What Are the Best Trading Platforms in the UK for 2024?

Thomas Drury

Co-Founder

Seasoned finance professional with 10+ years' experience. Chartered status holder. Proficient in CFDs, ISAs, and crypto investing. Passionate about helping others achieve financial goals.

Twitter ProfileAuthor Bio

Dom Farnell

Co-Founder

Dom, a Co-Founder at TIC, is an avid investor and experienced blogger who specialises in financial markets and wealth management. He strives to help people make smart investment decisions through clear and engaging content.

Twitter ProfileAuthor Bio

How We Test

At The Investors Centre, we pride ourselves on our rigorous fact-checking process. To delve deeper into our meticulous testing procedures and discover how we ensure accuracy and reliability, visit our dedicated page on how we test.

Please bear in mind that trading involves the risk of capital loss. 51% to 84% of retail investor accounts lose money when trading CFDs with the providers below. You should consider whether you can afford to take the high risk of losing your money.

Here are the Top 7 Trading Platforms

- eToro: User-friendly, social trading, commission-free, educational.

- Spreadex: Competitive spreads, multiple markets, intuitive interface.

- AvaTrade: Advanced tools, diverse assets, reliable support.

- IG: Extensive market access, robust features, secure.

- Pepperstone: Fast execution, low spreads, various platforms.

- XTB: Comprehensive analysis, diverse assets, user-friendly.

- CMC Markets: Competitive pricing, advanced tools, reliable support.

What Does This Page Cover?

- How do These Trading Platforms Compare?

- How Did We Choose the Top Trading Platforms?

- Which Are the Top 7 Trading Platforms in the UK?

- What Should You Consider When Selecting a Trading Platform?

- How Can You Start Trading Online

- What Types of Investment Accounts Are There?

- How Do Online Trading Fees Work?

- Which Platform Has the Best Customer Service?

- Conclusion: Which Trading Platform Is Right for You

- Conclusion: Which Trading Platform Is Right for You?

- References

- FAQs

How do These Trading Platforms Compare?

Fee Score | 4 | 4.1 | 3.8 | 3.5 | 4.1 | 3.4 | 3.8 |

Platform Score | 5 | 4.8 | 4.8 | 4.9 | 3.5 | 4.3 | 4.6 |

Account Opening Score | 5 | 4.8 | 5 | 4.5 | 3.5 | 4.4 | 4.4 |

EURUSD Spread | 1 | Varies | 0.9 | 0.6 | 0.1 | 1 | 0.7 |

Withdrawl/ Deposit Fee | $5 | No | No | No | No | No | No |

Minimum Deposit | $0 | $0 | $100 | $0 | $0 | $10 | $0 |

Demo Account | Yes | No | Yes | Yes | Yes | Yes | Yes |

FCA Regulated | Yes | Yes | No (CBI In Ireland) | Yes | Yes | Yes | Yes |

FSCS Protection of £85K to UK Clients | Yes | Yes | No | Yes | Yes | Yes | Yes |

Supported Assets | Stocks ETFs Cryptocurrencies Indices (CFDs) Commodities (CFDs) | Forex Stocks (CFDs) ETFs (CFDs) Indices (CFDs) Commodities (CFDs) | Forex Stocks (CFDs) ETFs (CFDs) Cryptocurrencies Commodities (CFDs) Indices (CFDs) | Forex Stocks (including fractional shares) ETFs Options Cryptocurrencies Futures Indices Commodities | Forex Stocks (CFDs and DMA) ETFs (CFDs and DMA) Cryptocurrencies (CFDs) Commodities (CFDs) Indices (CFDs) | Forex Stocks (CFDs) ETFs (CFDs) Indices (CFDs) Commodities (CFDs) | Forex Stocks (including fractional shares) ETFs Options Futures Spread bets Commodities |

How Did We Choose the Top Trading Platforms?

Selecting the best trading platforms isn’t just about finding the one with the lowest fees or the flashiest interface. Over the years, I’ve learned the importance of looking beyond the surface. You need to dig into the details—things like user experience, range of assets, and customer support can make or break your trading journey. That’s why I’ve been through more than my fair share of platforms, trying to find the right fit.

So, how did we narrow it down to the top picks? It’s a blend of my own hands-on experience and the careful consideration of several key factors that can significantly impact your trading success. Here’s what I always keep in mind:

One of the first things I check is how much it costs to trade. Hidden fees can eat into your profits faster than a bad trade. Some platforms have sneaky charges, like inactivity fees or withdrawal costs. Others might seem cheap up front, but their spreads are wider than you’d expect. From my experience, you want a platform that’s transparent about its pricing, with competitive fees that don’t catch you off guard.

Let’s face it—if a trading platform is hard to navigate, you’ll spend more time figuring out how to place a trade than actually making money. A clean, intuitive interface is a must. Personally, I’ve found that platforms with clunky designs or too many hidden features end up costing you time—and potentially money—because you’re not reacting quickly enough. The best platforms make everything—from chart analysis to executing trades—smooth and straightforward, even for beginners.

Another big factor I consider is what you can actually trade. There are platforms that only offer a handful of markets, and that’s limiting, especially if you want to diversify your portfolio. The top trading platforms allow you to trade everything from stocks and ETFs to forex and cryptocurrencies. Over the years, I’ve gravitated towards platforms that give me the flexibility to explore new markets as I evolve as a trader. The more options, the better.

Whether you’re just starting out or have been trading for years like me, having access to high-quality educational resources is a game-changer. I’ve been on platforms that bombard you with jargon and others that break down complex strategies into digestible lessons. The best ones offer webinars, video tutorials, and even interactive courses that help sharpen your skills. Trust me, no matter how long you’ve been trading, you’re always learning, and good resources are invaluable.

You’d be surprised how important this is until something goes wrong. I’ve been stuck in situations where I needed urgent help, and a quick response from customer service made all the difference. Platforms that offer 24/7 support via multiple channels—live chat, email, and phone—are always a plus. If you run into a technical issue or need clarity on fees, you want someone who’s knowledgeable and can resolve it quickly.

If there’s one thing I’ve learned, it’s to never underestimate the importance of security. You’re trusting these platforms with your money, so they’d better have robust measures in place to protect your data and funds. I only recommend platforms that are regulated by respected authorities like the Financial Conduct Authority (FCA) in the UK. This adds a layer of trust and security that’s non-negotiable.

Lastly, I like to consider the bells and whistles. Things like demo accounts, advanced charting tools, social trading features, or mobile app functionality might not seem crucial at first, but they can add to your overall experience. For example, demo accounts can be invaluable for testing strategies without risking real money. Social trading, on platforms like eToro, allows you to learn from the moves of more experienced traders, which can be particularly useful if you’re still honing your skills.

Why These Criteria Matter

Choosing the right trading platform is about aligning it with your personal needs and trading style. When I was a beginner, I wanted simplicity and educational resources. Now, I value market access and speed of execution. These criteria are flexible enough to accommodate traders at different stages of their journey. Whether you’re trading daily or just managing a long-term portfolio, these platforms can provide the tools you need to succeed.

So, how did we narrow it down to the top picks? It’s a blend of my own hands-on experience and the careful consideration of several key factors that can significantly impact your trading success. Here’s what I always keep in mind:

Which Are the Top 7 Trading Platforms in the UK?

When it comes to user-friendly trading, eToro stands out as a platform designed for simplicity without sacrificing functionality. From the moment you sign up, the interface feels intuitive, even if you’re new to trading. With a well-organized dashboard and clear navigation, it’s easy to see why eToro has become one of the go-to platforms for beginners and experienced traders alike.

Pros

Cons

CFDs are complex instruments with a high risk of losing money rapidly due to leverage. 51% of retail CFD accounts lose money when trading CFD’s with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

- User-friendly interface for easy navigation.

- Social trading features to follow expert traders.

- Commission-free trading on stocks.

- Comprehensive educational resources for beginners.

- High spreads compared to some competitors.

- Limited research tools for advanced analysis

- Withdrawal fees on some transactions.

- Customer support can be slow at times.

What Makes eToro So User-Friendly?

eToro has mastered the art of simplicity in trading by focusing on a clean and straightforward user experience. Here’s why it’s so easy to use:

- Simple Account Setup: Opening an account on eToro takes minutes. They’ve streamlined the verification process, so you’re not bogged down by endless forms.

- Intuitive Interface: Everything is laid out in a way that makes sense—whether you’re on the desktop site or using their mobile app. You can quickly find your portfolio, watchlist, and trading options without unnecessary clutter.

