Quick Answer:

VWRP and VWRL are effectively the same fund – the difference is in their treatment of their dividends. VWRP is accumulating Vanguard reinvests the dividends on your behalf. VWRL is distributing: the dividends are paid into your investment account.

What does this page cover?

Featured Brokers

Best for Beginners - Etoro

- 5,000+ Tradable assets

- Beginner friendly platform

- Copy trading feature

Your capital is at risk.

Best for Intermediates - Saxo

- 71,000 Trading instruments

- Advanced tools, research & expert tips

- Fees lowered in 2024

OFFER: Open an account and receive up to £200 back in online trading fees* to help you get started.

Your capital is at risk.

What are Vanguard FTSE All-World UCITS ETFs?

Vanguard FTSE All-World UCITS ETFs are exchange-traded funds (ETFs) that aim to provide broad exposure to global equity markets. These ETFs track the FTSE All-World Index, which includes large and mid-cap stocks from both developed and emerging markets, covering approximately 90-95% of the global investable market capitalization.

VWRP vs VWRL: What is the Difference?

When considering the Vanguard FTSE All-World UCITS ETFs, Vanguard FTSE All-World UCITS ETF Accumulating (VWRP) and Vanguard FTSE All-World UCITS ETF Distributing (VWRL), the primary distinction lies in how they handle dividends. Both Exchange-Traded Funds (ETFs) track the same index, include the same stocks, and are managed by Vanguard, but they cater to different investor preferences.

Key Differences

Dividend Treatment:

- VWRL (Distributing ETF): This ETF distributes dividends to investors quarterly. This can be beneficial for those seeking regular income from their investments. Receiving dividends might be preferable for investors looking to supplement their cash flow or for those in the retirement phase of their financial planning.

- VWRP (Accumulating ETF): VWRP reinvests the dividends back into the fund. This structure is advantageous for investors focused on long-term growth and capital appreciation, as reinvested dividends can benefit from compounding over time. This approach reduces the need for investors to manually reinvest dividends and potentially incur additional transaction fees.

Tax Implications:

- VWRL: Dividends received are typically subject to immediate taxation, depending on your country’s tax rules. This can affect the net income you receive from these distributions.

- VWRP: Since dividends are reinvested, they are not immediately taxable. However, it’s crucial to account for these accumulated dividends when calculating capital gains tax upon selling the ETF to avoid being taxed twice.

Suitability Based on Investment Goals:

- VWRL: Suitable for investors looking for periodic income from their investments.

- VWRP: Ideal for those aiming for long-term capital growth without the hassle of reinvesting dividends manually.

Total Expense Ratio (TER): Both VWRL and VWRP have an identical expense ratio of 0.22%. This fee is competitive and reflects the cost-effectiveness of passive management.

Geographic and Sector Diversification: Both ETFs offer extensive global diversification, encompassing over 3,700 stocks from different sectors and regions worldwide. This broad diversification helps mitigate specific country or sector risks.

Fund Domicile and Tax Efficiency: Both ETFs are domiciled in Ireland, benefiting from favorable tax treaties, especially with the US. This results in a lower withholding tax on dividends from US companies, enhancing tax efficiency for investors.

Unit Prices and Trading: The unit price for both ETFs hovers around 70-80 GBP, making them relatively accessible for investors. However, consider your broker’s minimum fees when buying these ETFs to ensure cost efficiency.

Accumulating vs Distributing ETFs

Accumulating ETFs (VWRP)

Accumulating ETFs reinvest dividends back into the fund rather than paying them out to investors. This approach supports long-term capital growth through the power of compounding.

- Tax Efficiency: Reinvested dividends aren't immediately taxable, which can defer taxes until the investment is sold.

- Compounding Growth: Reinvestment leads to potential higher returns over time due to compound interest.

- No Regular Income: Investors do not receive periodic cash payouts.

- Complex Tax Calculation: Investors must account for reinvested dividends when calculating capital gains tax upon sale.

Distributing ETFs (VWRL)

Distributing ETFs pay out dividends directly to investors, usually on a quarterly basis. This is preferred by those who need a regular income from their investments.

- Regular Income: Provides a steady stream of income, which can be ideal for retirees or those seeking periodic cash flow.

- Simplicity: No need to track reinvested dividends for tax purposes.

- Immediate Taxation: Dividends are taxable in the year they are received, potentially leading to higher annual tax liabilities.

- Missed Compounding: Cash payouts mean that investors miss out on the potential benefits of compounding if they do not reinvest the dividends.

Accumulating ETFs and UK Tax

Tax Implications: In the UK, the tax treatment of accumulating ETFs like VWRP can be favorable, but it requires careful record-keeping.

- Capital Gains Tax (CGT): Investors in accumulating ETFs must include reinvested dividends when calculating CGT on sale. The accumulated dividends increase the cost basis, potentially reducing the taxable gain.

- Dividend Allowance: The first £2,000 of dividends are tax-free. Accumulating ETFs indirectly benefit from this allowance since dividends are not received directly.

