Personally Tested Saxo Review: New 2024 Fee Structure!

Adam Woodhead

Co-Founder

Adam is a Co-Founder and content creator for The Investors Centre. His key areas of interest and expertise are cryptocurrency and blockchain technology.

Twitter ProfileAuthor Bio

Dom Farnell

Co-Founder

Dom is a Co-Founder of TIC, a passionate investor and seasoned blog writer with a keen interest in financial markets and wealth management. "My goal is to empower individuals to make informed investment decisions through informative and engaging content."

Twitter ProfileAuthor Bio

How We Test

At The Investors Centre, we pride ourselves on our rigorous fact-checking process. To delve deeper into our meticulous testing procedures and discover how we ensure accuracy and reliability, visit our dedicated page on how we test.

Quick Answer: Is Saxo a Good Investment Platform?

Saxo (Rated 4.6/5) is a Good and Powerful Investment Platform, offering a wide range of assets, sophisticated tools, and a secure trading environment. However, it would not be our first pick for beginners.

It’s important to be aware that the value of investments can fluctuate, potentially decreasing as well as increasing. There’s a possibility that you might not recover the entire amount you have invested. The information provided on this page does not constitute a personal endorsement of any investment. If you’re uncertain about whether an investment or financial service is appropriate for you, it’s advisable to consult with a licensed financial advisor.

Page Contents:

- First Impressions

- What is Saxo?

- Pros and Cons

- What are the Fees and Charges?

- Which Account Types are Available?

- Which Products are Available on Saxo?

- Additional Features

- Research Amenities

- Which Platforms are Available?

- Saxo in the UK

- Who Is Saxo Best for?

- How do I open an account?

- Alternatives to Saxo

- The Final Verdict: Is Saxo Right for You?

- Key Takeaways

- Frequently Asked Questions

First Impressions

Personally I had a pretty good time while exploring Saxo.

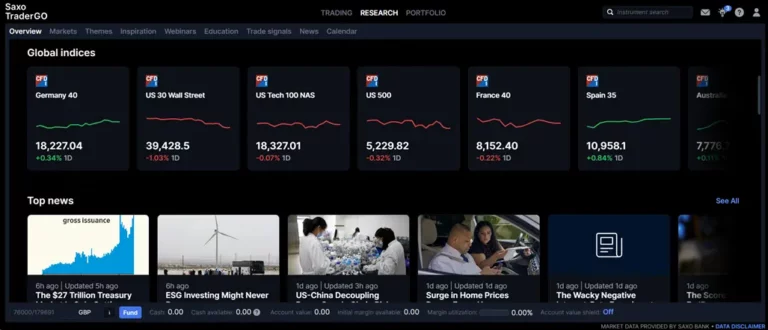

Opening SaxoTraderGO for the first thing, I was greeted by a clean and user-friendly interface. Unlike some finance apps I’ve tried, everything felt well-organized and easy to navigate.

Placing a basic order seemed straightforward thanks to the clear icons. As I explored further, I realized the platform offered a significant amount of features.

This was both exciting and a little intimidating at first. There were advanced charting tools, research options, and huge range of in-depth market analysis sections – a treasure trove for experienced investors for sure.

Finding specific features within these menus took some time, and a search function readily available would have been helpful for those new to the platform.

On the positive side, SaxoTraderGO offered some customization options. I could rearrange the screens to better suit my needs and prioritize the information I found most important. This level of personalization made the powerful platform feel a bit more approachable.

Beyond just buying and selling, I was happy to discover a wealth of research materials and market analysis directly within the app. This built-in resource section felt valuable, especially for staying informed as a new investor.

While SaxoTraderGO might have a steeper learning curve initially, its potential for in-depth trading seems very promising.

Add New | |

Investing Options | Stocks, ETFs, Bonds, Forex, CFDs, Mutual Funds |

Interest on Uninvested Cash | 3.91% £ |

FCA Regulated | |

Founded | 2011 |

Investor Protection | |

4.0/5 | |

ISA Account | |

Mobile App | |

Inactivity Fee | |

Monthly Fee | |

Base Fiat | £ $ € |

Min Deposit | |

Fractional Shares | |

Demo Account | |

Available in UK | |

Add New Add New | |

What is Saxo?

