How to Buy Cryptocurrency in the UK

Adam Woodhead

Co-Founder

Adam is a Co-Founder and content creator for The Investors Centre. His key areas of interest and expertise are cryptocurrency and blockchain technology.

Twitter ProfileAuthor Bio

Thomas Drury

Co-Founder

Seasoned finance professional with 10+ years' experience. Chartered status holder. Proficient in CFDs, ISAs, and crypto investing. Passionate about helping others achieve financial goals.

Twitter ProfileAuthor Bio

Fact Checked

How we test

At The Investors Centre, we pride ourselves on our rigorous fact-checking process. To delve deeper into our meticulous testing procedures and discover how we ensure accuracy and reliability, visit our dedicated page on how we test.

Risk Warning

Please bear in mind that trading involves the risk of capital loss. 51% to 84% of retail investor accounts lose money when trading CFDs with the providers below. You should consider whether you can afford to take the high risk of losing your money.

Last Updated 23/04/2025

In 2025, owning cryptocurrency in the UK is easier than ever. Whether you’re looking to invest in Bitcoin, Ethereum, or something a bit more niche, you’ll find everything you need to get started safely and confidently. In this guide, I’ll walk you through the entire process step by step.

To Buy Crypto in the UK, you'll need to:

- Create an account with a crypto exchange like eToro or Coinbase.

- Verify your identity and deposit GBP into your account.

- Research cryptocurrencies such as Bitcoin or Ethereum.

- Purchase crypto via the exchange’s app or website.

- Use a crypto wallet for secure storage or keep it on the exchange.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

Which Crypto Platforms are the most UK-Friendly?

- eToro: Best for beginners interested in social trading. Allows direct buying with GBP through a broker model.

- Coinbase: Suitable for casual users, offering an intuitive interface with strong security features. Operates both as a broker (for direct purchases) and an exchange (Coinbase Advanced Trade) for experienced traders.

- Uphold: Known for fee-free trading but with higher spreads. Supports cross-asset swaps and direct fiat purchases, functioning as both a broker and an exchange.

Here’s a table where we have broken down their distinct features and functionalities:

| Feature | eToro | Coinbase | Coinbase Advanced Trade | Best Wallet |

|---|---|---|---|---|

| Ease of Use | Beginner-friendly, social trading features | Simple interface, ideal for beginners | Advanced tools, suited for experienced traders | User-friendly, simple interface for multi-asset trading |

| Fees | 1% trading fee | 1.49% transaction fee | Lower fees (0.4% maker, 0.6% taker) | Low fees (0.08% maker, 0.10% taker) or spread-based pricing (0.8-1.2%) |

| Funding Options | Bank transfer, debit/credit card | Bank transfer, debit/credit card, PayPal | Bank transfer, debit/credit card | Bank transfer, debit/credit card |

| Crypto Selection | 75+ cryptocurrencies | 240+ cryptocurrencies | 240+ cryptocurrencies | 350+ cryptocurrencies |

| Security | FCA-regulated, 2FA, cold storage | Insured funds, 2FA, cold storage | Insured funds, 2FA, cold storage | Strong security, cold storage, 2FA |

| Extras | CopyTrading, multi-asset platform | Educational tools, staking | Advanced charting, order types, lower fees | Multi-asset trading, competitive spreads |

What is Crypto

Cryptocurrency is a digital or virtual currency that uses cryptography for security. Unlike traditional currencies, cryptocurrencies operate on decentralised networks using blockchain technology, making them immune to centralised control.

- Decentralisation: No single authority governs the network.

- Peer-to-Peer Transactions: Direct transfers without intermediaries.

- Types: Payment tokens (Bitcoin), utility tokens (Ethereum), and stablecoins (Tether).

Cryptocurrencies are reshaping finance, offering a new way to store, transfer, and generate value globally.

