Quick Answer: Which is best?

For 2024, Trading 212 is recognised as the leading trading platform, featuring an intuitive interface, no commission on trades, and a broad selection of financial tools. It is appealing for both beginners and experienced traders, distinguishing itself with comprehensive offerings, while Freetrade is valued for its straightforward, no-fee trades.

Trading 212 & Freetrade Comparison Chart

Regulation | FCA, CySEC, FSC Regulated | FCA Regulated |

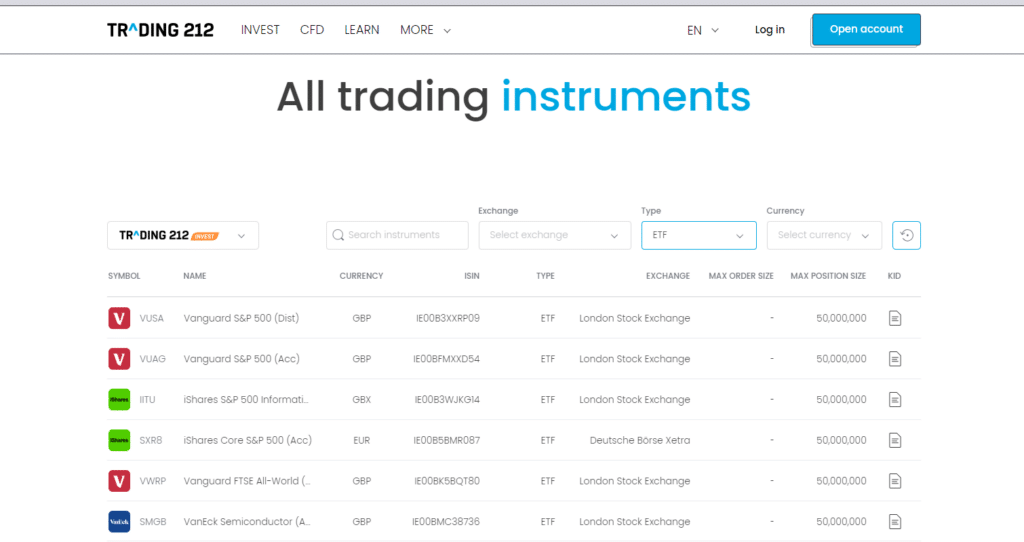

Tradable Assets | UK, US, Germany stocks, ETFs, CFDs on various assets | UK, US stocks, ETFs, Investment Trusts |

Account Types | Invest, CFD, ISA | General, Plus (£9.99/month), ISA, SIPP |

Fees | No dealing fees, No FX fees on international | No dealing fees, 0.45% FX mark-up on international |

Minimum Deposit | £1 | £0 |

Minimum Trade | 0.01 Lots | £2 |

Demo Account | Yes | No |

Mobile App | iOS & Android | iOS & Android |

User Experience | Simple, intuitive, great for beginners | Simple, suited for beginners |

Additional Features | Commission-free CFD trading, intuitive mobile app | 3% interest on cash in Plus account, limit orders |

Payment Methods | Apple Pay, Credit/Debit Card, Google Pay, PayPal, Skrill, Wire Transfer | Apple Pay, Wire Transfer |

