Best Trading Platforms in the UK 2025

Thomas Drury

Co-Founder

Seasoned finance professional with 10+ years' experience. Chartered status holder. Proficient in CFDs, ISAs, and crypto investing. Passionate about helping others achieve financial goals.

Twitter ProfileAuthor Bio

Dom Farnell

Co-Founder

Dom, a Co-Founder at TIC, is an avid investor and experienced blogger who specialises in financial markets and wealth management. He strives to help people make smart investment decisions through clear and engaging content.

Twitter ProfileAuthor Bio

Fact Checked

How we test

At The Investors Centre, we pride ourselves on our rigorous fact-checking process. To delve deeper into our meticulous testing procedures and discover how we ensure accuracy and reliability, visit our dedicated page on how we test.

Risk Warning

Please bear in mind that trading involves the risk of capital loss. 51% to 84% of retail investor accounts lose money when trading CFDs with the providers below. You should consider whether you can afford to take the high risk of losing your money.

Last Updated 18/04/2025

Explore our curated list of reliable, regulated Trading Platforms for 2025, each rigorously tested with real capital. All brokers are accessible to traders in the United Kingdom.

1

eToro

Trading Platform Score: 4.8/5

51% of retail CFD accounts lose money.

2

CMC Markets

Trading Platform Score: 4.7/5

70% of retail CFD accounts lose money.

XTB

Trading Platform Score: 4.6/5

73% of Retail CFD Accounts Lose Money

4

IG

Trading Platform Score: 4.5/5

71% of Retail CFD Accounts Lose Money

Quick Answer: What are the Best Trading Platforms in the UK?

Our top picks are eToro, CMC Markets and XTB. We’ve tested them all — from IG to Saxo — and ranked the top picks for beginners, forex traders, and pros. Find the right fit for your style, budget, and goals.

The Best Trading Platforms in the UK (2025) are:

- eToro – Best for Social Trading and Beginners

- CMC Markets – Best for Range of Instruments

- XTB – Best for Access to Global Markets

- IG – Best for Advanced Traders

- SpreadEX – Best for Spread Betting

- Pepperstone – Best for MetaTrader and cTrader Users

- Saxo – Best for Premium Trading Experience

Featured Brokers

eToro - Best for Beginners

- Copy Trading

- User Friendly Platform

- Regulated & Trusted

- 30 Million+ Users

CFDs are complex instruments with a high risk of losing money rapidly due to leverage. 51% of retail CFD accounts lose money when trading CFD’s with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Spreadex - Best for Advanced Traders

- Spread Betting

- Competitive Spreads

- Trade With Leverage

- User Friendly

81% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Introduction to UK Trading Platforms

In 2025 the UK’s trading platform scene has something for everyone — whether you’re just dipping your toes into investing or you’ve been trading for years and want access to more advanced tools. I’ve spent a lot of time exploring the options out there, and in this guide, I’ll walk you through the ones that really stand out — the platforms that are easy to use, cost-effective, and packed with a wide range of assets. My goal? To help you find the one that fits your trading style and actually makes your life easier, not harder.

What’s the Best Trading Platform for Beginners?

If you’re just starting out, trust me — the platform you choose can either make your learning curve smooth… or painfully steep. When I was new to trading, I looked for platforms that didn’t overwhelm me with jargon but still gave me the tools to actually learn. Two standouts I always recommend to beginners are eToro and XTB.

eToro is incredibly beginner-friendly. The layout is clean, the navigation is simple, and — you can copy the trades of experienced investors. That was a game-changer for me early on. Just watching how pros set up their trades helped me learn.

XTB, on the other hand, takes a more structured approach. Their education section is very solid — videos, articles, live webinars, the whole lot. And their platform, xStation 5, is intuitive without being too basic. If you’re the type who wants to understand the why behind each trade, XTB is a great choice.

Which Platform Is Best for Low-Cost or Commission-Free Trading?

Let’s be honest I’ve tested a bunch of platforms that claim to be “low cost,” but only a couple truly stand out: eToro and Trading 212.

eToro is famous for its zero-commission stock trading, which really helped me when I wanted to build a portfolio without being eaten alive by fees. You’ll still pay a spread, and there’s a small withdrawal fee, but overall, it is the affordable choice for small account holders.

