Plus500 Review – My Honest Experience and Rating (4.5 Stars)

Adam Woodhead

Co-Founder

Adam is a Co-Founder and content creator for The Investors Centre. His key areas of interest and expertise are cryptocurrency and blockchain technology.

Twitter ProfileAuthor Bio

Thomas Drury

Co-Founder

Seasoned finance professional with 10+ years' experience. Chartered status holder. Proficient in CFDs, ISAs, and crypto investing. Passionate about helping others achieve financial goals.

Twitter ProfileAuthor Bio

Fact Checked

How we test

At The Investors Centre, we pride ourselves on our rigorous fact-checking process. To delve deeper into our meticulous testing procedures and discover how we ensure accuracy and reliability, visit our dedicated page on how we test.

Risk Warning

The content provided on this website is for general informational purposes only and should not be regarded as professional advice from The Investors Centre. We are not financial advisers. It is recommended that you seek independent legal, financial, or tax advice to ensure the information is appropriate for your individual circumstances. The Investors Centre accepts no responsibility for any loss or damage, whether caused by negligence or otherwise, resulting from reliance on the information provided here.

Please bear in mind that trading involves the risk of capital loss. 51% to 84% of retail investor accounts lose money when trading CFDs with the providers below. You should consider whether you can afford to take the high risk of losing your money.

Updated 13/01/2025

As someone who’s spent years exploring online trading platforms, I’ve had my fair share of wins and losses. Among the brokers I’ve tried, Plus500 stands out for its simplicity and accessibility. Whether you’re an experienced trader or just looking for a new platform, this one has a lot to offer. Here’s my honest 4.5-star review of Plus500, based on my experience as a retail trader in the UK.

Quick Review Summary

Plus500 is a highly-rated trading platform, earning 4.5 stars for its intuitive design, diverse CFD offerings, and robust risk management tools. While it lacks advanced research features, its simplicity and transparency make it a strong choice for many traders.

| Aspect | Score (Out of 5) | Comments |

|---|---|---|

| Ease of Use | ⭐⭐⭐⭐⭐ | Intuitive and beginner-friendly. |

| Asset Variety | ⭐⭐⭐⭐ | Broad CFD offering but lacks physical asset trading. |

| Fees | ⭐⭐⭐⭐ | Transparent and competitive fees, though inactivity costs are a drawback. |

| Risk Management Features | ⭐⭐⭐⭐⭐ | Comprehensive tools like guaranteed stop-loss and negative balance protection. |

| Research & Tools | ⭐⭐ | Basic tools, limited market insights, and no MetaTrader integration. |

| Educational Resources | ⭐⭐⭐ | Helpful for beginners but lacks depth for advanced traders. |

| Customer Support | ⭐⭐⭐ | Prompt responses but no phone support. |

| Regulation & Security | ⭐⭐⭐⭐⭐ | High regulatory compliance and FSCS protection in the UK. |

What is Plus500, and Who is it For?

Overview of Plus500’s Platform

Founded in 2008 and headquartered in Israel, Plus500 has built a solid reputation in the trading world. It is regulated by the FCA in the UK and is publicly listed on the London Stock Exchange, making it part of the FTSE 250 Index. These credentials reflect the platform’s transparency and trustworthiness.

