How to Buy Bitcoin in the UK

Adam Woodhead

Co-Founder

Adam is a Co-Founder and content creator for The Investors Centre. His key areas of interest and expertise are passive investing and blockchain technology.

Twitter ProfileAuthor Bio

Thomas Drury

Co-Founder

Seasoned finance professional with 10+ years' experience. Chartered status holder. Proficient in CFDs, ISAs, and crypto investing.

Twitter ProfileAuthor Bio

Fact Checked

How we test

At The Investors Centre, we pride ourselves on our rigorous fact-checking process. To delve deeper into our meticulous testing procedures and discover how we ensure accuracy and reliability, visit our dedicated page on how we test.

Risk Warning

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

Updated 09/12/204

Explore our curated list of reputable exchanges to buy Bitcoin (BTC), each rigorously tested with real funds. All brokers are accessible to traders in the United Kingdom.

To Buy Bitcoin in the UK, You'll Need to:

To invest in Bitcoin in the UK, use a trusted crypto exchange like eToro or Coinbase. These platforms simplify buying and selling Bitcoin, allowing you to trade directly from your smartphone, tablet, or computer.

Featured Exchange

eToro

- Copy Trading

- User Friendly Platform

- Regulated & Trusted

- 30 Million+ Users

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

When I first started investing in Bitcoin, I was both intrigued and cautious. The idea of a digital currency operating independently of traditional banks was fascinating, but the market’s volatility was intimidating.

I began with a small investment to familiarize myself with the process, learning the ropes through trial and error. This hands-on experience taught me the importance of securing my assets and staying informed about market trends.

Through this guide, I aim to share the insights I’ve gained along the way to help you navigate your own Bitcoin investment journey with confidence.

This guide is designed to provide a clear and practical approach to investing in Bitcoin in the UK.

UPDATE 09/12/2024: Bitcoin recently surpassed the $100,000 mark, reaching an all-time high of $103,000. Over the past week, it has fluctuated between approximately $90,500 and $103,000.

This surge is attributed to investor optimism regarding favourable cryptocurrency policies from the incoming U.S. administration.

How to Buy Bitcoin in the UK for Beginners - Quick Steps

- Select an Exchange – Choose platforms like eToro, Coinbase, or Uphold with strong security and low fees.

- Register & Verify – Sign up and complete KYC with ID and proof of address.

- Deposit Funds – Use bank transfer (low fees, slow) or card (instant, higher fees).

- Select and Buy Bitcoin (BTC) – Place a market or limit order, confirm, and complete.

- Secure Your Bitcoin – Transfer to a wallet

- Monitor Your Investment

Comprehensive Step-by-Step Guide to Investing in Bitcoin

Step 1: Select a Reputable Exchange

Choosing the Right Exchange

Choosing the right exchange is the cornerstone of investing in Bitcoin. Start by prioritizing security measures such as two-factor authentication (2FA) and cold storage of funds to protect your assets. Fees are another critical aspect, as they can vary widely between exchanges. Consider transaction fees, deposit fees, and withdrawal fees when making your choice.

User experience is also important, especially for beginners. Opt for platforms with intuitive interfaces and reliable customer support to ease your trading experience.

Additionally, regulatory compliance is vital for UK investors. Ideally the exchange would be registered with the Financial Conduct Authority (FCA) for compliance with UK financial regulations.

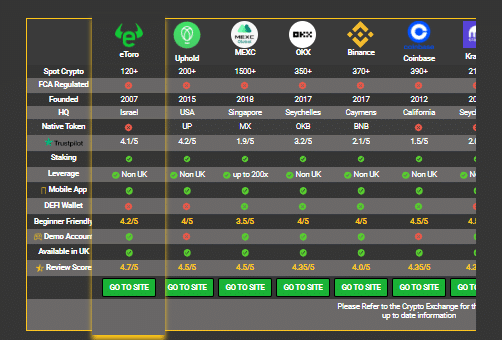

Comparison of Top Exchanges:

- eToro: Best for beginners and social trading.

- Coinbase: Ideal for casual users with simple tools and strong security.

- Coinbase Advanced Trade: Suited for experienced traders with lower fees and advanced tools.

