Quick Answer: Why Is eToro the Best Platform to Start Trading Stocks?

eToro offers extensive educational resources, including the eToro Trading Academy, video tutorials, webinars, live events, and market analysis tools. These resources help beginners understand trading basics, develop skills, and stay informed about market trends, ensuring a solid foundation for trading.

- 5,000+ Tradable assets

- Beginner friendly platform

- Copy trading feature

{etoroCFDrisk}% of retail CFD accounts lose money.

- FCA Regulated

- User Friendly Platform

- Tight Spreads

82% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Understanding the Basics of Stock Trading

What is Stock Trading?

Stock trading involves buying and selling shares of publicly traded companies. Each share represents a small ownership stake in the company. When you buy a share, you become a part-owner of the company and can benefit from its success. The primary goal of stock trading is to make a profit by buying shares at a lower price and selling them at a higher price. Traders can also earn income through dividends, which are portions of a company’s profits distributed to shareholders.

How the Stock Market Works

The stock market is a network of exchanges where investors can buy and sell shares of publicly listed companies. Major stock exchanges include the New York Stock Exchange (NYSE) and the Nasdaq. Companies list their shares on these exchanges through a process called an Initial Public Offering (IPO). The price of a stock is determined by supply and demand in the market. When more people want to buy a stock (demand) than sell it (supply), the price goes up. Conversely, if more people want to sell a stock than buy it, the price goes down.

Common Terms and Definitions

Understanding common stock market terms is crucial for beginners. Here are a few key definitions:

- Bull Market: A market condition where prices are rising or expected to rise.

- Bear Market: A market condition where prices are falling or expected to fall.

- Dividends: Payments made by a company to its shareholders, usually from profits.

- Market Capitalisation: The total value of a company’s outstanding shares, calculated by multiplying the stock price by the number of shares.

- P/E Ratio: The price-to-earnings ratio, a measure of a company’s current share price relative to its per-share earnings.

Setting Up Your Trading Account

Choosing a Broker

Selecting the right broker is a critical step for any aspiring stock trader. Brokers act as intermediaries between you and the stock exchanges. When choosing a broker, consider factors such as fees, the range of services offered, ease of use, and customer support. Look for a broker that provides a robust trading platform, comprehensive research tools, and educational resources to help you make informed decisions.

Why eToro?

eToro is a popular choice for beginner traders due to its user-friendly platform and extensive educational resources. eToro stands out because it combines traditional brokerage services with innovative social trading features. One of the key advantages of eToro is its emphasis on education, providing a wealth of resources to help beginners understand the stock market and develop their trading skills. Additionally, eToro offers competitive fees and a wide range of assets to trade, making it an excellent choice for newcomers.

Steps to Open an Account with eToro

Opening an account with eToro is straightforward. First, visit the eToro website and click on the “Sign Up” button. You’ll need to provide some personal information, including your name, email address, and phone number. Next, create a username and password for your account. After registering, you may need to verify your identity by uploading a government-issued ID and proof of address. Once your account is verified, you can fund it and start trading.

Funding Your Account

Understanding Different Funding Methods

Funding your trading account is an essential step before you can start buying and selling stocks. Brokers typically offer multiple funding methods to accommodate different preferences. Common funding methods include bank transfers, credit or debit cards, and online payment services like PayPal. Each method has its own processing times and fees, so it’s important to choose the one that best suits your needs. For instance, bank transfers might take a few days to process but often have lower fees, while credit card deposits are usually instant but may come with higher costs.

Initial Deposit Requirements

Most brokers, including eToro, require a minimum initial deposit to start trading. This amount varies by broker and can range from as low as $50 to several thousand dollars. On eToro, the minimum deposit typically starts at $100; however, in the United Kingdom, the minimum deposit is $50 for certain payment methods. Deposit requirements may vary depending on your location and the payment method you choose, so it is essential to check the latest requirements directly on eToro’s website before opening an account.

👉 Find the exact minimum deposit for your country by visiting eToro’s official help page.

Managing Your Funds

Once your account is funded, managing your funds effectively is key to successful trading. Allocate your funds wisely, ensuring you have enough capital to diversify your investments and manage risks. Avoid putting all your money into a single stock; instead, spread your investments across different sectors and asset classes. Regularly review your account balance and performance, and be prepared to make adjustments as needed to align with your trading goals and market conditions.

Learning the Essentials of Trading

Educational Resources on eToro

eToro provides a wealth of educational resources designed to help beginners learn the fundamentals of trading. These resources are essential for building a strong foundation and developing the skills needed to succeed in the stock market.

eToro Trading Academy

The eToro Trading Academy offers comprehensive courses that cover various aspects of trading, from basic concepts to advanced strategies. These courses are structured to guide you step-by-step through the learning process. Whether you’re a complete beginner or looking to refine your skills, the Trading Academy has something to offer. The courses include video lessons, quizzes, and practical exercises to help reinforce your learning.