Trading 212 is another great option. You get commission-free trading on stocks, ETFs, and even forex, which is pretty rare. Plus, their app is slick and easy to use. It’s solid choice if you’re looking to keep costs low while trying out different strategies.

Which Platforms Offer the Widest Range of Assets?

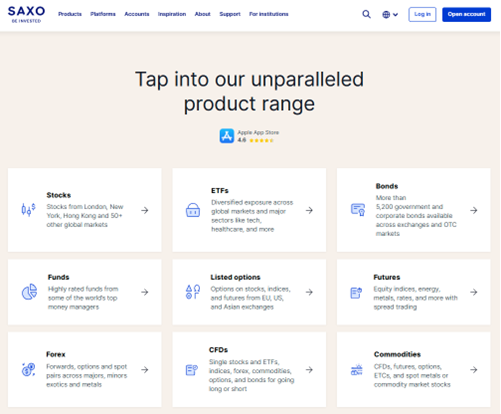

As my trading style evolved, I started caring more about asset variety — being able to shift between forex, stocks, commodities, and even trading cryptocurrencies without juggling multiple accounts. If you’re in the same boat, Saxo and IG are the two platforms that really deliver.

Saxo has an “unparalleled product range” which gives you access to a massive list of tradable instruments — including niche and exotic markets that most brokers don’t. It’s definitely aimed at more serious or high-net-worth traders, but if you want global market access, Saxo has it covered.

IG, on the other hand, offers 17,000+ markets. That’s everything from forex and shares to indices and crypto. I’ve used IG when I wanted a bit of everything in one place, and their platform handles it all without slowing down.

Reviews of Top 7 Trading Platforms

We’ve examined several platforms based on their features, usability, and trader feedback. Below, find a comparative table summarising the key aspects of each platform to help you make an informed decision:

Ranked Comparison Table – Top UK Platforms

| Rank | Platform | Best For | Fees | FCA Regulated | Key Features | Rating |

|---|---|---|---|---|---|---|

| #1 | eToro | Beginners, Copy Trading | 0% stocks | Yes | Copy portfolios, social trading | 4.8/5 |

| #2 | CMC Markets | Advanced tools | Competitive | Yes | Pro charting, CFD range | 4.7/5 |

| #3 | XTB | Forex/CFD & Education | 0% stocks/ETFs | Yes | xStation 5, learning tools | 4.6/5 |

| #4 | IG | Experienced traders | Tight spreads | Yes | Spread betting, MT4 | 4.5/5 |

| #5 | SpreadEX | Spread betting | Flexible | Yes | Niche markets | 4.3/5 |

| #6 | Pepperstone | Forex scalping | Razor spreads | Yes | MT4/5, cTrader | 4.3/5 |

| #7 | Saxo | Wealthy investors | Tiered pricing | Yes | Premium service, global access | 4.2/5 |

eToro – Best for Social Trading and Beginners

I chose eToro for its beginner-friendly approach and social trading features, which made learning feel intuitive and accessible. The CopyTrader tool helped me follow top traders, and the platform’s wide range of assets and mobile-friendly interface made it easy to explore. Most of all, the active community turned it into a great space to learn and grow as a trader.

Pros & Cons

- Industry-leading social trading features

- Super user-friendly platform and app

- Higher-than-average spreads and fees

- Limited technical analysis tools for advanced traders

What Trading Tools are Available?

| Tool | Description | Best Used For |

|---|---|---|

| CopyTrader | Automatically replicates trades of top investors | Beginners & passive investors |

| Smart Portfolios | Thematic, diversified portfolios managed by eToro | Hands-off investors |

| CryptoPortfolio | Pre-built basket of major cryptocurrencies | Crypto-curious investors |

| eToro API | Advanced automation tools for custom strategies | Experienced coders/traders |

Best For:

- Beginners learning to trade

- Passive investors who want to copy top performers

- Users interested in a simple, all-in-one platform for stocks, crypto, and ETFs

What Do Our Experts Say?

eToro is the most beginner-friendly trading platform we’ve tested. Its standout CopyTrader feature lets you mirror the moves of successful investors — ideal if you’re still learning the ropes. The interface is clean, the mobile app runs smoothly, and the built-in community adds a social layer that makes trading feel approachable.

