Best Day Trading Platforms in the UK for 2025

Thomas Drury

Co-Founder

Seasoned finance professional with 10+ years' experience. Chartered status holder. Proficient in CFDs, ISAs, and crypto investing. Passionate about helping others achieve financial goals.

Twitter ProfileAuthor Bio

Dom Farnell

Co-Founder

Dom, a Co-Founder at TIC, is an avid investor and experienced blogger who specialises in financial markets and wealth management. He strives to help people make smart investment decisions through clear and engaging content.

Twitter ProfileAuthor Bio

Fact Checked

How we test

At The Investors Centre, we pride ourselves on our rigorous fact-checking process. To delve deeper into our meticulous testing procedures and discover how we ensure accuracy and reliability, visit our dedicated page on how we test.

Risk Warning

Please bear in mind that trading involves the risk of capital loss. 51% to 84% of retail investor accounts lose money when trading CFDs with the providers below. You should consider whether you can afford to take the high risk of losing your money.

Last Updated 16/04/2025

Explore our curated list of reputable, regulated brokers, each rigorously tested with real funds. All brokers are accessible to traders in the United Kingdom.

1

IG

Day Trading Score: 4.9/5

71% of Retail CFD Accounts Lose Money

SpreadEX

Day Trading Score: 4.8/5

81% of retail CFD accounts lose money.

XTB

Day Trading Score: 4.7/5

73% of Retail CFD Accounts Lose Money

4

eToro

Day Trading Score: 4.5/5

51% of retail CFD accounts lose money.

5

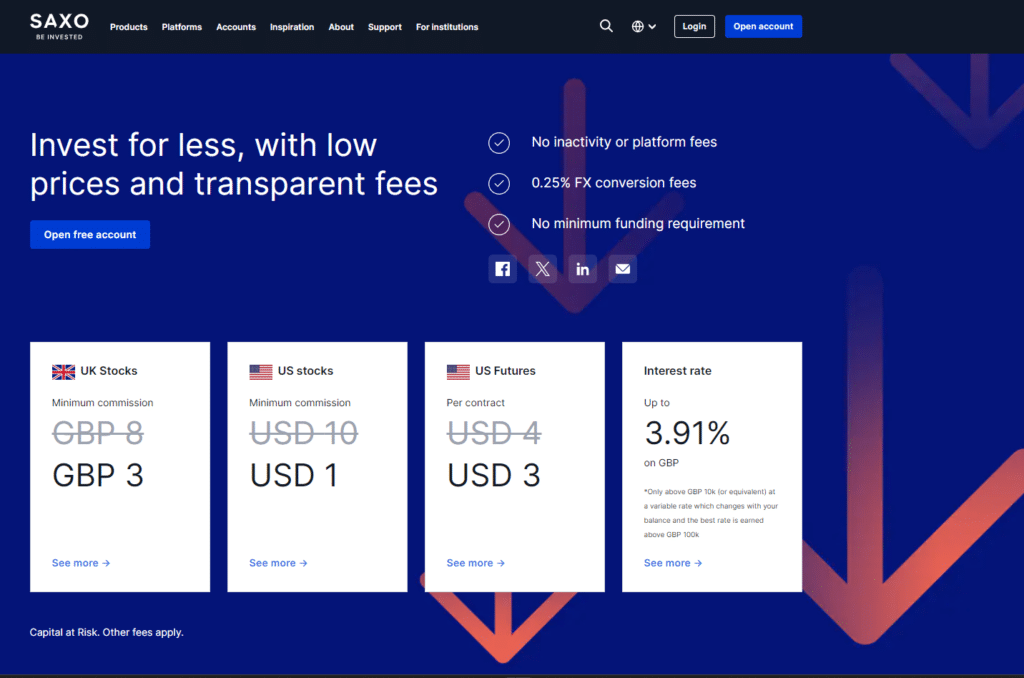

Saxo

Day Trading Score: 4.3/5

64% of retail CFD accounts lose money.

6

Interactive Brokers

Day Trading Score: 4.2/5

62.5% of Retail CFD Accounts Lose Money

Quick Answer: What is the best platform for day trading in the UK?

