Trading Pillar

Thomas Drury

Co-Founder

Seasoned finance professional with 10+ years' experience. Chartered status holder. Proficient in CFDs, ISAs, and crypto investing. Passionate about helping others achieve financial goals.

Twitter ProfileAuthor Bio

Dom Farnell

Co-Founder

Dom is a Co-Founder and of TIC. A passionate investor and seasoned blog writer with a keen interest in financial markets and wealth management.My goal is to empower individuals to make informed investment decisions through informative and engaging content.

Twitter ProfileAuthor Bio

How We Test

At The Investors Centre, we pride ourselves on our rigorous fact-checking process. To delve deeper into our meticulous testing procedures and discover how we ensure accuracy and reliability, visit our dedicated page on how we test.

Please bear in mind that trading involves the risk of capital loss. 68% to 84% of retail investor accounts lose money when trading CFDs with the providers below. You should consider whether you can afford to take the high risk of losing your money.

Page Contents:

- What is Trading?

- What Accounts Can Be Used for Trading?

- What are the Differences Between Trading and Investing?

- How Do I Start Trading?

- What Strategies Are Used for Trading?

- How Are Trades Placed?

- What is CFD Trading?

- What Are The Best Markets for Day Trading?

- What Are the Fees Associated with Trading?

- Final Thoughts

- Related Articles

What is Trading?

Trading, often regarded as the lifeblood of financial markets, is an exhilarating and multifaceted world. This domain, where various assets are actively bought and sold, is not just about profit-making; it’s a testament to human economic activities, tracing its roots back to the dawn of civilization. The essence of trading has remained constant, but its methods, tools, and impact have evolved drastically, hand-in-hand with technological progress.

At its core, trading is the process of exchanging assets with the primary goal of achieving financial gains. These assets range widely, encompassing stocks, bonds, commodities (like oil and gold), and currencies (such as the Euro or the US Dollar). However, trading is far more intricate than mere transactions. It represents a complex ballet of market dynamics, psychological factors, and strategic planning. Traders must interpret market trends, economic indicators, and geopolitical events, all while balancing risk and reward.

Types of Trading

There are several types of trading, including day trading (buying and selling within the same day), swing trading (holding for days or weeks), and position trading (long-term holding). Each style demands different skills and strategies, with varying degrees of risk and potential reward.

From Traditional to Modern

The journey of trading is a narrative of continual transformation. Historically, trading was conducted in physical marketplaces and trading pits, characterised by the open outcry system where traders would shout and gesture to make trades. Today, the scenario is radically different. The advent of digital technology has led to sophisticated electronic trading platforms, algorithmic trading, and high-frequency trading. These technologies have not only enhanced the speed and efficiency of transactions but have also introduced new forms of analysis like quantitative trading, which relies on mathematical and statistical models.

Impact of Technology

Technology has democratized access to financial markets. Now, individual investors can trade from anywhere in the world, using just a computer or a smartphone. This shift has led to an increase in retail trading and has also influenced how professional traders operate.

- Dynamic Nature: Trading is a vibrant and ever-changing field, offering opportunities to generate returns through active engagement in the markets.

- Active Involvement: Successful trading requires more than just buying and selling assets; it involves a deep understanding of market trends, economic indicators, and the ability to make quick, informed decisions.

- Essential Skills: To thrive in trading, one needs a blend of knowledge, discipline, strategic thinking, and effective risk management. Emotional control and the ability to adapt to changing market conditions are also vital.

- Risk and Reward: While trading offers the potential for significant profits, it also comes with risks. Effective risk management strategies are crucial to protect investments and achieve consistent returns.

- Technological Evolution: The advancement of technology has fundamentally altered the landscape of trading, making it more accessible, faster, and more complex.

What Accounts Can Be Used for Trading?

Expanding on your text, here’s a more detailed and optimized version for your parent page:

Introduction to Trading Accounts

The selection of the right trading account is a critical step in your trading journey. It transcends the choice of a platform; it’s about finding a match that resonates with your individual trading style, objectives, and financial goals. A well-chosen account can significantly enhance your trading efficiency and success.

Variety and Purpose

The world of trading offers a diverse range of account types, each tailored to different trading needs and strategies. The most common types are:

Margin Accounts: These accounts allow traders to borrow money from their broker to make trades, offering the potential for higher profits but also greater risks due to the possibility of magnified losses.

