How to Buy Netflix Shares in the UK – Step-by-Step Guide

Adam Woodhead

Co-Founder

Adam is a Co-Founder and content creator for The Investors Centre. His key areas of interest and expertise are cryptocurrency and blockchain technology.

Twitter ProfileAuthor Bio

Thomas Drury

Co-Founder

Seasoned finance professional with 10+ years' experience. Chartered status holder. Proficient in CFDs, ISAs, and crypto investing. Passionate about helping others achieve financial goals.

Twitter ProfileAuthor Bio

Fact Checked

How we test

At The Investors Centre, we pride ourselves on our rigorous fact-checking process. To delve deeper into our meticulous testing procedures and discover how we ensure accuracy and reliability, visit our dedicated page on how we test.

Risk Warning

The information provided in this article is for educational and informational purposes only and does not constitute financial or investment advice.

Some of the links on this website are affiliate links, meaning we may earn a commission if you click through and make a purchase or investment, at no extra cost to you. This helps support our website and allows us to continue providing quality content.

Updated 02/01/2025

Quick Answer: These are the steps to buying Netflix shares:

- Choose a regulated broker – Pick a UK-friendly platform like eToro or Saxo.

- Open an account – Complete verification with a photo ID.

- Deposit funds – Use bank transfer, debit card, or PayPal.

- Search for Netflix (NFLX) – Find the stock on your broker’s platform.

- Select order type – Market or limit order.

- Buy shares – Confirm and place your trade.

- Monitor investment – Track performance and decide on an exit strategy.

Featured Platform: eToro

- Copy Trading

- User Friendly Platform

- Regulated & Trusted

- 30 Million+ Users

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

I remember the first time I considered buying Netflix shares. It was after yet another binge-watch session, and I realised how much I relied on the platform. I started wondering—could I own a piece of Netflix? The answer was yes, and getting started was easier than I thought.

Netflix (NFLX) is a well-known stock, but before jumping in, it’s important to know the process, costs, and risks.

In this guide, I’ll share a clear step-by-step method to buy Netflix shares in the UK—including my experience, expert insights, and the best platforms to use.

How to Buy Netflix Shares in the UK – Step-by-Step Guide

Buying Netflix shares in the UK is straightforward, but choosing the right broker is key. Some charge high fees, while others offer better features for different trading styles.

Here’s how to buy Netflix shares in seven simple steps. I’ll also share my experience using different platforms.

1. Choose a Broker to Buy Netflix Shares

To buy Netflix shares, you need an FCA-regulated broker. Some platforms have low FX fees, while others are better for beginners.