IG and Spreadex remain top choices for day trading in the UK in 2025. IG offers advanced tools, competitive fees, and a user-friendly interface, while Spreadex stands out for its excellent spread betting options and smooth trading experience, making it ideal for active traders.

Here are the top 9 best Trading Platforms in the UK:

- IG – By far the Best Platform for Trading

- SpreadEX – Best Choice for Intermediate Traders

- XTB – Unique Trading Platform features

- eToro – Most easy to use platform

- Saxo – Outstanding advanced technical analysis features

- Interactive Brokers – Great for Experienced Traders

- Plus500 – Great for CFD Service Analytic tools

- Pepperstone – Best for a range of platforms

- CMC Markets – Access to great trading assets

SpreadEX

- Free Market Analysis Tools

- UK-Based, FCA Regulated

- Spread Betting & CFDs

- No Minimum Deposit

81% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

CFDs are complex instruments with a high risk of losing money rapidly due to leverage. 51% of retail CFD accounts lose money when trading CFD’s with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

What are the Best Trading Platforms in the UK?

| Rank | Broker | Fee Score | Platform Score | Account Opening Score | EURUSD Spread | Withdrawal Fee | Min Deposit | MT4 Available | FCA Regulated | FSCS Protected | Forex ✔️ | Stocks ✔️ | ETFs ✔️ | Crypto ✔️ | Options ✔️ | Commodities ✔️ | Indices ✔️ |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| #1 | IG | 4.1 | 4.9 | 4.5 | 0.6 | ❌ | $0 | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ❌ | ✔️ | ✔️ | ✔️ |

| #2 | Spreadex | 4.1 | 4.8 | 4.8 | Varies | ❌ | $0 | ❌ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ❌ | ❌ | ✔️ | ✔️ |

| #3 | XTB | 4 | 4.3 | 4.4 | 1 | ❌ | $0 | ❌ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ❌ | ❌ | ✔️ | ✔️ |

| #4 | eToro | 4 | 5 | 5 | 1 | ✔️ ($5) | $0 | ❌ | ✔️ | ✔️ | ❌ | ✔️ | ✔️ | ✔️ | ❌ | ✔️ | ✔️ |

| #5 | Saxo | 4.1 | 4.8 | 4.9 | Varies | ❌ | $0 | ❌ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ❌ | ✔️ | ✔️ | ✔️ |

| #6 | Interactive Brokers | 4 | 4.8 | 4.2 | 0.1-0.2 | ❌ | $0 | ❌ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ❌ | ✔️ | ✔️ | ❌ |

| #7 | Plus500 | 3.9 | 4.9 | 5 | 0.8 | ❌ | $100 | ❌ | ✔️ | ✔️ | ✔️ (via CFDs) | ✔️ (via CFDs) | ✔️ (via CFDs) | ❌ | ✔️ (via CFDs) | ✔️ (via CFDs) | ✔️ (via CFDs) |

| #8 | Pepperstone | 4.1 | 3.5 | 3.5 | 0.1 | ❌ | $0 | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ❌ | ❌ | ✔️ | ✔️ |

| #9 | CMC Markets | 3.8 | 4.6 | 4.4 | 0.7 | ❌ | $0 | ❌ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ❌ | ✔️ | ✔️ | ✔️ |

9 Best Day Trading Platforms

IG - Our Top Choice Platform for Day Trading

Pros & Cons

- Wide market access: stocks, forex, indices & more

- Powerful tools: ProRealTime, L2 Dealer, sentiment indicators

- Highly rated for usability and performance

- Strong educational resources for all levels

- No MetaTrader support

- Occasional support delays

- Fee structure could be clearer

Platform Fees

- Spread: From 0.6 pips (forex)

- Commissions: Shares £3/trade, CFDs £0.10/share, Options £10/contract

- Other fees: £12 inactivity fee after 12 months, withdrawal fees vary

Day Trading Tools

- L2 Dealer, ProRealTime, advanced orders, API access, sentiment data

What do our experts say?

IG remains a top pick thanks to its powerful tools, broad market access, and educational resources—ideal for both new and seasoned day traders.