Cash Accounts: In a cash account, traders can only trade with the money they have deposited, limiting the risk but also potentially capping the earning potential compared to margin trading.

Retirement Accounts: Designed for long-term investment, these accounts, such as IRAs in the United States, offer tax advantages but come with certain restrictions, particularly regarding withdrawal of funds.

Each account type has its specific features, benefits, and limitations, making it crucial to understand them in detail.

Alignment with Personal Trading Approach

Selecting the appropriate account type requires a deep understanding of your own trading approach. Consider the following factors:

Risk Tolerance: Assess your comfort level with risk. Margin accounts may offer higher potential returns, but they also come with increased risk. Cash accounts, on the other hand, are more conservative.

Investment Strategy: Your trading strategy – whether it’s day trading, swing trading, or long-term investing – will influence the type of account that’s best for you. Margin accounts might be more suitable for active, short-term traders, while retirement accounts are ideal for long-term strategies.

Financial Goals: Consider your financial objectives. Are you looking to grow your wealth over time, or seeking immediate income? Your goals will guide you towards the account that best facilitates your aspirations.

Legal and Tax Considerations: Each account type has different tax implications and legal restrictions. Understanding these can help you choose an account that aligns with your financial planning.

Informed Decision-Making

Ultimately, the decision comes down to a combination of personal preferences, financial objectives, and trading strategies. It is advisable to consult with a financial advisor or a trading expert to understand the nuances of each account type fully. This way, you can make a well-informed decision that aligns with your overall trading plan.

By carefully considering these aspects, you can select a trading account that not only complements your trading style but also positions you for success in the financial markets. Remember, the right account is a fundamental tool in your trading arsenal, paving the way for a more controlled and potentially rewarding trading experience.

What Are the Differences Between Trading and Investing?

Trading and investing, though sometimes mistakenly used as synonyms, are in fact two distinct approaches to the financial markets, each with its unique methodologies, goals, and risk profiles.

Differentiating Timeframes and Goals

The primary distinction between trading and investing lies in the timeframe and underlying objectives:

Trading: Traders often engage in the financial markets with a short-term perspective. They aim to exploit market volatility, benefiting from fluctuations in asset prices. Their strategies might range from intra-day trading, where positions are held for just a few hours, to swing trading, where positions are maintained for several days or weeks. The focus here is on quick gains, often driven by market news, technical analysis, and short-term trends.

Investing: In contrast, investors typically adopt a long-term approach. The goal is gradual wealth accumulation over years or even decades. Investors often focus on the intrinsic value of assets, looking for opportunities where they believe the market has undervalued a stock or asset. This approach involves holding onto investments through market ups and downs, with a belief in the long-term growth potential of their assets.

Understanding Risk and Return Profiles

Each approach comes with its own set of risks and potential returns, and understanding these can guide you towards the path that aligns with your personal financial goals and risk tolerance:

Risk and Return in Trading: Trading, given its short-term nature, often involves higher risks. The rapid buying and selling of assets can lead to significant gains, but also substantial losses, especially in volatile markets. Traders need to be adept at managing these risks, often using sophisticated strategies and tools to mitigate potential downsides.

Risk and Return in Investing: Investing, with its long-term horizon, generally involves lower relative risk, especially when diversified across different asset classes. The returns on investments are typically realized over a longer period, and while they might be lower in the short term compared to trading, they tend to be more stable and consistent over the long term.

By carefully considering these aspects, you can better understand which approach – trading or investing – is more suitable for your financial situation, goals, and comfort level with risk. It’s also important to note that many successful financial strategies incorporate elements of both trading and investing, providing a balanced way to approach the financial markets.

How Do I Start Trading?

Entering the world of trading can indeed be an intimidating venture, but with a structured approach and the right resources, it becomes a much more manageable and achievable goal. Here’s a more detailed guide to help you get started:

Embarking on Your Trading Journey: Key Steps to Take

Educational Foundation: The first and foremost step is to educate yourself about the financial markets. This includes understanding different asset classes like stocks, bonds, and commodities, as well as the factors that influence their prices. There are numerous online courses, books, and webinars available for beginners.

