Best Crypto Apps in the UK for 2025

Adam Woodhead

Co-Founder

Adam is a Co-Founder and content creator for The Investors Centre. His key areas of interest and expertise are cryptocurrency and blockchain technology.

Twitter ProfileAuthor Bio

Dom Farnell

Co-Founder

Dom is a Co-Founder of TIC, a passionate investor and seasoned blog writer with a keen interest in financial markets and wealth management. "My goal is to empower individuals to make informed investment decisions through informative and engaging content."

Twitter ProfileAuthor Bio

Fact Checked

How we test

At The Investors Centre, we pride ourselves on our rigorous fact-checking process. To delve deeper into our meticulous testing procedures and discover how we ensure accuracy and reliability, visit our dedicated page on how we test.

Risk Warning

General Disclaimer

Cryptocurrency trading involves significant risks, including the potential loss of your entire investment. Prices can be highly volatile, and past performance is not indicative of future results. Please consider your financial situation, risk tolerance, and seek independent financial advice before engaging in cryptocurrency trading.

Affiliate Disclosure

This page contains affiliate links, meaning we may earn a commission if you click through and sign up with one of our partners. This does not influence our reviews or rankings, which are based on our honest opinions and thorough research.

Last Updated 05/02/2025

In 2025, finding the best crypto app in the UK can be challenging given the multitude of options available. Selecting the right app is crucial as it can significantly impact your trading experience, security, and overall investment success.

Whether you’re a beginner looking for a user-friendly platform or an experienced trader seeking advanced features, choosing the right app is key. This guide explores the top crypto apps in the UK, breaking down their features, pros, and cons to help you make an informed decision tailored to your needs.

Which App Is Best for You? (Quick Overview)

App | Best For | Key Features | Fee Structure |

Beginners | Social & Copy Trading | Competitive, transparent | |

Ease of Use | Simple Interface, Strong Security | Moderate, per transaction | |

Low-Cost Trading | Advanced Tools, Low Fees | Low, volume-based | |

Unique Features | Innovative Trading Tools | Varies, depending on use | |

Variety of Assets | Large Selection of Cryptos | Transparent, no deposit fees | |

Broad Market Options | Advanced Trading, High Liquidity | Competitive, tiered | |

Advanced Traders | Comprehensive Tools, High Liquidity | Low, volume-based |

Featured Broker

eToro - Best for Beginners

- Copy Trading

- Competitive Fees

- Diverse Asset Range

- Regulated & Trusted

- 30 Million+ Users

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

What Does This Page Cover?

- What Are the Key Differences Between These Apps?

- How Did We Choose the Best Crypto Apps?

- Top 7 Crypto Trading Apps in the UK for 2025

- How to Get Started with Crypto Trading Apps in the UK

- Features to Look for in a Crypto Trading App

- Which Crypto App Is Best for Beginners?

- Final Thoughts on Choosing the Best Crypto App in the UK

- References

- FAQs

What Are the Key Differences Between These Apps?

Spot Crypto | 120+ | 390+ | 60+ | 200+ | 350+ | 60+ | 370+ |

Founded | 2007 | 2012 | 2024 | 2015 | 2017 | 2013 | 2017 |

HQ | Israel | California | Portugal | USA | Seychelles | Australia | Caymens |

Native Token | Pending | UP | OKB | BNB | |||

4.1/5 | 3.5/5 | N/A | 4.2/5 | 3.2/5 | 4.2/5 | 2.1/5 | |

Leverage | Non UK | Non UK | Non UK | Non UK | Non UK | ||

Mobile App | |||||||

DEFI Wallet | |||||||

Beginner Friendly | 4.2/5 | 4.5/5 | 4.5/5 | 4/5 | 4/5 | 4.5/5 | 4/5 |

Demo Account | |||||||

Available in UK | |||||||

Review Score | 4.7/5 | 4.5/5 | 4.5/5 | 4.5/5 | 4.35/5 | 4/5 | 4.0/5 |

Please Refer to the Crypto Exchange for the most up to date information. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. | Add New | Add New | Add New | Add New | Add New | Add New | Add New |

How Did We Choose the Best Crypto Apps?

What Criteria Did We Use for Rating?

Our evaluation of the best crypto apps was based on a comprehensive set of criteria to ensure a balanced and user-centric review. Security was paramount, as safeguarding your funds and personal data is critical. We focused on apps that offer robust security measures like two-factor authentication (2FA), encryption, and insurance against breaches. Fees were another key factor; we looked for apps with transparent fee structures, including low trading fees, minimal withdrawal costs, and no hidden charges. Ease of Use played a significant role, especially for beginners. Apps with intuitive interfaces, straightforward onboarding processes, and educational resources ranked higher. Finally, the Range of Cryptocurrencies offered was crucial. We favoured apps that provide access to a diverse selection of cryptocurrencies, allowing users to explore and invest in various digital assets.

Why Should You Trust Our Recommendations?

Our recommendations are based on hands-on experience and thorough research. As experienced traders, we’ve personally tested these apps, evaluating their strengths and weaknesses. We’ve also delved into user reviews and industry insights to provide a well-rounded perspective. This combination of firsthand testing, user feedback, and industry analysis ensures that our reviews are trustworthy and reliable, giving you confidence in selecting the right crypto app for your needs.