- Uphold: Great for fee-free trading with higher spreads and cross-asset options.

| Feature | eToro | Coinbase | Coinbase Advanced Trade | Uphold |

|---|---|---|---|---|

| Ease of Use | Beginner-friendly, social trading features | Simple interface, ideal for beginners | Advanced tools, suited for experienced traders | Straightforward, easy-to-navigate app |

| Fees | 1% trading fee | 1.49% transaction fee | Lower fees (0.4% maker, 0.6% taker) | 0% trading fee, but higher spreads |

| Funding Options | Bank transfer, debit/credit card | Bank transfer, debit/credit card, PayPal | Bank transfer, debit/credit card | Bank transfer, debit/credit card, Apple/Google Pay |

| Crypto Selection | 75+ cryptocurrencies | 240+ cryptocurrencies | 240+ cryptocurrencies | 200+ cryptocurrencies |

| Security | FCA-regulated, 2FA, cold storage | Insured funds, 2FA, cold storage | Insured funds, 2FA, cold storage | Strong security, but not FCA-regulated |

| Extras | CopyTrading, multi-asset platform | Educational tools, staking | Advanced charting, order types, lower fees | Multi-asset platform with cross-asset trades |

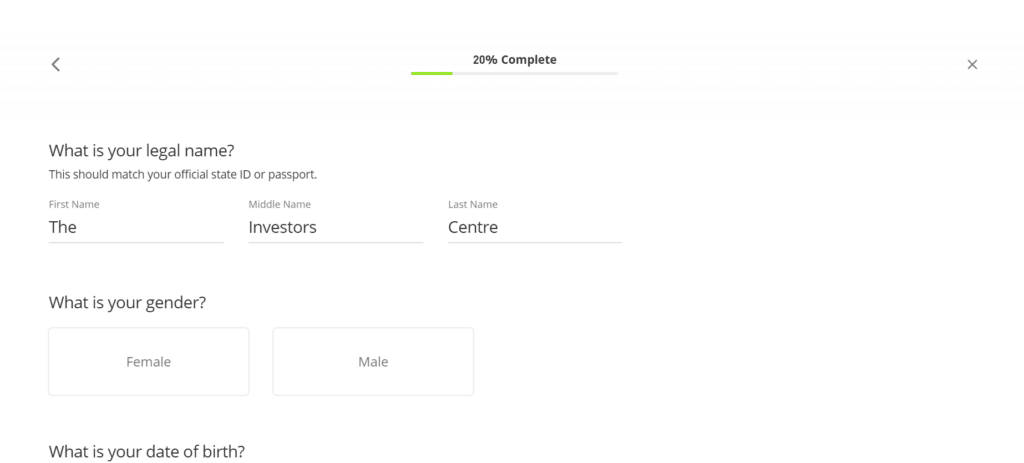

Step 2: Register and Verify Your Account

How to Register and Verify

After selecting an exchange, the next step is to register an account. Registration typically involves providing your email address, creating a secure password, and agreeing to the exchange’s terms of service. Following registration, you’ll need to complete the KYC (Know Your Customer) process to verify your identity and comply with financial regulations.

The KYC process requires you to provide personal information such as your full name, date of birth, and residential address. You’ll also need to upload a government-issued ID (like a passport or driver’s license) and a proof of address (such as a utility bill). The verification process can vary in duration, from a few minutes to several hours, depending on the exchange’s system.

Verification is essential for security and compliance, helping prevent fraud and ensuring the exchange meets anti-money laundering (AML) regulations. This adds an extra layer of security, safeguarding your account and investments.