What Are the Most Popular Crypto

While there are thousands of cryptocurrencies, here are the most popular:

- Bitcoin (BTC) – The first and most recognised cryptocurrency, often seen as digital gold.

- Ethereum (ETH) – Powers smart contracts and DeFi applications, with strong developer support.

- Tether (USDT) – A stablecoin pegged to the US Dollar, widely used for trading.

- Binance Coin (BNB) – Fueling transactions on the Binance Smart Chain.

- Cardano (ADA) – Focused on scalability and sustainability for blockchain projects.

What Key Factors Do I Need to Consider when Buying Cryptocurrency?

- Security: Opt for platforms that enforce robust security measures like two-factor authentication (2FA) and cold storage of assets to protect your funds from unauthorised access and hacks.

- Costs & Fees: Take some time to analyse your potential platforms’ fees. Brokers generally include their fees in the price of the crypto, whereas exchanges have explicit fee structures.

- User Experience: A platform with an efficient interface and a responsive customer support department enhances the trading experience.

- Fiat Currency Support: Check whether the platform allows you to purchase cryptocurrency using fiat currencies like GBP, which is crucial for beginners without existing crypto holdings.

Investing in Cryptocurrency in the UK (Step-by-Step Guide)

Step 1: Choose a Cryptocurrency Exchange or Broker

Select a platform to buy, sell, and trade. This can be either a dedicated cryptocurrency exchange or a broker offering cryptocurrency services. Here’s what you should consider to make an informed choice:

What is the Difference Between Exchanges and Brokers?

Cryptocurrency Exchanges: These are platforms where users can trade cryptocurrencies for other assets like fiat money or different cryptocurrencies. Exchanges are ideal for those who want hands-on control over their trades. They typically offer a wide range of cryptocurrencies and have varied fee structures.

Cryptocurrency Brokers: Brokers act as intermediaries, selling you cryptocurrencies directly. They are usually easier to use than exchanges and may be a better option for beginners who prefer a straightforward buying process. However, brokers might charge higher fees and offer a smaller selection of cryptocurrencies. They can also impose restrictions on the transfer of your crypto holdings to other wallets.

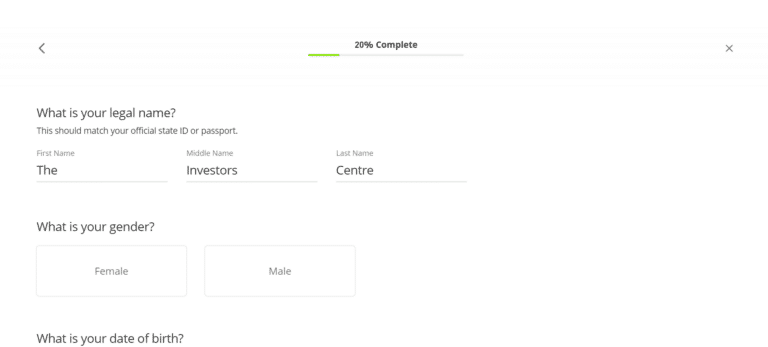

Step 2: Register and Verify Your Identity

Before buying crypto, you’ll need to create an account. This involves providing personal information and verifying your identity, a process known as KYC (Know Your Customer).

How to Complete Registration and Verification:

- Sign Up

- Provide Your Personal Info

- Verify Your ID: Upload a government-issued ID.

- Set Up Security: Enable 2FA

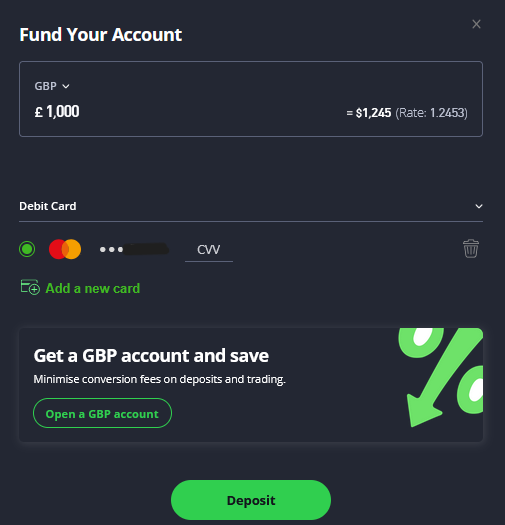

Step 3: Deposit Funds into Your Account

Once your account is set up and verified, you’ll need to deposit funds to start buying cryptocurrency.

