Adam Woodhead

Co-Founder

Adam is a Co-Founder and content creator for The Investors Centre. His key areas of interest and expertise are cryptocurrency and blockchain technology.

Twitter ProfileAuthor Bio

Thomas Drury

Co-Founder

Seasoned finance professional with 10+ years' experience. Chartered status holder. Proficient in CFDs, ISAs, and crypto investing. Passionate about helping others achieve financial goals.

Twitter ProfileAuthor Bio

Fact Checked

How we test

At The Investors Centre, we pride ourselves on our rigorous fact-checking process. To delve deeper into our meticulous testing procedures and discover how we ensure accuracy and reliability, visit our dedicated page on how we test.

Risk Warning

The information provided in this article is for educational and informational purposes only and does not constitute financial or investment advice.

Please bear in mind that trading involves the risk of capital loss. 68% to 84% of retail investor accounts lose money when trading CFDs with the providers below. You should consider whether you can afford to take the high risk of losing your money. CFDs are complex instruments with a high risk of losing money rapidly due to leverage.

Updated 21/01/2025

Page Contents

- Introduction

- Head to head Comparison Table

- Key Considerations for UK Investors

- Platform Features & Usability

- Investment Options & Fees

- User reviews

- Verdict: Who Should Choose eToro or ii?

- Frequently Asked Questions

- Conclusion

Introduction

Choosing the right investment platform is crucial for any UK investor. Here we dissect two popular options: eToro and Interactive Investor. (ii) Both platforms are FCA-regulated, but cater to different investment styles. Let’s delve into their histories and offerings to help you pick the perfect partner for your financial goals.

eToro

- Founded in 2007, eToro is a leading multi-asset platform offering commission-free stock and ETF trading.

- They’re renowned for their innovative social trading features, allowing users to copy the portfolios of successful investors.

- eToro boasts a user-friendly interface and a wide range of assets, including fractional shares, making them ideal for beginners looking to build a diversified portfolio.

Your capital is at risk.

Interactive Investor

- Established in 1995, Interactive Investor is a well-respected UK stockbroker with a long track record.

- They offer a comprehensive investment platform with extensive research tools, educational resources, and a flat fee structure that caters to frequent traders.

- Interactive Investor shines for experienced investors seeking tax-efficient investment options like ISAs and SIPPs for retirement planning.

Your capital is at risk.

Head to Head Comparison Table

Broker | eToro | ii |

Investing Options | Spread Betting, CFDs, Stocks, ETFs, Crypto | Stocks, ETFs, Investment Trusts |

Interest on Uninvested Cash | Add New | Add New |

FCA Regulated | Add New | Add New |

Founded | 2007 | 1995 |

Investor Protection | Add New | Add New |

4.2/5 | 4.7/5 | |

ISA Account | Add New | Add New |

Mobile App | Add New | Add New |

Inactivity Fee | 12 Months | 12 Months |

Monthly Fee | Add New | Add New |

Base Fiat | £ $ € | £ $ € |

Min Deposit | £10 | Relative to method |

Fractional Shares | Add New | Add New |

Demo Account | Add New | Add New |

Active Users | 20,000,000+ | 400,000+ |

Investor Protection | FSCS (up to £85,000) | FSCS (up to £85,000) |

Available in UK | Add New | Add New |

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

Key Considerations for UK Investors

Making the right choice between eToro and Interactive Investor hinges on several crucial factors. Here’s a breakdown of key considerations for UK investors:

Fees & Account Types

Fees: eToro boasts commission-free stock and ETF trading, but charges spreads on trades. Interactive Investor utilizes a flat fee structure, making them cost-effective for frequent traders. Consider your trading activity – for occasional investors, eToro might be cheaper, while high-volume traders might benefit from Interactive Investor’s flat fees.

Account Types: ISAs (Individual Savings Accounts) and SIPPs (Self-Invested Personal Pensions) offer valuable tax benefits for UK investors. Interactive Investor allows you to open ISAs and SIPPs, while eToro currently does not.

Regulations & Security

Both eToro and Interactive Investor are regulated by the Financial Conduct Authority (FCA), the UK’s financial watchdog. This ensures investor protection and adherence to strict financial regulations. Look for the FCA logo on their websites for peace of mind.

