Best Online Stock Brokers in the UK

Thomas Drury

Co-Founder

Seasoned finance professional with 10+ years' experience. Chartered status holder. Proficient in CFDs, ISAs, and crypto investing. Passionate about helping others achieve financial goals.

Twitter ProfileAuthor Bio

Dom Farnell

Co-Founder

Dom is a Co-Founder and of TIC. A passionate investor and seasoned blog writer with a keen interest in financial markets and wealth management.My goal is to empower individuals to make informed investment decisions through informative and engaging content.

Twitter ProfileAuthor Bio

How We Test

At The Investors Centre, we pride ourselves on our rigorous fact-checking process. To delve deeper into our meticulous testing procedures and discover how we ensure accuracy and reliability, visit our dedicated page on how we test.

Please bear in mind that trading involves the risk of capital loss. 51% to 84% of retail investor accounts lose money when trading CFDs with the providers below. You should consider whether you can afford to take the high risk of losing your money.

Quick Answer: Which Broker is the Best?

The best stock online broker we recommend for use in the UK is Spreadex. Spreadex provides a wide array of trading options, outstanding customer service, and a user-friendly trading platform, making it an ideal choice for both beginners and seasoned traders aiming to explore the financial markets.

Here are the Top 10 Online Stock Brokers In the UK

- Spreadex – Ideal for versatile spread betting options.

- IG – Comprehensive market access for active traders.

- eToro – Leading platform for social trading enthusiasts.

- Saxo – Advanced tools for professional technical traders.

- Admiral Markets – Broad investment options for global markets.

- Plus500 – Popular for trading CFDs on assets.

- Hargreaves Lansdown – Best for diversified investment fund access.

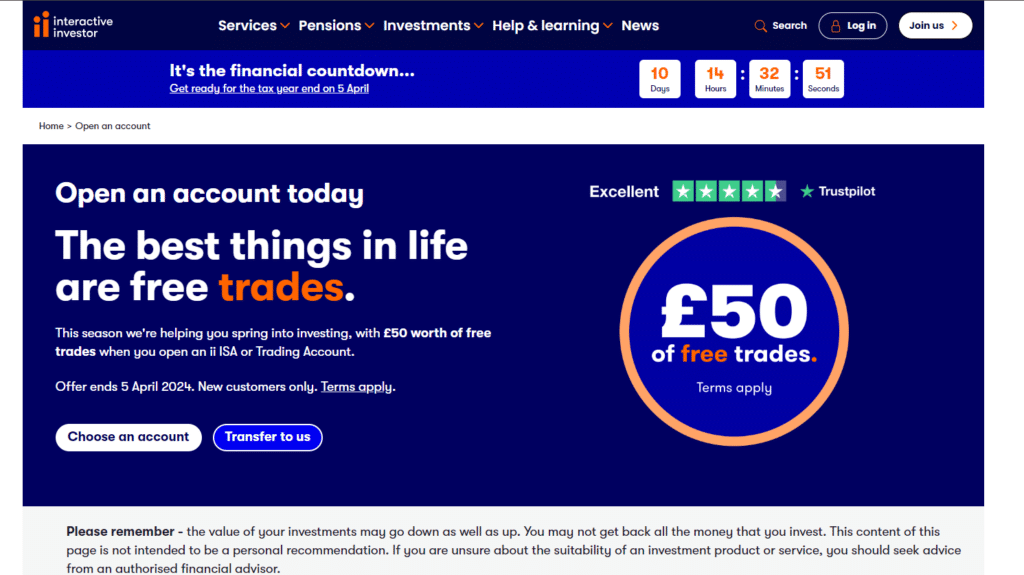

- Interactive Investor – Reliable platform with excellent customer service.

- Pepperstone – Low forex fees for active traders.

- AvaTrade – Beginner-friendly platform with educational resources.

Featured Brokers

eToro - Best for Beginners

- Copy Trading

- User Freindly Platform

- Regulated & Trusted

- 30 Million+ Users

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

72.3% of retail investors lose money when trading spread bets and CFDs with this provider.

Open an account and deposit £500 to get a 6 month gift subscription to the Financial Times.

What Does This Page Cover?

- How Do UK Stock Brokers Compare for Traders?

- What are the Top 10 Stock Brokers in the UK?

- What Is an Online Stock Broker and How Does It Work?

- What Are the Differences Between Stock Investing and Trading?

- How Can I Trade Stocks in the UK?

- What Are the Common Fees for Stock Brokers?

- What Are Popular Stock Trading Strategies?

- What Are the Pros and Cons of Stock Trading?

- References

- FAQs

How Do UK Stock Brokers Compare for Traders?

Platform Focus | User-friendly | User-friendly | User-friendly | Advanced | User-friendly | User-friendly | User-friendly | Web-based | Advanced | User-friendly |

Trading Fees | Zero commission on most trades, though costs can vary depending on the asset being traded. | Varies (CFDs, Spread Betting, Shares) | Commission-based (stocks & ETFs) | Tiered (spreads, commissions) | No Commissions for Trading Stocks, though some CFD trading commissions will apply | Spreads (CFD) | Commission-based | Tiered commissions | Commission-based (Razor) or Spreads (Standard) | Spreads (CFD) + Commissions (some assets) |

Account Types | Standard | Standard, ISA, Islamic | Standard | Classic, Platinum, VIP | Standard, Mt4, MT5 | Standard | Standard, ISA | Standard, ISA | Standard, Razor | Standard, Demo, Islamic |

Options Trading | No | Yes | No | Yes | No | No | No | No | Yes | Yes |

Comments | Ideal for versatile trading across multiple financial instruments, for both novice and experienced traders. | Wide range of products, ISA tax benefits, consider fees for different products | Social investing features, good for beginners | Powerful platform, best for experienced traders, lower fees for higher tiers | Beginner-friendly, fractional shares | Simple platform, CFDs only, high risk of loss | Established platform, good for share dealing, ISA tax benefits (restrictions apply) | Research & charting tools, ISA tax benefits (restrictions apply) | Powerful platform for active traders, lower fees for Razor accounts | Islamic accounts, various features, consider CFD risks |

What are the Top 10 Stock Brokers in the UK?