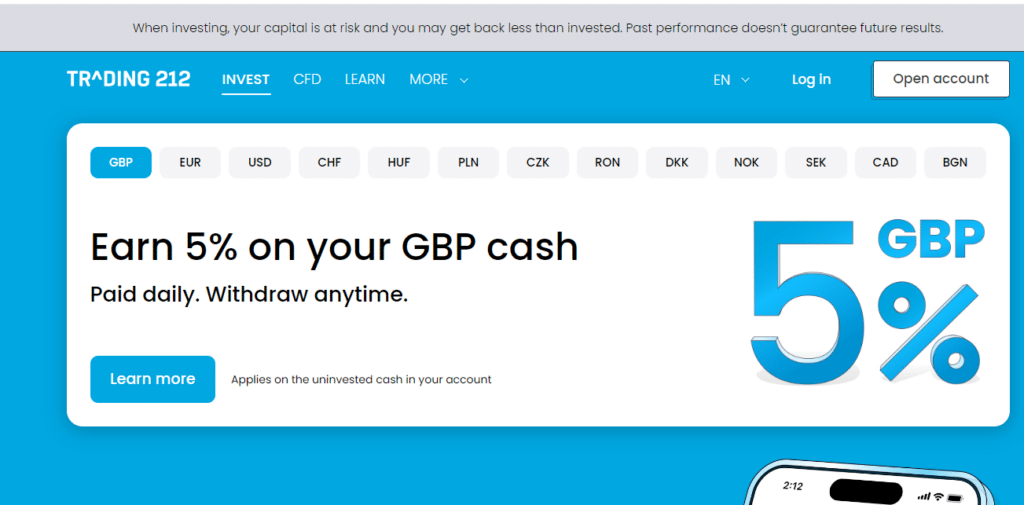

Interest on Uninvested Cash | Up to 5.1% | Yes |

Leveraged Trading | Yes | No |

Social Trading | Yes | No |

Ethical Investing | Yes | No |

Head-to-Head Comparison:

In the realm of online trading platforms, both Trading 212 and Freetrade are commission free trading platforms for your investment portfolio and have established themselves as prominent choices for investors worldwide.

Each platform boasts its own unique set of features, trading tools, and user benefits. Let’s break down the comparison across key categories:

User Interface & Experience:

Trading 212: This platform is celebrated for its sleek, intuitive design. Navigation is smooth, and users can effortlessly switch between instruments, access technical tools, and place trades. The mobile app, available on both iOS and Android, is consistently praised for its ease of use and comprehensive features.

Freetrade: While Freetrade’s interface is less feature-rich than Trading 212, it offers a clean and straightforward design. For beginners or those looking for a no-fuss trading experience, Freetrade’s minimalist approach is appreciated. Its mobile app is user-friendly, making basic trading operations a breeze.

Range of Instruments:

Trading 212: Offers a vast array of instruments, from stocks and indices to commodities and Forex. For traders interested in a diversified portfolio, Trading 212 provides ample opportunities.

Freetrade: Freetrade primarily focuses on stocks and ETFs. While the range is more limited compared to Trading 212, it covers major markets and offers a curated selection for its users.

Fees fees and Charges:

Trading 212: Prides itself on offering a majority of its services commission-free. However, like all platforms, there are fees associated with certain activities and instruments, so it’s crucial to be aware of the fine print.

Freetrade: Known for its fee-free basic trades, Freetrade also offers a premium ‘Plus’ subscription that unlocks more features and investment options. Outside of this subscription, some services may incur fees.

Research & Educational Tools:

Trading 212: Offers advanced charting tools, news feeds, and educational resources like webinars, tutorials, and articles, catering to both beginners and advanced traders.

Freetrade: While its educational content is somewhat limited compared to Trading 212, Freetrade offers insightful blog posts and guides, particularly beneficial for those new to investing.

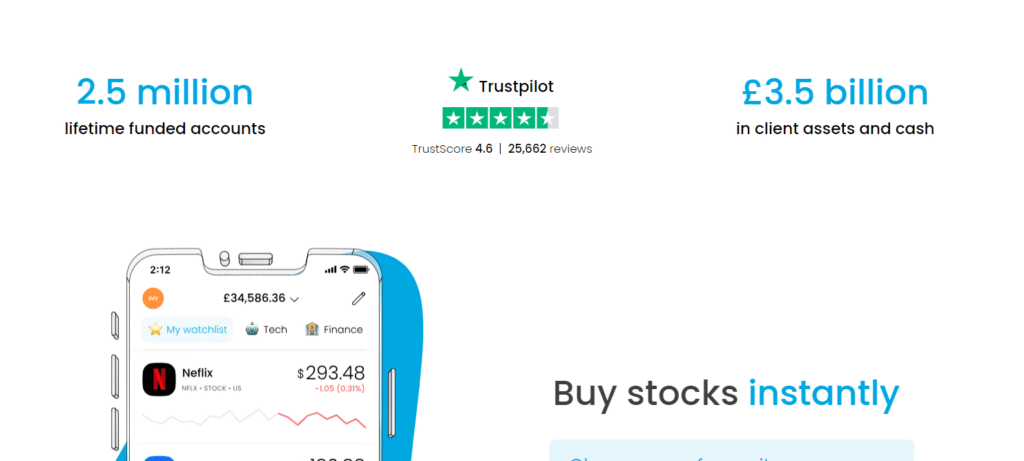

Customer Support & Reviews:

Trading 212: Most users report satisfactory experiences with Trading 212’s support, noting quick response times and helpful staff. The platform has garnered positive reviews on various financial forums and review sites.

