What is eToro? and Is it the right choice for you?

Adam Woodhead

Co-Founder

Adam is a Co-Founder and content creator for The Investors Centre. His key areas of interest and expertise are cryptocurrency and blockchain technology.

Twitter ProfileAuthor Bio

Thomas Drury

Co-Founder

Seasoned finance professional with 10+ years' experience. Chartered status holder. Proficient in CFDs, ISAs, and crypto investing. Passionate about helping others achieve financial goals.

Twitter ProfileAuthor Bio

Fact Checked

How we test

At The Investors Centre, we pride ourselves on our rigorous fact-checking process. To delve deeper into our meticulous testing procedures and discover how we ensure accuracy and reliability, visit our dedicated page on how we test.

Risk Warning

The information provided in this article is for educational and informational purposes only and does not constitute financial or investment advice.

Some of the links on this website are affiliate links, meaning we may earn a commission if you click through and make a purchase or investment, at no extra cost to you. This helps support our website and allows us to continue providing quality content.

Updated 27/02/2025

Quick Answer - What is eToro?

eToro is a social trading platform that allows users to invest in stocks, cryptocurrencies, forex, and more. It offers CopyTrading, enabling users to mirror top investors’ trades. With commission-free stock trading and strong regulation, it’s a popular choice for beginners and experienced traders alike.

Featured Exchange

eToro

- Copy Trading

- User Friendly Platform

- Regulated & Trusted

- 30 Million+ Users

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

If you’ve ever wondered about eToro and how it works, you’re in the right place! In this article, we’ll explore everything you need to know about eToro—from what it is, how it operates, and what makes it unique, to its pros, cons, and how safe it really is.

Whether you’re a beginner or an experienced trader, you’ll find useful insights to help you decide if eToro is right for you.

My Experience with eToro

I first discovered eToro when I was looking for a beginner-friendly trading platform. I wanted something that was easy to use but also provided enough tools to grow my skills. eToro ticked all those boxes. It is an online trading platform that allows you to invest in stocks, cryptocurrencies, commodities, forex, and ETFs. Launched in 2007, it has millions of users worldwide, and for good reason.

What makes eToro stand out for me is its social trading feature. Instead of making trading decisions alone, you can see what experienced investors are doing and even copy their trades. This was a game-changer for me when I was learning the ropes.

Key Features of eToro

| Feature | Details | My Take |

|---|---|---|

| Founded | 2007 – Over a decade of experience in online trading. | A well-established platform with a strong track record. |

| Headquarters | Based in Israel, with offices in the UK, Australia, and the U.S. | Global presence ensures strong market coverage. |

| Regulated By | FCA (UK), CySEC (Europe), ASIC (Australia), FinCEN (U.S.) | Ensures compliance with financial regulations and trader protection. |

| Assets Available | Stocks, ETFs, Cryptocurrencies, Forex, Commodities, Indices. | Offers a diverse range of investment options to suit different trading styles. |

| Trading Model | Commission-free stock trading, CFD trading, CopyTrading. | Provides flexibility for both passive and active traders. |

| Social Trading | Copy and follow expert traders’ strategies. | A great way for beginners to learn by watching top-performing investors. |

| Demo Account | Free virtual trading environment for practice. | Ideal for testing strategies without risking real money. |

| Leverage Options | Available for certain assets, up to 1:30 for retail traders (varies by jurisdiction). | Useful for experienced traders but should be used with caution. |

| Security Features | Two-factor authentication (2FA), encrypted transactions, segregated customer funds. | Provides strong protection against fraud and hacking attempts. |

My Honest Take on eToro’s Advantages and Drawbacks

What I like about eToro

One of the first things I noticed about eToro was just how easy it was to use. The interface is clean, and whether you’re a complete beginner or an experienced trader, you’ll find your way around in no time.

Another standout feature is social trading. I’ve been able to follow and copy top traders, which has helped me learn strategies I wouldn’t have figured out on my own. The variety of assets available is also impressive—stocks, crypto, forex, ETFs, and more—all in one place. Plus, the fact that eToro offers commission-free stock trading makes a big difference when it comes to cost savings.

Pros of eToro

- User-Friendly Interface – From day one, I found the platform simple to use.

- Social Trading – I’ve learned so much just by copying expert traders.

- Diverse Investment Options – I can trade stocks, crypto, forex, and more all in one place.

- Commission-Free Stocks – This is a big plus because it saves money on fees.

