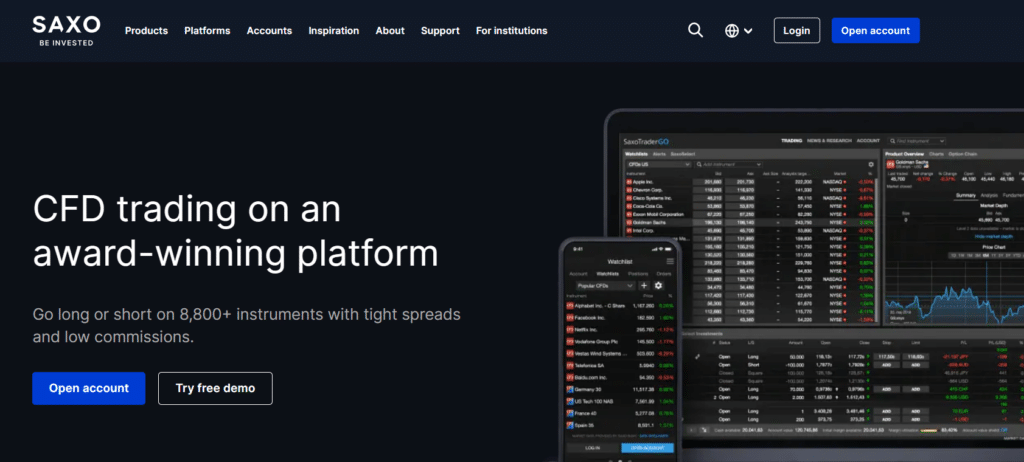

Quick Answer: Is Saxo Any Good for CFD Trading?

Yes, Saxo is acclaimed for CFD trading, offering traders a vast array of over 8,800 instruments, ultra-competitive pricing, an award-winning multi asset trading platform, and a depth of market access that caters adeptly to both novice and experienced investors’ needs.

Who are Saxo and What do They Offer?

Saxo, a name synonymous with innovation and reliability in the financial markets, offers a comprehensive suite of trading and investment solutions.

Known for their advanced trading platforms, Saxo caters to a global clientele, emphasizing transparency, technology, and service excellence.

Their offerings span across a broad spectrum, including Contracts for Difference (CFDs), forex, stocks, bonds trading futures, and much more, making them a one-stop shop for traders and investors alike.

A Brief History of Saxo

Founded in 1992 in Denmark, Saxo has grown from a modest, brokerage services firm to a significant player in the global financial market. Initially focusing on providing online trading services to a niche market, the company has expanded its services worldwide, acquiring numerous awards and accolades along the way. Saxo’s commitment to technology and innovation has been a cornerstone of their success, enabling them to stay ahead in a highly competitive industry.

What do they specialise in?

Saxo specialises in online trading and investment services, particularly in:

-

CFDs: Offering a broad range of CFDs across various asset classes, including indices, commodities, and bonds, enabling traders to speculate on price movements without owning the underlying asset.

-

Forex Trading: Providing one of the most comprehensive forex trading platforms, with access to over 180 currency pairs.

-

Equity Trading: Facilitating access to global stock exchanges, allowing clients to trade shares directly.

-

Portfolio Management: Offering managed portfolios for investors looking for a hands-off approach to investing.

