Thomas Drury

Co-Founder

Seasoned finance professional with 10+ years' experience. Chartered status holder. Proficient in CFDs, ISAs, and crypto investing. Passionate about helping others achieve financial goals.

Twitter ProfileAuthor Bio

Dom Farnell

Co-Founder

Dom, a Co-Founder at TIC, is an avid investor and experienced blogger who specialises in financial markets and wealth management. He strives to help people make smart investment decisions through clear and engaging content.

Twitter ProfileAuthor Bio

Fact Checked

How we test

At The Investors Centre, we pride ourselves on our rigorous fact-checking process. To delve deeper into our meticulous testing procedures and discover how we ensure accuracy and reliability, visit our dedicated page on how we test.

Risk Warning

Please bear in mind that trading involves the risk of capital loss. 51% to 84% of retail investor accounts lose money when trading CFDs with the providers below. You should consider whether you can afford to take the high risk of losing your money.

Last Updated 02/01/2025

Quick Answer: To Buy Google Shares You'll Need To:

- Open an account with a UK-regulated stockbroker.

- Deposit funds into your brokerage account.

- Search for Google shares using the ticker symbol GOOG.

- Place a buy order for the desired number of shares.

- Confirm and monitor your investment.

Investing in Google, now under Alphabet Inc., is more than just buying stocks—it’s about backing a company that continues to shape the digital world. My journey into investing in Google began years ago, drawn by its dominance in search and its rapid expansion into AI, cloud computing, and consumer electronics.

In 2025, Google remains a leader in technological advancements, maintaining its strong market presence and driving innovation. Its stock performance reflects this, showing resilience and growth even in volatile markets. Last year, Alphabet demonstrated robust financial health, reinforcing its appeal for investors seeking stability and long-term potential in tech.

Investing in Google has taught me the value of aligning with companies whose vision and innovation resonate personally. It’s not just about financial gains but also supporting a company that continues to push technological boundaries in an increasingly interconnected world.

Step 1: Select a Broker

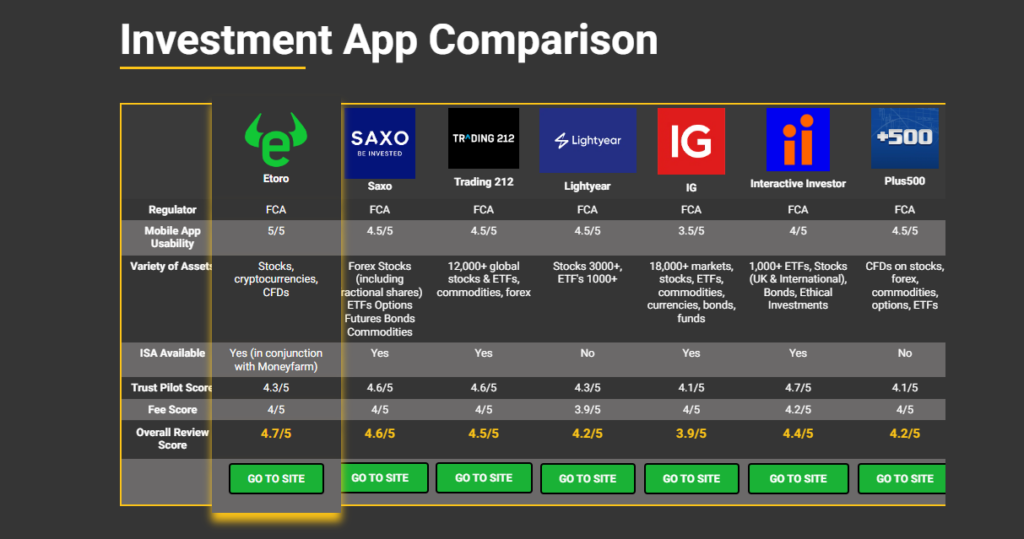

When selecting a trading platform from the UK to buy Google shares, consider factors like user-friendliness, fees, and access to U.S. stocks. Platforms such as eToro are top picks for UK investors.

