Is Uphold Safe?

Adam Woodhead

Co-Founder

Adam is a Co-Founder and content creator for The Investors Centre. His key areas of interest and expertise are cryptocurrency and blockchain technology.

Twitter ProfileAuthor Bio

Thomas Drury

Co-Founder

Seasoned finance professional with 10+ years' experience. Chartered status holder. Proficient in CFDs, ISAs, and crypto investing. Passionate about helping others achieve financial goals.

Twitter ProfileAuthor Bio

Fact Checked

How we test

At The Investors Centre, we pride ourselves on our rigorous fact-checking process. To delve deeper into our meticulous testing procedures and discover how we ensure accuracy and reliability, visit our dedicated page on how we test.

Risk Warning

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

Updated 06/02/2025

Security is one of the most crucial aspects when choosing a cryptocurrency and asset trading platform. With hacking incidents and exchange failures making headlines, investors need to ensure their funds are safe. Uphold has gained popularity as a multi-asset platform, offering crypto, stocks, and even precious metals—but the real question remains: Is Uphold safe?

This article will break down Uphold’s security measures, regulatory compliance, and potential risks. If you’re a UK-based investor looking to use Uphold for cryptocurrency trading or other financial assets, this guide will help you determine whether it’s a secure choice.

Quick Answer: Is Uphold Safe?

Yes, Uphold is considered a safe platform due to its FCA registration in the UK, encryption protocols, and real-time proof of reserves. However, as a custodial platform, users do not have full control over their private keys, making external wallets a recommended security measure.