CFDs are complex instruments with a high risk of losing money rapidly due to leverage. 51% of retail CFD accounts lose money when trading CFD’s with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

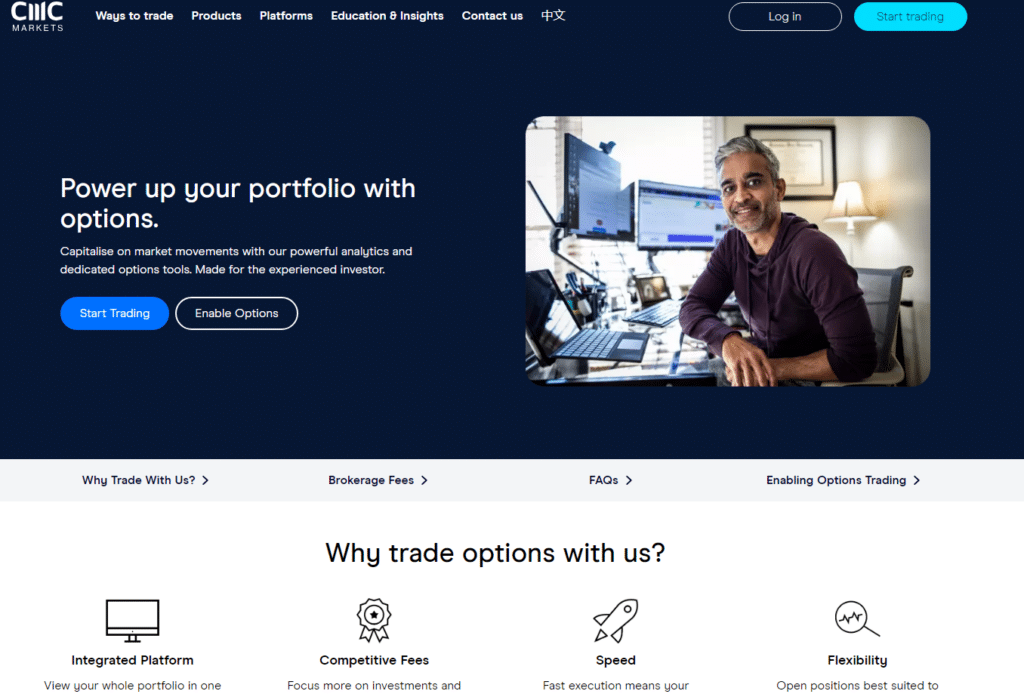

CMC Markets – Best for Range of Instruments

CMC Markets stood out to me as I moved from beginner to more experienced trading, thanks to its powerful tools and wide range of assets. While the platform can be complex at first, its advanced charting, customizable dashboard, and tight spreads make it ideal for serious traders. I’ve especially appreciated trading everything from forex to commodities with no commission on shares, all within a highly efficient setup.

Pros & Cons

- Huge range of instruments across global markets

- Exceptional technical analysis and charting tools

- Interface can be overwhelming for beginners

- Some advanced features require higher trading volumes or balances

What Trading Tools are Available?

| Tool | Description | Best Used For |

|---|---|---|

| Next Generation | Customisable trading platform with 100+ indicators and powerful charting | Advanced technical traders |

| MetaTrader 4 (MT4) | Trusted forex platform with support for automated trading | Forex and algo traders |

Best For:

- Experienced traders looking for market variety

- Forex and CFD traders who need top-tier tools

- Active traders who rely on detailed technical analysis

What Do Our Experts Say?

CMC Markets is my go-to when I want flexibility and depth. The Next Generation platform is packed with advanced charting tools and customisable layouts that suit my more analytical trading style. While the interface has a learning curve, it becomes a powerful asset once mastered. I’ve traded everything from forex to treasuries — all from one account.

70% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

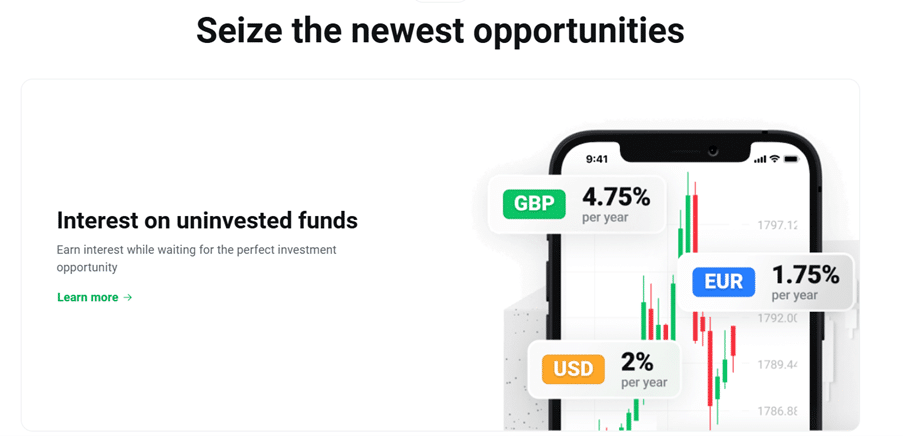

XTB – Best for Access to Global Markets

Choosing XTB was a no-brainer for me as a forex enthusiast. Their low forex fees and exceptional customer service set them apart in a crowded market.

Their trading platform, xStation 5, is not only user-friendly but comes with features like superior trade execution which is crucial when dealing with fast-moving forex markets. I particularly appreciate their commitment to transparency and trader education—XTB regularly hosts webinars and workshops that have helped me refine my strategies.

Plus, their customer support is always responsive and knowledgeable, providing that extra layer of reassurance that every trader appreciates.

Pros & Cons

- Excellent access to forex, indices, commodities, and crypto markets

- User-friendly, powerful platform with strong educational support

- Some products limited by region

- Inactivity fees apply after periods of no trading

What Trading Tools are Available?

| Tool | Description | Best Used For |

|---|---|---|

| xStation 5 | Fast, customisable platform with advanced charting and news integration | Active forex and CFD traders |

| Commodity Trading | Access to energy, metal, and agricultural markets | Portfolio diversification |

Best For:

- Forex traders looking for low fees and fast execution

- Investors seeking exposure to global markets

- Traders who value education and ongoing support

What Do Our Experts Say?

As someone who trades forex regularly, XTB quickly became one of my top picks. The xStation 5 platform is fast, reliable, and packed with pro-level tools — yet still intuitive enough for intermediate traders. What really stands out, though, is their commitment to education. Plus, their support team has never let me down — quick, helpful, and knowledgeable.

73% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

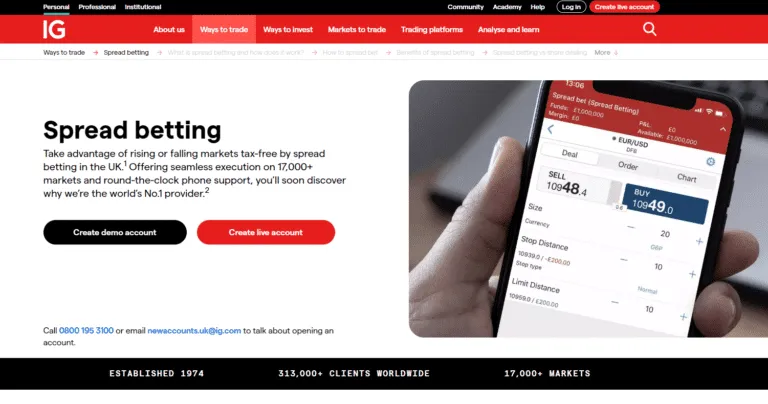

IG – Best for Advanced Traders

I chose IG for its extensive market access and advanced trading tools, with over 17,000 markets and features like ProRealTime integration and direct market access that suit my trading style. While the platform is more sophisticated and requires a higher minimum deposit, the wealth of educational resources and powerful capabilities make it a worthwhile investment.

Pros & Cons

- Huge selection of global markets and asset classes

- Advanced tools like ProRealTime and direct market access

- Complicated fee structure with variable costs

- Steep learning curve not ideal for beginners

What Trading Tools are Available?

| Tool | Description | Best Used For |

|---|---|---|

| ProRealTime | Automated trading, custom indicators, and in-depth technical analysis | Technical and strategy-heavy traders |

| Advanced Charting | 100+ indicators, drawing tools, and custom chart layouts | Market timing and trend analysis |

Best For:

- Experienced traders needing advanced tools

- Those trading global markets at scale

- Technical analysts and strategy-focused investors

What Do Our Experts Say?