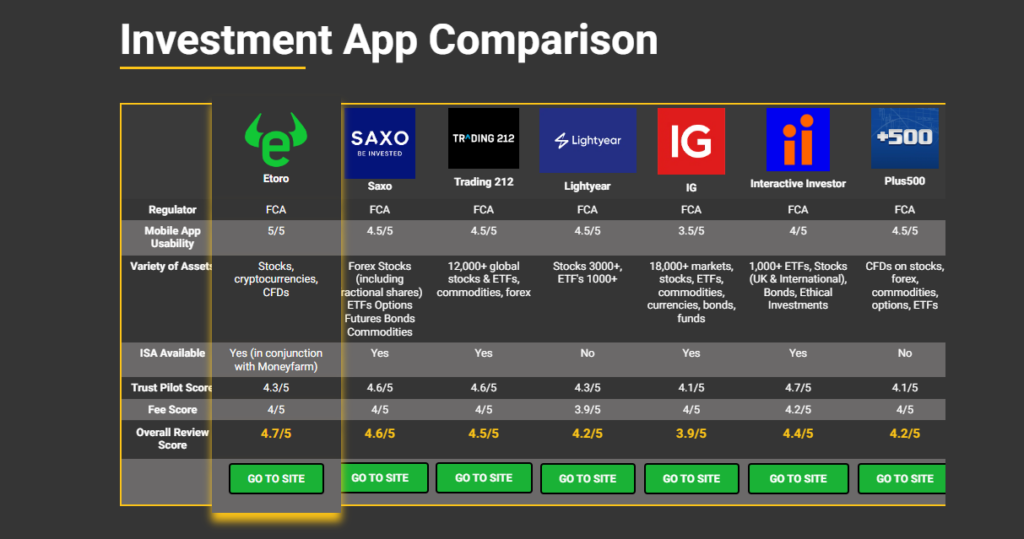

Best Brokers for Buying Netflix Shares in the UK

| Rank | Broker | Fees | Best For | Min. Deposit |

|---|---|---|---|---|

| #1 | eToro | £0 commission | Beginners | £50 |

| #2 | Saxo Bank | £9.90 per trade | Advanced traders | £500 |

| #3 | Interactive Brokers | Low FX fees | Frequent investors | £0 |

Key Considerations When Choosing a Broker:

- Trading Fees – Some brokers charge commission per trade, while others offer commission-free stocks.

- Currency Conversion Costs – Netflix shares trade in USD, so FX fees apply.

- Ease of Use – eToro is beginner-friendly, while Saxo Bank has advanced tools.

I personally started with eToro because it was easy to use, but when I wanted more technical analysis, I switched to Saxo Bank. Interactive Brokers is great for frequent investors who want to minimise FX fees.

2. Open an Account & Verify Your Identity

Opening an account is straightforward, but brokers require identity verification to comply with FCA regulations. This is called KYC (Know Your Customer). It prevents fraud and ensures only legitimate users can trade.

When I first signed up for eToro, I was surprised by how quick the process was. I uploaded my passport, a bank statement, and within a few hours, my account was verified. Some brokers, like Saxo Bank, took longer—about one business day.

What You’ll Need for Verification:

- Photo ID (passport or driving licence)

- Proof of address (bank statement or utility bill)

- Payment method (debit card, bank transfer, or PayPal)

Once verified, you’re ready to deposit funds.

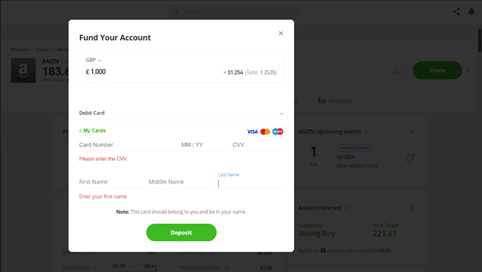

3. Deposit Funds into Your Account

After verification, you need to add funds to your brokerage account. Most brokers accept GBP, but since Netflix trades in USD, some charge a currency conversion fee.

Common Deposit Methods & Fees:

| Deposit Method | eToro | IG | Saxo Markets | Processing Time |

|---|---|---|---|---|

| Bank Transfer | ✅ Free | ✅ Free | ✅ Free | 1-3 business days |

| Credit/Debit Card | ✅ 0.5% FX fee | ❌ Not available | ✅ 0.5% FX fee | Instant |

| PayPal/Skrill | ✅ 1% fee | ❌ Not available | ❌ Not available | Instant |

When I first funded my account, I used a debit card because it was instant. Later, I switched to bank transfers to save on FX fees.