Freetrade: Freetrade’s support is decent, with most issues being resolved in a timely manner. The overall sentiment in the community is positive, with particular emphasis on its user-centric approach.

Evaluating Trading 212: Is It the Right Broker for You?

Trading 212 has surged in popularity over recent years, offering a blend of intuitive tools and a diverse range of trading instruments. But is it the right broker for your needs? Let’s dissect its prominent features:

1. Comprehensive Toolset:

Trading 212 offers advanced charting capabilities, technical indicators, and a myriad of tools tailored for both novice traders and seasoned professionals.

2. Wide Array of Trading Instruments:

From stocks, commodities, Forex, and more, traders have a broad spectrum of options to diversify their portfolio.

3. Fee Structure:

Known for its commission-free trading, Trading 212 is appealing for those mindful of costs. However, be aware of potential hidden charges and always read the terms.

4. Educational Resources:

A highlight of Trading 212 is its commitment to trader education. With a vast library of tutorials, webinars, and articles, it’s a hub for continuous learning.

5. User Experience:

With a clean interface on both desktop and mobile platforms, users can seamlessly navigate the platform, execute trades, and manage their portfolios.

6. Customer Support:

Generally receiving positive feedback, Trading 212’s support team is lauded for its responsiveness and helpfulness.

Assessing Freetrade: Key Strengths and Weaknesses

Freetrade has carved out a niche in the trading world by being money, using low fees, simplifying the process share trading online brokers and prioritizing user experience. Let’s delve into what sets it apart and where it might fall short:

Strengths:

1. User-Centric Design:

The minimalist design ensures that even those new to trading can get started without a steep learning curve.

2. Fee-Free Basic Trades:

Freetrade prides itself on offering basic trades without fees, making it a cost-effective choice for many traders.

3. Curated Selection:

Instead of overwhelming users with countless options, Freetrade provides a curated list of stocks and ETFs, simplifying the decision-making process.

4. Educational Content:

Their blog is rich with insights, especially tailored for beginners, offering guidance on various aspects of trading and investing.

Weaknesses:

1. Limited Advanced Features:

Seasoned traders might find the platform lacking in terms of advanced charting tools and technical indicators.

2. Restricted Range of Instruments:

Primarily focusing on stocks and ETFs, Freetrade doesn’t offer the breadth of options available on some other platforms.

3. Premium Features at a Cost:

While basic trades are fee-free, accessing advanced features requires a ‘Plus’ subscription, incurring additional costs.

Cost Analysis: Which Broker is More Affordable?

Both Trading 212 and Freetrade are known for their top service and competitive fee structures, especially in an industry where charges can quickly erode profits and assets. But when put head-to-head, which broker offers a more wallet and broker-friendly experience?

Trading 212:

Commission-Free Trades: Trading 212 predominantly offers commission-free trading for stocks and ETFs, which is a significant advantage for active traders.

Foreign Exchange Fees: While Forex trading is available, it’s important to be aware of potential foreign exchange fees, especially for international stocks.

Inactivity Fee: After a certain period of inactivity, Trading 212 may charge a fee. This is crucial for passive investors to consider.

Other Charges: Like all brokers, certain activities like withdrawing funds or accessing specific market data may incur minor charges.

Freetrade:

Fee-Free Basic Trades: Freetrade is renowned for its fee-free basic trades, offering users the opportunity to trade without incurring transaction costs.

Freetrade Plus: For a monthly subscription, Freetrade Plus members gain access to additional stocks, greater market depth, and other premium features. This cost needs to be weighed against its benefits.

