How to Short GameStop Shares in the UK: Beginners Guide

Thomas Drury

Co-Founder

Seasoned finance professional with 10+ years' experience. Chartered status holder. Proficient in CFDs, ISAs, and crypto investing. Passionate about helping others achieve financial goals.

Twitter ProfileAuthor Bio

Dom Farnell

Co-Founder

Dom, a Co-Founder at TIC, is an avid investor and experienced blogger who specialises in financial markets and wealth management. He strives to help people make smart investment decisions through clear and engaging content.

Twitter ProfileAuthor Bio

Fact Checked

How we test

At The Investors Centre, we pride ourselves on our rigorous fact-checking process. To delve deeper into our meticulous testing procedures and discover how we ensure accuracy and reliability, visit our dedicated page on how we test.

Risk Warning

Please bear in mind that trading involves the risk of capital loss. 51% to 84% of retail investor accounts lose money when trading CFDs with the providers below. You should consider whether you can afford to take the high risk of losing your money.

Last Updated 08/01/2025

Have you ever wondered how traders profit when stocks like GameStop decline in value? Short selling allows you to take advantage of falling stock prices, and it has become particularly popular during GameStop’s dramatic market fluctuations.

GameStop rose to fame during the 2021 “meme stock” frenzy, experiencing wild price swings driven by retail traders and social media hype. For traders who anticipate the stock price will fall, short selling offers a way to potentially profit from that movement.

In this guide, I’ll explain how to short GameStop shares in the UK, step by step. We’ll also cover the risks you should consider before diving in—because short selling isn’t without its challenges.

Quick Answer: How to Short GameStop Shares in the UK

To short GameStop shares in the UK, you will need to use a trading platform that offers CFDs (Contracts for Difference). Simply open an account, find GameStop under the available assets, and place a sell order to open a short position.

What Is Short Selling?

Short selling is a trading strategy where you profit when the price of an asset drops. Here’s how it works:

- You borrow shares of a stock, such as GameStop, from a broker.

- You sell those borrowed shares at the current market price.

- Later, you buy the shares back at a (hopefully) lower price and return them to the broker.

- The difference between the sell price and the buy price is your profit.

Think of it like this: imagine borrowing a rare collector’s item from a friend, selling it at a high price, and later buying it back at a lower price before returning it. The difference in price is your gain.

Why Short GameStop Shares?

GameStop has become infamous for its price volatility, making it an attractive target for short sellers. Its stock value has often been driven by market hype rather than underlying business fundamentals, which can create opportunities for traders who believe the price will decline.

However, shorting GameStop is highly speculative. The same factors that cause its price to drop can just as easily lead to sudden surges, creating significant risk for short sellers.

Can You Short GameStop Shares in the UK?

Yes, GameStop shares can be shorted by UK traders, but it’s important to understand how this works. GameStop is listed on the New York Stock Exchange (NYSE), and although it’s a US-based stock, many UK trading platforms provide access to international markets.

Rather than shorting the physical shares directly, most UK traders use Contracts for Difference (CFDs) to short GameStop. CFDs allow you to speculate on the price movement of the stock without actually owning it, making them a convenient option for short selling.

Platforms That Allow Shorting in the UK

Several popular trading platforms in the UK enable short selling of GameStop shares through CFDs. Here are a few reliable options:

- eToro: Offers GameStop CFDs with low fees and an intuitive interface, making it beginner-friendly.

- IG: Provides a professional-grade platform with advanced charting tools for experienced traders, along with GameStop CFDs.

- Plus500: Features commission-free CFD trading, including access to GameStop and other international stocks.

Each of these platforms offers the tools necessary for short selling, including leverage, stop-loss settings, and market analysis features.

Regulatory Considerations in the UK

In the UK, short selling via CFDs is regulated by the Financial Conduct Authority (FCA). This ensures that platforms adhere to strict rules designed to protect traders. However, it’s essential to be aware of the risks involved, as CFDs are leveraged products that can amplify both gains and losses.

Before shorting GameStop or any stock, ensure the platform you choose is FCA-regulated to guarantee a secure trading environment.

GameStop’s Business Challenges and the Digital Market Impact

Before the 2021 meme stock frenzy, GameStop faced significant business challenges that contributed to its declining stock price. As a traditional brick-and-mortar video game retailer, the company struggled to adapt to the rapid digitalization of the gaming industry.

Shift to Digital Downloads: With the rise of online marketplaces like Steam, PlayStation Store, and Xbox Game Pass, more consumers opted to download games digitally rather than purchase physical copies. This shift reduced foot traffic to GameStop’s stores and impacted revenue streams.