Video Tutorials

eToro’s video tutorials are a great way to learn at your own pace. These tutorials cover a wide range of topics, including how to use the eToro platform, understanding different trading strategies, and analysing market trends. The videos are concise and easy to follow, making complex concepts more accessible. Watching these tutorials can help you quickly get up to speed with the basics of trading and the features of the eToro platform.

Webinars and Live Events

Participating in webinars and live events hosted by eToro can provide valuable insights into the world of trading. These events are often led by experienced traders and market experts who share their knowledge and strategies. Webinars typically cover current market trends, trading techniques, and Q&A sessions where you can ask questions and get personalised advice. Attending these live sessions can enhance your understanding and keep you updated on the latest market developments.

eToro Demo Account for Practice

One of the most valuable tools eToro offers for beginners is the demo account. The demo account allows you to practice trading with virtual money, providing a risk-free environment to learn and experiment. You can use the demo account to familiarise yourself with the platform, test different trading strategies, and gain confidence before investing real money. It’s an excellent way to build your skills and knowledge without the fear of losing capital.

Developing a Trading Plan

Setting Your Goals

Before you start trading, it’s important to set clear, achievable goals. Determine what you want to accomplish with your trading activities. Are you looking to build wealth over time, generate a secondary income, or save for a specific goal? Your objectives will influence your trading strategy, risk tolerance, and the amount of time you dedicate to trading. Setting both short-term and long-term goals can help you stay focused and measure your progress.

Risk Management Strategies

Effective risk management is crucial to successful trading. Start by determining how much capital you can afford to risk on each trade. A common rule of thumb is to risk no more than 1-2% of your total trading capital on any single trade. Diversify your portfolio to spread risk across different assets and sectors. Use stop-loss orders to automatically sell a stock when it reaches a certain price, limiting potential losses. Additionally, regularly review and adjust your risk management strategies based on your trading performance and market conditions.

Choosing the Right Stocks

Selecting the right stocks is a critical aspect of your trading plan. Begin by researching companies and industries that interest you and align with your trading goals. Look for stocks with strong fundamentals, such as healthy financial statements, consistent earnings growth, and competitive advantages in their industry. Consider both blue-chip stocks, which are typically more stable and less volatile, and growth stocks, which have the potential for higher returns but come with increased risk. Use both fundamental and technical analysis to make informed decisions.

Conducting Market Research

Fundamental Analysis

Fundamental analysis involves evaluating a company’s financial health and overall business prospects to determine its stock’s intrinsic value. This approach considers factors such as revenue, earnings, profit margins, and debt levels.

Evaluating Company Financials

Start by examining a company’s financial statements, including the income statement, balance sheet, and cash flow statement. Look for consistent revenue and profit growth, manageable debt levels, and positive cash flow. Pay attention to key metrics such as the price-to-earnings (P/E) ratio, which compares a company’s stock price to its earnings per share, and the price-to-book (P/B) ratio, which compares the stock price to the company’s book value.

Understanding Market Trends

In addition to individual company analysis, it’s important to consider broader market trends and economic indicators. Monitor economic data, such as GDP growth, employment rates, and interest rates, as these can impact market conditions. Stay informed about industry trends, technological advancements, and regulatory changes that could affect the sectors you are interested in. Understanding these trends can help you make better trading decisions and identify potential opportunities.

Technical Analysis

Technical analysis involves studying historical price and volume data to predict future price movements. This approach relies on charts and various technical indicators.

Chart Patterns

Technical analysts use chart patterns to identify potential market trends and reversals. Common patterns include head and shoulders, double tops and bottoms, and triangles. These patterns can indicate whether a stock is likely to continue in its current direction or reverse course. Learning to recognise these patterns can help you make more informed trading decisions.

Key Indicators

Technical indicators are mathematical calculations based on price and volume data that help traders identify trends and market conditions. Popular indicators include moving averages, which smooth out price data to identify trends, and the relative strength index (RSI), which measures the speed and change of price movements to indicate overbought or oversold conditions. Combining multiple indicators can provide a more comprehensive view of a stock’s potential direction.

