- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 50+ platforms · 200+ guides authored

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 40+ brokers with funded accounts

- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 50+ platforms · 200+ guides authored

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 40+ brokers with funded accounts

How We Test

Real accounts. Real money. Real trades. No demo accounts or press releases.

What we measure:

- Spreads vs advertised rates

- Execution speed and slippage

- Hidden fees (overnight, withdrawal, conversion)

- Actual withdrawal times

Scoring:

Fees (25%) · Platform (20%) · Assets (15%) · Mobile (15%) · Tools (10%) · Support (10%) · Regulation (5%)

Regulatory checks:

FCA Register verification · FSCS protection

Testing team:

Adam Woodhead (investing since 2013), Thomas Drury (Chartered ACII, 2018), Dom Farnell (investing since 2013) — 50+ platforms with funded accounts

Quarterly reviews · Corrections: [email protected]

Disclaimer

Not financial advice. Educational content only. We're not FCA authorised. Consult a qualified advisor before investing.

Capital at risk. Investments can fall. Past performance doesn't guarantee future results.

CFD warning. 67-84% of retail accounts lose money trading CFDs. High risk due to leverage.

Contact: [email protected]

Choosing the right ETF platform shapes how efficiently you can build wealth through diversified, low-cost investing. The UK ETF market has reached a historic milestone, with the London Stock Exchange now hosting over 2,350 ETF products and more than £1 trillion in assets under management. European ETF inflows hit a record €247 billion in 2024—40% higher than any previous year—while the UK has produced the biggest influx of new investors anywhere in Europe, with 3.5 million people entering the market since 2022.

Spreadex

ETF Platform Score: 4.8/5

65% of retail CFD accounts lose money.

IG

ETF Platform Score: 4.7/5

68% of Retail CFD Accounts Lose Money

eToro

ETF Platform Score: 4.7/5

61% of retail CFD accounts lose money.

XTB

ETF Platform Score: 4.6/5

71% of Retail CFD Accounts Lose Money

Quick Answer: What is the Best ETF Platform in the UK?

In the UK, the best platform for trading ETFs is Spreadex. It offers commission-free ETF trading, competitive spreads, and a user-friendly interface. For investors prioritising ISA access alongside comprehensive ETF tools, IG stands out with 12,000+ shares and ETFs, commission-free trading, a flexible ISA, and 4% interest on uninvested cash.

Featured Broker - SpreadEX

A respected name in the online trading space, SpreadEX offers a unique blend of spread betting and CFD trading to both retail and professional clients. Known for its user-friendly platform, competitive pricing, and comprehensive market access, SpreadEX delivers flexibility and control for traders of all levels.

- Minimum Deposit £1

-

- Market Spread:

- From 0.6 pips (Major Forex Pairs)

- From 0.1% (UK Shares)

- Market Spread:

- FCA regulated

- Web and Mobile Trading Platform

- Acess to Thousands of global markets including indices, shares, forex, commodities, cryptocurrencies, and bonds – all through spread betting or CFDs

65% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

How Do These ETF Platforms Compare?

| Rank | Platform | Review Score | Mobile Score | Variety of Assets | ISA? | Trustpilot | Fee Score | ETF Availability | Regulator |

|---|---|---|---|---|---|---|---|---|---|

| 1 | Spreadex | 4.8/5 | 4.5/5 | Over 1,000 global ETFs, 3,000+ stocks, 15 major commodities, and more than 50 forex pairs for trading. | No | 4.6/5 | 4.2/5 | Excellent | FCA |

| 2 | IG | 4.7/5 | 3.5/5 | 18,000+ markets: stocks, ETFs, commodities, currencies, bonds, funds | Yes | 4.1/5 | 4/5 | Excellent | FCA |

| 3 | eToro | 4.7/5 | 5/5 | ETFs, stocks, crypto, CFDs & social trading | Yes | 4.3/5 | 4/5 | Good | FCA |

| 4 | XTB | 4.6/5 | 4.6/5 | 2,100+ global ETFs, stocks, commodities, indices | No | 4.7/5 | 4.5/5 | Excellent | FCA |