Competition from E-Commerce Giants: Retailers like Amazon and major electronics chains offered competitive pricing and convenience, making it harder for GameStop to maintain market share in physical game sales and gaming accessories.

Declining Console Cycle Impact: GameStop’s business historically benefited from new console releases, but with increasing cloud gaming services and subscription models, the traditional upgrade cycle became less of a revenue driver.

Financial Struggles and Store Closures: The company faced multiple years of declining sales and profitability, leading to widespread store closures and restructuring efforts. Investors questioned the sustainability of its business model, contributing to a bearish outlook on the stock before the short squeeze.

These underlying challenges made GameStop a popular target for short sellers before retail traders rallied behind the stock. Understanding this context helps explain why GameStop experienced such extreme volatility and why it remains a high-risk stock for short selling.

How to Short GameStop Shares: Step-by-Step Guide

Step 1: Choose the Right Platform

Before you begin, select a trading platform that meets your needs. Consider these key factors:

- Fees: Look for platforms with low or no commissions on CFD trades.

- Ease of Use: A user-friendly interface is crucial, especially if you’re new to short selling.

- Tools and Features: Access to stop-loss settings, leverage options, and market analysis tools can help manage risk.

Popular platforms like eToro, IG, and Plus500 are excellent options for shorting GameStop shares in the UK.

Step 2: Open an Account and Deposit Funds

Once you’ve chosen a platform, follow these steps to set up your account:

- Register: Sign up by providing personal details and verifying your identity, as required by FCA-regulated platforms.

- Deposit Funds: Add money to your trading account using a payment method like bank transfer, debit card, or e-wallet. Ensure you deposit enough to meet margin requirements for short selling.

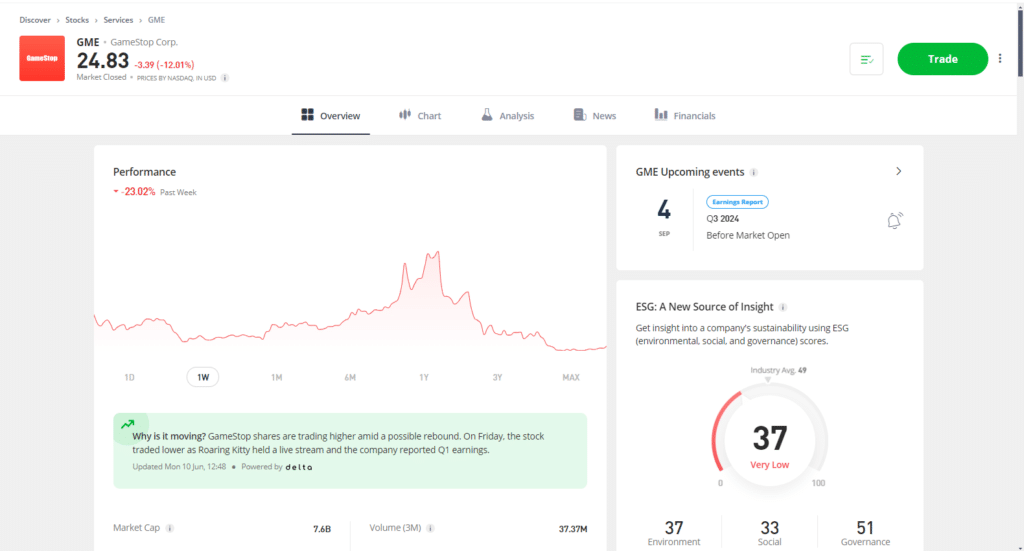

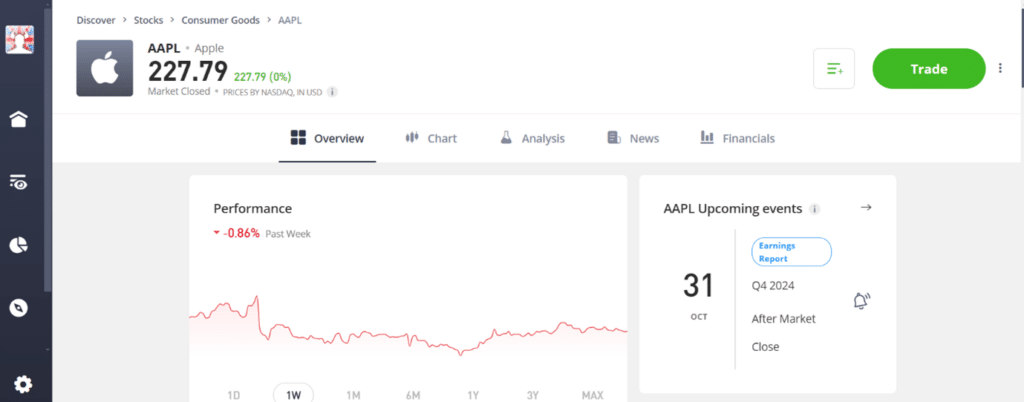

Step 3: Locate GameStop Shares

After funding your account, search for GameStop shares or CFDs on your platform.