- Regulation and Security – Knowing that eToro is licensed gives me confidence in its reliability.

Some Downsides I’ve Experienced

No platform is perfect, and eToro is no exception. While stock trading is commission-free, some assets have higher spreads, which can eat into profits. I also wish there were more customisation options for advanced traders, as the tools are somewhat limited.

One thing that bothers me is the withdrawal fee—it’s not huge, but it adds up over time. Also, CFDs can be risky if you’re not careful, so I always recommend doing thorough research before diving in. Lastly, eToro isn’t available in all countries, which can be frustrating for those looking to join.

Cons of eToro

- High crypto fees (spreads, $5 withdrawal).

- No full crypto ownership in some regions.

- Slow customer support & inactivity fee ($10/month).

- Lacks advanced trading tools & staking options.

- Limited direct crypto withdrawals.

My Experience with CopyTrading at eToro

One of the biggest reasons I chose eToro was its CopyTrading feature. I didn’t have years of trading experience, so being able to copy successful investors made a huge difference in how I learned the market.

Instead of spending hours analysing charts and news, I could browse through a list of top-performing traders, check out their track record, and allocate funds to mirror their trades automatically. Whenever they made a move, my portfolio adjusted in real-time. It felt like having a mentor guiding my trades without requiring constant effort on my part.

How does CopyTrading work?

The process is straightforward:

- Find a trader whose performance and strategy align with your goals.

- Allocate funds to start copying their trades.

- Your account will automatically mirror their trading activity in proportion to your investment.

- You have full control—you can stop copying, adjust the investment, or switch traders anytime.

This feature was a game-changer for me when I was starting out, allowing me to build confidence while still making strategic trades.

What is the Popular Investor Program?

As I became more experienced, I realised eToro also rewards skilled traders through its Popular Investor Program. If others start copying your trades, there is a chance to earn additional income based on how many people follow your strategy.

The more copiers you have, the more rewards you get—on top of any profits from your own trades. It’s a great incentive for traders who develop solid, consistent strategies.

How Secure and Regulated is eToro?

When it comes to security, I always make sure a platform is properly regulated before investing my money. eToro is regulated by some of the most well-known financial authorities, which gives me confidence in its legitimacy.

These regulatory bodies ensure that eToro follows strict guidelines to protect users and their funds. However, while regulation adds a layer of security, trading always carries risk, so it’s important to do your research before investing.

Security Features

eToro takes security seriously, which is why they offer multiple protective measures such as two-factor authentication (2FA) to prevent unauthorised access. They also use encrypted transactions and segregated customer funds, ensuring that users’ money is kept separate from the company’s operational funds.

I feel safer knowing that my data and funds are protected, but I always recommend enabling all available security features to minimise any risk of breaches or fraud.

Available Asset Classes on eToro

| Asset Type | Description | Example Investments |

|---|---|---|

| Stocks | Shares of publicly traded companies, allowing investment in individual firms. | Apple, Tesla, Amazon |

| Cryptocurrencies | Digital assets that operate on blockchain technology. Offers high volatility and potential gains. | Bitcoin, Ethereum, Dogecoin |

| ETFs | Exchange-Traded Funds that track an index, sector, or commodity, offering diversification. | SPDR S&P 500, ARK Innovation ETF |

| Forex | Foreign exchange market, where traders buy and sell currency pairs. | EUR/USD, GBP/USD |

| Commodities | Physical assets including precious metals, energy, and agricultural products. | Gold, Oil, Silver |

| Indices | A selection of stocks representing a market segment or economy, used for broad exposure. | S&P 500, NASDAQ 100, FTSE 100 |

| CFDs | Contracts for Difference, allowing speculation on asset price movements without ownership. | Available on stocks, forex, crypto, and commodities |