Spreadex is highly regarded for its versatility in spread betting, offering a broad range of markets, including sports, financials, and cryptocurrencies. Traders can enjoy flexible stake sizes and numerous risk management tools, making it a great fit for both novices and experienced spread bettors. Its competitive spreads and extensive educational resources contribute to its reputation, placing it in the top tier of spread betting platforms.

The platform’s unique features, such as live betting options and market insights, further enhance its appeal. As a result, Spreadex is consistently ranked among the best for versatile spread betting, providing traders with the tools needed for a successful betting experience.

Pros

Cons

69% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

- Customizable Platform: Spreadex offers a highly customizable trading platform, allowing users to tailor their trading experience to their preferences.

- Diverse Asset Selection: The platform provides access to a wide range of assets, including stocks, ETFs, commodities, and forex, making it suitable for diverse trading strategies.

- Responsive Customer Support: Spreadex is known for its attentive and responsive customer service, ensuring that traders have the support they need.

- Complexity for Beginners: The platform’s advanced features may be overwhelming for new traders, resulting in a steeper learning curve.

- Limited Account Types: Spreadex offers fewer account types compared to some other brokers, which might limit options for investors seeking specific account features.

- Higher Trading Costs for Certain Assets: While competitive in some areas, trading costs for certain assets may be higher compared to other online brokers.

How Easy is the Platform to Use?

Spreadex’s platform is user-friendly but offers a high level of customization, which may be more suited to experienced traders. Beginners may find the advanced features somewhat complex at first.

What are the Trading Fees?

Spreadex has competitive spreads and no commission fees for most trades, but costs can vary depending on the asset class, potentially leading to higher fees for certain instruments.

What Account Types are Available?

Spreadex offers standard trading accounts but lacks the variety of specialized account types (e.g., ISAs, SIPPs) that some other brokers provide, which may limit options for certain investors.

IG is recognized as one of the best platforms for market access due to its extensive offering of over 17,000 markets. This includes forex, commodities, indices, and cryptocurrencies, providing traders with a wealth of options. The platform is also equipped with advanced trading tools and research resources, enhancing the trading experience for users.

Additionally, IG’s reputation for reliability and security boosts its ranking among trading platforms. Its comprehensive market access makes it a top choice for traders seeking diverse trading opportunities.

Pros

Cons

69% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

- Extensive regulatory oversight from multiple top-tier authorities, ensuring a high level of client fund protection and broker transparency.

- Wide range of trading platforms including IG’s proprietary platform, MetaTrader 4, ProRealTime, and L2 Dealer, catering to all levels of traders from beginners to professionals.

- No withdrawal fees and a selection of deposit methods including bank transfer, credit/debit card, and PayPal, making account funding easy and affordable.

- Comprehensive educational resources and research tools available on both web and mobile platforms, helping traders make informed decisions.

- Account verification process can be slow, taking around 3 business days, which is longer than some competitors.

- CFD trading fees can be high, particularly for stock CFDs, which might affect cost-efficiency for some traders.

- Limited account base currency options, and changing the account currency requires contacting customer service, which could be inconvenient.

- Professional clients and non-EU clients do not receive negative balance protection, which adds a layer of risk.

How Easy is the Platform to Use?

IG offers a user-friendly web-based platform and mobile app with various features like charting tools and news feeds.

What are the Trading Fees?

IG offers CFDs, spread betting, and share dealing, each with distinct fee structures. Spreads typically differ between CFDs and spread bets. Commissions apply to share dealing (percentage or fixed fee per trade). Overnight financing (CFDs) and guaranteed stop-loss orders may incur additional fees. (Check IG’s website for detailed fee schedules).

What Account Types are Available?

Standard, ISA, and Islamic accounts. Fees may differ depending on the account type.

eToro - Is it the best for social trading?

eToro stands out as the premier platform for social trading, allowing users to follow and copy the trades of experienced investors. This innovative approach makes trading more accessible for beginners while promoting a community-oriented environment. The platform’s user-friendly interface and features like copy portfolios emphasize collaboration and knowledge sharing.

Its active community and educational resources solidify its position as the best choice for social trading. eToro’s unique features attract traders looking to learn and earn simultaneously, making it a leader in this category.

Pros

Cons

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

- Commission-free real stock and ETF trading provides a cost-effective option for investing.

- Social trading capabilities stand out, allowing users to copy trades from successful investors, fostering a learning and community-driven investment environment.

- VIP club and Popular Investor program offer additional benefits, including discounted fees and dedicated account managers for eligible investors.

- $5 withdrawal fee and the necessity for all accounts to operate in USD could incur conversion costs for international traders.

- Limited customer support might not meet the expectations of all users.

- Cryptocurrency trading fees are at 1% for buying and selling positions, which is around the industry average, but still a cost to consider.

How Easy is the Platform to Use?

eToro offers a user-friendly web-based platform and mobile app with social investing features like copy trading.