Foreign Exchange Fees: When buying US stocks, there’s a foreign exchange fee to consider.

No Inactivity Fee: Unlike some brokers, Freetrade doesn’t penalize users for inactivity.

Minimum Deposit Showdown

This often a determining factor for new investors to trade, or those testing a new platform to trade. Here’s how Trading 212 and Freetrade compare on minimum investment amount:

Trading 212:

No Minimum Deposit: One of Trading 212’s most attractive features is the absence of a minimum requirement for its Invest and ISA accounts. This allows users to start trading with whatever amount they’re comfortable with.

CFD Accounts: For those interested in CFD trading, there might be a specific minimum , which varies based on the account type and regional regulations.

Freetrade:

Low Minimum: Freetrade requires a minimal amount to start, making it accessible for most new traders.

Freetrade Plus: Opting for the premium ‘Plus’ account might have different deposit requirements, so it’s crucial to check the latest terms before upgrading.

Diverse Investment Options: Does Trading 212 or Freetrade Offer More?

In the world of online trading, the range of investment options a platform provides can significantly impact a trader’s ability to leverage them to diversify their portfolio. Let’s explore how Trading 212 and Freetrade compare in this domain:

Trading 212:

Broad Spectrum: Trading 212 is known for offering a wide array of investment options. Users can access stocks, Forex, commodities, indices, and even certain types of derivatives.

Global Markets: Traders can invest in both domestic and international markets, further enhancing the diversification potential.

Thematic Investments: The platform also introduces thematic collections, allowing users to invest in trends or industries like green energy or tech innovations.

Freetrade:

Focused Offering: While Freetrade primarily centers its offerings around stocks and ETFs, the selection is curated and covers significant markets.

UK & US Markets: Freetrade provides access to both UK and US stocks, catering to a broad audience but might not match the global reach of some competitors.

Dividend Stocks: Freetrade emphasizes dividend-paying stocks, allowing users to build income-generating portfolios.

ISA and SIPP Accounts

ISA (Individual Savings Account) and SIPP account (Self-Invested Personal Pension) are UK-specific investment vehicles offering tax advantages. Here isa accounts here’s how the two platforms stack up against other countries’ in providing these accounts:

Trading 212:

ISA: Trading 212 offers a Stocks & Shares ISA account, allowing UK residents to invest up to a certain annual allowance without incurring capital gains or dividend tax. To help you get started they will give you a free share worth upto £100.

SIPP: As of my last update in 2022, Trading 212 did not offer a SIPP account. However, the financial landscape evolves, and it’s prudent to check their official website or contact their support for the most recent offerings.

Freetrade:

ISA: Freetrade provides a Stocks & Shares ISA, enabling users to make the most of their annual tax-free allowance.

SIPP: Freetrade also offers a SIPP account, allowing users to manage their pension investments while benefiting from tax reliefs.

Exploring Cryptocurrency Options

Cryptocurrencies have taken the financial world by storm, and many online brokerages online brokers have responded by integrating crypto trading into their platforms. Let’s evaluate how Trading 212 and Freetrade fare in this domain:

Trading 212:

Limited Crypto Offerings: As of my last update in 2022, Trading 212 provided access to a limited selection of popular cryptocurrencies through CFDs (Contracts for Difference). However, it’s essential to note that trading crypto via CFDs doesn’t grant ownership of the actual coin.

Crypto CFDs: While offering the potential for profits, CFDs come with their set of risks, particularly given the volatile nature of cryptocurrencies. It’s crucial for traders to understand the mechanics and risks associated with CFD trading.

Freetrade:

Cryptocurrency ETPs: Freetrade doesn’t offer direct cryptocurrency trading. Instead, they offer a selection of cryptocurrency Exchange-Traded Products (ETPs), which track the performance of particular crypto assets.

Indirect Exposure: Through these ETPs, traders gain exposure to cryptocurrency price movements without owning the actual cryptocurrencies. This can be a more structured way to invest in the volatile crypto market for those unfamiliar with direct crypto trading.

Research Capabilities: Which Brokerage Excels?