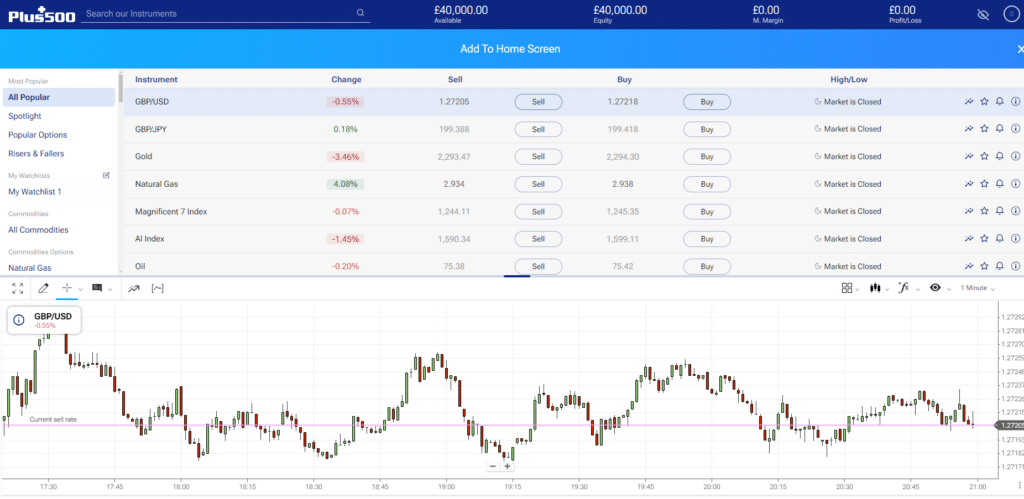

The platform is proprietary, offering a streamlined and intuitive trading experience that doesn’t rely on third-party tools. With access to over 2,800 CFDs spanning forex, stocks, indices, and cryptocurrencies, Plus500 caters to diverse trading interests.

Key features include:

- Guaranteed Stop-Loss Orders to manage market risks.

- Negative Balance Protection, ensuring traders never lose more than their deposited funds.

- Responsive mobile and desktop interfaces, which are easy to navigate and consistent across devices.

| Feature | Details |

|---|---|

| Regulation | ✔️ FCA (UK), ASIC (Australia), CySEC (Cyprus) |

| Assets Available | ✔️ Over 2,800 CFDs |

| Proprietary Platform | ✔️ Yes |

| Mobile & Desktop Access | ✔️ Yes |

| Negative Balance Protection | ✔️ Yes |

Who Should Use Plus500?

Plus500 is designed for traders who value simplicity, transparency, and a broad range of CFDs. Its features make it a great choice for:

- Casual traders who prefer a straightforward platform.

- Active traders looking for risk management tools like stop-loss orders.

However, CFD trading carries inherent risks due to leverage.

James Atkins, a UK-based financial advisor, recommends, “Always assess your risk appetite and make informed decisions when trading CFDs.”

How Does Plus500 Work in the UK?

Quick Answer

Yes, Plus500 works seamlessly in the UK. It is FCA-regulated, supports GBP transactions, and provides access to over 2,800 CFDs on forex, stocks, indices, and more. UK traders benefit from FSCS coverage for funds up to £85,000, ensuring financial security.

UK-Specific Features

Operating in the UK, Plus500 complies with FCA regulations, which are some of the strictest financial standards globally. This ensures a high degree of transparency and client protection. Additionally, UK traders’ funds are safeguarded through FSCS (Financial Services Compensation Scheme), which covers losses up to £85,000 if the broker faces insolvency.

The platform also supports GBP transactions, eliminating currency conversion fees when funding accounts or withdrawing earnings. This is particularly convenient for UK-based users.

| UK-Specific Features | Details |

|---|---|

| Regulator | FCA (Financial Conduct Authority) |

| FSCS Protection | £85,000 fund protection for eligible accounts |

| GBP Transactions | Supported for deposits and withdrawals |

Available Markets for UK Traders

UK traders can access a wide variety of CFDs, including:

- Forex: Major, minor, and exotic currency pairs.

- Indices: Global indices like FTSE 100 and S&P 500.

- Stocks: Leading UK and international equities.

- Cryptocurrencies: Bitcoin, Ethereum, and more (availability depends on regulations).

- Commodities: Trade gold, crude oil, and other key assets.

This broad market range makes Plus500 versatile for different trading strategies.

Live Trading Account vs Demo Account

Quick Answer: Does Does Plus500 Use Real Money?

Yes, Plus500 uses real money for live trading. However, it also provides a demo account for practising strategies and exploring the platform without financial risk.

Live Trading vs Demo Trading

One of Plus500’s strengths is its demo account, which mimics real trading conditions using virtual funds. This feature is useful for exploring the platform and refining trading strategies without financial risk.

When switching to live trading, users can trade with real money and experience real-time market conditions. However, keep in mind that live trading involves emotional decision-making and financial risk, so employing risk management tools is essential.

