eToro Review 2025: A Transparent Review

Thomas Drury

Co-Founder

Seasoned finance professional with 10+ years' experience. Chartered status holder. Proficient in CFDs, ISAs, and crypto investing. Passionate about helping others achieve financial goals.

Twitter ProfileAuthor Bio

Dom Farnell

Co-Founder

Dom, a Co-Founder at TIC, is an avid investor and experienced blogger who specialises in financial markets and wealth management. He strives to help people make smart investment decisions through clear and engaging content.

Twitter ProfileAuthor Bio

Fact Checked

How we test

At The Investors Centre, we pride ourselves on our rigorous fact-checking process. To delve deeper into our meticulous testing procedures and discover how we ensure accuracy and reliability, visit our dedicated page on how we test.

Risk Warning

Please bear in mind that trading involves the risk of capital loss. 51% to 84% of retail investor accounts lose money when trading CFDs with the providers below. You should consider whether you can afford to take the high risk of losing your money.

Last Updated 25/04/2025

When I first started trading, I was overwhelmed by the sheer number of platforms out there. I wasn’t looking for just any broker—I wanted something intuitive, beginner-friendly, and diverse in asset selection. Most importantly, I wanted to learn from experienced traders without feeling completely lost.

I tried a few platforms, but many felt too complex, lacked proper education, or had sky-high fees. Some had great tools but were clearly built for professionals, while others offered a sleek interface but lacked depth. Then I stumbled upon eToro.

What caught my attention was its CopyTrader feature—the ability to mirror the trades of experienced investors. It felt like a game-changer for someone like me who wanted to learn by doing. Add to that a diverse range of stocks, crypto, forex, and ETFs, and I was intrigued.

Now, after months of using eToro, I can confidently give it a 4.8/5 rating. It’s not perfect—fees could be lower—but for beginners and traders who enjoy social investing, it’s one of the best platforms out there. In this review, I’ll walk you through my experience—the wins, the frustrations, and whether eToro is the right fit for you.

Quick Answer: How Does eToro Rate as a Trading Platform?

eToro scores a 4.8/5 for its user-friendly platform, unique social trading features, and diverse asset selection. While its fees are slightly higher than some competitors, its CopyTrader system and intuitive design make it a fantastic choice for beginners and social traders.

Update: eToro News 2025

The company has submitted confidential filings to the Securities and Exchange Commission (SEC) for an initial public offering (IPO) in hopes of valuing eToro at $5 billion, the Financial Times (FT) reported Thursday (Jan. 16), citing sources familiar with the matter.

First Impressions and Account Setup

Ease of Signing Up

Signing up for eToro was one of the smoothest experiences I’ve had with a trading platform. The process was straightforward—just an email, password, and a few basic details. Within 10 minutes, I was inside the platform, exploring its features.

However, KYC verification (Know Your Customer) was required before I could start trading. I had to upload my ID and proof of address, and the approval process took about 24 hours. While some platforms allow instant verification, eToro’s wait time was reasonable, and I appreciated the extra layer of security.

User Interface

Right from the start, eToro’s interface felt clean and easy to navigate. As a trader who prefers simplicity without sacrificing depth, I found the platform well-organized.

The dashboard made it easy to switch between my portfolio, live markets, and the CopyTrader feature. Unlike other brokers that clutter the screen with excessive data, eToro strikes a balance between being beginner-friendly while still offering enough tools for more advanced traders.

That said, I did find charting tools slightly limited compared to competitors like TradingView or Binance, but for most traders, eToro’s built-in analytics should be sufficient.

Deposits and Withdrawals

Funding my account was quick and hassle-free. eToro supports a variety of deposit options, including credit/debit cards, PayPal, bank transfers, and even crypto deposits in some regions.

The minimum deposit will vary by location but starts at $50 in the United Kingdom for certain payment methods and may differ in other regions. This makes it accessible for beginners. Withdrawals, however, were a slight downside. While depositing was instant, withdrawing funds took 2-5 business days, and eToro charges a $5 withdrawal fee, which felt unnecessary.