- Most platforms have a search bar where you can type “GameStop” or the ticker symbol (GME).

- Once located, click on the stock to view its trading options, including short selling.

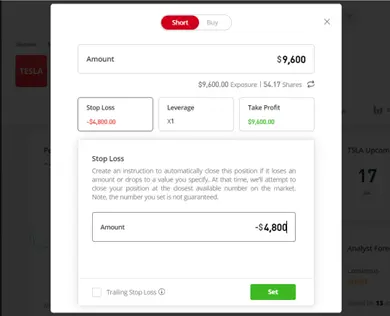

Step 4: Place a Short Trade

Here’s how to execute your short trade:

- Select the Asset: Click on GameStop or the associated CFD to open the trading window.

- Choose Trade Size: Determine how much capital you want to allocate to this position.

- Set Stop-Loss and Take-Profit Levels:

- Stop-Loss: Automatically closes your position if the price rises to a certain level, limiting your losses.

- Take-Profit: Closes the trade when the stock price hits your target, locking in profits.

- Confirm the Trade: Once you’ve adjusted all settings, click the “Sell” or “Short” button to open your position.

Step 5: Monitor Your Position

Shorting is an active trading strategy that requires ongoing attention. To manage your trade effectively:

- Stay Updated: Regularly check market news and price movements. GameStop’s volatility means sudden price changes are possible.

- Adjust Stop-Loss Levels: If the trade moves in your favour, consider tightening your stop-loss to protect profits.

- Close the Trade Strategically: When you’re satisfied with your profit or market conditions change, close the trade to lock in gains or minimize losses.

By following these steps, you’ll be better prepared to short GameStop shares responsibly. Remember, short selling involves significant risk, so always trade with caution and use risk management tools.

Technical Analysis: Evaluating GameStop’s Share Price Movements

Traders often use technical analysis to assess price trends and make informed trading decisions when shorting GameStop shares. Given GameStop’s history of volatility, understanding chart patterns and key technical indicators can help identify potential shorting opportunities.

1. Chart Patterns to Watch

- Head and Shoulders: A bearish reversal pattern that signals a potential price decline.

- Descending Triangle: Indicates a continuation of a downtrend, which can be useful for short sellers.

- Double Top Formation: Suggests a possible trend reversal from bullish to bearish, signaling a potential short trade opportunity.

2. Key Technical Indicators

- Moving Averages (MA): The 50-day and 200-day moving averages help identify overall trends. A “death cross” (when the 50-day MA crosses below the 200-day MA) is often seen as a bearish signal.

- Relative Strength Index (RSI): RSI above 70 may indicate an overbought stock, signaling a potential price drop, while RSI below 30 suggests an oversold stock.

- Volume Analysis: A spike in trading volume often precedes large price movements. Watching volume surges can help traders gauge the strength of a downtrend.

3. Historical Price Action and Market Sentiment

GameStop’s price movements have been highly influenced by social media trends, retail trading sentiment, and short squeeze scenarios. Monitoring price history alongside market sentiment indicators, such as options volume and social media mentions, can help traders anticipate volatility.

By applying these technical analysis methods, traders can make more strategic decisions when shorting GameStop, minimizing risks associated with its unpredictable price movements.

Fundamental Analysis: Assessing GameStop’s Business Health and Share Price

While technical analysis focuses on price movements, fundamental analysis examines GameStop’s financial health and market position to determine its intrinsic value. Understanding these factors can help traders assess whether the stock is overvalued or undervalued.

1. Financial Performance Metrics

- Revenue and Profitability: Reviewing GameStop’s quarterly earnings reports and net revenue trends helps gauge its financial stability. Declining revenue may signal long-term challenges for the company.

- Earnings Per Share (EPS): EPS provides insight into GameStop’s profitability per share. A decreasing EPS trend could indicate financial struggles.

- Debt-to-Equity Ratio: A high debt level compared to equity suggests financial risk, which may impact the company’s ability to sustain operations.