Choose Your Market and Strategy: Decide which markets you want to trade in, be it equities, forex, commodities, or others. Each market has its unique characteristics and requires different trading strategies. Also, determine whether you want to be a day trader, swing trader, or pursue another trading style.

Opening a Trading Account: Choose a reputable broker that aligns with your trading goals and preferences. Look for factors like trading fees, platform features, and educational resources while selecting a broker.

Practicing with a Demo Account: Before diving into real trading, practice with a demo account. This allows you to get a feel of the trading platform and test your strategies without risking real money.

Building a Trading Plan: Develop a trading plan that outlines your investment goals, risk tolerance, methodology, and evaluation criteria. A well-defined plan helps in making disciplined trading decisions.

Understanding Risk Management: Learn about risk management techniques. This includes setting stop-loss orders to limit potential losses and understanding how to size your positions appropriately to manage risk.

Equipping Yourself with Essential Trading Tools

As a beginner in trading, having the right tools can significantly improve your chances of success:

Reliable Trading Platform: Choose a platform that is user-friendly and provides essential tools like real-time charts, news feeds, and technical analysis indicators.

Analytical Tools: Familiarize yourself with basic analytical tools and indicators such as moving averages, Relative Strength Index (RSI), and Bollinger Bands. These tools can help in making informed trading decisions.

Access to Quality Educational Resources: Continuously educate yourself by accessing quality resources. Many brokers provide educational materials, and there are also independent websites, books, and seminars that offer valuable insights.

News and Market Data: Stay updated with the latest market news and data as they can significantly impact asset prices. Many trading platforms offer integrated news feeds and market analysis.

Community and Support: Engage with trading communities online or locally. These communities can provide support, insights, and tips, which can be particularly helpful for beginners.

By following these steps and equipping yourself with the right tools, you can set a solid foundation for your trading journey. Remember, success in trading doesn’t happen overnight; it requires continuous learning, practice, and discipline.

What Strategies Are Used for Trading?

Trading strategies are indeed vital for successful trading, serving as the framework guiding decisions and actions in the market. These strategies are based on careful market analysis, risk management principles, and personal trading styles.

Diverse Array of Popular Trading Strategies

Day Trading: This strategy involves buying and selling securities within the same trading day. Traders capitalize on small price movements and avoid the risk of overnight market fluctuations. It requires quick decision-making and constant market monitoring.

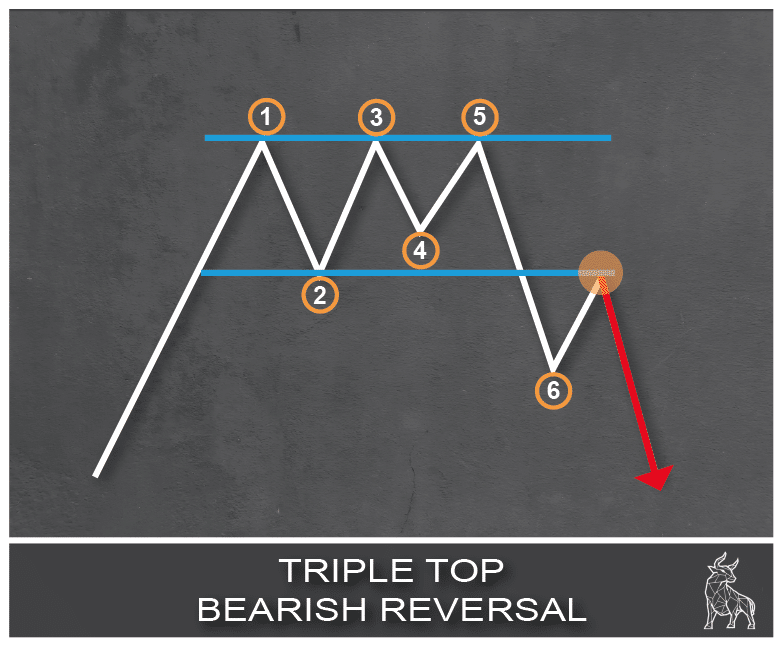

Swing Trading: Swing traders hold positions for several days to capitalize on expected upward or downward market shifts. This strategy relies on interpreting momentum indicators and patterns to predict market movements.

Position Trading: Position traders hold their positions for long periods, from weeks to months or even years. This strategy is less affected by short-term market fluctuations and is based more on long-term trends and fundamental analysis.