| 5 | Saxo | 4.5/5 | 4.6/5 | Invest in 7,000+ ETFs from tech, healthcare, environment and other major sectors | Yes | 3.9/5 | 4/5 | Limited | FCA |

| 6 | Interactive Brokers | 4.2/5 | 4/5 | 13,000+ ETFs, global stocks, bonds, mutual funds, options, futures, forex, CFDs | Yes | 3.3/5 | 4.9/5 | Excellent | FCA |

| 7 | Hargreaves Lansdown | 3.9/5 | 3.5/5 | Stocks, shares, funds, bonds, ISAs, SIPPs | Yes | 4.1/5 | 3.5/5 | Excellent | FCA |

Here are the Top 7 ETF Platforms Ranked:

- Spreadex – Best overall platform for trading ETFs

- IG – Best overall platform for investing in ETFs

- eToro – Social trading, user-friendly, broad asset range

- XTB – Excellent for beginners with commission-free ETFs and easy platform

- Saxo – Preferred for active traders and investors seeking engagement

- Interactive Brokers – Great for experienced investors

- Hargreaves Lansdown – Unmatched for a diverse fund portfolio offering

What Do Our Experts Say?

Spreadex stands out as a top choice for UK-based ETF investors by combining commission-free ETF trading with a user-friendly, customisable platform. Unlike many competitors, Spreadex also integrates financial spread betting, offering a versatile solution for those seeking both long-term ETF investment and short-term trading flexibility—all from a single FCA-regulated account.

Pros & Cons

Commission-free ETF trading

Competitive spreads

- Strong charting and analytical tools

- FCA-regulated and UK investor-focused

- No ISA account

- Limited ETF-focused educational resources

- No automated or algorithmic trading support

-

What are the Fees?

-

How user friendly is the platform?

-

How Safe is the Platform?

-

Tools & services available

Feature | ETF Trading with Spreadex |

Spread Cost | Built into the ETF buy/sell price (variable depending on market conditions) |

Commission | None |

Overnight Financing | Applicable for leveraged positions or CFDs on ETFs |

Inactivity Fee | None |

Deposit Fee | None |

Withdrawal Fee | Free for most UK methods (charges may apply for international transfers) |

Spreadex offers a clean, intuitive platform designed for simplicity. Order execution is reliable, navigation is straightforward, and account tools are easy to use. Its functionality suits beginners and regular investors who value transparency and efficiency over extensive research features or advanced analytical options.

Spreadex is regulated by the Financial Conduct Authority (FCA) in the UK. Client funds are kept in segregated bank accounts, ensuring protection in the event of company insolvency. While the platform currently lacks two-factor authentication, it maintains strong data and fund security standards.

Spreadex provides essential trading tools such as watchlists, simple charting, and portfolio tracking. It focuses on reliable execution rather than advanced features. While not tool-heavy, it delivers the core services investors need for consistent ETF trading and portfolio management without unnecessary complexity.

65% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

What Do Our Experts Say?

IG earns its place as a top ETF platform for UK investors thanks to its unmatched market access, professional-grade trading tools, and extensive educational content. With over 17,000 markets available, including a vast selection of global ETFs, IG is ideal for active investors seeking depth, diversification, and analytical precision within an FCA-regulated environment.

Pros & Cons

ISA account available

Wide ETF selection

Professional-grade tools

FCA-regulated

Higher trading commissions

Complex for beginners

-

What are the Fees?

-

What Trading Tools Are Available?

-

How Safe is the Platform?

