Dom Farnell

Co-Founder

Dom is a Co-Founder of TIC, a passionate investor and seasoned blog writer with a keen interest in financial markets and wealth management. "My goal is to empower individuals to make informed investment decisions through informative and engaging content."

Twitter ProfileAuthor Bio

Thomas Drury

Co-Founder

Seasoned finance professional with 10+ years' experience. Chartered status holder. Proficient in CFDs, ISAs, and crypto investing. Passionate about helping others achieve financial goals.

Twitter ProfileAuthor Bio

Fact Checked

How we test

At The Investors Centre, we pride ourselves on our rigorous fact-checking process. To delve deeper into our meticulous testing procedures and discover how we ensure accuracy and reliability, visit our dedicated page on how we test.

Risk Warning

The information provided in this article is for educational and informational purposes only and does not constitute financial or investment advice.

Please bear in mind that trading involves the risk of capital loss. 68% to 84% of retail investor accounts lose money when trading CFDs with the providers below. You should consider whether you can afford to take the high risk of losing your money. CFDs are complex instruments with a high risk of losing money rapidly due to leverage.

Updated 01/02/2025

Quick Answer: What Tools is Necessary to Start Investing?

To start investing in 2025, you’ll need a brokerage account, AI-powered investment apps, and access to reliable financial news sources. These tools help you manage investments, track real-time market trends, and make informed decisions to grow your wealth effectively in an evolving financial landscape.

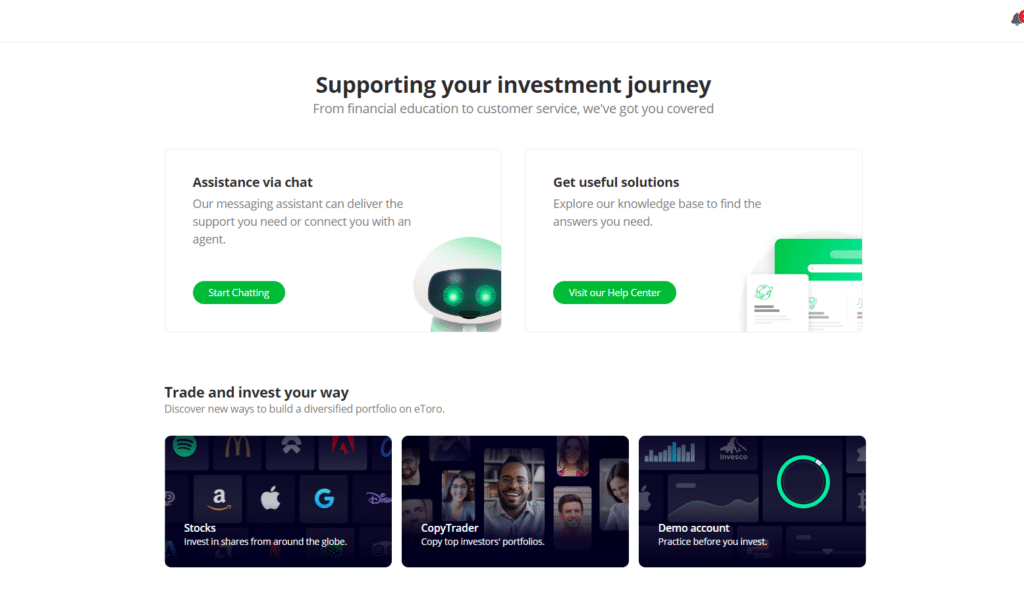

Featured Partner - Etoro

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

Introduction to Investing

Investing can seem daunting at first, like a game only the well-versed in finance can play. But from my own journey, I’ve learned that anyone can participate. At its core, investing involves putting your resources—typically money—into ventures like stocks, bonds, or real estate, with the aim of generating additional income or gains over time.

The importance of investing cannot be overstated. For me, it began as a means to secure a better future, allowing me to plan not just for retirement, but also other significant life events such as buying a home or funding education. Unlike saving, which preserves your money for future use, investing can grow it. The potential financial freedom that comes from wise investing can provide peace of mind and significantly impact your quality of life in the long term.

When I started investing, it felt like planting a seed. It required patience, care, and most importantly, a strategy tailored to my financial goals and risk tolerance. As each year passed, I watched the initial investments mature and branch out, compounding and growing beyond what a simple savings account could ever yield. This experience has reinforced the value of being an investor, not merely a saver.

Basic Concepts You Need to Understand Before Investing

Stocks, Bonds, and Mutual Funds:

When I first delved into investing, navigating the choices was the first challenge. Stocks, or equities, are shares of ownership in a company. When the company does well, so do you; when it doesn’t, your stock’s value may decrease. Bonds seemed safer—a fixed income investment where you loan your money to an entity (corporate or governmental) that borrows the funds for a defined period at a fixed interest rate. Mutual funds offered a middle ground, pooling money from many investors to invest in a diversified portfolio managed by professionals. Understanding these options helped me tailor my investments according to risk and potential return.

