Thomas Drury

Co-Founder

Seasoned finance professional with 10+ years' experience. Chartered status holder. Proficient in CFDs, ISAs, and crypto investing. Passionate about helping others achieve financial goals.

Twitter ProfileAuthor Bio

Dom Farnell

Co-Founder

Dom, a Co-Founder at TIC, is an avid investor and experienced blogger who specialises in financial markets and wealth management. He strives to help people make smart investment decisions through clear and engaging content.

Twitter ProfileAuthor Bio

Fact Checked

How we test

At The Investors Centre, we pride ourselves on our rigorous fact-checking process. To delve deeper into our meticulous testing procedures and discover how we ensure accuracy and reliability, visit our dedicated page on how we test.

Risk Warning

Please bear in mind that trading involves the risk of capital loss. 51% to 84% of retail investor accounts lose money when trading CFDs with the providers below. You should consider whether you can afford to take the high risk of losing your money.

Last Updated 29/01/2025

Quick Answer: Which is Best?

eToro remains a top choice in 2025 for those who value a collaborative trading environment. Its social trading features, diverse asset range, and strong educational resources make it ideal for both new and experienced investors looking to refine their trading strategies.

Page Contents

| Key differences | eToro | Robinhood |

|---|---|---|

| Deposit and withdrawal score | 4.5 / 5 | 2.1 / 5 |

| Markets and products score | 4.6 / 5 | 2.8 / 5 |

| Fees score | 4.7 / 5 | 4.8 / 5 |

| Recommended for | Beginners | Equity |

| Equity | Yes | Yes |

| Forex | Yes | Yes |

| CFD | Yes | Yes |

| Fees score | 4.8 / 5 | |

| US stock fee | $0.00 | $0.00 |

| EURUSD spread | 1 | N/A |

| US index options fee | N/A | $0.00 |

| S&P 500 CFD spread | 0.8 | N/A |

| Deposit fee | $0 | $0 |

| Inactivity fee | Yes | No |

| Top-tier regulators | FCA, SEC, ASIC | SEC, FINRA, FCA |

| Foundation date | 2007 | 2013 |

| Investor protection | Yes | Yes |

| Minimum deposit | $10 | $0 |

| Mobile platform score | 4.9 / 5 | 4.8 / 5 |

| Web platform score | 4.8 / 5 | 3.5 / 5 |

| MT4 available | No | No |

| MT5 available | No | No |

| Customer service score | 4.1 / 5 | 2.4 / 5 |

| Account opening score | 5.0 / 5 | 4.6 / 5 |

Introduction

What Are eToro and Robinhood?

eToro and Robinhood are two trailblazing platforms that have dramatically changed the landscape of online trading. Both platforms emerged with a mission to democratize the financial markets, making investment opportunities accessible to everyone, regardless of their financial background or experience level.

From my personal experience, both eToro and Robinhood have successfully lowered the entry barriers for new investors. eToro, with its social trading focus, allows users to learn from seasoned traders and even replicate their trades, which is incredibly valuable for newcomers who are still learning the ropes. Meanwhile, Robinhood’s streamlined, intuitive user interface makes it easy for anyone to start trading with just a few taps on their smartphone. Their commitment to zero-commission trading was a game-changer, enticing a younger, tech-savvy crowd to start investing.

These experiences have not only made trading straightforward but have also fostered a sense of empowerment among users who may have previously felt excluded from the financial markets.

Platform Comparison

What’s the History of eToro and Robinhood?

eToro

eToro was founded in 2007 with a vision to open up the global markets for everyone to trade and invest in a simple and transparent way. The introduction of social trading features, like CopyTrader and CopyPortfolios, has set eToro apart as a leader in the social trading space, helping to expand its user base rapidly across Europe and later in the United States.

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

Robinhood

Robinhood, launched in 2013, began as a disruptor in the U.S. financial brokerage industry by offering commission-free trades of stocks and ETFs. This approach appealed massively to Millennials and Gen Z investors, quickly establishing Robinheim as a key player in mobile and online trading. The platform gained significant attention and user growth following its introduction of cryptocurrency trading and features like fractional shares.

Your capital is at risk.

What Can You Trade on eToro and Robinhood?