Practical Example: Suppose an investor holds VWRP for several years. When they sell, they must adjust the purchase price by adding the reinvested dividends to the initial investment amount. This ensures they are not taxed twice—once when the dividends were reinvested and again on the sale proceeds.

How to Invest in Vanguard Funds and ETFs (For UK Investors)

Investing in Vanguard funds and ETFs can be done through various platforms that cater to different investor needs.

- Choose Your Investment Platform

- Open an Account

- Select Your Vanguard ETF: VWRP (Accumulating) and VWRL (Distributing)

- Place Your Order

- Monitor Your Investment

While it may seem logical to invest in a Vanguard FTSE All World ETF or other Vanguard funds directly through Vanguard’s own platform, this may not always be the most cost-effective option in the long run. Vanguard’s platform exclusively offers its own products and can be more expensive over time compared to other platforms.

Competitors offer lower annual fees for shares and ETFs, making them significantly cheaper over extended investment periods. Therefore, it’s crucial to consider platform fees carefully as they can impact your future financial security. Evaluate whether the services provided justify the costs over the long term. Here’s a look at some of the most popular options:

Where to Invest in Vanguard Funds and ETFs?

Investors looking for funds can access these assets through several other well-regarded platforms. More on Fund Platforms here.

Description: eToro is a user-friendly platform known for its social trading features, allowing users to follow and copy the trades of successful investors.

Suitable for: Investors interested in social investment strategies and learning from others.

- Intuitive interface, social trading features, access to a broad range of ETFs and stocks.

- Higher fees for certain transactions, may not offer as extensive research tools as some other platforms.

Description: IG offers a comprehensive trading platform with robust tools and extensive market coverage. It includes a wide variety of ETFs and other investment products.

Suitable for: Traders looking for advanced tools and a wide selection of investments.

- Powerful trading tools, extensive market coverage, suitable for both beginners and advanced traders.

- Higher fees compared to some platforms, more complex interface for beginners.

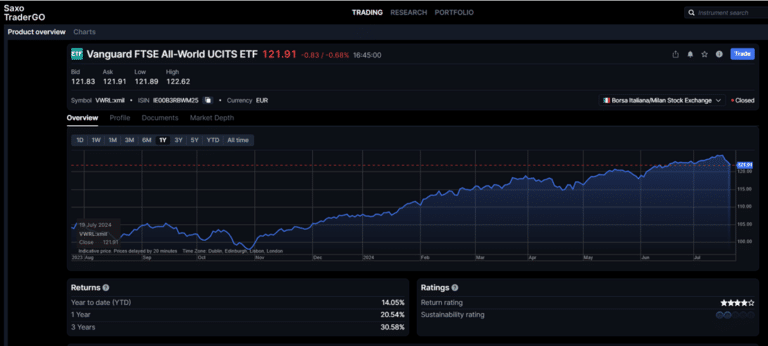

Saxo

Capital at risk.

OFFER: Open an account and receive up to £200 back in online trading fees* to help you get started.

Description: Saxo provides a sophisticated trading platform with access to numerous UK and global investment funds. It offers extensive research resources.

Suitable for: Experienced investors seeking comprehensive research tools and advanced trading features.

- Advanced trading features, in-depth research resources, broad selection of investment options.

- Complexity: The platform’s extensive features and tools can be overwhelming for beginner investors.

Which Fund Should You Choose?

Your choice between VWRL and VWRP should be guided by your investment goals:

- If you prefer regular income and are perhaps in or nearing retirement, VWRL may be more suitable due to its dividend distributions.

- If you are in the accumulation phase and prefer reinvesting dividends for potential higher growth over time, VWRP would be the better option.

Both ETFs provide the same core benefits of diversification and low management fees, but their different approaches to dividend management cater to distinct investor needs.

By understanding these nuances, you can make a more informed decision that aligns with your financial goals and tax considerations.

FAQs

VWRP is an accumulating ETF that reinvests dividends back into the fund, ideal for long-term growth. VWRL is a distributing ETF that pays out dividends quarterly, suitable for those seeking regular income. Both track the same FTSE All-World Index and are managed by Vanguard.

VWRP is generally better for long-term growth due to its accumulating nature, where dividends are reinvested, leading to potential higher returns through compounding.

In accumulating ETFs like VWRP, dividends are reinvested and not immediately taxable, deferring tax until the ETF is sold. In distributing ETFs like VWRL, dividends are paid out and typically taxed in the year they are received.

Yes, Vanguard ETFs can be accessed through various platforms like eToro, IG, and Saxo. These platforms offer additional features and may have different fee structures compared to Vanguard’s platform.

Consider the platform’s fees, range of investment options, trading tools, and user interface. Platforms like eToro are known for social trading features, IG for comprehensive trading tools, and Saxo for advanced features and research resources.

Gain Access to Our #1 Recommended Investment Platform in the UK

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

How to Invest in IPOs on eToro in 9 steps: 2025 Best Practise Guide

What are the UK Equivalents of Popular US Investment Funds in 2025?

How to Buy Berkshire Hathoway Shares (BRK) in the UK: 2024 Guide