How to Mine Bitcoin UK 2025

Thomas Drury

Co-Founder

Seasoned finance professional with 10+ years' experience. Chartered status holder. Proficient in CFDs, ISAs, and crypto investing. Passionate about helping others achieve financial goals.

Twitter ProfileAuthor Bio

Adam Woodhead

Co-Founder

Adam is a Co-Founder and content creator for The Investors Centre. His key areas of interest and expertise are cryptocurrency and blockchain technology.

Twitter ProfileAuthor Bio

Fact Checked

How we test

At The Investors Centre, we pride ourselves on our rigorous fact-checking process. To delve deeper into our meticulous testing procedures and discover how we ensure accuracy and reliability, visit our dedicated page on how we test.

Risk Warning

Please bear in mind that trading involves the risk of capital loss. 51% to 84% of retail investor accounts lose money when trading CFDs with the providers below. You should consider whether you can afford to take the high risk of losing your money.

Last Updated 11/04/2025

Is mining Bitcoin worth it anymore? After the 2024 halving, which slashed the block reward from 6.25 to 3.125 BTC, the game has certainly changed. But people are still doing it. Why? Because mining isn’t just about chasing block rewards; it’s about supporting the Bitcoin network, staying plugged into the ecosystem, and for some, creating a (potentially) profitable side hustle or business.

Quick Answer: How Do I mine Bitcoin in the UK?

Bitcoin mining in the UK is possible in 2025 with the right hardware, software, and energy strategy. While high electricity costs are a challenge, smart setup choices and pool mining can make it viable for individuals looking to participate in the Bitcoin network.

Featured Platform - eToro

- Copy Trading

- User Friendly Platform

- Regulated & Trusted

- 30 Million+ Users

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

Whether or not Bitcoin mining is profitable in the UK really depends on a few key variables.

First, there’s the Bitcoin price. If it’s hovering in the £40k–£50k range or higher, it opens the door to profitability—assuming the rest of your setup is efficient. But price alone isn’t enough. You also have to consider network difficulty—which tends to rise as more miners come online—and that reduced block reward. These two factors combined mean you really need high-performance hardware and low electricity costs to stay competitive.

And that’s where the UK gets tricky. Electricity here isn’t cheap. I’m paying around £0.30 per kWh, which eats into profits fast unless your rig is super energy efficient. Plus, with our mild (but humid) climate, cooling isn’t as simple as opening a window year-round.

Hardware access is another headache. ASICs aren’t exactly on the shelves at your local Currys. You’ll likely need to import them (I’ll get into that shortly).

In my experience, mining in the UK can be profitable—but it’s definitely easier if you’re treating it like a business rather than a solo weekend project. That said, I know a few hobbyists who’ve made it work by using renewable energy or mining during off-peak hours. If you plan smart and manage your costs, there’s still life in Bitcoin mining here.

What Hardware Do You Need to Start Mining Bitcoin?

If you are serious about mining Bitcoin in 2025, you’re going to need an ASIC miner. Full stop. Gone are the days when you could mine BTC with a GPU or even a high-end CPU. I actually tried spinning up a mining rig on an old gaming PC just for fun, and… yeah, don’t bother. You’ll burn through electricity and barely earn enough satoshis to fill a thimble.

ASICs (Application-Specific Integrated Circuits) are purpose-built machines designed to do one thing: mine Bitcoin. They’re dramatically faster and more energy efficient than any GPU setup. The trade-off is they’re not cheap—and they’re loud, hot, and power-hungry.

Right now, two of the top-performing ASIC miners on the market are the Antminer S21 and the Whatsminer M60S. The S21 pushes around 200 TH/s with solid efficiency, and the M60S is no slouch either, especially in cooler environments. But expect to pay anywhere from £2,500 to £4,500 for one of these units—more if you’re buying new or from a UK-based seller with a markup.

When I got into ASIC mining, I couldn’t find much locally. So I ended up importing my first unit from Germany. Here’s what I learned: customs fees are no joke. I got slapped with VAT and import duties that added nearly 20% to the overall cost. Definitely something to factor into your budget if you’re ordering from abroad.

Noise and heat are two more things people underestimate. My miner sounds like a jet engine and easily heats up a small room. You’ll need proper ventilation, maybe even industrial fans if you’re running multiple units.

