When Will Lloyd's Shares Reach £1?

Adam Woodhead

Co-Founder

Adam is a Co-Founder and content creator for The Investors Centre. His key areas of interest and expertise are cryptocurrency and blockchain technology.

Twitter ProfileAuthor Bio

Dom Farnell

Co-Founder

Dom, a Co-Founder at TIC, is an avid investor and experienced blogger who specialises in financial markets and wealth management. He strives to help people make smart investment decisions through clear and engaging content.

Twitter ProfileAuthor Bio

Last Updated 23/04/2025

Will Lloyd’s Shares Reach £1 in 2025?

Probably Not and here’s Why: the odds of Lloyd’s shares hitting £1 in 2025 are not looking great. It is not impossible. But given where we are right now with the UK economy, investor sentiment, and market conditions, it’s a tall order. For Lloyd’s to get back to that magic £1 mark, we’d need to see a pretty strong economic rebound and a shift in investor mood. That kind of turnaround doesn’t typically happen overnight — or even within a year.

Since then, I have taken crypto taxes seriously. I have worked with HMRC guidelines, utilised crypto tax tools, consulted with accountants, and gone through the Self Assessment process myself. If you’re trading, staking, or even just receiving the odd airdrop, there’s a good chance you’ll owe something, and it’s better to know upfront than be surprised later.

Quick Answer:

Lloyd’s shares are unlikely to hit £1 in 2025 due to a weak UK economy, expected rate cuts, and regulatory uncertainty. While long-term growth is possible, short-term gains are likely limited to 60–70p under current conditions.

There was a time when Lloyd’s felt like a rock-solid bet — a cornerstone of the UK banking sector. But the 2008 financial crisis changed everything. Since then, the share price has struggled to reclaim its former highs. It hasn’t touched £1 in over a decade. And while Lloyd’s still gets plenty of attention — and for good reason — its stock price tends to mirror the wider economy. When the UK’s growing, Lloyd’s does well. But when growth stalls, the share price tends to lag.

So, can Lloyd’s shares actually hit £1 again soon? That’s the big question. In this article, I’ll break down what it would take to get there. We’ll look at the valuation case, current market sentiment, macroeconomic conditions, and what analysts are projecting. Whether you’re already holding Lloyd’s shares or thinking about getting in, understanding the road ahead is key.

A few things will heavily influence Lloyd’s’ path forward — like its relatively low valuation, the health of the UK economy, and how financial regulations evolve. And while there are reasons to be cautiously optimistic about some moderate upside, let’s not ignore the roadblocks. Falling interest rates, consumer uncertainty, and a general lack of investor enthusiasm for bank stocks are all major hurdles. That’s why, realistically, £1 per share in 2025 feels like a stretch — but that doesn’t mean the stock has no potential.

CFDs are complex instruments with a high risk of losing money rapidly due to leverage. 51% of retail CFD accounts lose money when trading CFD’s with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

What Needs to Happen for Lloyd's Shares to Reach £1?

What is the Current Valuation Telling Us?

One of the big reasons investors keep circling back to Lloyd’s is its valuation — it just looks cheap. Right now, Lloyd’s is trading at a forward price-to-earnings (P/E) ratio of around 8.5. That’s well below the FTSE 100 average, which hovers closer to 12.5. In plain English: the market is already pricing in most of the risks, and any positive surprise could spark a rally.

Then there’s the dividend. Lloyd’s is currently yielding about 3.4%, which might not blow your socks off — especially when the FTSE 100 average is closer to 4.7% — but it’s still a solid offering for income-focused investors. The dividend alone won’t push the price to £1, but it’s a reminder that there’s value here for long-term holders, particularly if the broader outlook improves.

What Could Potentially Push the Share Price Higher?

If Lloyd’s is going to make a serious run at £1, a few big-picture things would need to change.

First off, the UK economy would have to shift gears. We’re talking consistent GDP growth, stronger consumer confidence, and better business sentiment. If the economy shows signs of sustained strength, Lloyd’s — which is deeply tied to domestic lending and housing — would likely benefit.

Second, sentiment around UK stocks would need a makeover. Right now, international investors aren’t exactly rushing into the UK market. Places like the US and India are stealing the spotlight with faster growth and tech-led excitement. If that narrative flips — or even just softens — Lloyd’s could see renewed buying interest.

Finally, let’s talk interest rates. Higher rates typically help banks like Lloyd’s because they widen the margin between what they pay to savers and what they earn from borrowers. But here’s the catch: most analysts are expecting rate cuts in 2025. If that happens, it could shrink margins and weigh on profitability — not exactly a recipe for a sharp price surge.