Saxo (formerly Saxo Bank), founded in 1992, is a Danish multinational online investment and trading platform. They have established themselves as a pioneer in online trading, initially focusing on foreign exchange (forex) markets.

Over the years, Saxo group has expanded its offerings to to a global audience, offering both professional and retail investor accounts. They offer access to a vast array of markets – from stocks and bonds to currencies and CFDs.

Review Scoring

Saxo scores an outstanding 4.8 in both Investment Options and Regulatory Compliance, reflecting its expansive offering of financial instruments and stringent adherence to global regulatory standards.

The Desktop and Mobile Trading Platforms impress with a 4.7 and 4.6 score respectively, showcasing user-friendly interfaces packed with powerful trading tools, although the desktop platform could pose a slight learning curve for novices.

Research & Education Tools and Security both earn a high score of 4.7 and 4.8, highlighting the depth of market insights available and robust measures to protect client assets. Customer Support sees a slight increase to 4.6, acknowledging their reliable and knowledgeable service team, while Performance Tracking receives a solid 4.5 for its comprehensive yet user-friendly analytics.

The Costs and Fees at 4.0, due to its higher pricing structure compared to some competitors, the overall average score remains a strong 4.6 out of 5, signifying Saxo as a leading platform that balances cost with a premium service offering.

Saxo Pros and Cons

- Wide Range of Investment Options: including stocks, ETFs, options, forex, bonds, commodities, and potentially CFDs (depending on regulations).

- Multiple Account Types: Including SIPP and ISA.

- Platform Options: SaxoTraderGO provides a good balance of features and ease of use, while SaxoTraderPRO caters to professionals with its advanced functionalities.

- Competitive Spreads: Saxo offers competitive spreads on many popular assets, reducing your overall trading costs.

- Global Market Access: Invest in a wide range of international markets from a single platform.

- Fractional Shares (on some assets): This feature allows for easier portfolio diversification and investment flexibility, especially for beginners.

- Learning Curve: The SaxoTraderGO and SaxoTraderPRO platforms' features may be overwhelming for new traders and beginners.

- Potentially High Fees: Saxo's fee structure can be a little complex, with commissions and other charges that might be higher than some competitors.

- No Access to Bitcoin and other Digital Assets.

64% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

What are the Fees and Charges?

Saxo offers a variety of features and benefits, but their fee structure can be a bit more complex compared to some other platforms.

Account Tiers and Minimum Deposits:

Saxo has three main account tiers:

Classic: This is the entry-level tier with a no minimum deposit requirement. However, it may have slightly higher fees compared to the other tiers.

Platinum: For accounts with a minimum deposit of £200,000, this tier potentially offers lower fees and access to additional services.

VIP: This exclusive tier requires a minimum deposit of £1 million and boasts the best fee rates and even event invitations.

| Feature | Classic | Platinum | VIP |

|---|---|---|---|

| Minimum Deposit | No Minimum | £200,000 | £1,000,000 |

| US Stock Fee | 0.015 $/ Share | 0.010 $/ Share | 0.005 $/ Share |

| UK Stock Fee | 0.08% min £3 | 0.05% min £3 | 0.03% min £4 |

| ETFs | Similar to stock fees | Similar to stock fees | Similar to stock fees |

| Foreign Exchange Fee | 0.25% (currency conversion) | 0.25% (currency conversion) | 0.25% (currency conversion) |

| Deposit Fee | £0 | £0 | £0 |

| Custody Fee pa Stocks, ETF, ETC, Bonds | 0.12% | 0.12% | 0.08% |

| Custody Fee pa Funds | 0.40% | 0.20% | 0.10% |

| Withdrawal Fee | £0 | £0 | £0 |

| Inactivity Fee | Na | Na | Na |

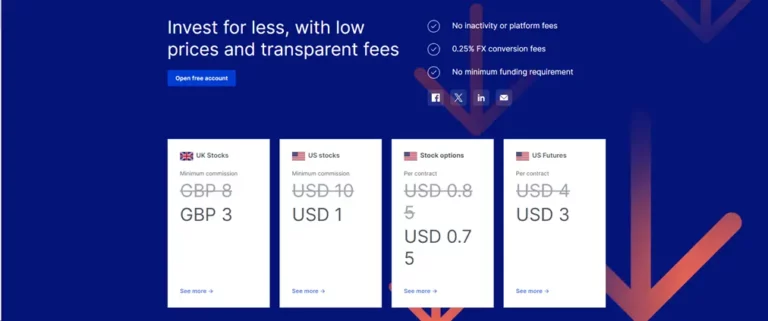

Key Fee Changes in 2024:

There’s some good news! Saxo recently implemented fee reductions:

Minimum Commissions: They now have a minimum commission of just $1 for US trades and £3 for UK trades – a significant decrease.

No More Platform Fees: The platform fee has been eliminated, making it cheaper to use their trading platforms.

Reduced Custody Fees

Reduced Currency Conversion Fees: The maximum currency conversion fee is now a competitive 0.25% across all account types.

Here’s where it can get a bit trickier:

Account Tier Impacts Fees: While minimum commissions have decreased, some fees, like custody fee fees, can still vary depending on your chosen account tier. Classic accounts generally have slightly higher fees compared to Platinum accounts and VIP tiers.

Trading Fees Based on Asset and Account: Trading fees can vary based on the type of asset classes you’re trading (stocks, bonds, ETFs) and your account tier. Classic accounts might have higher minimum trade fees or a percentage-based fee structure.

For the most accurate and up-to-date information on fees specific to your trading needs, it’s always best to contact Saxo customer support.

Which Account Types are Available?

- Saxo Trading Account: This is the standard account type, suitable for beginners or those with smaller investment amounts. It provides access to a wide range of products and platforms.

- Joint Account: Open a joint account to invest with a partner or spouse. This can be a good option for managing shared investment goals.

- Corporate Account: If you’re investing on behalf of a company, you’ll need a corporate account.

- Professional Account: Experienced traders with very high risktrading volumes can qualify for a professional account, which may offer certain benefits like lower fees.

- ISA Account: Invest with tax benefits within a UK Individual Savings Account (ISA).

- SIPP Account: Invest towards your retirement in a Self-Invested Personal Pension (SIPP).

Which Products are Available on Saxo?

Stocks: Invest in individual companies from a vast global pool, allowing you to target specific businesses with growth potential.

Forex: Trade currency pairs and speculate on exchange rate movements, or hedge your portfolio against currency fluctuations. Saxo has its roots as a forex broker, so you can expect competitive spreads.

CFDs (Contracts for Difference): For experienced traders, trading CFDs offer leveraged exposure to various assets, allowing for potentially magnified returns (and magnified losses). Remember, trading CFDs carry a high degree of risk.

Futures and Options: These more complex instruments are suitable for experienced traders with advanced strategies. They offer additional ways to manage risk and potentially amplify returns, but also come with increased risk.

Bonds: Invest in government or corporate bonds for potential income and portfolio diversification. Bonds generally offer lower risk than stocks but also come with potentially lower returns.

ETFs (Exchange-Traded Funds): Gain instant diversification with Saxo’s extensive ETF offerings. ETFs bundle a basket of assets, allowing you to invest in a specific sector or strategy with a single purchase.

Mutual Funds: Invest in professionally managed funds that pool investor capital. This can be a good option for beginners seeking diversification and expertise.

Investment Portfolios: Saxo offers pre-built investment portfolios tailored to different risk profiles and investment goals. This can be a convenient option for those who prefer a hands-off approach.

Margin Trading: Saxo allows margin trading on some products, which can magnify both profits and losses. Remember, margin trading is a high-risk strategy and should be used cautiously.

Additional Saxo Features

- Advanced Charting Tools: Analyse market trends and make informed decisions with a range of charting tools and technical indicators (more extensive on SaxoTraderPRO).

- Fractional Shares (on some assets): Invest in fractions of shares with some assets on Saxo, making it easier to build a diversified portfolio even with limited capital (availability may vary).