Both platforms have evolved to offer a range of trading and investment options but cater to slightly different investor needs based on their available assets and tools.

eToro:

- Cryptocurrencies

- Stocks

- ETFs

Robinhood:

- Stocks

- ETFs

- Options

- Cryptocurrencies

- American Depository Receipts (ADRs) for over 650 global companies

While eToro offers a unique blend of stock and cryptocurrency trading coupled with social trading features, Robinhood broadens its appeal with a straightforward approach to equities, options, and its recent expansions into cryptocurrency and international trading via ADRs. This breadth of offerings makes Robinhood a comprehensive choice for traders looking to explore a variety of asset classes, whereas eToro remains a top choice for those interested in combining trading with social interaction and learning from others.

Trading Technology

How User-Friendly Are eToro and Robinhood?

Both eToro and Robinhood excel in creating user-friendly environments that cater to beginners and experienced traders alike. From my personal navigation experiences, eToro’s platform is particularly impressive with its clean design and intuitive navigation, making complex trading operations seem straightforward. The integration of social trading elements is seamless, enhancing the learning curve for new investors by providing easy access to follow and copy the trades of successful investors.

Robinhood, on the other hand, has streamlined the process of trading to a few simple taps. The design ethos here is minimalism, which works incredibly well on mobile devices. Every function is within a few touches or swipes, making the platform exceptionally responsive. Robinhood’s commitment to providing a frictionless trading experience is evident in how quickly a user can move from logging in to executing a trade.

What’s the Mobile Trading Experience Like?

When comparing the mobile app features of eToro and Robinhood, both platforms showcase strong performances but cater to different user preferences.

eToro Mobile App:

- Offers comprehensive functionalities mirroring its desktop features including social feed integration, which allows users to engage with the community directly from their phone.

- The app provides advanced charting tools that are optimized for touchscreens, making it easy to execute technical analysis on the go.