Top 7 Crypto Trading Apps in the UK for 2025

Quick Review

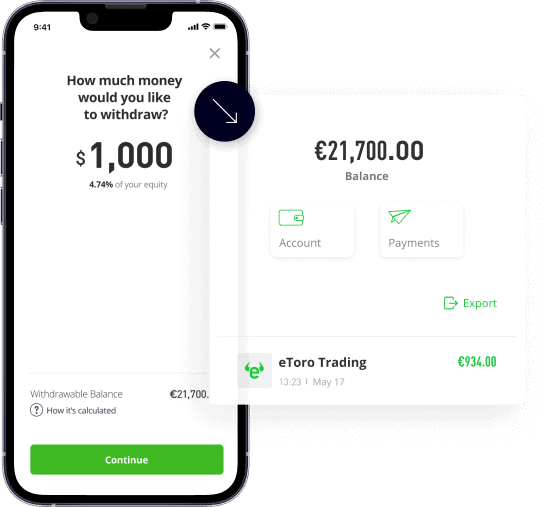

eToro is often heralded as one of the best crypto trading apps for beginners, thanks to its user-friendly platform and innovative features. It simplifies the trading process, making it accessible even for those new to cryptocurrency. With eToro, you can start trading with just a few clicks, and the app provides various tools to help you learn and grow as a trader.

Overall, eToro is a solid choice for beginners due to its ease of use, educational features, and regulatory backing. However, those looking for lower fees or more advanced trading options might want to consider other platforms. If you’re starting out and want a platform that helps you learn while you trade, eToro is a top contender.

Why Choose eToro?

eToro stands out for its social trading and copy trading features, which allow users to observe and replicate the trades of more experienced investors. This is particularly beneficial for beginners who are still learning the ropes, as it offers an educational aspect alongside actual trading. The platform also includes a virtual portfolio feature, giving you $100,000 in virtual funds to practice trading without any financial risk. Additionally, eToro provides a wide range of cryptocurrencies to trade, including popular options like Bitcoin and Ethereum, as well as lesser-known altcoins, allowing for portfolio diversification.

Another advantage of eToro is its regulation and security. It’s regulated by reputable authorities like the FCA in the UK, ensuring compliance with strict financial standards. This regulatory oversight gives users peace of mind knowing their investments are protected. eToro also offers an integrated wallet feature, making it easy to store and manage your digital assets directly within the platform.

What Are the Pros and Cons of eToro?

Pros:

- User-Friendly Interface: eToro’s platform is designed with beginners in mind, featuring an intuitive layout and easy-to-use tools.

- Social and Copy Trading: Allows users to follow and copy the trades of experienced investors, which is a great learning tool.

- Virtual Portfolio: Offers a practice account with virtual funds to help beginners get comfortable with trading.

- Regulated and Secure: Regulated by the FCA, providing a secure environment for trading and investing.

- Wide Range of Cryptocurrencies: Offers access to a variety of cryptocurrencies, including major coins and emerging altcoins.

- Integrated Wallet: Simplifies the process of buying, storing, and managing cryptocurrencies within one app.

Cons:

- Higher Fees for Crypto Trades: eToro’s fee structure can be higher for cryptocurrency trading compared to some other platforms, including spreads and withdrawal fees.

- Limited Ownership: When buying crypto on eToro, you are purchasing CFDs rather than the actual coins, which means you don’t have full ownership of the underlying asset.

- Withdrawal Time: Withdrawals can sometimes take longer compared to other platforms, which might be inconvenient if you need quick access to funds.

- No Advanced Trading Features: While great for beginners, eToro lacks some of the advanced trading tools and charting options preferred by experienced traders.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

Quick Review

Coinbase is widely regarded as one of the most user-friendly crypto trading apps available, making it an excellent choice for both beginners and those looking for a simple, straightforward trading experience. Its clean design and intuitive interface allow users to navigate the app with ease, which is crucial for newcomers who might find the world of cryptocurrency trading overwhelming. Coinbase also offers robust security measures and a diverse range of cryptocurrencies, making it a comprehensive option for many traders.

Coinbase excels as a user-friendly platform with a strong emphasis on security and education, making it an excellent starting point for beginners. Its straightforward approach to buying and selling cryptocurrencies simplifies the trading process, allowing users to focus on learning and growing their portfolios. However, the higher fees and lack of advanced trading tools might make it less appealing to seasoned traders who require more sophisticated features. If ease of use and security are your top priorities, Coinbase is a great choice to consider.

Why Choose Coinbase?

Ease of Use is the standout feature of Coinbase. The platform’s design is minimalistic and intuitive, ensuring that even those who have never traded before can quickly understand how to buy, sell, and manage cryptocurrencies. The onboarding process is simple and quick, with clear instructions at each step. Coinbase offers a streamlined experience with its one-click buy/sell options, making transactions straightforward without overwhelming users with complex trading charts and data.

Coinbase also places a strong emphasis on security, which is essential for any crypto trading app. It employs industry-leading security practices, including two-factor authentication (2FA), biometric logins, and the majority of customer funds being stored in cold storage (offline) to prevent hacking attempts. Furthermore, Coinbase is regulated and holds various licenses, adding an extra layer of trust and compliance with regulatory standards.