- One-Click Trading: Executing a trade is as simple as a few clicks, and eToro provides visual aids like charts and performance graphs that are easy to interpret, even if you’re not a seasoned trader.

- Mobile App Excellence: I’ve used plenty of trading apps over the years, but eToro’s is among the smoothest. The transition between their desktop platform and app is seamless, and the app includes all the features you need to trade on the go.

How Does eToro's Social Trading Work?

One of eToro’s standout features is its social trading functionality, which allows you to copy the strategies of successful traders.

- CopyTrader™: This feature lets you literally mirror the trades of top investors. You can see their portfolios, performance stats, and risk ratings, making it easier to follow in the footsteps of pros.

- How it works: Simply choose a trader you like, set the amount you want to allocate, and eToro will automatically copy their trades in real time. It’s like having a personal mentor without any direct interaction.

- Popular Investor Program: For more advanced traders, you can become a “popular investor” yourself, allowing others to copy your trades and earn extra income based on your followers’ performance.

- Discussion Boards and Feeds: Think of it as social media for traders. You can comment on market movements, share insights, and interact with other traders, making it an engaging platform for anyone looking to learn from a community.

What Assets Can You Trade on eToro?

eToro offers a diverse range of assets, making it a versatile platform for all types of investors. Whether you’re interested in traditional stocks or want to dabble in crypto, eToro has you covered.

- Stocks: Trade shares from companies worldwide, including UK and US markets. You can buy fractional shares, which is great for beginners who don’t want to invest large sums right away.

- Cryptocurrencies: eToro is one of the leading platforms for crypto trading. You can trade popular coins like Bitcoin, Ethereum, and Ripple, along with several other altcoins.

- Commodities: Gold, oil, silver—you name it. eToro offers a good selection of commodities for those looking to diversify their portfolio beyond stocks.

- Forex: With access to the major currency pairs, eToro provides a solid platform for forex traders.

- ETFs and Indices: You can invest in a wide range of ETFs and indices, making it easy to follow market trends without having to pick individual stocks.

Here’s a breakdown of the key asset types available on eToro:

| Asset Type | Examples |

|---|---|

| Stocks | Apple, Tesla, Barclays |

| Cryptocurrencies | Bitcoin, Ethereum, Dogecoin |

| Commodities | Gold, Oil, Silver |

| Forex | GBP/USD, EUR/USD, JPY/USD |

| ETFs | S&P 500 ETF, Nasdaq-100 ETF |

| Indices | FTSE 100, Dow Jones, DAX |

What Fees Does eToro Charge?

eToro is transparent about its fees, and one of the reasons it’s popular among traders is that it offers commission-free trading on stocks, making it an attractive choice for beginners and budget-conscious investors.

Here’s a quick breakdown of eToro’s fee structure:

- Stocks and ETFs: 0% commission. You only pay the spread, which is the difference between the buy and sell prices.

- Crypto Trading: Spread starts from 0.75%, which is relatively competitive in the crypto space.

- Withdrawal Fees: A flat fee of $5 per withdrawal. While not free, this fee is reasonable compared to other platforms.

- Inactivity Fee: If you don’t log into your account for 12 months, a $10 monthly inactivity fee is charged. Keep this in mind if you’re a casual trader.

- Currency Conversion: Since eToro operates in USD, you’ll incur conversion fees when depositing or withdrawing in GBP.

What Educational Resources Does eToro Offer?

eToro goes beyond just providing a platform for trading—they actively educate their users. Whether you’re a novice looking to learn the ropes or an experienced trader seeking advanced strategies, eToro’s educational tools are comprehensive and accessible.

- eToro Academy: A dedicated learning hub offering courses, webinars, and tutorials on trading strategies, market analysis, and platform usage.

- Trading Guides: These range from beginner-friendly introductions to in-depth guides on technical analysis and trading strategies.

- News Feed: Real-time updates on market trends, company earnings, and global financial news. You can customize your feed to follow assets or traders that interest you.

- Demo Account: If you’re just starting out, eToro offers a fully functional demo account where you can practice trading with $100,000 in virtual funds. It’s a risk-free way to get comfortable with the platform before investing real money.

Spreadex: How Does It Provide Competitive Spreads?

Spreadex has built a strong reputation in the trading world thanks to its consistently competitive spreads across a wide range of markets. For anyone who wants to minimize trading costs without sacrificing access to various financial instruments, Spreadex is a solid choice. Let’s take a closer look at what makes Spreadex an attractive platform for traders seeking tight spreads and an intuitive interface.

Pros

Cons

64% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

- Competitive spreads across various markets.

- Wide range of markets available.

- User-friendly interface for ease of use.

- No commission on trades.

- Limited educational resources for beginners.

- No demo account available.

- Platform can feel outdated compared to others.

- Customer service could be more responsive.

What Are Spreadex's Spreads Like?

One of the main draws of Spreadex is its tight spreads, which are particularly appealing for day traders and those working with lower margins. Spreadex specializes in spread betting and CFD trading, and it has earned a name for offering some of the most competitive spreads in the industry.

- Spread Betting: Spreadex offers fixed spreads on many of its spread betting products, meaning the difference between the bid and ask prices remains stable, even during volatile market conditions. This is especially useful for traders who need cost predictability.

- CFD Trading: When trading CFDs (Contracts for Difference), the spreads vary depending on the asset, but Spreadex still manages to keep them competitive. This allows you to take positions in various markets without excessive trading costs eating into your profits.

Here’s an example of how Spreadex’s spreads compare with other platforms:

| Asset Type | Spreadex Spread | Industry Average Spread |

|---|---|---|

| Major Forex Pairs | From 0.6 pips | 1.0 – 1.5 pips |

| UK Shares | From 0.08% | 0.10% – 0.15% |

| Indices | From 0.9 points | 1.0 – 2.0 points |

| Commodities | From 0.3 points | 0.4 – 0.5 points |

As you can see, Spreadex frequently offers spreads that are below the industry average, making it an excellent platform for traders who want to maximize their returns through low transaction costs.

Which Markets Can You Access with Spreadex?

Spreadex offers an impressive variety of markets, giving traders access to a broad range of financial instruments. Whether you’re interested in the major global indices, forex, or even niche markets, Spreadex likely has something for you.

Here’s a quick overview of the markets you can trade on Spreadex:

- Forex: Spreadex provides access to major currency pairs such as GBP/USD, EUR/USD, and JPY/USD, with tight spreads that are highly competitive in the forex trading space.

- Shares: You can trade shares from major global markets, including the UK, US, and Europe. Spreadex allows both spread betting and CFD trading on shares, offering flexibility in how you trade.

- Indices: From the FTSE 100 to the Dow Jones and S&P 500, Spreadex gives you access to global indices with low spreads, making it a great platform for index trading.

- Commodities: Gold, oil, and silver are available for trading with narrow spreads, giving commodity traders another cost-effective option.

- Cryptocurrencies: If you’re into crypto, Spreadex offers trading on popular digital currencies such as Bitcoin and Ethereum.

The variety and flexibility Spreadex offers allow you to diversify your trading strategy without having to switch between platforms. Whether you’re trading traditional assets like stocks or more volatile markets like cryptocurrencies, Spreadex has you covered.

How Easy Is It to Use Spreadex's Platform?

In terms of ease of use, Spreadex strikes a good balance between functionality and simplicity. It’s designed to cater to both beginner traders and seasoned professionals, offering tools that are powerful yet intuitive.

- Platform Layout: The interface is clean and well-organized, making it easy to locate different markets, place trades, and track your portfolio. It doesn’t overwhelm you with unnecessary features, but it’s robust enough for more advanced traders to find everything they need.

- Charting Tools: Spreadex provides a variety of charting options that let you analyze market movements. The charts are customizable and include technical indicators that help you make informed trading decisions.

- Mobile App: I’ve used the mobile app extensively, and it offers a smooth, hassle-free experience. Whether you’re trading from your phone or desktop, the user experience is virtually identical, making it easy to manage trades on the go.

- Risk Management Tools: Spreadex includes built-in risk management features such as stop-loss orders and take-profit limits. These tools are easy to set up and are crucial for controlling risk, especially in volatile markets.

What Support Does Spreadex Offer?

Good customer support can be the difference between a smooth trading experience and a frustrating one, and Spreadex doesn’t disappoint in this area. The platform offers a variety of ways to get help when you need it.