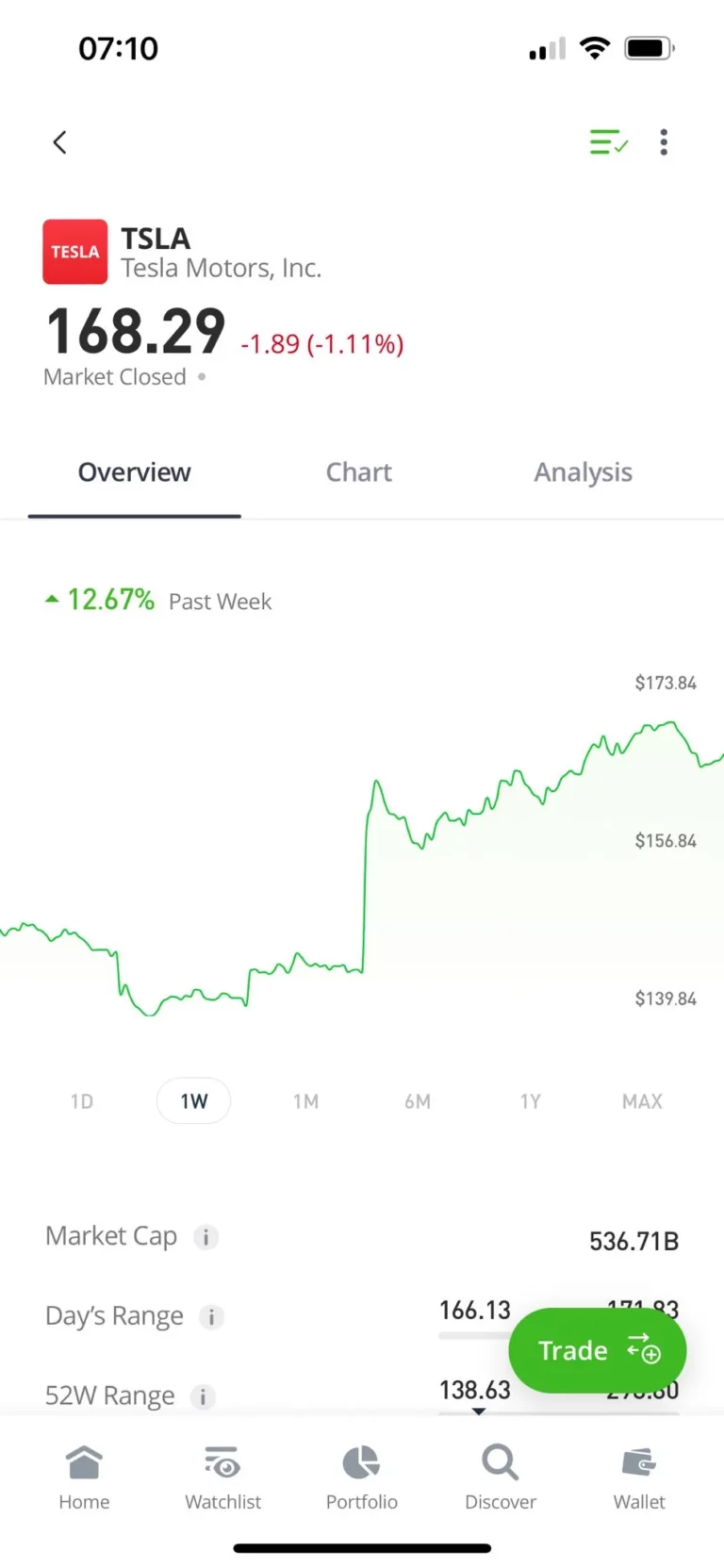

Robinhood Mobile App:

- Known for its clean, intuitive interface that makes buying and selling incredibly streamlined.

- Includes unique features like customizable alerts and the ability to stream live earnings calls, which is a boon for more engaged traders.

- Lacks some of the advanced analytical tools that might be available on more robust platforms but excels in simplicity and speed.

Both apps are highly rated by users for their stability and ease of use, though eToro’s app is better suited for those who appreciate community interaction and learning from others’ strategies, while Robinhood’s app is ideal for those who prioritize quick transactions and minimalistic design.

Fees and Costs

What Are the Trading Fees for eToro and Robinhood?

The fee structures of eToro and Robinhood are designed to cater to their respective target markets, emphasizing the accessibility of financial markets to everyone.

eToro primarily attracts users with its social trading features, but it’s essential to note the associated costs:

- Cryptocurrencies: eToro charges a 1% fee for buying or selling cryptocurrencies, which can add up but is transparent and upfront.

- Stocks and ETFs: Trading stocks and ETFs on eToro is commission-free, which is highly attractive for traditional and social traders alike.

Robinhood, known for its role in popularizing commission-free trading, maintains this model across all its offerings:

- All Trades: $0 commission on stocks, ETFs, options, and cryptocurrencies, making it extremely cost-effective for traders who frequently adjust their portfolio.

From personal experience, Robinhood’s lack of trading fees provides exceptional cost savings, especially for active traders who would otherwise accrue significant fees on other platforms. Meanwhile, eToro’s fees are reasonable considering the added value of social trading tools, which can justify the cost for those who utilize these features effectively.

What Are the Account Requirements?

The account requirements for eToro and Robinhood reflect their different approaches to user engagement and market participation.

eToro:

- Minimum for CopyTrader: $200, which is required to engage in copy trading—a unique feature that allows users to mimic the trades of experienced traders, offering a hands-on learning approach through observation.

- General Account Minimum: While the platform allows for a lower initial deposit, accessing certain features like CopyTrader requires meeting this higher threshold.

Robinhood:

- No minimum account requirement: This policy makes it particularly accessible for new investors or those with limited funds to start trading. It encourages experimentation and learning without a significant upfront investment.

These account structures demonstrate how eToro and Robinhood tailor their services to meet the needs of different investor types—from novices looking for education and low entry barriers to more seasoned traders interested in leveraging advanced trading strategies.

Special Features

What Special Features Does eToro Offer?

eToro sets itself apart with its pioneering social trading features, which have transformed the way many of its users engage with the financial markets:

- Social Trading: eToro’s platform integrates social networking with trading, enabling users to follow and interact with other traders. This community-centric approach not only enhances the trading experience but also provides invaluable insights and learning opportunities from peer discussions and strategy sharing.

- CopyTrader: Perhaps eToro’s most notable feature, CopyTrader allows users to automatically copy the trades of experienced traders. This functionality is incredibly beneficial for beginners who can learn by watching the moves of seasoned investors in real time, or for those who prefer a more passive investment strategy.

These features make eToro a compelling choice for those who value community engagement and collaborative learning in their trading strategy.

What Makes Robinhood Unique?

Robinhood’s standout feature is its zero-commission trading model, which has significantly influenced the brokerage industry and trading behaviors:

- Zero-Commission Trading: By eliminating trading fees on stocks, ETFs, options, and cryptocurrencies, Robinhood has made financial markets more accessible than ever before. This approach has particularly appealed to a younger demographic, encouraging more frequent trades and greater experimentation with portfolio strategies without the deterrent of incremental costs.

- User-Centric Design: Beyond its pricing model, Robinhood’s clean, intuitive interface simplifies the investment process, making it especially attractive to first-time and casual investors. This simplicity has not only democratized access to trading but has also helped users feel more confident in managing their investment choices.

