Is eToro Safe?

Adam Woodhead

Co-Founder

Adam is a Co-Founder and content creator for The Investors Centre. His key areas of interest and expertise are cryptocurrency and blockchain technology.

Twitter ProfileAuthor Bio

Thomas Drury

Co-Founder

Seasoned finance professional with 10+ years' experience. Chartered status holder. Proficient in CFDs, ISAs, and crypto investing. Passionate about helping others achieve financial goals.

Twitter ProfileAuthor Bio

Fact Checked

How we test

At The Investors Centre, we pride ourselves on our rigorous fact-checking process. To delve deeper into our meticulous testing procedures and discover how we ensure accuracy and reliability, visit our dedicated page on how we test.

Risk Warning

The information provided in this article is for educational and informational purposes only and does not constitute financial or investment advice.

Some of the links on this website are affiliate links, meaning we may earn a commission if you click through and make a purchase or investment, at no extra cost to you. This helps support our website and allows us to continue providing quality content.

Updated 02/01/2025

Quick Answer: Is eToro Safe??

Yes, eToro is safe. eToro complies with FCA, CySEC, and ASIC regulations, ensuring a secure trading environment. Always check for security indicators in your browser before trading. Client funds are safeguarded in Tier 1 banks, and personal information is protected with SSL encryption, providing a safe and reliable platform for investors.

Featured Platform: eToro

- Copy Trading

- User Friendly Platform

- Regulated & Trusted

- 30 Million+ Users

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

I first heard about eToro back in 2018, during the cryptocurrency boom. A friend had made a decent return trading Bitcoin and recommended I try it.

I was sceptical. At the time, online trading platforms were popping up everywhere, and scams were common. The idea of handing over my money to a platform I barely knew felt risky.

But after digging deeper, I realised eToro was FCA-regulated and had been around since 2007. That gave me some confidence, so I decided to give it a go with a £500 deposit.

Fast forward to today, and I’ve used eToro for six years, trading everything from stocks to crypto and ETFs. eToro now has over 30 million registered users worldwide (www.etoro.com), showing just how popular commission-free trading has become.

In the UK, platforms like eToro and Trading 212 have gained 35% of the retail trading market as more people look for easy-to-use investment apps (www.bbc.co.uk/news/business-57614506).

Is eToro Legit? – Breaking Down the Regulation and Security

Regulation and Investor Protection

One of the first things I check before investing is regulation. eToro ticks this box, being licensed in multiple regions:

| Feature | Binance | Coinbase |

|---|---|---|

| Headquarters | Cayman Islands | USA (San Francisco) |

| Founded | 2017 | 2012 |

| Regulated in UK? | ❌ No (FCA restrictions) | ✅ Yes (FCA-approved) |

| Cryptocurrencies | 350+ | 260+ |

| Trading Fees | 0.1% (0.075% with BNB) | Up to 0.6% (Coinbase Advanced: 0.4%) |

| Payment Methods (UK) | GBP deposits restricted | Bank transfer, card, PayPal |

| Futures & Margin Trading? | ✅ Yes (Up to 125x leverage) | ❌ No |

| Staking & Rewards? | ✅ Yes (60+ coins) | ❌ Limited (9 coins) |

| Ease of Use | ❌ Complex for beginners | ✅ Best for beginners |

In the UK, certain regulated investment services on eToro (UK) Ltd are covered by FSCS protection up to £85,000. However, crypto investments do not qualify for FSCS protection. Also under CySEC rules, European users can claim up to €20,000 if eToro were to collapse.

eToro also keeps client funds in segregated tier-1 banks, meaning your money is not mixed with company funds. This reduces the risk of funds being lost if eToro ever had financial troubles.

How eToro Protects Your Data

Security is another key concern for me. eToro uses:

✅ SSL encryption to protect personal and financial data.

✅ Two-Factor Authentication (2FA) for extra account security.

✅ Advanced fraud detection to spot suspicious activity.

I strongly recommend enabling 2FA. I once received a fake “eToro security email” asking me to reset my password. It looked real, but the dodgy email address gave it away. If I had clicked the link, I could have lost my account. Always log in directly through eToro’s website, not links in emails.

Has eToro Ever Been Hacked?

Surprisingly, eToro has never suffered a major hack. Unlike crypto exchanges like Binance, which have been hit by security breaches, eToro has avoided any major incidents.

However, phishing scams are a real risk.

