Best Investment Apps in the UK - 2025

Thomas Drury

Co-Founder

Seasoned finance professional with 10+ years' experience. Chartered status holder. Proficient in CFDs, ISAs, and crypto investing. Passionate about helping others achieve financial goals.

Twitter ProfileAuthor Bio

Dom Farnell

Co-Founder

An investor and blogger with a focus on financial markets and wealth management. He’s dedicated to helping others make informed investment choices through straightforward and engaging content.

Twitter ProfileAuthor Bio

Fact Checked

How we test

At The Investors Centre, we pride ourselves on our rigorous fact-checking process. To delve deeper into our meticulous testing procedures and discover how we ensure accuracy and reliability, visit our dedicated page on how we test.

Risk Warning

Please note that the information provided by The Investors Centre is for educational purposes only and should not be considered financial advice. Always consult a professional before making any investment decisions.

Last Updated 12/03/2024

Discover our carefully selected list of reputable Investment Apps for 2025, each thoroughly tested with real funds. All brokers are available to traders in the United Kingdom.

IG

Investment App Score: 4.9/5

71% of Retail CFD Accounts Lose Money

2

eToro

Investment App Score: 4.7/5

51% of retail CFD accounts lose money.

XTB

Investment App Score: 4.6/5

73% of Retail CFD Accounts Lose Money

4

Interactive Brokers

Investment App Score: 4.6/5

62.5% of Retail CFD Accounts Lose Money

Quick Answer: Our Pick

The best investment app in the UK for 2025 is IG, ideal for both beginners and experienced investors. It provides a user-friendly platform, a wide range of investment options, low fees, and robust security features, making it the top choice for investors seeking efficient portfolio management.

Featured Broker

eToro

- Copy Trading

- Competitive Fees

- Diverse Asset Range

- Regulated & Trusted

- 30 Million+ Users

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

How Do These Investment Apps Compare?

| Rank | Platform Name | Regulator | Mobile App Usability | Variety of Assets | ISA Available | Min Deposit | Trust Pilot Score | Fee Score | Overall Review Score |

|---|---|---|---|---|---|---|---|---|---|

| #1 | IG | FCA | 4.1/5 | 18,000+ markets, including stocks, ETFs, commodities, currencies, bonds, and funds | Yes | £250 | 4.1/5 | 4.7/5 | 4.9/5 |

| #2 | eToro | FCA | 4.5/5 | Stocks, cryptocurrencies, and CFDs | Yes (via Moneyfarm) | $50 | 4.1/5 | 4.5/5 | 4.7/5 |

| #3 | XTB | FCA | 4.4/5 | Forex, indices, commodities, stock CFDs, ETFs, and cryptocurrencies | No | £0 | 4.6/5 | 4.4/5 | 4.6/5 |

| #4 | Interactive Brokers | FCA | 4.5/5 | Forex, stocks, ETFs, options, futures/FOPs, CFDs, metals, bonds, and mutual funds | Yes | £1 | 3.3/5 | 4.1/5 | 4.5/5 |

| #5 | Saxo | FCA | 4.5/5 | Forex, stocks (including fractional shares), ETFs, options, futures, bonds, and commodities | Yes | £0 | 4.6/5 | 4.5/5 | 4.6/5 |

| #6 | Trading 212 | FCA | 4.5/5 | 12,000+ global stocks & ETFs, commodities, and forex | Yes | £1 | 4.6/5 | 4.2/5 | 4.5/5 |

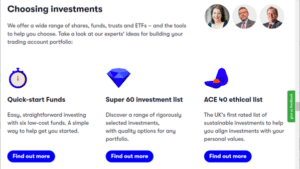

| #7 | Interactive Investor | FCA | 4.5/5 | 1,000+ ETFs, stocks (UK & international), bonds, and ethical investments | Yes | £100 | 4.7/5 | 4.2/5 | 4.4/5 |

Here are the Top 7 Investment Apps

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 71% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

Why we like it?

IG stands out in the UK market as one of the most established and respected online trading platforms, offering extensive market access with over 17,000 tradeable assets. Known for its robust trading technology, IG caters to both beginners and advanced traders with its comprehensive range of tools and resources. The platform is particularly favoured for its ability to handle large volumes and its high-speed execution, making it a top choice for serious traders looking for a dynamic trading environment.