Quick Glance at the Numbers

| Metric | Value |

|---|---|

| Lloyd's Forward P/E Ratio | ~8.5 |

| FTSE 100 Average P/E | ~12.5 |

| Lloyd's Dividend Yield | ~3.4% |

| FTSE 100 Average Dividend Yield | ~4.7% |

| Projected UK GDP Growth (2025) | 1.6% (IMF Forecast) |

| Interest Rate Outlook | Multiple rate cuts likely |

| Analyst Average Price Target | ~65p |

So, while there’s potential for moderate gains, hitting £1 would require a big shift in economic momentum and investor appetite. As of now, we’re just not seeing the right conditions lined up.

How has Lloyd's performed previously?

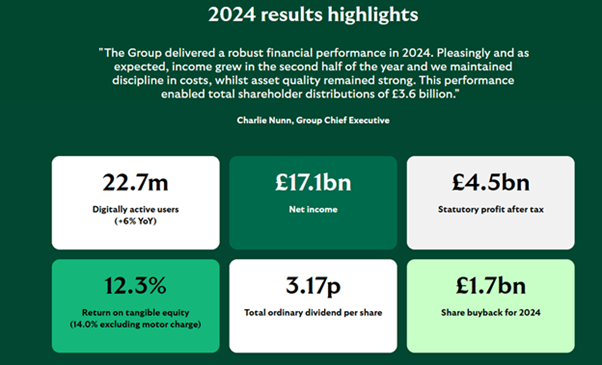

Lloyds Banking Group, a key component of the FTSE 100, has shown resilience in recent quarters, with 2024 earnings reflecting solid earnings generation capacity despite ongoing regulatory uncertainties.

The bank reported strong statutory profits after tax, supported by stable housing market activity and disciplined cost control. Historically, Lloyds has delivered consistent dividend payments, appealing to income-focused investors conducting Lloyds fundamental analysis. However, its performance remains closely tied to UK economic growth, and its domestic focus leaves it more exposed than peers to shifts in UK equities sentiment. Limited international investor interest and macroeconomic headwinds continue to cap upside potential, though long-term prospects remain closely linked to economic recovery and sector re-rating.

What factors are preventing Lloyd's from Hitting £1?

So, we’ve looked at what could help Lloyd’s shares climb. Now let’s flip the script and talk about what’s keeping them grounded.

A Weak UK Economy

Let’s start with the obvious: the UK economy just isn’t firing on all cylinders. Recent GDP data shows sluggish growth, and the IMF’s forecast for 2025 is only 1.6%. That’s hardly the kind of momentum needed to lift a bank stock like Lloyd’s.

Lloyd’s is a domestic heavyweight — most of its business is UK-based. That means when the local economy stalls, Lloyd’s feels it hard. Unlike a bank like HSBC that has operations across Asia and beyond, Lloyd’s doesn’t have much of a cushion when things go south at home. Unless we see a meaningful pickup in GDP, consumer confidence, and investment, it’s tough to see Lloyd’s making a strong push toward £1.

Rate Cuts Are Coming — And That’s a Problem

Lloyd’s has done well recently thanks to high interest rates. It’s been able to earn more on loans without paying too much on deposits — a sweet spot for any bank.

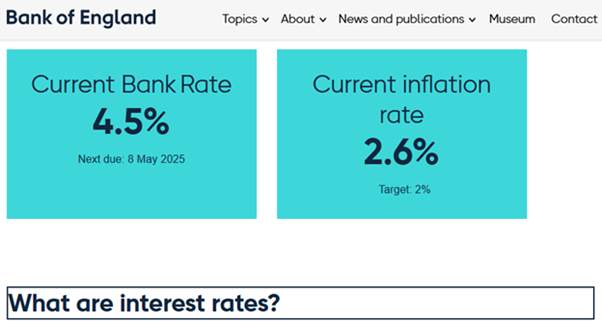

But that window’s starting to close. The Bank of England is expected to cut interest rates several times in 2025, possibly dropping from 4.75% to around 3.75%. And while that might help stimulate the broader economy, it’s not great for Lloyd’s’ profit margins.

Lower rates mean smaller spreads between what banks earn and what they pay out. For Lloyd’s, that could translate to softer earnings, which isn’t going to excite investors or do the share price any favours.

Regulatory Risk Looming

There’s also the issue of regulatory uncertainty. The FCA is currently investigating motor finance mis-selling — and Lloyd’s is right in the crosshairs. Early estimates suggest potential fines and compensation could hit billions of pounds.