Here’s what happened to me:

A year ago, I got a WhatsApp message from someone claiming to be an eToro representative. They offered me a “bonus deposit match” if I sent money to a “safe account.” Luckily, I knew eToro never contacts users on WhatsApp, so I ignored it.

How to avoid scams:

✅ Only trust emails from @etoro.com.

✅ Never send money to third-party accounts.

✅ Enable 2FA for extra protection.

Scammers often target new traders, so be extra careful with emails and messages.

The Positives – Why I Rate eToro 4.5 Stars

1. Social Trading & CopyTrader – A Game-Changer for Beginners

When I first joined eToro, I had zero experience trading stocks or crypto. That’s when I discovered CopyTrader, and it changed everything.

With CopyTrader, you can copy top investors on the platform. You choose a trader, set an amount, and your portfolio automatically mirrors their trades.

My First Win Using CopyTrader

I copied a trader called JayEdwardSmith, who had a strong track record. I started with £200 and, within a month, saw a 6% profit—not bad for a beginner!

Why CopyTrader is great:

✅ Lets beginners learn by watching experts.

✅ No need to manually trade—auto-invest does the work.

✅ You can diversify by copying multiple traders.

However, not all traders perform well, so it’s important to research their history before copying them.

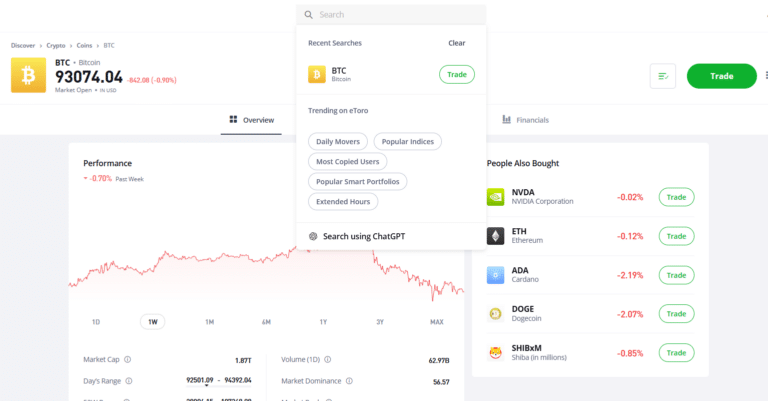

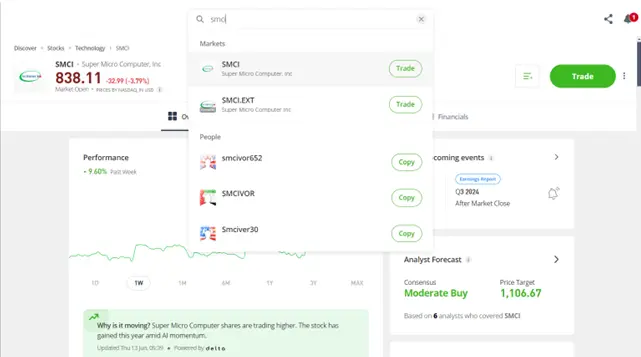

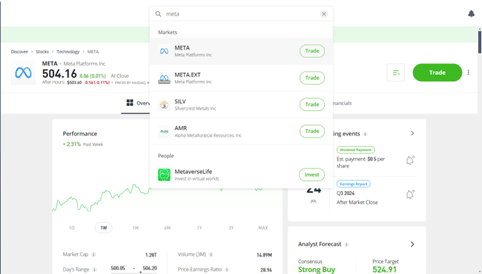

2. User-Friendly Platform – Simple but Not Perfect

I’ve used several trading platforms, but eToro stands out for its clean, beginner-friendly design.

What I Like:

✅ Easy to use: The interface is clear and simple, even for first-timers.

✅ Quick account setup: I signed up in less than 10 minutes.

✅ Great mobile app: Trading on the go is smooth and reliable.

However, if you’re an advanced trader, eToro might feel too basic. Some features, like detailed technical charts, aren’t as in-depth as platforms like TradingView.

3. Free Stock & ETF Trading – But Watch for Hidden Fees

One of eToro’s biggest selling points is zero commission on stocks and ETFs. Unlike traditional brokers that charge £5-£10 per trade, eToro lets you invest for free.

What’s the Catch?

While trading itself is free, hidden fees exist, particularly for UK users. Currency conversion fees (0.5%-1.5%) apply because eToro only operates in USD.

The UK ETF market is worth over £500 billion and is growing 20% year-on-year (www.ft.com). If you’re focused on ETFs, platforms like Trading 212 and DEGIRO may offer more options with lower fees.