Fees and charges

- Trading Fees: Competitive trading fees which vary by asset class; lower fees for more frequent traders.

- Platform Fees: No platform fee, but a quarterly charge if minimum trade volume is not met.

- Overnight Fees: Financing charges for positions held overnight, typical for CFD trading.

- Currency Conversion Fees: Charges apply when trading products in a currency different from the account’s base currency.

- Inactivity Fees: A fee is levied on accounts that remain inactive for an extended period.

Tradable assets

- Stocks & Shares: Direct market access to global stock exchanges with competitive commission rates. Including popular choices like REITs

- Forex: One of the leading forex trading platforms with over 80 currency pairs, offering low spreads and advanced charting tools.

- CFDs: Extensive range of CFD trading on stocks, indices, forex, commodities, and more.

- Indices: Trade on the world’s leading stock indices with flexible leverage options.

- Cryptocurrencies: Offers trading on major cryptocurrencies such as Bitcoin, Ethereum, and others.

- Options and Futures: A comprehensive derivatives market providing options and futures contracts across global markets.

Platform ease of use

IG’s trading platform is designed to be intuitive yet powerful, accommodating the needs of both novice traders and experienced professionals. It offers a customizable interface, real-time data streaming, advanced charting tools, and comprehensive risk management features. The platform’s reliability and speed are crucial for traders who need to respond quickly to market movements. Additionally, IG provides an excellent mobile trading experience, ensuring traders can manage and execute trades anywhere at any time.

Pros and Cons

- Extensive Market Access: One of the broadest ranges of tradeable assets available on any platform.

- Advanced Trading Tools: High-quality charting, analysis tools, and automated trading options.

- No Platform Fee: Attractive for active traders, enhancing cost-efficiency.

- Reputation and Reliability: Well-established with a strong track record of reliability and customer satisfaction.

- Quarterly Inactivity Fee: Can be costly for less active traders.

- Complex for Beginners: The wide array of tools and options might overwhelm new traders.

- Currency Conversion Fees: Additional costs for trading in non-base currencies.

- Overnight Financing Costs: Can add up for traders holding positions open overnight on a regular basis.

CFDs are complex instruments with a high risk of losing money rapidly due to leverage. 51% of retail CFD accounts lose money when trading CFD’s with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Why we like it?

eToro sets itself apart with its unique social trading platform that empowers new investors by enabling them to copy the trades of more experienced ones. This not only demystifies investing for beginners but also enriches the learning process. Its commitment to no trading and platform fees makes it exceptionally appealing for both new and regular traders. Furthermore, the platform’s integration of a multi-asset offering allows UK users to diversify their investments easily across global markets.

Fees and charges

- Trading Fees: None, allowing users to trade without the burden of per-trade charges.

- Platform Fees: None, which is rare in the industry.

- Withdrawal Fees: $5 charge per withdrawal.

- Currency Conversion Fees: 0.5% for non-USD deposits and withdrawals. However, this can be avoided by using an eToro Money account for currency conversion.

- Inactivity Fees: $10 per month after 12 months of inactivity.

Tradable assets

eToro offers a broad array of assets that cater to various investment styles:

- Stocks & Shares: Users have access to over 4,500 stocks from global exchanges.

- Cryptocurrencies: Including major ones like Bitcoin and Ethereum among others.

- ETFs: More than 500 ETFs covering diverse sectors and geographies.

- Indices: Trade on the world’s leading indices such as NASDAQ, FTSE 100, and more.

- Commodities: Options include gold, oil, silver, and other popular commodities.

Platform ease of use

eToro is celebrated for its user-friendly interface, which is designed to be intuitive for traders at all levels. The platform’s mobile and web versions are streamlined to ensure that managing and executing trades can be done effortlessly. Features like one-click trading, real-time data streaming, and integrated risk management tools make the platform accessible and convenient for everyday use.

Pros and Cons

- Social Trading Features: Enables users to replicate the strategies of successful traders.

- No Trading or Platform Fees: Makes it cost-effective for active users.

- Comprehensive Asset Selection: Wide variety of stocks, ETFs, and other instruments.

- User-Friendly Interface: Suitable for beginners and experienced traders alike.

- Withdrawal Fee: Fixed $5 fee on all withdrawals.

- Inactivity Fee: Charges after a year of no account activity.

- Limited Advanced Tools: May not satisfy the needs of highly experienced traders.