The Importance of Diversification:

Early on, I learned the crucial lesson of not putting all my financial eggs in one basket. Diversification is spreading your investments across various assets to reduce risk. By investing in a mix of stocks, bonds, and mutual funds, I could safeguard my portfolio against the volatility of the market. This strategy has helped smooth out the bumps along the investment road, ensuring that the under performance of one asset doesn’t unduly hurt my overall portfolio.

Understanding Risk and Return:

The relationship between risk and return is fundamental in investing. Initially, high-risk investments with the potential for high returns tempted me. However, understanding and accepting my personal risk tolerance—how much fluctuation in my investment value I could comfortably withstand—was essential. It guided my decision-making, helping me choose investments that offered a satisfactory balance between risk and return, suitable for my long-term financial aspirations and sleep-well-at-night level.

These foundational insights have been instrumental in my investing journey, shaping a pathway through the complexities of financial markets with a balanced and informed approach.

Essential Tools for Beginner Investors

Brokerage Accounts:

For anyone looking to enter the world of investing, opening a brokerage account is the first step. A brokerage account allows you to buy and sell investments like stocks, bonds, mutual funds, and ETFs through a platform provided by a brokerage firm. When I started, choosing the right broker was pivotal—it needed to align with my investment goals and experience level. Costs are a critical factor, including fees for trades and account maintenance. Today, many brokerages offer zero-commission trades, which is a boon for beginners. Additionally, the quality of customer support, the ease of use of the platform, and educational resources available can significantly enhance your investing experience.

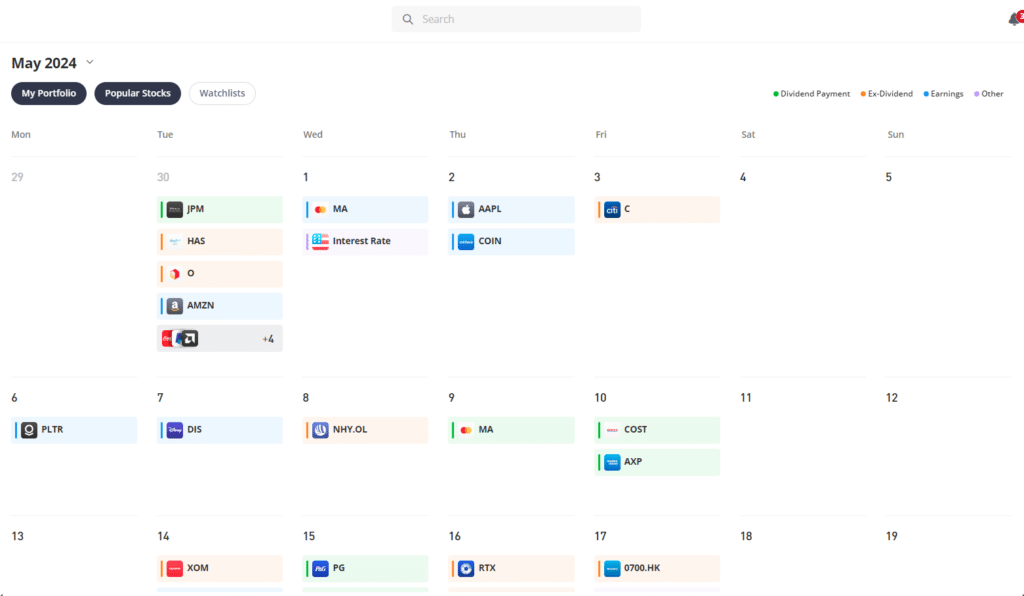

Investment Apps:

The rise of investment apps has democratised access to the financial markets, allowing beginners to start investing with small amounts of money. Apps like Robinhood, Acorns, and Stash provide user-friendly interfaces that remove much of the intimidation from the investing process. Many of these apps also offer features like automatic dividend reinvesting, fractional shares purchasing, and curated investment portfolios. When I used these apps, I appreciated features like real-time alerts and educational content that helped me make informed decisions. For beginners, these apps not only provide convenience but also empower with tools and knowledge, making investing a less daunting endeavor.

Financial News and Information Sources:

Staying informed is crucial in investing. Reliable financial news and information sources can make a significant difference in making sound investment decisions. As a beginner, I leaned heavily on sources like Bloomberg, CNBC, and reputable financial news websites. These platforms offer insights into market trends, economic data releases, and expert analyses. Moreover, specialised financial newsletters and podcasts can provide deeper dives into specific industries or markets. The key is to find sources that provide accurate, timely, and comprehensive financial information that aligns with your investment strategy and goals.

How to Choose the Right Investment Tools

Factors to Consider When Choosing a Brokerage:

Selecting the right brokerage involves more than just comparing fees. It’s about understanding what each platform offers and how it matches your investment style. For beginners, user-friendly interfaces and good customer support are crucial. Additionally, consider the types of assets you want to invest in; not all brokerages offer the same things. Some may provide a wide range of stocks and funds while others might specialise in specific markets like forex or crypto. Security is also paramount, so ensure the brokerage is well-regulated and offers robust protection for your account and personal data.