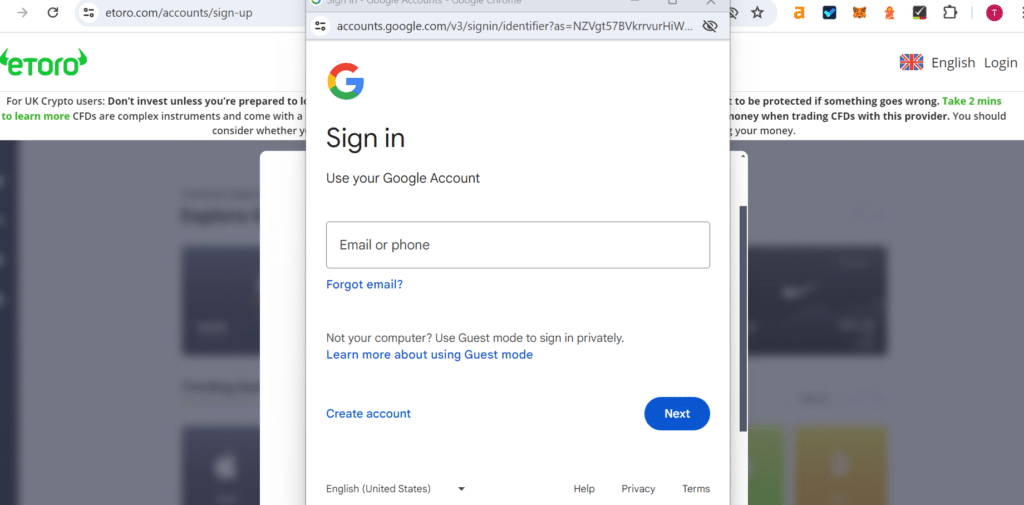

Getting Started with eToro

Opening an account on eToro is a simple process:

- Sign Up – Visit eToro’s website and create an account.

- Verify Your Identity – Upload documents to comply with regulations.

- Deposit Funds – Use a credit/debit card, bank transfer, or e-wallet.

- Start Trading – Choose assets or copy top traders.

Minimum Deposit Requirement

eToro’s minimum deposit varies by country and region, but it typically ranges from $50 to $1,000 depending on account type and payment method.

Is eToro the Right Choice for You?

If you’re looking for a platform that is easy to use and offers a range of assets, eToro is a solid choice. It is great for beginners and intermediate traders, and the social trading feature makes learning the market much easier. However, while it has many advantages, there are some downsides to consider, like high spreads and withdrawal fees.

Who Should Use eToro?

- Beginners who want an easy-to-use platform.

- Traders interested in social and copy trading.

- Investors looking for commission-free stocks.

- If you want a simple, innovative trading experience where you can follow expert investors, eToro is one of the best options available.

Who Should Look Elsewhere?

- Advanced traders who need deep customisation and technical tools.

- Investors who dislike spread-based fees.

- People who prefer traditional brokerage accounts.

- If you’re someone who needs advanced trading features or lower spreads on CFDs and Forex trading, you might want to explore other platforms that cater more to experienced investors.

Final Thoughts

eToro is one of the most well-known trading platforms, offering a mix of traditional investing and innovative social trading. It’s well-regulated, beginner-friendly, and provides a unique experience compared to traditional brokers. However, like any trading platform, it comes with risks, so always do your research before diving in.

If you’re considering giving eToro a try, start with a demo account and explore the platform before investing real money. That way, you can get a feel for how it works without any risk.

FAQs

Yes, eToro is regulated by multiple financial authorities, including the FCA (UK), CySEC (Europe), ASIC (Australia), and FinCEN (U.S.). These regulations ensure compliance with financial laws and enhance user security. Additionally, eToro employs two-factor authentication (2FA), encrypted transactions, and segregated customer funds to protect traders.

The minimum deposit on eToro varies based on your location. In most regions, the starting deposit is $50 – $200, but it can be higher depending on the country and payment method used.

While stock trading on eToro is commission-free, the platform applies other fees, such as:

CFD Trading: Spreads apply based on market conditions.

Crypto Trading: 1% fee per transaction.

Withdrawals: $5 per withdrawal.

Inactivity Fee: $10/month after 12 months of inactivity.

eToro offers both real stock investments and CFDs (Contracts for Difference). If you buy stocks without leverage, you own them outright. However, leveraged positions or short-selling involve CFDs, which means you don’t own the underlying asset but speculate on its price movements.

You May Also Like:

References:

eToro FCA Compliance (BBC News): https://www.bbc.co.uk/news

What is eToro?. Available at: https://help.etoro.com/s/article/what-is-etoro?language=en_GB

eToro Review 2025. Available at: https://www.forbes.com/uk/advisor/investing/etoro-review/

Trading and investing involve risk. The value of your investments can go up or down, and you may lose all or part of your capital. These products may not be suitable for all investors. Please ensure you fully understand the risks involved.

- Stocks, ETFs, crypto, more

- Copy top investors easily

- User & beginner friendly

- 30M+ global users

- Regulated, trusted platform