Another reason to choose Coinbase is its educational resources. The platform provides a range of learning materials, including articles, tutorials, and even quizzes that reward you with small amounts of cryptocurrency upon completion. This educational aspect is particularly beneficial for beginners looking to understand the basics of crypto trading. Additionally, Coinbase offers a built-in wallet feature that allows users to store and manage their cryptocurrencies within the app securely.

What Are the Pros and Cons of Coinbase?

Pros:

- User-Friendly Interface: Coinbase is designed with simplicity in mind, featuring a clean layout and easy-to-navigate menus that make it accessible for beginners.

- Strong Security: Implements top-tier security measures, such as 2FA and cold storage, to protect user funds and data.

- Regulated and Trustworthy: As a regulated platform with various licenses, Coinbase adheres to strict compliance and safety standards.

- Educational Resources: Offers a wealth of learning materials, helping users understand crypto basics and earn small crypto rewards.

- Diverse Range of Cryptocurrencies: Provides access to a wide variety of cryptocurrencies, from popular coins like Bitcoin and Ethereum to a selection of altcoins.

- Integrated Wallet: Features an integrated wallet for secure storage and easy management of digital assets.

Cons:

- Higher Fees: Coinbase’s fee structure is relatively higher compared to some other platforms, particularly for smaller transactions, which can add up for frequent traders.

- Limited Advanced Trading Features: The simplicity of Coinbase comes at the cost of advanced trading tools and features, which may not satisfy experienced traders looking for more control.

- Slow Customer Support: Users have reported that Coinbase’s customer support can be slow to respond, which can be frustrating in time-sensitive situations.

- Limited Payment Methods: Although Coinbase supports various payment methods, some users may find the options limited compared to other platforms, especially regarding instant deposits.

Quick Review

Kraken has built a reputation as one of the most reliable and cost-effective crypto trading platforms. Known for its low fees, advanced trading tools, and solid security measures, Kraken appeals to both novice and experienced traders who are looking to minimize trading costs without compromising on functionality. If you’re searching for a platform that offers a broad range of cryptocurrencies and sophisticated trading options at competitive rates, Kraken is worth considering.

Kraken is a top choice for traders who prioritize low fees and advanced trading features. Its transparent fee structure and wide range of trading tools make it a cost-effective and versatile platform for both casual and professional traders. However, the complexity of its interface and slower account verification process may pose challenges for beginners. If you’re an experienced trader or someone looking to minimize trading costs while having access to sophisticated trading options, Kraken is an excellent platform to consider.

Why Choose Kraken?

Low-Cost Trading is one of Kraken’s standout features. The platform offers some of the lowest fees in the industry, making it an attractive option for traders who want to maximize their profits. Kraken’s fee structure is transparent and based on a maker-taker model, with fees ranging from 0% to 0.26%, depending on your 30-day trading volume. This tiered fee system rewards higher volume traders with even lower fees, making it a cost-effective choice for both casual and frequent traders.

Kraken also shines with its advanced trading tools. It offers a wide range of order types, including market, limit, stop-loss, and take-profit orders, which provide traders with greater control over their transactions. The platform also includes advanced charting tools, margin trading with up to 5x leverage, and futures trading, catering to experienced traders looking for more sophisticated options. These features make Kraken a versatile platform suitable for those who wish to employ advanced trading strategies.

Security is another area where Kraken excels. The platform uses industry-leading security protocols, including two-factor authentication (2FA), global settings lock (GSL), and encrypted cold storage to safeguard user funds and data. Kraken also conducts regular security audits and has a dedicated team of experts to monitor and respond to any potential threats. Furthermore, it is a regulated exchange, complying with financial regulations in the jurisdictions where it operates, which adds an extra layer of trust.

What Are the Pros and Cons of Kraken?

Pros:

- Low Fees: Kraken offers a transparent and competitive fee structure, with lower fees for high-volume traders, making it one of the most cost-effective platforms in the industry.

- Advanced Trading Tools: Provides a wide range of order types, advanced charting tools, margin, and futures trading, catering to experienced traders.

- Strong Security Measures: Implements robust security features, including 2FA, GSL, and encrypted cold storage, to protect user funds and data.

- Wide Range of Cryptocurrencies: Offers a diverse selection of cryptocurrencies, from major coins to a variety of altcoins, allowing for portfolio diversification.

- Regulated and Trustworthy: Kraken is a regulated exchange, adhering to strict compliance standards and building trust with its user base.

- High Liquidity: Known for its high liquidity, especially in major cryptocurrencies, ensuring that users can easily buy and sell assets without significant price slippage.

Cons:

- Complex Interface for Beginners: Kraken’s advanced features and tools can be overwhelming for beginners, who may find the interface less intuitive compared to more beginner-friendly platforms.

- Limited Instant Buy Option: While Kraken does offer instant buy options, they are somewhat limited compared to other platforms, which may be inconvenient for users seeking quick transactions.

- Slower Verification Process: The verification process can be slower than on some other platforms, especially during periods of high demand, which can delay account setup.