How to Deposit GBP:

- Bank Transfer: Link your bank account to the exchange and transfer GBP. This method usually has lower fees but might take a few days.

- Credit/Debit Card: Some exchanges allow you to use a card to buy crypto instantly, but this may come with higher fees.

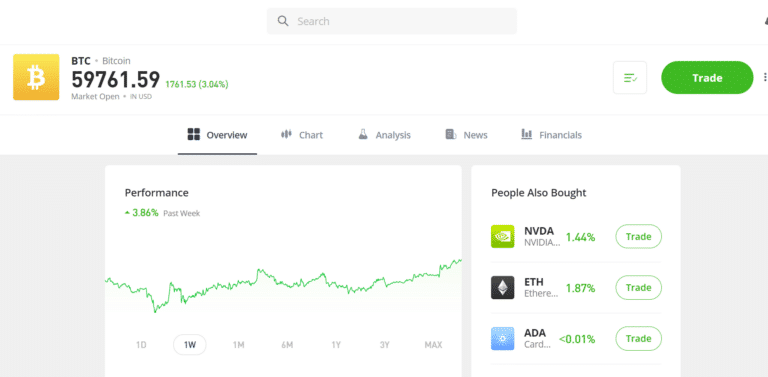

Step 4: Place Your First Order

Now that your account is funded, you’re ready to place your first order to buy cryptocurrency.

- Choose a Cryptocurrency: A popular example would be Bitcoin.

- Enter Amount: Decide how much you want to invest, either in GBP or the specific amount of crypto.

- Select Order Type – Choose between:

- Market Order: This buys the cryptocurrency immediately at the current market price and is straightforward and quick.

- Limit Order: Set a specific price at which you want to buy the cryptocurrency. The order will execute only if the market reaches your set price.

4. Confirm Purchase: Review all details and confirm your purchase.

Step 5: Secure Your Investment in a Crypto Wallet

After purchasing cryptocurrency, it is essential to store it securely.

What is a Crypto Wallet? The best crypto wallets allow you to store, send, and receive crypto with ease. The wallet will store your private keys, which serve as passwords that grant you access to your crypto.

Should You Keep Your Crypto on an Exchange or in a Wallet?

You have two main options for storing your cryptocurrency: keeping it on the exchange or transferring it to a private wallet.

Here’s a table to breakdown the key difference sbteween the two:

| Storage Option | Pros | Cons | Security Level |

|---|---|---|---|

| Exchange | Easy access, convenient for trading | Higher risk of hacks | Moderate (with 2FA) |

| Private Wallet | Greater control, enhanced security | Less convenient for frequent trades | High (especially with cold storage) |

By following these steps, you can start investing in cryptocurrency in the UK securely and efficiently.

What are Some Alternative Options for Purchasing Crypto in the UK?

- Exchange-Traded Funds (ETFs): Investing in cryptocurrency-related ETFs is another way to gain exposure to the crypto market. ETFs allow you to invest in a basket of cryptocurrencies without directly owning them. This method is ideal for those looking to diversify their investment through traditional stock exchanges.

- Shares in Crypto-Related Companies: Buying shares is another way to indirectly participate in the growth of the crypto market. This option suits investors who prefer established companies within the stock market while still gaining exposure.