Scalping: A strategy that involves making numerous trades within a day to profit from small price gaps created by order flows or spreads. It’s fast-paced and requires a significant amount of time and attention.

Technical Analysis Based Trading: This approach relies on the analysis of historical market data, including price and volume, to forecast future price movements.

Each of these strategies has distinct characteristics, with varying levels of risk and potential return, making them suitable for different types of traders based on their risk tolerance, investment horizon, and interests.

Matching Strategies with Market Conditions

Understanding Market Dynamics: The success of a trading strategy is heavily dependent on its suitability to current market conditions. For example, day trading and scalping may be more effective in highly volatile markets, where price movements are more pronounced and frequent.

Adaptability: An effective trader must be adaptable, willing to modify strategies as market conditions change. This might involve shifting from a short-term strategy like day trading to a longer-term approach like position trading in response to evolving market dynamics.

Continuous Learning and Analysis: Regularly analyzing market conditions and staying informed about global economic events is crucial. This ongoing learning helps traders understand when to apply different strategies.

Risk Management: Regardless of the strategy, effective risk management is essential. This includes setting stop-loss orders, diversifying investments, and only risking a small percentage of the trading capital on a single trade.

In conclusion, successful trading is about choosing and applying the right strategy at the right time. It requires a thorough understanding of different trading methods, an ability to read and react to market conditions, and a strong emphasis on risk management. By mastering these elements, traders can significantly enhance their chances of achieving favorable outcomes in the markets.

How Are Trades Placed?

The advancement of technology has indeed revolutionized the trading process, making it more accessible, efficient, and sophisticated than ever before. Understanding the intricacies of this process is crucial for anyone looking to engage effectively in trading.

Exploring the Trading Process

Understanding Order Types: Familiarizing yourself with different types of orders is fundamental. This includes market orders (executed immediately at current market prices), limit orders (set to execute at a specific price or better), and stop orders (triggered when a specific price is reached). Each order type has its strategic use depending on your trading goals and market conditions.

Trade Execution: Once you place an order, it goes through a process of execution, which has been greatly streamlined thanks to technology. High-speed networks and advanced trading algorithms can execute trades within fractions of a second, significantly reducing the time lag that was once a major hurdle in trading.

Monitoring and Adjusting Trades: Active trading involves not just placing trades but also monitoring them and making adjustments as needed. This could mean setting stop-loss orders to limit potential losses or taking profits at predetermined levels.

The Integral Role of Technology in Trading

Market Analysis Tools: Technology has provided traders with powerful tools for market analysis. This includes sophisticated charting software, real-time news feeds, and advanced indicators for technical analysis. These tools help traders make informed decisions by analyzing market trends and patterns.

Automated and Algorithmic Trading: Advanced algorithms can now automate trading strategies, executing trades based on predefined criteria. This helps in eliminating emotional biases and allows for high-speed, high-volume trading, which is particularly useful in day trading and scalping.

Risk Management Technologies: Managing risk is a critical aspect of trading, and technology plays a key role here. Traders use various tools to set automatic stop-loss orders, track portfolio performance, and analyze risk exposure in real-time.

Accessibility and Convenience: Online trading platforms have made the markets more accessible to a broader audience. Traders can now access global markets from their computers or mobile devices, trade at almost any time, and get a wealth of information and resources at their fingertips.

Continual Innovation: The field of trading technology is continually evolving, with new tools and features being developed regularly. This constant innovation keeps pushing the boundaries of what’s possible in trading.

In summary, the integration of technology into trading has not only streamlined the process of placing and executing trades but also enhanced the capabilities of traders at all levels. From comprehensive market analysis to rapid trade execution and robust risk management, technology is an indispensable part of modern trading. For anyone embarking on a trading journey, leveraging these technological advancements is key to achieving effectiveness and efficiency in the markets.

What Is CFD Trading?

Contract for Difference (CFD) trading has become a popular method in the world of financial derivatives, offering traders a way to speculate on the price movements of various assets without actually owning them. Understanding the mechanics, benefits, and risks associated with CFD trading is crucial for anyone considering this form of investment.

Understanding CFDs

What are CFDs?: CFDs are complex financial instruments that allow traders to speculate on the rising or falling prices of fast-moving global financial markets or instruments. These could include stocks, commodities, currencies, indices, and more.