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 71% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

SpreadEX - Best Choice for Intermediate Traders

Pros & Cons

- Tax-free spread betting profits (UK)

- Leverage allows larger positions with less capital

- Wide market access: stocks, forex, indices, more

- No commission fees *

- No ISA or non-leveraged accounts

- Limited to UK/Ireland users

- No MetaTrader support (but integrates with TradingView)

Platform Fees

- Spread: Varies by asset

- Commissions: None*

Day Trading Tools

- Web platform with basic analysis tools

- Economic calendar, news feed, limited order types

What do our experts say?

SpreadEX is a solid pick for intermediate UK traders, especially those looking for tax-free gains and straightforward, commission-free trading.

*Other fees may apply

81% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

XTB - Unique Trading Platform features

Pros & Cons

- Broad market access: forex, stocks, crypto & more

- Low forex spreads for cost-effective trading

- xStation 5 offers fast execution & advanced tools

- Regulated by multiple top-tier authorities

- No MetaTrader 4/5 support

- Inactivity fees for dormant accounts

Platform Fees

- Spread: From 0.6 pips (forex)

- Commissions: £0.02/share for CFDs

- Other fees: £10 inactivity (after 12 months), withdrawal fees vary

Day Trading Tools

- xStation 5, advanced order types, algorithmic trading, news & economic calendar

What do our experts say?

XTB delivers a tech-forward trading experience with low forex spreads and a top-tier platform—great for traders who value speed and sleek design.

73% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

eToro - Most easy to use platform

Pros & Cons

- Social and copy trading ideal for beginners

- Simple, intuitive interface for all experience levels

- No stock/ETF commissions

- $5 withdrawal and currency conversion fees

- Limited tools for advanced analysis

- Inactivity fee for dormant accounts

Platform Fees

- Spread: From 0.1 pips (forex)

- Commissions: None on stocks/ETFs; 1% crypto fee

- Other fees: $5 withdrawal

Day Trading Tools

- Copy trading, Smart Portfolios, sentiment indicators, basic web platform

What do our experts say?

eToro is ideal for beginners—its intuitive design and copy trading features make getting started easy, though advanced users may want deeper tools.

CFDs are complex instruments with a high risk of losing money rapidly due to leverage. 51% of retail CFD accounts lose money when trading CFD’s with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Saxo - Outstanding advanced technical anlaysis features

Pros & Cons

- Huge range of forex pairs and instruments

- Competitive spreads and pricing

- SaxoTrader platforms offer advanced analysis tools

- Strong research and educational content

- Complex fee structure may confuse some users

- No MetaTrader support

- Can be overwhelming for beginners

Platform Fees

- FX Spreads: From 0.4 pips

- CFDs: From 0.85 (UK 100)

- Other fees: From $1 commission on US stocks

Day Trading Tools

- SaxoTraderGO/PRO, algorithmic trading, advanced order types, real-time data & research

What do our experts say?

Saxo is a top-tier choice for experienced traders, offering powerful platforms and deep analysis tools—though it may overwhelm total beginners.

64% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Interactive Brokers - Great for Experienced Traders

Pros & Cons

- Ultra-low spreads (EURUSD from 0.1 pips)

- No deposit/typical withdrawal fees

- Access to 150+ global markets

- Advanced tools with real-time data and deep analysis

- Complex platform with steep learning curve

- $10/month inactivity fee

- No MetaTrader support

- Interest only paid on $100K+ balances

Platform Fees

- Spread: From 0.1–0.2 pips (EURUSD)

- Commissions: Vary by asset; forex often commission-free

- Other fees: $10/month inactivity (if criteria not met), limited withdrawal fees

Day Trading Tools

- IBKR TWS, IBKR Mobile, GlobalAnalyst, algo trading, market data & research

What do our experts say?

Interactive Brokers is built for seasoned traders, offering unmatched global access, ultra-low spreads, and professional-grade tools—with a steeper learning curve.

62.5% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Plus500 - Great for Analytic tools

Pros & Cons

- Low spreads (EURUSD from 0.8 pips)

- No deposit or withdrawal fees

- Multiple funding options incl. PayPal & Wise

- Quick, beginner-friendly account setup

- No MetaTrader 4/5 support

- $10/month inactivity fee after set period

Platform Fees

- Spread: From 0.8 pips (forex)

- Commissions: None

- Other fees: Overnight fees; 0.7% currency conversion charge

Day Trading Tools

Web platform, guaranteed & trailing stops, economic calendar, news feed

What do our experts say?