Comparison Table: Account Setup Features

| Feature | Available on eToro | Notes |

|---|---|---|

| Easy registration process | ✔ | Took less than 10 minutes to sign up. |

| KYC verification | ✔ | Required for full account access; approval took ~24 hours. |

| Deposit options | ✔ | Supports bank transfers, PayPal, credit/debit cards. |

| Minimum deposit required | ✔ | Starts at $50 in some regions. |

| User-friendly interface | ✔ | Simple and intuitive for beginners. |

Trading on eToro – What Stood Out

Diverse Asset Selection

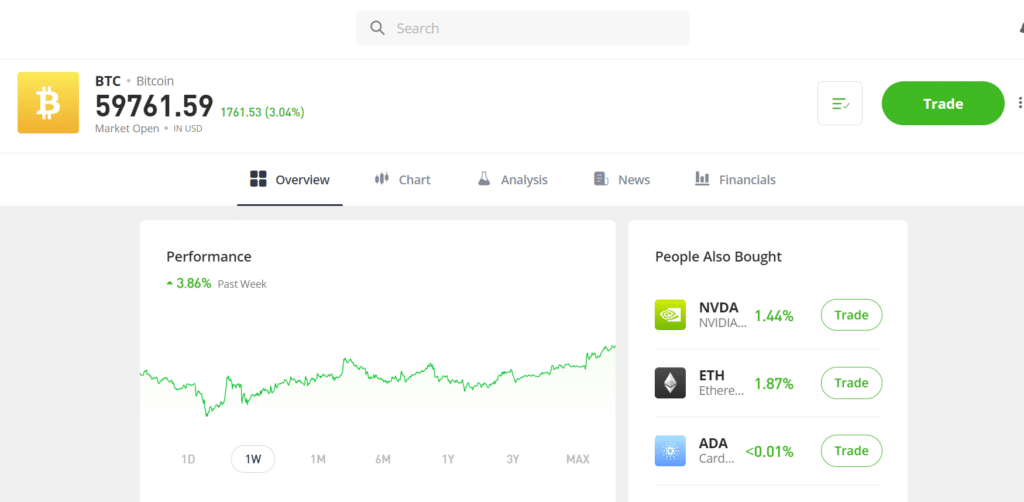

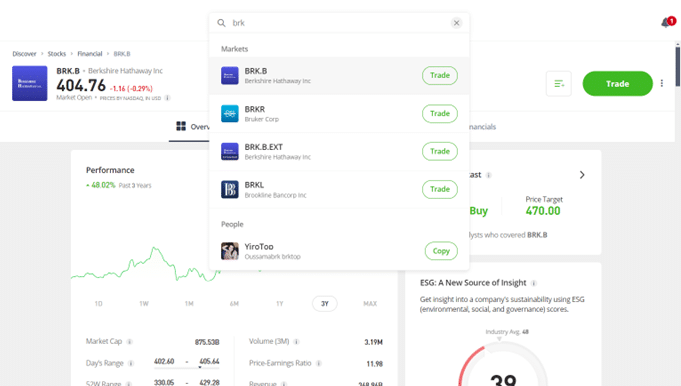

One of the things I immediately loved about eToro was the wide range of assets available. Whether you’re into stocks, crypto, forex, ETFs, commodities, or indices, eToro has it all.

I started with stocks, buying shares of Tesla and Apple with zero commission, which was a huge plus. Later, I explored crypto trading, where eToro offers dozens of digital assets, including Bitcoin, Ethereum, and Cardano.

Compared to competitors like Binance (which focuses mainly on crypto) or IG (which leans towards forex), eToro stands out as a well-rounded, multi-asset platform, making it ideal for traders who like diversification.

Copy Trading & Social Features

The CopyTrader feature was what drew me to eToro in the first place. The ability to automatically mirror the trades of successful investors felt like an easy way to learn while still making money.

I followed a few experienced traders, and within my first month, I saw a 12% gain—something I probably wouldn’t have achieved on my own. The transparency of each trader’s performance stats made it easy to decide who to follow.

Beyond CopyTrading, eToro’s social feed lets you interact with traders, share insights, and learn from real-time discussions—almost like a trading-focused social network.

Trading Fees & Spreads

While eToro offers zero commission on real stocks, its forex and crypto fees are higher than some competitors. The spread-based model means you’re charged based on the difference between buy and sell prices.

For example, when I traded Bitcoin, the spread was 1%, which is higher than Binance’s 0.1% spot trading fee. Forex pairs like EUR/USD had spreads starting at 1 pip, which was fair but not the lowest in the market.

Another downside is the $5 withdrawal fee, which feels outdated compared to platforms that offer free withdrawals. That said, for stock traders, the zero commission policy makes up for it.

