Quick Answer: To Buy Berkshire Hathaway Inc. Shares You Will Need To:

- Select a reliable broker.

- Open and fund your account.

- Locate the BRK ticker symbol.

- Place a buy order.

- Confirm and monitor your investment.

Introduction

Berkshire Hathaway Inc. is a multinational conglomerate holding company led by Warren Buffett, one of the most successful investors of all time. Investing in Berkshire Hathaway provides exposure to a diverse range of industries, including insurance, utilities, manufacturing, and retail. Since its inception, Berkshire Hathaway has delivered substantial long-term returns to its shareholders, making it a popular choice for both novice and experienced investors. The company’s dual-class share structure, with BRK.A and BRK.B shares, offers flexibility for investors with different budget constraints.

Step 1: Select a Broker

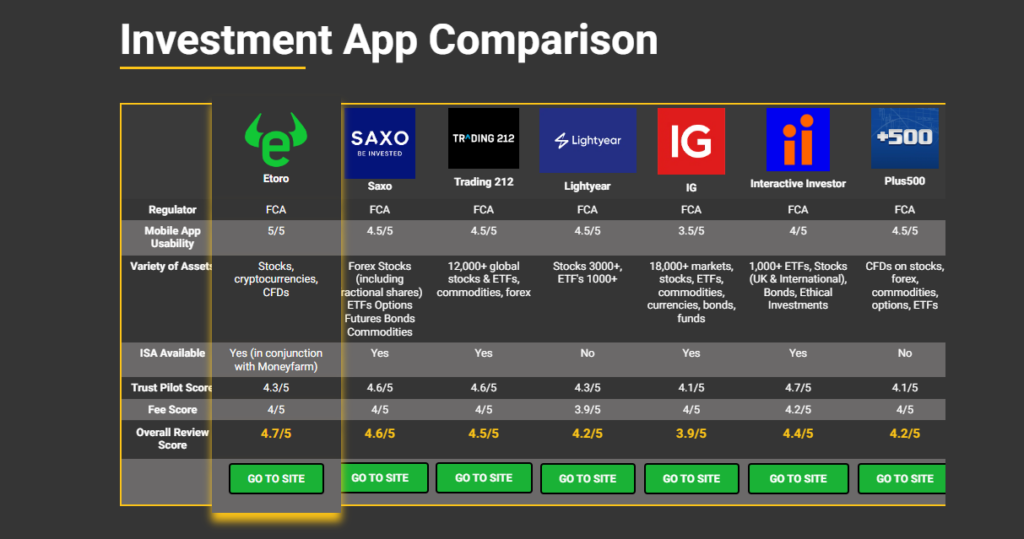

Choosing the right broker is crucial for buying Berkshire Hathaway shares. Look for brokers that offer low fees, a user-friendly platform, and strong customer support. Popular brokers in the UK include eToro, which is great for beginners, and Saxo, preferred by intermediate traders. Additionally, IG and Trading 212 are well-regarded for their comprehensive services and competitive pricing. Ensure the broker you choose is regulated by the Financial Conduct Authority (FCA) to guarantee the safety of your investments.

Step 2: Open and Fund Your Account

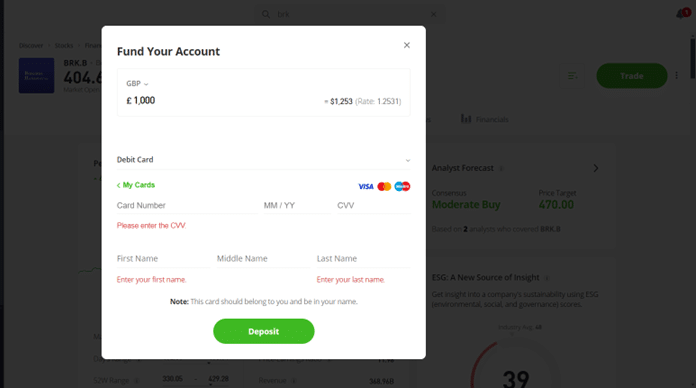

Once you’ve selected a broker, you need to open an account. This process typically involves providing personal information, verifying your identity, and completing a suitability assessment.

Funding your account can usually be done via bank transfer, credit/debit card, or e-wallets like PayPal. Some brokers also accept local payment methods, making it easier for UK investors to deposit funds.