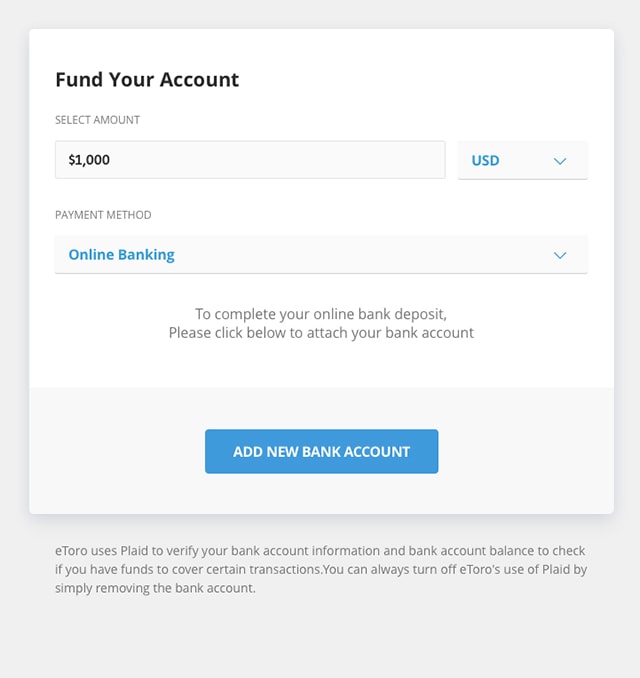

Step 3: Deposit Funds into Your Exchange Account

Funding Your Account

With your account verified, the next step is to deposit funds into your exchange account. Most exchanges offer a variety of funding options, with bank transfers and credit/debit cards being the most commonly used. Bank transfers usually have lower fees and can take anywhere from a few hours to a couple of days to process, depending on your bank and the exchange. Credit/debit card payments are processed almost instantly but typically incur higher fees.

Funding Options:

- Bank Transfer: Lower fees, 1-3 days processing time.

- Credit/Debit Card: Higher fees (typically 2-4%), instant processing.

Be mindful of any associated fees during the deposit process. While some exchanges offer free deposits, others might charge a fee based on the transaction amount. It’s also crucial to ensure the exchange supports GBP deposits to avoid unnecessary currency conversion fees. Double-check all deposit details before proceeding to prevent any transaction errors.

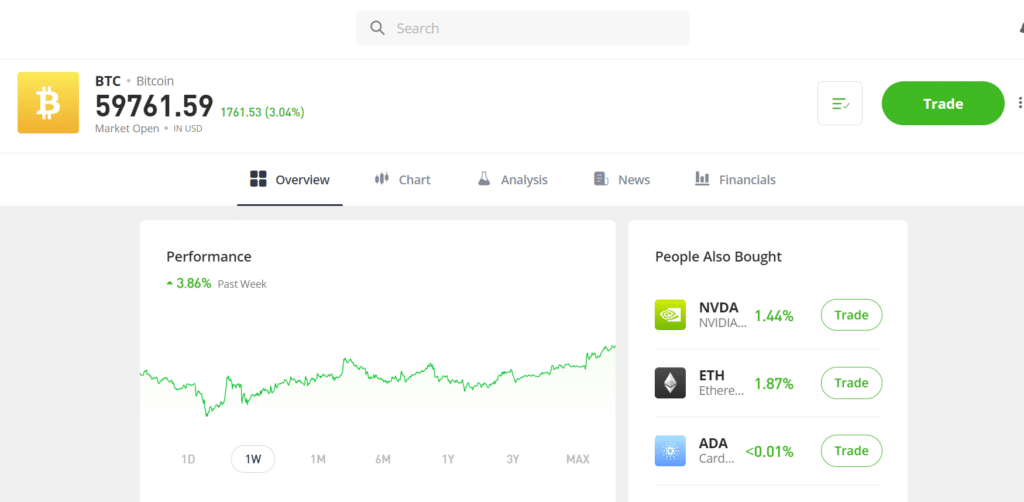

Step 4: Purchase Bitcoin

How to Buy Bitcoin

After funding your exchange account, you’re ready to purchase Bitcoin. Navigate to the Bitcoin section on the exchange platform, typically found under “Markets” or “Trade.” Enter the amount of Bitcoin you wish to purchase in either GBP or Bitcoin units. You’ll usually have the option to place a market order or a limit order.

- Market Order: Executes immediately at the current market price. This is straightforward and ideal for beginners, but be aware of potential slippage if the market is volatile.

- Limit Order: Allows you to set a specific price at which you want to buy Bitcoin. The trade will only execute when the market reaches your set price. This gives you more control but may take longer to fill.