- Currency Conversion Fee: Applicable unless using eToro’s own money service.

73% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Why we like it?

XTB stands out as one of the leading brokers in Europe due to its low-cost structure, responsive platform, and high-quality educational resources. With no minimum deposit requirement, it’s ideal for beginners who want to test the waters, while experienced traders benefit from tight spreads and rapid trade execution. The award-winning xStation 5 platform offers a fast, intuitive, and feature-rich experience that appeals to both casual and professional investors. XTB also offers extensive market coverage, with access to global CFDs on forex, indices, commodities, stocks, and ETFs.

Fees and charges

- Trading Fees: No commission on stock and ETF CFDs; tight spreads starting from 0.1 pips on forex pairs.

- Platform Fees: None. Both the desktop (xStation 5) and mobile platforms are free to use.

- Withdrawal Fees: No fees for withdrawals over £60. Smaller withdrawals may incur a minor charge.

- Currency Conversion Fees: 0.5% conversion fee for accounts trading in a different currency.

- Inactivity Fees: €10/month after 12 months of inactivity.

Tradable assets

XTB offers a solid selection of assets, particularly for CFD traders:

- Forex: Over 45 currency pairs including majors, minors, and exotics.

- Indices: Major global indices including NASDAQ, S&P 500, FTSE 100, DAX 40, and more.

- Commodities: Trade CFDs on gold, silver, oil, natural gas, and agricultural products.

- Stock CFDs: Access to thousands of global stocks including Apple, Tesla, and Amazon.

- ETFs: Wide range of ETF CFDs tracking sectors, geographies, and investment themes.

Platform ease of use

XTB’s xStation 5 platform is one of the best-rated trading platforms for speed and user experience. It includes interactive charts, real-time analytics, integrated trading calculators, and comprehensive news feeds. Whether you’re trading on desktop or mobile, the platform remains highly intuitive and customizable, with rapid order execution and in-platform learning tools.

Pros and Cons

- No Minimum Deposit: Get started without a funding threshold.

- Commission-Free Stock and ETF CFDs: Great for cost-conscious traders.

- Advanced Trading Platform: xStation 5 offers real-time data and analysis tools.

- Excellent Educational Resources: Includes live webinars, tutorials, and market insights.

- CFD-Only Model: Investors looking for physical asset ownership may find this limiting.

- No ISA Accounts: Not suitable for UK investors seeking tax-efficient savings.

- Limited Long-Term Investing Tools: Designed more for active trading than investing.

- Inactivity Fee: Charges apply after one year of no use.

62.5% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Why we like it?

Interactive Brokers is highly regarded for its comprehensive trading services, offering access to a vast range of financial instruments, including stocks, forex, commodities, futures, options, and more across over 150 global markets. The platform is especially favored by experienced investors and professional traders due to its advanced trading tools, low-cost structure, and global market access. Interactive Brokers’ robust trading environment is further enhanced by its sophisticated risk management features, extensive research offerings, and transparent pricing, making it a top choice for serious investors and traders.

Fees and charges

- Trading Fees: Low trading fees, with competitive spreads and commission structures tailored to different asset classes.

- Platform Fees: No platform fees, making it an attractive option for active traders.

- Overnight Fees: Charges apply for holding positions overnight, particularly for leveraged products like forex.

- Currency Conversion Fees: Currency conversion costs apply when trading instruments in a currency different from your account’s base currency.

- Inactivity Fees: A monthly fee is charged if certain trading volume or account balance criteria are not met.

Tradable assets

- Stocks & Shares: Trade on major global exchanges with the ability to purchase actual stocks or CFDs.

- Forex: Access to over 100 currency pairs with tight spreads and deep liquidity.

- Commodities: Trade a wide range of commodities, including metals, energy, and agricultural products.

- Indices: Trade CFDs or ETFs on major world indices such as the S&P 500, FTSE 100, and others.

- Options & Futures: Extensive selection of options and futures contracts, providing advanced strategies for experienced traders

Platform ease of use

Interactive Brokers is designed for traders who seek a blend of powerful functionality and comprehensive tools. While the platform’s advanced features are best suited for experienced traders, its user interface remains highly customizable, catering to both intermediate and professional investors. The Trader Workstation (TWS) platform offers advanced charting, risk management tools, and a wide range of order types. The mobile app mirrors much of the desktop functionality, ensuring a seamless trading experience on the go.