- Ready-Made Portfolios: For those who prefer a hands-off approach, Saxo offers a selection of pre-built portfolios. Developed by their in-house team alongside reputable asset managers like BlackRock and Morningstar, these are managed portfolios can cater to various risk tolerances, ranging from conservative (defensive) to aggressive (maximum growth).

- Mobile Convenience: Manage your investments on the go with the Saxo mobile app, available on both Android and iOS devices.

- Advanced Trade Management: Saxo empowers you with a variety of tools to manage and analyze your portfolio. Integrate tools you’re familiar with, such as Excel, MultiCharts, and Updata, for a seamless user experience.

- Security First: Saxo prioritizes security. They are regulated by the Financial Conduct Authority (FCA) in the UK, ensuring adherence to strict financial regulations and consumer protection standards. Furthermore, each Saxo account utilizes third-party banks and custodians to hold client funds. This segregation safeguards your money in the event of an unlikely company liquidation scenario.

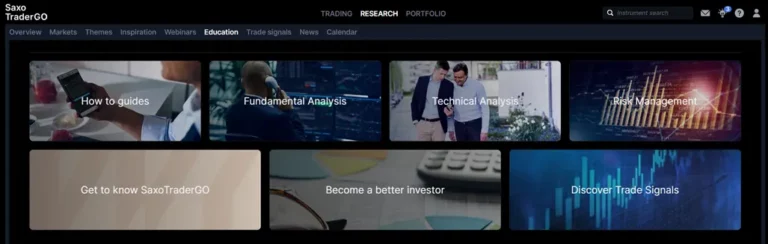

Research Amenities

Saxo understands the importance of equipping investors with the necessary tools to make informed decisions. Beyond the trading platform, they offer a variety of research amenities to empower you on your investment journey:

- Market Analysis: Saxo’s research team provides ongoing market analysis, covering various asset classes and economic trends. These insights can help you stay informed about current market conditions and potential investment opportunities.

By understanding broader market trends, you can make more informed decisions about your portfolio allocation and adjust your strategy as needed.

- Analyst Reports: Saxo collaborates with experienced analysts who publish regular reports offering in-depth research on specific companies, sectors, or economic indicators. These reports can provide valuable insights to guide your investment decisions.

In-depth research by qualified analysts can provide valuable insights you might not have discovered on your own. This can help you identify promising investment opportunities or potential risks.

- News & Education: Saxo offers a comprehensive news feed keeping you updated on relevant financial news and events. Additionally, they provide educational resources, including webinars, articles, and video tutorials, to help you hone your investment knowledge and skills.

Staying informed about current events and learning new investment strategies can empower you to make sound financial decisions.

Which Platforms are Available on Saxo?

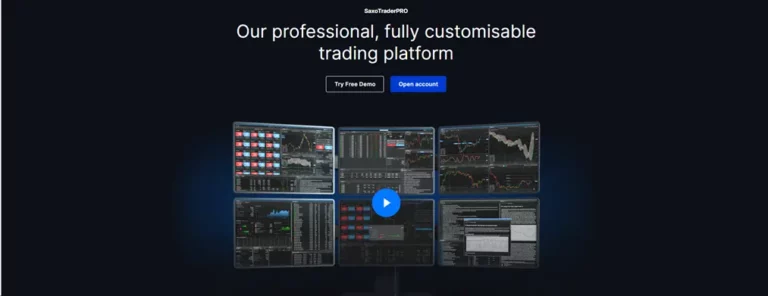

Saxo offers two platforms: SaxoTraderGO and SaxoTraderPRO. SaxoTraderGO is a user-friendly web and mobile app ideal for beginners, while SaxoTraderPRO is a downloadable desktop platform with advanced features catering to more experienced traders.

Who is Saxo Best For?

Saxo can be a good fit for a variety of investors, depending on their needs , risk appetite, and experience level:

Beginners: The user-friendly SaxoTraderGO mobile app and access to educational resources can be helpful for new investors getting started.

Active Traders: The powerful SaxoTraderPRO platform with advanced charting tools and order types caters to experienced traders seeking a customizable trading experience.

High-Net-Worth Investors: The tiered account structure offers increasing benefits (like lower fees and priority support) for investors with larger portfolios (e.g., Platinum and VIP tiers).

