How to Invest in Stocks in the UK

Thomas Drury

Co-Founder

Seasoned finance professional with 10+ years' experience. Chartered status holder. Proficient in CFDs, ISAs, and crypto investing. Passionate about helping others achieve financial goals.

Twitter ProfileAuthor Bio

Dom Farnell

Co-Founder

Dom is a Co-Founder of TIC, a passionate investor and seasoned blog writer with a keen interest in financial markets and wealth management. "My goal is to empower individuals to make informed investment decisions through informative and engaging content."

Twitter ProfileAuthor Bio

How We Test

At The Investors Centre, we pride ourselves on our rigorous fact-checking process. To delve deeper into our meticulous testing procedures and discover how we ensure accuracy and reliability, visit our dedicated page on how we test.

Please bear in mind that the value of investments can decrease in addition to increasing, which means there is a possibility of receiving an amount lower than your initial investment. It is generally advisable to retain your investments for a minimum of five years in order to maximize the likelihood of achieving your desired returns. Capital at risk.

Quick Answer.

To start investing in stocks, you’ll need to open a brokerage account with a reputable firm in the UK. Research and choose stocks based on your financial goals and risk tolerance. It’s advisable to diversify your investments and consider long-term strategies.

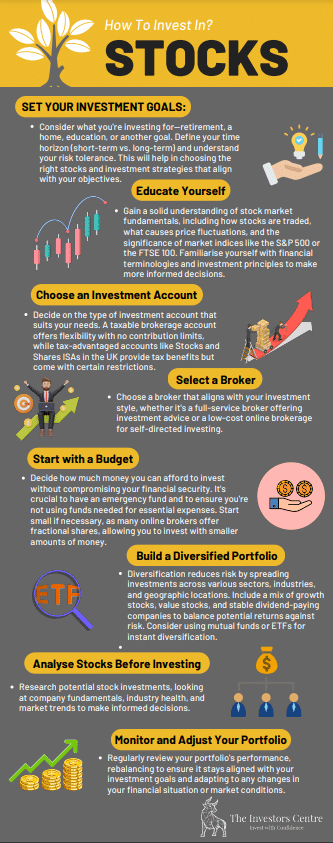

5 Step Guide to Start Investing in Stocks

Define Your Investment Goals

- Before you begin investing, it’s crucial to understand what you want to achieve. Are you saving for retirement, accumulating a down payment for a house, or building wealth over time?

- Setting clear, achievable goals affects how you will invest, including your risk tolerance and the types of stocks you might choose.

- For instance, long-term goals may allow more room for volatile investments with potentially higher returns, such as tech stocks, while short-term goals might lean towards safer, dividend-paying stocks.

Understand Different Types of Stocks

- Stocks can broadly be categorized into various types, each with its own set of characteristics and associated risks. Common stocks grant shareholders voting rights but are last in line during liquidation.

- Preferred stocks provide no voting rights but offer fixed dividends and priority during liquidation. Stocks are also classified by company size, industry, and growth potential.

- For example, blue-chip stocks are shares in large, reputable companies known for their financial stability. Understanding these distinctions will help you make informed decisions and tailor your investment portfolio to match your financial goals.

Set Up a Brokerage Account

- To start buying stocks, you’ll need to set up a brokerage account. Choose between a traditional broker or an online brokerage platform based on your investment style and support needs.

- Traditional brokers offer personalized advice and expertise but typically charge higher fees. Online brokers offer lower fees and are convenient but require you to make investment decisions independently.

- When choosing a broker, consider factors like fees, services offered, trading platforms, and customer support. Ensure that the broker is regulated by the Financial Conduct Authority (FCA) in the UK, which adds a layer of security and trust.

Learn to Analyse Stock Markets

- Analyzing stock markets involves understanding both fundamental and technical analysis. Fundamental analysis looks at company-specific metrics such as earnings, revenue growth, and debt levels, as well as broader economic factors like interest rates and economic growth.

- Technical analysis, on the other hand, involves analyzing statistical trends gathered from trading activity, such as price movement and volume.

- Familiarize yourself with financial news sources, stock market data, and trends analysis tools available through your brokerage platform to make educated predictions about future movements and trends in the stock market.