Live Trading Account vs Demo Account

Funding a Plus500 account is simple, with multiple payment options, including:

- Debit/Credit Cards (Visa and MasterCard).

- PayPal and Skrill for e-wallet convenience.

- Bank Transfers for direct deposits.

The minimum deposit is £100, and trades in non-GBP currencies incur a 0.7% conversion fee. These options offer flexibility for traders of various preferences.

Is Plus500 Safe?

Quick Answer

Yes, Plus500 is a safe and regulated platform. It is licensed by top-tier authorities, including the FCA in the UK, and offers robust client protections like negative balance protection and segregated accounts for user funds.

Why Plus500 is Safe

- Regulated by Authorities: Plus500 is regulated by multiple reputable organisations, including the FCA (UK), ASIC (Australia), and CySEC (Cyprus).

- Segregated Accounts: Client funds are stored separately from company accounts to prevent misuse.

- FSCS Protection: UK traders are covered by the Financial Services Compensation Scheme, protecting funds up to £85,000.

- Transparency: As a publicly listed company on the London Stock Exchange, Plus500 adheres to strict reporting standards.

| Safety Feature | Details |

|---|---|

| Regulation | FCA (UK), ASIC (Australia), CySEC (Cyprus) |

| Fund Protection | Segregated accounts and FSCS protection up to £85,000 |

| Negative Balance Protection | Ensures you cannot lose more than your deposit |

| Public Listing | Listed on the London Stock Exchange |

With these features, Plus500 provides a secure trading environment for users worldwide.

What Fees Does Plus500 Charge?

Plus500 charges spreads, overnight funding fees, and optional fees for guaranteed stop-loss orders (GSLOs). However, there are no commission charges or withdrawal fees, and all costs are transparently displayed.

Breakdown of Fees

One of Plus500’s strengths is its transparent fee structure, making it easy for traders to understand their costs. Here’s a breakdown of the key fees:

| Fee Type | Details |

|---|---|

| Spreads | Competitive spreads, e.g., EUR/USD averages 1.2 pips. |

| Overnight Fees | Applied for holding positions after market hours; varies by asset. |

| GSLO Fee | Wider spread when using guaranteed stop-loss orders. |

Notable advantages include the absence of withdrawal and deposit fees, making it cost-effective for transactions.

Fee Comparison with Competitors

To understand Plus500’s fee structure better, let’s compare it with two major competitors: eToro and Capital.com.

| Fee Type | Plus500 | eToro | Capital.com |

|---|---|---|---|

| Spread (EUR/USD) | ⭐ 1.2 pips | ⭐⭐ 1.0 pips | ⭐⭐⭐ 0.6 pips |

| Inactivity Fee | ✔️ £10/quarter | ❌ $10/month | ✔️ None |

| Withdrawal Fee | ✔️ None | ❌ $5/withdrawal | ✔️ None |

| Overnight Funding | ✔️ Variable | ✔️ Variable | ✔️ Variable |

Plus500’s fee structure is competitive for casual traders, particularly for those looking to avoid non-trading fees like withdrawals.

Risk Management With Plus500

Quick Answer: Can You Go into Debt with Plus500?

No, Plus500 provides negative balance protection, ensuring traders cannot lose more money than their account balance. This feature, along with risk management tools, helps limit exposure to significant losses.

Risk Management Features

Plus500 includes several tools to manage risks effectively:

- Negative Balance Protection: A regulatory safeguard under ESMA rules that prevents traders from owing more than their deposits.

- Guaranteed Stop-Loss Orders (GSLOs): These allow you to set strict loss limits, ensuring your position closes at the price you specify, even in volatile markets.

These features give traders greater confidence, especially when navigating high-risk assets.

Tips for Managing Risk

Here are some actionable strategies for managing trading risks on Plus500:

- Use Stop-Loss Orders: Define a maximum loss level for each trade.

- Avoid Overleveraging: Limit the amount of borrowed capital to reduce potential losses.

- Diversify Trades: Spread your investments across multiple markets to minimise risks.

