Is Trading 212 Safe? An Honest Evaluation

Thomas Drury

Co-Founder

Seasoned finance professional with 10+ years' experience. Chartered status holder. Proficient in CFDs, ISAs, and crypto investing. Passionate about helping others achieve financial goals.

Twitter ProfileAuthor Bio

Dom Farnell

Co-Founder

An investor and blogger with a focus on financial markets and wealth management. He’s dedicated to helping others make informed investment choices through straightforward and engaging content.

Twitter ProfileAuthor Bio

Fact Checked

How we test

At The Investors Centre, we pride ourselves on our rigorous fact-checking process. To delve deeper into our meticulous testing procedures and discover how we ensure accuracy and reliability, visit our dedicated page on how we test.

Risk Warning

Please note that the information provided by The Investors Centre is for educational purposes only and should not be considered financial advice. Always consult a professional before making any investment decisions.

Last Updated 27/01/2025

When I first started trading, one of my biggest concerns was whether the platform I was using was safe. After all, you’re trusting your hard-earned money to a company, and the last thing you want is to worry about it disappearing into the void. That’s exactly why I decided to dig into Trading 212. It’s one of the most talked-about platforms out there, but how secure is it really?

In this article, I’ll take a closer look at Trading 212’s safety measures, including its regulation, how it protects user funds, and the potential risks. By the end, you’ll have a clear idea of whether this platform is a safe choice for your trading journey.

Quick Answer: Is Trading 212 Safe?

Yes, Trading 212 is considered safe for most users. It is regulated by the FCA in the UK and other authorities, uses robust encryption, and segregates client funds. However, as with any trading platform, it’s essential to be aware of risks, especially in volatile markets.

Featured Broker - Trading 212

Use Promo code 'TIC' to get a free share worth up to £100!

Capital at risk.

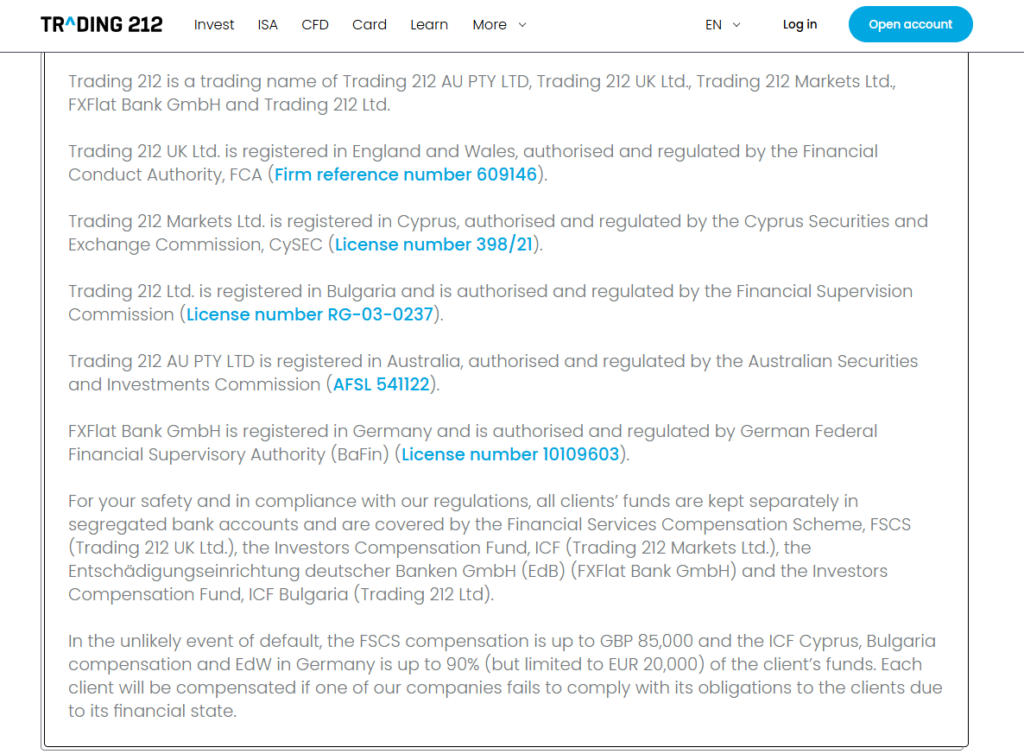

Who Regulates Trading 212?

One of the first things I check when assessing a platform’s safety is its regulation, and Trading 212 doesn’t disappoint. It’s authorised and regulated by the Financial Conduct Authority (FCA) in the UK, one of the most reputable financial regulators in the world. This means Trading 212 must follow strict rules about transparency, client fund protection, and operational standards.

For users in Europe, Trading 212 is also compliant with MiFID II regulations, which provide additional layers of investor protection. These regulations are designed to ensure fair trading practices and safeguard your money.

Another reassuring point is the Financial Services Compensation Scheme (FSCS). For UK-based clients, Trading 212 protects funds up to £85,000 through this scheme, ensuring that even in the unlikely event the company collapses, your money is still safe.