Investment Options

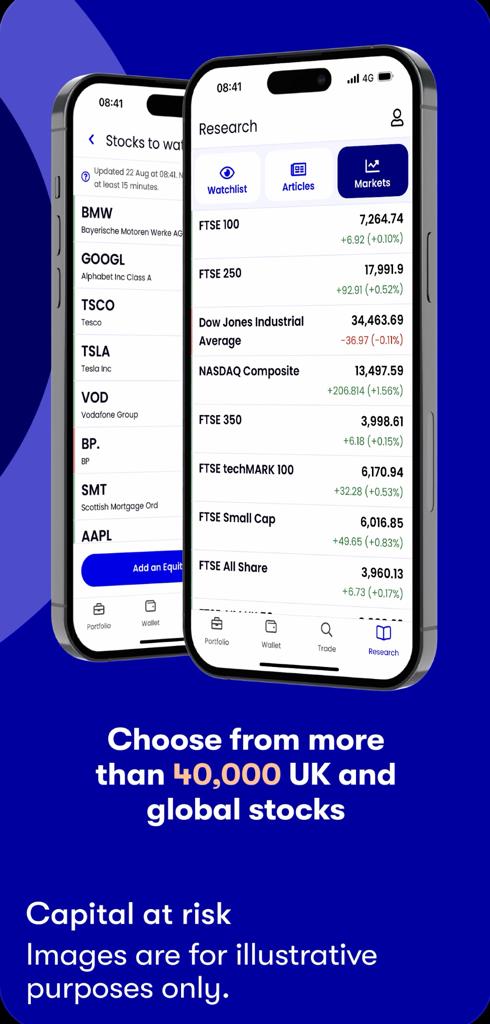

- Stocks & ETFs: Both platforms offer a wide range of UK and international stocks and ETFs.

- Fractional Shares: eToro allows you to invest in fractional shares, ideal for building a diversified portfolio with limited capital. Interactive Investor currently doesn’t offer fractional shares.

- CFDs: Consider your risk tolerance – eToro offers CFD (Contract for Difference) trading, a leveraged product that can magnify both profits and losses. Interactive Investor does not offer CFDs.

- Cryptocurrencies: Crypto assets like Bitcoin and Ethereum.

Platform Features & Usability

Beyond fees and investment options, platform features and usability play a vital role in your investment experience. Let’s see how eToro and Interactive Investor stack up:

