Quick Answer: To Buy Super Micro Computer Inc Shares You Will Need To:

- Select a reputable broker that offers access to NASDAQ.

- Open and fund your brokerage account.

- Find SMCI’s ticker symbol on the trading platform.

- Place a buy order for the desired number of shares.

- Confirm and monitor.

Introduction

Investing in technology stocks can be an excellent way to diversify your portfolio and capitalize on the growth of the tech sector. Super Micro Computer, Inc (SMCI) is a prominent player in the server technology market, known for its high-performance and energy-efficient products.

Whether you’re a beginner or an experienced trader, buying SMCI shares in the UK involves a straightforward process. This guide will take you through each step, from selecting a broker to monitoring your investment, ensuring you have all the information needed to make an informed decision.

Step 1: Select a Broker

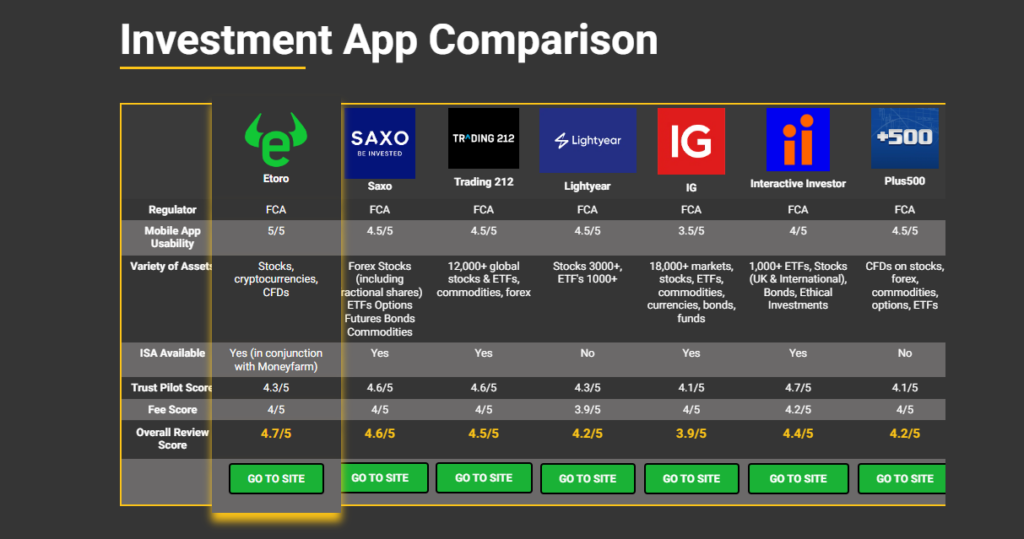

Choosing the right broker is crucial for your investment experience. When selecting a broker, consider the following factors:

- Access to NASDAQ: Ensure the broker provides access to US markets where SMCI is listed.

- Fees and Commissions: Compare the fee structures, including trading commissions, currency conversion fees, and account maintenance charges.

- User Interface: Opt for a platform that is user-friendly and provides advanced trading tools for both beginners and experienced traders.

- Regulation and Security: Verify that the broker is regulated by the Financial Conduct Authority (FCA) to ensure your investments are protected.

- Customer Support: Look for brokers with robust customer service options to assist with any issues or queries.

Popular brokers in the UK include eToro, known for its social trading features, Saxo for its comprehensive market access and low fees, and Hargreaves Lansdown for excellent customer service.

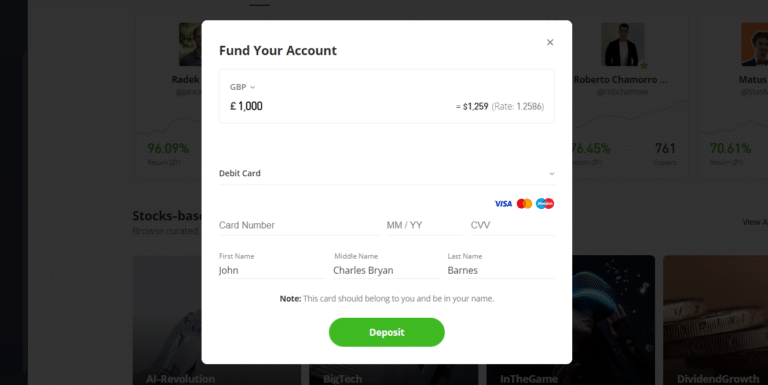

Step 2: Open and Fund Your Account

Once you have selected a broker, the next step is to fund your account. This involves:

- Opening the Account: Complete the registration process by providing personal details such as your name, address, and identification documents.

