DGX:

These products are tailored for AI research, deep learning, and big data analytics, offering massive computational power necessary to train complex AI models and process large datasets.

Tegra:

NVIDIA’s Tegra processors are designed for mobile devices, automotive applications, and embedded systems, providing high performance and energy efficiency for on-the-go computing and autonomous vehicles.

NVIDIA DRIVE:

This is an AI platform for autonomous vehicles, combining software, data centers, and the in-vehicle hardware to enable self-driving cars and trucks.

Market Impact

NVIDIA has significantly impacted various markets through its continuous innovation and technology advancements. In gaming, NVIDIA has set the standard for graphics performance, enabling more realistic and immersive experiences. In professional visualization, its GPUs accelerate the creation of complex designs and simulations. NVIDIA’s biggest game-changer has been in AI and deep learning, where its GPUs have become the de facto standard for training AI models, making it possible to process and analyze data at unprecedented speeds.

NVIDIA’s contributions to AI have not only advanced research and development in technology fields but also enabled practical applications in healthcare, autonomous vehicles, and robotics, among others. The company’s strategic pivot to focus on AI and deep learning in recent years has positioned it as a leader in a technology area that is expected to drive future innovation and economic growth.

NVIDIA has evolved from a graphics chip maker to a multifaceted technology company at the forefront of several key technology trends, including gaming, professional visualization, mobile computing, and, most importantly, artificial intelligence and machine learning. Its products and technologies are shaping the future of computing, making it a critical player in the global tech landscape.

Decide if NVIDIA Makes Sense for You

Investment Goals

Start by assessing your investment goals. Are you looking for short-term gains, or are you more interested in long-term growth? NVIDIA, with its strong foothold in several fast-growing technology sectors, might appeal more to long-term investors who believe in the future of AI, gaming, and autonomous vehicles. Understanding your objectives will help determine if NVIDIA stock aligns with your investment horizon and goals.

Risk Tolerance

Investing in technology stocks, including NVIDIA stock, comes with its own set of risks. The tech sector can be volatile, with prices fluctuating significantly in response to new product launches, regulatory changes, or shifts in consumer demand. NVIDIA’s stock performance is also closely tied to the semiconductor industry, which is subject to cyclical trends and supply chain disruptions. Assess your risk tolerance to decide if you’re comfortable with the potential ups and downs associated with NVIDIA’s stock.

Sector Analysis

Technology is a broad sector that includes companies with vastly different profiles, from established giants to high-growth startups. NVIDIA stock occupies a unique position within this landscape, thanks to its leadership in GPUs and growing presence in AI and autonomous driving technologies. Consider the growth potential of these industries and NVIDIA’s role within them. Is the company well-positioned to benefit from future tech trends? Understanding the sector’s dynamics can help you gauge NVIDIA’s growth prospects.

Portfolio Diversification

Adding NVIDIA shares to your portfolio should also be viewed through the lens of diversification. How does investing in NVIDIA fit with your existing investments? Given NVIDIA’s prominence in specific tech niches, owning its stock can provide exposure to growth areas like AI and gaming. However, it’s important to balance this with investments in other sectors or asset classes to manage risk effectively.

Competition and Challenges

Evaluate NVIDIA’s competitive landscape. The company faces stiff competition from other tech giants like AMD and Intel in the GPU market, as well as emerging players in AI and autonomous driving technologies. Consider how NVIDIA’s innovation, product pipeline, and market strategy position it against competitors. Additionally, be aware of regulatory challenges and geopolitical factors that could impact NVIDIA’s operations and growth prospects.

Personal Conviction

Finally, personal conviction in NVIDIA’s vision and management should play a role in your decision. Research the company’s leadership, its track record of innovation, and its strategic direction. Do you believe in the company’s ability to execute its vision and maintain its competitive edge? Your confidence in NVIDIA’s future performance is a crucial factor in deciding whether to invest.

In summary, deciding if NVIDIA stock makes sense for you as an investment requires a thorough analysis of your personal financial goals, risk tolerance, and an understanding of the technology sector’s landscape. NVIDIA offers a unique investment opportunity given its leadership in critical and growing technology areas. However, like any investment, it comes with risks that should be carefully weighed against your investment strategy and portfolio needs.