What are the Trading Fees?

eToro charges a commission fee on stock and ETF trades. eToro charges inactivity fees of $10 per month if the account has not been used for 12 months. (Always check eToro’s website for the latest fee information).

What Account Types are Available?

Standard account. eToro offers a simple account structure with one main account type.

TIC Score 4.5/5

Saxo is considered ideal for technical traders due to its advanced trading tools and analytics. The platform offers a comprehensive suite of charting tools, technical indicators, and customizable layouts, allowing traders to implement complex strategies effectively. With access to a wide range of instruments, including forex, stocks, and ETFs, Saxo caters specifically to technical analysis enthusiasts.

Its commitment to providing high-quality data and research resources enhances its appeal. As a result, Saxo consistently ranks among the top platforms for traders who prioritize technical analysis in their trading strategies.

Pros

Cons

81% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

- User-friendly mobile and desktop platforms with high customizability for charts and workspace

- Comprehensive product portfolio covering all asset classes with competitive pricing on FX options and access to over 1,200 listed options from 23 exchanges worldwide.

- No deposit or withdrawal fees and a variety of convenient funding options, including bank wire transfer and credit/debit cards.

- Diverse account types with tailored benefits, including dedicated support and exclusive invitations for Platinum and VIP account holders.

- High minimum deposit for certain regions and premium account types.

- Limited mutual fund selection compared to competitors.

- Not available for residents of the US, Iran, Cuba, Sudan, Syria, and North Korea.

- Limited funding options, with a preference for traditional methods over more modern or diverse choices like online payment processors or cryptocurrency.

How Easy is the Platform to Use?

Saxo offers a powerful and customizable web-based platform (SaxoTraderGO) and mobile app with advanced charting and order types. Fees may apply for specific platform features.

What are the Trading Fees?

Saxo has a tiered account structure (Classic, Platinum, VIP) with varying fee structures. Generally, spreads are lower and commissions decrease for higher tiers. Overnight financing and guaranteed stop-loss orders may incur additional fees. (Check Saxo’s website for detailed fee schedules).

What Account Types are Available?

Classic, Platinum, VIP. Each tier offers different minimum deposit requirements, fee structures, and features.

TIC Score 4.5/5

Admiral Markets – Is it good for global investing?

Admiral Markets is recognized for its robust offering in global investing, providing access to a diverse array of international markets. Traders can invest in stocks, ETFs, CFDs on

commodities, indices, bonds and forex across multiple exchanges worldwide, making it a

versatile option for global investment strategies. The platform’s attractive spreads and various

account types cater to different investment styles.

Admiral Markets’ strong regulatory framework and commitment to customer service further

bolster its reputation. These factors contribute to its ranking among reputable platforms for

global investing, attracting a wide range of investors.

Pros

Cons

- Wide selection of educational tools: Tutorials, webinars, and in-depth market analysis.

- Multiple platform options: MetaTrader 4, MetaTrader 5, and a WebTrader platform.

- Commission-free stock and ETF trading: please, check out more detail on https://admiralmarkets.com/start trading/contract-specifications/stock

- UK regulated

- No ISA or tax-efficient accounts: Lack of investment tax benefits for UK investors.

- Higher minimum deposit for premium accounts: Minimum deposit requirement might be high for traders who are cautious about their spending

- Forex leverage is capped: Limited leverage for retail clients due to regulatory restrictions.

How Easy is the Platform to Use?

Admiral Markets offers a user-friendly platform with multiple options to suit different trading styles. Both MetaTrader 4 and MetaTrader 5 are intuitive and customisable, providing easy navigation for beginners while still offering advanced features for experienced traders. The platforms are accessible via desktop, web, and mobile apps, making it convenient to trade on the go. Users appreciate the streamlined layout, one-click trading, and a wide range of technical analysis tools available. Also Admiral Markets offer its own trading platform Admiral Markets available for every client to try.

What are the Trading Fees?

- Spreads: Variable spreads starting as low as 0 pips on certain forex pairs.

- Commissions: No commission fees for trading stocks and ETFs, though some CFD trading comes with commissions.

- Overnight Fees: Swap rates apply if positions are held overnight (depending on the instrument and leverage).

- Inactivity Fee: Accounts that remain inactive for over 12 months are charged a fee. Overall, the platform is considered cost-effective, particularly for those trading stocks and ETFs.

What Account Types are Available?

- Trade.MT4 and Trade.MT5: Standard accounts for trading CFDs on forex, commodities, indices, and more via MetaTrader 4 and MetaTrader 5.

- Invest.MT5: An account specifically for buying real stocks and ETFs with no commission for certain investments.

- Zero.MT4 and Zero.MT5: Accounts designed for professional traders with lower spreads (starting at 0 pips) but a commission-based structure.

- Demo Account: A risk-free option for testing strategies with virtual funds before committing real capital.

61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

TIC Score 4.5/5

Plus500 is a popular choice for CFD trading, thanks to its user-friendly interface and extensive range of tradable assets. The platform offers a variety of instruments, including stocks, forex, and commodities, making it suitable for traders interested in CFDs. Its competitive spreads and no-commission policy enhance its appeal for both novice and experienced traders.

Moreover, Plus500’s risk management tools and educational resources support informed trading decisions. This combination of features positions Plus500 as a top platform for those looking to engage in CFD trading.

Pros

Cons

80% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

- User-friendly proprietary platform, ensuring a seamless trading experience across all devices without the need for additional software.

- No commissions charged on trades, with competitive spreads on a vast range of CFD products.

- Regulated by multiple top-tier authorities, ensuring high levels of trust and security for your trading activities.