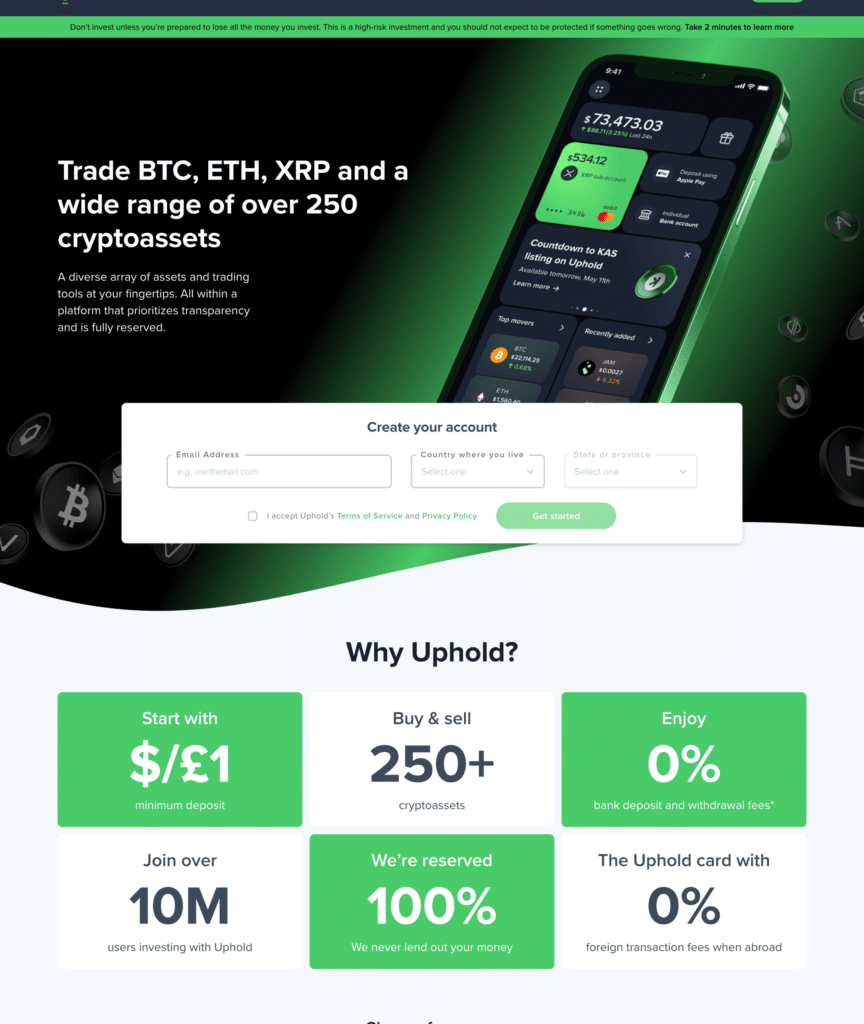

What Is Uphold? A Quick Overview

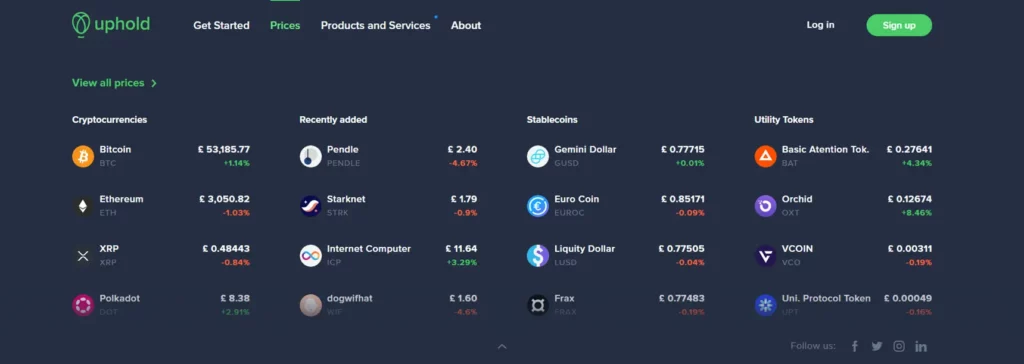

Launched in 2015, Uphold is a digital asset platform that allows users to trade cryptocurrencies, stocks, forex, and even precious metals. Unlike traditional exchanges that focus solely on crypto, Uphold offers a broader range of financial instruments, making it an appealing choice for diversified investors.

Uphold’s standout feature is its transparent proof-of-reserves model, which allows users to verify that the company holds enough assets to back customer balances. Additionally, for UK users, Uphold is regulated by the Financial Conduct Authority (FCA), adding an extra layer of credibility and security.

📌 Key Facts About Uphold

| Feature | Details |

|---|---|

| Founded | 2015 |

| Headquarters | London, UK |

| Regulatory Status | FCA Registered (UK) |

| Assets Supported | Crypto, Stocks, Metals, FX |

| User Base | 10M+ Users Worldwide |

How Secure Is Uphold? Breaking Down Its Safety Features

Uphold implements multiple security layers to protect user funds and personal data. From encryption protocols to compliance with financial regulations, the platform takes various measures to ensure safety. Let’s examine its core security features.

Platform Security

Uphold prioritizes security by utilizing end-to-end encryption, ensuring that sensitive user data is protected from unauthorized access. The platform also employs cold storage for the majority of cryptocurrency holdings, reducing exposure to online threats and hacks.

To further enhance security, Uphold uses multi-layer authentication for transactions, including password verification and additional approvals for large withdrawals.

Unlike some exchanges, Uphold does not provide direct insurance for individual user accounts. However, it maintains a real-time proof-of-reserves system, which ensures that all assets on the platform are fully backed and accessible at any time.

Account Protection

For individual account security, Uphold offers:

- Two-Factor Authentication (2FA): Users must verify their identity via SMS, authentication apps, or email.

- Biometric Login: Fingerprint and facial recognition for mobile users.

- Device Whitelisting: Users can approve trusted devices, preventing unauthorized logins.

In case of account compromise, Uphold’s recovery process includes identity verification and security questions, helping users regain access securely.

Regulatory Compliance & Transparency

Uphold is registered with the UK Financial Conduct Authority (FCA) and complies with anti-money laundering (AML) and know-your-customer (KYC) regulations. This ensures that the platform adheres to strict financial security standards.

One of Uphold’s key transparency features is its proof-of-reserves policy, which provides real-time data showing that user funds are fully backed 1:1. This prevents issues like liquidity shortages or insolvency risks.

📌 Uphold’s Security Features

| Security Feature | Details |

|---|---|

| Encryption | End-to-end encryption for data security |

| Cold Storage | Majority of crypto assets held offline |

| Two-Factor Auth | Required for account access and withdrawals |

| Regulatory Compliance | FCA Registered, follows AML & KYC rules |

| Proof of Reserves | Ensures all user funds are backed 1:1 |

Risks and Limitations of Using Uphold

While Uphold offers a secure and regulated platform, it’s important to consider its limitations before investing. Here are the key risks associated with using Uphold.

