Quick Answer: To Buy CWB.TO Shares You Will Need To:

- Open an account with a UK-regulated stockbroker like eToro.

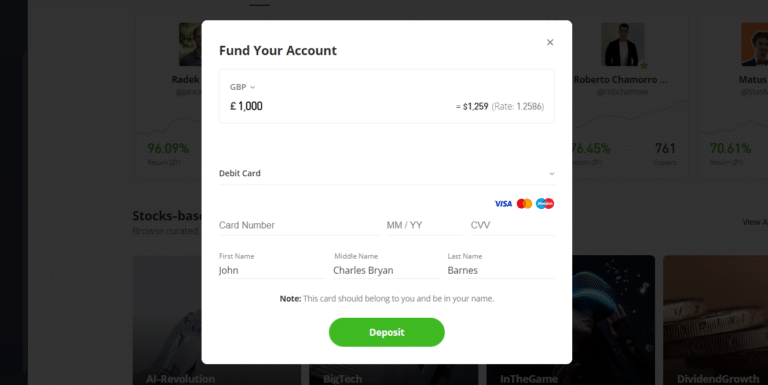

- Deposit funds into your brokerage account.

- Search for Canadian Western Bank shares using the ticker symbol CWB.TO.

- Place a buy order for the desired number of shares.

- Confirm trade and monitor your investment.

Introduction

Buying shares in Canadian Western Bank (CWB.TO) can be a profitable investment strategy, offering potential growth and dividends. Whether you are a novice investor or a seasoned trader, understanding the process and knowing the right platforms to use is crucial. This guide provides a comprehensive overview of how to purchase CWB.TO shares, including detailed steps, recommended trading platforms, and criteria for selecting the best brokerage for your needs.

How to Buy Shares in Canadian Western Bank

1 - Choose a Brokerage Account

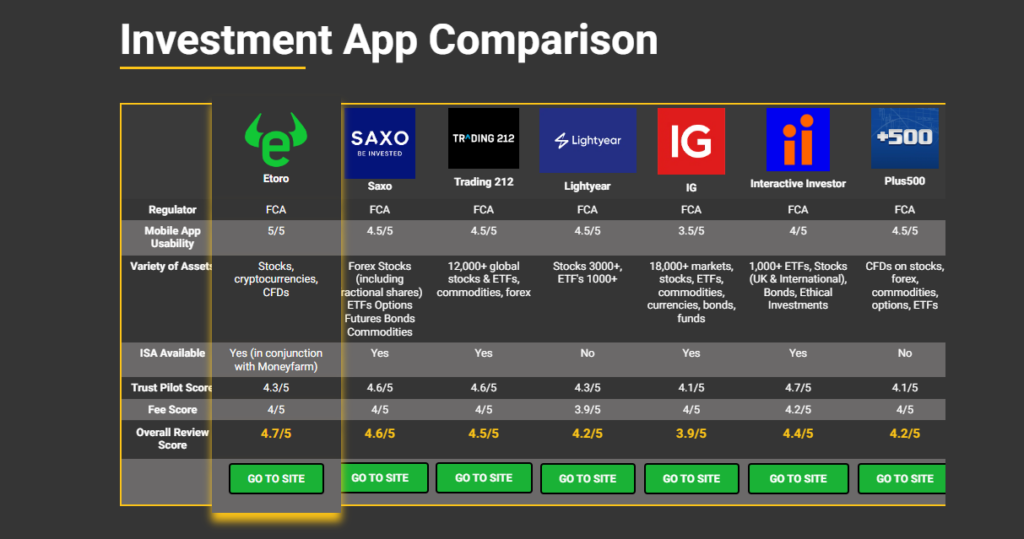

Begin by selecting a brokerage account that supports trading on the Toronto Stock Exchange (TSX). Major platforms like and Saxo and Trading 212 are popular choices for trading Canadian stocks. Consider factors such as fees, user interface, and additional features when making your selection.

3 - Search for Ticker Symbol

Log into your brokerage account and use the search function to find Canadian Western Bank shares, denoted by the ticker symbol CWB.TO. Verify the stock details, including the current price and market data.

4 - Place Your Order

Decide how many shares of Canadian Western Bank you wish to purchase. You will need to choose between a market order, which buys shares at the current price, or a limit order, which buys shares only at a specific price or better. Review your order details carefully before placing the trade.

5 - Confirm and Moniter

After placing your order, confirm that it has been executed. Keep an eye on your investment by regularly monitoring the stock’s performance and any news related to Canadian Western Bank. Set up alerts if your platform offers this feature to stay informed about significant price movements.

Where to Trade Canadian Western Bank Shares

Best for Beginners - Etoro

- 5,000+ Tradable assets

- Beginner friendly platform

- Copy trading feature

Your capital is at risk.

Best for Intermediates - Saxo

- 71,000 Trading instruments

- Advanced tools, research & expert tips

- Fees lowered in 2024

Your capital is at risk.

AvaTrade

- Diverse Trading Options

- Educational Resources

Capital at risk.

Trading 212

- Commission-Free Trading

- User-Friendly Interface

Capital at risk.

How we choose our Platforms

To ensure you have the best experience trading McDonald’s shares, we evaluated platforms based on several key criteria:

User Experience: Platforms should be intuitive and easy to navigate, catering to both beginners and experienced traders.

Fees and Commissions: Competitive pricing structures to maximize your returns.

Research and Tools: Access to comprehensive research tools, market analysis, and educational resources.