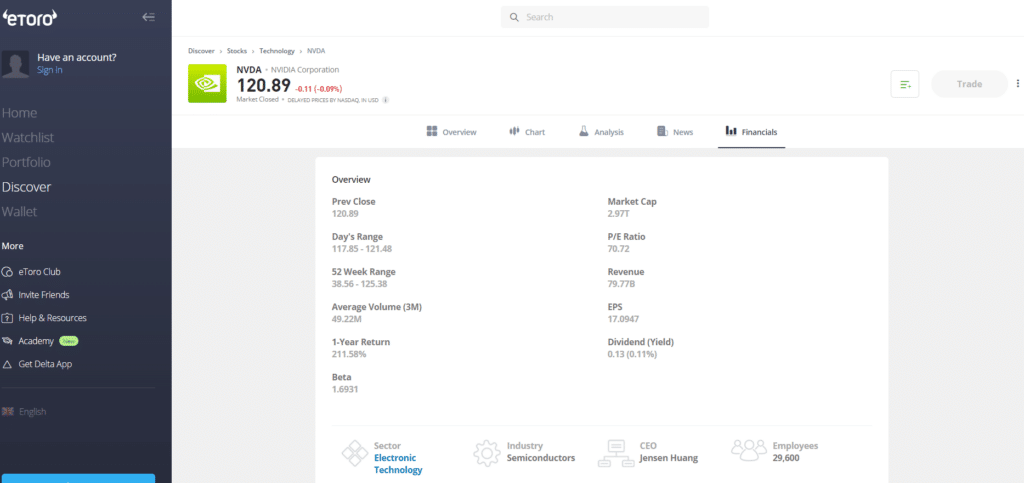

Financial Update on NVIDIA

Revenue Growth

NVIDIA stock reported a remarkable revenue of $22.1 billion for the fourth quarter ended January 28, 2024, marking a substantial increase of 22% from the previous quarter and an impressive 265% growth from the same period a year ago. This growth indicates NVIDIA’s strong market position and the high demand for its products and services, particularly in areas like gaming, professional visualization, data centers, and AI technologies.

Earnings Per Share (EPS)

The company’s GAAP earnings per diluted share for the same quarter were $4.93, which represents a 33% increase from the previous quarter and a staggering 765% increase from the year-ago period. This significant rise in EPS demonstrates NVIDIA’s profitability and operational efficiency, reflecting well on its ability to manage costs and maximize earnings amidst rapid growth.

Market Performance and Outlook

The financial update signifies NVIDIA’s robust performance and its successful navigation through the competitive and fast-evolving tech landscape. The company’s focus on high-growth areas such as artificial intelligence, deep learning, and autonomous vehicles, coupled with its strong footing in the gaming and professional graphics markets, has been instrumental in driving revenue and earnings growth.

NVIDIA’s impressive financial results are indicative of the company’s innovative capabilities and strategic investments in research and development, which have positioned it as a leader in the technology sector. Investors and stakeholders can view these results as a testament to NVIDIA’s strong market position and its potential for sustained growth in the coming years.

NVIDIA’s financial update for the fiscal year 2024 highlights its exceptional growth in revenue and earnings, underscoring the company’s success in leveraging its technological advancements and market leadership to drive financial performance. As NVIDIA continues to innovate and expand its product offerings, its financial health and growth prospects remain strong, making it an attractive consideration for investors looking at long-term growth opportunities in the technology sector.

How to open a brokerage account

To sign up, simply visit eToro’s website, complete the application form with your personal and financial details, and provide necessary identity verification documents, such as a passport or driver’s license.

Once your account is approved, you can fund it using various methods like bank transfer. eToro’s straightforward account setup and funding process make it easy for beginners to start trading and investing wisely in the stock market, including in popular stocks like NVIDIA.

Consider How Much to Invest in NVIDIA

Deciding how much to invest in NVIDIA stock requires a thoughtful approach, balancing your financial goals, risk tolerance, and market conditions. Here’s an expanded view on considerations for determining the appropriate investment amount in NVIDIA:

Assess Your Financial Situation

Start by evaluating your financial health. Ensure you have a solid emergency fund, and your high-interest debt is under control. Investing in the stock market, including NVIDIA, should come after these financial priorities. Determine the amount of disposable income you can comfortably allocate to investments without compromising your financial security.

Understand Your Investment Goals

Your investment goals are crucial in deciding how much to invest. Are you looking for long-term growth, or are you more interested in short-term gains? NVIDIAstock , with its strong presence in growth sectors like AI, gaming, and data centers, can be appealing for long-term investors. Align your investment in NVIDIA with your broader financial objectives, considering time horizons and expected returns.

Evaluate Your Risk Tolerance

Investing in individual stocks, such as NVIDIA, carries higher volatility compared to diversified investments like index funds. Assess your comfort with market fluctuations and the possibility of losing money. If you’re risk-averse, you might opt for a smaller position in NVIDIA, balancing it with more conservative investments. Conversely, a higher risk tolerance could justify a larger allocation, especially if you’re bullish on NVIDIA’s market prospects.

Research NVIDIA’s Market Position and Prospects

Before deciding on the amount to invest, thoroughly research NVIDIA. Look into its financial health, market position, competition, and growth prospects. NVIDIA stock operates in highly competitive and rapidly evolving sectors. Its future growth will be influenced by factors such as technological advancements, market demand for its products, and its ability to innovate. A strong belief in NVIDIA’s growth potential based on solid research can justify a larger investment.

Consider Market Conditions

Market timing shouldn’t be the primary factor in your investment decisions, but it’s wise to consider overall market conditions. In a bullish market, you might be more inclined to invest a larger amount, anticipating continued growth. However, in volatile or bearish markets, caution might dictate a more conservative investment until conditions stabilize.