- Live Chat: Spreadex provides real-time support via live chat, which is my go-to whenever I have quick questions or issues that need resolving fast. The response times are generally excellent.

- Phone Support: If you prefer speaking to someone directly, Spreadex also offers phone support during trading hours. From my experience, the representatives are knowledgeable and helpful.

- Email Support: For less urgent matters, you can email the support team. While it’s not as immediate as live chat or phone support, I’ve always received timely responses.

- Help Center: Spreadex also has a detailed help center that covers a wide range of topics, from platform tutorials to market explanations. It’s a great resource if you’re new to the platform or just need a quick reference.

When it comes to advanced trading tools, AvaTrade stands out as a platform that caters to both beginner and experienced traders. With a focus on providing cutting-edge technology and resources, AvaTrade gives you access to a suite of tools that can elevate your trading game. Whether you’re into algorithmic trading or prefer manual strategies with detailed market analysis, AvaTrade equips you with everything you need.

Pros

Cons

76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

- Advanced trading tools and platforms.

- Diverse range of assets to trade.

- Reliable customer support available 24/5.

- Regulated in multiple jurisdictions.

- Inactivity fees apply after three months.

- High minimum deposit for some accounts.

- Limited educational resources compared to competitors.

- Withdrawal fees can be high.

Which Advanced Trading Tools Does AvaTrade Provide?

AvaTrade is known for its powerful set of tools designed for in-depth market analysis and trade execution. Here are some of the advanced tools that make AvaTrade a top choice for seasoned traders:

MetaTrader 4 (MT4) and MetaTrader 5 (MT5): These are the industry standards for advanced trading. MT4 and MT5 offer robust charting capabilities, expert advisors (for automated trading), and a wide range of technical indicators. Whether you’re an algorithmic trader or someone who likes to customize their trading strategies, MT4 and MT5 are invaluable tools.

AvaOptions: This tool allows you to trade forex options with powerful analytics and risk management features. AvaOptions provides a comprehensive range of risk profiles and options strategies, allowing you to hedge your positions or speculate on market movements with precision.

AutoChartist: AvaTrade integrates AutoChartist, an advanced pattern-recognition tool that automatically identifies trading opportunities by scanning the markets in real time. It saves you time and helps you catch market movements you might otherwise miss.

AvaTradeGO: For traders who like to stay on the move, AvaTradeGO is the platform’s mobile trading app. It’s packed with advanced tools like market trends and risk management features, all in a sleek, user-friendly interface. The app allows you to keep track of market volatility and get instant updates, making it a powerful companion for mobile trading.

Zulutrade: This is AvaTrade’s social and copy trading feature, which lets you automatically mirror the trades of successful traders. It’s particularly useful for those who want to blend manual and automated strategies or learn from experienced traders.

Risk Management Tools: AvaTrade offers an array of built-in tools to help you manage risk, including stop-loss orders, trailing stops, and take-profit limits. These features are easy to set up and crucial for minimizing losses, especially in fast-moving markets.

What Variety of Assets Does AvaTrade Offer?

AvaTrade prides itself on offering a diverse selection of assets, ensuring you can trade across multiple markets. This variety allows you to diversify your portfolio and take advantage of different market conditions.

Here’s a breakdown of the main asset categories available on AvaTrade:

Forex: AvaTrade offers over 50 currency pairs, including all the major pairs like EUR/USD, GBP/USD, and USD/JPY. Whether you’re a forex trader looking for tight spreads or high liquidity, you’ll find plenty of opportunities here.

Cryptocurrencies: AvaTrade provides access to top cryptocurrencies, including Bitcoin, Ethereum, Litecoin, and Ripple. You can trade cryptos both as CFDs (Contracts for Difference) and traditional asset purchases.

Stocks: You can trade shares of major global companies like Apple, Amazon, and Facebook, either as CFDs or through traditional stock trading. The platform offers access to numerous stock exchanges, including the NYSE and LSE.

Commodities: AvaTrade offers a solid range of commodities including gold, silver, crude oil, and agricultural products like wheat and coffee.

Indices: AvaTrade provides access to major indices like the FTSE 100, NASDAQ, and S&P 500. These allow you to speculate on the broader market performance without having to pick individual stocks.

Bonds: The platform allows trading on various government bonds, such as Japanese, European, and US bonds, providing traders with a way to hedge or diversify into more stable assets.

| Asset Type | Examples |

|---|---|

| Forex | EUR/USD, GBP/USD, USD/JPY |

| Cryptocurrencies | Bitcoin, Ethereum, Ripple |

| Stocks | Apple, Tesla, Amazon |

| Commodities | Gold, Silver, Crude Oil |

| Indices | FTSE 100, NASDAQ, S&P 500 |

| Bonds | US Treasury Bonds, Japanese Bonds |

This variety of assets ensures that no matter what market or sector you’re interested in, AvaTrade has something for you.

How Reliable Is AvaTrade's Customer Support?

Customer support is crucial when trading, especially when you’re dealing with large sums of money or have urgent questions. AvaTrade’s customer service is generally responsive and reliable, which is a must for traders who may need assistance at critical moments.

24/5 Availability: AvaTrade offers customer support around the clock during trading days, which is helpful if you’re trading in global markets across different time zones. While support isn’t available on weekends, I’ve found their weekday coverage more than sufficient for most situations.

Multilingual Support: The platform offers multilingual support via phone, email, and live chat, catering to a global user base. Whether you prefer English, Spanish, or another language, there’s likely a support agent available to assist you.

Live Chat: For quick queries, the live chat function is extremely useful. In my experience, you can expect to get connected to a representative within minutes, and they are generally well-informed about platform features, fees, and technical issues.

Phone Support: If you prefer speaking directly, AvaTrade provides local phone support in several countries, which can make resolving more complex issues faster.

Overall, AvaTrade’s customer service is reliable, and their team is knowledgeable and efficient in dealing with both technical and trading-related questions.

What Are AvaTrade's Fees and Commissions?

AvaTrade offers competitive pricing, with clear information about their fee structure. While there are no commissions on most trades, AvaTrade operates using a spread-based pricing model, meaning your cost to trade is built into the difference between the buy and sell prices.

Here’s a breakdown of AvaTrade’s fees:

Forex Spreads: The spreads on major currency pairs are competitive, starting from as low as 0.9 pips on EUR/USD. This is slightly better than the industry average, which can be between 1.0 and 1.5 pips.

Cryptocurrency Spreads: On cryptos, spreads start from 0.25%, which is quite competitive in the fast-moving world of digital assets.

Inactivity Fee: If your account is inactive for more than 3 months, AvaTrade charges a fee of $50 per quarter. This is something to watch out for if you don’t trade regularly.

Overnight Financing (Swap Fees): Like most platforms, AvaTrade charges overnight financing fees on positions held open beyond the trading day, which can vary depending on the asset and market conditions.

| Fee Type | AvaTrade Rate |

|---|---|

| Forex Spreads | From 0.9 pips on major pairs |

| Cryptocurrency Spreads | From 0.25% |

| Inactivity Fee | $50 per quarter after 3 months of inactivity |

| Overnight Financing | Varies based on asset and position |

AvaTrade’s fees are transparent, and while there are a few charges to be mindful of, the platform remains cost-effective for the average trader.

TIC Score 4/5

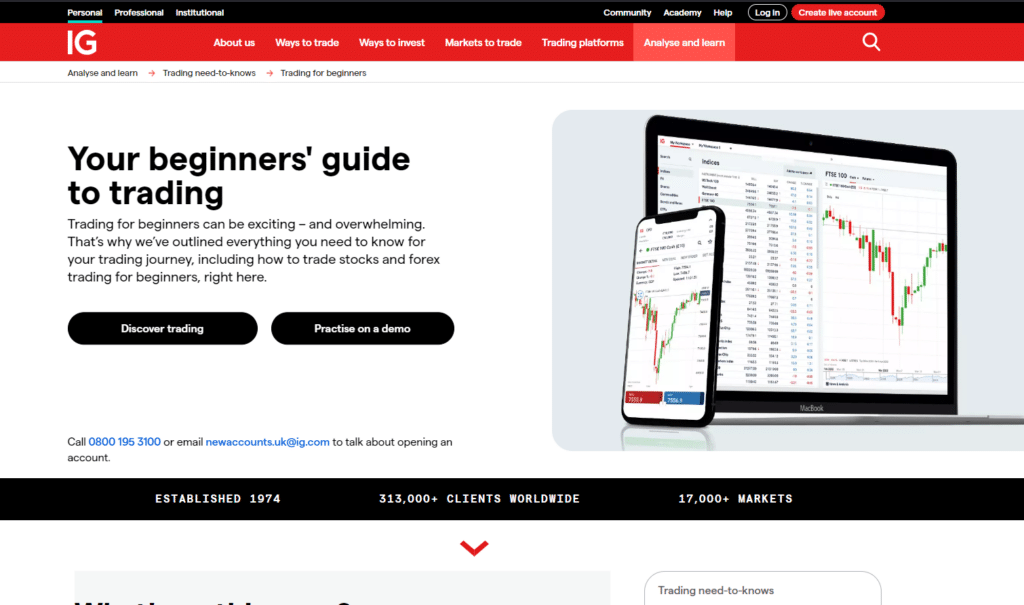

IG is a veteran in the trading world, known for its extensive market access and a reputation built over decades of providing reliable and feature-rich trading services. Whether you’re interested in trading forex, indices, shares, or more niche markets, IG offers one of the broadest ranges of assets. This makes it particularly appealing for traders looking to diversify and tap into global opportunities.