Security and Regulation: Robust security measures and regulation by reputable financial authorities to protect your investments.

Customer Support: Reliable and responsive customer service to assist you with any issues or questions.

What is the Cheapest Way to Buy Canadian Western Bank Shares?

To buy Canadian Western Bank shares cheaply, use commission-free platforms like eToro and Trading 212. These platforms eliminate trading fees, making investing more affordable and accessible. Both offer user-friendly interfaces, ideal for beginners and experienced traders alike.

How to Sell Canadian Western Bank Shares

- Log into Your Brokerage Account: Start by logging into the brokerage account where your Canadian Western Bank shares are held.

- Access Your Portfolio: Navigate to the section of your account that shows your holdings. Locate your Canadian Western Bank shares.

- Initiate a Sell Order: Select the shares you want to sell. Click on the option to sell these shares, which will prompt an order form.

- Choose the Order Type: Decide between a market order (sells at the current market price) or a limit order (sells at a specified price). A market order ensures immediate execution, while a limit order gives you control over the sale price.

- Specify the Quantity: Enter the number of shares you wish to sell. Ensure this matches your investment strategy and financial goals.

- Review and Confirm: Double-check all details of your order, including the order type, quantity, and sale price. Confirm the transaction to execute the sale.

- Monitor the Execution: Once confirmed, monitor the order status until it is executed. This could be immediate or take some time, depending on the order type and market conditions.

- Check Proceeds: After the sale, verify that the proceeds have been credited to your account. Take note of any fees or commissions that may have been deducted.

Is it a Good Time to Buy Canadian Western Bank Stock?

Assessing whether it is a good time to buy Canadian Western Bank stock involves looking at current market conditions. Factors such as interest rate trends, economic outlook, and the bank’s recent financial performance play crucial roles. As of now, evaluating recent earnings reports, dividend yields, and market sentiment can provide insight. Consulting financial news and expert analysis will further help in making an informed decision.

Risks of Buying Stock

Investing in stocks comes with inherent risks. Stock prices can fluctuate due to market volatility, economic changes, and company-specific events, potentially leading to financial loss. Understanding your time horizon is critical; short-term investments may experience more volatility, while long-term investments can often ride out market fluctuations. Diversification and thorough research are key strategies to mitigate these risks.

CWB.TO Technical Analysis

Conducting technical analysis on CWB.TO involves examining historical price and volume data to forecast future price movements. Tools such as moving averages, Relative Strength Index (RSI), and MACD (Moving Average Convergence Divergence) are commonly used. Analyzing these indicators helps identify trends, support and resistance levels, and potential buy or sell signals.

Share Price Volatility

The share price of Canadian Western Bank has historically shown varying levels of volatility. High volatility can present both opportunities and risks, offering chances for significant gains or losses. Understanding historical volatility helps investors set realistic expectations and manage their investment strategy accordingly.

Is Canadian Western Bank Under- or Over-valued?

To determine if Canadian Western Bank is under- or over-valued, examine key valuation metrics such as the Price-to-Earnings (P/E) ratio, Price-to-Book (P/B) ratio, and Dividend Yield. Comparing these metrics with industry averages and historical data provides insight into the stock’s valuation. Additionally, consider the bank’s earnings growth, financial health, and overall market conditions in your analysis.

How Do You Monitor Your Investment in Canadian Western Bank (CWB.TO) Shares?

Monitoring your investment in Canadian Western Bank shares involves regular review of market performance and financial news. Utilize portfolio tracking tools like Yahoo Finance, Google Finance, or your brokerage’s built-in features to stay updated on price changes and news. Set up alerts for significant price movements and corporate announcements. Regularly review quarterly earnings reports, dividend updates, and industry news to assess the health and performance of your investment. Using financial analysis tools, such as stock screeners and market analytics, can help you make informed decisions based on real-time data.

Important Note: Always refer to the latest information and specific instructions directly from the relevant platform. These platforms might update their processes or requirements over time.

Conclusion

Investing in Canadian Western Bank (CWB.TO) shares can be a strategic move for building your portfolio. By understanding the buying process, utilizing cost-effective trading platforms, and regularly monitoring your investment, you can make informed decisions. Stay informed about market conditions and the bank’s performance to optimize your investment strategy. Whether you’re a novice or an experienced investor, these steps will guide you in managing your CWB.TO shares effectively. Start today to take advantage of potential growth and dividends from Canadian Western Bank.

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

FAQs

Platforms like eToro and Trading 212 offer commission-free trading.

Economic conditions, interest rates, and the bank’s financial performance.

Yes, many brokers offer a Dividend Reinvestment Plan (DRIP).

Analysts rate Canadian Western Bank as a moderate buy with a twelve-month price target averaging C$33.15, suggesting potential upside

The all-time high price for Canadian Western Bank (CWB.TO) is C$44.00, reached in the past year.

The dividend growth rate for Canadian Western Bank is approximately 3.2%, with a current dividend yield of around 5.62%

Gain Access to Our #1 Recommended Investment Platform in the UK

Your capital is at risk.

References

MarketBeat. “Canadian Western Bank (CWB) Stock Price, News & Analysis.” Accessed June 12, 2024. Available at: MarketBeat.

Simply Wall St. “Canadian Western Bank (TSX) – Stock Price, News & Analysis.” Accessed June 12, 2024. Available at: Simply Wall St.

Investing.com. “Canadian Western Bank Stock Price Today | TSX CWB.” Accessed June 12, 2024. Available at: Investing.com Canada.