Mobile App Experience

eToro’s mobile app is clean, responsive, and fully functional for trading on the go. I could easily check my portfolio, copy traders, and execute trades with a few taps.

However, charting on mobile felt limited, and I often had to switch to the desktop version for deeper analysis.

Fee Comparison Table: eToro vs Competitors

| Broker | Stock Trading Fees | Forex Trading Fees | Crypto Trading Fees | Notes |

|---|---|---|---|---|

| eToro | 0% (for real stocks) | 1 pip+ spread | 1% spread | Higher crypto fees than competitors. |

| Binance | N/A | 0.1% trading fee | 0.1% spot trading | Lower fees for crypto. |

| IG | $0 commission | 0.6 pip spread | Not available | Lower forex spreads than eToro. |

Learning and Improving with eToro

Educational Resources

One of the things I appreciated about eToro was its commitment to education. As a trader still refining my skills, I found the eToro Academy, blog, and webinars to be useful starting points.

The Academy covers trading basics, market analysis, and risk management, making it ideal for beginners. I particularly enjoyed their weekly market updates, which helped me stay informed on global trends.

That said, the content felt a bit basic compared to what IG or Saxo offer. I would have liked to see more in-depth strategy guides or technical analysis courses for intermediate traders.

Practice Account (Demo Trading)

Before risking real money, I tested eToro’s demo account, which comes with $100,000 in virtual funds. This was a great way to practice and explore the platform without pressure.

I used it to experiment with forex trading and copy trading, which helped me build confidence before switching to a live account. The ability to test strategies risk-free made a huge difference, especially when learning to manage trades with leverage.

Unlike some brokers that limit demo accounts to 30 days, eToro lets you keep it open indefinitely, which is a big plus. It was one of the best demo experiences I’ve had—simple to use and realistic in execution.

Practical Application

The best part about eToro is how seamlessly learning translates into action. After completing some Academy lessons, I applied my knowledge to real trades, particularly in stocks and crypto.

One key takeaway? Risk management is everything. After a small loss due to overleveraging, I started using stop-loss orders more effectively.

Similarly, I fine-tuned my copy trading strategy, choosing traders with lower risk scores instead of blindly following high-return traders. This small shift made my portfolio more stable.

Summary Table: eToro’s Educational Offerings

| Feature | Available | Notes |

|---|---|---|

| eToro Academy | ✔ | Covers trading basics and market insights. |

| Webinars | ✔ | Weekly market updates and expert insights. |

| Copy Trading Learning | ✔ | Learn by following top traders. |

| Market Research | ✘ | Limited compared to IG and Saxo. |

What Could Be Better – My Frustrations with eToro

Higher Fees for Crypto & Forex Traders

While stock trading on eToro is commission-free, the crypto and forex fees are noticeably higher than other platforms. When I bought Bitcoin, I was charged a 1% spread, which is significantly higher than Binance’s 0.1% trading fee.

Forex spreads start at 1 pip, which is decent but not as low as brokers like IG or Pepperstone. If you’re a high-frequency trader or looking for the absolute lowest fees, eToro might not be the most cost-effective choice.

For long-term investors, the fees are manageable. But for active traders, especially in crypto, the costs can add up quickly.

Withdrawal Fees & Delays

One of my biggest gripes with eToro is the $5 withdrawal fee. While this isn’t a dealbreaker, many competitors—like Binance and IG—offer free withdrawals.

On top of that, withdrawals take 2-5 business days, which felt frustratingly slow compared to other platforms where I’ve received my funds within 24 hours.

The process itself is simple, but if you’re someone who needs quick access to your funds, you might find this a drawback. I’d love to see faster withdrawal processing or an option for instant withdrawals with lower fees in the future.

Limited Research Tools

While eToro has an intuitive platform, its research and analysis tools felt underwhelming. Unlike platforms like TradingView or IG, eToro’s built-in charting options lack advanced indicators and customization.

For traders who rely on deep market research, eToro falls short. I often found myself using external charting platforms before placing trades.

If you’re a casual or beginner trader, this won’t be a big issue. But for technical traders who depend on in-depth analysis, eToro may feel a bit limiting.

Customer Support & Response Times

eToro’s customer support is hit or miss. While they offer live chat and email support, response times were often slower than expected.

