Quick Answer: To Buy Microsoft Shares You'll Need To:

- Open an account with a UK-regulated stockbroker.

- Deposit funds into your brokerage account.

- Search for Microsoft shares using the ticker symbol MSFT.

- Place a buy order for the desired number of shares.

- Confirm and monitor your investment.

Step 1: Select a Broker

Your journey begins by choosing a broker. Whether you opt for an online platform or a traditional brokerage, it’s crucial to compare their fees, services, and user experience. From my own trading, I’ve found that selecting a broker that aligns with your investment style and support needs is fundamental.

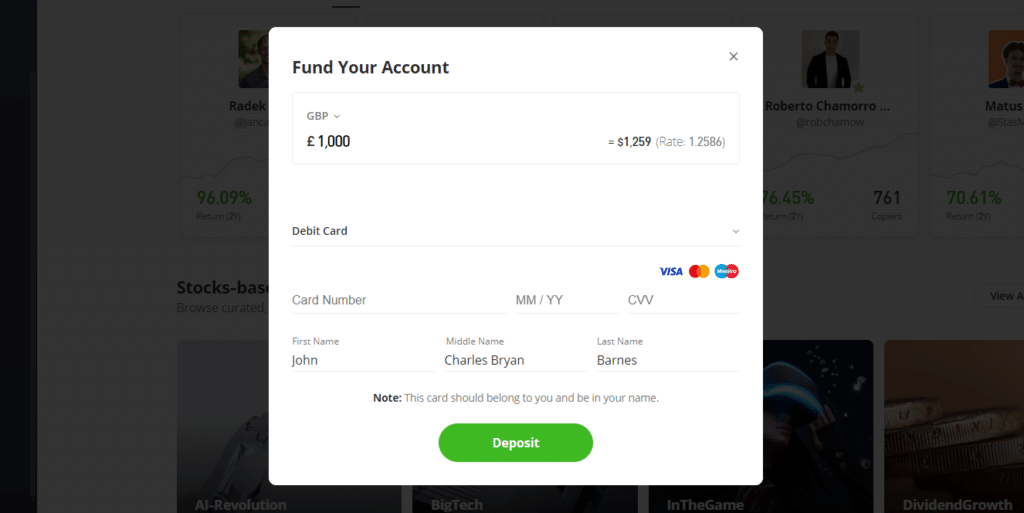

Step 2: Fund Your Account

Once you’ve chosen your broker, fund your account. Typically, you can use a bank transfer, or if quicker access is needed, a debit or credit card might also be an option. Remember, the time it takes to clear funds can impact your ability to trade swiftly.

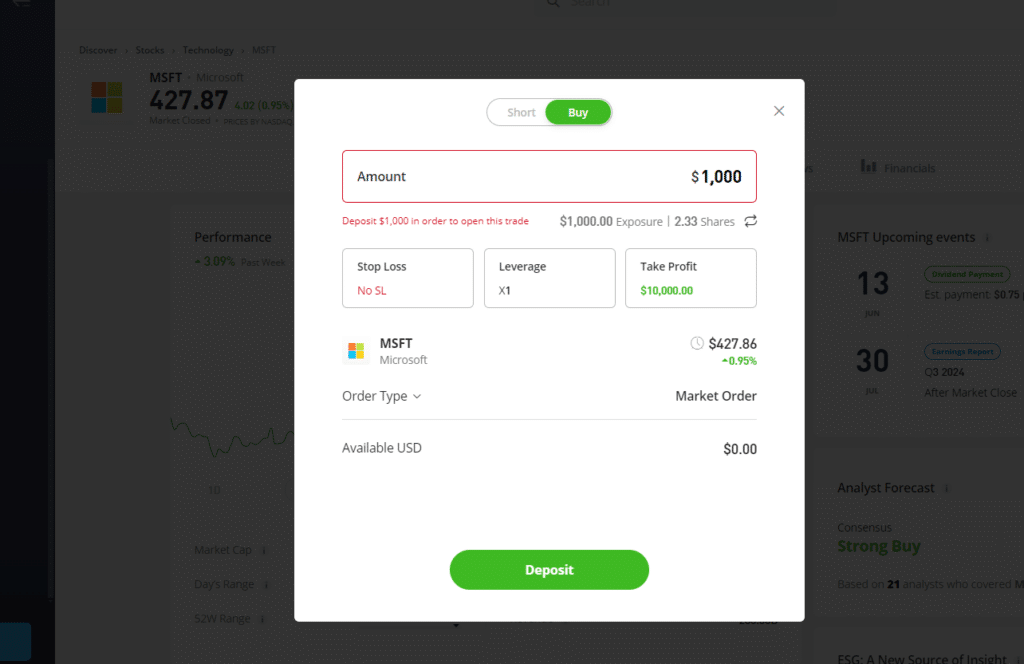

Step 3: Execute Your Purchase

With your account funded, you’re set to buy Microsoft shares. This can generally be done online, which I prefer for its speed and ease, or by phone. It’s important to understand the types of orders available and how broker fees could affect your investment.