- Robust risk management tools and real-time alerts, aiding in effective trading and risk mitigation.

- Limited customizability on its web trading platform, which may not satisfy traders used to more personalized setups.

- Overnight holding and inactivity fees may apply, adding to the cost of trading for some users.

- Does not support automated trading, which might be a limitation for traders employing complex strategies.

- High spreads on certain instruments compared to other brokers, potentially impacting cost-efficiency

How Easy is the Platform to Use?

Plus500 offers a user-friendly web-based platform and mobile app designed for CFD trading.

What are the Trading Fees?

Please check Plus500’s website for their full fees and charges: https://www.plus500.com/en/help/feescharges

What Account Types are Available?

A real account and a demo mode account.

TIC Score 4/5

Hargreaves Landsdown - Is it best for investment fund access?

Hargreaves Lansdown is lauded for its exceptional access to investment funds, boasting a selection of over 3,000 funds for investors. This vast range allows users to easily diversify their portfolios. The platform also provides in-depth research and fund ratings, making it user-friendly and accessible for all types of investors.

Its commitment to transparency and robust customer support enhances its reputation in the investment community. As a result, Hargreaves Lansdown ranks highly for investment fund access, appealing to investors seeking a wide variety of fund options.

Pros

Cons

- Extensive range of investments: Offers a wide variety of shares, funds, and other investment vehicles across global markets.

- High-quality research and analysis: Provides exceptional market insights and research tools, even for non-customers, with more detailed information upon login.

- Variety of account types: More account types than any other UK stockbroker, increasing the odds of having the most efficient account for personal situations.

- Robust mobile and web trading platforms: Both platforms are user-friendly, facilitating easy access to investments.

- High fees for stocks and ETFs: Notably higher trading fees compared to the industry average, making it less attractive for frequent stock traders.

- Limited to GBP base currency: Accounts are only available in GBP, which may incur conversion fees for international investors.

- Offline account opening for non-UK clients: The process is not fully digital for clients outside the UK, potentially complicating access for international investors.

How Easy is the Platform to Use?

Hargreaves Lansdown offers a user-friendly web-based platform and mobile app for share dealing, investment trusts, and ISAs.

What are the Trading Fees?

Hargreaves Lansdown charges a commission fee per trade, with discounts for frequent traders. Account inactivity fees may apply. (Always check Hargreaves Lansdown’s website for the latest fee information).

What Account Types are Available?

Standard investment accounts and ISAs. ISAs offer tax benefits for UK residents but come with restrictions on tradable assets.

TIC Score 4/5

Interactive Investor - Does it have great customer service?

Interactive Investor is well-known for its outstanding customer service, prioritizing user experience with various support options. The platform offers phone, email, and live chat assistance, ensuring that users can quickly resolve their inquiries. It also provides helpful resources and educational materials, further enhancing the overall customer experience.

Its dedication to client satisfaction and transparent communication strengthens its reputation. Consequently, Interactive Investor is frequently recognized for having great customer service among investment platforms.

Pros

Cons

- Flat-fee pricing structure: Benefits investors with larger portfolios, making costs predictable regardless of the portfolio size.

- Diverse investment choices: Access to over 40,000 trading products spanning shares, funds, trusts, and ETFs, including high-risk investments not widely available on most platforms.

- Excellent customer service and community features: Highly rated on Trustpilot, with a robust online community and forums for investors.

- Interest on cash balances: Pays interest on cash held in accounts, with rates depending on the account type and balance.

- Monthly account fee: Charges a monthly fee ranging from £4.99 to £19.99 depending on the chosen service plan, which may deter some investors.

- Limited to traditional investment products: While offering a vast range of products, it focuses on traditional ones like UK market funds and stocks, potentially limiting for those seeking broader options.

- Basic trading platform: The trading platform is straightforward and user-friendly but lacks advanced charting and analytic tools, which might not satisfy all users.

How Easy is the Platform to Use?

Interactive Investor offers a web-based platform and mobile app with a wider range of features than Hargreaves Lansdown, including charting tools and research.

What are the Trading Fees?

Interactive Investor offers a tiered commission structure with lower fees for larger trade sizes. Account inactivity fees may apply. (Always check Interactive Investor’s website for the latest fee information).

What Account Types are Available?

Standard investment accounts and ISAs. ISAs offer tax benefits for UK residents but come with restrictions on tradable assets.

TIC Score 4/5

Pepperstone is highly regarded for its low forex fees, offering some of the most competitive spreads in the industry. The platform features various account types tailored to different trading preferences, ensuring that traders can find a suitable option for their needs. With a focus on forex trading, Pepperstone provides a vast selection of currency pairs.

Its commitment to transparency and cost-effectiveness makes it an excellent choice for forex traders. This combination of low fees and robust trading conditions earns Pepperstone a top position among forex trading platforms.

Pros

Cons

74-89% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

- Fast and fully digital account opening process, making it quick and easy for new users to start trading.

- Exceptional customer service with seamless and free deposit and withdrawal processes.

- Competitive forex and CFD trading fees, with low spreads and commissions, particularly through its Razor account offering spreads from 0.0 pips plus commission.

- Primarily offers CFDs, which may not be suitable for all investors due to their complexity and risk.

- Basic MetaTrader platform that might not meet the needs of traders seeking advanced features, although alternatives are available.

How Easy is the Platform to Use?

Pepperstone offers powerful web-based platforms (cTrader, MT4, MT5) and mobile apps designed for advanced traders. They cater to various trading styles with advanced order types and charting tools.

What are the Trading Fees?