So to sum it up: yes, ASICs are essential. They’re expensive, and noisy—but they’re the only viable path if you’re mining Bitcoin seriously in 2025. And doing it right from the start saves a ton of headaches down the line.

What Is the Best Bitcoin Mining Software to Use in 2025?

One of the biggest surprises when I first got into mining wasn’t the hardware or the noise—it was how important the software was.

Mining software is what does the heavy lifting—it connects your ASIC to the blockchain, syncs with your mining pool, tracks performance, and helps you get the most out of your setup.

If you’ve never touched mining software before, it is not as intimidating as it sounds (depending on which one you use). Over time, I found a few key things to look for when choosing the right software:

- User-friendliness – Can you install and run it without confusion?

- Hardware compatibility – Does it support your ASIC or GPU model?

- Remote access – Can you monitor or control your rig from your phone or another PC?

- Analytics and monitoring – Does it track your hash rate, temperatures, earnings, etc.?

I’ve tested a few different tools, and here’s how they stack up:

Best Bitcoin Mining Software Compared (2025)

| Software | Best For | Ease of Use | Supported Hardware | Cost | Highlights |

|---|---|---|---|---|---|

| CGMiner | Pros | Low | ASICs, FPGAs | Free | Full control, command line only |

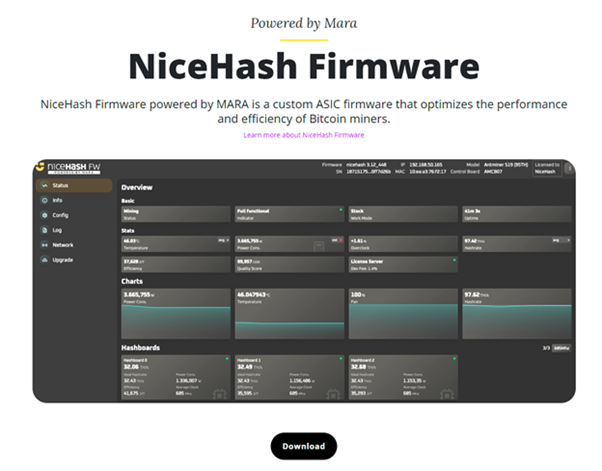

| NiceHash | Beginners | High | ASICs, GPUs | 1% fee on mined coins | Sells hashpower, easy setup |

| EasyMiner | Casual miners | High | CPUs, GPUs | Free | GUI-based, simple dashboard |

| Hive OS | Multi-rig setups | Medium | ASICs, GPUs | Paid | Full rig and farm control |

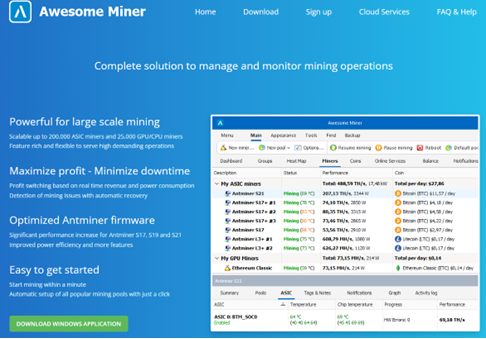

| Awesome Miner | Hobbyists & pros | High | ASICs, GPUs | Freemium | Centralised dashboard & alerts |

When I started out, I gave both NiceHash and Hive OS a proper test run. NiceHash was straightforward to set up so I was mining in under 10 minutes—it was honestly as simple as downloading the app, plugging in my wallet address, and letting it do its thing.

Hive OS, on the other hand, was abit more difficult. It’s incredibly powerful, but I had to follow a few online tutorials to configure it properly.

If you’re brand new, I’d say start with NiceHash or EasyMiner—they’re super approachable. If you’re running multiple rigs or want tight control over your setup, Hive OS or Awesome Miner are well worth exploring. And if you’re looking to go pro then CGMiner is still the gold standard.

How Do You Start Mining Bitcoin in the UK?

If you’re starting from scratch, here’s exactly how I went about it—and how you can too.

Step 1: Choose and Buy Your Hardware

This is your foundation. I went with an ASIC miner—the Antminer S21—because it offered great efficiency and hash power for the price. Make sure to check the power requirements and whether your home setup can handle it (trust me, you don’t want to trip your fuse box on day one).

Step 2: Install and Configure Your Mining Software

I started with NiceHash because it’s beginner-friendly. The install process took under 10 minutes. Later, I moved to Hive OS when I wanted more control. Either way, follow your ASIC manufacturer’s setup guide to get connected.