Those Seeking Diverse Investment Options: Saxo offers a wide range of assets, including stocks, bonds, ETFs, currencies, mutual funds and CFD trading.

How Do I Open an Account with Saxo?

Here’s a general outline for opening retail investor accounts.

Visit the Saxo website.

Click on the “Open Account” button.

Fill out the online application form. This will collect your personal information and investment experience details.

Verify your identity by providing required documents. This may include proof of address and identification.

Choose your desired account tier (Classic, Platinum, or VIP) based on your minimum deposit and desired features.

Fund your account using one of their available deposit methods.

User Reviews

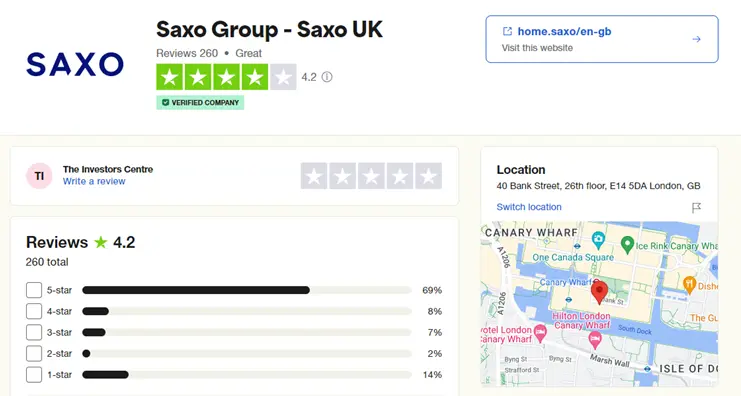

Saxo currently holds a rating of 4.2 out of five stars on Trustpilot, a popular online review platform. While this might not be the highest score, it suggests a generally positive user experience with the platform. It’s important to remember that online reviews can be subjective, and individual experiences may vary. However, reading both positive and negative reviews on platforms like Trustpilot can offer valuable insights into the strengths and weaknesses of Saxo from a real-world perspective.

Alternatives to Saxo: A Look at the Competition

Saxo offers a comprehensive trading platform with a wide range of features, but it might not be the perfect fit for everyone. Here’s a comparison of Saxo along with some popular alternative trading platforms to consider:

| Broker | Saxo Markets | IG | Trading 212 | Plus500 | Avatrade | Pepperstone |

|---|---|---|---|---|---|---|

| Fees | Tiered fee structure, minimum commissions recently reduced, some fees vary by account tier. | Generally lower fees than Saxo Markets for stock and ETF trading, competitive FX fees. | Commission-free stock and ETF trading, charges fees for inactivity and currency conversion. | Primarily focused on CFD trading, competitive fees for active traders. | Competitive spreads for forex trading, offers various account types with different fee structures. | Known for low forex spreads and commissions, offers various account types. |

| Trading Platform | SaxoTraderGO (mobile-friendly), SaxoTraderPRO (powerful desktop platform), supports 3rd-party platforms like TradingView. | User-friendly IG platform, powerful features for advanced traders. | User-friendly mobile app, limited account features. | Simple and user-friendly platform. | User-friendly platform, supports MetaTrader 4 and MetaTrader 5. | User-friendly cTrader platform, MetaTrader 4 and MetaTrader 5 also supported. |

| Investment Products | Wide range of assets: stocks, bonds, ETFs, currencies, CFDs, mutual funds. | Stocks, ETFs, options, CFDs, forex. | Stocks, ETFs, CFDs (limited selection). | Primarily CFDs (stocks, indices, commodities, forex). | Forex, CFDs (stocks, indices, commodities, cryptocurrencies). | Forex, CFDs (indices, commodities, cryptocurrencies). |

| Ideal for | Active traders, high-net-worth investors, those seeking diverse investment options. | Active traders, beginners interested in a user-friendly platform. | Beginners, cost-conscious investors with a focus on stocks and ETFs. | CFD traders, short-term traders comfortable with leverage risks. | Forex traders, CFD traders seeking a platform with MetaTrader support. | Forex traders seeking low spreads and commissions. |

The Final Verdict: Is Saxo Right for You?

