How Do Premium Bonds Work?

Thomas Drury

Co-Founder

Seasoned finance professional with 10+ years' experience. Chartered status holder. Proficient in CFDs, ISAs, and crypto investing. Passionate about helping others achieve financial goals.

Twitter ProfileAuthor Bio

Dom Farnell

Co-Founder

Dom, a Co-Founder at TIC, is an avid investor and experienced blogger who specialises in financial markets and wealth management. He strives to help people make smart investment decisions through clear and engaging content.

Twitter ProfileAuthor Bio

Fact Checked

How we test

At The Investors Centre, we pride ourselves on our rigorous fact-checking process. To delve deeper into our meticulous testing procedures and discover how we ensure accuracy and reliability, visit our dedicated page on how we test.

Risk Warning

The information provided in this blog is for general informational purposes only and should not be considered financial advice. While we strive to ensure that the details, including fees and charges, are accurate and up-to-date, financial products and services may change without notice. Always conduct your own research or consult with a financial advisor to ensure that you fully understand the fees and risks involved.

Last Updated 06/01/2025

Quick Answer: How Do Premium Bonds Work?

Premium Bonds are a savings product where each £1 bond enters a monthly prize draw instead of earning interest. Bondholders have a chance to win tax-free prizes ranging from £25 to £1 million, with all investments backed by the UK government.

What Is Our Opinion on Premium Bonds as an Investing Tool?

In our opinion, Premium Bonds are a fun, secure option for those who enjoy the chance of winning tax-free prizes. However, they shouldn’t replace traditional investments, as returns are not guaranteed, and inflation can erode the value of your savings over time.

Featured Broker

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

Premium Bonds Overview Table

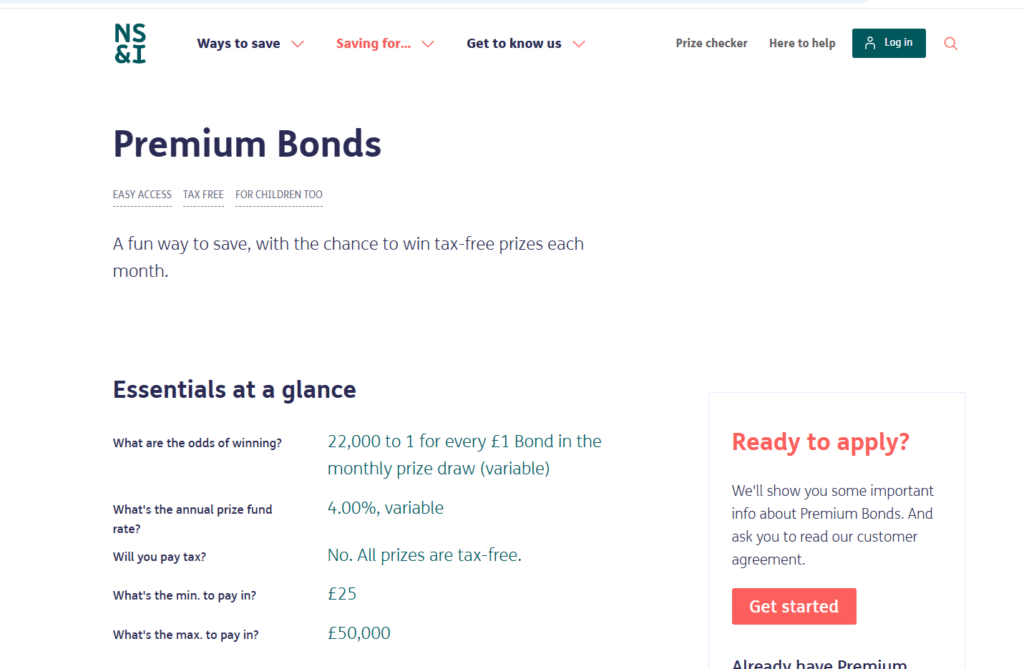

| Topic | Key Points |

|---|---|

| What Are Premium Bonds? | Investment product issued by NS&I, offering tax-free prizes instead of interest. |

| How Do Premium Bonds Work? | Each £1 bond enters a monthly draw. Prizes range from £25 to £1 million, with odds of 21,000 to 1 per bond. |