Ease of Use & Mobile App Functionality

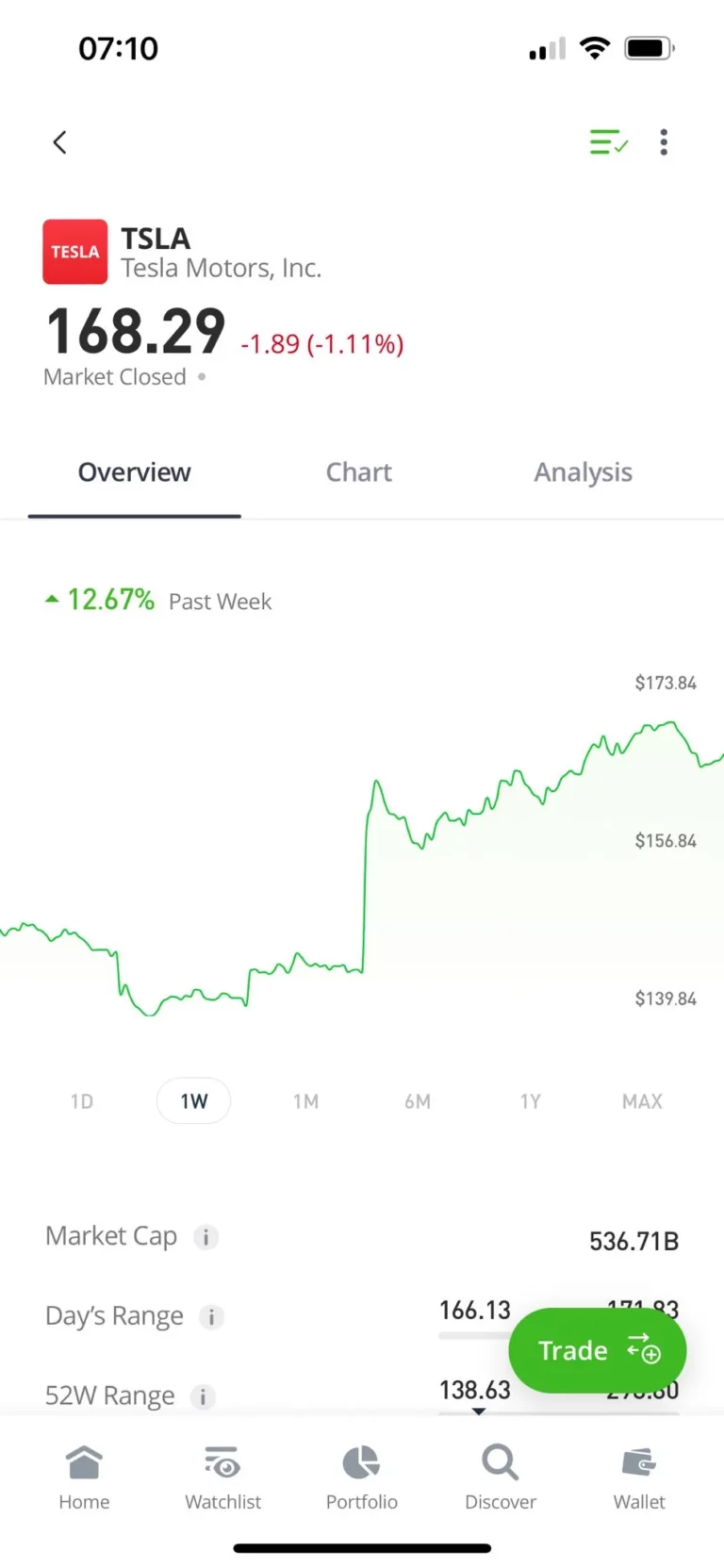

- eToro: Known for its user-friendly interface, eToro is perfect for beginners. Their mobile app boasts excellent functionality, allowing you to trade and manage your portfolio on the go.

- Interactive Investor: While not as beginner-friendly as eToro, Interactive Investor offers a robust platform with advanced features. Their mobile app is functional, but may have a steeper learning curve for new investors.

Research & Educational Resources

- eToro: While eToro doesn’t have extensive research tools, their social trading features allow you to learn by mimicking successful investors.

- Interactive Investor: Interactive Investor shines in this category, offering in-depth market analysis, stock reports, and educational resources to empower you to make informed investment decisions.

Customer Support Options

- eToro: eToro offers customer support via email and live chat. While phone support is limited, their live chat is generally responsive.

- Interactive Investor: Interactive Investor provides customer support via phone, email, and live chat, offering multiple avenues for assistance.

Investment Options & Fees Comparison

Now that we’ve explored platform features, let’s delve deeper into the investment options and fees offered by eToro and Interactive Investor:

Asset Classes Available

While both platforms offer a wide range of investment options, there are some key differences to consider:

- Stocks & ETFs: Both platforms provide access to a wide range of UK and international stocks and ETFs.

- Fractional Shares: eToro allows you to invest in fractional shares of US stocks, perfect for building a diversified portfolio with limited capital. Interactive Investor currently doesn’t offer fractional shares.

- Cryptocurrencies: A key differentiator! eToro allows you to invest in a variety of cryptocurrencies, while Interactive Investor currently doesn’t offer cryptocurrency trading.

- CFDs: Consider your risk tolerance! eToro offers CFD (Contract for Difference) trading on various assets, including stocks, indices, commodities, and even cryptocurrencies. Interactive Investor does not offer CFDs.

Socially Responsible Investing (SRI)

Currently, neither eToro nor Interactive Investor offers dedicated SRI portfolios or screening tools to filter investments based on environmental, social, and governance (ESG) factors. However, both platforms allow you to research individual companies’ ESG practices before investing.

Commission Structures & Spreads

eToro: While eToro boasts commission-free stock and ETF trading, they make money through spreads (the difference between the buy and sell price). These spreads can vary depending on the asset you’re trading, with cryptocurrencies typically having wider spreads compared to stocks.

Here’s a general breakdown of eToro’s spreads:

- Stocks & ETFs: Typically range between 0.09% – 0.4 pips (percentage points)

- Cryptocurrencies: Spreads can vary significantly depending on the specific cryptocurrency.

Interactive Investor: Interactive Investor utilizes a flat fee structure. You pay a set fee per trade, regardless of the trade value. This can be cost-effective for frequent traders, but occasional investors might find eToro’s commission-free structure on stocks and ETFs more appealing.

Here’s a breakdown of their fee structures

Fees Comparison Table

| Feature | eToro | Interactive Investor |

|---|---|---|

| Stock & ETF Trading Commission | Free | Flat fee per trade |

| Account Fee | Free | Free |

| Inactivity Fee | None | Yes |

| Minimum Investment | $10 (USD) | Varies |

| Currency Conversion Fee | Yes | Yes |

| CFD Fees | Overnight financing fees apply | N/A |

| Deposit/Withdrawal Fees | May apply | May apply |

| Stamp Duty (UK Stocks) | 0.5% on purchases exceeding £1,000 | Yes |

| Margin Fees (if applicable) | Apply | N/A |

| Spreads (for stocks & ETFs) | Typically range between 0.09% - 0.4 pips | N/A |

Remember: This table provides a general overview. For the most up-to- date fee information, consult the platform’s official websites.