How CFDs Work: In CFD trading, you agree to exchange the difference in the price of an asset from when you open your position to when you close it. You can go ‘long’ (buy) if you believe the market price will rise, or go ‘short‘ (sell) if you think it will fall.

Leverage in CFDs: One of the key features of CFD trading is the use of leverage. This means you can open a position by only depositing a fraction of the full value of the trade. While leverage can magnify profits, it also significantly increases the potential for loss.

Pros and Cons of CFD Trading

Advantages

Flexibility: CFDs allow for a high degree of flexibility, permitting traders to trade on both rising and falling markets.

Access to Global Markets: Traders can access a wide range of global markets through CFDs, often from a single platform.

Hedging Opportunities: CFDs can be used to hedge other investment positions, helping to offset potential losses in a declining market.

Disadvantages

High Risk with Leverage: The leverage in CFD trading can lead to large losses as well as gains. Small market movements can have a proportionally higher impact, potentially leading to losses exceeding deposits.

Market Risks: CFD markets can be volatile, and sudden market movements can result in significant losses.

Complexity: The complexity of CFDs and the lack of ownership of the underlying asset can be challenging for some traders to understand.

Regulatory Differences: The regulation of CFDs varies by country, and they are not permitted in some jurisdictions. It’s important to be aware of the regulatory environment in your region.

Understanding both the advantages and the risks of CFD trading is vital. It’s a powerful tool in a trader’s arsenal but requires a good grasp of market dynamics and risk management to navigate successfully. Traders should also consider their own experience level and financial situation before engaging in CFD trading, and many find it prudent to start with a demo account to familiarize themselves with the mechanics before trading with real money.

What Are the Best Markets for Day Trading?

Day trading, characterized by its rapid pace and the necessity for quick decision-making, involves executing multiple trades within the confines of a single trading day. Success in day trading hinges significantly on choosing the right market, where factors like liquidity and volatility play pivotal roles.

Identifying Top Markets for Day Trading

Certain markets stand out as particularly suitable for day trading due to their unique characteristics:

Forex Market: The foreign exchange market is immensely popular among day traders due to its massive liquidity and 24-hour operation. This market deals with currency pairs, offering continuous opportunities for trading.

Stock Market: Individual stocks can offer excellent day trading opportunities, especially those with high liquidity and volatility. These stocks are often associated with large, well-known companies and can show significant price movements within a single day.

Futures Market: Futures contracts on commodities, indices, and even financial instruments can be lucrative for day traders. These markets often have high liquidity and allow for the use of leverage, but they also carry a higher risk.

Cryptocurrency Market: Although relatively new, the cryptocurrency market has become a hotspot for day traders, thanks to its extreme volatility and 24/7 operation. However, this market can be unpredictable and is considered high-risk.

Characteristics of Ideal Day Trading Markets

Understanding the key attributes of suitable markets for day trading can greatly aid in selecting the right one:

High Liquidity: Liquidity, the ability to buy or sell an asset without causing a significant price movement, is crucial. High liquidity ensures that orders can be executed quickly and at predictable prices.

Volatility: While it increases risk, volatility is vital for day trading as it creates opportunities for profiting from price movements within the day.

Market Transparency: Markets that provide clear, real-time information about prices and trades allow for better decision-making and strategy execution.

Accessible Information: Markets where information is readily available enable traders to make informed decisions based on the latest market news and analyses.

Regulatory Environment: A well-regulated market provides a certain degree of security and fairness, crucial for day trading which often involves rapid transactions.

Availability of Technology and Tools: Markets where advanced trading tools and platforms are available help traders in analysis, execution, and risk management, which are essential aspects of day trading.

By understanding these characteristics, traders can make more informed decisions about which markets best align with their day trading strategies, risk tolerance, and overall trading goals. While day trading can be profitable, it’s important to approach it with a solid understanding of the markets and a well-thought-out trading plan.

What Are the Fees Associated with Trading?

In the world of trading, being cognizant of various fees and effectively managing them is crucial for maintaining profitability. Different types of trading activities can incur a range of costs, and understanding these fees is key to developing an effective cost management strategy.

Types of Fees in Trading

Commission Fees: These are charges imposed by brokers for executing trades on behalf of clients. They can vary widely depending on the broker, the type of account, and the volume of trade.