Pros

Cons

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 69% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

- Extensive market access across various asset classes.

- Robust trading features and tools.

- Highly secure and regulated.

- Comprehensive educational resources available.

- High fees for certain trades.

- Complex platform for beginners.

- Inactivity fees apply.

- Customer support can be inconsistent.

How Many Markets Can You Trade with IG?

One of IG’s biggest strengths is the sheer variety of markets you can trade. Few platforms offer the same level of access across as many asset classes, making it a go-to for traders who want to explore multiple opportunities without jumping between platforms.

Forex: IG provides access to over 80 forex pairs, including major, minor, and exotic currencies. This gives forex traders plenty of flexibility to trade the currencies they prefer.

Indices: IG offers access to all the major global indices, such as the FTSE 100, S&P 500, and DAX. This allows you to speculate on broader market movements without picking individual stocks.

Shares: You can trade shares from more than 17,000 companies across global exchanges, including the London Stock Exchange, NASDAQ, and the New York Stock Exchange. This vast selection makes it ideal for traders interested in individual equities.

Commodities: For those who prefer tangible assets, IG covers a wide range of commodities including gold, oil, and agricultural products like wheat and corn.

Cryptocurrencies: IG allows trading of popular cryptocurrencies such as Bitcoin, Ethereum, and Litecoin, either as CFDs or spread bets, providing flexible ways to trade volatile digital assets.

Options, Bonds, and ETFs: IG also offers a variety of derivative products, including options and bonds, as well as ETFs for those interested in trading baskets of assets.

| Asset Type | Number of Markets Available |

|---|---|

| Forex | 80+ currency pairs |

| Indices | 30+ global indices |

| Shares | 17,000+ across global exchanges |

| Commodities | 35+ commodities including metals, oil, and gas |

| Cryptocurrencies | Popular cryptos like Bitcoin, Ethereum, Litecoin |

| Bonds & ETFs | A wide selection of bond and ETF trading |

The diversity of markets on IG means you can diversify your portfolio without having to move to other platforms.

What Features Make IG Stand Out?

IG goes beyond just offering a broad range of markets. The platform also provides numerous standout features designed to enhance the trading experience for both beginners and experienced traders.

Advanced Trading Platforms: IG supports a variety of trading platforms, including its own proprietary platform and MetaTrader 4 (MT4). These platforms provide professional-grade charting tools, real-time data, and advanced order types like stop-loss and limit orders.

ProRealTime Charting: IG offers ProRealTime, an advanced charting tool that allows you to perform deep technical analysis. It includes automated trading features, over 100 indicators, and a customizable interface for detailed market analysis.

L2 Dealer: For advanced traders, IG provides Level 2 (L2) Dealer access, which shows the order book for direct market access (DMA) trading. This feature is ideal for traders who want a deeper insight into market liquidity and order flow.

Risk Management Tools: IG includes essential risk management features, such as guaranteed stop losses, which ensure you never lose more than a set amount, even in volatile markets. This is particularly useful when trading instruments like forex or cryptocurrencies where market movements can be unpredictable.

Mobile Trading: IG’s mobile trading app is one of the best in the market. It offers full functionality, meaning you can open, close, and monitor trades from your phone. The app includes advanced charting, real-time alerts, and market analysis tools, ensuring you never miss a trading opportunity.

Is IG Secure and Trustworthy?

When you’re choosing a trading platform, security and trust are non-negotiable. IG has been around since 1974, and its long-standing presence in the industry is a testament to its reliability and reputation. Here’s why IG is considered secure and trustworthy:

Regulation: IG is regulated by top-tier authorities, including the Financial Conduct Authority (FCA) in the UK and the Australian Securities and Investments Commission (ASIC). These regulatory bodies ensure that IG follows strict guidelines to protect your funds and maintain transparency in its operations.

Segregated Accounts: IG keeps client funds in segregated accounts, separate from the company’s own funds. This means your money is protected even in the unlikely event that IG faces financial difficulties.

Two-Factor Authentication (2FA): For additional security, IG offers two-factor authentication on its platform, making it harder for unauthorized users to access your account.

Risk Disclosure: IG is transparent about the risks involved in trading, providing clear and accessible information on leverage, margin, and potential losses. This allows traders to make informed decisions and avoid taking on unnecessary risk.

IG’s history, regulation, and security features make it a platform you can trust with your trading activities and funds.

What Educational Materials Does IG Provide?

IG goes above and beyond when it comes to educational resources. Whether you’re just starting out or looking to refine your trading strategies, IG provides a wealth of materials to support your learning.

IG Academy: This is the core of IG’s educational offering, providing free online courses that cover everything from the basics of trading to more advanced concepts like technical analysis and risk management. Each course is broken down into digestible modules, making it easy to learn at your own pace.

Webinars and Seminars: IG hosts regular webinars that cover live market analysis, trading strategies, and platform tutorials. These webinars are led by professional traders and market analysts, giving you access to expert insights. Occasionally, IG also offers in-person seminars for more hands-on learning.

News and Analysis: IG provides daily market analysis and news, including updates on key economic events, stock earnings, and market movements. This is crucial for traders who want to stay informed about the latest developments that could impact their trades.

Trading Tools and Calculators: IG’s platform includes various calculators to help you manage your trades. These include margin calculators, pip value calculators, and profit/loss calculators, all of which are designed to help you make more informed trading decisions.

Demo Account: For those who want to practice without risking real money, IG offers a demo account. This is an excellent tool for beginners to get a feel for the platform and test out strategies in a risk-free environment.

| Educational Resource | Description |

|---|---|

| IG Academy | Free online courses on trading basics and advanced topics |

| Webinars & Seminars | Regular live sessions led by professional traders |

| Market Analysis | Daily news, insights, and economic event coverage |

| Trading Calculators | Tools to help manage trades (e.g., margin, pip calculators) |

| Demo Account | Risk-free environment to practice trading |

IG’s commitment to education makes it a fantastic platform for traders at any level who want to deepen their understanding of the markets and improve their trading strategies.

TIC Score 4/5

When it comes to fast execution, Pepperstone is known for offering some of the best speeds in the trading world. Speed is everything when you’re trying to catch the right price in a volatile market, and Pepperstone’s infrastructure ensures that trades are executed with minimal delay, making it an ideal platform for both retail and professional traders.

Pros

Cons

81.7% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

- Fast trade execution speeds.

- Low spreads on major currency pairs.

- Multiple trading platforms available.

- Excellent customer support.

- Limited educational resources for novices.

- High minimum deposit for some accounts.

- No proprietary platform.

- Inactivity fees apply.

How Quick Is Pepperstone's Trade Execution?

Pepperstone has made significant investments in technology to ensure lightning-fast execution speeds, especially for forex and CFD traders who rely on rapid order fulfillment. In my experience, the speed at which trades are executed can often mean the difference between a profit and a missed opportunity.

Average Execution Speed: Pepperstone boasts an average trade execution time of less than 30 milliseconds. This speed is a result of their partnership with Equinix data centers, which are renowned for their low-latency environments. For traders, this means that orders are filled almost instantly, reducing the likelihood of slippage or price changes between the time you place the order and when it’s executed.

Low-Latency Servers: Pepperstone’s servers are located in Equinix’s NY4 data center in New York, which is one of the fastest financial trading infrastructures in the world. This setup gives Pepperstone an edge, particularly for high-frequency traders and those who use automated trading systems.