Pros and Cons

- Global Market Access: Extensive selection of instruments across global markets, including over 150 exchanges.

- Low-Cost Trading: Highly competitive fees and spreads, with no hidden costs.

- Advanced Trading Tools: Comprehensive tools for analysis, risk management, and order execution.

- Customizable Interface: Platforms are highly customizable to meet the needs of individual traders.

- Platform Complexity: The advanced features can be overwhelming for beginners, requiring a learning curve.

- Inactivity Fees: Monthly fees apply if trading volume or balance requirements are not met.

- Limited MetaTrader Integration: No support for MetaTrader platforms, which may be a drawback for some traders.

- High Minimum for Interest Payments: Interest on cash balances is only paid on accounts with a net asset value of $100,000 or more.

64% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Why we like it?

Saxo Bank is highly esteemed for its comprehensive trading tools and extensive market access, making it a favourite among serious traders and investors in the UK. The platform offers a sophisticated suite of trading instruments and analytics, designed to cater to the needs of professional traders demanding deep market analysis and a wide range of investment options. Saxo Bank stands out not only for its technological excellence but also for its reliable execution and competitive pricing, which empower traders to act swiftly and confidently in the financial markets.

Fees and charges

- Trading Fees: Competitive commissions on stocks, dependent on the market; forex, CFDs, and derivatives trading involve low spreads and commissions based on volume.

- Platform Fees: No monthly or annual platform fees, adding to its appeal for active traders.

- Currency Conversion Fees: Currency conversion costs apply for trades in a currency other than your account base currency, calculated as a percentage of the trade amount.

Tradable assets

- Stocks & Shares: Access to over 19,000 global stocks across 37 international exchanges.

- Forex: Offers over 180 currency pairs, making it one of the leaders in forex trading.

- CFDs: Extensive range of CFDs available, covering markets such as stocks, indices, and commodities.

- Options and Futures: Robust options for traders interested in derivatives, including a variety of futures markets.

- Bonds: Comprehensive access to both government and corporate bonds globally.

- Funds: A selection of mutual funds from leading global providers.

Platform ease of use

While Saxo Bank’s platform is feature-rich and designed for experienced traders, it maintains a level of intuitiveness that allows for straightforward navigation. The platform offers customizability and advanced charting capabilities, comprehensive research and insights, and seamless order execution. Both the desktop and mobile versions are engineered to provide a stable and powerful trading experience, with the mobile app mirroring the functionality of the desktop platform, ensuring traders can manage their portfolios and execute trades from anywhere.

Pros and Cons

- Extensive Financial Instruments: Provides one of the most comprehensive lists of tradeable assets.

- Advanced Trading Tools: High-end analytical tools suitable for detailed financial analysis and trading strategies.

- Highly Customizable Platform: Offers a personalized trading experience that can be tailored to individual trader preferences.

- Regulatory Assurance: Regulated by multiple financial authorities, including the UK’s FCA, which ensures a high standard of operation.

- Complex for Beginners: The wealth of features and detailed interface might be overwhelming for new traders.

- Higher Minimum Deposit: The platform requires a relatively high minimum deposit, which could be a barrier for novice traders or those with limited capital.

- Inactivity Fees: Penalizes inactive accounts, which might affect casual investors.

- Currency Conversion Fees: Additional costs for trading in non-base currencies can accumulate, affecting profitability.

Trading and investing involve risk. The value of your investments can go up or down, and you may lose all or part of your capital. These products may not be suitable for all investors. Please ensure you fully understand the risks involved.

Why we like it?

Trading 212 distinguishes itself in the UK market with its user-friendly interface and commitment to providing a commission-free trading environment. This makes it highly accessible to beginners and cost-effective for experienced traders alike. The platform is known for its straightforward design, making financial markets more approachable for everyone. Trading 212 also offers a practice mode with a demo account loaded with virtual money, which is perfect for newcomers looking to hone their trading skills without financial risk.

Fees and charges

- Trading Fees: No commission charged on stock and ETF trades, which is one of the platform’s major selling points.

- Platform Fees: No monthly or annual platform fees.

- Currency Conversion Fees: Low currency conversion fees, making it economical for trading accounts in currencies other than GBP.

- Withdrawal Fees: No fees on withdrawals, enhancing the appeal for regular profit takers.

Tradable assets

- Stocks & Shares: Access to thousands of UK and international stocks without commission.