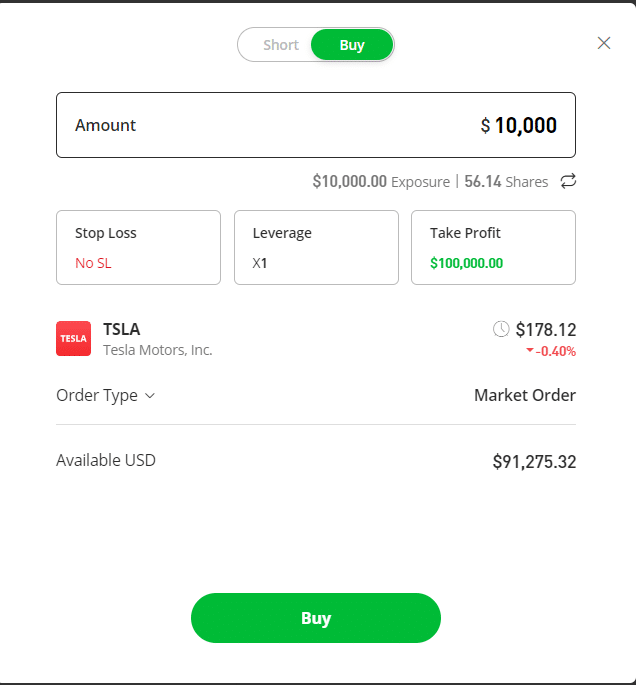

Placing Your First Trade

Understanding Order Types

When placing a trade, it’s essential to understand the different order types available. The most common order types include:

- Market Order: Executes the trade immediately at the current market price. This type is best for stocks with high liquidity.

- Limit Order: Executes the trade only at a specified price or better. This type allows you to control the price at which you buy or sell but may not be executed if the market doesn’t reach your limit price.

- Stop-Loss Order: Automatically sells a stock when it reaches a certain price, helping to limit potential losses.

- Stop-Limit Order: Combines a stop order and a limit order. Once the stop price is reached, the order becomes a limit order and is executed at the specified limit price or better.

How to Execute a Trade on eToro

Executing a trade on eToro is straightforward. After logging into your account, use the search bar to find the stock you want to trade. Click on the stock to open its trading page, where you can see detailed information and charts. Click on the “Trade” button to open the order window. Choose the type of order you want to place (market, limit, etc.), enter the amount you wish to invest, set any stop-loss or take-profit levels, and click “Open Trade” to execute your order. eToro’s platform is user-friendly, making it easy for beginners to navigate and execute trades.

Monitoring Your Trades

After placing a trade, it’s important to monitor its performance. Regularly check your portfolio to see how your investments are doing. Use eToro’s tools and features, such as real-time charts and market news, to stay informed about market conditions and any factors that might affect your trades. Be prepared to adjust your strategy or exit a position if the market moves against you. Monitoring your trades helps you stay proactive and make informed decisions to achieve your trading goals.

Evaluating and Adjusting Your Strategy

Reviewing Your Performance

Regularly reviewing your trading performance is crucial for continuous improvement. Analyse your past trades to identify patterns, successes, and mistakes. Look at metrics such as your win/loss ratio, average profit per trade, and maximum drawdown. Assess whether your trades align with your initial goals and strategy. By understanding what works and what doesn’t, you can refine your approach and make more informed decisions in the future.

Learning from Mistakes

Mistakes are inevitable in trading, especially for beginners. The key is to learn from them. Each mistake provides an opportunity to improve your strategy and avoid similar errors in the future. Document your trades, noting down why you made certain decisions and what the outcomes were. Analyse losing trades to understand what went wrong and how you can adjust your strategy to minimise such risks. Continuous learning and adaptation are essential for long-term success in trading.

Adjusting Your Plan

As you gain more experience and insights, you may need to adjust your trading plan. This could involve tweaking your risk management strategies, exploring new types of assets, or setting new goals. Stay flexible and open to change, as the market conditions and your personal circumstances can evolve. Regularly updating your trading plan ensures it remains relevant and aligned with your objectives. Make adjustments based on your performance reviews and the lessons you’ve learned from past trades.

Utilising Advanced Tools on eToro

CopyTrader: Copying Experienced Traders

eToro’s CopyTrader feature allows you to mimic the trades of experienced and successful traders. This can be a great way to learn from the best and potentially achieve similar results. To use CopyTrader, browse through the profiles of top traders on eToro, check their performance stats, risk scores, and trading styles. Once you find a trader whose strategy aligns with your goals, allocate a portion of your funds to copy their trades automatically. This feature is particularly useful for beginners who want to learn by observing the strategies of more experienced traders.

eToro’s Social Trading Network

eToro’s social trading network is a unique feature that combines trading with social media. It allows you to interact with other traders, share insights, and discuss market trends. You can follow traders, comment on their posts, and participate in discussions. This collaborative environment can provide valuable insights and support, helping you make more informed trading decisions. Engaging with the community can also help you stay updated with the latest market news and trends.

Using eToro’s Mobile App for Trading

The eToro mobile app provides the flexibility to trade on the go. With the app, you can access your portfolio, execute trades, and monitor the markets from your smartphone or tablet. The app includes all the features of the desktop platform, including charts, research tools, and social trading functions. This allows you to stay connected to the market and manage your trades anytime, anywhere. The convenience of mobile trading ensures you never miss out on trading opportunities.