Both eToro and Robinhood offer unique features that cater to distinct user needs and preferences, with eToro focusing on social connectivity and learning, while Robinhood prioritizes cost efficiency and user-friendliness. These special features have enabled both platforms to carve out strong positions in the crowded online brokerage market.

Security and Regulation

How Secure Are eToro and Robinhood?

Security is a top priority for both eToro and Robinhood, as they aim to protect their users’ investments and personal information. From my own use and the general consensus among users, both platforms employ robust security measures:

- eToro: eToro uses industry-standard security protocols, including SSL encryption to secure user data and transactions. Additionally, it offers two-factor authentication (2FA) for all accounts, enhancing security by requiring a second form of verification before accessing an account. My interactions with eToro have always left me feeling secure, especially with the transparency about its security practices.

- Robinhood: Similarly, Robinhood employs state-of-the-art security features including data encryption, 2FA, and custom-built infrastructure to protect against potential threats. Despite facing some challenges in the past, such as the widely publicized data breach, Robinhood has significantly bolstered its security measures. In my experience, updates and communication from Robinhood regarding security have been timely and clear, which reassures users about the safety of their investments.

Are eToro and Robinhood Regulated in the UK?

Regulatory compliance is critical for trading platforms operating in the UK, and both eToro and Robinhood meet these requirements:

- eToro: In the UK, eToro operates under the regulation of the Financial Conduct Authority (FCA), ensuring that it adheres to strict financial standards and practices. This regulatory oversight provides a significant layer of security and trust, making eToro a reliable platform for UK traders.

- Robinhood: Although primarily regulated by U.S. bodies, Robinhood also complies with FCA regulations for its operations in the UK. This adherence to regulatory standards underlines Robinhood’s commitment to providing a secure and trustworthy trading environment for its UK user base.

The regulatory compliance of both platforms not only enhances their credibility but also ensures that they operate within the legal frameworks designed to protect investors. This adherence to regulations by eToro and Robinhood adds an essential layer of trust and security for their users.

Customer Service and Support

How Can You Get Support from eToro and Robinhood?

Customer service is a crucial element of any trading platform, impacting user satisfaction and trust. Based on personal interactions and widely shared user experiences, here’s how eToro and Robinhood stack up in terms of customer support:

eToro:

- Accessibility: eToro offers support through multiple channels including email, tickets, and a chat service, though the latter is primarily available for members of the eToro Club.

- Responsiveness: My experience with eToro’s support has generally been positive, with email queries typically answered within a few business days. However, during high volume periods, responses can be slower.

- Helpfulness: The support staff has proven knowledgeable and capable of resolving issues ranging from account queries to technical support. The detailed FAQ and help sections on their website also provide valuable self-help resources.

Robinhood:

- Accessibility: Robinhood provides a 24/7 chat support system, which is quite accessible directly through its app. Phone support is available but must be initiated via an in-app request.

- Responsiveness: Robinhood has made significant improvements in its response times over the years. Initial responses via chat are quick, usually within minutes, which is commendable.

- Helpfulness: The support team is generally well-informed and efficient at addressing common issues such as account verification, trade execution problems, and general inquiries. However, more complex issues may require multiple interactions for resolution.

Both platforms strive to maintain a high standard of customer service, with each having strengths in different areas. eToro excels in providing detailed and comprehensive assistance, especially beneficial for new traders needing more in-depth support. Robinhood, meanwhile, offers rapid response times and efficient problem-solving, which is crucial for trading environments where time is often of the essence.

Educational Resources

What Learning Resources Do eToro and Robinhood Provide?

Both eToro and Robinhood understand the importance of education in empowering traders. Each platform offers a range of educational tools tailored to assist users in enhancing their trading knowledge and skills. Here’s how each platform’s educational offerings measure up:

eToro:

- Range of Resources: eToro provides a comprehensive learning hub known as eToro Academy. This platform includes a wide array of materials from detailed guides and videos to live webinars. The topics covered are extensive, ranging from the basics of forex trading to complex investment strategies.

- Quality: The content is well-curated and presented in a way that is accessible to both beginners and more experienced traders. The inclusion of practical examples and the availability of social trading insights directly from experienced traders are particularly valuable. My personal experience with eToro’s educational resources has significantly deepened my understanding of market dynamics and trading strategies.