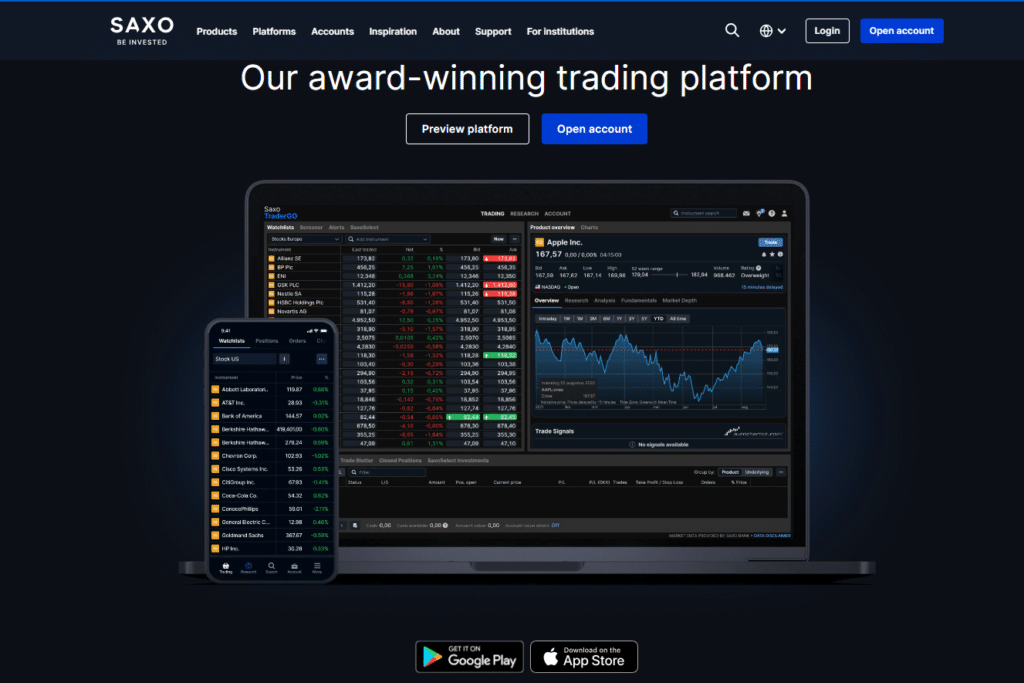

Their advanced trading platforms, SaxoTraderGO and SaxoTraderPRO, cater to all levels of traders, from beginners to professionals, providing sophisticated tools and features for market analysis margin trading, and trade execution.

Their UK Operations

Saxo’s UK operations are pivotal to their global strategy, serving as a gateway to the European financial markets. Regulated by the Financial Conduct Authority (FCA), Saxo offers UK clients:

-

A Secure Trading Environment: Adherence to strict regulatory standards ensures that clients’ funds and transactions are protected.

-

Local Support and Services: Dedicated UK customer support teams and localized services cater to the unique needs of British traders and investors.

-

Access to UK and International Markets: Clients can trade a wide array of asset classes, including UK stocks, bonds, and international markets, all from a single platform.

In summary, Saxo’s extensive product offerings, coupled with their commitment to technology and regulatory compliance, make them a strong contender for traders interested in CFD trading and beyond.

Their UK operations further underscore their commitment to providing localized and globally competitive trading services professional clients.

Saxo’s CFD Trading Offering

Saxo stands out in the competitive CFD trading landscape through its expansive offerings and innovative trading platforms. Traders have access to a wide range of markets, including indices, forex, commodities, shares, and bonds.

Saxo’s approach combines user-friendly interfaces with advanced tools and analytics, catering to both novice and experienced traders. Furthermore, Saxo offers competitive pricing, tight spreads, and low commission rates, making it an attractive option for those looking to trade CFDs.

What makes them Unique

Several features set Saxo apart in the realm of CFD trading:

Comprehensive Market Access: Saxo provides CFD traders with access to global markets, allowing them to trade on price movements of thousands of different assets across the world.

Advanced Trading Tools: Their platforms, SaxoTraderGO and SaxoTraderPRO, offer advanced charting tools, risk management features, and real-time data, empowering traders to make informed decisions.

Educational Resources: A wealth of educational materials and resources is available to traders. Saxo’s insights, webinars, and training modules help traders at all levels enhance their trading skills and knowledge.

Regulatory Assurance: Being regulated by multiple financial authorities worldwide, including the FCA in the UK, Saxo provides a secure and transparent trading environment.

Which Traders This could suit

Saxo’s CFD trading services are designed to meet the needs of a diverse range of traders:

Novice Traders: The simplicity of the SaxoTraderGO platform, combined with extensive educational resources, makes Saxo an excellent choice for beginners looking to enter the world of CFD trading.

Experienced Traders: Advanced traders will appreciate the depth of SaxoTraderPRO’s analytical tools, customizable trading environment, and access to complex order types.

Active Traders: Competitive pricing, including tight spreads and low commissions, alongside high-speed order execution, suits the needs of active traders who value efficiency and cost-effectiveness.

Long-term Investors: Those looking to use CFDs as part of a diversified investment strategy will find Saxo’s market access and portfolio management services beneficial.