Pepperstone offers commission-based accounts (Razor) with lower spreads and standard accounts with wider spreads but no commissions. Overnight financing and guaranteed stop-loss orders may incur additional fees. (Always check Pepperstone’s website for the latest fee information).

What Account Types are Available?

Standard and Razor accounts. Razor accounts are better suited for active traders due to the commission structure.

TIC Score 4/5

AvaTrade is recognized as a beginner-friendly platform, featuring a straightforward user interface and ample educational resources. The platform offers webinars, tutorials, and trading guides to help newcomers learn the basics of trading. With a variety of account types and a wide range of tradable assets, AvaTrade is designed to accommodate new traders as they develop their skills.

Its robust customer support and commitment to trader education further enhance its appeal. This focus on accessibility and learning resources positions AvaTrade as a top choice for beginners in the trading world.

Pros

Cons

71% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

- Accessible account opening: The process is straightforward, encouraging quick start-up for new traders.

- Free deposits and withdrawals: AvaTrade does not charge for these transactions, enhancing user convenience.

- Rich educational and research tools: Provides valuable resources for traders to make informed decisions.

- Limited product range: Focuses on CFDs, forex, and cryptos, which may not cater to all trading preferences.

- High inactivity fees: Charges substantial fees for accounts inactive for three months or more, which can add up over time.

How Easy is the Platform to Use?

AvaTrade offers a user-friendly web-based platform (AvaTradeGO) and mobile app with various features like social trading and technical analysis tools.

What are the Trading Fees?

AvaTrade charges spreads (difference between buy and sell price) on CFDs and commissions on some asset classes (check AvaTrade’s website for details). Overnight financing and guaranteed stop-loss orders may incur additional fees. (Always check AvaTrade’s website for the latest fee information).

What Account Types are Available?

Standard, Demo, and Islamic accounts. Islamic accounts cater to those following Sharia law and offer swap-free trading options.

What Is an Online Stock Broker and How Does It Work?

An online stock broker is a platform that allows you to buy and sell stocks and other securities via the internet. Unlike traditional brokers who operate through phone calls or in-person meetings, online brokers enable traders like you and me to execute trades directly from our computers or mobile devices. This shift to online trading has democratized access to financial markets, making it easier for anyone with an internet connection to start investing.

In my experience, using an online stock broker simplifies the trading process. You can quickly set up an account, fund it, and start trading within minutes. These platforms also provide a wealth of information, tools, and resources to help you make informed decisions.

Types of Online Stock Brokers

There are several types of online stock brokers to consider, each catering to different trading styles and needs. Here are a few:

Full-Service Brokers: These brokers offer comprehensive services, including investment advice, portfolio management, and research reports. They’re ideal for those who prefer a hands-off approach but typically come with higher fees.

Discount Brokers: These platforms provide the essentials for trading without the frills. You’ll get access to a trading platform and basic research tools, often at a much lower cost. This is where I started my trading journey, as it allowed me to keep costs down while learning the ropes.

Robo-Advisors: These automated platforms manage your investments based on your risk tolerance and goals. They are great for beginners who want a hands-off approach without worrying about day-to-day trading.

Direct Market Access Brokers: These are designed for professional traders who need speed and efficiency. They provide direct access to market exchanges, which can be crucial for high-frequency trading.

Each type has its pros and cons, so it’s essential to choose one that aligns with your trading style and financial goals.

How Online Stock Brokers Facilitate Trading

Online stock brokers facilitate trading by acting as intermediaries between you and the stock exchanges. When you place a trade through your broker, they execute it on your behalf. Here’s a simplified breakdown of how it works:

Order Placement: After analyzing the market and deciding which stock to buy or sell, you enter the details into your broker’s trading platform.

Order Execution: Your broker sends the order to the relevant stock exchange. This happens almost instantly, allowing you to take advantage of market movements.

Confirmation: Once your order is executed, you receive a confirmation along with details about the trade, such as the price at which your order was filled and any fees incurred.

Account Management: Your broker tracks all your trades, managing the details in your account. You can monitor your investments, view performance reports, and withdraw funds whenever you choose.

This streamlined process has made trading accessible to so many people, including myself. The convenience of being able to trade from anywhere is a game changer.

Key Features of Online Trading Platforms

When choosing an online stock broker, it’s crucial to look for specific features that enhance your trading experience. Here are some key features I’ve found beneficial:

User-Friendly Interface: A clean and intuitive layout helps you navigate the platform easily, especially during busy trading hours when quick decisions are necessary.

Research Tools: Quality brokers provide access to research reports, market analysis, and stock screeners. These tools have been invaluable for me, helping to make informed investment decisions.

Mobile Access: Being able to trade on the go through a mobile app is a must for modern traders. I often find myself checking my portfolio or placing trades while away from my desk.

Educational Resources: Many brokers offer tutorials, webinars, and articles. As a beginner, I relied heavily on these resources to improve my understanding of the markets and trading strategies.

Customer Support: Reliable customer service can save you a lot of stress. Whether you need assistance with account issues or have questions about trading, having responsive support is vital.

In conclusion, online stock brokers have revolutionized the way we trade and invest. Understanding their functions, types, and features can help you make informed choices that align with your trading style and goals. As you embark on your trading journey, selecting the right broker will set the foundation for your success.

What Are the Differences Between Stock Investing and Trading?

Time Horizon: Short-Term vs. Long-Term

One of the primary differences between investing and trading lies in the time horizon. Investing typically involves a long-term perspective, where you buy stocks and hold them for years, if not decades. The goal is to benefit from the company’s growth, dividends, and the overall market appreciation over time. I’ve found this approach particularly rewarding, as it allows you to ride out market fluctuations and benefit from compounding returns.