When I discovered this, it gave me peace of mind knowing that the platform isn’t just operating on goodwill—it’s backed by solid regulations that are designed to protect traders like you and me.

| Feature | Details |

|---|---|

| Regulator | Financial Conduct Authority (FCA), UK; CySEC (Cyprus Securities and Exchange Commission), EU |

| Regulatory Compliance | MiFID II (Markets in Financial Instruments Directive II) for fair trading and investor protection |

| Client Fund Protection | Segregated client funds held in separate accounts to ensure they are not used for company operations |

| Compensation Scheme | FSCS (Financial Services Compensation Scheme) protects UK clients' funds up to £85,000 |

| Encryption | Advanced encryption protocols protect personal and financial data during transactions |

| Two-Factor Authentication | Yes, offering additional security against unauthorised access to accounts |

| Headquartered | London, United Kingdom |

| Founded | 2004 |

| Ownership | Privately owned by Trading 212 Group Limited |

| Reputation | Widely regarded as a trusted platform for trading; has a significant user base and positive user feedback |

| Key Risks | Market volatility and user error (e.g., misuse of leverage) remain potential risks to individual traders |

Security Features: How Does Trading 212 Protect Your Funds?

When it comes to security, Trading 212 takes several robust measures to ensure your funds and data are safe. Here’s a breakdown of how the platform protects its users:

Fund Segregation

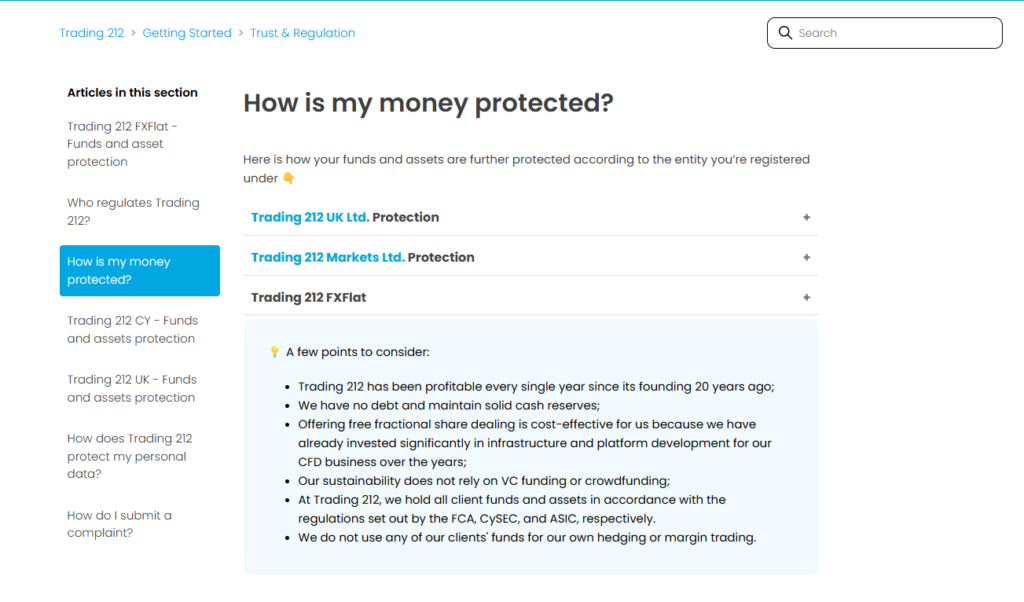

Trading 212 complies with strict regulations requiring the segregation of client funds. This means that your money is held in separate bank accounts, entirely independent of the company’s operational accounts. Even in the unlikely event of Trading 212 going bankrupt, your funds are safe from creditors. This safeguard ensures that your deposits are not at risk due to company mismanagement.

Encryption

The platform uses advanced encryption technology to secure your personal data and transactions. All communication between your device and Trading 212’s servers is encrypted, ensuring that sensitive information like passwords and financial data remains protected from hackers.

Account Protection

Trading 212 also prioritises account security with features like two-factor authentication (2FA). This adds an additional layer of protection by requiring a second verification step (e.g., a code sent to your phone) before allowing access to your account. This significantly reduces the risk of unauthorised access.

Certifications and Audits

As a regulated platform, Trading 212 is required to undergo regular audits and comply with industry standards. This ensures that its security measures remain up-to-date and effective against evolving threats.

These features make Trading 212 a platform you can trust with your funds, although it’s always wise to take your own precautions when trading.

The Pros and Cons of Trading 212’s Safety Measures

Pros

- Regulated by Major Authorities: Trading 212 is overseen by reputable regulators like the FCA and CySEC, ensuring compliance with strict financial rules.

- Fund Segregation and FSCS Protection: Client funds are held in segregated accounts, and UK clients are protected up to £85,000 under the FSCS.

- Strong Encryption: The platform uses cutting-edge encryption technology to safeguard data and transactions.

- Data Privacy: Trading 212 follows strict privacy policies to protect user information.

Cons

- No Guaranteed Returns: While Trading 212 provides a secure platform, trading itself is inherently risky, and no system can guarantee profits.

- Limited Customer Service: Some users have reported delays in resolving urgent issues due to limited support options.