-

How user friendly is the platform?

| Feature | Details |

|---|---|

| Spread Cost | Market spread (variable) — included in bid/ask |

| Commission | £0 per online trade (UK & many international ETFs) |

| FX Conversion | 0.7% on non-GBP ETF trades |

| Custody / Platform Fee | £24 per quarter if fewer than 3 trades that quarter; waived with 3+ trades (or £15k+ in a Smart Portfolio) |

| Overnight Financing | Not applicable to unleveraged ETF share dealing; applies only to leveraged ETF CFDs |

| Inactivity Fee | No inactivity fee for share dealing (CFD account: £12/month after 24 months of inactivity) |

| Deposit Fee | None |

| Withdrawal Fee | Free for UK bank transfers; other methods may incur charges |

- ProRealTime Advanced Charting & Automated Strategies

- IG Trading Platform (desktop & app) with Custom Indicators

- ETF Screeners, Market News, and Risk Management Tools

These features are designed to meet the needs of more serious ETF investors and those integrating ETFs into broader, multi-asset strategies.

IG is one of the UK’s most established brokers, authorised and regulated by the Financial Conduct Authority (FCA). Client funds are held in segregated Tier 1 bank accounts, and the platform incorporates strong cybersecurity measures, including two-factor authentication (2FA).

G delivers a feature-rich interface best suited to active traders. Advanced charting, analytics, and screeners are embedded, though beginners may find it complex. Dashboards are customisable, allowing traders to adapt tools to personal needs and making it a strong platform for professional ETF investors.

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 68% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

What Do Our Experts Say?

eToro is ideal for UK investors seeking a beginner-friendly platform with a social edge. With access to over 300 ETFs and the ability to copy top investors through its CopyTrader™ feature, eToro simplifies ETF investing for newcomers. Its clean interface and strong community tools make it particularly appealing to users looking to learn from others while building a diversified portfolio—all within a regulated, easy-to-use environment.

Pros & Cons

ISA Account through Moneyfarm

Social copy trading

Easy-to-use app

- FCA-regulated and trusted globally

Currency conversion fees

Smaller ETF selection

Limited advanced analytics

-

What are the Fees?

-

How user friendly is the platform?

-

What Trading Tools and services Are Available on eToro?

-

How Safe is the Platform?

Feature | ETF Trading with eToro (UK) |

Spread Cost | Variable – included in the price at time of trade |

Commission | £0 commission on real ETF purchases (not CFDs) |

Overnight Financing | Applies only to leveraged or CFD ETF positions |

Inactivity Fee | $10/month after 12 months of inactivity |

Deposit Fee | None |

Withdrawal Fee | $5 flat fee per withdrawal |

eToro is designed for accessibility. Its social trading tools allow beginners to copy successful investors, reducing complexity. The mobile-first platform is intuitive, making ETF investing simple. While advanced traders may find it limiting, beginners benefit from its ease of use and interactive features.

The platform provides CopyTrader, basic charts, and portfolio management features. While not advanced, these tools are effective for beginners. Its social features remain the standout service, enabling less experienced investors to replicate expert strategies and gain confidence in ETF investing.

eToro is regulated by the Financial Conduct Authority (FCA) in the UK and complies with strict security protocols. Client funds are held in segregated accounts, and the platform offers SSL encryption and two-step verification, providing a secure environment for retail investors.

61% of retail CFD accounts lose money when trading CFDs with this provider.

What Do Our Experts Say?

XTB is a strong entry point for new ETF investors, offering a commission-free trading model and an intuitive, well-designed platform. While it lacks tax-efficient options like ISAs or SIPPs, its simplicity, fast execution, and educational support make it one of the best low-cost options for beginners looking to explore ETF investing without overwhelming complexity.

Pros & Cons

- £0 commission on ETFs and stocks

- User-friendly platform with strong educational support

- Fast order execution and real-time pricing

- FCA-regulated and trusted across Europe

- No ISA or pension (SIPP) account options

- Limited product range (no mutual funds or crypto)

- Platform not tailored specifically for UK tax efficiency

-

What are the Fees?

-

What Trading Tools Are Available?

-

How Safe is the Platform?

Feature | ETF Trading with XTB (UK) |

Spread Cost | Competitive and variable; built into the price |

Commission | £0 commission on ETF and stock trades |

Overnight Financing | Applies to leveraged CFD positions |

Inactivity Fee | None |

Deposit Fee | None for standard payment methods |

Withdrawal Fee | Free over £60; a small fee applies for lower amounts |

- xStation 5 Platform with Custom Charts and Technical Indicators

- Free ETF Education Hub with Webinars and Courses

- Mobile App with Live Quotes, Watchlists, and Economic Calendar

XTB balances simplicity for beginners with depth for more experienced users, thanks to its professional-grade platform and training resources.