- Customer Support: Although Kraken has improved its customer support, some users have reported slower response times during peak trading periods.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

4. Mexc – Does It Offer Unique Trading Features?

Quick Review

Mexc has quickly gained recognition in the crypto trading world for its innovative and unique trading features. Known for offering a diverse range of trading options, including spot, margin, and futures trading, Mexc caters to both beginners and advanced traders. Its focus on providing a wide array of tools and services sets it apart from many other crypto exchanges, making it an attractive option for those looking for a more versatile trading experience.

Mexc is an excellent platform for traders who are looking for more than just basic buying and selling of cryptocurrencies. Its unique trading features, such as margin and futures trading, along with opportunities to participate in new token launches, make it a versatile choice for both casual and advanced traders. The platform’s wide range of cryptocurrencies and high liquidity provide ample opportunities for diversification and efficient trading. However, those who are concerned about regulatory compliance or require immediate customer support might need to weigh these factors before choosing Mexc. If you seek a platform that offers a blend of innovation, variety, and competitive fees, Mexc is certainly worth exploring.

Why Choose Mexc?

Mexc stands out primarily due to its variety of trading features. It provides a comprehensive trading platform that includes spot trading, margin trading, and futures trading. This allows traders to take advantage of various market conditions and employ different strategies to maximize their profits. Margin trading with leverage up to 10x is available for those looking to amplify their gains, while futures trading offers advanced tools like perpetual contracts, giving traders the ability to speculate on price movements over different time frames.

Another unique aspect of Mexc is its Launchpad and Staking features. The Mexc Launchpad allows users to participate in new project token sales, giving them early access to potentially high-growth tokens before they are listed on major exchanges. This feature is especially appealing to investors looking to diversify their portfolios with new and emerging cryptocurrencies. Additionally, Mexc offers staking services, where users can earn passive income by holding and staking their digital assets on the platform. These features add value for users seeking more than just traditional trading.

Liquidity and wide selection of cryptocurrencies are other significant advantages of Mexc. The platform provides access to a vast range of cryptocurrencies, including many emerging altcoins that are not readily available on other exchanges. This extensive selection, combined with high liquidity, ensures that users can trade with minimal price slippage. Mexc’s deep liquidity pools across various trading pairs make it a preferred choice for traders who need to execute large orders without impacting market prices significantly.

What Are the Pros and Cons of Mexc?

Pros:

- Unique Trading Features: Offers a wide range of trading options, including spot, margin, and futures trading with up to 10x leverage, catering to both beginners and advanced traders.

- Launchpad and Staking: Provides opportunities to participate in new token sales and earn passive income through staking, adding value beyond traditional trading.

- Wide Selection of Cryptocurrencies: Supports a vast range of cryptocurrencies, including many emerging altcoins, allowing for extensive portfolio diversification.

- High Liquidity: Offers deep liquidity across various trading pairs, enabling smooth and efficient trading with minimal price slippage.

- User-Friendly Interface: Despite its advanced features, Mexc maintains an intuitive and user-friendly interface, making it accessible to both new and experienced traders.

- Competitive Fees: Mexc offers a competitive fee structure, with relatively low trading fees compared to some other exchanges, especially for high-volume traders.

Cons:

- Limited Regulatory Oversight: Unlike some other major exchanges, Mexc operates with less regulatory oversight, which might be a concern for users prioritizing compliance and regulatory adherence.

- Customer Support: Some users have reported slower customer support response times, which can be an issue during peak trading periods or when immediate assistance is required.

- Geographical Restrictions: Mexc is not available in certain regions, which may limit access for some users depending on their location.

- Learning Curve for Beginners: While the platform is user-friendly, the abundance of features and tools may still present a learning curve for complete beginners who are unfamiliar with advanced trading options.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

Quick Review

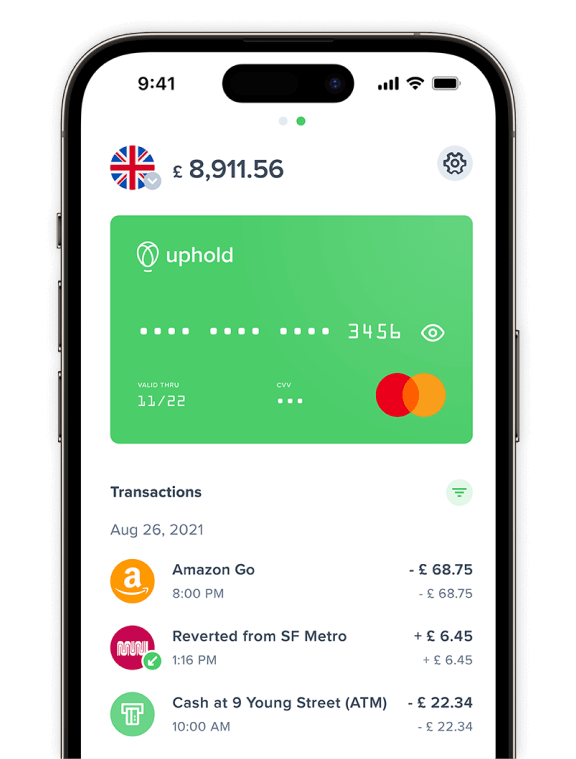

Uphold is a versatile crypto trading platform known for its extensive selection of assets, including a wide range of cryptocurrencies. Its all-in-one approach allows users to trade not only cryptocurrencies but also other assets like precious metals, equities, and fiat currencies. This unique offering makes Uphold an attractive option for those looking to diversify their investment portfolio beyond just digital currencies. If having access to a large variety of coins and other assets is important to you, Uphold is worth considering.