In conclusion, Saxo’s blend of accessible trading platforms, rich educational content, and robust stock market and access positions them as a leading choice for individuals looking to engage in CFD trading, regardless of their experience level or trading style.

Saxo’s dedication to providing a comprehensive and user-friendly trading experience makes it suitable for a broad spectrum of traders, from those taking their first steps in the financial markets to seasoned professionals seeking a reliable and advanced trading environment.

Saxo’s CFD Trading Pros and Cons

Exploring Saxo’s CFD trading platform reveals a blend of advantages and areas where professional traders also might seek improvements. Below, we’ll delve into the pros and cons to offer a balanced view of what Saxo offers to retail traders and CFD traders.

Pros

Extensive Market Access: Saxo provides its users with unparalleled access to a wide range of global markets, including forex, stocks, indices, commodities, and bonds, all through CFDs.

Advanced Trading Platforms: With SaxoTraderGO and SaxoTraderPRO, traders of all levels can benefit from robust, intuitive platforms that offer advanced charting, analysis tools, and seamless mobile trading options.

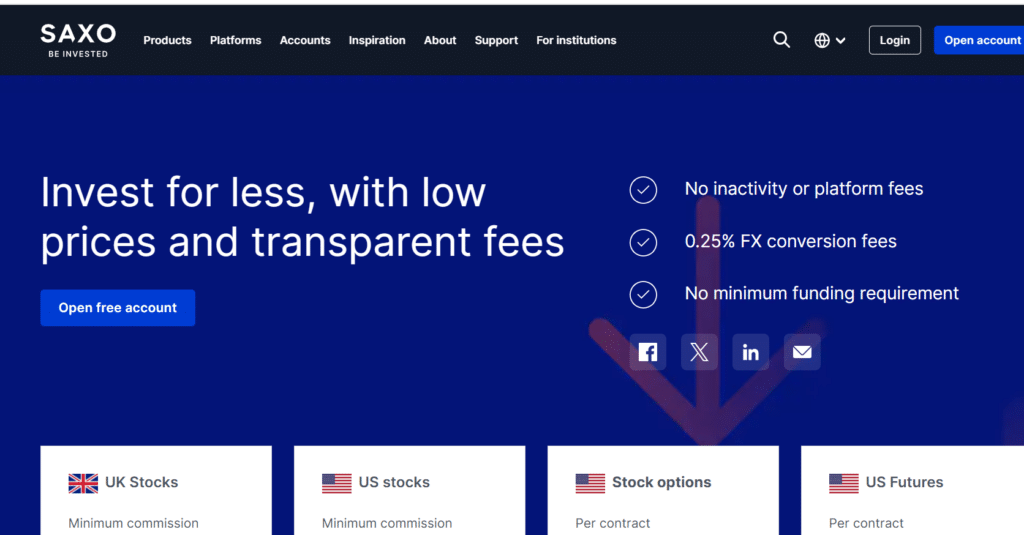

Competitive Pricing: Saxo’s pricing structure is transparent and competitive, featuring tight spreads and low commissions, which can significantly benefit active and high-volume traders.

Strong Regulatory Framework: Being regulated by several top-tier financial authorities, including the UK’s Financial Conduct Authority (FCA), Saxo offers a secure and trustworthy trading environment.

Comprehensive Educational Resources: Saxo’s commitment to trader education is evident through its extensive offering of webinars, guides, and tutorials designed to support traders at every skill level.

High-Quality Customer Support: Traders have access to responsive and knowledgeable customer support, ensuring that help is readily available when needed.

Cons.

Complexity for Beginners: While Saxo offers extensive educational resources, the sheer depth and breadth of its platforms and options can be overwhelming for absolute beginners.

Limited Account Types: Compared to some competitors, Saxo offers fewer account types, which may limit customization options for individual trading needs or preferences.

In summary, Saxo’s CFD trading platform is a strong contender in the financial services industry, offering advanced trading tools, comprehensive market access, and a regulated environment.

While its high minimum deposit and complexity may pose challenges for some, the benefits of robust educational resources, high risk take, competitive pricing, and high-quality support make it an attractive option for serious traders committed to engaging in the global markets.

How Does Saxo Compare to Other Platforms?