XTB is authorised and regulated by the Financial Conduct Authority (FCA) in the UK and adheres to MiFID II compliance across Europe. Client funds are kept in segregated accounts, and the platform maintains strong data security, including encryption protocols and secure login features.

71% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

What Do Our Experts Say?

Saxo stands out as a premium choice for UK investors seeking extensive ETF access and institutional-grade trading tools. With over 7,000 ETFs across global markets, Saxo offers unmatched diversification and professional-level analytics. While the platform may be complex for beginners, active traders and serious investors will appreciate the precision, depth, and global reach Saxo provides.

Pros & Cons

- Access to 7,000+ ETFs globally

- Advanced trading platforms with institutional-grade tools

- FCA-regulated with strong investor protections

- ISA account available

- Interface may be overwhelming for beginners

- Commission-based model can add up for low-volume traders

- Higher minimum deposit (£500+) may limit accessibility

-

What are the Fees?

-

How user friendly is the platform?

-

What Trading Tools Are Available?

-

How Safe is the Platform?

Feature | ETF Trading with Saxo (UK) |

Spread Cost | Competitive; varies by market and liquidity |

Commission | From £1.50 per ETF trade (varies by account tier) |

Overnight Financing | Applies to margin or CFD positions |

Inactivity Fee | None (as of most recent fee schedule) |

Deposit Fee | None |

Withdrawal Fee | Free for standard UK bank transfers |

SaxoTraderGO offers an advanced interface built for professionals. While the design is clean, the sheer depth of tools requires expertise. Beginners may find it intimidating, but seasoned traders value its flexibility and comprehensive capabilities for managing ETF investments across global markets.

SaxoTraderGO offers an advanced interface built for professionals. While the design is clean, the sheer depth of tools requires expertise. Beginners may find it intimidating, but seasoned traders value its flexibility and comprehensive capabilities for managing ETF investments across global markets.

- SaxoTraderGO and SaxoTraderPRO platforms with deep technical capabilities

- ETF screeners, heatmaps, and macroeconomic overlays

- Access to global market data, real-time news, and research reports

These tools are ideal for advanced traders looking to construct and manage diversified, high-performance ETF portfolios.

Saxo is regulated by the Financial Conduct Authority (FCA) in the UK and operates under strong international oversight. Client funds are held in segregated accounts, and the platform offers two-factor authentication (2FA) along with top-tier data security practices, ensuring peace of mind for investors.

64% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

What Do Our Experts Say?

Interactive Brokers is a top-tier platform for experienced UK investors who demand depth, global reach, and highly sophisticated trading capabilities. With access to over 13,000 ETFs worldwide and a powerful suite of tools, IBKR is designed for serious traders and portfolio builders. While it offers some of the most competitive pricing on the market, the platform can be overwhelming for beginners due to its complexity and professional focus.

Pros & Cons

- Access to 13,000+ ETFs across global exchanges

- Extremely low trading costs, especially for active traders

- Industry-leading trading platform with advanced tools

- Highly secure and regulated across multiple jurisdictions

No ISA account

USD-based pricing

Not beginner-friendly

-

What are the Fees?

-

How user friendly is the platform?

-

What Trading Tools Are Available?

-

How Safe is the Platform?

Feature | ETF Trading with Interactive Brokers (UK) |

Spread Cost | Market-based; extremely tight due to direct market access |

Commission | From $0/£0 on select ETFs (IBKR Lite) or tiered pricing from £1 per trade (IBKR Pro) |

Overnight Financing | Applies to margin positions and leveraged products |

Inactivity Fee | None (IBKR removed inactivity fees as of 2021) |

Deposit Fee | None |

Withdrawal Fee | One free withdrawal/month; fees apply after that |

Interactive Brokers offers enormous functionality but with a steep learning curve. Its interface is tailored to professionals, with dense menus and customisation options. Beginners often find it overwhelming, but experienced investors appreciate the breadth of tools and the control it offers for ETF trading.