If those costs materialise, they’ll hit profits hard. Add in the extra expenses of improving compliance and potentially restructuring operations, and it’s clear this isn’t just a headline risk — it’s a genuine drag on the investment case. Until the outcome is clearer, it’s another reason investors might steer clear.

UK Stocks Are Still Out of Favour

Finally, let’s talk about market sentiment. UK equities, in general, just aren’t on global investors’ radar right now. The buzz is all about the US and India — faster growth, stronger tech sectors, and fewer political distractions.

That leaves UK stocks looking cheap but unloved. For Lloyd’s to break out and push toward £1, we’d need a serious turnaround in how investors view the UK market. That could happen — but it likely depends on more stable politics, stronger economic growth, and maybe even a re-rating of the entire FTSE.

| Challenge | Details | Impact on Lloyd's Share Price |

|---|---|---|

| Weak UK Economy | IMF projects just 1.6% GDP growth in 2025; sluggish consumer spending and investment. | Limits domestic growth potential and investor confidence. |

| Interest Rate Cuts Expected | Bank of England is forecasted to cut rates from 4.75% to ~3.75% in 2025. | Shrinks net interest margins, hurting profitability. |

| Regulatory Risks | FCA investigating motor finance mis-selling; potential multi-billion pound penalties. | Creates uncertainty, dents profits, and deters investors. |

| Poor Investor Sentiment | UK stocks out of favour compared to US and India; political and economic concerns linger. | Keeps valuations low and limits buying interest. |

What is the Historical Performance of Lloyd's Shares?

The last time Lloyd’s shares traded at £1 feels like a lifetime ago — and that’s because it kind of is. That pre-2008 level was wiped out by the global financial crisis, which triggered a massive bailout and left Lloyd’s in survival mode. The stock’s been fighting to recover ever since.

To be fair, Lloyd’s has done a lot to right the ship. We’ve seen restructuring, cost-cutting, and a tighter focus on core operations. But even with all those changes, one thing hasn’t shifted: Lloyd’s’ deep exposure to the UK economy. And over the past 15 years, that’s been more of a burden than a blessing, thanks to Brexit, ultra-low interest rates, and generally sluggish growth.

How Does Lloyd's Stack Up Against Competitors?

Let’s put Lloyd’s side-by-side with some of its peers. On paper, it still looks like decent value — a low P/E ratio and a respectable dividend yield.

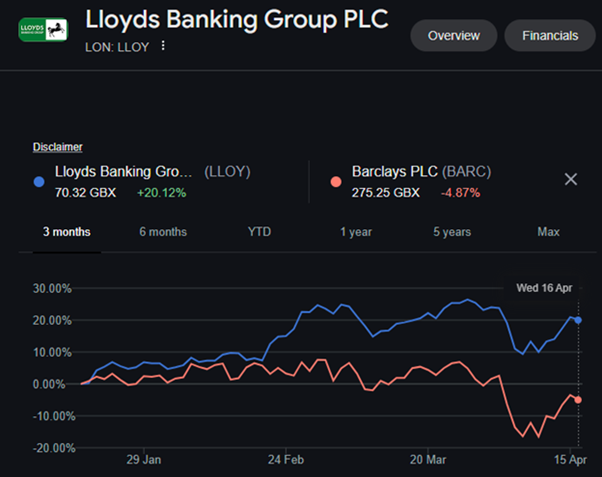

Above is a 3-Month Performance comparison between Lloyds and Barclays, The Lloyds Banking Group (LON: LLOY) is shown:

- Current Share Price: 70.32 GBX

- 3-Month Performance: +20.12%

- Trend: Strong upward momentum since early February, outperforming the broader market and peers.

While The Barclays PLC (LON: BARC) has:

- Current Share Price: 275.25 GBX

- 3-Month Performance: -4.87%

- Trend: Volatile with a downward trend, particularly sharp decline in late March to mid-April.

As you can see, Lloyds has significantly outperformed Barclays over the past three months, showing steady gains while Barclays has struggled with a noticeable drop.

But unlike HSBC or Barclays, Lloyd’s doesn’t have global operations to lean on. That means when the UK stumbles, Lloyd’s takes the full hit.

Here’s a snapshot comparison:

| Bank | Share Price | Dividend Yield | Forward P/E Ratio |

|---|---|---|---|

| Lloyd's | 57p | 3.40% | 8.5 |

| NatWest | 164p | 4.10% | 9.2 |

| HSBC | 626p | 5.10% | 10.5 |

| Barclays | 250p | 4.30% | 8.8 |

Lloyd’s might look like a bargain, but that domestic-only focus makes it more exposed to UK-specific headwinds than its globally diversified peers.