- ETFs: A broad selection of ETFs covering global markets and industries.

- Forex: Extensive forex trading options with competitive spreads.

- Commodities: Trade commodities like gold, oil, and natural gas.

- Cryptocurrencies: Includes popular options such as Bitcoin, Ethereum, and more, allowing for speculative investment in digital currencies.

Platform ease of use

Trading 212 is renowned for its clean, intuitive interface that simplifies the trading process. The platform is designed to be user-friendly for beginners while still offering advanced features that more experienced traders will appreciate. These include detailed charting tools, risk management options, and a streamlined process for placing trades. Both the web and mobile applications are optimized to ensure a seamless trading experience, whether on a home computer or on the go.

Pros and Cons

- Zero Commission Trading: Makes it very attractive for all levels of investors, especially those trading frequently.

- Advanced Trading Features: Despite its simplicity, the platform offers sophisticated tools for detailed market analysis.

- No Withdrawal Fees: Allows traders to access their funds without extra charges.

- Extensive Asset Range: Provides a wide variety of markets including stocks, forex, and cryptocurrencies.

- Limited Research Tools: The platform does not provide as in-depth research and analytical tools as some of its competitors.

- Customer Support: Some users report delays in customer service response times during peak hours.

- Product Depth: While it offers a range of assets, niche markets and advanced derivatives may be limited.

- Currency Conversion Fees: While low, these fees still apply and can add up depending on the trading frequency and volume.

Use code TIC to get a free share worth up to £100

Trading and investing involve risk. The value of your investments can go up or down, and you may lose all or part of your capital. These products may not be suitable for all investors. Please ensure you fully understand the risks involved.

Why we like it?

Interactive Investor stands out in the UK market for its comprehensive investment offerings and its flat-fee subscription model, which can be particularly cost-effective for active traders. The platform is celebrated for providing a wealth of investment options, including direct equities, funds, investment trusts, and ETFs. It’s also known for its strong emphasis on providing extensive investor education and research tools, making it a favourite among those who prefer to make informed investment decisions based on thorough analysis.

Fees and charges

- Trading Fees: A flat trading fee structure that reduces in cost with the more trades you make per month.

- Platform Fees: A monthly subscription fee that varies depending on the service level chosen (Investor, Funds Fan, Super Investor).

- Transfer Fees: No fees for transferring investments in or out of the platform.

- Inactivity Fees: No inactivity fees, making it a good option for long-term investors.

- Currency Conversion Fees: Charges for trading in currencies other than GBP, which is standard across the industry.

Tradable assets

- Stocks & Shares: Provides access to UK and international stocks across major exchanges.

- Funds: A wide range of mutual funds, including actively managed and passive funds.

- ETFs and Investment Trusts: Extensive offerings that help diversify investment portfolios.

- Bonds: Government and corporate bonds are available for more conservative investment strategies.

- Options and Futures: For more advanced traders looking for derivatives trading opportunities.

Platform ease of use

Interactive Investor’s platform is designed to cater to users of all experience levels, from beginners to professionals. The interface is user-friendly and offers customizable features that allow investors to manage their portfolios effectively. It also provides excellent tools for portfolio analysis, real-time monitoring, and performance assessment. The mobile app ensures that users can keep track of their investments and trade on the go, providing flexibility and convenience.

Pros and Cons

- Extensive Range of Investment Options: Caters to all types of investors, from stock traders to those interested in funds or bonds.

- Flat-Fee Subscription Model: Can be cost-effective for active traders who perform many transactions each month.

- No Inactivity Fees: Ideal for buy-and-hold investors who make fewer transactions.

- Strong Educational Resources: Provides comprehensive tools and insights to help investors make informed decisions.

- Account Types: Stocks and Shares ISA, Junior ISA, SIPP (Self-Invested Personal Pension), Trading Accounts

- Monthly Subscription Fee: While it can be cost-effective for some, it might be expensive for casual investors who trade less frequently.

- Limited Advanced Trading Tools: While great for most investors, may not suffice for high-frequency traders looking for very advanced tools.

- Currency Conversion Fees: Additional costs for trading in non-GBP currencies.

- Mobile App Functionality: Some users find the mobile app less intuitive compared to the desktop version.

How Did We Conduct Our Research?

When looking into the best investment apps available to UK users, we adopted a comprehensive research method that combined data analysis with customer reviews and expert feedback.