Plus500 is a solid option for cost-conscious traders who want built-in risk tools and smooth setup—though MetaTrader users may feel limited.

80% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Pepperstone - Best for a range of platforms

Pros & Cons

- Extremely low spreads (EURUSD from 0.1 pips)

- No deposit/withdrawal fees

- Multiple payment methods incl. PayPal

- Fast, user-friendly account setup

- Proprietary platform lacks cutting-edge features

- Educational content could be improved

Platform Fees

- Spread: From 0.0 pips (forex)

- Commissions: £8/lot (DMA stocks), £0.50/share (CFDs)

- Other fees: £10 inactivity fee (after 12 months), withdrawal fees vary

Day Trading Tools

- MT4, MT5, cTrader, Smart Trader tools, tick charts, VPS hosting

What do our experts say?

Pepperstone stands out for ultra-low spreads and platform variety—ideal for traders who value flexibility and fast execution across MT4, MT5, and cTrader.

81.7% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

CMC Markets -Access to great trading assets

Pros & Cons

- Huge range of markets incl. forex, stocks, crypto

- Tight spreads and competitive pricing

- Powerful charting and analysis tools

- Strong educational content and FCA regulation

- Complex for beginners

- Inactivity fees apply

- Some premium tools incur extra charges

Platform Fees

- Spread: From 0.6 pips (forex)

- Commissions: £3/share trade, £0.10 for CFDs, £10 for options

- Other fees: £12 inactivity fee (after 12 months), withdrawal fees vary

Day Trading Tools

- NextGen & web platforms, advanced orders, real-time market data, news feed

What do our experts say?

CMC Markets offers deep market access and advanced tools, making it a strong pick for serious traders—though beginners may face a steeper learning curve.

70% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Step-by-Step Guide: Day Trading for Beginners

1. Understand Market Dynamics

Day trading isn’t as easy as it looks. I started by focusing on just one market—forex—and spent time learning how price moves with news, open/close sessions, and global events. That early groundwork helped me build real trading intuition. If you’re new, do your research first—it’ll save you trouble later.

2. Pick a Strategy That Suits You

Scalping wasn’t for me—it felt chaotic. But momentum trading made sense. I practiced with a demo account first, which I highly recommend. It helps you test strategies and figure out what fits your style and routine without risking real money.

3. Use Both Technical and Fundamental Analysis

I rely on technical tools like moving averages and RSI daily—but I also pay attention to the news. Things like central bank updates or job reports can shake the market. Using both types of analysis has helped me find better trade setups and avoid nasty surprises.

4. Choose the Right Trading Platform

At first, picking a platform was overwhelming. I tested a few—including Plus500, eToro, and Saxo Bank—and landed on one with quick execution and solid charting tools. Just make sure it’s FCA-regulated so your money’s protected.

5. Stick to a Trading Plan

Discipline is everything. I’ve created a plan that outlines my risk limits, entry/exit rules, and how I deal with losses—and I stick to it. Every time I’ve traded emotionally, I’ve paid for it. Treat trading like a business, not a gamble.

| Aspect | Key Information |

|---|---|

| Markets to Trade | Stocks, Forex, Cryptocurrencies, Indices, Commodities |

| Common Trading Strategies | Scalping, Momentum Trading, Swing Trading, Trend Following |

| Essential Indicators | Moving Averages, RSI, MACD, Bollinger Bands, Fibonacci Retracements |

| Risk Management Tools | Stop-Loss, Take-Profit, Position Sizing, Diversification |

| Best Trading Platforms | eToro, Plus500, Saxo Bank, IG, Interactive Brokers |

| Regulatory Bodies | FCA (UK), SEC (US), ASIC (Australia), CySEC (EU) |

| Common Mistakes to Avoid | Overtrading, Ignoring Stop-Loss, Trading Without a Plan, Emotional Trading |

| Best Times to Trade | London Session (8 AM - 4 PM GMT), US Session (1 PM - 9 PM GMT) |

| Psychological Discipline | Avoid FOMO (Fear of Missing Out), Stay Patient, Stick to Your Strategy |

| Useful Trading Tools | TradingView, MetaTrader 4/5, Bloomberg Terminal, Economic Calendar |

What Features Should I Look Out for on Trading Platforms?