Uphold is an excellent choice for those who value having access to a wide selection of assets, including a vast array of cryptocurrencies and other investment options like precious metals and equities. Its user-friendly interface, transparent fee structure, and the ability to trade directly between different types of assets make it a versatile platform for both beginners and experienced investors. However, its lack of advanced trading tools and reliance on spreads for revenue may make it less suitable for professional traders seeking a more feature-rich environment. If you’re looking for a platform that offers a large selection of coins and an easy-to-use interface, Uphold is definitely worth considering.

Why Choose Uphold?

One of the primary reasons to choose Uphold is its diverse asset selection. Uphold offers access to over 200 cryptocurrencies, including major coins like Bitcoin, Ethereum, and XRP, as well as a wide variety of altcoins. This extensive range allows users to explore and invest in emerging digital assets that are not easily found on other platforms. Additionally, Uphold supports cross-asset trading, meaning you can trade between cryptocurrencies, precious metals, equities, and fiat currencies directly. This feature provides a convenient way to diversify your investments without needing multiple accounts on different platforms.

Another standout feature of Uphold is its transparency and fee structure. Unlike many other platforms that have complex fee schedules, Uphold offers a straightforward and transparent pricing model. There are no hidden fees or charges; instead, Uphold makes its money through a small spread on transactions. This transparency is beneficial for users who want to know exactly what they are paying for each trade. Additionally, Uphold does not charge fees for deposits, withdrawals, or trading within the platform, making it a cost-effective option for many traders.

Ease of use and accessibility are also key benefits of Uphold. The platform is designed with simplicity in mind, featuring a user-friendly interface that caters to both beginners and experienced traders. Uphold’s mobile app is particularly convenient, allowing users to trade, manage their portfolios, and access various assets on the go. Moreover, Uphold offers an AutoPilot feature that lets users set up recurring transactions to automate their investments, which is useful for those who prefer a hands-off approach to building their portfolio over time.

What Are the Pros and Cons of Uphold?

Pros:

- Large Selection of Assets: Offers access to over 200 cryptocurrencies and a variety of other assets, including precious metals and equities, providing extensive diversification opportunities.

- Cross-Asset Trading: Allows for direct trading between different types of assets, making it easy to diversify your portfolio within a single platform.

- Transparent Fee Structure: Uphold has a straightforward fee model with no hidden charges, and it doesn’t charge fees for deposits, withdrawals, or internal trading, making it cost-effective.

- User-Friendly Interface: The platform and mobile app are designed to be intuitive and easy to navigate, catering to both beginners and experienced traders.

- AutoPilot Feature: Enables automated, recurring investments, which is useful for users who want to automate their investment strategy.

- Instant Account Funding: Uphold allows for instant funding of accounts through various methods, including bank transfers, debit/credit cards, and even cryptocurrencies.

Cons:

- Spreads Can Be Higher: While there are no direct fees, Uphold makes its money through spreads on transactions, which can sometimes be higher than the fees on other platforms, especially for less liquid assets.

- Limited Advanced Trading Tools: Uphold’s simplicity is a double-edged sword. While it’s easy to use, it lacks some of the advanced trading tools and features preferred by professional or highly experienced traders.

- Customer Support: Some users have reported that customer support can be slow to respond during high-traffic periods, which could be a concern if you encounter issues.

- Less Focus on Advanced Charting: The platform doesn’t offer advanced charting tools or technical analysis features, which might limit its appeal to traders who rely on these tools for making trading decisions.

6. OKX – How Does It Stand Out in the Market?

Quick Review

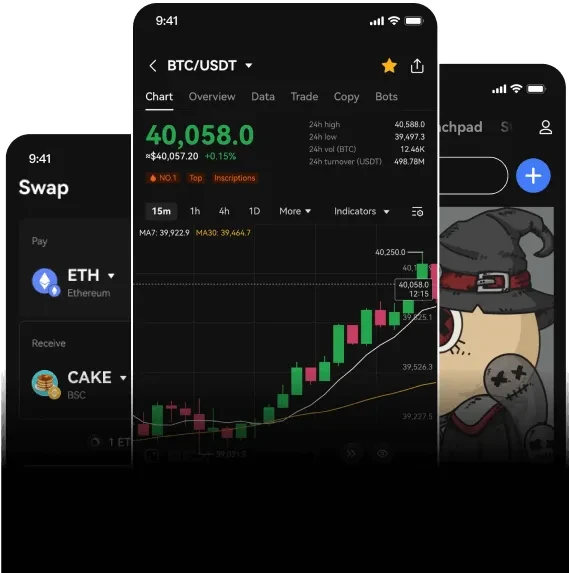

OKX is a well-established cryptocurrency exchange that distinguishes itself with a comprehensive suite of trading features and a strong global presence. Known for its wide range of trading options, high liquidity, and innovative tools, OKX caters to both novice and experienced traders. The platform is not just limited to standard spot trading; it also offers futures, options, and margin trading, making it a versatile choice for those looking to explore different facets of the crypto market.