| Annual Prize Fund Rate | 4.40%, variable. Reflects the rate at which the prize fund is distributed among bondholders. |

| Tax Payable on Prizes? | No. All prizes are tax-free. |

| Minimum Investment | £25 |

| Maximum Investment | £50,000 |

| Who Should Consider Premium Bonds? | Suitable for those looking for secure savings with a chance to win tax-free prizes. Ideal for individuals with £25+ to invest and for children's savings. |

| Are Premium Bonds Safe and Secure? | Fully backed by the UK government, providing security beyond the FSCS protection limit. |

| Are Premium Bonds Worth It? | Potential returns are uncertain, with inflation potentially eroding savings' real value over time. |

| Inheritance of Premium Bonds | Probate required for holdings over £5,000. NS&I assists with the process to cash in or transfer bonds after a holder's death. |

What Are Premium Bonds?

Premium Bonds are a unique savings product offered by National Savings and Investments (NS&I). Instead of earning interest like traditional savings accounts, Premium Bond holders are entered into a monthly prize draw for a chance to win tax-free cash prizes ranging from £25 to £1 million. Each bond costs £1, with a minimum investment of £25 and a maximum holding of £50,000.

These bonds are fully backed by the UK government, meaning your capital is secure. Unlike traditional investments that offer a predictable return, Premium Bonds provide an opportunity for potential high returns through prizes, though there is no guarantee of income. The prize fund rate, currently at 4.40%, reflects the interest that would otherwise have been paid out, making Premium Bonds a fun yet speculative alternative to conventional savings products.

The concept is simple: you don’t earn interest on your investment, but instead, your bonds are entered into a monthly draw conducted by ERNIE, NS&I’s random number generator. This makes Premium Bonds an appealing option for those seeking a secure investment with the possibility of winning tax-free prizes.

How Do Premium Bonds Differ from Traditional Investments?

The primary difference between Premium Bonds and traditional investments is the way returns are generated. With Premium Bonds, returns are not based on interest rates or dividends but on a monthly prize draw. Every £1 bond has an equal chance of winning, regardless of how long it has been held.

This contrasts with traditional savings accounts or bonds, where interest is guaranteed, and the return is predictable. While Premium Bonds offer the excitement of potential wins, they lack the certainty of income, making them more suitable for those who can afford to take a risk on the possibility of tax-free rewards.

How Do Premium Bonds Work?

How to Buy Premium Bonds

Purchasing Premium Bonds is straightforward. The minimum investment is £25, and the maximum you can hold is £50,000. Each bond costs £1, so a £25 investment buys you 25 individual bond numbers, each with a chance of winning in the monthly prize draw. You can buy Premium Bonds online through the NS&I website, by phone, or by post.

Once your bonds are purchased, they need to be held for a full month before being eligible for the prize draw. You can buy Premium Bonds for yourself or as a gift for someone under the age of 16, making them a flexible savings option.

How the Monthly Prize Draw Works

Each month, the Premium Bonds prize draw is conducted by ERNIE (Electronic Random Number Indicator Equipment). ERNIE generates millions of random bond numbers, matching them against eligible bonds to determine the winners. Every bond number has an equal chance of being selected, and the prizes range from £25 to the top jackpot of £1 million.

The prize draw is entirely random, and winners are notified after the draw takes place. The number of prizes and the prize tiers can vary each month, with many smaller prizes and a few high-value awards, including two £1 million jackpots each month.

What are my Chances of Winning?

Each £1 bond gives the holder one unique bond number, with an equal chance of winning. The odds of winning a prize in the monthly draw are currently 21,000 to 1 for each bond. While every bond has a chance, the more bonds you hold, the more chances you have to win.

Are Premium Bonds Right for You?

Who Should Consider Premium Bonds?

Premium Bonds are a good fit for individuals who enjoy the excitement of a lottery-style savings product while wanting to keep their capital secure. They’re particularly appealing to people with £25 or more to invest who are attracted by the prospect of winning tax-free prizes. Premium Bonds are also a popular choice for parents and grandparents who want to buy a savings gift for children under 16.

However, Premium Bonds are not for those seeking regular income or guaranteed returns. Instead, they cater to those who are willing to trade predictable interest for the chance of winning significant tax-free prizes.