Saxo offers an impressive range of financial instruments for traders and investors, catering to a broad spectrum of trading strategies and asset class preferences. Below are the key asset class classes you can trade with Saxo:

Forex

Extensive Currency Pairs: Saxo provides access to a wide range of forex trading options, with over 180 currency pairs available, including major, minor, and exotic pairs. This vast selection allows for significant flexibility in forex trading strategies.

Competitive Spreads: Traders benefit from tight spreads, enhancing trading efficiency and cost-effectiveness in forex markets.

Leverage Options: Saxo offers leverage options for forex trading, enabling traders to open larger positions with a smaller initial investment, though it’s essential to understand the risks involved with leveraged trading.

Stocks & ETFs

Global Market Access: Saxo enables trading in stocks and ETFs from 36 exchanges worldwide, offering traders the opportunity to diversify their portfolios internationally.

Direct Market Access (DMA): For more experienced traders, Saxo provides DMA, allowing for high-speed execution and deeper liquidity.

No Minimum Commission: Saxo offers competitive commission rates for stock and ETF trading, with no minimum commission on US stocks, making it accessible for traders of all levels.

Bonds

Wide Range of Bonds: Traders have access to over 5,000 bonds, including government, corporate, and high-yield bonds from various global markets, enabling diversified fixed-income portfolios.

Direct Access: Saxo offers direct access to the bond markets, allowing traders to buy and sell bonds as easily as stocks, without the need for a specialized broker.

Options

Variety of Options: Saxo provides the ability to trade options on forex, stocks, indices, and more, offering a range of strategies for hedging, speculation, or income generation.

Tools and Resources: Traders can utilize Saxo’s comprehensive tools and resources for options trading, including detailed analytics and risk management tools.

Saxo’s Different Account Types

Saxo caters to a wide range of traders and investors by offering several account types, each designed to meet specific trading needs and goals. The main account types include:

Saxo Essential

Designed for new traders, the Essential account offers access to all trading platforms with lower minimum funding requirements. It includes basic trading features and access to Saxo’s educational resources.

Saxo Classic

The Classic account is suitable for most traders, offering a full range of instruments and access to all Saxo platforms and tools without a high minimum deposit requirement or withdrawal fees. Customer support and comprehensive educational materials are included.

Saxo Platinum

Aimed at serious traders, the Platinum account provides more competitive pricing, tighter spreads, and higher service levels. with Platinum accounts, members also benefit from priority customer support and access to exclusive products and services.

Saxo VIP

The VIP account is the premium option, offering the best prices, lowest commissions, and highest priority in customer support. VIP clients have direct access to Saxo’s team of strategists and personalized support from an account manager.

Each account type is designed to scale with the trader’s experience, trading conditions and investment size, with other brokers ensuring that Saxo clients can select the account that best fits their trading strategy and goals.

Want more on Saxo, you might like our Saxo Review

FAQs

Trading CFDs with Saxo gives you access to a wide range of markets including forex, stocks, commodities, and indices. It allows for leverage and margin trading, enabling you to potentially increase your returns. However, it’s important to remember that trading CFDs carries a high level of risk and can result in losses that exceed your deposits.

Yes, retail investor accounts at Saxo can trade CFDs. The platform offers tools and resources tailored to retail traders, including educational materials to help you understand CFD trading and the risks involved.

Saxo Markets is part of Saxo Bank Group, which is regulated by top-tier financial authorities around the world. This ensures a high level of security and protection for your funds. Additionally, Saxo offers negative balance protection to retail traders, safeguarding them from losing more or lose money when trading more than they have in their accounts.

Margin trading with Saxo allows you to withdraw funds to open larger positions than your current account balance would permit, at high risk but potentially increasing your returns. Saxo provides competitive margin rates and clear, transparent information on all trading costs associated with CFDs and other instruments.

Yes, Saxo provides direct market access (DMA) for trading CFDs, allowing you to trade directly into the order books of global stock exchanges. This feature is particularly beneficial for experienced traders looking for greater control over their trades and access to deeper liquidity.

Seasoned finance professional with 10+ years' experience. Chartered status holder. Proficient in CFDs, ISAs, and crypto investing. Passionate about helping others achieve financial goals.

Seasoned finance professional with 10+ years' experience. Chartered status holder. Proficient in CFDs, ISAs, and crypto investing. Passionate about helping others achieve financial goals.