Fees and Hidden Costs

Uphold’s fee structure differs from traditional exchanges, as it primarily relies on spread fees rather than fixed trading fees. These spreads vary based on the asset but are generally higher than competitors like Binance or Coinbase Pro. For example, crypto-to-crypto transactions can carry a spread fee of up to 1.85%, whereas Coinbase and Binance offer lower fees, particularly for high-volume traders.

Additionally, deposit and withdrawal fees can be costly. While bank deposits are typically free, withdrawing to a bank account or crypto wallet may incur charges, making Uphold less cost-effective for frequent transactions.

Customer Support Challenges

One common complaint among Uphold users is its slow customer support response times. Unlike some competitors that offer live chat or 24/7 phone support, Uphold primarily relies on email-based support, which can result in delays during peak trading times. Users have reported frustration with account verification issues and transaction delays due to the lack of immediate assistance.

Custodial Wallet Risks

Uphold operates as a custodial platform, meaning users do not control their private keys. While this makes it easier for beginners, it also means users must trust Uphold to secure their assets. If the platform were to experience a security breach or financial instability, user funds could be at risk.

For long-term security, it’s recommended that users transfer large holdings to private wallets where they control their own keys.

📌 Potential Risks of Using Uphold

| Risk | Details |

|---|---|

| High Fees | Spread fees higher than some competitors |

| Custodial Wallet | Users don’t control private keys for their assets |

| Support Issues | Limited customer support options |

| Regulatory Risks | Compliance rules may change, affecting users |

Is Uphold Safe for Beginners?

Uphold is considered a beginner-friendly platform due to its intuitive user interface, diverse asset options, and simple onboarding process. Users can easily buy and trade crypto, stocks, and metals from one account, making it a convenient choice for new investors.

Security for Beginners

Uphold also integrates strong security features like two-factor authentication (2FA), encryption, and FCA oversight, which are critical for protecting new users who may not yet be familiar with best security practices.

Factors to Consider

While the platform is easy to use, beginners should be aware of the higher fees compared to other exchanges. Additionally, since Uphold is a custodial platform, users do not control their private keys, which may be a disadvantage for those seeking full ownership of their assets.

📌 Why Uphold Appeals to Beginners

| Feature | Why It’s Beginner-Friendly |

|---|---|

| User Interface | Simple, easy-to-use platform |

| Security Features | 2FA, encryption, and FCA oversight |

| Asset Variety | Trade crypto, stocks, and metals in one place |

| Fiat Support | Allows GBP deposits via bank transfer or card |

Tips to Maximize Your Security on Uphold

Even though Uphold offers strong security features, users should take additional steps to safeguard their accounts and assets.

- Enable Two-Factor Authentication (2FA): This adds an extra layer of security for logging in and making transactions.

- Use a Strong, Unique Password: Avoid using the same password across multiple platforms to reduce the risk of hacking.

- Store Large Holdings in a Hardware Wallet: If you plan to hold crypto long-term, transfer assets to a hardware wallet for enhanced security.

- Monitor Transactions Regularly: Keep an eye on account activity to detect any suspicious withdrawals or unauthorized logins.

📌 Security Best Practices for Uphold Users

| Security Tip | How It Helps |

|---|---|

| Enable 2FA | Protects account from unauthorized logins |

| Strong Password | Reduces the risk of hacking attempts |

| Use Hardware Wallet | Keeps crypto safe from exchange risks |

| Monitor Activity | Detects fraud or suspicious withdrawals |

Conclusion: Should You Use Uphold?

Uphold offers strong security measures, including FCA regulation, encryption, two-factor authentication, and proof-of-reserves transparency. These features make it a reliable platform for trading crypto, stocks, and other assets.

However, higher fees and the custodial nature of Uphold’s wallets mean users should weigh their options carefully. While the platform is secure, users don’t control their private keys, making external wallets a better choice for long-term holdings.

Final Recommendation:

Uphold is generally safe, but users should enable 2FA, use strong passwords, and store large holdings in private wallets for maximum security.

Trade Smarter, not Harder

- Multi-Asset

- Low Minimum Trades

- Fast Account Set up

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

FAQs

Yes, Uphold is FCA-registered, ensuring compliance with UK financial regulations.

No, while it follows security best practices, user funds are not insured against hacks or insolvency.

It’s possible, but using a private wallet is safer for long-term storage.

Uphold follows AML and KYC laws, so transactions may be reported to regulators.

Both offer strong security, but Coinbase has a longer track record and stronger regulatory compliance.

Featured Blogs

Award Winning Crypto Exchange!

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.