Research is an invaluable tool for traders and investors. The depth, breadth, and quality of research tools a brokerage offers can heavily influence trading decisions. Let’s delve into what Trading 212 and Freetrade have in their arsenal:

Trading 212:

Analytical Tools: Trading 212 is equipped with a suite of analytical tools. From advanced charting capabilities to various technical indicators, it’s well-suited for those who prefer detailed analysis.

Market News & Updates: The platform provides regular news updates and insights into global markets, helping traders stay abreast of significant developments.

Economic Calendar: This feature gives traders a heads-up on upcoming economic events, which can influence market movements.

Freetrade:

User-Friendly Insights: Freetrade focuses on simplifying research, offering easy-to-understand insights, especially tailored for beginners.

Regular Blog Updates: Through its blog, Freetrade provides analyses of recent market events, educational content, and investment ideas.

Community Insights: Freetrade has a community forum where users share insights, discuss market trends, and offer peer advice, adding a collaborative element to research.

Platform Usability

In an era where digital interactions dominate, the usability of an online trading platform can greatly influence a user’s overall experience. Let’s assess how Trading 212 and Freetrade match up in terms of platform interface, ease of use, and overall user experience.

Trading 212:

Intuitive Design: Trading 212’s platform is designed with a clean interface that caters to both beginners and seasoned traders.

Advanced Features: For those who wish to delve deeper, the platform offers advanced charting tools, multiple order types, and customization options.

Mobile Experience: Their mobile app mirrors the web platform’s efficiency, ensuring traders can manage their portfolios on the go without compromise.

Freetrade:

User-Centric Interface: Freetrade’s design ethos centers on simplicity. The platform’s interface is uncluttered, making it particularly appealing to new traders.

Streamlined Operations: With fewer advanced features, the emphasis is on being an easy stock trading app and ETF trading, which can be a blessing for those overwhelmed by too many options.

Mobile-First: Freetrade began as a mobile-only platform, and this mobile-first philosophy ensures a seamless experience for users who prefer trading on their phones.

Educational Resources: What Trading 212 and Freetrade Offer for New Traders

Education is paramount in the world of investment social trading platforms and trading, investing involves risk, where informed decisions can mean the difference between profit and loss. Let’s see how these investment and trading platforms can support their users in their educational journey towards investing.

Trading 212:

Learning Hub: Trading 212 has a dedicated section filled with articles, tutorials, and videos covering a wide range of topics – from basics to more advanced strategies.

Demo Account: One of its standout features is the demo account, allowing users to practice trading with virtual money. This hands-on approach helps users understand market dynamics without financial risk.

Webinars & Live Sessions: Periodically, the platform hosts webinars and live sessions where experts discuss market trends, strategies, and answer user queries.

Freetrade:

Educational Blog: Freetrade’s blog is a rich resource with articles that demystify complex financial concepts, stock analyses, and general market education.

Beginner’s Guides: Tailored to those new to trading, these guides cover the essentials, from understanding stocks and ETFs to developing investment strategies.

Community Forum: Beyond official resources, Freetrade’s community is an informal educational space where users share experiences, ask questions, and learn collaboratively.

References

FAQs

Exchange Traded Funds, or ETFs, are investment funds traded on stock exchanges, much like stocks. They hold assets such as stocks, commodities, or bonds and generally operate with an arbitrage mechanism designed to keep the trading close to its net asset value, though deviations can occasionally occur.

Yes, some ETFs are specifically designed for leveraged trading, allowing investors to amplify their exposure to the market’s fluctuations. However, leveraged ETFs increase both the potential gains and the potential risks, so they’re recommended for experienced traders.

Retail CFD (Contract for Difference) accounts allow you to speculate on the price movement of financial assets without owning the underlying asset. It’s important to understand the risks involved, as CFDs are complex instruments that come with a high risk of losing money rapidly due to leverage.

Yes, the Freetrade app is designed to be user-friendly and is suitable for first-time investors. It offers a simple interface for buying stocks, ETFs, and other investment options, making it accessible for those new to investing.

Fractional shares allow investors to purchase a portion of a share, making it easier to invest in high-priced stocks with a smaller amount of money. Trading 212 does offer the option to buy fractional shares, enabling more diversified portfolios without requiring large investments.