Risk Management With Plus500

How To Get Started Start Trading with Plus500

To start trading with Plus500, explore its demo account to practise strategies, then transition to live trading with a small deposit. The platform’s tools and intuitive interface support efficient trading and risk management.

Step-by-Step Guide to Getting Started

Starting with Plus500 is straightforward and designed to provide users with a seamless trading experience. Here’s how you can get started:

Create a Demo Account

- Register for free on Plus500’s platform and gain access to virtual funds.

- Use this account to practise and explore available trading tools risk-free.

Understand the Markets

- Familiarise yourself with the range of CFDs, including forex, stocks, commodities, and cryptocurrencies.

- Leverage the +Insights Tool to identify trends and market sentiment.

Set Clear Goals

- Define your trading objectives and risk tolerance.

- Plan a strategy before transitioning to live trading.

Fund Your Live Account

- Deposit a minimum of £100 via debit/credit card, PayPal, Skrill, or bank transfer.

- Monitor currency conversion fees if trading in non-GBP assets.

Practise Risk Management

- Use tools like stop-loss orders and guaranteed stop-loss orders to minimise potential losses.

- Keep track of your open positions and make adjustments based on market conditions.

Leveraging Plus500’s Resources

Plus500 offers several features to enhance your trading experience:

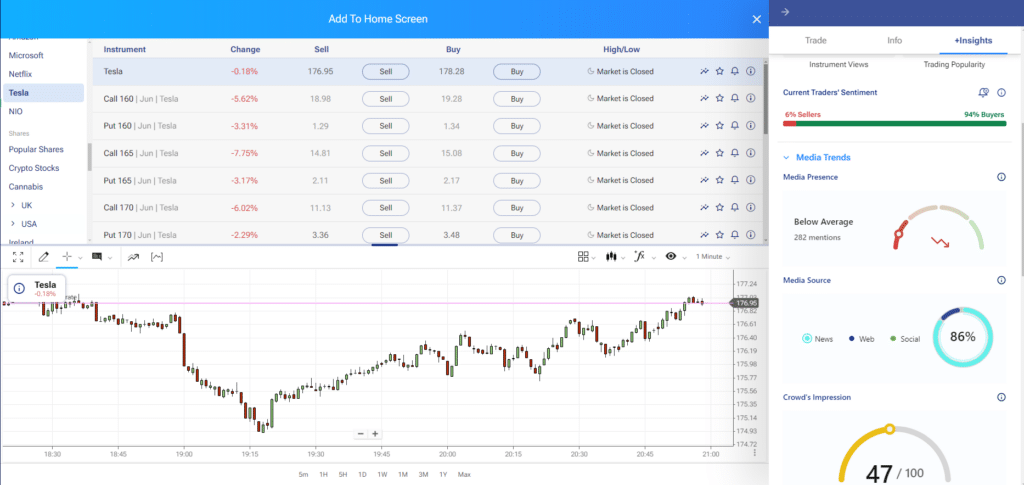

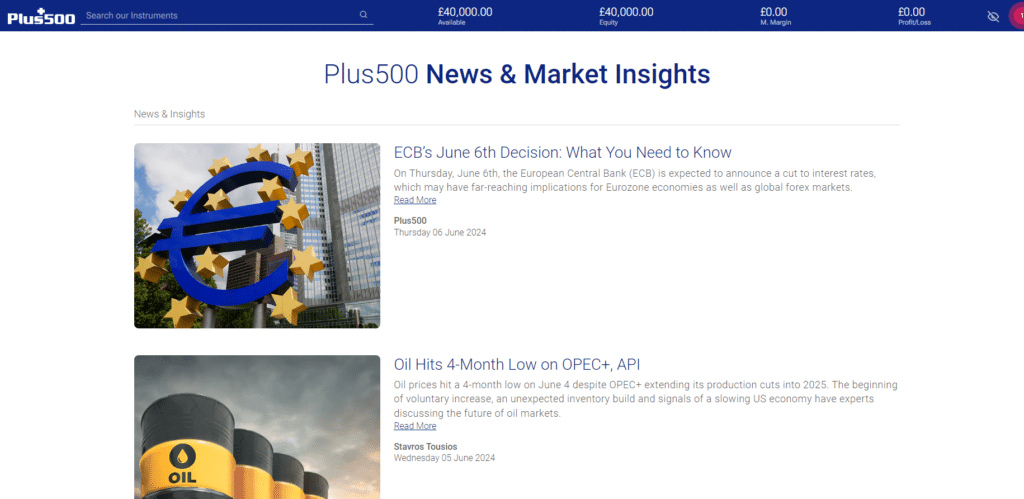

- +Insights Tool: Helps identify trending assets and market sentiment.

- Trading Academy: Offers short videos and articles to develop your trading knowledge.

- Customer Support: Available through email and WhatsApp for timely assistance.

By using these resources, you can build a comprehensive approach to trading, improving your chances of achieving your goals.

My Personal Experience with Plus500 (Pros & Cons)

What I Love About Plus500

From the moment I started using Plus500, I was impressed by its intuitive design. Both the desktop and mobile platforms are cleanly laid out, making navigation simple and seamless. Adding and managing watchlists, monitoring open positions, and executing trades felt effortless.

The range of CFDs offered is exceptional. With over 2,800 instruments available, including forex, stocks, indices, and cryptocurrencies, Plus500 caters to diverse trading preferences. For someone like me who enjoys experimenting across different markets, this variety was a major advantage.

Risk management is another area where Plus500 excels. Features like guaranteed stop-loss orders provide peace of mind when trading volatile assets, and the inclusion of negative balance protection ensures that losses are capped at the account balance.