Step 3: Set Up a Secure Bitcoin Wallet

You’ll need a wallet to collect your mining rewards. I use a hardware wallet (Ledger Nano X) for security, but there are also plenty of solid desktop and mobile options. Just make sure you control the private keys.

Step 4: Join a Mining Pool (or Go Solo)

You can mine solo—but in 2025, unless you’re running a warehouse full of ASICs, your odds of earning a reward are basically zero. Mining pools let you contribute your hash power with others and earn a share of the rewards more frequently.

Step 5: Start Mining and Monitor Performance

Once you’re connected to a pool and your wallet is set, it’s time to mine! Keep an eye on hash rates, temperature, and uptime using your mining software dashboard. I also set up email alerts for downtime—just in case.

Should You Join a Mining Pool or Mine Solo?

I tried both. Solo mining sounds romantic—just you and the blockchain—but in reality, it’s a long and lonely grind. The chances of solving a block on your own are microscopic. Pools, on the other hand, offer regular payouts and way less stress.

Most pools pay using one of these models:

- PPS (Pay Per Share) – Consistent payouts, even if the pool doesn’t find a block.

- PPLNS (Pay Per Last N Shares) – More variable, rewards depend on recent luck.

- FPPS (Full Pay Per Share) – Like PPS but includes transaction fees.

| Pool | Payout Type | Fees | UK Access | Notable Features |

|---|---|---|---|---|

| F2Pool | PPS+ | 2.5% | Yes | Consistent payouts |

| ViaBTC | PPS/PPLNS | 2% | Yes | Cloud options available |

| Slush Pool | Score-based | 2% | Yes | Historical stats, API |

| Luxor | FPPS | 1.5% | Yes | Firmware & analytics tools |

I actually started out with Slush Pool because I liked their dashboard—it’s super transparent and has great tracking tools. But after a few weeks, I switched to F2Pool for more consistent payouts. It’s a little more hands-off, which worked better for my setup.

How Much Does Electricity Cost Impact Your Profit?

If there’s one thing that you will need to consider it’s the cost of electricity. When I first plugged in my ASIC, I nearly choked looking at my energy usage. We’re talking serious wattage—most ASIC miners chew through between 3,000 to 3,500 watts per hour. At around £0.30 per kWh (which is pretty standard here in the UK), that adds up fast.

To figure out your daily mining cost, you just take your miner’s power consumption in kilowatts, multiply it by the number of hours it runs per day (usually 24), and then multiply that by your electricity rate. For example:

£23.04/Day in Power – The Real Cost of Running My Rig

That’s why I started looking into ways to make my setup more energy efficient. One trick that helped? Undervolting my miner. It slightly reduces performance, but it also cuts down your power usage, which can be the difference between profit and loss. Some firmware options like Braiins OS make this a lot easier.

Another option I explored was immersion cooling. It’s not something most hobby miners do, but if you’ve got multiple rigs or just want to kill the noise and extend the hardware’s life, it’s worth a look.

What helped me the most, though, was switching to an Economy 7 energy tariff. This gives you cheaper electricity during off-peak hours (usually overnight), and I managed to shave nearly 20% off my monthly electricity bill just by syncing my mining schedule with those hours.

I also recommend checking out tools like WhatToMine and ASICMinerValue. They give you real-time estimates on profitability based on your hardware and electricity rate, and I check them regularly to stay on top of my setup.

In the UK, electricity is your biggest ongoing cost—get that part right, and the rest becomes a lot easier.

What Are the Risks of Bitcoin Mining in the UK?

Some are financial, others are technical, and a few are legal. Here’s what I’ve learned:

- Financial risks: Bitcoin’s price is volatile, and when it dips, your mining profits shrink—or disappear entirely. Add to that the constant hardware depreciation (ASICs lose value quickly as new models come out), and you’ve got a setup that requires real cashflow awareness. And don’t forget rising energy prices—your margins can vanish overnight if rates jump.

- Technical challenge: I’ve had miners shut down due to overheating, and one unit nearly fried a power strip during a particularly hot week last August. Downtime costs money, and troubleshooting can be frustrating if you’re not familiar with networking, port forwarding, or monitoring software.

- Security: Mining software can be a target for malware, and if your wallet isn’t properly secured, you could lose your earnings in an instant. I use a hardware wallet and avoid storing any coins on exchanges.