Raw Spread Accounts: For traders who need the fastest execution possible, Pepperstone offers Raw Spread Accounts, which provide direct market access (DMA). This means that orders are sent straight to the liquidity providers, ensuring that they are executed at the best available prices with minimal interference.

What Are Pepperstone's Spreads and Fees?

Pepperstone is also known for its competitive spreads and transparent fee structure. Whether you’re trading forex, commodities, or indices, you can expect some of the lowest spreads available, especially with their Raw Spread Account.

Forex Spreads: For major forex pairs like EUR/USD, spreads can be as low as 0.0 pips with the Raw Spread Account, although a small commission per trade applies. This is perfect for active traders who need tight spreads and fast execution. For the Standard Account, spreads start around 1.0 pip, with no commission fees.

Commission Fees: If you’re using the Raw Spread Account, commissions are competitive—around $3.50 per 100K traded, depending on the currency pair. This keeps your trading costs low, which is especially useful for frequent traders.

CFD Spreads: On indices like the S&P 500, spreads start from as low as 0.4 points, which is highly competitive compared to industry standards. Commodities like gold and oil also have similarly tight spreads.

| Account Type | Spreads | Commission |

|---|---|---|

| Standard Account | From 1.0 pips (forex) | No commission |

| Raw Spread Account | From 0.0 pips (forex) | $3.50 per 100K traded (round turn) |

| Indices (CFDs) | From 0.4 points (S&P 500) | No commission |

| Commodities | Tight spreads | No commission |

Pepperstone’s focus on low spreads and minimal fees makes it a very cost-effective platform for both casual and advanced traders.

Which Trading Platforms Does Pepperstone Support?

Pepperstone doesn’t just provide a fast and cost-effective trading environment; it also supports some of the most advanced and popular trading platforms in the world, giving traders the flexibility to choose one that suits their style.

MetaTrader 4 (MT4): The most widely used platform in forex trading, MT4 is known for its robust features, including customizable charts, over 30 technical indicators, and support for automated trading via Expert Advisors (EAs). If you prefer a reliable and proven platform, MT4 is the go-to.

MetaTrader 5 (MT5): A more advanced version of MT4, MT5 offers enhanced features like additional order types, more timeframes, and an economic calendar. It’s perfect for traders who want even more flexibility and precision in their trading strategies.

cTrader: Pepperstone also supports cTrader, a platform designed for high-frequency and algorithmic traders. With advanced order types, Level II pricing, and custom-built charting features, cTrader offers an institutional-level trading experience for retail traders.

TradingView: If you’re a fan of TradingView‘s charting and social features, you’ll be pleased to know that Pepperstone integrates with TradingView, allowing you to execute trades directly from the charts.

Each of these platforms is available on both desktop and mobile, ensuring you can access your trades and monitor the markets wherever you are.

| Platform | Key Features |

|---|---|

| MetaTrader 4 (MT4) | Customizable charts, automated trading (EAs), low latency |

| MetaTrader 5 (MT5) | More order types, extended timeframes, economic calendar |

| cTrader | Level II pricing, advanced order types, fast execution |

| TradingView | Social trading, advanced charting, direct execution |

The variety of platforms supported by Pepperstone ensures that every trader, regardless of their style, has access to the tools they need.

How Can Pepperstone Benefit Advanced Traders?

Advanced traders often need specific features that cater to fast execution, deep liquidity, and powerful analytical tools—and Pepperstone delivers on all these fronts.

Scalping and High-Frequency Trading: Due to Pepperstone’s ultra-low spreads and fast execution speeds, it’s an ideal platform for scalpers and high-frequency traders. You can execute trades rapidly without worrying about slippage or wide spreads eating into your profits.

Algorithmic Trading: Pepperstone’s integration with MT4, MT5, and cTrader makes it highly suitable for algorithmic trading. These platforms support Expert Advisors (EAs) and custom indicators, allowing advanced traders to automate strategies and backtest their systems.

Direct Market Access (DMA): Pepperstone’s Raw Spread Account offers DMA, giving you access to real market prices and tight spreads, which are essential for professional traders who need transparency and efficiency in their trades.

VPS Hosting: For algorithmic traders who rely on their systems running around the clock, Pepperstone offers Virtual Private Server (VPS) hosting. This ensures that your trading algorithms run 24/7 with minimal downtime, even if your local machine is offline.

Depth of Market (DOM): Advanced traders using cTrader can benefit from Depth of Market (DOM), which shows the full range of buy and sell orders at different price levels, allowing for more informed trading decisions.

| Advanced Features | Description |

|---|---|

| Scalping & HFT | Fast execution, low spreads ideal for rapid trading |

| Algorithmic Trading | Supports EAs and custom indicators on MT4/MT5, cTrader |

| Direct Market Access (DMA) | Raw spreads and real-time prices |

| VPS Hosting | Ensures continuous operation for automated strategies |

| Depth of Market (DOM) | Shows real-time market liquidity and order flow |

For advanced traders who need speed, precision, and flexibility, Pepperstone is a top choice, providing all the features necessary to execute sophisticated strategies.

TIC Score 3.5/5

XTB: How Does It Offer Comprehensive Analysis?

One of the standout features of XTB is its emphasis on providing comprehensive analysis tools for traders who want to make data-driven decisions. Whether you’re a technical analyst looking for in-depth charting features or a fundamental trader interested in market news and sentiment, XTB offers a robust set of tools that cater to both styles.

Pros

Cons

81% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

- Comprehensive market analysis tools.

- Diverse asset range for trading.

- User-friendly platform design.

- Low minimum deposit requirement.

- Limited customer support outside trading hours.

- Inactivity fees after a period of non-use.

- Higher spreads on some assets.

- Educational resources could be improved.

What Analysis Tools Are Available on XTB?

XTB is well-equipped with advanced analysis tools that help traders evaluate the markets from multiple angles. These tools are particularly beneficial for those who like to dive deep into market trends and technical data.

xStation 5: XTB’s proprietary trading platform, xStation 5, is a powerful tool that provides a wide range of analysis features. It’s packed with advanced charting capabilities, technical indicators, and real-time market data. The platform allows you to customize charts, add multiple indicators, and view real-time price movements across various asset classes.

Technical Indicators: xStation 5 comes loaded with 30+ technical indicators, including Moving Averages (MA), Bollinger Bands, MACD, and RSI. You can easily apply these to your charts to analyze price trends, momentum, and potential reversals.

Drawing Tools: The platform provides multiple drawing tools, like Fibonacci retracements, trendlines, and support/resistance levels, which are essential for visualizing potential breakout or breakdown points.

Sentiment Indicators: XTB also offers market sentiment analysis, showing the percentage of traders buying versus selling a particular asset. This can be a valuable tool to gauge market psychology and potential reversals.

Real-Time News and Economic Calendar: XTB integrates a live news feed and an economic calendar into its platform, keeping traders updated on important events such as earnings reports, central bank meetings, and key economic data releases. This helps traders anticipate potential market movements.

Stock Scanner: For stock traders, XTB’s stock screener allows you to filter through various equities based on key metrics like price-to-earnings (P/E) ratios, dividends, and market capitalization, making it easier to find potential trading opportunities.

| Tool | Description |

|---|---|

| xStation 5 | Proprietary platform with customizable charts, real-time data, and news feed |

| Technical Indicators | 30+ indicators including MACD, RSI, and Moving Averages |

| Sentiment Indicators | Shows percentage of traders buying versus selling in real time |

| Economic Calendar | Upcoming events that could affect the markets |

| Drawing Tools | Fibonacci retracements, trendlines, support/resistance levels |

| Stock Screener | Filter stocks by various fundamental and technical factors |

What Assets Can You Trade with XTB?

XTB offers a diverse range of assets, making it suitable for traders who want to explore multiple markets or diversify their portfolios.

Forex: XTB provides access to over 50 currency pairs, including major, minor, and exotic pairs. The tight spreads on major pairs like EUR/USD make it a competitive choice for forex traders.

Indices: You can trade global indices like the FTSE 100, S&P 500, and DAX. XTB offers low spreads on these indices, making them attractive for both short-term and long-term traders.

Shares and ETFs: XTB allows you to trade CFDs on thousands of shares from markets like the US, UK, and Europe. They also offer access to ETFs, which provide diversified exposure to specific sectors or markets.

Commodities: XTB covers popular commodities such as gold, oil, silver, and natural gas. These are great for traders looking to hedge or capitalize on price movements in physical assets.

