Quick Answer…

Economic indicators like GDP, CPI, and employment figures are crucial for Forex traders to monitor as they significantly influence currency values and help in predicting market trends. Utilizing tools like economic calendars and advanced trading platforms can enhance the analysis and trading strategies.

What Are Economic Indicators and Why Are They Vital for Forex Traders?

Economic indicators are statistics that provide insights into the overall health of an economy. They are crucial for Forex traders because they signal potential movements in exchange rates. These indicators influence monetary policy and can affect investor sentiment and currency values. Understanding these metrics allows traders to predict market trends and make informed decisions on currency trades using forex brokers.

For Forex traders, especially those dealing with pairs involving the British pound, knowing when and how these indicators are released can be the difference between a profitable trade and a loss. Key indicators include GDP, inflation rates, employment data, and trade balances—all of which directly influence currency strength or weakness.

What Is Forex Trading and How Does It Operate?

Forex trading involves exchanging national currencies against one another to profit from fluctuations in exchange rates. Operating 24 hours a day, five days a week, the Forex market is the largest and most liquid in the world, attracting participants from global banks to individual traders in the UK. For a deeper insight into the complexities and strategies of Forex trading, click here to understand forex trading.

Traders speculate on the rise or fall of currencies, influenced by economic, political, and market sentiment factors. Trades are executed over-the-counter (OTC), with no centralized exchange, making it essential for traders to be well-versed in economic indicators that could affect market conditions.

How Do Economic Indicators Influence Forex Markets?

Economic indicators play a significant role in shaping Forex market trends. Traders watch these indicators closely as they can hint at changes in economic policies or shifts in economic performance. For instance, a higher-than-expected inflation rate in the UK might prompt the Bank of England to raise interest rates, leading to a stronger pound.

Here’s a simple table summarizing how some key indicators typically affect currency values:

| Economic Indicator | Typical Effect on Currency |

|---|---|

| GDP Growth | Higher GDP → Stronger Currency |

| Inflation Rate | High Inflation → Weaker Currency in long-term |

| Unemployment Rate | Lower Unemployment → Stronger Currency |

By tracking these indicators, traders can anticipate market moves and adjust their strategies accordingly. This knowledge not only aids in risk management but also enhances the potential for profitability in the volatile Forex market.

What Are the Most Influential Economic Indicators for Forex Trading?

For Forex traders, several economic indicators are pivotal in shaping market perceptions and currency value fluctuations. Among the most critical are the Gross Domestic Product (GDP), the Consumer Price Index (CPI), employment figures, and central bank interest rate decisions. Other significant indicators include retail sales, industrial production, and various business sentiment surveys. These metrics provide a snapshot of economic health and potential shifts in monetary policy, which can directly influence exchange rates.

How Does the Gross Domestic Product (GDP) Impact Forex Trading in the UK and Globally?

GDP is the broadest measure of economic activity and a primary gauge of an economy’s health. In Forex trading, strong GDP growth signals a healthy economy and is typically bullish for the currency, attracting investment from abroad seeking higher returns in a robust environment. Conversely, if GDP growth falters, it can indicate economic trouble, leading to a depreciation of the currency as investors pull out in search of safer assets. For instance, a higher than expected GDP report from the UK could strengthen the GBP against other currencies, whereas a decline might weaken it.

Why Is the Consumer Price Index (CPI) Significant for Movements in the Forex Market?

The CPI measures inflationary pressures by tracking the price changes of a basket of consumer goods and services. Forex markets are sensitive to CPI data because inflation influences central bank interest rates, which affect currency strength. A higher CPI may prompt a central bank to raise rates to manage inflation, strengthening the currency. On the other hand, a lower CPI can lead to lower interest rates, weakening the currency. Traders often watch CPI announcements closely to gauge future monetary policy moves.

How Do Employment Reports from the UK and Other Major Economies Affect Forex Market Trends?

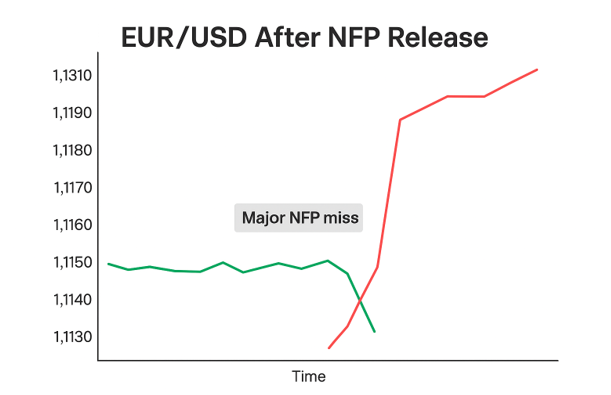

Employment reports are critical economic indicators, providing insight into labour market health, consumer spending potential, and overall economic momentum. Strong employment growth suggests a robust economic outlook, bolstering the currency as it may lead to higher interest rates to curb potential inflation. Conversely, rising unemployment can signal economic downturns, leading to falling interest rates and a weaker currency. Notable employment reports include the U.S. Non-Farm Payrolls, the UK’s Labour Market Report, and similar statistics from other major economies, each of which can significantly impact global Forex markets.

How Can Forex Traders in the UK Effectively Analyse Economic Reports?