- Legal side: In the UK, HMRC treats mining rewards as taxable income, which means you’re expected to keep records and potentially file taxes on anything you earn—even if you’re just mining as a hobby. I spoke to an accountant early on, and I’m glad I did—it saved me a lot of stress later.

- Policy changes: Always a risk. The UK government hasn’t cracked down on mining yet, but things could shift, especially with growing energy concerns.

In short: mining isn’t just plug-and-play profit. There are real risks to manage—but if you’re informed and prepared, you can stay ahead of most of them.

What If Mining Isn’t Right for You?

Not everyone is cut out for mining. It’s noisy, can be costly and there is a definite learning curve. If you’re on the fence or don’t have the right setup at home, there are still other ways to get exposure to Bitcoin.

Cloud mining is one option I looked into early on. Platforms like BitFuFu and ECOS offer the ability to “rent” hash power without owning any hardware. I recommend always reading the fine print, and checking how long it takes to break even.

Hosted mining services are another route. These are UK or EU-based facilities where you can send your ASIC to be managed and operated offsite. You’ll usually pay a monthly hosting fee, but you avoid the noise, heat, and energy costs at home. It’s more hands-off, which is great—but you’re also trusting a third party with your hardware…

Sometimes, it makes more sense to buy Bitcoin outright. After crunching the numbers, I realised I’d earn more just buying BTC and holding it long-term than trying to mine with my setup. That said, mining taught me a ton about how the network works, and it was a hands-on way to really understand crypto beyond just buying coins.

If you’re leaning toward the buy-and-hold route, eToro is a solid place to start. It’s beginner-friendly, FCA regulated, and lets you invest in Bitcoin (and other assets) without the upfront hardware costs or energy headaches. I still mine to stay connected to the space, but for most people, buying BTC directly is the simpler—and sometimes smarter—option.

If you’re after passive income, you might also look into staking altcoins or earning yield through DeFi platforms. Just make sure you do your research—rewards often come with risk.

At the end of the day, mining isn’t your only option—but going through the process helped me become a far more confident and informed crypto investor.

Final Thoughts

Mining Bitcoin in the UK in 2025 is doable with the right tools, mindset, and expectations. For me, it’s been a mix of trial and error, technical learning curves. But it’s also been incredibly rewarding.

The key takeaway? If you’re just hoping to get rich quick, mining probably isn’t your best bet—especially with high electricity costs and increasing network difficulty. But if you’re curious, technically inclined, and want to participate in the backbone of the Bitcoin network, mining can be a fantastic way to deepen your understanding of how it all works.

FAQs

Yes, Bitcoin mining is legal in the UK. However, any income or profits from mining are subject to HMRC tax rules, so make sure to keep accurate records and report your earnings.

Yes, but it depends on your setup. Home mining requires specialised ASIC hardware, a stable power supply, and proper ventilation. Be prepared for noise, heat, and high electricity usage.

Startup costs vary, but expect to spend £2,500–£4,500+ for an ASIC miner, plus potential import fees, setup costs, and ongoing electricity bills of £20–£25 per day, depending on usage.

NiceHash and EasyMiner are great options for beginners. They’re easy to set up, have user-friendly dashboards, and handle most of the technical heavy lifting for you.

It can be, but only with energy-efficient hardware and a low electricity rate. Using tools like WhatToMine helps calculate potential profitability based on your setup and power costs.

A mining pool is a group of miners who combine their hash power to increase the chances of earning rewards. In 2025, solo mining is rarely profitable—joining a pool is usually the better option.

Trade Smarter, not Harder

- Copy Trading

- Competetive Fee's

- Multi Asset Platforn

CFDs are complex instruments with a high risk of losing money rapidly due to leverage. 51% of retail CFD accounts lose money when trading CFD’s with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

References:

- HMRC – Cryptoassets: Tax for Individuals

- WhatToMine – Crypto Mining Profitability Calculator

- ASIC Miner Value – ASIC Profitability Rankings

- Bitmain – Antminer Product Page

- MicroBT – Whatsminer Series

- NiceHash – Beginner-Friendly Mining Platform

- Hive OS – Operating System for Mining Rigs

- CryptoCompare – Energy Consumption Index

- Slush Pool – Mining Pool Overview and Stats

Featured Blogs

Our #1 Recommended Crypto Wallet & Exchange Platform in the UK

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.