- Online Payment Platforms: Platforms like PayPal now offer options to buy, hold, and sell cryptocurrencies directly within their system. This method provides a familiar and accessible way to purchase cryptocurrencies, especially appealing to those new to crypto or prefer using existing online payment accounts.

By understanding these various methods and options for buying cryptocurrencies, you can choose the right approach that aligns with your investment strategy, whether you prefer direct ownership through exchanges or indirect exposure via ETFs or stocks.

What Do I Need to Consider Before Investing in Crypto?

Start by thoroughly researching the cryptocurrency you’re interested in. Be prepared for high volatility, as prices can swing dramatically in short periods. It is also wise to evaluate a coin’s long-term potential by having a look at it’s roadmap, real-world utility, and adoption prospects. Above all, only invest what you can afford to lose.

Is it Legal to Invest in Cryptocurrency in the UK?

Yes, investing in cryptocurrency is legal in the UK. Use FCA-registered platforms for added safety. While cryptocurrencies aren’t FSCS-protected, profits may be subject to Capital Gains Tax. Always follow regulations and ensure you understand the risks involved.

Do You Have to Pay Taxes on Cryptocurrency in the UK?

In the UK, crypto is taxed as property. You may owe Capital Gains Tax when you sell, swap, or spend crypto, and Income Tax on staking, mining, or payments. In 2025, HMRC began collaborating with exchanges to utilise data analytics and track cryptocurrency transactions. Whether you’re making gains or earning crypto as income, understanding your tax obligations is no longer optional — it is essential. Read more regarding this on our Crypto Tax UK page.

Final Thoughts

Buying cryptocurrency in the UK is more accessible than ever, thanks to a growing number of regulated platforms and payment options. The key is to begin with solid research and select a platform that meets your needs. Don’t forget to factor in regulations and tax implications, and always store your crypto safely, ideally in a personal wallet if you plan to hold it long-term.

Crypto can be an exciting and potentially rewarding investment. By understanding the basics and making informed decisions, you’ll be in a much better position to navigate this rapidly evolving space with confidence.

FAQs

It is wise to start with a small amount of money that you can afford to lose. The cryptocurrency market is highly volatile, so investing a small sum helps you get familiar with the market dynamics without risking a significant portion of your savings.

Begin by selecting a reputable platform. Create and verify your account, deposit funds, and choose a cryptocurrency to buy. Complete the purchase and transfer your assets to a secure wallet for safekeeping.

You can sell it for a traditional currency, such as GBP, or choose to withdraw it to your bank account. Please be aware of withdrawal fees, which can vary from bank to exchange/broker.

Yes, buying cryptocurrency is legal in the UK. For Consumer protection always use FCA-registered platforms and be cautious of scams or phishing schemes.

We recommend eToro, Coinbase, Uphold and OKX.

Bank transfers, debit/credit cards, and sometimes PayPal. Bank transfers usually have lower fees, while cards offer convenience but higher costs. Select the method that best suits your preferences and transaction size.

Top 5 Exchanges

1

eToro

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

2

Coinbase

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

3

Best Wallet

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

4

Uphold

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

5

OKX

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

References:

- FCA (Financial Conduct Authority) – Cryptoasset consumer research

- Bank of England – What are cryptoassets?

- Coinbase UK – How to buy crypto in the UK (official guide)

- HMRC – Cryptoassets: tax for individuals

- eToro UK – Guide to crypto trading and investing

- CoinTelegraph – How to buy Bitcoin and Ethereum in the UK

- Forbes – Get Started In Investing In Cryptocurrency

- BBC News – Bitcoin: Crypto Fans

- GOV.UK – Economic Crime and Corporate Transparency act

Featured Blogs

Trading and investing involve risk. The value of your investments can go up or down, and you may lose all or part of your capital. These products may not be suitable for all investors. Please ensure you fully understand the risks involved.

- Stocks, ETFs, crypto, more

- Copy top investors easily

- User & beginner friendly

- 30M+ global users

- Regulated, trusted platform