2. Industry and Market Conditions

- Retail Market Trends: GameStop’s reliance on physical retail sales puts it at risk due to the increasing shift to digital game downloads and cloud gaming services.

- Competitive Landscape: Examining how GameStop compares to digital-first gaming retailers and subscription-based platforms like Xbox Game Pass or PlayStation Plus can provide insights into its long-term business viability.

- Investor Sentiment: Looking at analyst ratings, institutional ownership, and insider trading activity helps gauge broader market confidence in the stock.

3. Valuation Metrics

- Price-to-Earnings (P/E) Ratio: A high P/E ratio may indicate that GameStop is overvalued relative to its earnings potential.

- Book Value vs. Market Value: Comparing GameStop’s actual assets (book value) against its stock price helps determine if it’s trading at a fair valuation.

By incorporating fundamental analysis, traders can better understand whether GameStop’s stock price aligns with its underlying business performance, helping them make informed short-selling decisions.

Risks and Rewards of Shorting GameStop Shares

Rewards of Short Selling

Short selling GameStop shares can be a lucrative strategy for traders who anticipate a price decline. Here are the main rewards:

- Potential for High Profits: If GameStop’s stock price drops significantly, short sellers can realize substantial gains. The more the price falls after opening a short position, the greater the profit margin.

- Hedging Capabilities: Short selling can also act as a hedge for long positions in other stocks or sectors. For instance, if you own a portfolio of retail stocks, shorting GameStop could help offset potential losses during market downturns.

Risks of Short Selling

While the potential rewards can be appealing, short selling carries significant risks, particularly with a highly volatile stock like GameStop.

- Unlimited Loss Potential: Unlike buying a stock, where losses are limited to your initial investment, short selling exposes you to theoretically unlimited losses if the stock price surges. GameStop’s price volatility during the “meme stock” frenzy highlights this risk, as prices skyrocketed unpredictably.

- Margin Requirements and Interest Fees: Most platforms require margin accounts for short selling. This means you’ll need to maintain a minimum account balance, and you may incur interest fees for borrowing shares.

- Extreme Price Movements: GameStop’s history of rapid price increases, fuelled by social media-driven hype, makes it a particularly risky stock to short. Traders should be prepared for sudden and unexpected market shifts that can result in significant losses.

Platforms to Use for Shorting GameStop Shares in the UK

AvaTrade provides everything a beginner needs to start their trading journey, including a user-friendly platform, a robust demo account, and extensive educational resources. These features make it a standout option for those new to trading.

However, the inability to onboard UK clients is a significant limitation. If you’re based outside the UK, AvaTrade is a fantastic platform to build confidence and knowledge in trading.

If AvaTrade is available in your country, my advice is simple: open a demo account, explore their educational tools, and take your first steps toward becoming a confident trader.

| Platform | Fees | Ease of Use | CFD Availability | Regulation | Key Features |

|---|---|---|---|---|---|

| eToro | Low spreads | Beginner-friendly | ✅ Yes | FCA-regulated | Social trading, copy trading, educational tools |

| IG | Competitive fees | Advanced tools | ✅ Yes | FCA-regulated | Advanced charting, news analysis, wide range of markets |

| Plus500 | No commission | Intuitive interface | ✅ Yes | FCA-regulated | Simple platform, risk management tools, mobile-friendly |

- eToro: Ideal for beginners, with a straightforward interface and educational tools.

- IG: Perfect for experienced traders seeking advanced charting tools and insights.

- Plus500: Offers a simple, no-frills approach with zero commissions and an easy-to-use platform.

Each platform has FCA regulation, ensuring a secure trading environment for UK traders.

Strategies for Effectively Selling GameStop Shares: Timing and Market Conditions

Selling GameStop shares at the right time requires careful planning and an understanding of market conditions. Whether you’re exiting a long position or closing out a short trade, having a well-defined selling strategy can help maximize profits and minimize potential losses.

1. Setting a Target Exit Price

- Profit Targets: Establishing a pre-determined price target helps remove emotional decision-making. This ensures you exit the trade at a level that meets your financial goals.

- Trailing Stop Orders: Using a trailing stop-loss can lock in profits while allowing for potential price increases before automatically triggering a sale if the stock declines.

- Support and Resistance Levels: Selling near resistance levels (historical price ceilings) can be a strategic approach when GameStop shows signs of peaking.

2. Monitoring Trading Volume and Market Sentiment

- High Trading Volume on Price Spikes: A significant increase in volume during a price surge often suggests strong selling pressure may follow, making it an opportune time to sell.