- Verification: Upload necessary documents for identity and address verification. This typically includes a passport or driver’s license and a utility bill or bank statement.

- Depositing Funds: Transfer money into your brokerage account using methods such as bank transfer, debit/credit card, or electronic payment services like PayPal. Be mindful of any fees associated with funding your account and the processing time for deposits.

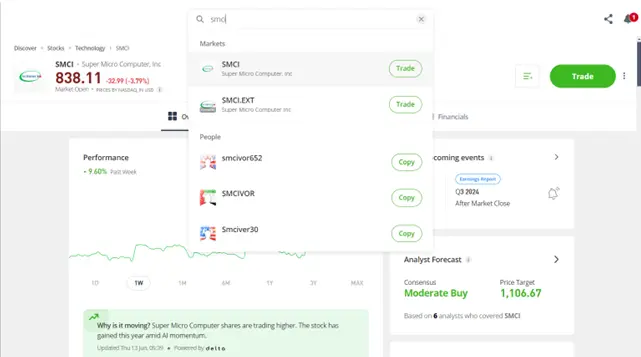

Step 3: Find Ticker

Finding the ticker symbol for Super Micro Computer, Inc. is simple:

- Search Function: Use the search bar on your broker’s trading platform to enter “Super Micro Computer” or “SMCI.”

- Check Details: Confirm that the ticker symbol “SMCI” corresponds to Super Micro Computer, Inc. listed on NASDAQ.

- Add to Watchlist: For easy access, add SMCI to your watchlist or favorites on the platform

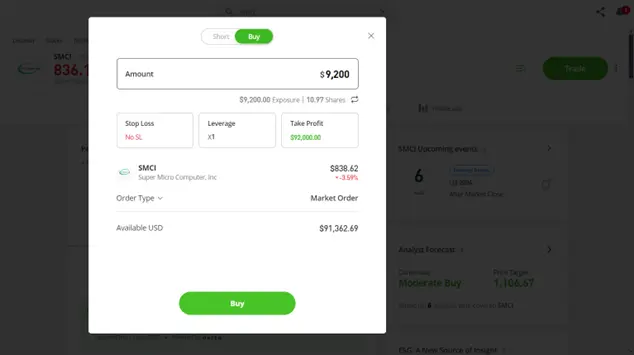

Step 4: Place Buy Order

Placing a buy order for SMCI shares involves a few key steps:

- Select SMCI: Navigate to SMCI’s page on your trading platform.

- Choose Order Type: Decide between a market order (buy immediately at the current price) or a limit order (buy at a specific price or better).

- Specify Quantity: Enter the number of shares you wish to purchase.

- Review Order: Double-check the order details, including the total cost and any applicable fees.

- Execute Order: Click the “Buy” button to execute the order. You will receive a confirmation once the purchase is complete.

Step 5: Confirm and Monitor

After purchasing SMCI shares, it’s important to confirm and monitor your investment:

- Confirmation: Check for an order confirmation from your broker, either via email or within the platform’s transaction history.

- Portfolio Review: Regularly review your portfolio to track the performance of your SMCI shares.

- Market News: Stay informed about Super Micro Computer, Inc. and the broader technology market by following news and analyst reports.

- Set Alerts: Utilize any alert features provided by your broker to notify you of significant price movements or news.

By following these steps, you can effectively buy and manage your investment in Super Micro Computer, Inc shares, leveraging the growth potential of this leading tech company.

Where to Trade Canadian Western Bank Shares

Best for Beginners - Etoro

- 5,000+ Tradable assets

- Beginner friendly platform

- Copy trading feature

Your capital is at risk.