Staying Informed and Continuing Education

Keeping Up with Market News

Staying informed about the latest market news is essential for making informed trading decisions. Regularly check financial news websites, subscribe to market newsletters, and follow reputable analysts on social media. Use eToro’s market news and analysis section to stay updated on global economic events, company earnings reports, and market trends. Being well-informed helps you anticipate market movements and make timely trading decisions.

Leveraging eToro’s Market Insights

eToro offers a range of market insights and analysis tools to help you stay ahead. Utilise these resources to gain a deeper understanding of market trends, economic indicators, and potential trading opportunities. eToro’s insights include daily market summaries, expert analysis, and real-time data on various assets. Leveraging these insights can enhance your trading strategy and help you identify profitable trades.

Continuous learning with eToro’s Resources

The learning journey doesn’t end once you start trading. Continually expanding your knowledge and skills is vital for long-term success. eToro provides numerous educational resources, including articles, videos, and webinars, to support your ongoing education. Take advantage of these resources to stay updated on the latest trading strategies, market developments, and best practices. Engaging in continuous learning helps you adapt to changing market conditions and refine your trading approach.

Conclusion

Recap of Key Points

In this blog, we covered the essentials of beginning stock trading as a complete beginner. We discussed the basics of stock trading, setting up your trading account, funding your account, and utilising eToro’s educational resources. We also explored developing a trading plan, conducting market research, placing your first trade, and evaluating and adjusting your strategy. Additionally, we highlighted the advanced tools available on eToro and the importance of staying informed and continuing your education.

Starting Your Trading Journey with Confidence

Starting your trading journey can be both exciting and challenging. By following the steps outlined in this guide and utilising the resources provided by eToro, you can build a solid foundation for your trading activities. Remember to stay patient, manage your risks, and continuously learn from your experiences. With dedication and the right approach, you can navigate the stock market with confidence and work towards achieving your trading goals.

eToro is a multi-asset platform which offers both investing in stocks

and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high

risk of losing money rapidly due to leverage. 51% of retail investor

accounts lose money when trading CFDs with this provider. You should

consider whether you understand how CFDs work, and whether you can

afford to take the high risk of losing your money.

This communication is intended for information and educational purposes

only and should not be considered investment advice or investment

recommendation. Past performance is not an indication of future

results.

Copy Trading does not amount to investment advice. The value of your

investments may go up or down. Your capital is at risk.

Don’t invest unless you’re prepared to lose all the money you invest.

This is a high-risk investment and you should not expect to be protected

if something goes wrong.

Take 2 mins to learn more

eToro USA LLC does not offer CFDs and makes no representation and

assumes no liability as to the accuracy or completeness of the content

of this publication, which has been prepared by our partner utilizing

publicly available non-entity specific information about eToro.

Additional Resources

Useful Links and Further Reading

Investopedia – Stock Trading for Beginners – Investopedia offers comprehensive articles and tutorials on stock trading basics, strategies, and market analysis.

eToro – Trading Academy eToro trading academy provides educational resources, including courses, webinars, and tutorials designed to help beginners learn trading fundamentals.

Yahoo Finance – Stock Market News Yahoo finance delivers the latest market news, stock quotes, and analysis to keep traders informed about current market conditions.

The Motley Fool – How to Invest in Stocks The Motley Fool offers insightful articles and guides on how to invest in stocks, including tips and strategies for beginners.

FAQs

The minimum deposit required to start trading on eToro typically starts at $50, but this amount can vary depending on your location and the payment method you choose. It’s important to check the specific requirements for your region before opening an account.

eToro offers a demo account feature that allows you to practice trading with virtual money. This risk-free environment enables you to familiarise yourself with the platform, test different trading strategies, and build your skills without the fear of losing real capital.

eToro provides a wide range of educational resources for beginners, including the eToro Trading Academy, video tutorials, webinars, live events, and market analysis tools. These resources are designed to help you understand the basics of trading and develop your trading skills.

Yes, eToro’s CopyTrader feature allows you to copy the trades of experienced and successful traders. By browsing through the profiles of top traders, you can allocate a portion of your funds to automatically replicate their trades, which is a great way to learn from the best and potentially achieve similar results.

To research stocks, you should use both fundamental and technical analysis. Fundamental analysis involves evaluating a company’s financial health and business prospects, while technical analysis focuses on studying historical price and volume data to predict future price movements. Combining both methods can provide a comprehensive view of a stock’s potential.

Gain Access to Our #1 Recommended Trading Platform in the UK

{etoroCFDrisk}% of retail CFD accounts lose money.