- Social Media and Retail Investor Trends: GameStop’s price has been heavily influenced by online communities such as Reddit’s r/wallstreetbets. Monitoring discussions and trending topics can provide clues about potential price movements.

3. Avoiding Emotional Selling

- Fear of Missing Out (FOMO): Many traders hold onto GameStop shares longer than intended due to speculative hype, which can lead to losses if prices suddenly drop. Sticking to a predefined strategy helps mitigate this risk.

- Market Corrections: Sharp price corrections are common with volatile stocks. Selling before an anticipated downturn can protect gains, especially if sentiment shifts negative.

Key Market Conditions That Influence the Decision to Sell GameStop Shares

Understanding market conditions can significantly impact when and how you choose to sell GameStop shares. Here are some key factors to consider:

1. Broader Stock Market Trends

- Bull vs. Bear Market: In a bull market, holding onto shares may yield higher returns, whereas in a bear market, selling early can prevent heavy losses.

- Interest Rate Changes: Higher interest rates tend to reduce speculative investing, which can negatively impact meme stocks like GameStop.

2. GameStop’s Financial Performance

- Earnings Reports: Weak earnings or lowered revenue forecasts can trigger sell-offs, making earnings season a crucial period for making selling decisions.

- Insider Selling: If GameStop executives or major investors begin selling large amounts of stock, it can signal declining confidence in the company’s future.

3. Economic and Industry-Specific Factors

- Retail Industry Trends: A decline in brick-and-mortar retail performance can impact GameStop’s outlook. Monitoring consumer spending trends and gaming industry shifts is essential.

- Regulatory Changes: New regulations affecting retail trading or short selling can influence GameStop’s share price and selling opportunities.

The Impact of Market Volatility on Selling Decisions

GameStop is one of the most volatile stocks in recent history, meaning price swings can be extreme. Here’s how volatility affects selling strategies:

1. Sudden Price Spikes and Short Squeezes

- Short Squeeze Risks: If GameStop experiences another short squeeze, the price could temporarily skyrocket. Selling into strength during a squeeze can capture significant gains before the stock corrects.

- Pump-and-Dump Cycles: The stock has been known to rise sharply due to retail-driven hype before experiencing rapid declines. Recognizing these cycles can help traders exit before losses mount.

2. Managing Risk During High Volatility

- Use of Stop-Loss Orders: Setting a well-placed stop-loss order prevents excessive losses if GameStop’s price suddenly drops.

- Partial Selling Strategy: Selling in increments instead of all at once can help mitigate the risks of selling too early or too late.

3. Liquidity Considerations

- Bid-Ask Spreads: Wider spreads during volatile periods can make selling more challenging. Checking liquidity levels ensures smoother order execution.

- Market vs. Limit Orders: Using limit orders instead of market orders can prevent selling at an unfavorable price during high volatility.

By understanding how volatility impacts GameStop’s stock price, traders can better prepare for strategic exit points, reducing the risks associated with unpredictable market movements.

Final Thoughts: Should You Short GameStop Shares?

Shorting GameStop shares can be a profitable strategy if executed with careful planning and risk management. In this guide, we’ve covered the steps to short GameStop shares in the UK, the platforms you can use, and the potential risks and rewards.

However, GameStop’s history of extreme price volatility highlights the importance of fully understanding the risks of short selling. The potential for unlimited losses, combined with the unpredictability of meme stock movements, makes this strategy suitable only for traders who are prepared and confident in their market analysis.

If you’re confident in your research and willing to manage the risks effectively, shorting GameStop shares could be a strategic move. But always trade responsibly and use risk management tools like stop-loss orders to protect your capital.

FAQs

In the UK, most traders short GameStop shares using CFDs (Contracts for Difference) rather than directly shorting physical shares. This method is more accessible and flexible for retail traders.

Shorting GameStop shares carries significant risks, including unlimited loss potential if the stock price rises, margin requirements, and interest fees. GameStop’s volatility adds another layer of unpredictability, making careful risk management essential.

Popular platforms for shorting GameStop in the UK include eToro, IG, and Plus500. These platforms offer CFDs, intuitive interfaces, and FCA regulation for a secure trading experience.

Short selling is generally considered an advanced strategy due to its risks. Beginners should fully educate themselves about the process, risks, and tools like stop-loss orders before attempting to short stocks like GameStop.

Trade Smarter, not Harder

- Copy Trading

- Competetive Fee's

- Multi Asset Platforn

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

Short GameStop Today!

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.