- Trader Workstation (TWS) – institutional-grade platform

- Custom algorithmic trading, smart routing, and risk management tools

- ETF screeners, performance analytics, and global market scanners

Interactive Brokers offers one of the most powerful trading platforms available to retail investors, especially those managing multi-asset ETF portfolios across international markets.

IBKR is regulated by the FCA in the UK, as well as numerous global regulators. It offers segregated client funds, two-factor authentication (2FA), and robust data encryption. The firm is also publicly listed, adding transparency and accountability to its operations.

62.5% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

What Do Our Experts Say?

Hargreaves Lansdown is a go-to choice for UK investors building long-term, diversified portfolios. With access to a broad range of ETFs, mutual funds, and investment trusts, it pairs quality with clarity through one of the most user-friendly platforms in the market. Backed by strong FCA regulation and award-winning customer service, HL excels in research-driven investing, though its higher ETF trading fees may not suit cost-sensitive or high-frequency traders.

Pros & Cons

- Extensive range of UK-listed ETFs and funds

- Award-winning research, education, and support

- Highly intuitive platform suited for long-term investors

- FCA-regulated with strong brand trust and client protections

- £11.95 ETF trading fee is higher than many competitors

- May overwhelm beginners with research depth and ETF choices

- Limited access to international ETFs compared to global brokers

-

What are the Fees?

-

What Trading Tools Are Available?

-

How Safe is the Platform?

Feature | ETF Trading with Hargreaves Lansdown (UK) |

Spread Cost | Market-based; typically minimal but varies by ETF |

Commission | £11.95 per ETF trade (reduces to £5.95 with frequent trading) |

Overnight Financing | Not applicable to direct ETF investing |

Inactivity Fee | None |

Deposit Fee | None |

Withdrawal Fee | Free for standard UK bank transfers |

- ETF Research Centre with Analyst Ratings and Risk Scores

- Portfolio Tracking, Watchlists, and Investment News

- Mobile and Desktop Platform with Clean Navigation

While not built for technical traders, HL’s strength lies in guiding long-term investors through expert commentary, fund factsheets, and intuitive portfolio management tools.

Hargreaves Lansdown is regulated by the Financial Conduct Authority (FCA) and is one of the UK’s most established financial services firms. It offers segregated client accounts, robust security measures, and optional two-factor authentication (2FA), ensuring that investor assets and data are well protected.

Trading and investing involve risk. The value of your investments can go up or down, and you may lose all or part of your capital. These products may not be suitable for all investors. Please ensure you fully understand the risks involved.

What Do I Need to know about ETFs?

An ETF, or exchange-traded fund, is an investment fund that tracks a basket of assets such as stocks, bonds, or commodities. It trades on stock exchanges like individual shares, allowing investors to gain diversified exposure at lower costs with flexible intraday buying and selling.

How do ETFs Work?

ETFs pool investor money to purchase a portfolio of assets, with each share representing fractional ownership of that portfolio. Prices fluctuate throughout the trading day like stocks. Investors benefit from diversification, liquidity, and transparency, while fund managers ensure the ETF continues tracking its underlying index.

How to trade ETFs

Open an account with an FCA-regulated broker.

Verify identity and deposit funds.

Research ETFs that match your investment goals.

Place a buy order (market or limit).

Monitor performance and manage holdings.

Review fees, spreads, and tax efficiency regularly.

What are the different ETF Types?

A lot of people ask me whether ETFs and index funds are basically the same. They’re similar in that both often track an index, but there are some important differences I’ve learned over the years:

- ETFs trade like stocks—meaning you can buy or sell them any time during the trading day. That flexibility has been really helpful when I want to react quickly to market news.

- Index Funds, on the other hand, only execute trades at the end of the day. They’re usually fine for passive investors, but I find them a bit rigid for my style.