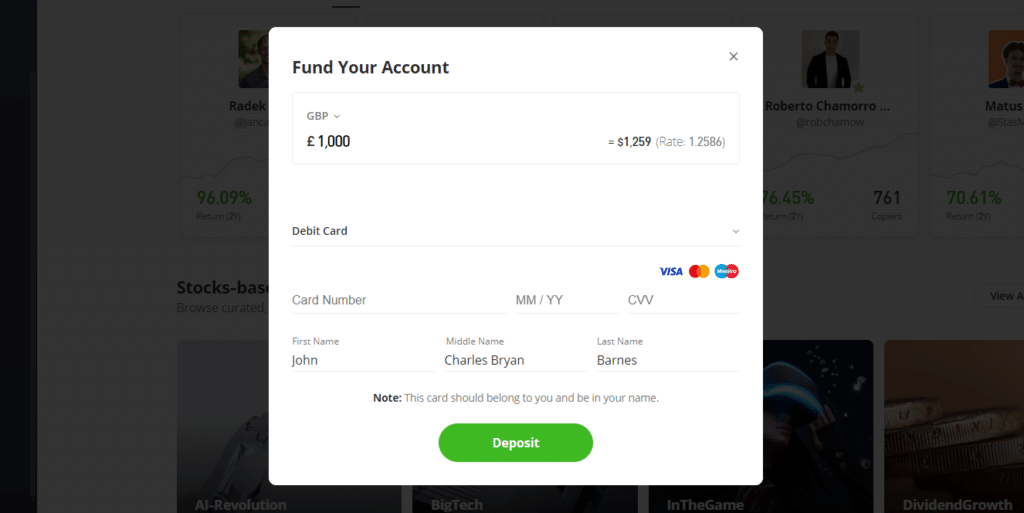

They offer intuitive interfaces that simplify the trading process, competitive fees, and direct access to NASDAQ where Google shares are listed. These platforms also support fractional shares, allowing you to invest in Google regardless of the stock price. I chose eToro based on its low fees and comprehensive educational resources, which are invaluable for both novice and experienced investors.

Step 2: Register and Verify Your Account

Creating an account on your chosen investment platform typically involves providing personal details such as your name, address, and National Insurance number.

Most platforms will require a form of photo ID (passport or driver’s license) and a recent utility bill to verify your identity and address. The verification process can take anywhere from a few minutes to several days.

From my experience, ensuring all your documents are up-to-date and clearly visible can speed up this process significantly, making it smoother and less cumbersome.

Step 3: Purchase Shares

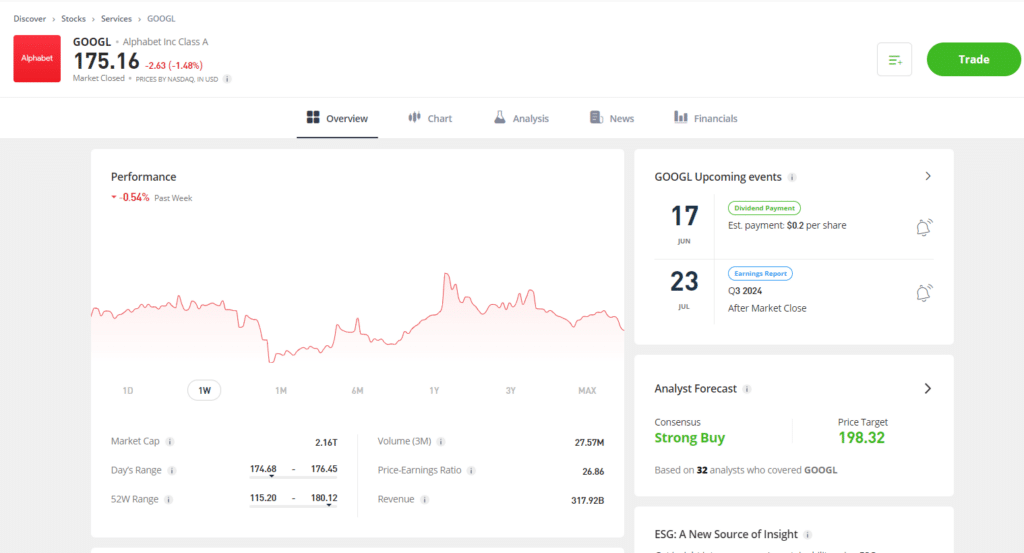

Once your account is funded and all paperwork is in order, purchasing Google shares is straightforward. Simply log in to your platform, search for Alphabet Inc. using the ticker GOOGL or GOOG, and you’ll see the current price per share.

Enter the amount of money you wish to invest or the number of shares you want to buy.

Review your order to ensure everything is correct, then confirm the purchase. Most platforms provide a real-time confirmation of your transaction. Having bought shares both as full and fractional units, I appreciate the flexibility modern platforms offer, allowing investors to engage with the market regardless of their budget size.

Step 4: Monitor Your Shares

After purchasing your Google shares, it’s crucial to keep an eye on your investment. Monitoring your shares allows you to understand how your investment performs over time and react accordingly to any market changes. Here are some tips for effective monitoring:

- Use Alerts: Set up alerts in your trading platform to notify you of significant price changes, earnings announcements, or other relevant news that could impact your investment.

- Regular Reviews: Schedule regular intervals to review the performance of your shares. This could be monthly, quarterly, or annually, depending on your investment strategy.

- Stay Informed: Keep up with news about Google and the tech industry as a whole. Changes in regulation, technology breakthroughs, and economic shifts can all affect your investment.