After years of trial and error, here’s what I focus on:

Trading Costs: Don’t Let Fees Eat Your Wins

Even small spreads and commissions add up fast. I stick to platforms with tight spreads or zero commissions—but more importantly, I look for transparency. Hidden fees? Instant deal-breaker.

Platform Features: Tools That Matter

I need strong charting tools, real-time data, and, ideally, support for automated trading. Platforms with Level 2 data and custom indicators have seriously streamlined my process.

User Experience: Simple is Best

Clunky platforms slow you down. I want fast execution and a clean, intuitive interface—whether I’m on desktop or mobile.

Security & Regulation: Must-Have

I only use FCA-regulated platforms (or SEC/ASIC depending on region). It’s not just about fund protection—it’s knowing the platform’s legit.

Customer Support: Crucial When You Need It

I’ve hit issues during peak hours. Fast, helpful support—especially live chat—has saved my skin more than once. If support’s poor, I’m out.

How Can I Tell if a Trading Platform is Safe?

When you’re trading online, you’re not just risking your capital—you’re also sharing sensitive financial data. That’s why I make sure any platform I use is rock-solid on the security front.

Must-Have Security Features

- Regulatory Compliance: First thing I check? Whether it’s FCA-regulated. No FCA license? I’m out.

- Two-factor authentication (2FA): I always enable this—it’s a simple but powerful way to block unauthorised access.

- Encryption: I look for SSL encryption to keep all my data and transactions secure.

- Segregated Client Funds: This is key—regulated brokers must keep my money separate from their company funds. It’s a basic safety net.

- Fraud Prevention Systems: I appreciate platforms that go the extra mile with fraud detection and suspicious activity alerts. Peace of mind matters.

Watch Out for These Common Trading Scams

Here’s something I always tell new traders: if it sounds too good to be true, it probably is. Scam platforms often promise huge returns, insane bonuses, or guaranteed wins—total red flags.

My Go-To Tip: If I’m ever unsure about a platform, I head straight to the FCA Register to double-check its credentials. If it’s not listed, I won’t go near it.

What Are the Top Markets for Day Trading in the UK?

If you’re trading in the UK, you’ve probably wondered which market to focus on. I’ve tested a few, made mistakes, and figured out which ones fit my style. Here’s what I’ve learned:

1. The UK Stock Market

This was my starting point—and a solid one. The variety across sectors like tech and energy is great, and FTSE 100 stocks offer strong liquidity.

The secret to stock trading? Know why the price moves. Earnings, news, even a tweet can shift things fast. It’s volatile, but that’s where the profit potential is. I recommend keeping up with market news and watching the open every day.

2. Forex Trading

Forex was a natural next step. It’s 24/7, global, and ideal if you’re trading around a job. I focus on GBP/USD and EUR/GBP because they’re liquid with tight spreads.

Staying on top of macroeconomic news—like interest rate decisions or inflation reports—has helped me time trades. Bank of England statements in particular can really move the pound. But with leverage, gains and losses grow fast, so solid risk management is essential.

3. Options & Futures

Options and futures seemed complex at first, but once I got comfortable, they became a key part of my strategy. I mostly use them to hedge or trade short-term volatility during major events.

You can profit in any direction, but there’s a steep learning curve—especially with options. Pricing, time decay, and volatility all come into play. I backtested for weeks before going live, and that prep made all the difference.

Which Market Is Best?

The truth is, there’s no single “best” market—it all depends on your goals, risk tolerance, and how much time you can dedicate to trading. Personally, I trade across a couple of markets, which helps me spread my risk and catch opportunities in different environments.

If you’re new, I’d suggest starting with one—maybe stocks or forex—and really getting to know how it behaves. From there, you can branch out into other markets, like derivatives once you’ve built up your confidence and trading knowledge.

The more you trade, the more you’ll understand your style and preferences. Just keep learning, stay disciplined, and don’t try to master everything all at once.