We analysed a wide range of applications, with a focus on their functionality, the diversity of investment options they provide, and their performance reliability.

Each app was evaluated based on these parameters:

- Functionality – We had a look into the technical capabilities of the apps, their ease of use, and the quality of the user interface.

- Investment Options – Our analysis and app comparisons included looking at the range of available investment instruments, such as stocks, bonds, ETFs, and cryptocurrencies.

- User Ratings – We also considered user reviews from platforms such as Trustpilot to gauge overall satisfaction and trustworthiness.

We gathered this data alongside some qualitative insights from financial experts and existing users to ensure a balanced view of each app’s strengths and weaknesses.

How Did We Calculate the Fees and Costs?

Our breakdown of the fee and cost structure was based on several assumptions designed to standardise the comparison across the different platforms. For example:

- Investment Type: We assumed a 50/50 split between stocks and funds unless an app focused exclusively on one type.

- Trading Frequency: We modelled costs based on twelve yearly trades, evenly split across the investment types.

- Portfolio Value: Fees were calculated for three hypothetical portfolio values: £1,000, £10,000, and £50,000, representing a range of investor scenarios.

- Platform Fees: Assumed fees were adjusted based on whether platforms offered discounts or perks for frequent trading.

What Are Investment Trading Apps?

Investment trading apps are digital platforms that allow individuals to manage their investments directly from smartphones, laptops, tablets or desktop PCs. These apps enable seasoned investors and novices to engage with the stock market, purchase shares, and monitor their portfolios in real time.

What Are the Statistics for the Top Investment Apps?

In today’s digital landscape, the popularity and reputation of online trading platforms can be assessed using easily available online data. These metrics provide valuable insights into user engagement and satisfaction, which are crucial for potential investors considering a platform to choose.

The following table gathers the data from several key online sources, including Google Trends, social media, website traffic, and average user ratings on Trustpilot.

This table helps paint a comprehensive picture of how each platform stands in the public eye:

| Platform | Google Trends (Relative Search Volume) | Social Media Followers (Combined) | Website Traffic (Estimated Monthly Visits) | Review Platforms (Average Rating) |

|---|---|---|---|---|

| IG | Medium | 1.7 Million | High | 4.3 Stars |

| eToro | High | 7.2 Million | Medium | 4.2 Stars |

| XTB | Medium | 1.2 Million+ (est.) | Medium | 4.6 Stars |

| Interactive Brokers | High | 1.5 Million | High | 4.5 Stars |

| Saxo Bank | Medium | 1.5 Million | Low | 4.0 Stars |

| Trading 212 | High | 1.8 Million | Medium | 4.4 Stars |

| Interactive Investor | Medium (UK Focus) | 400,000 | Medium | 4.1 Stars |

Analysing this table, we can see which platforms are currently leading in terms of online visibility and user engagement.

Platforms like eToro and Trading 212 show high search interest and considerable social media followings, indicating strong brand presence and active community engagement.

Ratings on Trustpilot further provide a snapshot of overall customer satisfaction, with Hargreaves Lansdown leading the pack in the UK-focused segment.

What Assets Can You Trade on These Apps?

Right now, UK investment apps offer a wide variety of assets, catering to the diverse needs and strategies of investors. Commonly, some of these apps allow users to trade in:

| Investment Type | Description |

|---|---|

| Stocks and Shares | Includes both domestic and international markets, allowing for a global investment reach. |

| Exchange-Traded Funds (ETFs) | Popular for diversified investment at a lower cost and risk than individual stocks. |

| Bonds | Government and corporate bonds available for those seeking more stable, income-generating investments. |

| Investment Trusts | Closed-ended funds managed by professionals aiming to generate specific financial returns. |

| Commodities | Some apps provide options to invest in commodities like gold, oil, or agricultural products. |

| Foreign Exchange (Forex) | Trading in currency pairs, suitable for more experienced traders. |

| Cryptocurrencies | Many apps now include options to buy and sell cryptocurrencies like Bitcoin and Ethereum. |

The range of assets available varies between apps, so it’s essential to choose a platform that matches your investment preferences and risk tolerance.