Analyst Projections for Lloyd's Shares

What Are Other Analysts Saying about the price of Lloyd's Shares?

Most analysts aren’t expecting fireworks from Lloyd’s anytime soon — but they’re not bearish either. The average price target is around 65.4p, according to Stockopedia. That’s roughly a 15% upside from the current price of 57p. So yes, there’s room for growth, but it’s more of a steady grind than a moonshot to £1.

The cautious tone makes sense. Analysts are balancing Lloyd’s’ cheap valuation and solid income potential with the very real risks.

TLDR? There is potential here, but it’s not a rocket ship.

What’s the Long-Term Outlook?

Looking further ahead, things could get more interesting — but it all hinges on the macro picture. If UK economic growth picks up, investor sentiment improves, and the banking sector sees a re-rating, then Lloyd’s could slowly work its way higher.

But hitting £1? That’s still a big ask. It would take a significant uplift in profitability and a broader shift in how investors value UK banks. Possible, yes. Likely to happen soon? Not really.

Our Analysis – When Will Lloyd's Reach £1?

Is £1 a Realistic Target Anytime Soon?

Probably not. The UK economy is barely growing, interest rate cuts are on the horizon, and the FCA’s motor finance investigation still hangs over Lloyd’s. Include the fact that global investors aren’t exactly piling into UK stocks right now, and you’ve got a pretty tough environment for any serious rally.

Now, don’t get me wrong — Lloyd’s does offer value. It’s cheap compared to its peers, and the dividend yield is attractive for income-focused investors. But those things alone won’t push the price to £1. We’d need a much broader shift: strong economic growth, renewed confidence in the UK market, and a regulatory clean bill of health. Right now, none of that looks particularly close.

My Prediction for 2025

If I had to pin it down, I’d say Lloyd’s shares will likely be trading somewhere in the 60–70p range by the end of 2025. That’s assuming the economy finds a bit of stability and there aren’t any huge fines from the FCA. It’s not an exciting forecast — but it’s a realistic one.

Longer-term? If the UK economy finally turns a corner and investors warm up to British banks again, there’s a path to £1. But we’re talking years, not months.

Final Thoughts: When Will Lloyd’s shares reach £1?

Lloyd’s is a value play with a solid dividend — and for the right investor, that’s enough. If you’re in it for income and you’re happy to hold through the ups and downs, it can still earn its place in a long-term portfolio.

But if you’re hoping for fast gains or expecting that £1 mark anytime soon, it’s probably time to reset expectations.

TLDR? With the economic and regulatory backdrop being what it is, Lloyd’s is more of a cautious hold than a breakout star.

FAQs

It’s unlikely. Economic headwinds, falling interest rates, and regulatory uncertainty make a £1 share price in 2025 an ambitious target.

Analysts expect modest gains, with average price targets around 65p. Significant upside depends on improved economic conditions and investor sentiment.

Lloyd’s’ domestic focus, economic uncertainty in the UK, and ongoing regulatory risks contribute to its low price-to-earnings ratio and share price.

For income-focused investors, Lloyd’s offers value with a strong dividend yield. However, growth investors may prefer stocks with more upside potential.

A stronger UK economy, higher interest rates, improved investor sentiment, and regulatory clarity could help lift Lloyd’s’ share price over the long term.

Trade Smarter, not Harder

- Copy Trading

- Competetive Fee's

- Multi Asset Platforn

51% of retail CFD accounts lose money when trading CFD’s with this provider.

References:

- Stockopedia – Lloyd’s Banking Group Stock Forecast

- International Monetary Fund (IMF) – UK Economic Outlook 2025

- Bank of England – Monetary Policy Reports

- Financial Conduct Authority (FCA) – Motor Finance Investigation Updates

- Reuters – Lloyd’s Banking Group Share Price & Market News

- Yahoo Finance – Lloyd’s Banking Group Financials

- The Financial Times – UK Banking Sector Coverage

- Bloomberg – Lloyd’s and Peer Bank Comparison

Featured Blogs

Trading and investing involve risk. The value of your investments can go up or down, and you may lose all or part of your capital. These products may not be suitable for all investors. Please ensure you fully understand the risks involved.

- Stocks, ETFs, crypto, more

- Copy top investors easily

- User & beginner friendly

- 30M+ global users

- Regulated, trusted platform