OKX is an excellent platform for traders who want access to a wide range of trading options and advanced tools. Its high liquidity, diverse selection of cryptocurrencies, and innovative features make it a compelling choice for both experienced traders and those looking to expand their trading strategies. However, its complexity and limited fiat support may pose challenges for beginners or those who prefer a more straightforward trading experience. If you’re looking for a comprehensive and versatile trading platform with the potential for passive income opportunities, OKX is a strong contender in the crypto market.

Why Choose OKX?

One of the primary reasons to choose OKX is its extensive trading options. OKX offers spot trading, margin trading with leverage, futures, and options, giving traders the flexibility to employ various strategies. This range is particularly beneficial for those who want to delve into more advanced trading methods beyond just buying and holding cryptocurrencies. OKX also provides access to a vast array of trading pairs, including many altcoins that are not readily available on other platforms. This allows users to diversify their portfolios and explore different market opportunities.

High liquidity is another key advantage of OKX. With a large global user base and significant trading volumes, OKX provides deep liquidity across its trading pairs, ensuring that users can execute trades quickly and at competitive prices. This is especially important for traders who need to move large amounts of capital without experiencing significant price slippage. Additionally, OKX offers a robust order matching engine capable of processing millions of transactions per second, ensuring a seamless trading experience even during periods of high market volatility.

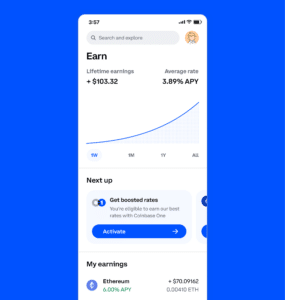

OKX also stands out for its innovative tools and features. The platform offers a variety of trading tools, including an advanced charting system with numerous technical indicators and drawing tools. For those interested in automated trading, OKX provides an API that allows users to connect trading bots to the platform. Furthermore, OKX has a unique feature called Earn, which lets users earn passive income through staking, DeFi, and lending services. This diversification of offerings allows users to grow their assets in multiple ways beyond just trading.

What Are the Pros and Cons of OKX?

Pros:

- Comprehensive Trading Options: Offers a wide range of trading options, including spot, margin, futures, and options trading, catering to both beginners and advanced traders.

- High Liquidity: Provides deep liquidity across various trading pairs, ensuring efficient trade execution with minimal price slippage.

- Advanced Trading Tools: Features an advanced charting system with multiple technical indicators, along with an API for automated trading, making it a robust platform for traders who rely on technical analysis.

- Wide Range of Cryptocurrencies: Offers access to a diverse selection of cryptocurrencies, including many altcoins, allowing for extensive portfolio diversification.

- Passive Income Opportunities: The Earn feature provides users with opportunities to earn passive income through staking, DeFi, and lending services.

- Global Presence: With a strong international user base, OKX supports multiple languages and provides a platform that’s accessible to users around the world.

Cons:

- Complex Interface for Beginners: The multitude of features and trading options can be overwhelming for beginners who may find the platform’s interface complex and challenging to navigate.

- Limited Fiat Support: OKX has limited support for direct fiat currency deposits and withdrawals, which can be inconvenient for users who prefer to fund their accounts with traditional currencies.

- Regulatory Uncertainty: OKX operates in a regulatory grey area in some jurisdictions, which might concern users who prioritize regulatory compliance and oversight.

- Customer Support: Some users have reported slow response times from customer support, particularly during high-traffic periods or when dealing with complex issues.

Quick Review

Binance is one of the largest and most popular cryptocurrency exchanges globally, known for its comprehensive range of trading features, high liquidity, and vast selection of cryptocurrencies. It has established itself as a go-to platform for advanced traders who seek a robust trading environment with access to various markets and sophisticated tools. Whether you’re into spot trading, futures, options, or margin trading, Binance offers an extensive suite of features that cater to different trading styles and strategies.

Binance is an ideal platform for advanced traders who seek a wide range of trading options, high liquidity, and access to a diverse array of cryptocurrencies. Its comprehensive suite of trading tools, competitive fees, and additional features like staking and lending make it a robust environment for those looking to engage in sophisticated trading strategies and maximize their earning potential. However, its complexity and regulatory challenges may present hurdles for beginners or those seeking a more straightforward, compliant platform. If you are an experienced trader looking for a versatile and powerful trading platform, Binance is one of the best options available.

Why Choose Binance?

Binance is particularly appealing to advanced traders due to its wide array of trading options and tools. The platform supports spot trading, margin trading with up to 10x leverage, futures trading with up to 125x leverage, and options trading. This range of trading products allows users to employ various strategies, from hedging and leveraging to arbitrage, making Binance a versatile platform for those looking to optimize their trading performance. The advanced trading interface offers customizable charting tools, a wide selection of technical indicators, and real-time data, providing a professional trading experience.

High liquidity is another significant advantage of Binance. As one of the largest exchanges by trading volume, Binance provides deep liquidity across a wide range of trading pairs, including major cryptocurrencies and numerous altcoins. This ensures that trades can be executed quickly and at competitive prices, minimizing slippage, which is crucial for high-frequency traders and those dealing with large order sizes. Additionally, Binance’s powerful matching engine can handle a large number of transactions per second, ensuring a smooth trading experience even during volatile market conditions.

