Quick Answer

Saxo ISA offers tax-free growth on profits and dividends, ideal for long-term savings and retirement. It has limited investment options. A Saxo Trading Account provides more flexibility and investment choices (including complex instruments) but profits are taxed and require more investment knowledge.

Page Contents

Introduction to Saxo

Who are Saxo?

Saxo is a leading Danish investment bank with a global presence. Founded in 1992, they’ve become a major player in online trading and investment, serving millions of clients worldwide. Unlike traditional high-street banks, Saxo focuses on empowering individuals to take charge of their finances through user-friendly online platforms and a vast array of investment options.

Saxo ranked highly in our Saxo review

What Investment Products Does Saxo Offer?

Saxo prides itself on being a one-stop shop for diverse investment needs. Whether you’re a seasoned investor or just starting your journey, they provide access to a comprehensive selection of products, including:

- Stocks and Shares: Invest directly in companies you believe in and potentially profit from their growth.

- Exchange-Traded Funds (ETFs): These convenient baskets of assets offer a diversified way to invest in a specific sector or market.

- Bonds: Loan money to governments or companies and earn regular interest payments in return.

- Mutual Funds: Pool your money with other investors and benefit from professional management expertise.

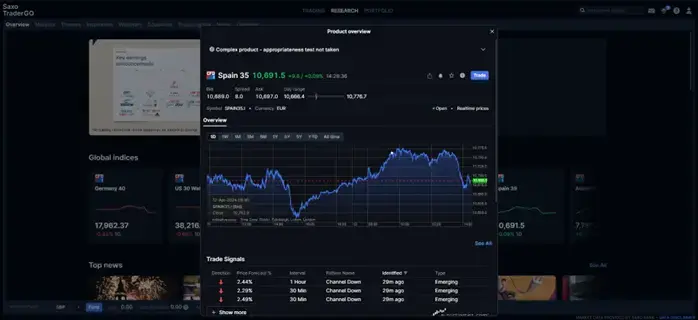

Beyond these traditional options, Saxo also offers a wider range of investment instruments for experienced users:

- Forex: Speculate on currency movements and potentially profit from exchange rate fluctuations.

- Contracts for Difference (CFDs): Gain exposure to the price movements of an underlying asset (like stocks or commodities) without directly owning it. CFDs are complex instruments and carry high risk of losing money rapidly (Source: Saxo Risk Warning: https://www.home.saxo/legal/risk-warning/saxo-risk-warning).

- Futures: Lock in a price for buying or selling an asset at a future date. Futures contracts are complex and can be risky.

- Commodities: Invest in physical commodities like gold, oil, or wheat, potentially benefiting from price fluctuations.

- Forex Options: Gain the right, but not the obligation, to buy or sell a currency at a specific price by a certain date. Forex options are complex financial instruments (Source: Saxo Product Guides – Forex Options: https://www.home.saxo/products/listed-options).

- Listed Options: Similar to forex options, but based on underlying assets like stocks or ETFs. Listed options involve significant risks https://www.optionseducation.org/).

Additionally, Saxo provides solutions for those seeking a more hands-off approach:

- Managed Portfolios & Investments: Benefit from professional investment management services that tailor a portfolio to your goals and risk tolerance.

Understanding The Saxo Account Options

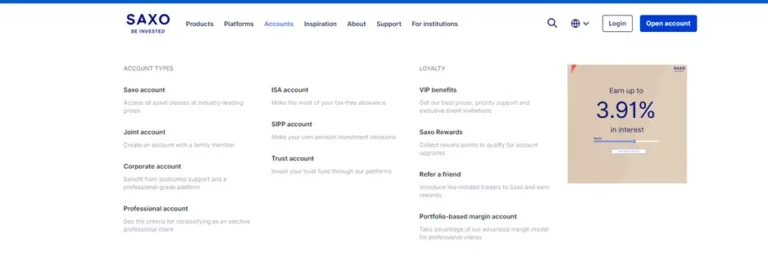

While Saxo primarily offers two main account types – Saxo ISAs and Trading Accounts – they also cater to a wider range of investor needs with additional account options:

Saxo ISA (Individual Savings Account): This account prioritizes tax benefits for long-term investment strategies. (Refer to previous explanation of Saxo ISA features).

Saxo Trading Account: This account prioritizes flexibility and access to a wider range of investment options. (Refer to previous explanation of Saxo Trading Account features).

Beyond these core options, Saxo offers specialized accounts for specific situations:

Joint Account: Open an account with a family member and manage investments together. This can be useful for shared financial goals or teaching younger generations about investing.

Corporate Account: Designed for businesses to manage their investment portfolios.

Professional Account: For experienced investors who meet certain criteria, Saxo offers Professional Accounts with potential benefits like higher leverage limits. However, these accounts also come with increased responsibility and risk.

SIPP Account (Self-Invested Personal Pension): Invest for your retirement within a tax-efficient wrapper. This option allows you to choose your own investments within the SIPP structure.

Trust Account: Manage investments on behalf of a beneficiary, often used for estate planning or managing assets for minors.

Saxo ISA Explained

Imagine growing your wealth without the taxman taking a bite! That’s the beauty of a Saxo ISA. The UK government allows you to stash away a chunk of your money each year (currently £20,000 as of April 2024) within an ISA and watch it flourish tax-free.

Tax Benefits of a Saxo ISA

Here’s how these tax benefits work:

- No Capital Gains Tax: Any profits you generate by selling investments held within your ISA are exempt from capital gains tax. This means you keep more of your hard-earned returns.