IG is my platform of choice when I want full control over my trades and access to global markets. With over 17,000 instruments, it’s one of the most comprehensive platforms out there. The integration with ProRealTime is a big win for technical traders — automated strategies, deep charting, and fast execution all in one place.

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 71% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

SpreadEX – Best for Spread Betting

SpreadEX stood out to me for its strong focus on spread betting, offering tight spreads and a straightforward platform tailored to UK markets. While its global reach is limited, its specialized tools and excellent customer service make it an ideal choice for spread betting enthusiasts like myself.

Pros & Cons

- One of the best platforms for UK-based spread betting

- Tight spreads that help lower overall trading costs

- Limited global market access

- Not suitable for traditional investing or long-term portfolios

What Trading Tools are Available?

| Tool | Description | Best Used For |

|---|---|---|

| Spread Betting Platform | Simple, responsive platform tailored for spread betting | UK-focused spread bettors |

| Tight Spread Options | Competitive pricing on major markets | Frequent traders managing costs |

Best For:

- UK traders focused on spread betting

- Cost-conscious traders seeking tight spreads

- Investors interested in tax-efficient strategies

What Do Our Experts Say?

If spread betting is your thing, SpreadEX is hard to beat. I chose it because it’s one of the few platforms that’s truly built around spread betting — not just offering it as an add-on. The platform is clean, focused and delivers consistently tight spreads, which helps maximise returns over time. While it doesn’t offer global coverage like some competitors, it’s ideal for UK-based traders who want a no-fuss, efficient experience.

81% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Pepperstone – Best for MetaTrader and cTrader Users

I chose Pepperstone for its low-latency trading and variety of platforms, which are perfect for my MetaTrader, cTrader, and algorithmic strategies. While the lack of investor protection outside the EU is a drawback, the fast execution, competitive pricing, and platform flexibility make it a strong fit for cost-effective, high-performance trading.

Pros & Cons

- Excellent platform variety (MT4, MT5, cTrader)

- Fast, no-dealing-desk execution with tight spreads

- More limited asset range compared to full-service brokers

- Better suited to experienced traders than beginners

What Trading Tools are Available?

| Tool | Description | Best Used For |

|---|---|---|

| MetaTrader 4 (MT4) | Automation-ready platform with custom indicators and EAs | Forex and CFD traders |

| MetaTrader 5 (MT5) | Enhanced version of MT4 with deeper analysis tools and more order types | Experienced traders |

| cTrader Automate | Precision-focused platform for algorithmic trading | High-frequency/automated traders |

| Pepperstone API | Direct market access for developing custom trading solutions | Developers and quant traders |

Best For:

- Forex and CFD traders using MetaTrader or cTrader

- Algorithmic traders and scalpers

- Advanced users who want custom trading setups

What Do Our Experts Say?

Pepperstone is one of my top picks when I need speed, automation, and flexibility. I use it with MetaTrader 4 and cTrader, especially for algorithmic trading and scalping strategies. The pricing is ultra-competitive, and execution is consistently fast thanks to their no-dealing-desk setup. Pepperstone shines for serious forex traders who want full control over their strategy and platform.

81.7% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Saxo – Best for Premium Trading Experience

Pepperstone is a top choice when I need speed, automation, and flexibility, especially for algorithmic trading and scalping on MetaTrader 4 and cTrader. With ultra-competitive pricing, fast execution, and a no-dealing-desk setup, it’s ideal for serious forex traders who want full control over their strategy and platform.

Pros & Cons

- Huge global market coverage (40,000+ instruments)

- Professional-grade platforms with high customisability

- High minimum deposit barrier

- Fee structure can be complex for infrequent or smaller traders

What Trading Tools are Available?

| Tool | Description | Best Used For |

|---|---|---|

| SaxoTraderGO | Powerful, flexible platform for multi-asset trading and portfolio analysis | Active traders and investors |

| SaxoTraderPRO | Advanced trading interface with deep customisation | Professional and institutional users |

| Global Market Access | 40,000+ instruments across stocks, bonds, forex, options, and more | Portfolio diversification |

Best For:

- High-net-worth or professional traders

- Investors managing large or diverse portfolios

- Users who need advanced tools and deep market access

What Do Our Experts Say?