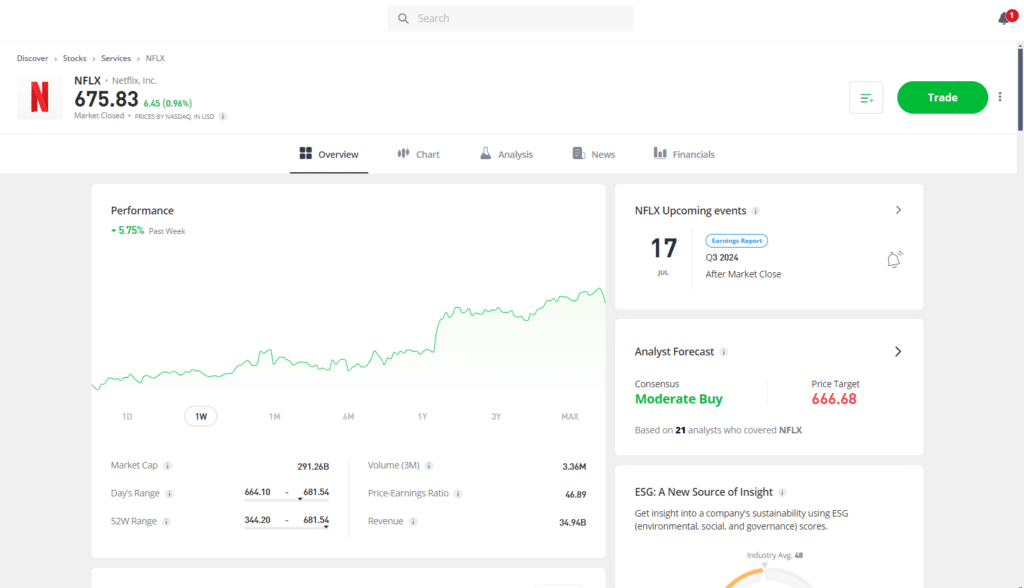

4. Search for Netflix Shares (Ticker: NFLX)

Once your account is funded, you can search for Netflix shares (NFLX) on your broker’s platform.

Steps to Find Netflix Shares:

- Use the search bar – Type Netflix or NFLX.

- Click on the stock – This brings up its price chart and details.

- Check share options – Some brokers allow fractional shares, so you don’t need to buy a full share.

📌 Did You Know?

As of Q4 2024, Netflix reported over 300 million paid subscribers worldwide, up nearly 20 million from the previous quarter. (Statista)

I started with fractional shares to test the waters. Instead of spending £400+ on a full Netflix share, I invested £50 and built my position over time.

5. Choose Your Order Type

Now, you need to decide how you want to buy Netflix shares. There are two main order types:

Market Order (Buy Instantly)

✔ Buys at the current price.

✔ Best for quick purchases but price may change slightly.

Limit Order (Set Your Price)

✔ Only executes if Netflix hits your chosen price.

✔ Useful if you want to buy at a lower price.

I’ve used both. If I want to buy immediately, I place a market order. If I think the stock price will drop, I set a limit order to get a better deal.

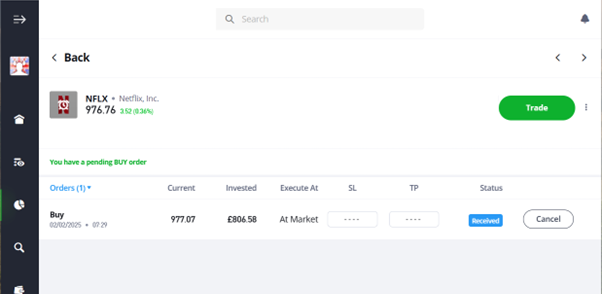

6. Confirm Your Order & Buy Netflix Shares

Once you’ve selected your order type, it’s time to confirm and place your trade. The process takes less than a minute on most platforms.

How to Buy Netflix Shares – Step-by-Step:

- Enter the amount – Choose how many shares or how much money to invest.

- Select order type – Market (instant) or limit (set price).

- Review transaction details – Check FX fees and total cost.

- Click ‘Buy’ – Confirm your purchase.

After my first trade, I kept refreshing the page, expecting immediate gains. But stock prices fluctuate—it’s best to hold long-term and not panic over daily moves.

7. Monitor Your Investment & Plan an Exit Strategy

After buying Netflix shares, keeping track of your investment is crucial.

Ways to Monitor Netflix Stock Performance:

Broker dashboard – View price changes and portfolio value.

Financial news & earnings reports – Stay updated on company performance.

Netflix’s competitors – Watch Disney+ and Amazon Prime Video for industry trends.

I check my stocks weekly, not daily, to avoid emotional decisions. Netflix has big swings, so it’s key to stay calm and think long-term.

When to Consider Selling:

- Target price reached – If Netflix hits your goal price.

- Better investment opportunities – If another stock offers more potential.

- Poor financial results – Declining revenue or subscriber losses.