Best for Intermediates - Saxo

- 71,000 Trading instruments

- Advanced tools, research & expert tips

- Fees lowered in 2024

Your capital is at risk.

eToro is an excellent choice for beginners looking to buy SMCI shares. It offers a user-friendly platform with a straightforward interface, making it easy to navigate and execute trades. One of eToro’s standout features is its social trading capability, allowing users to follow and copy the trades of experienced investors. This can be particularly beneficial for those new to investing, providing insights and learning opportunities. Additionally, eToro offers educational resources and a demo account to practice trading without financial risk.

Saxo is ideal for experienced traders seeking a comprehensive trading platform with advanced tools. Saxo offers access to a wide range of global markets, including NASDAQ, where SMCI is listed. It provides sophisticated trading tools, in-depth research, and analytics, which cater to the needs of seasoned investors. Saxo’s platform supports various order types and offers competitive pricing, making it suitable for those who require high functionality and lower trading costs. The broker also offers extensive educational content, although its primary appeal lies in its robust, professional-grade trading environment.

AvaTrade

- Diverse Trading Options

- Educational Resources

Capital at risk.

Trading 212

- Commission-Free Trading

- User-Friendly Interface

Capital at risk.

What is the Cheapest Way to Buy Super Micro Computer, Inc Shares?

The cheapest way to buy SMCI shares is through platforms like eToro, which offer commission-free trading. These platforms eliminate trading fees, making it cost-effective for investors to purchase shares without incurring additional costs. Always compare platform features and terms.

Pros and Cons of Investing in Super Micro Computer, Inc (SMCI) Shares

Pros

Investing in Super Micro Computer, Inc (SMCI) offers several advantages:

- Market Leadership: SMCI is a leading provider in the high-performance and energy-efficient server market, which positions it well for growth in sectors like cloud computing and big data.

- Innovation: The company consistently invests in research and development, ensuring it remains at the forefront of technological advancements and can offer cutting-edge solutions.

- Financial Performance: SMCI has demonstrated strong financial performance with increasing revenues and profitability, reflecting its operational efficiency and market demand.

- Diverse Customer Base: The company serves a wide range of industries, including data centers, enterprise IT, and scientific research, which reduces dependency on any single market segment.

Cons

However, there are also risks associated with investing in SMCI:

- Market Competition: The technology hardware sector is highly competitive, with major players like Dell and HP posing significant threats to SMCI’s market share.

- Economic Sensitivity: As a technology company, SMCI’s performance is closely tied to economic cycles. During economic downturns, spending on IT infrastructure may decrease, impacting revenue.

- Supply Chain Risks: SMCI relies on a complex global supply chain. Disruptions, such as those caused by geopolitical tensions or natural disasters, can affect production and delivery.

- Valuation Concerns: The stock may sometimes be overvalued due to market hype, leading to potential corrections. Investors need to assess if current prices reflect the company’s true value.

How to Sell Buy Super Micro Computer Inc Shares

Selling Super Micro Computer (SMCI) shares involves several straightforward steps:

- Log into Your Brokerage Account: Access your account on the broker’s platform where you hold your SMCI shares.

- Navigate to Your Portfolio: Go to the section of the platform that lists your holdings. Locate your SMCI shares.

- Select SMCI Shares: Click on the SMCI shares you wish to sell.

- Choose Order Type: Decide between a market order (sell immediately at the current market price) or a limit order (sell at a specific price or better). Market orders ensure immediate execution, while limit orders can help you achieve a better price if the market moves in your favor.

- Specify Quantity: Enter the number of shares you wish to sell.

- Review Order: Double-check the details of your order, including the total proceeds and any applicable fees.

- Execute Order: Click the “Sell” button to execute the order. You will receive a confirmation once the sale is complete.

- Confirm Transaction: Check for a confirmation from your broker, either via email or within your account’s transaction history, to ensure the sale has been processed.

- Withdraw Funds: If you wish to access the proceeds, transfer the funds from your brokerage account to your bank account.