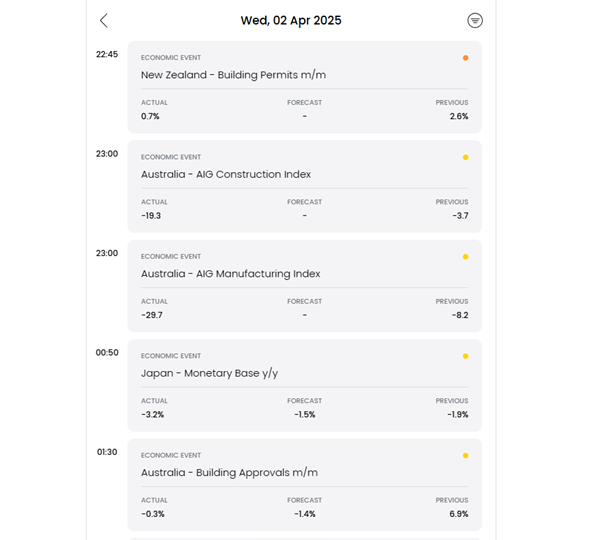

Forex traders should develop a routine to monitor and analyse economic reports such as GDP, CPI, and employment figures. Key to this analysis is comparing the actual data against market expectations and understanding its potential impact on currency movements. Utilizing an economic calendar can help traders prepare for and respond to market-moving data promptly.

What Tools and Resources Can Assist in Economic Indicator Analysis?

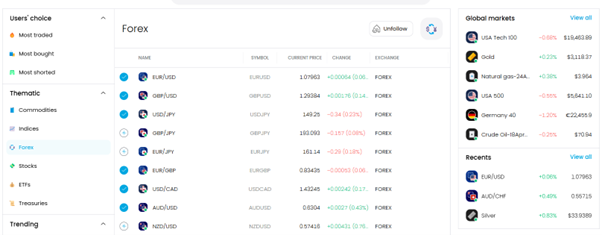

A variety of tools can enhance the analysis of economic indicators for Forex traders. Economic calendars are crucial for tracking significant events. Trading platforms like MetaTrader provide real-time data and analytical tools. For more in-depth analysis, resources such as Bloomberg Terminal or Reuters offer comprehensive data and sophisticated analytical capabilities. Websites of financial institutions and economic organizations also provide valuable insights and detailed reports.

Economic Indicator Impact on Forex Market Reason for Impact

| Economic Indicator | Impact on Forex Market | Reason for Impact |

|---|---|---|

| GDP Growth | Can strengthen currency | Indicates economic health and growth |

| CPI (Inflation Rate) | Can strengthen or weaken currency | High CPI may lead to higher interest rates; low CPI might result in lower rates |

| Employment Reports | Can strengthen currency | Low unemployment suggests economic strength, potentially leading to higher interest rates |

| Interest Rate Decisions | Direct impact on currency value | Higher rates attract foreign capital, strengthening currency; lower rates can weaken it |

Conclusion

In conclusion, understanding and analysing economic indicators is crucial for Forex traders, especially those operating in the UK’s dynamic financial markets. Indicators like GDP, CPI, and employment figures provide vital insights into economic health and are instrumental in shaping currency values. By effectively monitoring these indicators, traders can anticipate market trends and make more informed decisions.

The use of economic calendars, trading platforms, and advanced analytical tools further enhances a trader’s ability to assess economic conditions accurately. Staying updated with economic reports and leveraging sophisticated tools allows traders to navigate the Forex market more proficiently, optimizing their trading strategies for better outcomes.

Ultimately, the skilful analysis of economic indicators and the strategic use of trading resources can significantly impact a trader’s success in the volatile world of Forex trading. By continually refining their understanding of economic data and its implications, traders can maintain a competitive edge in the global currency markets.

FAQs - Frequently Asked Questions

While the importance of indicators can vary based on current economic conditions, the Consumer Price Index (CPI) and Gross Domestic Product (GDP) are generally considered critical because they directly impact central bank policies and currency strength.

Forex traders should regularly check economic indicators, especially ahead of and during major economic releases, as outlined in an economic calendar. This helps traders anticipate market movements and adjust their trading strategies accordingly.

Economic indicators can provide insights into potential currency movements, but they are not foolproof predictors. Traders must consider other factors such as geopolitical events, market sentiment, and technical analysis for a comprehensive market outlook.

Professional Forex traders often use tools like Bloomberg Terminal, Reuters, and MetaTrader for real-time data and analysis. These platforms provide access to advanced analytics, economic calendars, and real-time market data to help in decision-making.

-

- While it is beneficial to have a thorough understanding of major economic reports, Forex traders can prioritize key indicators that have a more pronounced impact on the markets they are active in. Understanding the broader economic context and focusing on significant reports can be more effective than trying to analyse every minor report.

References

- Bank of England – The official website provides extensive economic data, research, and policy updates relevant to the UK and global markets. Bank of England

- Bloomberg – Known for its comprehensive coverage of financial news and data. Bloomberg offers tools like Bloomberg Terminal which provide in-depth analysis and real-time market data. Bloomberg Finance

- Reuters – A leading source for business and financial news, offering detailed economic indicators, market analysis, and global financial updates. Reuters Finance