- ETFs also tend to have lower minimums. You can usually start with the price of a single share, which is great for beginners or anyone dollar-cost averaging.

Passive vs Actively Managed Funds

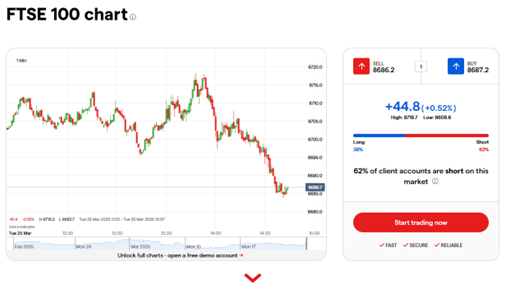

I’ve mostly stuck with passive ETFs because of their low fees and consistent long-term performance. They’re great for tracking big indices like the S&P 500 or FTSE 100. But I have dabbled in actively managed ETFs too—especially in sectors where I believe active management can add value, like emerging markets or thematic plays (think AI or green energy).

That said, actively managed ETFs usually come with higher fees and more risk, so I always make sure they fit within my broader strategy and that I’m not overweighting one theme too heavily.

Are there property focused ETF’s?

Sometimes, I would like the exposure to real estate without the hassle of owning property. That is where property ETFs—especially REIT-focused ones—came in. They’ve given me access to the real estate market without needing to be a landlord. Our expert guide on how to invest in REITs in the UK covers everything from the best REIT platforms to key tax considerations.

What are the most commonly bought ETFs

The most popular ETFs among UK investors include the iShares Core FTSE 100 UCITS ETF, Vanguard FTSE All-World UCITS ETF, and SPDR S&P 500 UCITS ETF. These funds attract investors seeking low-cost exposure to major markets, broad diversification, and long-term growth potential with consistent performance.

How have they performed in the last 20 years

Over the past 20 years, ETFs tracking global benchmarks such as the S&P 500 and FTSE All-World have returned 7–9% annually, while UK-focused ETFs like the FTSE 100 averaged lower growth. Despite volatility, long-term compounding shows ETFs remain a strong, reliable investment strategy.

How Can I Maximise ETF Flexibility and Tax Benefits?

Can You Buy ETFs in a Stocks & Shares ISA?

Yes. ISAs are one of the most tax-efficient ways to invest in the UK. Any gains or dividends from ETFs inside an ISA are tax-free—no capital gains tax, no income tax. I aim to max out my ISA allowance annually, filling it with a mix of global ETFs and income-focused funds. It’s a simple, hands-off strategy that grows quietly over time. See out page on the best Stocks and Shares ISA’s.

Can You Buy ETFs in a Pension?

Pros & Cons of ETF Investing

- Diversification: One ETF can give me exposure to hundreds of stocks or bonds. It’s one of the easiest ways I’ve found to spread risk without building a huge portfolio from scratch.

- Liquidity: Since ETFs trade like stocks, I can jump in or out of a position quickly during market hours. That flexibility is something I really value—especially when markets move fast.

- Lower Costs: Compared to actively managed mutual funds, ETFs are usually much cheaper to hold. And for me, every saved pound goes back into my investments.

- Transparency: Most ETFs publish their holdings daily, so I always know exactly what I’m investing in. No surprises.

- Market Risk: Like any market-based investment, ETFs can (and do) go down in value. I’ve had my fair share of red days, but that’s part of the game.

- Over-Trading Temptation: Because ETFs are so easy to trade, it’s tempting to buy and sell too often. I’ve learned the hard way that this can rack up fees and hurt long-term growth.

- Niche Risk: I’ve dabbled in thematic ETFs—like ones focused on blockchain or clean energy. While exciting, these can be very volatile. Now I keep niche ETFs as a small slice of my overall portfolio.

Is It Safe to Invest in ETFs?

People often ask if ETFs are safe. My answer is that they are safer than individual stocks if you invest smartly. It is important to keep in mind:

- Diversification: Most ETFs hold a wide mix of assets, so one poor performer won’t tank your entire portfolio.