On the other hand, trading focuses on short-term movements in the stock market. Traders may hold positions for minutes, hours, or days, aiming to capitalize on price fluctuations. This approach requires constant monitoring of the market and quick decision-making. I dabbled in day trading for a while, which was exhilarating but also demanding—time and attention are essential.

Risk Tolerance in Investing vs. Trading

Risk tolerance is another significant differentiator between investing and trading. Investors generally adopt a more conservative approach, focusing on established companies with solid fundamentals. Their primary concern is capital preservation, which is why they often diversify their portfolios to mitigate risk. For me, investing in stable companies with strong histories has provided peace of mind during market downturns.

Conversely, traders often embrace higher levels of risk, seeking to profit from market volatility. This can lead to substantial gains, but it also means potential losses can accumulate quickly. The thrill of trading comes with the necessity of managing risk actively, whether through stop-loss orders or strict position sizing. I learned early on that having a clear risk management strategy is essential in trading, as emotions can easily cloud judgment.

Strategy Approaches: Fundamental vs. Technical Analysis

The strategies employed in investing and trading can also differ significantly. Investors tend to focus on fundamental analysis, evaluating a company’s financial health, management, and market position. This involves examining financial statements, earnings reports, and industry trends. I often spend time researching companies before making an investment, seeking those with solid growth potential and good management.

In contrast, traders typically rely on technical analysis, analyzing price charts and market patterns to make decisions. This involves studying indicators, trends, and volume to identify entry and exit points. I found technical analysis fascinating during my trading days, as it allows you to react quickly to market changes. However, it also requires a different mindset and skill set compared to the more research-oriented approach of investing.

Capital Requirements for Investing vs. Trading

Finally, the capital requirements for investing and trading can vary greatly. Investing usually demands a more significant upfront investment, especially if you’re looking to build a diversified portfolio over time. With compound interest and reinvested dividends, even a small initial investment can grow substantially. I started with a modest amount and gradually built my portfolio through regular contributions and patience.

In contrast, trading can often be done with less capital, particularly with strategies like day trading or options trading. Many brokers offer margin accounts, allowing traders to borrow funds to increase their buying power. However, this also amplifies risk, as losses can exceed the initial investment. I experienced this firsthand, and it reinforced the importance of having adequate capital and a well-defined risk strategy before diving into trading.

How Can I Trade Stocks in the UK?

Trading stocks in the UK starts with opening a brokerage account, and the process is quite straightforward. Here’s a step-by-step guide based on my experience:

Research Brokers: First, I recommend researching different brokerage firms to find one that suits your needs. Look for factors like fees, available markets, and user reviews. Some popular options in the UK include Hargreaves Lansdown, IG, and eToro.

Complete the Application: Once you’ve chosen a broker, visit their website and fill out the application form. This typically requires personal information, including your name, address, and national insurance number. Be prepared to provide identification, such as a passport or driver’s license.

Verify Your Identity: Brokers are required to verify your identity to comply with regulations. This might involve uploading documents online, which I found to be a quick and easy process.

Fund Your Account: After your account is set up and verified, you can fund it. Most brokers offer various funding methods, including bank transfers and debit/credit cards. I usually opt for bank transfers for their simplicity and security.

Start Trading: Once your account is funded, you’re ready to start trading! Familiarize yourself with the platform’s features and tools to make informed decisions.

Understanding UK Stock Markets (LSE, AIM)

In the UK, the two main stock markets are the London Stock Exchange (LSE) and the Alternative Investment Market (AIM).

London Stock Exchange (LSE): This is the primary stock exchange in the UK and one of the largest in the world. It lists well-established companies, including many blue-chip stocks. Trading on the LSE generally involves more stable, mature companies, making it suitable for long-term investors.

Alternative Investment Market (AIM): AIM caters to smaller, growing companies, offering them access to capital while providing investors with opportunities for potentially higher returns. However, trading on AIM can also involve greater risks due to the volatility and less stringent regulations. I’ve found it essential to conduct thorough research when investing in AIM stocks, as they can be quite different from LSE-listed companies.

Choosing the Right Trading Platform

Selecting the right trading platform is crucial for your success as a trader. Here are some factors to consider:

User Experience: A user-friendly interface can make a significant difference, especially when executing trades quickly. I prefer platforms that are intuitive and easy to navigate.

Fees and Commissions: Different brokers have varying fee structures, including trading commissions, account maintenance fees, and spreads. I always recommend comparing these costs to ensure you’re getting the best deal.

Research and Analysis Tools: Look for platforms that provide robust research and analysis tools. Whether it’s technical indicators, market news, or educational resources, having these tools at your disposal can enhance your trading experience.

Customer Support: Good customer support can be a lifesaver, especially if you encounter issues while trading. Check if the broker offers multiple channels for support, like phone, email, or live chat.

Mobile Trading Capability: If you plan to trade on the go, ensure the platform has a reliable mobile app. I often find myself trading from my phone, so having a smooth mobile experience is essential.

Regulatory Considerations in the UK

When trading stocks in the UK, it’s essential to understand the regulatory environment. The Financial Conduct Authority (FCA) oversees brokers and ensures they comply with strict rules to protect investors. Here are a few key points:

Regulation and Licensing: Ensure that your chosen broker is FCA-registered. This adds a layer of security, as FCA-regulated brokers must meet specific financial standards and adhere to strict guidelines.

Investor Protection: In the UK, investments with FCA-regulated brokers are protected up to £85,000 per individual under the Financial Services Compensation Scheme (FSCS). This means that if a broker fails, you can claim compensation within this limit.