When I want a premium, all-in-one trading experience, I turn to Saxo. The minimum deposit is higher than most platforms, but the quality of service, market range, and tools more than justify it. The SaxoTraderGO platform strikes the perfect balance between usability and power. I’ve used Saxo to access global equities and niche bonds — it’s the kind of platform that serious investors can grow with long term.

64% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

How I Choose the Right Trading Platform

I’ve tried a lot of trading platforms over the years. Here’s what I look for when I’m deciding if a platform’s worth my time (and money).

Ease of Use

If the interface feels clunky or confusing, I’m out. Whether you’re brand new or have a few years under your belt, the user Interface (UI) should feel intuitive. I like platforms that work just as smoothly on mobile as they do on desktop — because let’s be honest, we’re not always at our desks when opportunity knocks.

Security, Safety and Regulation

I make it a point to trade on platforms that are FCA-regulated — that badge means you’re protected, and the broker is playing by strict rules.

Range of Instruments

The more, the better. I enjoy access to forex, stocks, commodities, and global indices — all from one place. Some platforms limit you to just a handful of markets, and that can be confining if you’re planning to diversify or evolve your strategy over time.

Learning Resources

When I was starting out, webinars and tutorials were a lifesaver. I still value platforms that offer a range of helpful educational tools, especially for testing strategies or brushing up on new indicators. A demo account is also a must-have; it lets you practice without the risk, and I still use one when I’m exploring a new strategy.

Customer Support

Last but not least — if something goes wrong, I want to know there’s someone I can actually reach. Solid, responsive support makes a big difference, especially during volatile market hours.

TLDR: Don’t just go with what’s popular. Test a couple of platforms, see how they feel, and choose the one that helps you trade smarter, not harder.

What Are the Key Features of These Trading Platforms?

| Feature / Specialisation | Description | Best Platforms for This |

|---|---|---|

| Social Trading | Enables users to copy the trades of experienced investors, turning trading into a collaborative experience. | eToro |

| Automated Trading | Allows you to program and automate your trading strategies, ideal for consistency and hands-off trading. | MetaTrader 4 & 5 (used by Pepperstone, IG) |

| Specialised Market Access | Platforms focused on specific markets like forex, commodities, or global equities, often with pro-grade tools. | Saxo |

| Algorithmic Trading | Advanced traders can automate complex strategies based on custom rules or indicators. | IG, Pepperstone |

| Advanced Charting Tools | Includes technical indicators, drawing tools, and custom layouts for detailed analysis. | CMC Markets |

| Trading Simulators | Risk-free environments that let you practice trading with virtual funds — great for beginners. | XTB |

By integrating these features, trading platforms not only enhance user engagement but also empower traders to manage their investments more effectively, adapt to market changes swiftly, and optimise their trading strategies.

How Do These Platforms Compare on Fees, Costs and Spreads?

Fee Comparison Table

| Platform | Commission | FX Conversion | Spread | Withdrawal Fees | Inactivity Fee |

|---|---|---|---|---|---|

| eToro | 0% stocks | 0.5% | Medium | £5 | Yes |

| CMC Markets | Varies by instrument | Yes | Tight | None | Yes |

| XTB | 0% stocks (limits apply) | Yes | Competitive | Free | Yes |

| IG | £0–£10 | Yes | Tight | Free (UK bank) | Yes |

| SpreadEX | Built-in | Yes | Medium | Free | Yes |

| Pepperstone | Commission/Spreads | Yes | Razor | None | No |

| Saxo | Tiered | Yes | Tight | Yes | Yes |

Which Trading Strategies are Best for Each App?

Not every trading strategy works on every platform — and forcing a strategy onto the wrong setup is a fast track to frustration (or worse, losses). So, if you’re trying to figure out which strategy fits which platform, here’s how I break it down based on real experience.

- Day Trading works best with platforms that offer fast execution and real-time data. I’ve found SaxoTraderGO particularly solid for this — it’s quick, responsive, and gives me the tools I need to jump in and out of positions within the same day, chasing those smaller, short-term price moves.