When I had an issue with a withdrawal, it took 48 hours to get a response, which felt frustrating. The help center and community forums are useful for basic questions, but if you need urgent assistance, expect some delays.

I’d love to see faster support responses, especially for financial concerns.

Pros & Cons Table: Frustrations with eToro

| Aspect | Pros (✔) | Cons (✘) |

|---|---|---|

| Fees | ✔ 0% commission on stocks. | ✘ High spreads on crypto & forex. |

| Withdrawals | ✔ Easy process. | ✘ $5 fee & slow processing (2-5 days). |

| Research Tools | ✔ Basic charting available. | ✘ Limited compared to TradingView & IG. |

| Support | ✔ Help center & forums are useful. | ✘ Slow response times for urgent issues. |

Is eToro Safe? My Thoughts on Trustworthiness

Regulation & Licenses

One of the main reasons I felt comfortable using eToro was its strong regulatory oversight. The platform is licensed by some of the most reputable financial authorities, including:

- FCA (UK) – Ensuring compliance with strict financial standards.

- ASIC (Australia) – Adding extra investor protection.

- CySEC (Europe) – Providing regulatory coverage across the EU.

This level of regulation gave me confidence that eToro isn’t some fly-by-night operation. Unlike unregulated offshore brokers, eToro adheres to strict financial guidelines, ensuring better protection for traders.

However, it’s worth noting that eToro does not offer investor protection on crypto holdings, as many regulators don’t cover digital assets.

Security Features

eToro implements multiple security measures to keep accounts safe. Two-factor authentication (2FA) adds an extra layer of protection when logging in, while SSL encryption secures transactions and personal data.

Another reassuring feature is fund segregation—client funds are kept in separate accounts, meaning eToro can’t use them for business operations.

Additionally, eToro has an insurance policy covering up to €1 million for certain jurisdictions, providing an extra safety net for traders.

Personally, I’ve never experienced any security breaches or unauthorized transactions, and eToro’s security measures have always felt solid and reliable.

Personal Experience with Safety

In my time using eToro, I’ve never faced any security issues. My deposits and withdrawals were processed without any complications, and I appreciated the account activity alerts that notified me of login attempts.

For a regulated broker, eToro provides a safe environment—but I still recommend using 2FA and strong passwords.

Security Feature Checklist

| Security Feature | Available | Notes |

|---|---|---|

| Regulated by FCA, ASIC, CySEC | ✔ | Strong oversight in multiple regions. |

| SSL Encryption | ✔ | Protects sensitive user data. |

| Two-Factor Authentication | ✔ | Extra security for login and transactions. |

| Fund Segregation | ✔ | Client funds stored separately from company funds. |

| Crypto Investor Protection | ✘ | Crypto holdings are not covered under regulation. |

Comparing eToro to Other Trading Platforms

What Stood Out About eToro

After testing several trading platforms, eToro stood out for its unique CopyTrader feature and user-friendly interface. Unlike traditional brokers that focus purely on technical trading, eToro offers a social trading experience, allowing users to follow and copy professional traders automatically.

Another huge plus is the 0% commission on stocks, making it one of the best platforms for long-term investors. While competitors like Binance and IG excel in crypto and forex fees, they lack the social trading features that make eToro so appealing.

For beginners and casual investors, eToro is one of the easiest platforms to get started with, but for highly active traders or those looking for lower spreads, other options may be more cost-effective.

Where Competitors Excel

While eToro shines in social trading and stock investing, platforms like Binance, IG, and Interactive Brokers outperform it in other areas.

- Binance is the best for crypto traders, offering much lower fees (0.1%) compared to eToro’s 1% spread on crypto transactions.

- IG Markets is better for forex trading, with tighter spreads starting at 0.6 pips compared to eToro’s 1 pip+ spreads.

- Interactive Brokers (IBKR) beats eToro in advanced stock trading and research tools, making it better for professionals.

If your priority is low fees or in-depth market analysis, these alternatives might be a better fit.

Why I Stuck with eToro

Despite its higher fees, I stuck with eToro because of its simplicity, CopyTrader feature, and commission-free stocks.

I like that I can diversify my investments across stocks, ETFs, crypto, and forex on a single platform without needing multiple accounts. The social trading aspect keeps me engaged, and I’ve genuinely learned a lot by following top traders.

If you’re a beginner or someone who prefers an easy-to-use platform, eToro is a fantastic choice—even if the fees aren’t the lowest out there.