Some investors sell when Netflix misses earnings expectations. I personally prefer to hold unless the long-term outlook changes.

What is the Cheapest Way to Buy Netflix Shares?

The cheapest way to buy Netflix shares is through a low-fee, FCA-regulated broker with minimal FX charges. Since Netflix trades in USD, currency conversion costs can eat into profits.

Best Low-Cost Option: eToro is the most affordable for beginners depositing in USD. IG offers zero-commission* trading and reduced fees while providing advanced trading tools and features.

*IG offers zero-commission fees when trading US, EU, and AU stocks/shares. However, other fees may apply. You can find out more on IG’s Commissions and Charges page.

Pros of Investing in Netflix Shares

✅ Strong Revenue Growth – Netflix generated $10.2 billion in Q4 2024, up from $8.8 billion in the same quarter the previous year. (Statista)

✅ Large Subscriber Base – Over 300 million paid subscribers worldwide, with continued growth in international markets. (Statista)

✅ Market Leader in Streaming – Netflix remains the #1 streaming service despite competition from Disney+ and Amazon Prime Video.

✅ Strong Original Content – Hit shows like Stranger Things, Squid Game, and Bridgerton drive high engagement and subscriber retention.

✅ New Revenue Streams – Netflix is expanding into advertising and gaming, opening new income opportunities.

Cons of Investing in Netflix Shares

❌ Intense Competition – Rivals like Disney+, Amazon Prime, and Apple TV+ are aggressively expanding market share.

❌ High Content Costs – Netflix spends billions annually on original content, reducing profit margins.

❌ Slowing Subscriber Growth – Growth has slowed in mature markets like North America and Europe.

❌ No Dividends – Netflix does not pay dividends, making it less attractive for income investors.

❌ Stock Price Volatility – Netflix shares have experienced major swings, dropping 60% in 2022 before rebounding.

💡 Key Takeaway: NFLX is a strong long-term investment, but competition, regulation, and metaverse spending are risks to watch.

How to Sell Netflix Shares

Selling Netflix shares is just as easy as buying them. Whether you want to take profits, cut losses, or reinvest elsewhere, you can sell your shares through your brokerage account.

How to Sell Netflix Shares – Step-by-Step:

- Go to your portfolio – Log in to your broker account and find Netflix (NFLX).

- Select ‘Sell’ – Choose how many shares or how much value you want to sell.

- Pick an order type – Market (sell instantly) or limit (set your price).

- Review the details – Check for FX conversion fees or commissions.

- Confirm the sale – Click ‘Sell’ to complete the transaction.

Tax Considerations in the UK:

- Capital Gains Tax (CGT) – If you make over £6,000 (2024 allowance) in profit, you may owe tax.

- ISA & SIPP Accounts – Selling inside an ISA or pension means no CGT.

- Dividend Tax – Netflix doesn’t pay dividends, so no dividend tax applies.

I always check my broker’s tax report feature before selling to see how much profit I made and if tax applies.

How to Invest in Netflix via a Fund

Instead of buying Netflix shares directly, you can invest through ETFs (Exchange-Traded Funds) or index funds. These spread risk by holding multiple stocks, including Netflix.

Why Invest in Netflix Through a Fund?

✔ Less risk than buying one stock

✔ Lower fees than actively managed funds

✔ Exposure to other top tech companies

For my long-term portfolio, I use ETFs because they provide diversification and steady growth.

Which Funds Contain Netflix Stock?

Several ETFs hold Netflix shares, offering diversified exposure to tech and media stocks.

| Fund Name | Netflix Weight % | Other Major Holdings | Best For |

|---|---|---|---|

| S&P 500 ETF (VOO, CSP1) | ~1.2% | Apple, Microsoft, Amazon | Broad market exposure |

| Nasdaq 100 ETF (QQQ, QQQ3) | ~2.5% | Tesla, Nvidia, Google | Tech-heavy investment |

| Communication Services ETF (XLC) | ~4% | Meta, Disney, Comcast | Media & streaming focus |

📌 Pro Tip:

I personally like QQQ (Nasdaq 100 ETF) because it holds top tech companies, not just Netflix.