Investment Strategies for Beginners

If you are new to investing, having a strategy can help you build wealth while managing risk. Here are a few key tips and strategies to consider when starting out:

You could start with Index Funds or ETFs, since these options offer broad market exposure and lower risk compared to individual stocks. Remember to diversify your portfolio – Spreading investments across different asset classes (stocks, bonds, ETFs) can reduce risk.

A lot of new traders like to focus on short-term gains, but more experienced investors know you can benefit significantly by focusing on long-term growth and avoiding emotional trading. As a beginner, consider investing in assets with long-term potential.

Finally, take the time to understand risk tolerance, assess your personal finances and determine how much risk you are comfortable with and then invest accordingly.

How Do You Open an Account with a Trading App?

Opening an account with a trading app is typically a straightforward process designed to be as user-friendly as possible:

- Download the App: Start by downloading your chosen trading app from the App Store or Google Play Store.

- Registration: You will need to provide some basic information, such as your name, email address, and a secure password. Some apps may also require a username.

- Verification: To comply with financial regulations, you’ll be asked to verify your identity. This usually involves submitting a form of ID (such as a passport or driver’s license) and a recent utility bill or bank statement as proof of address.

- Banking Details: Enter your banking or card details to fund your account. Some apps also offer options to transfer assets from another brokerage.

- Setup Preferences: Depending on the app, you may be able to set up trading preferences and choose from different types of accounts, such as individual savings accounts (ISAs) or pension accounts.

- Start Trading: Once your account is funded and all compliance checks are complete, you can begin trading.

This process usually takes anywhere from a few hours to a couple of days, depending on verification requirements.

What Costs & Fees can I expect using Trading Apps?

he cost of using trading apps can vary widely depending on the platform, the types of transactions, and the volume of trading.

Standard fees associated include trading fees, which are charges applied each time an asset is bought or sold, either as a flat fee per trade or a percentage of the transaction value. Withdrawal fees may apply when withdrawing funds, especially if currency conversion is involved, and foreign exchange fees may be incurred when trading in foreign currencies, with rates varying depending on the currency and market conditions.

Other fees can depend on the type of trading you are engaged in. For example, In forex and commodity trading, costs might be embedded in the spread.

Are there any optional Fees to consider?

Some apps, but not all of them impose platform fees, which may be charged monthly or annually for using their services. However, it should be noted that these fees can sometimes be waived or reduced based on account balance or trading activity. Some platforms also charge inactivity fees if an account remains dormant for a certain period.

Regardless of which platforms or apps you decide to use, it is essential to review the fee and cost structure before signing up to ensure that it aligns with your investment strategy and trading habits.

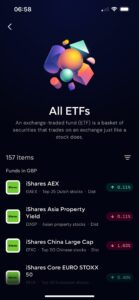

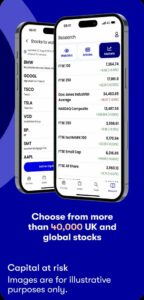

Lightyear Mobile App Screen Grabs

Which Other Trading Apps Could You Consider?

In the UK, there is a wide range of investment opportunities on offer through trading apps. It is beneficial to consider a diverse range of platforms to find one that best suits your financial goals and trading style. Here are a few notable apps that cater to different types of investors:

- Robinhood – a platform known for its user-friendly interface and zero-commission trading, Robinhood is particularly popular among beginners. However, it is essential to note that while this platform offers free trades, it earns money through payment for order flow.

- Freetrade – A UK-based app that offers simple and straightforward access to stock and ETF investments, with no commission on basic trades and a low-cost premium subscription model for additional features.

- Trading 212 – This trading platform features a blend of commission-free trading and access to a wide array of stocks and ETFs. It is known for its intuitive design and powerful analytical tools, suitable for both beginners and experienced traders.

- Hargreaves Lansdown – This is one of the UK’s leading trading platforms, offering a vast range of investment options and detailed research resources, although their fees can be considered higher compared to newer platforms.

Exploring these apps and what they have on offer can help provide a well-rounded view of what’s available, helping you choose a platform that aligns with your investment approach, whether you’re seeking low-cost trades, advanced tools, or specific types of investments.

Final Thoughts: Are Investment Trading Apps Worth Your Time and Money?

Investment trading apps can be a valuable tool for both novice and experienced investors. How much you can get out of the app depends on several factors, including your investment goals, trading style, and the level of engagement you wish to have with your investments. Here are a few key points to consider:

- Accessibility: Trading apps make the financial markets more accessible, allowing users to trade from anywhere at any time. This convenience can be particularly valuable for those who prefer hands-on management of their investments.