Spread Fees: The spread is the difference between the bid (sell) and ask (buy) price of an asset. Brokers typically add a small mark-up to the spread as their fee, especially in no-commission trading accounts.

Overnight or Swap Fees: If you hold a leveraged position overnight, your broker might charge a fee. This is particularly common in forex trading and is tied to the interest rate differentials between the two currencies in a pair.

Platform Fees: Some brokers charge monthly or annual fees for using their trading platform, especially if it offers advanced features.

Inactivity Fees: If an account is inactive for a certain period, some brokers may charge a fee.

Withdrawal and Deposit Fees: Fees may be applied for depositing or withdrawing funds from your trading account, depending on the method of payment.

Regulatory Fees: Traders may also incur fees imposed by regulatory bodies, although these are often small and incorporated into other fees.

Managing and Minimizing Trading Costs

Choosing the Right Broker: Research and choose a broker that offers a fee structure that aligns with your trading style and frequency. For high-frequency traders, a broker with lower commission fees might be preferable, while occasional traders might benefit from a broker with no inactivity fees.

Understanding Fee Structures: Read the fine print to understand how and when fees are charged. Knowing the exact cost of each trade can help you make more informed trading decisions.

Efficient Trading Strategy: Develop a trading strategy that takes into account the cost of trades. This might involve minimizing the number of trades or avoiding holding positions overnight to reduce swap fees.

Utilizing Limit Orders: Using limit orders instead of market orders can help control the cost of the spread, particularly in more volatile markets.

Monitoring Account Activity: Regularly monitor your account for any inactivity and avoid unnecessary fees by keeping your account active.

Avoiding Small Trades: Since fees can eat up a significant portion of profits from small trades, it might be more cost-effective to make fewer, larger trades.

Negotiating with Brokers: In some cases, especially for high-volume traders, there may be room to negotiate fees with your broker.

By carefully managing these costs and understanding the fee structures of your trading activities, you can effectively minimize expenses, thereby maximizing the potential for profit in your trading endeavors.

Final Thoughts

Trading, indeed, transcends being merely a financial endeavor. It is a dynamic journey that involves continuous learning, adapting to new market conditions, and evolving strategies. This journey is unique to every individual, marked by its own set of challenges, lessons, and successes.

Reflections on Trading as a Journey

Learning from Experience: Trading is not just about applying textbook knowledge; it’s about learning from real-world experiences. Each trade, whether successful or not, offers valuable lessons.

Adapting to Market Changes: Markets are constantly changing, influenced by economic, political, and social factors. Successful traders are those who adapt their strategies to these changes, continually refining their approach.

Emotional Resilience: Trading can be a rollercoaster of emotions. Developing emotional resilience is key to staying rational and making sound decisions, especially in volatile markets.

Patience and Discipline: Patience in waiting for the right trading opportunity and discipline in sticking to a trading plan are essential traits for longevity in trading.

Importance of Risk Management: Understanding and managing risk is a crucial aspect of trading. It involves not only protecting capital but also knowing when to take calculated risks.

Personal Growth: The journey of trading often mirrors a journey of personal growth, teaching lessons in patience, discipline, decision-making, and managing uncertainty.

Encouragement for Aspiring Traders

For those embarking on this journey:

Embrace Curiosity: Stay curious and eager to learn. The financial markets are vast, and there is always something new to discover.

Build a Solid Foundation: Start with a strong foundation of knowledge. Take advantage of the myriad of resources available – books, online courses, seminars, and trading communities.

Practice Makes Perfect: Utilize demo accounts to practice trading without financial risk. This is an excellent way to refine strategies and gain confidence.

Learn from Others: Engage with other traders. Sharing experiences and strategies with peers can provide insights and different perspectives on trading.

Stay Resilient: Remember that setbacks are part of the journey. Each challenge is an opportunity to learn and grow stronger.

Balance and Perspective: Maintain a healthy balance between trading and other aspects of your life. It’s important to have a well-rounded perspective for long-term success.

Continuous Improvement: The markets are always evolving, and so should you. Stay updated with market trends and continually seek to improve your knowledge and skills.

In conclusion, trading is more than just a financial venture; it’s a journey of self-discovery and personal development. Embrace it with resilience, an open mind, and a commitment to continuous learning, and it can be a truly rewarding experience.