How to Invest in SMCI via a Fund

Investing in SMCI through a fund is an alternative to buying individual shares directly. This approach offers diversification and professional management. Here’s how to do it:

- Choose the Right Fund: Look for mutual funds or exchange-traded funds (ETFs) that include SMCI in their holdings. Funds focused on technology, high-growth, or U.S. equity markets are likely to hold SMCI shares.

- Research Fund Performance: Examine the fund’s historical performance, fees, and management team. Check how often SMCI appears in the fund’s top holdings and its overall exposure to technology stocks.

- Open an Account: If you don’t already have one, open an account with a broker that offers access to the chosen fund.

- Fund Your Account: Transfer money into your brokerage account.

- Purchase Shares of the Fund: Navigate to the fund on your broker’s platform, enter the amount you wish to invest, and execute the purchase.

Investing via a fund provides exposure to SMCI while mitigating risk through diversification.

Which Funds Contain SMCI Stock?

Here are some funds that typically include Super Micro Computer, Inc (SMCI) in their holdings:

iShares Expanded Tech-Software Sector ETF (IGV): This ETF focuses on software and technology services companies, often including stocks like SMCI.

Invesco DWA Technology Momentum ETF (PTF): This ETF tracks the performance of technology stocks with strong momentum, and SMCI is a potential component due to its market performance.

First Trust NASDAQ Technology Dividend Index Fund (TDIV): This ETF includes technology companies listed on the NASDAQ that pay dividends, and SMCI might be part of its portfolio due to its technology focus and market presence.

Is Super Micro Computer Over-Valued?

To determine if SMCI is over-valued, consider key valuation metrics:

- Price-to-Earnings (P/E) Ratio: Compare SMCI’s P/E ratio with industry averages. A significantly higher P/E ratio may indicate over-valuation.

- Price-to-Sales (P/S) Ratio: Evaluate the P/S ratio relative to competitors.

- Earnings Growth: Analyze recent earnings reports and growth projections. Rapid growth can justify higher valuations, while stagnation might signal over-valuation.

- Market Sentiment: Monitor analyst ratings and investor sentiment.

Assessing these metrics helps determine if SMCI’s stock price aligns with its fundamental value.

Risks of Buying Stock

Investing in stocks involves inherent risks:

Market Volatility: Stock prices can fluctuate widely due to market conditions, economic changes, and geopolitical events. These fluctuations can lead to significant gains or losses.

Company-Specific Risks: Individual companies face risks such as poor management decisions, product failures, and regulatory changes, which can impact their stock prices.

Economic Cycles: Economic downturns can adversely affect stock prices, as companies may experience reduced revenue and profitability.

Time Horizon: Short-term investments are riskier due to market volatility. A long-term perspective can help mitigate some risks by allowing time for recovery and growth.

Understanding these risks is crucial for making informed investment decisions.

Important Note: Always refer to the latest information and specific instructions directly from the relevant platform. These platforms might update their processes or requirements over time.

Conclusion

Investing in Super Micro Computer, Inc (SMCI) shares involves a systematic process of selecting a broker, funding your account, placing buy orders, and monitoring your investment. Weighing the pros and cons, understanding market valuation, and recognizing investment risks are crucial for making informed decisions. Additionally, options like investing via funds and exploring other stocks such as Canadian Western Bank offer diversified opportunities. Whether you are a beginner or an experienced trader, this guide equips you with the knowledge to navigate the investment landscape effectively.

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

FAQs

The ticker symbol for Super Micro Computer, Inc is SMCI.

ou need a broker that provides access to the NASDAQ stock exchange. Like eToro or Saxo.

Fees vary by broker and can include trading commissions, currency conversion fees, and account maintenance charges.

Regularly review your portfolio, stay updated with market news, and set price alerts through your brokerage platform.

Like all stocks, investing in SMCI involves risks such as market volatility and economic changes. Diversifying your portfolio can help manage these risks.

Gain Access to Our #1 Recommended Investment Platform in the UK

Your capital is at risk.

References

Yahoo Finance – Provides comprehensive financial data, including stock prices, company financials, and analyst ratings for SMCI.