User Reviews

Both eToro and Interactive Investor have a significant user base, and their reviews offer valuable insights. Here’s a quick breakdown of key takeaways:

Positives: Users praise eToro’s user-friendly interface, commission-free stock and ETF trading, and innovative copy trading features. Beginners appreciate the platform’s accessibility.

Concerns: Some users express concerns about the wider spreads on eToro compared to some competitors and the lack of advanced research tools. Additionally, the platform’s focus on CFDs, which can be risky instruments, is a point of caution for some reviewers.

Positives: Users value Interactive Investor’s extensive research tools, educational resources, and flat fee structure, making it cost-effective for frequent traders. The availability of ISAs and SIPPs is a plus for long-term investors seeking tax benefits.

Concerns: Some users find the platform’s interface less user-friendly compared to eToro, and the lack of fractional shares and cryptocurrency trading options can be drawbacks for some investors.

Verdict: Who Should Choose eToro or Interactive Investor?

The best platform for you depends on your investment experience and goals:

Choose eToro If You Are:

- A Beginner Investor: The user-friendly interface and copy trading features make it a great place to learn the ropes.

- A Value Investor: Commission-free stock and ETF trading can save you money on frequent trades.

- Interested in Fractional Shares: Build a diversified portfolio with limited capital.

- Interested in Cryptocurrency Trading: Explore a wider range of assets.

Choose Interactive Investor If You Are:

- An Experienced Investor: Utilize advanced research tools and in-depth analysis for informed investment decisions.

- A Frequent Trader: The flat fee structure keeps your trading costs predictable.

- A Long-Term Investor: Benefit from tax advantages offered by ISAs and SIPPs.

- Not Interested in CFDs: Avoid the potential risks associated with leveraged products.

Ultimately, the best way to decide is to try both platforms with demo accounts. This will allow you to get a feel for their functionalities and see which one best suits your investment style.

Key Takeaways for UK Investors

- Beginners & Value Investors: Choose eToro for its user-friendly interface, commission-free stock & ETF trades, and copy trading features.

- Frequent Traders: Opt for Interactive Investor’s flat fee structure for cost-effective frequent trading.

- Tax-Efficient Investing: Interactive Investor offers ISAs & SIPPs for long-term investors seeking tax benefits.

- Fractional Shares: Build a diversified portfolio with limited capital using fractional shares on eToro (not available on Interactive Investor).

- Cryptocurrency Trading: Explore a wider range of assets with eToro, including cryptocurrencies (not offered by Interactive Investor).

- Advanced Research & Analysis: Interactive Investor provides in-depth research tools for experienced investors (limited research tools on eToro).

- Demo Accounts Available: Try both platforms risk-free with demo accounts before committing real capital.

- Invest Responsibly: Always prioritize a long-term investment strategy and never invest more than you can afford to lose.

Yes, eToro is a FCA-regulated platform, ensuring investor protection. However, CFD trading offered by eToro carries high risks and may not be suitable for all investors.

Currently, Interactive Investor does not offer fractional share investing. This feature is available on eToro, allowing you to invest in portions of stocks.

For occasional investors, eToro’s commission-free stock and ETF trading can be cheaper. Interactive Investor’s flat fee structure benefits frequent traders. Consider your trading activity when making a decision.

Currently, Interactive Investor does not offer fractional share investing. This feature is available on eToro, allowing you to invest in portions of stocks.

Currently, Interactive Investor does not offer fractional share investing. This feature is available on eToro, allowing you to invest in portions of stocks.

eToro’s user-friendly interface and copy trading features make it a good choice for beginners. Interactive Investor caters more towards experienced investors with its advanced research tools.

References

About eToro: https://www.etoro.com/about/

Commission & Fees: https://www.etoro.com/trading/fees/

Fractional Shares: https://help.etoro.com/en-us/s/article/what-is-a-fractional-share-US

Interactive Investor:

About Interactive Investor: https://www.ii.co.uk/about-us/our-ownership

Investment Accounts: https://www.ii.co.uk/ii-accounts/sipp/faq

Charges & Fees: https://www.ii.co.uk/our-charges

Additional Resources:

Financial Conduct Authority (FCA): https://www.fca.org.uk/

Gain Access to Our #1 Recommended Investment Platform in the UK

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.