- No Income Tax on Dividends: Dividends are payments companies sometimes distribute to their shareholders. Any dividends earned on investments within your ISA are free from income tax, allowing your money to compound faster.

These tax advantages make Saxo ISAs a fantastic tool for long-term investment goals like retirement planning. The power of compounding interest truly shines when your profits grow tax-free over extended periods.

Here’s a real-world example:

Let’s say you invest £10,000 in a Saxo ISA and it grows by 10% annually for 20 years. Without an ISA, you’d pay capital gains tax on the profits, potentially reducing your overall return. However, within a Saxo ISA, that growth accumulates tax-free. The result? You could potentially end up with a significantly larger sum compared to a non-ISA investment account.

Eligible Investments for a Saxo ISA

While Saxo ISAs offer fantastic tax benefits, it’s important to understand what you can invest in. Saxo provides a good selection of investment options suitable for long-term growth strategies within an ISA, including:

- Stocks and Shares

- Exchange-Traded Funds (ETFs)

- Investment Trusts

- Selection of Bonds

Saxo ISA vs. Trading Account

Here’s a breakdown of the key differences between Saxo ISAs and Trading Accounts to help you make an informed decision.

Choosing the Right Account for Your Goals

Saxo ISA:

- Ideal for: Long-term investors prioritizing tax efficiency.

- Benefits:

- Tax-free growth on profits and dividends.

- Great for retirement planning or long-term savings goals.

- Considerations:

- Limited investment options compared to a Trading Account (focus on long-term suitable assets).

Saxo Trading Account:

- Ideal for: Experienced investors seeking flexibility and a wider range of investment options.

- Benefits:

- Access to a vast array of investment options, including stocks, ETFs, bonds, forex, CFDs, futures, and even commodities.

- Greater control over your investment strategy, allowing for advanced techniques.

- Considerations:

- Profits are subject to capital gains tax regulations.

- Requires a higher level of investment knowledge and experience due to the wider range of potentially complex instruments.

Key Differences in Fees and Account Management

Both Saxo ISA and Trading Accounts have associated fees, but the structure can differ slightly. Here’s a breakdown to consider:

- Account Fees: Saxo ISAs might have a flat annual fee, while Trading Accounts might have a custody fee based on the total value of your assets.

- Trading Fees:Both accounts have trading fees associated with buying and selling investments. These fees can vary depending on the asset type and trading volume. Saxo offers commission structures with potentially lower fees for higher trading activity.

- Additional Fees: Certain complex instruments within a Trading Account, like CFDs, might have additional fees associated with holding them overnight.

Management Considerations:

- Saxo ISAs: Generally considered a “set and forget” option for long-term investing.

- Saxo Trading Accounts: Require more active management due to the wider range of investment options and potentially higher volatility. Saxo offers research tools and educational resources to help you navigate the platform, but ultimately, the investment decisions lie with you.

Deciding between a Saxo ISA and a Trading Account depends on your goals. Saxo ISAs are ideal for long-term savings or retirement plans, as profits and dividends grow tax-free. Saxo Trading Accounts provide more flexibility and a wider range of choices, including complex instruments, but profits are subject to tax and require a higher level of investment knowledge.

Key Takeaways: Choosing the Right Account

The best account for you depends on your individual circumstances and investment goals. Here’s a quick guide:

- For tax-efficient long-term investing: Saxo ISA

- For broader investment options and potentially higher risk strategies: Saxo Trading Account

- For managing investments with a family member: Joint Account

- For businesses: Corporate Account

- For experienced investors seeking higher leverage (with increased responsibility): Professional Account

- For retirement planning: SIPP Account

- For managing investments on behalf of someone else: Trust Account

Frequently Asked Questions

What is a Saxo ISA account and who is it for?

A Saxo ISA account is a tax-efficient savings account available to UK residents. This account allows individuals to invest in a range of assets including stocks, bonds, and funds without paying tax on gains and dividends. It’s ideal for savers and investors looking to maximize their returns without the tax burden associated with other types of investment accounts.

How much can I invest in a Saxo ISA account in 2024?

For the tax year 2024, the annual subscription limit for an ISA with Saxo, as set by the UK government, remains at £20,000. This means you can invest up to this amount across all your ISA accounts in the year without paying tax on the returns from these investments.

What types of investments can I hold in my Saxo ISA account?

Saxo’s ISA account offers a wide range of investment options. You can hold stocks, bonds, ETFs, and mutual funds. This diversity allows you to tailor your portfolio according to your risk tolerance and investment goals while taking advantage of the tax benefits.

Can I transfer existing investments into my Saxo ISA account?

Yes, Saxo allows transfers from both Cash ISAs and Stocks and Shares ISAs held with other providers. This transfer does not affect your ISA subscription limit for the year as long as the investments were already within an ISA wrapper. However, it’s important to check whether there are transfer fees or potential tax implications before proceeding.

What are the fees associated with a Saxo ISA account?

Saxo typically charges management fees for ISA accounts, which may include annual service charges and transaction fees for buying and selling assets within the ISA. It’s vital to review the specific fee structure on Saxo’s website or contact their customer service for detailed information about current charges.

How do I open a Saxo ISA account and what are the eligibility requirements?

To open a Saxo ISA account, you must be a UK resident and 18 years or older. You can apply directly through Saxo’s website, where you will need to provide personal identification and residency details. It’s a straightforward process intended to be completed online in just a few steps.

What happens to my Saxo ISA if I move abroad?

If you move abroad, you can keep your Saxo ISA open and continue to benefit from the tax-free status on existing investments. However, you will not be able to contribute further funds to the ISA unless you return to the UK and meet the residency requirements again.