Review the details of your order, including any fees that the exchange will charge. Fees can vary depending on the exchange and the size of your order, typically ranging from 0.1% to 2%. Once you’re satisfied, confirm the transaction. The Bitcoin will be added to your exchange account balance instantly or within a few minutes.

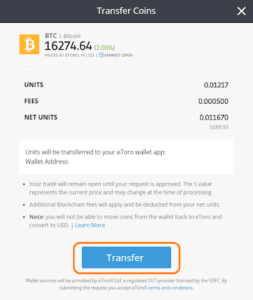

Step 5: Secure Your Bitcoin

After purchasing Bitcoin, it’s crucial to transfer it to a secure wallet rather than leaving it on the exchange, where it could be vulnerable to hacks. You have two primary wallet options: hardware wallets and software wallets. We have our Guide of Best Bitcoin Wallets here.

- Hardware Wallets: These are physical devices that store your Bitcoin offline, providing the highest level of security. Examples include Ledger and Trezor. Hardware wallets protect your private keys from online threats.

- Software Wallets: These are applications or software programs that store your Bitcoin on your computer or smartphone. While convenient, they are less secure than hardware wallets because they are connected to the internet. Examples include Exodus and Electrum.

Quick Steps to Set Up a Wallet and Transfer Bitcoin:

- Choose a Wallet: Select a hardware or software wallet based on your needs.

- Install/Set Up: For software wallets, download and install the app. For hardware wallets, follow the setup instructions provided by the manufacturer.

- Secure Your Wallet: Create a strong password and write down your recovery seed phrase on paper, storing it in a secure location.

- Transfer Bitcoin: On the exchange, go to your Bitcoin balance and choose the “Withdraw” or “Send” option. Enter your wallet’s public address (double-check for accuracy), select the amount, and confirm the transfer.

Best Practices for Wallet Security:

- Private Key Management: Never share your private key or recovery seed phrase. They are the only way to access your Bitcoin.

- Two-Factor Authentication (2FA): Enable 2FA on your wallet to add an extra layer of security.

- Backup: Always keep a secure backup of your wallet’s recovery phrase in case of device loss or failure.

Step 6: Monitor and Manage Your Investment

Monitoring Your Bitcoin Investment

After securing your Bitcoin, it’s important to actively monitor your investment. Use the exchange’s tools or third-party apps like CoinMarketCap or Coingecko for real-time tracking of Bitcoin’s price and your portfolio’s performance.

Set up price alerts to notify you of significant market movements. Staying informed about market trends, news, and regulatory changes will help you make informed decisions about when to buy, sell, or hold. Diversifying your sources of information ensures you have a well-rounded view of the market’s health and potential opportunities.

Understanding Bitcoin

What is Bitcoin?

Bitcoin is a decentralized digital currency, free from the control of any government or central authority. It operates on a peer-to-peer network that allows users to send and receive payments directly without the need for intermediaries like banks.

Unlike traditional currencies, Bitcoin is entirely digital and exists only online. Transactions are recorded on a public ledger called the blockchain, ensuring transparency and security.

Bitcoin is often referred to as “cryptocurrency” because it uses cryptographic principles to secure transactions and control the creation of new units.

The Blockchain Technology

Blockchain technology is the foundation of Bitcoin. It is a decentralized and distributed ledger that records all transactions across a network of computers.

Each transaction is grouped into a “block” and added to a “chain” of previous transactions, creating a secure and chronological history of all transactions.

This technology ensures that once a transaction is added to the blockchain, it is immutable and cannot be altered or deleted.

The decentralized nature of the blockchain means that no single entity has control over the network, making it resistant to censorship and fraud.

Each participant in the network has a copy of the blockchain, which they can verify independently, enhancing security and trust.

Why Bitcoin Matters

Bitcoin has several key properties that make it a unique and influential asset in the financial landscape.

Limited Supply: Only 21 million Bitcoins will ever be created, making it a scarce asset and often compared to digital gold.

Decentralization: Bitcoin operates without a central authority, reducing the risk of government interference or manipulation.

Pseudonymity: Users can hold multiple Bitcoin addresses without needing to link them to personal information, providing a level of privacy in transactions.