Which Day Trading Strategies Do traders use?

I’ve tried all kinds of day trading strategies—some were total flops, others became cornerstones of my trading routine. What I’ve found is that no single strategy works all the time. The trick is having a few reliable setups in your toolkit and knowing when to use each one. Here are the ones that have worked best for me:

1. News Trading

News trading is one of my go-to’s, particularly when I know a big announcement is coming.

- Central bank decisions

- Inflation reports,

- Earnings releases

These events can cause massive short-term volatility—which, if you’re prepared, is pure opportunity. I recommend staying on top of the economic calendar and setting up alerts for high-impact events.

One thing to note is you have to be fast though—really fast. I’ve had trades last less than 10 minutes that made more than a full day’s worth of setups just by reacting to news momentum. But don’t guess—wait for the market’s reaction and then jump on the trend.

2. Swing Trading

Even though I day trade, I often take swing trades too. Sometimes, I spot a great setup but it needs a bit more time to play out. That’s where swing trading fits in for me.

I look for stocks or currency pairs with strong momentum and clear patterns—think breakouts or flag formations. I’ll usually hold these trades for a few days, sometimes up to a couple of weeks. I rely heavily on technical analysis, especially support and resistance zones, to find good entry and exit points. The patience can really pay off.

3. Momentum Trading

Momentum trading is the strategy I use most often. There’s something addictive about catching a stock right when it’s breaking out and riding the wave.

I look for high-volume movers—stocks that are up big on news or technical breakout levels. I use indicators like RSI and MACD to confirm momentum, but honestly, price action and volume are what I trust most. If a move has legs, I try to ride it until the momentum starts fading. Just be careful—momentum can reverse quickly, so I always have my stop-loss in place.

4. Money Flow to Confirm Setups

This is one of the more underrated strategies. Money flow tells you where the smart money is going. I use the Money Flow Index (MFI) as a confirmation tool alongside other indicators.

If I see a bullish pattern forming and the MFI is also trending up, that’s a green light. I especially like watching for divergences—when price is rising but money flow is dropping (or vice versa), it can signal a reversal is coming. It’s helped me avoid some bad trades and spot a few hidden gems.

5. Mean Reversion

Mean reversion strategies are something I use in calmer markets or during consolidation periods. I look for assets that have deviated far from their average price—usually using Bollinger Bands to spot overbought or oversold conditions.

But here’s the thing: this strategy only works if the market isn’t trending hard. I’ve been burned trying to call a reversal in a strong trend—so now I combine mean reversion setups with volume and confirmation indicators. And I keep my risk tight, just in case I’m wrong.

Essential Day Trading Terminology

When I started out, the jargon felt overwhelming. But trust me—once you understand a few key terms, everything starts to click.

- Bid/Ask: The bid is what buyers are willing to pay; the ask is what sellers want.

- The difference between the two? That’s the spread, and it eats into your profits, so tighter is better.

- Leverage: This one’s powerful but dangerous. Leverage lets you control a larger position with a smaller deposit, but it can magnify your losses just as fast as your wins.

Learning this lingo early on helped me feel more confident and make better decisions in real time. If you’re new, don’t gloss over this stuff—it really does matter.

Is Day Trading Worth It?

Learning this lingo early on helped me feel more confident and make better decisions in real time. If you’re new, don’t gloss over this stuff—it really does matter.

What I Enjoy About Day Trading in the UK

One of the biggest draws for me was the freedom. I don’t have to stick to a 9-to-5 or wait years to see returns like with long-term investing. With day trading, I can be in and out of a position within minutes or hours—and if I’ve done my research beforehand, those trades can be quite profitable.

You can also take into account the fact that the UK is a great place to be a trader. The regulatory environment is solid—FCA-regulated brokers offer a layer of security. Plus, the infrastructure here is top-notch. I’ve never had issues with trade execution or access to real-time data, which makes a huge difference when every second counts.

Here’s What I Don't Like

I won’t lie—day trading can be mentally exhausting. Markets move fast, and one wrong click or emotional decision can wipe out a day’s gains (or worse). I’ve had days where I’ve taken more than a few losses in a row.