- Performance Metrics: Utilize tools available on your trading platform to analyze the performance metrics of your shares, such as growth trends, volume changes, and comparative performance against industry benchmarks.

By staying engaged with your investment, you can make more informed decisions about when to buy more shares, hold onto your current shares, or sell, based on your financial goals and market conditions.

Pros and Cons of Investing in Alphabet

Pros of Investing in Alphabet

Diversified Business Model:

- Alphabet has a wide range of successful products and services beyond its core Google search business, including YouTube, Android, and Google Cloud. This diversification helps mitigate risks associated with dependence on a single revenue source.

Strong Financial Performance:

- Alphabet consistently demonstrates strong financial health with impressive revenue growth, high profit margins, and robust cash flow. This financial stability makes it a potentially safer investment compared to less established companies.

Innovation Leadership:

- The company is a leader in innovation, particularly in high-growth areas like artificial intelligence, autonomous vehicles (Waymo), and health technology. Its continuous investment in R&D positions it well for future growth.

Dominance in Digital Advertising:

- Google remains the leader in online advertising, commanding a significant share of the market. This dominance provides a steady flow, and often growth, of ad revenue.

Strong Brand and Market Position:

- Alphabet’s Google is one of the most recognized brands globally, and its services are integral to internet infrastructure. This strong market position offers a competitive advantage and customer loyalty.

Cons of Investing in Alphabet

Regulatory Risks:

- Alphabet faces significant regulatory scrutiny in the U.S. and abroad, particularly concerning antitrust issues and data privacy concerns. Increased regulation or legal actions could impact its operations and profitability.

Market Volatility:

- As a major player in the tech industry, Alphabet’s stock is susceptible to market fluctuations that affect the tech sector. Issues such as economic downturns, technology shifts, or geopolitical events can cause volatility in its stock price.

Competition:

- While Alphabet is a leader in many areas, it faces intense competition from other tech giants like Amazon, Microsoft, and emerging players in AI and cloud computing. This competition could erode Alphabet’s market share and affect its growth.

Dependence on Advertising Revenue:

- Despite its diversification, a significant portion of Alphabet’s income still comes from advertising, making it sensitive to shifts in advertising spend, which can be cyclical and influenced by economic conditions.

Complexity of Operations:

- Alphabet’s large scale and scope of operations, spanning various technologies and markets, can make managing such a sprawling enterprise complex. This complexity could potentially lead to inefficiencies or challenges in responding to market or technological changes quickly.

Investors should weigh these factors based on their own investment goals, risk tolerance, and the broader market environment when considering an investment in Alphabet.

What Broker to Choose?

Best for Beginners - Etoro

- 5,000+ Tradable assets

- Beginner friendly platform

- Copy trading feature

Your capital is at risk.

Best for Experts- Saxo

- 71,000 Trading instruments

- Advanced tools, research & expert tips

- Fees lowered in 2024

Your capital is at risk.

How to Sell Google Shares

Selling Google shares, officially listed as Alphabet Inc. (GOOGL for Class A shares and GOOG for Class C shares), involves a process that’s similar to buying them but in reverse. Here’s a step-by-step guide on how to sell your Google shares through an online brokerage platform:

1. Log into Your Investment Account

- Access your trading platform where you initially purchased your Alphabet shares. This could be through a mobile app or website of your brokerage firm.

2. Review Your Portfolio

- Navigate to your portfolio section to view all the stocks you own. Locate your Google (Alphabet) shares. It’s a good practice to review the current performance and recent news related to Alphabet to decide if it’s the right time to sell.

3. Select the Number of Shares to Sell

- Decide how many shares you want to sell. You can choose to sell all your shares or only a portion. Consider your financial goals and the tax implications of selling your shares.

4. Choose the Type of Sell Order

- Market Order: Sells your shares immediately at the best available current market price.

- Limit Order: Sets a specific price at which you want to sell the shares. The order will only execute if the market price meets or exceeds your set price.

- Stop-Loss Order: Allows you to set a sell price below the current market price to mitigate potential losses if the stock price falls sharply.

5. Execute the Sell Order

- Once you’ve chosen the type of order, enter the details into the trading platform and submit your sell order. Confirm all details are correct before finalizing the transaction to avoid any mistakes.

6. Confirm the Transaction

- After submitting, the platform will usually provide a confirmation that your sell order has been placed. Monitor your account to ensure that the order executes according to your specifications. Depending on the type of order and market conditions, this may happen instantly or take some time.

7. Manage the Proceeds

- After the sale is complete, the proceeds from the sale will be credited to your brokerage account. You can choose to withdraw these funds, reinvest them into other stocks, or transfer them to a different account depending on your investment strategy.