Know Your Rights: Familiarize yourself with your rights as an investor in the UK. Understanding the rules surrounding trading and investor protection can help you navigate the markets with confidence.

Tax Implications: Be aware of the tax implications of trading in the UK. Profits from trading stocks may be subject to Capital Gains Tax (CGT). Keeping track of your gains and losses is crucial for accurate tax reporting.

In conclusion, trading stocks in the UK involves several steps, from opening a brokerage account to understanding the stock markets and regulations. By following these guidelines and doing your research, you can navigate the trading landscape with confidence and make informed decisions.

What Are the Common Fees for Stock Brokers?

Commission fees are one of the most common costs associated with trading stocks through a broker. These fees are charged every time you buy or sell a security, and they can vary significantly from one broker to another. Some brokers charge a flat fee per trade, while others may have a tiered system based on the number of trades you make or the size of your transactions.

In my experience, it’s essential to compare commission fees when choosing a broker, as they can eat into your profits, especially if you trade frequently. Some platforms, like Robinhood and eToro, offer commission-free trading, which can be very appealing. However, be sure to check if they offset these costs with other fees or by widening the spread on trades.

Account Maintenance Fees

Account maintenance fees are another cost to watch out for. These fees are charged for keeping your brokerage account open and can be applied monthly or annually. Not all brokers charge maintenance fees, and some may waive them if you maintain a certain account balance or meet other criteria.

I learned early on that it’s a good idea to choose a broker with low or no account maintenance fees. Over time, these fees can add up and reduce your overall investment returns. Always read the fine print when setting up an account to ensure you’re not caught off guard by these charges.

Spread Markup and Other Costs

In addition to commission fees, many brokers earn money through spread markups. The spread is the difference between the buying price (ask price) and the selling price (bid price) of a security. For example, if you want to buy a stock for £100 and the broker’s selling price is £102, the spread is £2. This markup can be a significant cost, especially for frequent traders.

Other costs may include fees for accessing advanced trading features, data feeds, or research tools. I’ve found that while some of these features can enhance your trading experience, they can also add up quickly. It’s crucial to evaluate what you really need before committing to a broker.

Understanding Inactivity Fees

Inactivity fees are charges that brokers may impose if your account remains inactive for a specified period. For example, if you don’t make any trades within a certain timeframe, the broker might deduct a fee from your account. Not all brokers have this policy, but it’s something to be aware of.

I’ve encountered inactivity fees in the past, which served as a reminder to remain active in my trading activities or to find a broker that doesn’t impose such fees. If you’re planning to hold investments long-term or take breaks from trading, make sure to check a broker’s inactivity fee policy before opening an account.

What Are Popular Stock Trading Strategies?

Day trading and swing trading are two popular trading strategies that cater to different styles and time commitments.

Day Trading: This strategy involves buying and selling stocks within the same trading day, often executing multiple trades in a single session. The goal is to capitalize on small price movements and market fluctuations. I dabbled in day trading for a period and found it exhilarating but also intense. It requires constant market monitoring, quick decision-making, and a solid understanding of technical analysis. Day traders often use chart patterns and indicators to identify short-term opportunities.

Swing Trading: In contrast, swing trading involves holding positions for several days or weeks to capture larger price movements. Swing traders analyze market trends and look for stocks with the potential for upward or downward swings. I’ve found swing trading to be more manageable for my schedule, allowing me to research stocks without being glued to the screen all day. This strategy strikes a balance between day trading’s intensity and the longer-term approach of investing.

Value Investing vs. Growth Investing

Value investing and growth investing are two fundamental approaches that cater to different philosophies and goals.

Value Investing: This strategy focuses on identifying undervalued stocks that are trading for less than their intrinsic value. Value investors look for companies with solid fundamentals, low price-to-earnings (P/E) ratios, and strong balance sheets. I’ve found value investing to be a rewarding approach, as it allows for long-term wealth accumulation through the purchase of quality companies at bargain prices. This method often requires patience, as it may take time for the market to recognize the true value of these stocks.

Growth Investing: In contrast, growth investing targets companies that are expected to grow at an above-average rate compared to their industry or the overall market. These stocks often come with higher valuations and P/E ratios, reflecting investor expectations for future growth. I’ve dabbled in growth investing, focusing on sectors like technology and renewable energy. While the potential for high returns is enticing, I’ve learned to be cautious, as growth stocks can be more volatile and sensitive to market sentiment.

Scalping Strategies

Scalping is a high-speed trading strategy that aims to make small profits from numerous trades throughout the day. Scalpers hold positions for very short periods, sometimes just a few seconds to minutes, taking advantage of small price fluctuations.

In my experience with scalping, success relies heavily on speed, precision, and access to advanced trading tools. Scalpers typically use direct market access platforms and algorithms to execute trades quickly. While the potential for quick profits is appealing, this strategy can be stressful and demands a deep understanding of market dynamics. I found that having a solid risk management plan is crucial, as the fast pace can lead to significant losses if not handled carefully.

Momentum Trading Techniques

Momentum trading is based on the idea that stocks that have been rising will continue to rise, and those that have been falling will continue to fall. Momentum traders look for stocks with strong trends and high volume, using technical indicators to identify entry and exit points.

In my trading experience, I’ve seen the power of momentum trading firsthand. I often look for stocks breaking out of resistance levels or those with significant news catalysts driving price changes. This strategy requires vigilance, as trends can shift rapidly. I’ve learned that timing is crucial; getting in and out of positions at the right moment can lead to substantial gains. However, I also recognize the risks involved, as momentum can fade quickly, leading to potential losses.