Comparison Table: eToro vs Competitors

| Feature | eToro | Binance | IG Markets | Notes |

|---|---|---|---|---|

| Copy Trading | ⭐⭐⭐ | ⭐ | ✘ | Best for social trading. |

| Crypto Fees | ⭐ | ⭐⭐⭐ | ✘ | Binance has lower fees. |

| Stock Trading | ⭐⭐⭐ | ✘ | ⭐⭐⭐ | 0% commission on real stocks. |

| Forex Spreads | ⭐⭐ | ⭐ | ⭐⭐⭐ | IG offers better forex pricing. |

| Education & Social Features | ⭐⭐⭐ | ⭐ | ⭐⭐ | eToro leads in community learning. |

Final Verdict – Is eToro Worth It?

Overall Rating

After months of trading on eToro, I’d give it a solid 4.8/5. It’s one of the most beginner-friendly platforms, offering commission-free stock trading, an intuitive interface, and the CopyTrader feature, which sets it apart from competitors. However, higher spreads on forex and crypto, plus withdrawal fees, are small drawbacks.

Top Features

The best things about eToro are:

✅ CopyTrader, which allows you to mirror expert traders.

✅ Zero commission on real stock trading, making it a cost-effective choice for long-term investors.

✅ User-friendly design, perfect for beginners.

✅ Multi-asset platform, supporting stocks, ETFs, crypto, forex, and commodities.

✅ Social trading tools, which make learning and interacting with other traders fun and engaging.

While the platform isn’t ideal for high-frequency forex or crypto traders due to its spreads, it excels in ease of use and community-driven investing. If you want a simple but feature-rich trading experience, eToro is a great choice.

Who It’s Best For

eToro is perfect for:

✅ Beginners who want an easy-to-use platform.

✅ Stock investors looking for zero-commission trading.

✅ Traders who want to learn through CopyTrader and social trading.

✅ Crypto traders who prioritize ease of use over lowest fees.

For low-cost forex or crypto trading, other platforms may be better.

Acknowledging Drawbacks

The main downsides of eToro are:

❌ Higher spreads on forex and crypto compared to platforms like Binance or IG.

❌ $5 withdrawal fee feels outdated.

❌ Limited research and advanced charting tools for pro traders.

However, for casual traders, long-term investors, and those interested in copy trading, these drawbacks don’t outweigh the benefits.

Final Thought:

If you’re looking for a beginner-friendly trading platform with a strong social aspect, eToro is one of the best options available.

FAQs

Yes! eToro is one of the most beginner-friendly trading platforms, thanks to its intuitive interface, commission-free stock trading, and CopyTrader feature. The platform also provides a demo account and educational resources to help new traders get started.

CopyTrader allows you to automatically copy the trades of experienced investors. You can choose a trader based on their performance history, risk level, and strategy, and any trades they make will be mirrored in your portfolio. This feature is great for learning and passive investing.

Stocks & ETFs: 0% commission on real stocks.

Forex: Spread starts at 1 pip.

Crypto: 1% spread per trade (higher than Binance).

Withdrawals: $5 fee per withdrawal.

Inactivity Fee: $10 per month after 12 months of inactivity.

While stock trading is cost-effective, crypto and forex spreads are higher than some competitors.

Find more information on eToro’s Fees.

Yes, but withdrawals take 2-5 business days and come with a $5 withdrawal fee. eToro supports withdrawals via bank transfer, PayPal, and credit/debit card. While the process is simple, some traders find the waiting time longer than on other platforms.

Yes, eToro is safe and regulated by top-tier financial authorities, including:

✔ FCA (UK)

✔ ASIC (Australia)

✔ CySEC (EU)

It also offers SSL encryption, two-factor authentication (2FA), and fund segregation, ensuring a secure trading environment. However, crypto holdings are not covered under investor protection schemes.

References

Trade Smarter, not Harder

- Copy Trading

- Competetive Fee's

- Multi Asset Platforn

51% of retail CFD accounts lose money when trading CFD’s with this provider.

Related Articles

Trading and investing involve risk. The value of your investments can go up or down, and you may lose all or part of your capital. These products may not be suitable for all investors. Please ensure you fully understand the risks involved.

- Stocks, ETFs, crypto, more

- Copy top investors easily

- User & beginner friendly

- 30M+ global users

- Regulated, trusted platform