💡 Tip: Use a multi-currency account like Wise or Revolut to deposit in USD and avoid conversion fees.

✅ Binance is cheaper for most users, with trading fees as low as 0.1%.

✅ Coinbase Advanced is better than the basic Coinbase platform but still costs more than Binance.

❌ Coinbase’s debit/credit card fees are high (3.99% compared to Binance’s 1.8% – 3%).

Important note: Binance offers 25% off fees if you pay with BNB, reducing costs further.

My Takeaways on Fees

I use Binance for trading because the fees are much lower, especially with BNB discounts. However, if I’m making a quick, small purchase, I sometimes use Coinbase Advanced, as it’s cheaper than the basic Coinbase platform.

The Downsides – What was Less Positive

1. CFD Risks – The Fine Print Most People Miss

CFDs (Contracts for Difference) allow traders to speculate on price movements without owning the actual asset. But here’s the problem:

76% of retail CFD traders lose money on platforms like eToro (www.etoro.com/trading/cfds).

My First CFD Trade – A Costly Mistake

I tried trading CFDs on Tesla stock with a £100 investment and 5x leverage. Tesla’s price dropped 2%, but because of leverage, my loss was 10% (£10). If I had used 10x leverage, I could’ve lost 20% in minutes.

Why CFDs are risky:

❌ Leverage amplifies losses – You can lose more than you expect.

❌ Overnight fees apply – Holding CFDs overnight costs extra.

❌ Market swings can wipe you out – Fast-moving assets like crypto can be dangerous.

I rarely trade CFDs now, and if you’re a beginner, I’d avoid them completely.

3. Limited ETF Choices – Not Ideal for UK Passive Investors

For long-term investing, ETFs are a great option. However, eToro only offers 263 ETFs, which is far fewer than platforms like DEGIRO or Trading 212.

The UK ETF market is worth over £500 billion and is growing 20% year-on-year (www.ft.com). That means more UK investors are turning to ETFs—but eToro doesn’t offer the best selection.

How I Built a Diversified ETF Portfolio on eToro

Since choices are limited, I had to get creative. I picked a mix of:

- Vanguard S&P 500 ETF (VOO) – US stocks 🇺🇸

- iShares MSCI World ETF (URTH) – Global stocks 🌍

- Vanguard FTSE 100 ETF (VUKE) – UK stocks 🇬🇧

This gave me decent diversification, but I still wish eToro offered more choices.

💡 Tip: If you’re a passive investor, consider Trading 212 or DEGIRO instead.

Is Your Money Safe on eToro?

Security is one of my biggest concerns when choosing a broker. After using eToro for six years, I’ve never had issues with deposits or withdrawals, but I did my research to ensure my money was properly protected. Here’s what I found.

Where eToro Stores Your Funds

eToro follows strict financial regulations and keeps client funds separate from its own operating funds. This is important because it means your money isn’t at risk if eToro runs into financial trouble.

How eToro Protects Your Money:

✅ Segregated accounts in Tier-1 banks – Client funds are held in top financial institutions, reducing risk.

✅ No co-mingling with company funds – eToro can’t use your money for its business operations.

However, UK users should know this:

✅ FSCS protection applies to certain investments – eToro (UK) Ltd is FCA-regulated, and some investment services are protected up to £85,000 under FSCS.

❌ Crypto investments are not covered – If you trade Bitcoin, Ethereum, or other cryptocurrencies, FSCS does not apply.

💡 Tip: If you’re depositing large sums, be aware that protection is limited to €20,000, which may not be enough for high-net-worth investors.

Security Features: How eToro Protects You

eToro has several layers of security to keep your account and funds safe.

1. SSL Encryption – Your Data Stays Secure

✅ eToro uses SSL encryption to protect sensitive data.

✅ Prevents hacking and identity theft when making transactions.

✅ Always check for the padlock symbol in your browser when logging in.

2. Two-Factor Authentication (2FA) – A Must-Use Feature

✅ Adds an extra security step by requiring a code sent to your phone.

✅ Stops hackers from accessing your account even if they steal your password.

✅ I personally enable 2FA on all my financial accounts—it’s worth the extra step.

3. How I Nearly Got Scammed – Watch Out for Phishing Attacks

Last year, I got an email claiming to be from eToro support. It said my account had “suspicious activity” and asked me to log in using a provided link. Luckily, I checked the sender’s email and saw it was from a random Gmail address—a clear scam.