What are the Adavantages and Disadvantages of Premium Bonds?

- Tax-free prizes: Any winnings are entirely tax-free.

- Government-backed: Your investment is 100% secure, backed by the UK government.

- Flexible: You can cash in your bonds at any time without penalties.

- Cash Generating Investment

- No guaranteed returns: There is no guaranteed interest or regular income.

- Inflation risk: Over time, inflation may erode the value of your savings, especially if you don’t win significant prizes.

- Lower odds: With 21,000 to 1 odds, many investors may not see frequent returns.

How to Manage and Cash In Your Premium Bonds

How to Check Your Premium Bonds for Prizes

Checking whether you’ve won a prize with Premium Bonds is straightforward and can be done in several ways. NS&I offers an online prize checker on their website, where you can enter your bond numbers and see if you’ve won. There’s also a dedicated prize checker app available on both the Apple App Store and Google Play. For those who prefer voice assistants, you can ask Amazon Alexa to check for prizes using the Premium Bonds skill. NS&I also notifies winners directly, but these tools provide quicker access to results.

How to Cash In Premium Bonds

Cashing in your Premium Bonds is simple and can be done at any time without penalties. You can do this online if you’re registered with NS&I, or use the online form to cash in specific bonds without needing an account. Alternatively, you can complete a paper form and post it.

How Long Does It Take to Cash In Premium Bonds?

Once you’ve submitted your request to cash in your Premium Bonds, it typically takes up to three banking days for the funds to reach your bank account. If you choose to cash in after the next prize draw, you may experience a slight delay while the draw is completed.

Are Premium Bonds Safe and Secure?

Premium Bonds are considered one of the safest savings options in the UK because they are fully backed by HM Treasury. This means your capital is 100% secure, regardless of how much you invest. In contrast, traditional savings accounts with UK banks and building societies are typically protected by the Financial Services Compensation Scheme (FSCS), which covers up to £85,000 per person per institution. However, Premium Bonds provide security beyond this limit, offering peace of mind even for larger investments up to £50,000.

Tax-Free Prizes and Financial Security

All prizes won through Premium Bonds are entirely tax-free, ensuring you can enjoy your winnings without worrying about deductions. This tax efficiency, combined with government backing, makes Premium Bonds a secure option for those seeking financial peace of mind.

Are Premium Bonds Worth It?

Potential Returns vs. Inflation

While Premium Bonds offer the chance to win tax-free prizes, the likelihood of winning a significant amount is low. The current odds of winning a prize are 21,000 to 1 per bond, and many investors may only win smaller prizes. Over time, this can mean that the returns may not keep pace with inflation, especially if no large prizes are won. Inflation erodes the purchasing power of your savings, meaning that even if your capital remains secure, its real value may decline. This makes Premium Bonds less ideal for long-term wealth preservation compared to traditional savings accounts or investments that offer interest.

The Real Value of Premium Bond Prizes

The annual prize fund rate is currently 4.40%, but this doesn’t guarantee returns for every bondholder. Most people who invest in Premium Bonds will win only small amounts, if anything, resulting in an effective return that may be below inflation for many holders.

FAQs

What are Premium Bonds?

Premium Bonds are a government-backed investment product issued by NS&I. Instead of earning interest, bondholders are entered into monthly draws for tax-free prizes ranging from £25 to £1 million.

How do I buy Premium Bonds?

You can buy Premium Bonds online, over the phone, or by post with a minimum investment of £25. Premium Bonds can also be purchased for children under 16 as a gift.

How often are the prize draws for Premium Bonds?

Premium Bond prize draws are held monthly. Every bond number held for a full month is entered, and prizes range from £25 to £1 million, all tax-free.

Are Premium Bonds safe?

Yes, Premium Bonds are safe and fully backed by the UK government. Your investment is secure, but returns are not guaranteed due to the prize-based nature of the product.

Can I cash in Premium Bonds at any time?

Yes, you can cash in Premium Bonds at any time without penalties. The funds will typically be deposited into your account within three banking days.

Trade Smarter, not Harder

- Copy Trading

- Competetive Fee's

- Multi Asset Platforn

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

Award Winning Investment Platform

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.