- Cost-Effectiveness: Many trading apps offer lower fees than traditional brokerages, with some offering commission-free trades. This can significantly reduce the cost barrier for new investors and increase the overall returns for active traders.

- Educational Resources: Most investment apps in the UK provide useful educational tools that can help users learn about buying stocks, which is invaluable for beginners. These resources often include tutorials, webinars, and real-time support.

- Real-Time Data and Tools: The ability to access real-time market data and analytical tools allows investors to make informed decisions quickly, potentially leading to better investment outcomes.

- Risks: While trading apps offer many benefits, they also come with risks. The ease and speed of trading can encourage overtrading or emotional trading, especially for those new to investing. Moreover, not all platforms provide the same level of security, scrutiny or regulatory protection, which could be a concern for the safety of your investments.

- FCSC Protection: The Financial Services Compensation Scheme (FSCS) is a government-backed safety net designed to protect your funds when financial firms fail. Traders in the UK can claim up to £85,000 in compensation per institution.

In conclusion, whether investment trading apps are worth your time and money largely depends on how well you use them to your advantage. They are certainly worth considering if you seek convenience, lower fees, and rich resources for learning and trading. However, like all investment tools, they should be used thoughtfully and strategically to meet your personal financial goals best.

FAQs

Before entering the stock market, it’s essential to assess your financial goals, risk tolerance, and investment time horizon. Conduct thorough research on market fundamentals, company performance, and economic trends. Diversification is also crucial to spread risk across different asset classes and sectors. Additionally, consider transaction costs, platform fees, and tax implications to maximize your returns.

Investment platforms often charge an annual management fee, which is a percentage of your assets under management. Over time, these fees can significantly reduce your investment gains due to compounding effects. Before choosing a platform, compare fee structures and assess their long-term impact on your portfolio. Some platforms offer lower fees for passive investing, while others charge higher fees for managed portfolios.

An investment account gives you access to a variety of financial instruments, including stocks, bonds, ETFs, and mutual funds. It allows you to build a diversified portfolio based on your financial objectives and risk appetite. To get started:

Research reputable brokerage firms or investment platforms.

Compare account types (e.g., general investment accounts, ISAs, or pensions).

Complete the account opening process, which may include identity verification.

Fund your account and start investing based on your chosen strategy.

Yes, retail investor accounts are tailored for individuals who are new to investing or prefer a more guided approach. Many platforms offer:

Pre-built, professionally managed portfolios based on your risk profile.

Educational resources to help beginners understand investment basics.

Automated investment options (e.g., robo-advisors) for hands-off investing.

Low minimum deposit requirements, making investing accessible to all.

To ensure your funds and data are secure when using investment apps, consider the following:

Choose platforms that are FCA-authorized and regulated (or equivalent in your region).

Look for strong security measures, such as encryption, two-factor authentication, and biometric login.

Read the platform’s privacy policy and terms regarding data handling.

Check for regular security updates and proactive fraud prevention measures.

Review customer service responsiveness in case of issues or concerns.

Ensure the app supports easy funding and multiple payment options for flexibility.

Read user reviews to gauge the platform’s reliability and performance.

Investment apps have revolutionized investing by making it more accessible, affordable, and user-friendly. Their effectiveness depends on:

The app’s investment options and whether they align with your financial goals.

Investment tracking features that provide insights into your portfolio performance.

The intuitive design of the app, making investing seamless even for beginners.

User feedback and real-world performance data. Some platforms share customer testimonials or historical returns to demonstrate their success.

To make the most of investment apps, choose a platform that aligns with your needs, whether it’s active trading, passive investing, or automated portfolio management.

References

- Are Demo Accounts an Indicator of Investing Skills? – Investopedia

- Keeping Your Investment Safe – AJ Bell

- Tax Efficient Wrapper Products – GOV.UK

- Explaining Pound Cost Averaging to Your Clients – FT Advisor

- All About Asset Classes And Diversification – Motley Fool

- Understanding Compound Interest – Forbes

- 11 Passive Income Ideas for 2024 – Time Magazine

- Financial Conduct Authority – FCA

- Business of Apps

- Finder

Related Articles

Our #1 Recommended Investment Platform in the UK

71% of retail investor accounts lose money when trading spread bets and CFDs with this provider.