The pressure to make constant decisions, react to news instantly, and stay focused for hours can take a toll. It’s not just about skill—it’s about having the right temperament. You need to be able to take losses on the chin, stick to your plan, and avoid revenge trading.

The Hidden Costs

When people think of trading costs, they usually think of just wins and losses. But there’s more to it. Commissions and spreads add up fast—especially if you’re making multiple trades a day. Even if your broker offers “zero commission,” you’re still paying in the spread.

Then there are overnight financing fees. If I leave a position open past market close, I can get charged interest, depending on the asset and broker. I’ve learned to factor all of this into my trade planning—otherwise, those small costs quietly eat away at your profits.

Summary of Pros and Cons of Day Trading

| Aspect | Summary |

|---|---|

| Pros | |

| Freedom & Flexibility | No 9-to-5 required; trades can be opened and closed within minutes or hours. |

| Potential for Quick Profits | With the right setup and timing, trades can be surprisingly profitable. |

| Strong UK Infrastructure | FCA regulation provides peace of mind; reliable execution and real-time data are a big plus. |

| Cons | |

| Mentally Demanding | Fast-paced decision-making and constant focus can be exhausting. |

| Emotional Discipline Required | Mistakes and losses can happen quickly—requires a solid mindset and emotional control. |

| Hidden Costs | |

| Commissions & Spreads | Even “commission-free” trading can add up through spreads. |

| Overnight Fees | Holding positions past market hours can incur financing charges. |

| Final Verdict | Depending on your mindset, discipline, and risk management, day trading can be rewarding, but it’s not easy. |

Final Thoughts: Is Day Trading for You?

Well, if you are willing to put in the work, effort, stay disciplined, and treat it like a business—not a get-rich-quick scheme—then yes, day trading can absolutely be worth it. But it is not easy. It takes time, patience, and a lot of trial and error.

The learning never really stops. Markets evolve, and successful traders evolve with them. If you’re serious about getting into day trading in the UK, start with education, test everything in a demo account, and only go live when you’ve got a solid strategy and risk management plan in place.

However, if you’re up for the challenge, it can be one of the most exciting ways to engage with the markets.

FAQs

From my experience, platforms like eToro and IG are great for beginners. They’re intuitive, easy to navigate, and come with loads of educational resources. I started out on a more complex platform and honestly wish I’d used something more beginner-friendly at the start—it would’ve saved me a few headaches.

Yes, absolutely. Day trading is 100% legal in the UK—as long as you’re using a regulated broker. I always stick to platforms authorised by the Financial Conduct Authority (FCA). It’s just not worth the risk trading on an unregulated site.

Not at all. I started small—just a few hundred pounds. Many platforms offer low minimum deposits and even demo accounts where you can practice with virtual funds. The key is learning and managing risk, not throwing a ton of cash at the market from day one.

Here in the UK, your trading profits might be subject to Capital Gains Tax (CGT)—especially if you’re trading shares. If you’re using spread betting accounts, though, profits are typically tax-free (but there are caveats). I’d recommend chatting with an accountant if you’re making consistent gains—it’s worth getting proper tax advice early on.

You can absolutely trade on your phone—I do it all the time. Most of the platforms I use have mobile apps that are just as functional as their desktop versions. That said, I still prefer a computer for charting and making detailed trade plans, especially if I’m scalping or reacting to news.

Top 5 Day Trading Brokers

1

IG

71% of retail investor accounts lose money when trading spread bets and CFDs with this provider.

2

SpreadEx

81% of retail investor accounts lose money when trading CFDs with this provider.

3

XTB

73% of Retail CFD Accounts Lose Money

4

eToro

51% of retail CFD accounts lose money when trading CFD’s with this provider.

5

Saxo

64% of retail investor accounts lose money when trading CFDs with this provider.

References:

- 7 Best Indicators for Day Trading – City Index

- Stock Market Trading Hours – CMC Markets

- Restricting Contract For Difference Products Sold To Retail Clients – FCA

- Top Financial Markets To Trade In 2024 – Admirals

- Glossary of trading terms – IG

Featured Blogs

81% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

- Spread betting & CFDs

- UK-based, FCA regulated

- No minimum deposit

- Free market analysis tools

- Desktop & mobile trading