These characteristics, combined with its growing acceptance as a medium of exchange and store of value, position Bitcoin as a revolutionary financial tool with the potential to reshape the way we think about money and investments.

Is Bitcoin a Good Investment?

The Investment Potential

Bitcoin has garnered attention as a potential high-reward investment, often referred to as “digital gold.”

Its historical performance has shown significant growth, with periods of rapid price appreciation.

As a decentralized asset with a finite supply, Bitcoin is seen by many investors as a hedge against inflation and economic instability. It offers portfolio diversification, as it typically does not correlate directly with traditional assets like stocks and bonds.

Additionally, institutional adoption has increased in recent years, lending credibility and potential stability to its long-term value.

Risks and Considerations

Investing in Bitcoin comes with notable risks.

Price volatility is a major concern, as Bitcoin can experience dramatic fluctuations within short periods, driven by market sentiment, regulatory news, or technological developments.

Regulatory uncertainty also poses a risk, as governments around the world are still developing frameworks to regulate cryptocurrencies, which could impact Bitcoin’s accessibility and legality.

Security concerns are another factor, as the digital nature of Bitcoin makes it vulnerable to hacking, particularly if not stored securely. Investors need to weigh these risks carefully against potential rewards.

Long-Term Outlook

The long-term potential of Bitcoin remains a topic of debate among investors and financial experts.

Proponents argue that as a decentralized, scarce asset, Bitcoin could serve as a reliable store of value and a global digital currency. Its increasing integration into the financial system and acceptance by mainstream institutions suggest that it could play a significant role in the future of finance.

However, its success will depend on its ability to overcome regulatory challenges, technological advancements, and market adoption.

A balanced investment approach, where Bitcoin is a part of a diversified portfolio, is often recommended for those considering its long-term potential.

Bitcoin vs Altcoins

An altcoin is any cryptocurrency other than Bitcoin. The term “altcoin” comes from “alternative coin,” meaning these are alternatives to Bitcoin, which was the first and remains the most well-known cryptocurrency.

Altcoins include Solana, XRP, Dogecoin, Kaspa, Litecoin, Stellar, and Cardano.

Altcoins diversify portfolios, offering unique benefits beyond Bitcoin’s capabilities.

More on altcoins here

Final Thoughts on Investing in Bitcoin

Investing in Bitcoin offers the potential for high returns but comes with significant risks.

It’s crucial to conduct thorough research, understand the market dynamics, and continuously educate yourself on developments in the cryptocurrency space.

Starting with a small investment can help you get familiar with the process while mitigating risk. Staying informed about market trends and regulatory changes is essential for making informed decisions.

Always approach Bitcoin investment with caution and a long-term perspective.

FAQs

Yes, buying and holding Bitcoin is legal in the UK. The UK government allows the purchase, sale, and use of Bitcoin and other cryptocurrencies. However, Bitcoin is not considered legal tender, and its regulation is still evolving. Make sure to use an FCA-registered exchange to comply with UK regulations.

In the UK, Bitcoin is subject to Capital Gains Tax (CGT) when you sell or trade it for profit. If you receive Bitcoin as income or through mining, it may also be subject to Income Tax. It’s important to keep detailed records of your transactions for accurate tax reporting.

Most exchanges allow you to invest in Bitcoin with a small amount, often as low as £10. Bitcoin is divisible up to eight decimal places, so you can buy a fraction of a Bitcoin, making it accessible to investors with varying budgets.

To store Bitcoin securely, use a hardware wallet, such as Ledger or Trezor, which keeps your private keys offline. Alternatively, use a reputable software wallet with strong security features like two-factor authentication (2FA). Avoid keeping large amounts on exchanges for extended periods.

To sell Bitcoin, transfer it from your wallet to an exchange where you have an account. Navigate to the exchange’s sell section, enter the amount you wish to sell, and choose the currency you want in return (e.g., GBP). Confirm the transaction, and the proceeds will be added to your exchange balance, which you can withdraw to your bank account.

Top 5 Exchanges

1

eToro

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

2

Coinbase

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

3

Uphold

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

4

MEXC

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

5

OKX

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

You May Also Like:

Our #1 Recommended Crypto Wallet & Exchange Platform in the UK

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.