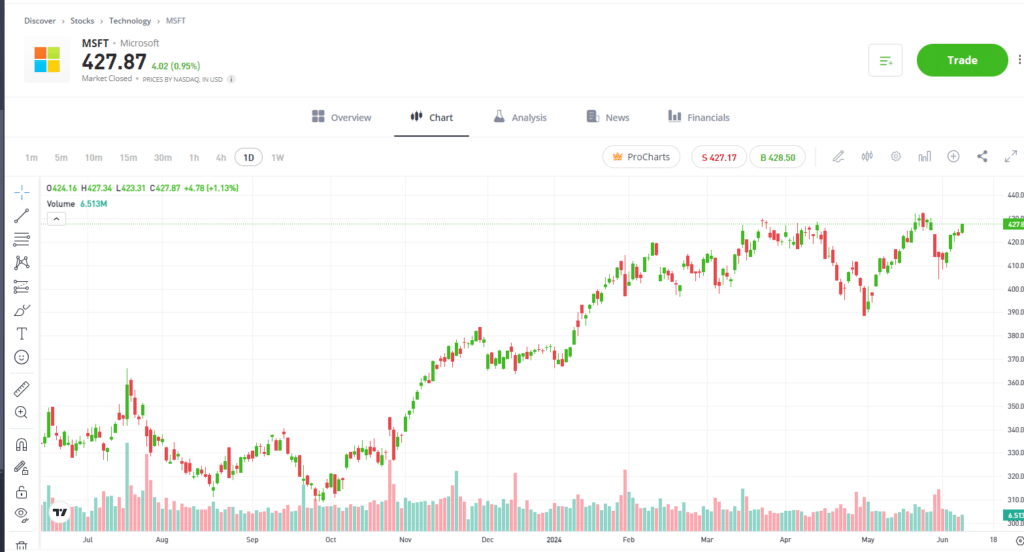

Step 4: Monitor Your Shares

After purchasing, actively monitoring your Microsoft shares is vital. Setting up alerts for price changes can be a proactive way to manage your investment. Keeping an eye on your portfolio not only helps in optimizing performance but also in aligning with your financial goals.

Pros and Cons of Investing in Microsoft Shares

Pros

- Participation in Financial Success: Investors get the chance to share in the profits and growth of Microsoft, a global leader in technology.

- Direct Investment in Innovation: By owning shares, investors directly support Microsoft’s advancements in cloud computing, software development, and artificial intelligence.

- Potential for Capital Growth: Microsoft’s strong market position can lead to significant capital appreciation over time.

- Dividend Payments: Microsoft has a history of paying dividends, providing a steady income stream to shareholders.

- Influence in Corporate Decisions: Shareholders have voting rights that allow them to influence important decisions at shareholder meetings.

Cons

- Market Volatility: Shares are subject to market fluctuations, which can be influenced by economic conditions, market trends, and technological disruptions.

- Industry Competition: Intense competition in the technology sector can impact Microsoft’s market share and profitability.

- Regulatory Risks: Changes in regulations affecting the technology industry can pose risks to Microsoft’s operations and financial performance.

- Investment Concentration: Investing heavily in a single company can expose investors to higher risk if the company faces downturns.

This balanced view provides a clearer understanding of what it means to invest in Microsoft, helping investors weigh their options based on their own risk tolerance and investment goals.

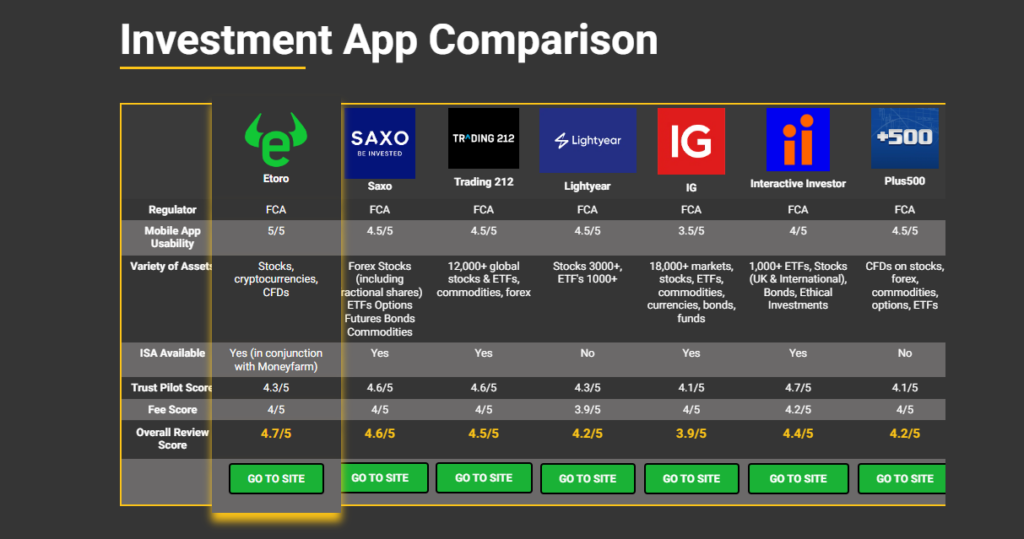

What Broker to Choose?