Cryptocurrencies: For those interested in digital assets, XTB offers trading on major cryptocurrencies, including Bitcoin, Ethereum, and Ripple.

| Asset Type | Examples |

|---|---|

| Forex | 50+ pairs including EUR/USD, GBP/JPY, AUD/CAD |

| Indices | FTSE 100, S&P 500, DAX |

| Shares | Amazon, Tesla, Barclays |

| ETFs | Sector-based and broad-market ETFs |

| Commodities | Gold, oil, silver, natural gas |

| Cryptocurrencies | Bitcoin, Ethereum, Ripple |

Is XTB Suitable for Beginners?

While XTB is packed with advanced features, it’s also very suitable for beginner traders, thanks to its user-friendly interface and educational resources.

xStation 5’s Simplicity: The platform is easy to navigate, even for those new to trading. You won’t feel overwhelmed by technical jargon, and there are clear, step-by-step guides on how to use the platform’s features.

Educational Resources: XTB provides a wealth of educational materials for beginners. Their educational section includes video tutorials, webinars, and in-depth articles that cover everything from basic trading concepts to advanced strategies. This makes it easier for newcomers to get up to speed and feel more confident in their trades.

Demo Account: For those who want to practice before committing real money, XTB offers a free demo account that allows you to trade with virtual funds. This is a great way for beginners to get familiar with the platform and test strategies without risking capital.

Customer Support: XTB provides 24/5 customer support through live chat, phone, and email. For beginners, having access to prompt support can make a big difference when you’re still learning the ropes.

Overall, XTB strikes a good balance between providing advanced tools for experienced traders and offering an intuitive, educational experience for beginners.

What Are XTB's Fees and Charges?

XTB’s fee structure is competitive, especially for forex and CFD traders. The platform operates on a spread-based model with no hidden fees, making it transparent and easy to understand.

Forex Spreads: For major forex pairs like EUR/USD, spreads start as low as 0.1 pips. This makes it one of the more cost-effective platforms for forex trading, particularly if you’re trading in high volumes.

Commissions: XTB doesn’t charge commissions on standard accounts for forex, indices, and commodities. However, for share CFDs and ETFs, there is a small commission—starting from 0.08% per lot.

Overnight Fees: Like most platforms, XTB charges swap fees if you hold positions overnight. These vary based on the asset and market conditions, but they’re clearly displayed in the platform, so you’re never caught off guard.

Inactivity Fee: If your account is inactive for 12 months, XTB charges a £10 monthly inactivity fee. However, this can be avoided by regularly logging in or placing a trade.

| Fee Type | Details |

|---|---|

| Forex Spreads | From 0.1 pips on major pairs |

| Commission (Shares/ETFs) | 0.08% per lot |

| Inactivity Fee | £10/month after 12 months of inactivity |

| Overnight Fees | Varies based on asset and duration |

XTB’s transparent fee structure, combined with low spreads, makes it a cost-effective choice for both beginners and more advanced traders.

TIC Score 4/5

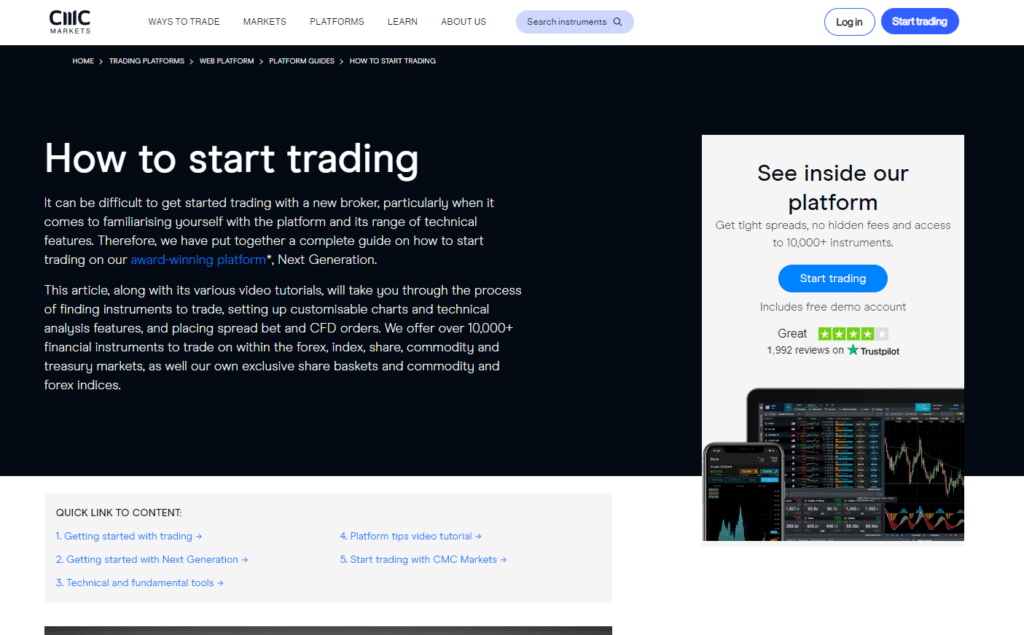

CMC Markets: What Makes It Reliable with Competitive Pricing?

CMC Markets has established itself as a leading platform for retail traders, thanks to its competitive pricing and reliable infrastructure. Whether you’re trading forex, indices, commodities, or shares, CMC Markets offers a wide range of instruments at some of the lowest costs in the industry. Combined with advanced trading tools and excellent customer support, CMC Markets is a solid choice for both beginners and experienced traders.

Pros

Cons

81% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

- Competitive pricing and low spreads.

- Advanced trading tools and charts.

- Reliable customer support.

- Extensive educational resources.

- Complex platform for new traders.

- High inactivity fees.

- Some tools require additional fees.

- Limited account types for beginners.

How Competitive Are CMC Markets' Prices?

One of the biggest draws to CMC Markets is its transparent and low-cost pricing structure. The platform is known for offering tight spreads, particularly on major forex pairs and popular indices. Here’s a breakdown of CMC Markets’ pricing:

Forex Spreads: CMC Markets offers extremely tight spreads, starting from 0.7 pips on major currency pairs like EUR/USD and GBP/USD. This is competitive compared to other major brokers and provides significant savings for high-frequency traders.

Indices: Spreads on major indices, such as the S&P 500, start from as low as 0.3 points, making CMC a great choice for index traders who want to minimize costs while trading on some of the most popular global indices.

Shares and ETFs: When it comes to share CFDs, CMC charges a commission-based fee structure, starting at 0.10% per transaction for UK shares and $0.02 per share for US shares. These fees are transparent and relatively low for the industry.

Commodities: Spreads on commodities like gold and oil are also competitive, starting from 0.3 points on oil and 0.3 pips on gold.

| Asset Type | CMC Markets Pricing |

|---|---|

| Forex | From 0.7 pips on major pairs |

| Indices | From 0.3 points on major indices (e.g., S&P 500) |

| Shares (UK) | 0.10% per transaction |

| Shares (US) | $0.02 per share |

| Commodities | From 0.3 pips (gold) and 0.3 points (oil) |

CMC Markets’ pricing is attractive for both retail and professional traders who seek low transaction costs without compromising on quality or execution speed.

What Advanced Tools Does CMC Markets Offer?

CMC Markets excels in providing advanced trading tools, particularly through its proprietary Next Generation platform. This platform offers a wide range of features designed to help traders perform in-depth market analysis and execute trades efficiently.

Charting Tools: CMC’s platform includes 80+ technical indicators and drawing tools, allowing traders to analyze market trends and price movements with precision. The charting tools are highly customizable, enabling traders to save templates and set alerts on price or technical levels.

Pattern Recognition Scanner: This tool automatically identifies chart patterns and potential trade setups in real-time, which is particularly useful for traders who rely on technical analysis. The scanner highlights key patterns like head-and-shoulders, triangles, and channels, helping traders catch potential market movements early.

Sentiment Analysis: CMC Markets provides real-time client sentiment data, which shows the percentage of traders buying or selling a particular asset. This tool can help you gauge market psychology and align your strategies with broader market trends.

Guaranteed Stop-Loss Orders (GSLO): For traders who want to manage risk with certainty, CMC Markets offers Guaranteed Stop-Loss Orders, which guarantee that your position will be closed at the exact price you specify, even during periods of high volatility.