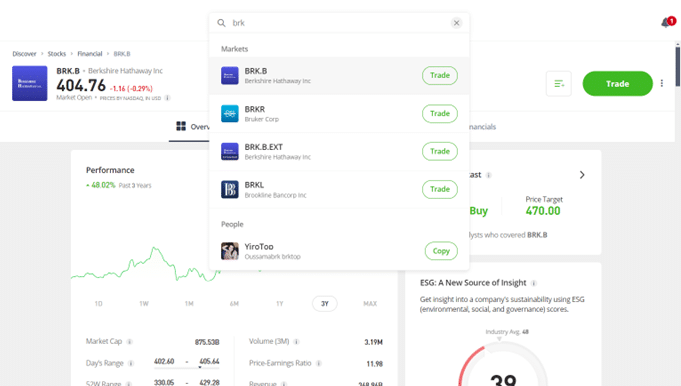

Step 3: Find Ticker

To buy Berkshire Hathaway shares, you need to know the ticker symbol. Berkshire Hathaway has two types of shares: BRK.A and BRK.B. BRK.A shares are more expensive and typically held by institutional investors, while BRK.B shares are more affordable and accessible to individual investors. Ensure you select the correct ticker based on your investment goals and budget.

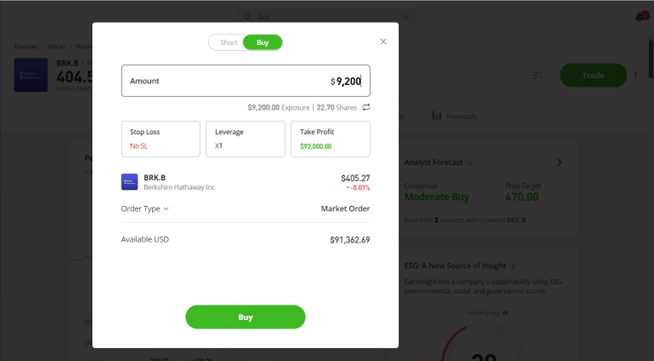

Step 4: Place Buy Order

Placing a buy order involves choosing the type of order you want to execute. Market orders buy the stock at the current market price, while limit orders buy the stock only at a specified price or better. Enter the number of shares you wish to purchase and review the order details before submitting. Your broker will then execute the order based on your instructions.

Step 5: Confirm and Monitor

After placing your buy order, confirm that it has been executed by checking your brokerage account. Monitoring your investment is essential to ensure it aligns with your financial goals. Regularly review the performance of your shares, stay informed about Berkshire Hathaway’s business activities, and consider adjusting your investment strategy as needed.

This structured approach ensures that you are well-prepared to invest in Berkshire Hathaway Inc. shares, helping you make informed decisions and achieve your financial objectives.

Where to Trade Berkshire Hathaway Inc. Shares

Best for Beginners - Etoro

- 5,000+ Tradable assets

- Beginner friendly platform

- Copy trading feature

Your capital is at risk.

Best for Intermediates - Saxo

- 71,000 Trading instruments

- Advanced tools, research & expert tips

- Fees lowered in 2024

Your capital is at risk.

eToro is an excellent choice for beginner investors due to its intuitive interface and social trading features. It allows users to follow and copy the trades of experienced investors, making it easier to learn the ropes. eToro offers commission-free investing on stocks and ETFs, which can be attractive for new investors looking to minimize costs. Additionally, it provides a demo account to practice trading without risking real money.

Saxo is well-suited for intermediate traders who need advanced tools and access to a wide range of markets. Saxo offers a comprehensive trading platform with in-depth research, real-time data, and a broad selection of investment options. The platform provides competitive pricing but comes with higher fees compared to beginner-focused platforms. Saxo’s educational resources and webinars are valuable for traders looking to enhance their skills.

AvaTrade

- Diverse Trading Options

- Educational Resources

Capital at risk.

Trading 212

- Commission-Free Trading

- User-Friendly Interface

Capital at risk.

What is the Cheapest Way to Buy Berkshire Hathaway Inc. Shares?

The cheapest way to buy Berkshire Hathaway Inc. shares is through commission-free platforms such as eToro and Trading 212. These platforms eliminate trading commissions, reducing overall costs. To minimize fees further, avoid frequent trading, and use limit orders to get the best price. Additionally, consider brokers that offer lower currency conversion fees if buying US stocks from the UK.

Pros and Cons of Investing in Super Micro Computer, Inc (SMCI) Shares

Pros

- Diversified portfolio across industries like insurance, utilities, and consumer goods, reducing risk.

- Led by Warren Buffett, a highly respected and successful investor with a strong track record.