Saxo Target Audience

Saxo isn’t a one-size-fits-all investment platform. It caters to investors with a keen interest in taking an active role in managing their wealth. Whether you’re a seasoned trader seeking advanced tools or a curious newbie looking to build a diversified portfolio, Saxo offers features that can benefit your investment journey.

Here’s a breakdown of investors who might find Saxo particularly appealing:

- Active Traders: Saxo shines for active traders who value a powerful platform with extensive features. They offer advanced charting tools for technical analysis, a wide range of order types for precise execution, and deep market access for competitive pricing.

- Long-Term Investors: Saxo isn’t just for day traders. Long-term investors can benefit from Saxo’s access to a vast array of investment products, including stocks, bonds, ETFs, and even fractional shares, allowing you to invest in expensive stocks with smaller amounts.

- DIY Investors: If you enjoy taking control of your investments and making your own decisions, Saxo empowers you to do just that. Their platform provides in-depth market research and educational resources to help you hone your investment skills and make informed choices.

Remember: Saxo caters to investors who are comfortable with a degree of self-directed investing. Their platform offers a wealth of information and tools, but the onus is on you to make your own investment decisions

Key Findings:

Saxo offers a powerful trading platform (SaxoTraderPRO) with advanced features and a wide range of assets (stocks, bonds, ETFs, currencies, CFDs, mutual funds). They also have a user-friendly online platform and mobile app (SaxoTraderGO) for on-the-go trading.

Saxo recently reduced fees across many areas, including minimum commissions and platform fees. However, their fee structure can still be complex, with some fees varying by account tier.

Saxo prioritizes security with FCA regulation and measures like segregated client funds and two-factor authentication.

They offer educational resources and investment research to support informed decision-making.

Strengths for the Target Audience:

Active Traders and Experienced Investors: SaxoTraderPRO caters to experienced traders with its advanced charting tools, diverse order types, and in-depth market analysis.

High-Net-Worth Investors: The tiered account structure offers reduced fees and additional benefits for investors with larger portfolios (Platinum and VIP tiers).

Those Seeking Multi Asset Trading and Investment Options: Saxo Markets provides a vast selection of assets, including the recent addition of mutual funds.

Is Saxo Right for You?

Consider the following:

Do you value a powerful trading platform with advanced features?

Do you intend to trade a wide range of assets?

Are you an active trader or experienced investor comfortable with trading strategies with a potentially more complex fee structure?

Do you prioritize security and FCA regulation?

If you answered yes to most of these questions, Saxo could be a strong contender for your brokerage needs. However, if you’re a beginner or prioritise low fees for stock and ETF trading, alternatives like IG or Trading 212 might be more aligned with your needs.

Remember: Conduct your own research and compare different brokers based on your investment goals, experience level, and trading activity.

Investment Top Tip

Consider Exploring Diversification: Many investors find value in diversifying their portfolios across a variety of asset classes, such as stocks, bonds, and commodities. It’s often suggested that diversification can be a good strategy to spread potential risks, as it avoids putting all of your eggs in the same basket.

Key Takeaways:

Review Score 4.6/5

Powerful Platform & Diverse Assets: Saxo offers SaxoTraderPRO, a powerful platform with advanced features, catering to experienced traders. They also provide a wide range of assets for investment, including stocks, ETFs, forex, bonds, and CFDs (depending on regulations).

Beginner Friendliness with a Caveat: SaxoTraderGO, the mobile and web app, offers a user-friendly interface suitable for beginners. However, the platform’s full potential with advanced features might have a steeper learning curve.

Fee Structure: Saxo recently reduced fees across many areas, but their structure can still be complex. Fees may vary by account tier and asset class. Consider contacting Saxo for the latest information on fees specific to your needs.

Security & Regulation: Security is a priority for Saxo. They are FCA regulated in the UK and segregate client funds, adding a layer of protection.

Target Audience: Saxo caters to a variety of investors. Active traders and experienced investors benefit from the advanced platform and diverse assets. High-net-worth individuals can leverage tiered accounts with reduced fees and additional perks.