- Vulnerability to Market Risks: The platform’s leverage features can amplify gains but also increase the risk of significant losses if not used carefully.

- User Errors: Trading 212’s simplicity can lead to overconfidence among beginners, potentially resulting in costly mistakes.

Understanding these pros and cons can help you make an informed decision about whether Trading 212 aligns with your trading needs.

How to Safeguard Yourself When Using Trading 212

While Trading 212 provides solid security measures, you also have a role to play in keeping your account and funds safe. Here are some practical tips:

- Enable Two-Factor Authentication: Activate 2FA to add an extra layer of security to your account.

- Trade Responsibly: Avoid trading with money you can’t afford to lose, especially when using leverage.

- Use Secure Connections: Always access Trading 212 from a secure internet connection. Avoid using public Wi-Fi when logging in or making transactions.

- Update Passwords Regularly: Choose strong, unique passwords and update them periodically.

- Monitor Account Activity: Regularly check your account for unauthorised transactions or suspicious activity.

By taking these precautions, you can minimise risks and enjoy a safer trading experience on Trading 212.

| Aspect | Details |

|---|---|

| Client Fund Storage | Segregated in top-tier banks to protect client funds from company liabilities. |

| Regulatory Authorities | FCA (UK), CySEC (EU), ensuring adherence to strict trading and operational standards. |

| Compensation Coverage | FSCS (UK) provides up to £85,000 of protection for eligible client funds. |

| Encryption Level | Industry-standard SSL encryption secures all data exchanges and transactions. |

| Authentication Options | Two-factor authentication (2FA) for enhanced account security against unauthorised access. |

| Audit Compliance | Regular audits required under FCA and CySEC regulations to maintain transparency and security. |

| Platform Accessibility | Available on web and mobile apps, both of which feature robust security protocols. |

| Market Risk Warnings | Clear warnings on leveraged products and the risks associated with CFD trading. |

| User Education | Resources available to help traders understand the platform and avoid common mistakes. |

| Customer Support | Support provided via app, email, and knowledge base, though response times can vary. |

Comparing Trading 212’s Safety to Other Platforms

When assessing whether Trading 212 is safe, it’s helpful to compare it to other popular trading platforms like eToro, Plus500, and IG. Each of these platforms offers strong security and regulation, but there are differences worth noting:

| Feature | Trading 212 | eToro | Plus500 | IG |

|---|---|---|---|---|

| Regulation | FCA, CySEC | FCA, ASIC | FCA, CySEC | FCA |

| Fund Protection | Segregated Funds | Segregated Funds | Segregated Funds | FSCS Cover (£85,000) |

| 2FA Available | Yes | Yes | Yes | Yes |

| Compensation Scheme | FSCS (UK clients) | No specific FSCS | No specific FSCS | FSCS (£85,000) |

| Encryption | Advanced SSL encryption | Advanced SSL encryption | Advanced SSL encryption | Advanced SSL encryption |

| Customer Support | Moderate | Moderate | Limited | Strong |

Trading 212 holds its own when compared to eToro, Plus500, and IG, offering strong regulation, fund protection, and robust security features. While platforms like IG have additional FSCS coverage for all clients, Trading 212 still provides excellent safeguards for most users, making it a reliable choice.

My Verdict: Is Trading 212 Safe to Use?

After exploring Trading 212’s regulatory framework, fund protection, and security features, I can confidently say that the platform is safe from a technical and regulatory standpoint. It is overseen by reputable regulators like the FCA and CySEC, ensures client funds are segregated, and employs industry-standard encryption to protect user data.

That said, it’s important to remember that no trading platform is entirely risk-free. Trading inherently carries risks, especially when leveraging CFDs or trading in volatile markets. While Trading 212 provides tools to manage risk, such as stop-loss orders and negative balance protection, the responsibility ultimately lies with the trader to use these tools wisely.

For beginners, Trading 212 is an excellent choice thanks to its simplicity and security. More experienced traders will appreciate its regulatory compliance and fund protection, but they should weigh these benefits against its relatively basic advanced tools.

My recommendation? If you’re just starting, give Trading 212 a try, but start with a small deposit to familiarise yourself with its features and risks before diving deeper.

Trade Smarter, not Harder

- Invest as little as £1

- Earn daily interest

- Earn 4.9% AER on GBP

When investing, your capital is at risk and you may get back less than invested. Past performance doesn’t guarantee future results.

FAQs

Yes, Trading 212 is regulated by the Financial Conduct Authority (FCA) in the UK and the Cyprus Securities and Exchange Commission (CySEC) in the EU. These regulators ensure the platform adheres to strict financial and operational standards, including fund protection.

Trading 212 safeguards your funds by keeping them in segregated bank accounts, separate from the company’s operational accounts. For UK clients, funds are also protected up to £85,000 under the Financial Services Compensation Scheme (FSCS).

Yes, Trading 212 offers two-factor authentication to enhance account security. This additional layer of protection ensures that even if someone gains access to your password, they won’t be able to access your account without the secondary verification code.

Featured Blogs

Use Promo code 'TIC' to get a free share worth up to £100!

When investing, your capital is at risk and you may get back less than invested. Past performance doesn’t guarantee future results.