- Liquidity: Well-known ETFs are easy to buy and sell.

- Market Risk: Like any investment, ETFs rise and fall.

- Fees: ETF costs are lower than most mutual funds

- Interest Rate Risk: My bond ETFs can be sensitive to rate changes. When rates rise, prices drop.

- Currency Risk: Some of my ETFs are in dollars or euros. I’ve learned to account for currency swings—they can boost or hurt returns.

Key Factors to Compare Before Choosing an ETF Platform

What fees should UK investors expect when trading ETFs?

ETF platform fees typically include trading commissions, spreads, custody charges, and inactivity fees. UK investors should compare total costs, as some platforms advertise commission-free trading but widen spreads. Evaluating all fees together is essential to identify the most cost-effective provider for consistent ETF investing.

How do ETF platforms handle commission versus spread costs?

Some UK platforms charge explicit commissions per ETF trade, while others advertise zero-commission trading but recover revenue through wider spreads. Both models affect overall returns. Comparing execution quality, spreads, and transparency ensures investors understand real costs rather than relying on headline “free trading” claims.

Which platforms offer the widest ETF selection?

Platforms like Interactive Brokers and Saxo typically offer thousands of global ETFs, while others focus mainly on UK and European funds. A wider ETF selection benefits investors seeking sector-specific or international exposure. Assessing product range ensures access to funds that align with your portfolio objectives.

Do platforms differ in research tools and educational content?

Yes, research tools and education vary. Advanced platforms like IG and Saxo provide charting, screeners, and in-depth analysis, while others focus on simple guides for beginners. Evaluating available resources helps ensure the platform supports your investing style, whether analytical, educational, or beginner-friendly.

How important is regulation and investor protection in the UK?

Regulation is crucial for safety. UK ETF platforms should be authorised by the Financial Conduct Authority (FCA) and offer investor protection through the Financial Services Compensation Scheme (FSCS). Choosing regulated providers ensures your assets are safeguarded against fraud, insolvency, and mismanagement risks.

My Final Thoughts on ETF Investing

The UK ETF market has never been more accessible, with the London Stock Exchange hosting over 2,350 ETF products and more than £1 trillion in assets under management. Record European inflows of €247 billion in 2024—combined with 3.5 million new UK investors since 2022—demonstrate growing appetite for diversified, low-cost investing.

For most UK investors, the choice comes down to priorities. Spreadex leads for pure trading execution with commission-free access and competitive spreads. IG offers the best combination of commission-free trading, a flexible ISA, and professional-grade tools for those wanting tax-efficient ETF investing. Trading 212 and XTB provide excellent zero-fee options with automated features like Pies and Investment Plans for hands-off wealth building.

FAQs

What is the best ETF platform for beginners?

The best ETF platform in the UK for beginners offers user-friendly interfaces, educational resources, and low-cost options. Platforms like eToro and XTB are often recommended for their comprehensive services and support for beginners.

How do ETF brokers compare to traditional brokers?

ETF brokers specialise in offering a wide range of exchange-traded funds with lower fees and often provide tools specifically designed for ETF trading. Traditional brokers, on the other hand, offer a broader range of investment products but may have higher fees for ETF transactions.

What features should I look for in an ETF platform?

Yes, you can find specialised ETF brokers in the UK that cater to investors looking to focus exclusively on ETF investments. These brokers typically offer extensive ETF selections, competitive pricing, and specialised trading tools.

How do trading tools on ETF platforms enhance my investment strategy?

Trading tools on ETF platforms can enhance your investment strategy by providing real-time market data, analytical tools, and the ability to set up alerts. These tools help you make more informed decisions, manage your portfolio efficiently, and identify potential investment opportunities.

Can I buy US ETFs on UK platforms?

Some UK platforms provide access to US ETFs, but availability varies. Interactive Brokers and Saxo offer extensive US ETF coverage, while others focus mainly on UCITS-compliant funds. Due to EU regulations, some US ETFs are restricted, so investors must confirm availability before trading.