Frequently Asked Questions

Is Saxo FCA regulated?

Saxo is indeed regulated by the FCA. This adds a layer of security and consumer protection for users in the UK.

Is Saxo trustworthy?

Trustpilot Score: As of today 23rd March 2024, Saxo has a Trustpilot score of 3.7/5 based on 5425 reviews. It is worth noting that this covers the whole group and not just the investment platforms.

What is Saxo?

Saxo, a prominent figure in the online trading industry, offers a cutting-edge web platform for trading across global financial markets, catering to both novice and experienced investors with a comprehensive suite of tools and resources.

What are Saxo Capital Markets?

Saxo Capital Markets is the investment arm of Saxo Bank Group, providing clients with expansive access to global capital markets, innovative financial products, and a trading environment optimized for both retail and institutional investors.

Can I trade CFDs with Saxo?

Yes, Saxo specializes in offering Contracts for Difference (CFDs), enabling clients to employ flexible trading strategies across various asset classes, including forex, stocks, commodities, and indices.

Is Saxo part of the Financial Services Compensation Scheme?

Saxo, under the Saxo Bank Group umbrella, offers financial safety nets akin to the Financial Services Compensation Scheme, though it operates under the Danish Guarantee Fund for depositors and investors.

Does Saxo offer Negative Balance Protection?

Saxo provides a safeguard for retail traders through Negative Balance Protection, ensuring clients do not lose more than their invested capital, especially during volatile market and trading conditions..

What features does Saxo’s Trading Platform offer?

Saxo’s web-based trading platform is equipped with direct market access, comprehensive charting tools, and sophisticated risk management features, offering a premier trading experience to both retail and professional clients.

Who can trade with Saxo?

Saxo’s trading platform serves a wide array of traders, from retail enthusiasts to professional clients, offering a robust trading environment with access to multiple markets and investment strategies.

Does Saxo provide Direct Market Access?

Yes, Saxo offers Direct Market Access (DMA), allowing seasoned traders to interact directly with the stock market’s order books, enabling more complex trading strategies and better execution.

What Account Currency options does Saxo offer?

Saxo accommodates global trading by offering accounts in various currencies, allowing clients to manage their capital and execute trades in their preferred currency.

Can I develop Trading Strategies with Saxo?

Saxo’s platform is conducive to cultivating sophisticated trading strategies with its extensive research, educational resources, and analytical tools, distinguishing it from other brokers.

How does Saxo compare to other brokers?

When compared to other brokers, Saxo stands out for its direct market access, diverse financial products, and commitment to offering a secure trading environment for its client assets.

What makes Saxo the right broker for VIP Clients?

Saxo’s VIP accounts offer discerning investors tailored services, such as personal relationship managers, in-depth market insights, and preferential pricing, making it the right broker for high-net-worth individuals.

How reliable is Saxo’s Financial Data?

Saxo’s commitment to providing reliable financial data ensures that traders and investors have access to accurate information, essential for making informed decisions in the fast-paced world of online trading.

What Brokerage Services does Saxo offer?

Saxo offers a full suite of brokerage services, including trading the stock market, forex, and CFDs, complemented by a robust trading platform, direct market access, and dedicated customer support.

What are the benefits of Saxo Rewards?

Saxo Rewards is an exclusive loyalty program designed to enhance the trading experience by offering benefits like reduced commissions, tighter spreads, and access to premium services for active traders.

Which asset classes does Saxo offer?

Saxo offers a diverse range of asset classes, including forex, stocks, CFDs, commodities, ETFs, options, futures, and bonds, catering to various trading preferences and strategies.

Is there a minimum deposit on Saxo?

Yes, Saxo requires a minimum deposit to start trading, which varies depending on the account type and the client’s region, ensuring a commitment to a professional trading environment.

References

Saxo Markets. https://www.home.saxo/ (Accessed March 24, 2024).

Financial Conduct Authority. https://www.fca.org.uk/. (Accessed March 24, 2024).

Trustpilot. Saxo Markets Reviews. https://www.trustpilot.com/review/home.saxo (Accessed March 24, 2024). (Note: this score reflects reviews across the entire Saxo group, not just the investment platform).