How to stay safe:

✅ eToro only contacts users through @etoro.com emails.

✅ Never click on links in unsolicited emails or WhatsApp messages.

✅ If in doubt, go to eToro’s official site and log in from there.

Scammers target new traders, so be extra careful with emails and messages.

Hidden Fees & Costs: What You Need to Know

eToro markets itself as a commission-free broker, but that doesn’t mean trading is 100% free. I learned this the hard way when I made my first deposit and realised there were hidden fees I hadn’t accounted for.

eToro’s Fee Structure – What UK Users Should Know

While eToro doesn’t charge stock trading commissions, it makes money in other ways.

| Fee Type | Cost | Who It Affects? |

|---|---|---|

| Stock & ETF trading | £0 commission ✅ | All users |

| Currency conversion fee | 0.5%-1.5% ❌ | UK users depositing GBP |

| Withdrawal fee | $5 per withdrawal ❌ | All users |

| Inactivity fee | $10/month after 12 months ❌ | Inactive accounts |

1. Currency Conversion Fees – A Costly Surprise

Since eToro only operates in USD, all deposits and withdrawals in GBP are converted to dollars, incurring a 0.5%-1.5% fee.

My mistake:

When I deposited £1,000, I didn’t realise eToro would take a 0.5% cut—so I actually ended up with less money to trade.

💡 How to avoid it: Use a multi-currency account like Wise or Revolut to deposit in USD and bypass eToro’s conversion fees.

CFD Fees & Leverage Risks – Read the Fine Print

CFDs are a major money-maker for eToro, but they come with higher fees.

1. Spread Fees – Why Trading Costs More Than You Think

When you buy or sell CFDs, you pay a spread fee, which is the difference between the buy and sell price.

| Asset Type | Spread Fee |

|---|---|

| Stocks & ETFs | 0.09% per trade |

| Crypto (Bitcoin, Ethereum, etc.) | 1% per trade |

| Forex & Commodities | Varies (0.005%-0.75%) |

💡 What this means:

If you buy £1,000 worth of Bitcoin, you immediately lose £10 due to the spread.

2. Leverage Traps – My Costly Lesson

eToro allows leverage, meaning you can trade with borrowed money. While this can amplify profits, it also increases losses.

My mistake:

I used 5x leverage on a £200 CFD trade. The stock dropped 2%, but my losses were 10% (£20) because of leverage. If I had used 10x leverage, my loss would’ve been £40.

✅ Good for short-term trading (if you know what you’re doing).

❌ Bad for beginners – 76% of CFD traders lose money (www.etoro.com/trading/cfds).

💡 Tip: If you’re new to trading, avoid CFDs completely. Stick to stocks and ETFs instead.

Final Verdict: Is eToro Safe?

fter six years of using eToro, I can confidently say:

✅ eToro is safe and legit – It’s regulated by the FCA, CySEC, and ASIC, and has strong security features.

❌ Biggest downsides: Withdrawal fees, currency conversion costs, and CFD risks.

🎯 Would I recommend it? Yes, especially for beginners and social traders.

Trade Smarter, not Harder

- Copy Trading

- Competetive Fee's

- Multi Asset Platforn

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

FAQs

Is eToro a scam?

No, eToro is a regulated broker operating under the FCA, CySEC, and ASIC. It has over 30 million users worldwide (www.etoro.com). However, scams impersonating eToro exist, so always verify official emails & avoid WhatsApp messages claiming to be from eToro.

Does eToro offer FSCS protection?

Yes, certain regulated investment services on eToro (UK) Ltd are covered by FSCS protection up to £85,000. However, crypto investments are not protected.

Is eToro good for beginners?

Yes! eToro is easy to use, offers CopyTrader to learn from experts, and has a simple interface. However, avoid CFD trading if you’re new, as it’s risky (76% of traders lose money).

You May Also Like:

References:

- eToro Official Website – www.etoro.com

- BBC News – Why Small Investors Are Piling into Share-Trading Apps – www.bbc.co.uk/news/business-57614506

- Statista – Cryptocurrency Adoption in the UK – www.statista.com/statistics/uk-crypto-adoption

- Financial Times – ETF Investing in the UK – www.ft.com/content/uk-etf-growth

- eToro Risk Disclosure (CFD Trading Losses) – www.etoro.com/trading/cfds/

- Zero-commission Stock Trading

- Our #1 Recommended Crypto Platform

- Copy Top Investors Easily

- User-friendly Trading Platform

- Fractional Shares

- Wide Range of Assets

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.