Is Netflix Overpriced?

Netflix stock has seen huge price swings, from over $700 in 2021 to under $200 in 2022.

How to Measure if Netflix is Overpriced:

- Price-to-Earnings (P/E) Ratio – Netflix trades at around 30x earnings, compared to the S&P 500 average of 20x.

- Revenue Growth – Netflix’s revenue growth is slowing from 20%+ to single digits.

- Subscriber Growth – Competition from Disney+ and Amazon is affecting new subscriptions.

📌 Stat:

In Q4 2024, Netflix generated total revenue of over $10.2 billion, up from $8.8 billion the previous year. (Statista)

Expert Insight:

“Netflix is still a dominant force in streaming, but its valuation is high compared to earnings growth.” – [Financial Analyst, GoodMoneyGuide]

When I invest in Netflix, I wait for price dips before buying more shares. Timing is key.

Final Thoughts

Netflix is a strong brand with long-term potential, but it’s not without risks. If you’re investing, consider fees, taxes, and competition before making a decision.

For beginners, eToro is a good entry point with fractional shares. Long-term investors might prefer ETFs for diversification.

Trade Smarter, Not Harder

I’ve learned that emotional trading leads to mistakes. Instead of reacting to daily price swings, I set clear goals, do research, and invest with a plan.

Think long-term, manage risk, and stay informed. That’s the best way to grow wealth in the stock market. 🚀

What’s Next?

📌 Want to buy Netflix shares today? Compare the best FCA-regulated brokers in the UK to find the right platform for your needs.

📌 Looking for more investments? Explore top-performing stocks and shares ISAs to grow your portfolio tax-free.

📌 Prefer short-term trading? Check out the best day trading platforms in the UK for active traders looking to profit from market swings.

Trade Smarter, not Harder

- Copy Trading

- Competetive Fee's

- Multi Asset Platforn

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

FAQs

The simplest way to buy Netflix shares is through a trading app by placing a market or basic order, prompting the platform to execute it as soon as possible.

Netflix is a leading streaming service with over 300 million subscribers. The stock has strong growth potential but faces competition from Disney+ and Amazon Prime Video. Its high valuation and stock volatility mean it suits long-term investors willing to handle risk.

Yes, UK investors can buy Netflix (NFLX) shares through FCA-regulated brokers like eToro, Saxo Bank, and Interactive Brokers. Since Netflix trades on the NASDAQ (USA), brokers may charge FX conversion fees when buying in GBP.

Netflix’s share price is over $400 per share, but some brokers, like eToro, offer fractional shares, allowing you to invest as little as £50. This makes it easier to start investing without buying a full share.

No, Netflix does not pay dividends. It reinvests profits into content production and global expansion. Investors in dividend stocks may prefer alternatives like Disney (DIS) or other dividend-paying media companies.

es, several brokers, including eToro and Interactive Brokers, allow you to buy fractional Netflix shares. This means you can invest a small amount, even if you don’t have enough for a full share.

Yes, you can invest in Netflix through:

- ETFs – Funds like S&P 500 ETFs (VOO, CSP1) or Nasdaq 100 ETFs (QQQ, QQQ3) hold Netflix shares.

- CFDs (Contracts for Difference) – Trade Netflix’s price movements without owning shares (higher risk).

- Options Trading – Advanced investors can trade Netflix options to bet on price movements.

I personally prefer ETFs because they offer diversification with less risk than buying individual stocks.

You May Also Like:

References:

Netflix Subscriber Growth & Revenue:

- www.statista.com/statistics/250934/quarterly-number-of-netflix-streaming-subscribers-worldwide/

- www.statista.com/statistics/273883/netflixs-quarterly-revenue/

Competition in Streaming Industry:

Market Insights & Stock Valuation:

- Zero-commission Stock Trading

- Our #1 Recommended Crypto Platform

- Copy Top Investors Easily

- User-friendly Trading Platform

- Fractional Shares

- Wide Range of Assets

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.