Areas for Improvement

While Plus500 is a strong platform, it’s not without its limitations. The lack of advanced research tools and third-party integrations may deter traders seeking in-depth analysis. There’s also no support for social or copy trading, which is offered by competitors like eToro.

Additionally, the educational content could be more comprehensive. While the Trading Academy is helpful, it lacks depth compared to platforms like IG or CMC Markets.

| Pros | Cons |

|---|---|

| ✔️ Intuitive platform design | ❌ Limited advanced research tools |

| ✔️ Wide range of CFDs | ❌ No third-party integrations |

| ✔️ Guaranteed stop-loss orders | ❌ Basic educational content |

Final Verdict

Plus500 earns a 4.5-star rating for its combination of user-friendly design, diverse CFD offerings, and robust risk management tools. While the platform’s simplicity is a major strength, its lack of advanced research tools and social trading options may not appeal to all traders.

For anyone seeking a straightforward trading platform with comprehensive risk management features, Plus500 is a strong choice. To get started, I recommend exploring the demo account to assess its features and suitability for your trading goals.

FAQs

Yes, Plus500 offers a wide range of CFDs, competitive spreads, and risk management tools like guaranteed stop-loss orders, making it appealing for traders with some experience.

es, Plus500 is fully FCA-regulated and offers GBP transactions alongside FSCS protection. UK users can trade a variety of CFDs securely.

Yes, live trading on Plus500 involves real money. However, a demo account is available for practising and exploring the platform risk-free.

Plus500 charges spreads, overnight funding fees, and inactivity fees but does not charge commissions or withdrawal fees. All costs are transparently displayed.

No, negative balance protection ensures that users cannot lose more money than their account balance.

References

Statista:

“CFD Trading Statistics Worldwide”

Available at: https://www.statista.com/statistics/cfd-trading-statistics

BBC:

“What is CFD Trading, and Why Is It So Popular?”

Available at: https://www.bbc.com/news/business-cfd-trading

Statista:

“UK Financial Conduct Authority’s Role in Regulating CFD Brokers”

Available at: https://www.statista.com/fca-cfd-regulation

BBC:

“Understanding Leverage in Trading”

Available at: https://www.bbc.com/news/business-leverage-trading

FCA Official Website:

“CFD Trading Regulations in the UK”

Available at: https://www.fca.org.uk/consumers/contract-difference

Featured Blogs

Our 4.5 Star Rated Trading Platform. Start now with a FREE demo account!

80% of retail CFD accounts lose money.