Evaluating Investment Apps:

Investment apps vary widely in their features and target audiences. When choosing an app, think about your investing goals: Are you looking to trade actively, or are you more interested in passive, long-term investing? Apps designed for day trading offer different tools compared to those built for retirement savings. Look for apps that align with your goals and offer scalable functionalities as your skills and needs grow. Also, check user reviews and ratings to gauge the reliability and overall user satisfaction.

Reliable Sources for Financial Information:

The abundance of financial information available can be overwhelming. To choose the best sources, focus on credibility and the quality of analysis. Major financial news outlets like The Wall Street Journal, Financial Times, and The Economist are known for their rigorous reporting standards. Additionally, consider specialised financial analysis websites that offer in-depth insights into specific sectors or markets. Avoid sources with a clear bias or those that push specific investments without sound reasoning. Remember, well-informed decisions are the backbone of successful investing.

Setting Up Your Investment Strategy

Defining Your Investment Goals:

Every successful investment strategy starts with clear, well-defined goals. Whether you’re saving for retirement, a down payment on a house, or your child’s education, each goal should shape how you invest. When I began my investment journey, I set both short-term and long-term goals which helped me choose suitable investment vehicles. It’s important to be realistic about your financial needs and timeline. Setting goals not only motivates but also provides a clear road map to gauge your progress.

Developing a Long-Term Investment Plan:

A solid investment plan is essential for staying committed and navigating through market volatility. This plan should include a mix of asset classes that reflects your time horizon and risk tolerance. Diversification across stocks, bonds, and other investments can reduce risk and enhance potential returns. When I crafted my plan, I incorporated regular reviews and adjustments to adapt to changing market conditions and personal circumstances, ensuring my investment strategy remains aligned with my overall objectives.

Risk Management Techniques:

Understanding and managing risk is crucial in investing. One of the first risk management techniques I learned was the importance of diversification—not putting all my investments in one basket. Additionally, using stop-loss orders and setting limits on the amount invested in risky assets can protect against significant losses. It’s also wise to continuously educate yourself about market trends and economic factors that could impact your investments, allowing you to make informed decisions promptly.

Learning and Resources for Continuous Improvement

Books and Educational Material for Investors:

Books have always been a fundamental resource for building knowledge about investing. For beginners, titles like “The Intelligent Investor” by Benjamin Graham provide a solid foundation in value investing, while “A Random Walk Down Wall Street” by Burton Malkiel offers insights into various investment strategies. These readings not only enlighten but also inspire more informed investment decisions.

Online Courses and Workshops:

Online courses are a fantastic way to learn at your own pace. Platforms like Coursera and Udemy offer courses in everything from basic financial literacy to advanced investment strategies. Participating in workshops led by experienced investors can also provide practical knowledge and firsthand insights into the markets.

Investment Clubs and Forums:

Joining investment clubs or online forums can be incredibly beneficial. These communities allow you to discuss strategies, exchange ideas, and receive feedback from more experienced investors. Forums such as Reddit’s r/investing or Bogleheads provide a platform for both learning and sharing experiences, enriching your understanding of investing.

Conclusion

Investing is a journey that begins with understanding the basics and selecting the right tools. It requires setting clear goals, developing a strategic plan, and managing risks effectively. By continuously learning and engaging with the investment community, you can enhance your skills and grow your wealth. Remember, the best time to start investing was yesterday; the next best time is today. Whether you are a beginner or looking to refine your strategies, use this guide as a stepping stone towards achieving your financial aspirations.

Additional Resources

Useful Links and Further Reading

- Investopedia: Comprehensive resource for financial education and terms.

- Morningstar: For in-depth research and data on mutual funds and stocks.

- Seeking Alpha: Platform for investment research, with broad coverage of stocks, asset classes, ETFs, and investment strategy.

FAQs

A brokerage account is a type of financial account that you open with a brokerage firm. Through this account, you can buy and sell various investments like stocks, bonds, ETFs, and mutual funds. It’s essential for anyone looking to enter the stock market or other investment areas.

When choosing an investment app, look for user-friendly interfaces, low fees, good customer support, and educational resources that help you learn as you go. Apps like Robinhood and Acorns are popular among beginners for their simplicity and minimal cost.

Beginners may want to start with mutual funds or ETFs, which offer diversified portfolios in a single transaction. This minimizes risk while allowing new investors to get accustomed to the market dynamics without the need to manage multiple stocks or bonds.

Keeping up with financial news helps you stay informed about the economic factors that could impact your investments. It provides insights into market trends, economic outlooks, and sector performances, crucial for making informed investment decisions.

Diversification is the strategy of spreading your investments across various financial instruments, industries, and other categories to reduce risk. It’s important because it helps mitigate the loss from any one investment, smoothing out potential financial fluctuations and safeguarding your portfolio.

Gain Access to Our #1 Recommended Investment Platform in the UK

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.