Mobile Trading App: The CMC Markets mobile app offers nearly the same functionality as the desktop version, allowing traders to manage trades, analyze charts, and set alerts on the go. The app is user-friendly and features fast execution, ensuring you don’t miss trading opportunities when you’re away from your desktop.

| Tool | Description |

|---|---|

| Technical Indicators | 80+ customizable indicators for in-depth market analysis |

| Pattern Recognition Scanner | Automatically identifies chart patterns and potential trade setups |

| Sentiment Analysis | Shows real-time client positioning data |

| GSLO (Guaranteed Stop-Loss) | Ensures position is closed at a specific price, even in volatile conditions |

| Mobile Trading App | Full-featured app for trading and analysis on the go |

These advanced tools make CMC Markets a highly versatile platform, catering to both technical traders and those who prefer fundamental analysis.

How Reliable Is Their Customer Support?

CMC Markets is known for providing high-quality customer support, which is crucial for traders who need help with technical issues or platform navigation.

24/5 Support: CMC Markets offers 24/5 customer service, ensuring you can get help whenever the markets are open. The support is available through multiple channels, including live chat, phone, and email.

Multilingual Support: Since CMC operates globally, they provide multilingual support, catering to traders in different regions and languages. This is particularly useful for non-English-speaking traders who want personalized assistance.

Comprehensive Help Center: CMC Markets also has an extensive online help center, with detailed FAQs and tutorials covering platform features, fees, and trading strategies. For traders who prefer self-help, the knowledge base is an excellent resource.

Webinars and Tutorials: For ongoing learning and support, CMC hosts regular webinars and offers a library of tutorials, covering everything from platform basics to advanced trading strategies.

Overall, CMC Markets’ customer support is responsive and well-regarded, with knowledgeable staff who can help both new and experienced traders with their questions and issues.

What Types of Accounts Does CMC Markets Provide?

CMC Markets offers various account types to suit different trading styles and needs. Whether you’re a casual trader or a high-volume professional, there’s likely an account structure that fits.

Spread Betting Account: CMC Markets offers spread betting, which is tax-free in the UK and ideal for traders who want to speculate on market movements without owning the underlying assets. Spread betting allows traders to profit from both rising and falling markets.

CFD Trading Account: For traders who prefer CFDs, CMC offers a CFD account, providing access to thousands of global markets, including forex, indices, commodities, and shares. This account type allows for leverage, enabling traders to open larger positions with smaller capital.

Professional Account: For high-volume traders who meet certain criteria, CMC offers a Professional Account. This account provides higher leverage and access to advanced tools, but it comes with fewer protections, as it’s designed for more experienced traders.

Demo Account: CMC also offers a demo account, which is great for beginners or those who want to test strategies risk-free before committing real funds.

| Account Type | Key Features |

|---|---|

| Spread Betting Account | Tax-free in the UK, profit from both rising and falling markets |

| CFD Trading Account | Access to thousands of global markets with leverage |

| Professional Account | Higher leverage, advanced tools, fewer retail protections |

| Demo Account | Practice trading with virtual funds, risk-free |

The variety of account options ensures that CMC Markets caters to a wide range of traders, from beginners to professionals.

What Should You Consider When Selecting a Trading Platform?

Choosing the right trading platform is crucial to your trading success. With so many options available, it’s important to weigh several key factors before committing to one. Below are some of the most important considerations to keep in mind when selecting a platform that suits your needs and trading style.

What Fees and Charges Will You Face?

Understanding the fees and charges associated with a trading platform is essential because these costs can significantly impact your profitability over time. Here are some typical fees to watch out for:

Spreads: This is the difference between the buy and sell price of an asset. Platforms with tight spreads offer better value, especially for high-frequency traders. For instance, a 0.7 pip spread on major forex pairs is more favorable than 1.5 pips.

Commissions: Some platforms charge a commission on each trade, particularly for shares and ETFs. Look for platforms that offer commission-free trading on certain assets but be aware of other costs, such as wider spreads.

Overnight or Swap Fees: If you hold a position overnight, some platforms charge an additional fee, called a swap fee. This is common in forex and CFD trading, where leveraged positions are involved.

Inactivity Fees: Many platforms charge inactivity fees if you don’t trade or log in for a certain period. These can add up if you’re a less frequent trader.

Deposit and Withdrawal Fees: Some platforms charge fees when you deposit or withdraw funds. Always check for hidden fees like currency conversion charges if you’re trading in different currencies.

| Fee Type | What to Look For |

|---|---|

| Spreads | Tighter spreads on major assets like forex and indices |

| Commissions | Commission-free trading or low commissions on shares/ETFs |

| Overnight Fees | Transparent and reasonable swap rates |

| Inactivity Fees | Look for platforms with no or low inactivity fees |

| Deposit/Withdrawal Fees | Low or no fees for deposits and withdrawals |

By carefully considering the platform’s fee structure, you can minimize trading costs and improve your bottom line.

Is the Platform User-Friendly?

A user-friendly platform can make a significant difference, especially if you’re new to trading. Complex and poorly designed platforms can be frustrating and increase the likelihood of mistakes, such as placing the wrong trade.

Ease of Navigation: The platform should have a clean and intuitive interface. Look for features like easily accessible charts, watchlists, and one-click trading. Platforms like eToro and XTB are known for their simple yet functional interfaces that make it easy to find your way around.

Mobile Trading: Ensure that the platform has a robust mobile app that mirrors the desktop experience. This allows you to manage your trades on the go, which is crucial for active traders who need to react quickly to market movements.

Customizability: A good platform allows you to customize your trading environment. For example, platforms like MetaTrader 4 (MT4) let you set up multiple charts, apply different indicators, and save templates for easy use.

Speed and Performance: The platform should offer fast execution times, with minimal downtime or glitches. Slow performance can result in missed opportunities, especially in fast-moving markets.

Choosing a user-friendly platform makes trading more efficient and enjoyable, whether you’re a beginner or an advanced trader.

Does It Offer Educational Resources?

Educational resources are invaluable, especially if you’re a beginner or want to sharpen your trading skills. The best platforms not only offer the tools to trade but also help you learn how to use them effectively.

Tutorials and Guides: Look for platforms that provide step-by-step guides on how to use their tools and place trades. These can come in the form of video tutorials, written guides, or platform walkthroughs.

Webinars and Live Events: Regular webinars hosted by professional traders or analysts can provide insights into market trends, trading strategies, and platform features. Platforms like IG and CMC Markets frequently offer these resources.

Trading Academy: Some platforms have a dedicated section for trading education, like XTB’s Trading Academy or IG’s Academy. These cover everything from basic concepts to advanced strategies.

Market Analysis and News: Up-to-date market news, daily analysis, and economic calendars are key features that help traders stay informed about major events that could impact their trades.

| Educational Resource | Description |

|---|---|

| Tutorials | Step-by-step guides on platform features and trading |

| Webinars | Live sessions covering trading strategies and insights |

| Trading Academy | Structured courses for beginners to advanced traders |

| Market Analysis | Real-time news and expert commentary |

Having access to quality educational resources can accelerate your learning and improve your trading performance over time.

What Assets Can You Trade?

The range of assets available on a trading platform is crucial, as it determines the markets you can access and the strategies you can use. Some platforms specialize in certain asset classes, while others offer a broad spectrum.

Forex: Look for platforms that offer a wide range of currency pairs, especially if you’re interested in forex trading. Major, minor, and exotic pairs provide opportunities for different trading strategies.

Shares: If you want to trade stocks, ensure the platform offers access to global markets like the US, UK, and Europe. Some platforms, like CMC Markets, offer thousands of shares from multiple exchanges.

Indices and Commodities: For those interested in indices and commodities, check for access to popular markets like the S&P 500, FTSE 100, gold, and oil. Many traders use these instruments for hedging or diversifying their portfolios.

Cryptocurrencies: If you’re looking to trade digital assets, platforms like eToro and XTB offer major cryptocurrencies like Bitcoin, Ethereum, and Litecoin.

| Asset Type | Examples |

|---|---|

| Forex | EUR/USD, GBP/USD, USD/JPY |

| Shares | Apple, Tesla, Barclays |

| Indices | S&P 500, FTSE 100, DAX |

| Commodities | Gold, Oil, Silver |

| Cryptocurrencies | Bitcoin, Ethereum, Litecoin |

A diverse asset offering gives you more flexibility in how you trade and the types of strategies you can implement.

Are Different Account Types Available?

Different traders have different needs, and the availability of various account types can be a deciding factor when choosing a platform. Here are some common account types to look for:

Standard Accounts: Ideal for beginners or casual traders, standard accounts typically have low minimum deposits and offer basic trading features.