Diversify Your Portfolio

Determine how much to invest before you go onto buy NVIDIA stock within the context of your entire investment portfolio. Diversification is key to managing risk. NVIDIA should represent only a portion of your investment portfolio, balanced with other stocks, bonds, and asset classes to reduce exposure to any single investment’s performance.

Start Small and Consider Dollar-Cost Averaging

If you’re uncertain, consider starting with a smaller investment in NVIDIA and potentially using a dollar-cost averaging (DCA) strategy. DCA involves regularly investing a fixed amount over time, which can help mitigate the impact of volatility by spreading out your investment entry points.

In summary, deciding how much to invest in NVIDIA involves a comprehensive evaluation of your financial situation, investment goals, risk tolerance, and research into NVIDIA’s potential. It’s also crucial to consider how this investment fits within your overall portfolio strategy to maintain a balanced and diversified investment approach.

How to Invest in NVIDIA Through a Fund

Investing in NVIDIA through a fund, such as a mutual fund or exchange-traded fund (ETF), can be an effective strategy for those looking to gain exposure to NVIDIA while also benefiting from the diversification that funds offer. Here’s how to approach this investment strategy:

Identify Suitable Funds: Start by researching mutual funds and ETFs that hold NVIDIA as part of their portfolio. Look for technology-focused or sector-specific funds that have a significant allocation to NVIDIA, indicating the fund’s belief in NVIDIA’s growth potential.

Evaluate Fund Performance and Fees: Examine the fund’s historical performance, keeping in mind that past performance is not indicative of future results. Also, compare the expense ratios and any other fees associated with the fund, as these can impact your investment returns over time.

Consider the Fund’s Diversification: Understand the fund’s diversification level by reviewing its holdings. Investing in a fund with a broad mix of companies can reduce the risk associated with individual stock investments. Ensure that the fund’s investment strategy aligns with your risk tolerance and investment goals.

Purchase Shares through a Brokerage Account: Once you’ve selected a suitable fund, you can purchase shares through your existing brokerage account. If you don’t have an account, you’ll need to open one by choosing a broker that meets your needs, as previously discussed.

Monitor Your Investment: Even though funds are managed by professionals, it’s important to periodically review your investment. Keep an eye on NVIDIA’s weight in the fund and the fund’s overall performance to ensure it continues to meet your investment objectives.

How to Sell NVIDIA

Selling NVIDIA stocks or fund shares that include NVIDIA requires careful consideration and planning. The process is the same as if you were to buy NVIDIA stock, the question is when do you sell NVIDIA stock. Here are steps and factors to consider:

Decide on the Timing: The decision to sell should be based on your investment strategy, financial goals, and market analysis. Consider selling if your investment has achieved its intended goal, if NVIDIA’s fundamentals have changed, or if you need to rebalance your portfolio.

Review Tax Implications: Selling stocks or fund shares can have tax consequences, particularly if you’ve made a profit. Understand the capital gains tax that may apply to your sale and plan accordingly. In some cases, timing your sale to manage tax implications can be beneficial.

Place a Sell Order: To sell your NVIDIA shares or shares of a fund that includes NVIDIA, log into your brokerage account and place a sell order. You can choose from different types of orders, such as market orders, limit orders, or stop-loss orders, depending on how much control you want over the selling price.

Reinvest or Allocate Funds: After selling, decide how to allocate the proceeds. You may choose to reinvest in another stock or fund, increase your cash holdings, or use the money for another financial goal. Consider your overall investment strategy and portfolio diversification when reallocating funds.

Conclusion

In the dynamic world of investing, choosing the right technology company to add to your portfolio requires careful consideration, especially when looking at a powerhouse like NVIDIA Corporation. Known for its cutting-edge graphics processing units (GPUs) and pioneering work in accelerated and high-performance computing, NVIDIA stands out as a beacon in the technology sector. This blog has taken you through the essentials of how to buy NVIDIA shares, whether you’re looking to invest in NVIDIA directly or through various investment platforms that offer exposure to its robust share price performance.

FAQs

No, to buy NVIDIA stock, you need to have an account with a brokerage that offers access to the NASDAQ, where NVIDIA is traded. Online brokers are the most accessible option for most investors.

The minimum amount depends on the brokerage’s requirements and the price of NVIDIA stock. Some brokers allow investing in fractional shares, meaning you can start with as little as you’re willing to spend.

NVIDIA is considered a leading company in the tech industry, especially in GPUs and AI technology. However, whether it’s a good investment depends on current market conditions, your investment goals, and risk tolerance. It’s important to do your research and consider consulting a financial advisor.

Consider your investment budget, the current price of NVIDIA shares, and how the investment fits into your overall portfolio strategy. Diversification is key to managing risk.

If NVIDIA’s stock price decreases, the value of your investment will also go down. It’s important to invest only what you can afford to lose and have a long-term perspective, as stock prices can fluctuate in the short term but may increase over time.

References

How to Buy Nvidia Stock (NVDA)- Nerd Wallet

NVIDIA About Us – NVIDIA

How To Buy NVIDIA (NVDA) Stocks & Shares- Forbes

Gain Access to Our #1 Recommended Investment Platform in the UK

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.