Binance also stands out for its extensive range of cryptocurrencies. The platform offers access to over 300 cryptocurrencies, including popular coins like Bitcoin, Ethereum, and Binance Coin (BNB), as well as a vast array of altcoins. This diversity allows traders to explore and invest in a wide spectrum of digital assets, from established projects to emerging tokens. Furthermore, Binance provides various features beyond trading, such as staking, lending, and liquidity mining, enabling users to earn passive income from their crypto holdings.

What Are the Pros and Cons of Binance?

Pros:

- Comprehensive Trading Options: Offers a wide range of trading products, including spot, margin, futures, and options trading, catering to advanced traders and different trading strategies.

- High Liquidity: Provides deep liquidity across a vast range of trading pairs, ensuring efficient trade execution with minimal slippage.

- Advanced Trading Tools: Features an advanced trading interface with customizable charts, a variety of technical indicators, and real-time market data, offering a professional trading experience.

- Extensive Cryptocurrency Selection: Supports over 300 cryptocurrencies, including a wide range of altcoins, allowing for extensive portfolio diversification and access to emerging projects.

- Low Fees: Binance offers competitive trading fees, with further discounts available when using Binance Coin (BNB) for fee payments.

- Ecosystem and Additional Features: Offers various ways to earn passive income, including staking, lending, and liquidity mining, along with access to innovative products like Binance Launchpad for new token offerings.

Cons:

- Complex for Beginners: The advanced interface and multitude of features can be overwhelming for beginners, who may find the platform’s learning curve steep.

- Regulatory Scrutiny: Binance has faced regulatory challenges in several countries, which may concern users who prioritize compliance and regulatory adherence.

- Customer Support: Although improving, some users have reported slow response times from customer support, especially during peak trading periods or in complex cases.

- Limited Fiat Support: While Binance supports a range of fiat currencies, the options for direct fiat deposits and withdrawals can be limited depending on the user’s location

How to Get Started with Crypto Trading Apps in the UK

Getting started with crypto trading in the UK can seem daunting, but it’s a straightforward process once you know the steps. Here’s a step-by-step guide to help beginners navigate through the setup and start trading confidently.

What Do You Need to Start Trading Crypto?

Before diving into crypto trading, there are a few essentials you’ll need:

- A Crypto Trading App: Choose a reputable trading app that suits your needs. Consider factors such as security, fees, ease of use, and the range of cryptocurrencies offered. Popular options include Binance, eToro, and Coinbase.

- Identification Documents: Most platforms require you to complete a Know Your Customer (KYC) process, which involves verifying your identity. Be prepared to provide documents like a passport or driver’s license and proof of address.

- A Payment Method: To buy cryptocurrencies, you’ll need a payment method. Most apps accept bank transfers, credit/debit cards, or even PayPal. Ensure your chosen app supports the payment method you prefer.

- A Secure Internet Connection: Always use a secure, private internet connection to protect your personal information when accessing crypto trading apps.

How Do You Set Up Your Account?

Once you have everything ready, follow these steps to set up your account:

- Download the App: Visit the official website of your chosen trading platform and download the app from the App Store or Google Play Store.

- Create an Account: Open the app and click on ‘Sign Up’ or ‘Create Account.’ You’ll need to provide your email address, create a strong password, and agree to the terms and conditions.

- Complete Verification (KYC): After creating your account, you’ll need to verify your identity. Follow the on-screen instructions to upload the required documents. Verification usually takes a few minutes to a couple of days.

- Secure Your Account: Enable two-factor authentication (2FA) for added security. This step is crucial to protect your account from unauthorized access.

- Add a Payment Method: Link your bank account, credit/debit card, or PayPal account to fund your trading account. This will allow you to deposit funds and start trading.

- Deposit Funds: Go to the ‘Deposit’ section of the app, choose your payment method, and enter the amount you wish to deposit. Follow the prompts to complete the transaction.

Do You Need a Cryptocurrency Wallet?

Yes, having a cryptocurrency wallet is recommended, though not mandatory. Most trading apps provide a built-in wallet for storing your purchased cryptocurrencies. However, for added security, especially if you plan to hold large amounts or invest for the long term, consider using a hardware wallet or a software wallet. A hardware wallet is an offline device that stores your private keys securely, reducing the risk of hacks. Examples include Ledger and Trezor. A software wallet is an app or software that stores your private keys online, offering more convenience but slightly less security than hardware wallets.

By following these steps and understanding the essentials, you’ll be well-prepared to start trading cryptocurrencies safely and efficiently.

Features to Look for in a Crypto Trading App

Choosing the right crypto trading app is crucial for a smooth and successful trading experience. With numerous options available, it’s important to understand what features make a crypto app stand out and how to decide between an exchange and a broker.

What Makes a Crypto App Stand Out?

Several key features make a crypto trading app stand out from the competition:

- Security: The most important feature is security. Look for apps that offer robust security measures such as two-factor authentication (2FA), encryption, cold storage for funds, and insurance against hacks. Apps regulated by financial authorities like the FCA in the UK provide an added layer of security and trust.

- Fees: Low and transparent fees are essential. Some apps charge for deposits, withdrawals, and trades, while others operate on a spread. It’s important to understand the fee structure to avoid unexpected costs. Compare the fees of different platforms, especially if you plan to trade frequently or in large volumes.