Robinhood:

- Range of Resources: Robinhood offers its educational platform, Robinhood Learn, which features a wealth of articles and newsletters like Robinhood Snacks. These resources focus primarily on investment basics, market updates, and personal finance tips.

- Quality: The content is concise and written in a very user-friendly tone, making it extremely approachable for beginners. While the depth of information may not be as extensive as eToro’s offerings, the quality is high, and it effectively demystifies complex financial concepts. My engagement with Robinhood Learn has bolstered my confidence in making informed trading decisions.

Both platforms prioritize education, but they cater to slightly different audiences. eToro is ideal for those who wish to engage deeply with the material and learn from the community, while Robinhood is better suited for those seeking quick, digestible insights to support their trading activities. The educational tools provided by both eToro and Robinhood have enriched my trading experience by enhancing my understanding of the financial markets and improving my trading efficacy.

Final Thoughts

Which Platform Is Right for You?

Choosing between eT and Robinhood largely depends on your trading style, preferences, and goals.

- eToro: This platform is exceptionally suited for those who are new to investing or prefer a more collaborative approach to trading. The social trading aspect, including features like CopyTrader, allows users to learn from and mimic the trades of experienced investors. This can be particularly advantageous for those who are still developing their trading strategies or who prefer a more hands-off approach while learning from the community. Additionally, if you are interested in a wider range of global assets, including a vast array of cryptocurrencies, eToro offers a robust platform that caters to a diverse investment portfolio.

- Robinhood: Robinhood is ideal for those who prioritize ease of use, speed, and cost efficiency. With its zero-commission model, it appeals to traders who engage in frequent buying and selling of stocks, ETFs, options, and cryptocurrencies. Its simple, intuitive interface makes it particularly attractive to beginners and those who prefer a straightforward trading experience without the complexity of too many features. If you’re a UK investor looking for a hassle-free way to invest in American stocks or crypto, Robinhood provides a seamless gateway.

What Should UK Investors Consider Before Trading?

As a UK investor, it’s crucial to approach trading with a well-rounded strategy that includes diligent risk management and thorough due diligence:

- Understand the Markets: Before investing, especially in platforms like eToro and Robinhood which offer access to both domestic and international markets, it’s important to understand the nuances of each market. This includes being aware of the economic, political, and regulatory factors that might impact your investments.

- Risk Management: Always be aware of the risks involved with trading. Utilize tools such as stop-loss orders to manage risk effectively. It’s wise to never invest more than you can afford to lose and to diversify your investment to spread risk.

- Due Diligence: Investigate before you invest. This includes not only researching the assets you are interested in but also understanding the tools and features offered by your trading platform. Make sure you are fully aware of any fees, the platform’s regulatory status, and the measures it takes to protect your investment.

- Keep Learning: Leverage the educational resources available on your chosen platform to continually enhance your knowledge and skills. An informed trader is typically a more successful trader.

Choosing the right platform and adopting a thoughtful trading strategy will help ensure that your investment experience is positive and aligned with your financial goals. Whether you choose eToro for its social trading benefits or Robinhood for its straightforward, cost-effective approach, make sure it aligns with your personal investing philosophy and objectives.

FAQs

Answer: eToro is known for its social trading features, allowing users to copy the trades of successful traders, which is great for beginners and those looking to engage with the community. Robinhood, on the other hand, offers a straightforward, user-friendly platform with zero commission on trades, making it ideal for cost-conscious traders and those who prefer a minimalist interface.

Answer: Yes, both eToro and Robinhood are regulated by the Financial Conduct Authority (FCA) in the UK. This ensures they adhere to strict financial and ethical standards, providing a secure environment for trading.

Answer: Consider your trading style, the types of assets you’re interested in, and how much support and learning you need. If social learning and a wide range of assets are important, eToro might be the better choice. If you prefer a simple, streamlined trading experience with minimal costs, Robinhood could be more suitable. Always practice risk management and due diligence, regardless of the platform you choose.

Answer: Yes, both platforms offer cryptocurrency trading. eToro provides a broad range of cryptocurrencies and social trading features, while Robinhood offers a more limited selection but with the benefit of zero commission on crypto trades.

Gallery

Gain Access to Our #1 Recommended Investment Platform in the UK

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

Seasoned finance professional with 10+ years' experience. Chartered status holder. Proficient in CFDs, ISAs, and crypto investing. Passionate about helping others achieve financial goals.

Seasoned finance professional with 10+ years' experience. Chartered status holder. Proficient in CFDs, ISAs, and crypto investing. Passionate about helping others achieve financial goals.