Best for Beginners - Etoro

- 5,000+ Tradable assets

- Beginner friendly platform

- Copy trading feature

Your capital is at risk.

Best for newcomers to stock trading, eToro provides a straightforward interface specifically advantageous for those starting with Microsoft shares. It features social trading capabilities, enabling users to observe and replicate the investments of seasoned Microsoft shareholders.

Best for Experts- Saxo

- 71,000 Trading instruments

- Advanced tools, research & expert tips

- Fees lowered in 2024

Your capital is at risk.

Perfect for seasoned investors, Saxo offers sophisticated analytical tools and extensive access to global markets, which is ideal for trading Microsoft shares. The platform’s competitive pricing also makes it a cost-effective choice for those looking to trade Microsoft shares frequently.

How to Sell Microsoft Shares

Selling shares of Microsoft is a straightforward process, typically involving the following steps:

- Review Your Investment: Before selling, assess the current market conditions and the performance of Microsoft shares to decide if it’s the right time to sell.

- Choose a Trading Platform: Use the trading platform where you hold your shares, whether it’s through an online brokerage or a traditional broker.

- Place a Sell Order: You can choose from various order types (such as market orders, limit orders, or stop-loss orders) to sell your shares based on your financial strategy.

- Execute the Sale: Confirm the transaction details and execute the sale of your shares. Monitor the transaction to ensure it completes as expected.

How to Invest in Microsoft via a Fund

Investing in funds that include Microsoft, such as mutual funds or exchange-traded funds (ETFs), is an excellent strategy for those looking to balance their portfolio. By incorporating Microsoft into a diversified fund, investors benefit from the stability and growth potential of a tech giant while mitigating the risks associated with single-stock investments. This method also offers the advantage of professional fund management, ensuring expert handling of your investments.

Steps to Begin Your Investment in Microsoft-Integrated Funds

1. Identify the Ideal Fund

Start by researching funds that feature Microsoft prominently in their portfolio. The right fund should not only include Microsoft but also align with your broader investment objectives, whether it’s growth, income, or stability.

2. Evaluate the Expenses

Before committing, it’s crucial to understand the fee structure of your chosen fund. Look into the management fees and performance fees, as these can vary widely and impact your returns. Lower fees generally mean more of your investment goes towards growing your wealth.

3. Acquisition of Fund Shares

Once you’ve settled on a fund and understood its cost implications, the next step is to purchase shares. This can typically be done through your preferred brokerage or directly from the fund’s management company. Setting up a regular investment plan can also be a savvy way to build your stake over time.

By following these steps, you can strategically invest in a fund that includes Microsoft, leveraging the company’s potential for growth while enjoying the benefits of diversification and professional management. This approach allows you to cultivate a robust and resilient investment portfolio.

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

FAQs

When buying Microsoft shares, you can use several types of orders:

- Market Order: Buys shares at the current market price.

- Limit Order: Allows you to set a specific price at which you want to buy the shares. The order executes only if the stock reaches that price or lower.

- Stop Order: Sets a purchase trigger if the share price hits or exceeds a certain level. This can be useful if you expect the stock to rise after passing a certain price.

Yes, non-U.S. investors can buy Microsoft shares through international brokers that offer access to U.S. stock markets. Ensure that the broker is regulated in your country and provides access to the NASDAQ, where Microsoft shares are traded.

Before investing, consider your investment goals and the risk associated with the technology sector. Research Microsoft’s financial health, recent performance, and future growth prospects. Also, keep an eye on market conditions and tech industry trends that could affect stock prices.

The minimum amount needed to buy Microsoft shares depends on the share price at the time of purchase and the minimum investment requirements set by your brokerage. Some brokers offer fractional shares, allowing you to start investing with a smaller amount of money by purchasing a portion of a Microsoft share.

Gain Access to Our #1 Recommended Investment Platform in the UK

Your capital is at risk.

Seasoned finance professional with 10+ years' experience. Chartered status holder. Proficient in CFDs, ISAs, and crypto investing. Passionate about helping others achieve financial goals.

Seasoned finance professional with 10+ years' experience. Chartered status holder. Proficient in CFDs, ISAs, and crypto investing. Passionate about helping others achieve financial goals.