Start Trading Stocks

- Once your brokerage account is set up and you’ve done your research, you’re ready to start trading. Begin with small investments to test your strategies without exposing yourself to significant losses.

- Consider starting with stocks that align with your analysis and investment goals. Utilize limit orders to specify the maximum price you’re willing to pay or the minimum price you’re willing to accept, helping manage risk. Monitor the performance of your stocks and the overall market, adjusting your portfolio as needed.

- Remember, investing is a long-term endeavor, and patience is key to managing the ups and downs of the market.

How to Invest in Stocks

Researching Stock Market Basics

To invest wisely in stocks, a solid understanding of market fundamentals is crucial.

Start by learning about different types of stocks, such as common and preferred, and the markets they trade in, like the New York Stock Exchange or the London Stock Exchange.

Familiarize yourself with key financial metrics such as earnings per share (EPS), price-to-earnings (P/E) ratios, and dividend yields, which can help assess a company’s financial health and stock valuation. Additionally, it’s important to understand broader economic indicators such as interest rates, inflation, and employment figures, as these can directly impact market performance.

Utilize financial news websites, stock market apps, and invest in financial education courses to build a solid foundation for your investment decisions.

Diversifying Your Investment Portfolio

Diversification is a key strategy to manage risk and increase potential returns over time. By investing in a variety of asset classes and sectors, you can reduce the impact of poor performance from a single investment.

Start by spreading your investments across different types of stocks, such as technology, healthcare, and consumer goods, which respond differently to economic conditions. Consider including international stocks to capitalize on growth in varying global markets. Furthermore, integrating other asset types like bonds, real estate investment trusts (REITs), and commodities can provide additional layers of security and income.

Tools like mutual funds and exchange-traded funds (ETFs) can also help achieve diversification without the need to manage multiple individual assets.

Monitoring Your Stock Investments

Regular monitoring of your investments is essential to staying aligned with your financial goals and reacting effectively to market changes. Set up a routine, whether it’s daily, weekly, or monthly, to check the performance of your stocks and the overall health of your portfolio. Use portfolio tracking tools offered by most brokerage platforms, which can provide real-time data and analytics.

Pay attention to market news and events that could affect your investments, such as economic announcements, earnings reports, or geopolitical events. Consider rebalancing your portfolio periodically to ensure it remains well-aligned with your target asset allocation and risk tolerance.

Finally, keep an eye on transaction costs and tax implications, which can eat into your returns if not managed carefully.

What is a Stockbroker?

Role of a Stockbroker

A stockbroker acts as a middleman between investors and the stock market. They execute buy and sell orders for stocks and other securities on behalf of their clients. These clients may be individuals or institutions.

Stockbrokers also offer advice, guiding clients on investment strategies based on market conditions and individual financial goals. They are licensed professionals, well-versed in financial markets, securities, and trading techniques.

Different Types of Stockbrokers

Stockbrokers fall into two main categories: full-service and discount. Full-service brokers provide a comprehensive range of services. These include investment management, financial planning, and retirement advice. They are ideal for investors who prefer a hands-off approach.

Discount brokers, in contrast, offer limited services at a lower cost. They facilitate direct trades through their platforms. This setup is suitable for experienced investors who like to actively manage their investments. Each type of broker serves different investor needs based on their investment style and level of desired guidance.

How to Choose a Stockbrokerage Account?

Assessing Your Needs and Goals

Before choosing a brokerage account, reflect on what you need from your investments. Are you looking for long-term growth, or more immediate returns? Your decision should align with how actively you plan to trade and how much guidance you require.

Consider if you need a full-service broker that provides comprehensive advice and portfolio management, or if a discount broker for more frequent, self-directed trades suits you better. Your investment experience and comfort level with the stock market should guide your choice.

Comparing Fees and Services

It’s crucial to compare the fees and services different brokers offer. Look at commission rates for trades, account maintenance fees, and any costs for additional services.

Discount brokers typically offer lower fees but fewer services. Full-service brokers charge higher fees but provide valuable advice and investment management services. Ensure the fee structure aligns with your investment strategy and frequency of trading.