- Strong balance sheet and significant cash reserves, providing stability and growth potential.

Cons

- High stock price of BRK.A shares, which can be a barrier for small investors.

- BRK.B shares are more affordable but still expensive for some investors.

- No dividend payments, relying solely on capital appreciation for returns.

- Performance heavily influenced by Warren Buffett's leadership, raising succession planning concerns.

How to Sell Berkshire Hathaway Inc. Shares

Selling Berkshire Hathaway shares involves a few straightforward steps:

Log into Your Brokerage Account: Access your brokerage account using your login credentials.

Navigate to Your Portfolio:Find and click on the portfolio section to view your holdings.

Select the BRK Shares to Sell: Locate your Berkshire Hathaway shares (BRK.A or BRK.B) and choose the option to sell.

Choose the Type of Order: Decide between a market order (sell at the current price) or a limit order (sell at a specific price).

Review and Confirm the Order: Carefully review the details of your order, including the number of shares and the type of order, then confirm the sale.

How to Invest in BRK via a Fund

Investing in Berkshire Hathaway via a mutual fund or ETF can be a smart way to gain exposure without buying individual shares. Mutual funds and ETFs offer diversification, professional management, and lower costs. These funds typically hold a broad range of stocks, including BRK, spreading risk across multiple assets. Indirect investment also allows smaller investors to benefit from BRK’s performance without needing significant capital.

Which Funds Contain BRK Stock?

Several funds include Berkshire Hathaway in their portfolios. For example, the Vanguard Total Stock Market ETF (VTI) and the SPDR S&P 500 ETF (SPY) both hold BRK shares. Additionally, the Fidelity Contrafund (FCNTX) includes Berkshire Hathaway as part of its diversified portfolio. Investing in these funds provides indirect exposure to BRK, along with other high-quality stocks.

Is Berkshire Hathaway Inc. Over-Valued?

Determining whether Berkshire Hathaway Inc. is over-valued requires an analysis of its current valuation metrics. As of now, Berkshire Hathaway trades at a price-to-earnings (P/E) ratio that is relatively higher compared to the historical average, indicating potential overvaluation. However, the company’s substantial cash reserves and diversified business model can justify a higher valuation. Financial experts suggest that while the stock may appear expensive, its consistent performance and strong leadership under Warren Buffett add intrinsic value. Analysts often emphasize looking at the company’s book value per share and operating earnings, which show steady growth, suggesting that the stock may be fairly valued despite high market prices.

Risks of Buying Stock

Investing in Berkshire Hathaway shares carries certain risks. Market volatility can impact the stock price significantly, especially in uncertain economic times. Additionally, the company’s performance is heavily reliant on Warren Buffett’s leadership and investment decisions, raising concerns about future management succession. There is also the risk of sector-specific downturns affecting Berkshire Hathaway’s diversified portfolio. Furthermore, the absence of dividend payments means investors must rely solely on capital appreciation for returns, which can be less predictable.

Important Note: Always refer to the latest information and specific instructions directly from the relevant platform. These platforms might update their processes or requirements over time.

Conclusion

Investing in Berkshire Hathaway Inc. shares offers potential for solid long-term returns due to the company’s diversified portfolio and strong leadership. However, it’s essential to consider the risks, including market volatility and succession concerns. For both beginners and experienced investors, thorough research and careful consideration of investment goals are crucial when deciding to invest in BRK. Diversifying your investments and monitoring market trends can help mitigate some of these risks.

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

FAQs

Berkshire Hathaway has two ticker symbols: BRK.A for its Class A shares and BRK.B for its Class B shares. BRK.B shares are more affordable for individual investors.

Yes, UK investors can buy Berkshire Hathaway shares through various online brokers, including eToro, IG, and Trading 212. Ensure the broker is FCA-regulated.

No, Berkshire Hathaway does not pay dividends. Instead, it reinvests its profits into the business, aiming for capital appreciation and long-term growth.

BRK.A shares are significantly more expensive and typically held by institutions, while BRK.B shares are more affordable and have a lower price point, suitable for individual investors.

Berkshire Hathaway can be a good investment due to its diversified portfolio and strong leadership under Warren Buffett. However, it does not pay dividends, and its performance depends on Buffett’s management.

Gain Access to Our #1 Recommended Investment Platform in the UK

Your capital is at risk.

References

Berkshire Hathaway Inc. – Official Website

Yahoo Finance – Berkshire Hathaway Inc. (BRK.A and BRK.B) Stock Prices and Financial Information