What Are the Pros and Cons of Stock Trading?

Advantages of Stock Trading

Stock trading offers several advantages that can make it an appealing investment strategy.

Potential for High Returns: One of the main attractions of trading stocks is the potential for substantial profits. Traders can take advantage of price fluctuations, making quick gains in a relatively short time. I’ve personally experienced the thrill of executing a well-timed trade that yielded impressive returns, which is undoubtedly a significant draw for many.

Liquidity: The stock market is highly liquid, meaning that stocks can generally be bought and sold quickly. This liquidity allows traders to enter and exit positions without significant delays, making it easier to capitalize on market opportunities. I appreciate the flexibility this provides, especially during volatile market conditions.

Accessibility: With the rise of online brokers, stock trading has become more accessible than ever. You can trade from anywhere with an internet connection, using a variety of platforms and tools. This ease of access has allowed me to manage my portfolio and execute trades conveniently, without the need for traditional brokerage services.

Diverse Opportunities: The stock market offers a wide array of investment options, from established companies to emerging startups. This diversity allows traders to tailor their strategies to their individual risk tolerance and market outlook. I often explore different sectors and industries, which keeps my trading experience dynamic and engaging.

Disadvantages of Stock Trading

While stock trading has its advantages, there are also notable disadvantages to consider.

High Risk: The potential for high returns comes with significant risks. Stock prices can be volatile, and traders can lose money quickly if they are not careful. I’ve faced losses in trades that didn’t go as planned, highlighting the importance of risk management strategies to mitigate these potential downsides.

Emotional Stress: The fast-paced nature of stock trading can lead to emotional stress and anxiety. Watching stock prices fluctuate in real-time can trigger impulsive decisions, such as panic selling or overtrading. I’ve learned the hard way that emotional trading often leads to poor outcomes, underscoring the need for a disciplined approach.

Time Commitment: Successful trading requires a considerable time commitment for research, analysis, and market monitoring. For those with busy schedules, finding the time to stay informed can be challenging. I often set aside specific times for market analysis and strategy development, which helps me maintain focus without feeling overwhelmed.

Fees and Costs: While trading can be profitable, it also comes with various costs, such as commission fees, account maintenance fees, and spreads. These costs can erode profits, especially for frequent traders. I’ve become more mindful of fees as I trade, ensuring that I choose brokers that align with my trading style and minimize unnecessary expenses.

The Impact of Market Volatility

Market volatility can significantly impact stock trading outcomes. While volatility can create opportunities for profit, it can also lead to increased risks and uncertainty. Sudden price swings can result in unexpected losses, making it essential for traders to stay informed about market conditions and news that may affect stock prices.

In my experience, learning to embrace volatility rather than fear it has been key. I’ve adjusted my strategies to account for market fluctuations, employing techniques such as stop-loss orders to protect my investments during turbulent times. Understanding volatility helps traders make informed decisions and adapt their strategies accordingly.

Psychological Factors in Trading Decisions

Psychological factors play a crucial role in trading decisions, often influencing outcomes more than one might expect. Emotions like fear and greed can cloud judgment, leading to impulsive actions that derail even the most well-thought-out strategies.

For example, fear of missing out (FOMO) can drive traders to enter positions without proper analysis, while fear of loss can result in panic selling during downturns. I’ve experienced both firsthand and have learned the importance of maintaining a disciplined mindset when trading. Establishing a trading plan, setting realistic goals, and practicing mindfulness can help manage these psychological factors effectively.

References

FAQs

The Financial Services Compensation Scheme (FSCS) is a UK statutory fund designed to provide security and trust in the financial markets, including the realm of online stock brokers.

If your online stock broker fails and cannot meet its financial obligations, the FSCS can compensate you up to £85,000 per eligible person, per firm.

This protection covers various investment products, including trading accounts, making it a critical consideration when choosing the best online stock broker for your needs.

Yes, most online trading platforms allow you to invest in Exchange Traded Funds (ETFs), which are popular investment vehicles that trade on major exchanges, like the New York Stock Exchange.

ETFs offer the flexibility of trading stocks combined with the diversified exposure of mutual funds, making them an attractive option for many investors. When selecting an online stock broker, ensure they offer a broad selection of ETFs, allowing you to diversify your portfolio efficiently.

Deciding on the best online stock broker for trading on the New York Stock Exchange (NYSE) involves evaluating several factors, including the broker’s fees, the range of investment options available (such as stocks, ETFs, and bonds), platform usability, customer service quality, and regulatory compliance.

Additionally, consider the broker’s access to international markets, including the NYSE, and whether they offer real-time data and analysis tools to help you make informed decisions.

Comparing these features among the leading online stock brokers will help you find the one that best suits your trading needs.

When looking for an online trading platform to trade exchange traded funds (ETFs) and stocks, prioritize features like user-friendly interface, comprehensive market research tools, real-time data and charting capabilities, low transaction fees, and robust security measures.

Also, consider platforms that offer educational resources to help you understand the market dynamics.

The best online trading platforms provide a seamless trading experience, whether you’re a novice or an experienced trader, facilitating easy management of your investment portfolio.

Online stock brokers operating in the UK are regulated by the Financial Conduct Authority (FCA), which ensures they adhere to strict standards of operation, protecting investors’ interests.

This regulatory framework impacts your investments on the New York Stock Exchange by ensuring that your broker operates with transparency, integrity, and in your best interest.

It provides a level of security and confidence, knowing that your investments are handled by a broker that is monitored and compliant with regulatory requirements.