Professional Accounts: These accounts are designed for high-volume or more experienced traders, offering higher leverage and access to advanced tools, but often with fewer retail protections.

Demo Accounts: Most platforms offer a demo account, allowing you to practice trading with virtual funds. This is perfect for testing strategies without risking real capital.

Islamic Accounts: Some platforms provide Islamic accounts that comply with Sharia law, offering interest-free trading and no swap fees.

| Account Type | Description |

|---|---|

| Standard Account | Basic account with low deposit requirements |

| Professional Account | Higher leverage, access to advanced tools |

| Demo Account | Practice trading with virtual funds, risk-free |

| Islamic Account | Interest-free accounts compliant with Sharia law |

Having multiple account options ensures that you can choose one that fits your trading style and experience level.

How Secure Is the Platform?

Security is one of the most critical factors when selecting a trading platform. You’re trusting the platform with your funds and personal information, so it’s essential to ensure that it has strong security measures in place.

Regulation: Always choose a platform that is regulated by reputable financial authorities, such as the Financial Conduct Authority (FCA) in the UK or the Australian Securities and Investments Commission (ASIC). This ensures the platform follows strict guidelines to protect your funds and personal data.

Two-Factor Authentication (2FA): Look for platforms that offer two-factor authentication to add an extra layer of security when logging in. This reduces the risk of unauthorized access to your account.

Data Encryption: The platform should use SSL encryption to protect your data during transactions and communication.

Segregated Accounts: Check if the platform keeps client funds in segregated accounts separate from company funds. This ensures that your money is protected even if the platform faces financial difficulties.

| Security Feature | Description |

|---|---|

| Regulation | Look for platforms regulated by FCA, ASIC, etc. |

| Two-Factor Authentication | Adds extra security during login |

| SSL Encryption | Protects your data and transactions from hacking |

| Segregated Accounts | Ensures client funds are separate from company funds |

Ensuring that your platform has strong security measures will give you peace of mind while trading.

How Can You Start Trading Online?

Getting started with online trading may seem daunting, but it’s a straightforward process once you understand the steps involved. Here’s a breakdown of how you can open an account, fund it, place your first trade, and even practice with a demo account before risking real money.

How Do You Open a Trading Account?

Opening a trading account is typically the first step in your trading journey. The process is usually quick and can be done entirely online.

Choose Your Trading Platform: Start by selecting a trading platform that suits your needs—whether you’re interested in forex, stocks, commodities, or crypto. Look for a platform that’s user-friendly and offers the assets and features you require.

Complete the Registration: Most platforms will ask you to fill out a basic registration form with your name, email, and contact details. Some may also request details about your trading experience.

Verify Your Identity: Due to regulatory requirements, you’ll need to upload documents to verify your identity. Typically, this involves submitting a photo ID (like a passport or driver’s license) and proof of address (utility bill or bank statement).

Choose Your Account Type: Depending on the platform, you may need to choose between different account types, such as a standard account or a professional account. Make sure to select the one that best fits your trading style and goals.

Accept Terms and Conditions: Before finalizing the process, you’ll be asked to accept the platform’s terms and conditions, which outline the rules and obligations of trading on their platform.

Once your documents are approved, you’ll be ready to fund your account and start trading.

How Do You Deposit Funds?

After opening your trading account, the next step is to deposit funds. This process is generally simple, and platforms offer multiple ways to fund your account.

Log Into Your Account: Once your account is active, log in to the platform’s dashboard.

Go to the Deposit Section: Navigate to the deposit or funding section. Here, you’ll be presented with various deposit methods.

Choose a Payment Method: Most platforms offer a variety of payment methods, including:

- Bank Transfer: A direct transfer from your bank account. This method is secure but can take a few days to process.

- Credit/Debit Card: This is often the fastest way to deposit funds, with funds typically available instantly.

- E-Wallets: Services like PayPal, Skrill, and Neteller offer a quick and convenient way to transfer funds.

Enter the Amount: Specify how much you want to deposit. Keep in mind that platforms often have minimum deposit requirements, which can vary based on the payment method you choose.

Confirm the Transaction: Double-check the details and confirm the deposit. Most platforms will process the deposit immediately, but bank transfers can take a few days.

How Do You Place Your First Trade?

Placing your first trade can be exciting, but it’s essential to approach it carefully, especially if you’re new to trading. Here’s how to go about it:

Research the Market: Before placing a trade, take time to research the asset you’re interested in. Use the platform’s charting tools, news feeds, and analysis features to inform your decision.

Choose Your Asset: Decide on the asset you want to trade—this could be forex, stocks, commodities, or cryptocurrencies. Select the specific instrument from the platform’s asset list.

Select Your Trade Type: Most platforms offer different types of trades:

- Market Order: Buy or sell immediately at the current market price.

- Limit Order: Set a specific price at which you want to buy or sell. The trade will only execute if the market reaches that price.

Set Your Position Size: Determine how much capital you want to risk on this trade. Many platforms offer leverage, allowing you to control a larger position with a smaller amount of money. Be mindful of leverage as it increases both potential gains and losses.

Manage Risk: Set stop-loss and take-profit levels to automatically close your position if the market moves to a certain price. This helps you manage your risk and lock in profits.

Execute the Trade: Once you’re ready, click the buy or sell button to execute your trade. The platform will display a confirmation that your trade has been placed.

What Is a Demo Account and Should You Use One?

A demo account is a fantastic tool for beginners or even experienced traders looking to test new strategies. It allows you to trade with virtual money, providing a risk-free way to familiarize yourself with the platform and market conditions.

Risk-Free Practice: Demo accounts let you experience real market conditions without risking your own money. This is ideal for learning how to use the platform, experimenting with different asset classes, and testing strategies.

Real-Time Market Data: While you’re trading with virtual funds, demo accounts usually operate with live market data. This gives you a realistic sense of how your strategies would perform in real-world conditions.

Build Confidence: If you’re new to trading, using a demo account can help you build the confidence you need to move to a live account.

Strategy Testing: Even seasoned traders use demo accounts to test out new strategies or adapt to changes in the market without putting their capital at risk.

| Advantages of Demo Accounts | Description |

|---|---|

| Risk-Free Learning | Trade with virtual funds, no financial risk |

| Real-Time Market Data | Experience live market conditions |

| Build Confidence | Gain confidence before moving to a live account |

| Strategy Testing | Experiment with strategies in a risk-free environment |

While demo accounts are invaluable for practice, it’s important to remember that emotions and psychology play a more significant role in live trading, where real money is at stake. However, using a demo account first is a smart step toward becoming a successful trader.

What Types of Investment Accounts Are There?

Choosing the right investment account is essential to your overall trading strategy. Each account type has unique features, benefits, and limitations that can affect how you manage your trades and investments.

What Is a Standard Trading Account?

A Standard Trading Account is the most common type of account for individual investors. It offers flexibility and access to a wide range of markets and asset classes, such as stocks, forex, commodities, and more.

No Tax Advantages: Unlike certain specialized accounts, standard trading accounts don’t offer tax advantages. You’ll need to pay capital gains tax and income tax on any profits you make.

Broad Asset Access: These accounts typically offer access to various financial instruments, including individual stocks, ETFs, and derivatives like options and futures, depending on the platform.

Ideal for Flexibility: This type of account is suitable for traders and investors who want full control over their portfolio without the restrictions that come with tax-efficient accounts.

A standard trading account is straightforward and offers the most freedom, but it’s important to factor in tax implications when managing your investments.

What Is a Stocks and Shares ISA?

A Stocks and Shares ISA (Individual Savings Account) is a tax-efficient account available to UK residents, allowing you to invest in stocks and other securities without paying capital gains tax or income tax on profits.

Tax-Free Profits: One of the key advantages of a Stocks and Shares ISA is that any profits, including dividends and interest earned, are free from both capital gains tax and income tax, up to an annual limit (£20,000 for the 2024 tax year).

Restricted Contributions: You can only deposit up to a certain amount each tax year (currently £20,000), but you have the flexibility to spread this across multiple types of ISAs (e.g., Cash ISAs, Lifetime ISAs).

Long-Term Investment Focus: Stocks and Shares ISAs are typically best for long-term investing, as the tax benefits become more significant over time.

For UK investors, a Stocks and Shares ISA is a great way to build wealth without the burden of taxes, especially if you plan to hold investments for the long term.

How Does a CFD Account Work?