- If you’re into scalping, you’ll need a platform that can handle rapid-fire trades with near-zero latency. For me, Pepperstone’s cTrader has been a go-to. It’s super snappy and built for the kind of micro-movements scalpers look to exploit all day long.

- Swing trading is a bit more relaxed — you’re holding positions for a few days and watching trends develop. That’s where platforms like MetaTrader 5 via IG come in handy. The backtesting and charting tools are top-notch, and it supports the kind of analysis that swing traders rely on.

And of course, no matter the strategy, risk management is key. I always look for platforms with customisable stop-losses, margin alerts, and real-time notifications. It’s how I sleep at night, honestly.

If you’re like me and rely heavily on technical analysis, you’ll love what CMC Markets brings to the table — tons of indicators, detailed charts, and historical data you can actually work with.

Lastly, the range of trading instruments matters more than most people think. Whether I’m trading forex, commodities, or stocks, I want the flexibility to switch things up or diversify. Make sure the platform you’re using actually supports the assets your strategy needs.

Final Thoughts

We have found that the Top 3 Trading Platforms in the UK (2025) are:

At The Investors Centre, we take platform testing seriously — because you deserve honest, hands-on insights. Every platform we review is tested using real accounts. We assess key areas like usability, fees, execution speed, available instruments, and mobile performance. We also evaluate customer support, regulation, and security protocols to make sure you’re trading with trusted providers.

At the end of the day, you need to tailor your choice of trading platform to your individual trading needs and preferences. What works for one trader might not suit another. It’s worth taking the time to assess how each platform aligns with your specific requirements, ensuring you make the most informed decision possible.

TLDR? Test a couple of platforms, see how they feel, and choose the one that helps you trade smarter, not harder.

FAQs

eToro and XTB are the easiest platforms to start with. They’re both FCA-regulated, have simple interfaces, and don’t overwhelm you with jargon. eToro’s CopyTrader feature is also great if you want to learn by following experienced traders.

Yes — as long as they’re FCA-regulated. That’s the key thing I always look for. Regulation means the platform has to follow strict rules, protect your funds, and operate fairly. I only ever use and recommend FCA-authorised brokers.

Yes, unless you’re spread betting (which is currently tax-free). If you’re trading stocks, CFDs, or forex, any profits you make may be subject to Capital Gains Tax or Income Tax, depending on your situation. Always speak to a tax adviser if you’re unsure — I do.

Platforms like eToro, XTB, and Trading 212 (if available) offer zero-commission stock trading and low forex spreads. But always check for hidden fees — like withdrawal charges, spreads, or overnight fees — which can catch you off guard.

Absolutely. Most of the platforms I’ve reviewed — especially eToro, XTB, IG, and CMC — have excellent mobile apps. I’ve placed trades, set alerts, and monitored charts all from my phone without issues.

Good question. Spread betting is tax-free in the UK but isn’t available everywhere. You’re betting on price movements rather than owning the asset. CFD trading works similarly, but profits are taxable. I’ve used both — spread betting is great if you’re trading frequently and want to keep things tax-efficient.

Yes — and I always recommend doing so. Most platforms offer free demo accounts where you can practice trading with virtual money. It’s a great way to get comfortable before committing real funds.

Trade Smarter, not Harder

- Copy Trading

- Competetive Fee's

- Multi Asset Platforn

51% of retail CFD accounts lose money when trading CFD’s with this provider.

References

- Financial Conduct Authority (FCA) – Register of Regulated Firms

- eToro UK Ltd – Legal and Fee Structure

- CMC Markets – Platform Features and Market Access

- XTB UK – Trading Costs and Educational Resources

- IG Group – ProRealTime Charts and Product Offering

- SpreadEX – Spread Betting Overview and Market Coverage

- Pepperstone UK – Execution Speed and Platform Options

- Saxo Markets UK – Fees and Global Investment Options

- UK Government – Capital Gains Tax on Shares

- Trustpilot – User Reviews for Top UK Trading Platforms

Trading and investing involve risk. The value of your investments can go up or down, and you may lose all or part of your capital. These products may not be suitable for all investors. Please ensure you fully understand the risks involved.

- Stocks, ETFs, crypto, more

- Copy top investors easily

- User & beginner friendly

- 30M+ global users

- Regulated, trusted platform