8. Review Tax Implications

- Selling stocks can have capital gains tax implications. The amount of tax you owe depends on how long you held the shares and the gain you made. Consider consulting with a tax professional to understand how your stock sale impacts your tax situation.

By following these steps, you can effectively manage the sale of your Google shares. Keep in mind that market conditions can change rapidly, and it’s important to stay informed about the factors that might affect Alphabet’s stock price.

How to Invest in Google via a Fund

Step 1: Understand the Types of Funds

- Mutual Funds: These are professionally managed investment programs that pool money from many investors to purchase securities. Google shares might be included in a mutual fund focused on technology or large-cap stocks.

- Index Funds: These funds aim to replicate the performance of a specific index, such as the S&P 500, which includes Alphabet Inc. as one of its major components. Investing in an S&P 500 index fund means you indirectly invest in Google.

- Exchange-Traded Funds (ETFs): Similar to index funds, ETFs track an index, a commodity, bonds, or a basket of assets like an index fund but trade like a stock on an exchange. ETFs holding Google are numerous and vary in focus and strategy.

Step 2: Research Suitable Funds

- Fund Selection: Look for funds that have a significant allocation to Alphabet Inc. You can find this information in the fund’s holdings on most financial news websites, or the fund’s prospectus.

- Performance History: Check the past performance of the fund, although it’s not indicative of future results, it can provide insight into how the fund manages market fluctuations.

- Expense Ratio: Pay attention to the fees associated with the fund. Lower expense ratios can significantly affect net returns over time.

Step 3: Choose a Brokerage or Fund Platform

- Online Brokers: Platforms like Vanguard, Fidelity, Charles Schwab, and others offer a wide range of mutual funds, index funds, and ETFs. These platforms typically provide tools to help you research and choose the best fund for your investment goals.

- Direct Investment Through Fund Companies: Some funds can be bought directly from the companies that manage them without needing to go through a broker.

Step 4: Open and Fund Your Investment Account

- Account Setup: If you don’t already have an investment account, you’ll need to open one. Provide necessary personal information and complete any required financial disclosures.

- Depositing Funds: Transfer money into your investment account. The transfer can typically be done via electronic bank transfer, check, or wire transfer.

Step 5: Purchase Fund Shares

- Buying Shares: Once your account is funded, you can buy shares of the fund that invests in Google. Decide how much you want to invest, and execute the purchase.

- Recurring Investments: Consider setting up a plan to invest regularly. Many funds offer the option to buy shares automatically at set intervals.

Step 6: Monitor Your Investment

- Keep track of how your investment performs relative to your financial goals. Review your fund’s performance periodically to ensure it remains a suitable investment for your portfolio.

Step 7: Consider the Tax Implications

- Understand how your investments in funds will be taxed. Dividends and capital gains distributions from funds that include Google can impact your tax liability.

Investing in funds that include Google allows you to benefit from Alphabet’s growth while mitigating some of the risks of individual stock investment through diversification. Always consider your risk tolerance and investment horizon before making investment decisions.

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

FAQs

Class A shares (GOOGL) come with voting rights, typically one vote per share, which allows shareholders to vote on corporate matters. Class C shares (GOOG), on the other hand, have no voting rights. This distinction is important for investors who wish to have a say in company governance. Financially, both share types have the potential to perform similarly in terms of dividends and stock value growth.

To buy Google shares directly, you’ll need to open a brokerage account with a firm that has access to the NASDAQ Stock Market, where Google shares are traded. Once your account is set up and funded, you can purchase shares by searching for Google’s ticker symbols GOOGL (Class A) or GOOG (Class C) and placing a buy order.

Google, or Alphabet Inc., remains a strong investment for many due to its continued dominance in the tech industry, particularly in areas like digital advertising, artificial intelligence, and cloud computing. However, potential investors should consider their individual financial circumstances and investment goals, as well as the current market conditions, before investing.

Yes, you can invest in Google indirectly by purchasing shares of mutual funds or ETFs that include Alphabet Inc. as part of their portfolio. Many technology-focused funds or broad-market index funds like those tracking the S&P 500 include Google among their holdings.

Risks of investing in Google include regulatory challenges, particularly with respect to privacy and anti-trust concerns. Additionally, intense competition in the tech sector, especially in areas like AI and cloud computing, could impact Google’s business. Market volatility also affects stock prices, so potential investors should be prepared for fluctuations in their investment value.

Gain Access to Our #1 Recommended Investment Platform in the UK

Your capital is at risk.

Seasoned finance professional with 10+ years' experience. Chartered status holder. Proficient in CFDs, ISAs, and crypto investing. Passionate about helping others achieve financial goals.

Seasoned finance professional with 10+ years' experience. Chartered status holder. Proficient in CFDs, ISAs, and crypto investing. Passionate about helping others achieve financial goals.