Reviewing Broker Reputation and Security

The reputation and security of a brokerage are paramount. Research the broker’s history and read reviews from other investors. Check their registration with relevant financial authorities, such as the Financial Conduct Authority (FCA) in the UK.

Security of your investments and personal data should be a top priority. Ensure the broker uses robust encryption methods and has strong measures against cyber threats. A reputable broker will prioritize client security and transparency in their operations.

How do you Invest Using a Share Dealing Platform?

Navigating the Platform Interface

Familiarizing yourself with the share dealing platform’s interface is the first step to successful investing. Start by exploring the dashboard where you can view market trends, access your portfolio, and see real-time stock prices.

Most platforms have tools for analyzing investments, setting up watchlists, and tracking performance. Spend some time understanding how to access these features. This will make your trading experience more efficient and informed.

Placing Your First Trade

To place your first trade, start by selecting the stock you want to buy. Enter the quantity of shares and review the current market price. Choose the type of order—such as a market order, which executes at the current price, or a limit order, which sets a maximum price you’re willing to pay.

After setting your order type, confirm all details are correct, then submit your order. Most platforms will have a confirmation process to review your order before finalizing.

Managing Investments on the Platform

Once you’ve started trading, it’s important to manage your investments actively. Use the platform’s tools to monitor your stock’s performance and the overall market conditions. Adjust your portfolio as necessary based on performance and changing market scenarios.

Set up alerts for price changes or news that might affect your stocks. This proactive approach will help you make timely decisions to either capitalize on opportunities or mitigate losses. Regularly reviewing your portfolio’s balance and diversification will also ensure it aligns with your long-term financial goals.

Advantages

- Potential for High Returns Investing in stocks can offer significant financial returns, often outperforming other traditional investments like bonds or savings accounts. The growth potential of companies and entire economic sectors can lead to substantial rewards for investors, especially those who select successful individual stocks or invest in rapidly growing industries.

- Long-Term Growth Over the long term, the stock market tends to appreciate, providing substantial growth potential for patient investors. Those who invest with a long-term strategy, such as through retirement accounts, can benefit from compound interest and reinvested dividends, which can exponentially increase the initial investment over time.

Disadvantages

- Risks and Volatility Stocks are inherently volatile, with prices subject to wide fluctuations in short periods due to economic changes, political events, or market sentiment. This volatility can lead to significant losses, particularly for inexperienced investors or those without diversified portfolios. Additionally, individual stocks can suffer from company-specific issues, like financial mismanagement or product failures, heightening investment risk.

- Short-Term Fluctuations vs. Long-Term Focus While the stock market generally provides long-term growth opportunities, it also experiences short-term fluctuations that can test an investor’s resolve. Managing these short-term downturns requires a steady, well-planned investment strategy, which can be challenging for those who react impulsively to market changes. Investors need to maintain a long-term focus to navigate temporary market dips effectively without compromising their overall investment goals.

References

FAQs

The minimum amount to start investing depends on the brokerage firm and the price of the stocks you wish to buy. Some online platforms allow you to start investing with as little as £1, using fractional shares, making it accessible to beginners with limited funds.

Choosing stocks should be based on thorough research, including company performance, industry health, and broader market conditions. Consider using a mix of fundamental and technical analysis to guide your decisions, or consult with a financial advisor to align selections with your investment goals and risk tolerance.

Stocks can be volatile in the short term and may not be ideal for those who need quick access to their money. They are typically recommended for longer-term investments due to their potential for higher returns over time. Short-term trading requires a different strategy and risk tolerance.

Profits from stocks are subject to capital gains tax unless shielded within a tax-advantaged account like an ISA in the UK. The tax rate depends on your overall income level and the amount of your gains. Always consult a tax professional to understand the current tax laws applicable to your situation.

Diversification can be achieved by investing in a variety of sectors, industries, and geographies. Consider mixing different types of stocks, such as growth stocks, dividend stocks, and international stocks. Additionally, diversifying across other asset classes like bonds or real estate can further reduce risk.

Related Articles

Gain Access to Our #1 Recommended Investment Platform in the UK

Capital at Risk.