- User Interface and Ease of Use: A user-friendly interface makes trading more accessible, especially for beginners. Look for apps that offer a clean and intuitive design, easy navigation, and helpful educational resources. A good app should simplify complex trading processes without sacrificing functionality for experienced traders.

- Range of Cryptocurrencies: A diverse selection of cryptocurrencies allows you to explore various investment opportunities. Some apps offer only a few major coins, while others provide access to a wide range of altcoins and new tokens. The more coins available, the greater your options for building a diversified portfolio.

- Additional Features: Innovative features like social trading, staking, lending, and advanced trading tools such as technical analysis charts can enhance your trading experience. Some apps also offer demo accounts, which are great for practicing trading strategies without risking real money.

Should You Choose an Exchange or a Broker?

The choice between an exchange and a broker depends on your trading needs:

- Crypto Exchange: Exchanges like Binance and Kraken allow you to buy, sell, and trade a wide range of cryptocurrencies directly. They typically offer lower fees and a greater selection of coins, along with advanced trading tools. Exchanges are suitable for those who want more control and flexibility in their trading activities.

- Crypto Broker: Brokers like eToro act as intermediaries, offering a simpler interface and often additional services like social trading. They usually charge a premium for the convenience but are a good choice for beginners who want a straightforward way to invest in crypto without dealing with the complexities of an exchange.

Which App Has the Most Coins?

If having access to a wide range of cryptocurrencies is a priority, apps like Binance and Uphold stand out. Binance offers over 300 cryptocurrencies, including major coins and a diverse range of altcoins, making it one of the most comprehensive platforms for coin selection. Uphold also provides a large selection, including over 200 cryptocurrencies, and even extends beyond crypto to offer assets like precious metals and equities. These platforms are ideal for investors seeking exposure to a broad spectrum of digital assets.

When choosing a crypto app, consider which features align with your trading goals and experience level to ensure a suitable and efficient trading environment.

Which Crypto App Is Best for Beginners?

For beginners, the ideal crypto app should be user-friendly and offer a smooth onboarding experience. Look for apps that provide an intuitive interface with easy navigation and clear instructions for buying, selling, and managing cryptocurrencies. Another important feature is educational resources; the best apps for beginners, like Coinbase and eToro, offer guides, tutorials, and learning materials to help you understand the basics of crypto trading and market trends. Additionally, consider apps that offer a demo account or practice mode. This feature allows you to trade with virtual funds, giving you the opportunity to practice and develop your trading skills without risking real money.

How Easy Is It to Use These Apps?

Apps like Coinbase and eToro are known for their simplicity and ease of use, making them ideal choices for beginners. Coinbase offers a clean, straightforward interface with simple buy/sell options, making it easy for newcomers to navigate the world of crypto. eToro goes a step further by incorporating social trading features, allowing beginners to follow and copy the trades of experienced investors. This can be an excellent way to learn about trading strategies while gaining exposure to the market. Both platforms also provide comprehensive educational resources, helping users build their knowledge and confidence in crypto trading.

Final Thoughts on Choosing the Right App for You

When choosing the best crypto app, consider factors such as security, fees, ease of use, and the range of cryptocurrencies offered. Evaluate whether the app meets your trading needs and experience level. For beginners, prioritize platforms with a user-friendly interface and ample educational resources. Advanced traders may prefer apps with more sophisticated tools and a broader range of trading options.

Which App Is Right for You?

The right app for you depends on your specific goals and preferences. If you are new to crypto trading, Coinbase and eToro are excellent starting points due to their simplicity and supportive features for beginners. For those seeking advanced trading capabilities and a wide selection of coins, Binance and Kraken are top choices. Ultimately, it’s about finding a platform that aligns with your trading strategy, comfort level, and desired level of engagement with the crypto market. Take the time to explore and test different options to find the best fit for your needs.

FAQs

Most reputable crypto apps implement robust security measures like two-factor authentication (2FA), encryption, and cold storage for assets to protect against hacks. However, no system is completely immune to security breaches. It’s crucial to use apps that are well-known for their security practices and to follow personal security best practices, such as using strong passwords and enabling 2FA.

Yes, many crypto apps offer opportunities to earn passive income through features like staking, lending, and interest-bearing accounts. For example, apps like Coinbase and Binance provide staking services where you can earn rewards by holding certain cryptocurrencies in your account. Always research the terms and risks associated with these features before participating.

Most crypto apps facilitate cross-border transactions, allowing users to send and receive cryptocurrencies anywhere in the world. However, the availability of fiat withdrawals and deposits may vary depending on your country and the app’s supported regions. Be sure to check if the app supports transactions in your desired locations and if there are any associated fees.

Yes, some crypto apps offer features that enable you to pay for goods and services directly with cryptocurrency. For instance, apps like Uphold and Binance provide crypto debit cards that you can use for purchases. Additionally, some apps have integrated payment gateways, allowing users to make payments directly from their crypto balance.

Many crypto apps now offer tax reporting tools to help users track their transactions and calculate potential tax liabilities. These tools can generate reports that outline your trading history, profits, and losses, which are helpful during tax season. However, it’s important to consult with a tax professional or accountant to ensure compliance with your local tax regulations.

Related Articles

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

Our #1 Recommended Crypto Exchange Platform in the UK

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.