eToro vs Trading 212: Comparison for 2025 (UK)

Adam Woodhead

Co-Founder

Adam is a Co-Founder and content creator for The Investors Centre. His key areas of interest and expertise are cryptocurrency and blockchain technology.

Twitter ProfileAuthor Bio

Thomas Drury

Co-Founder

Seasoned finance professional with 10+ years' experience. Chartered status holder. Proficient in CFDs, ISAs, and crypto investing. Passionate about helping others achieve financial goals.

Twitter ProfileAuthor Bio

Fact Checked

How we test

At The Investors Centre, we pride ourselves on our rigorous fact-checking process. To delve deeper into our meticulous testing procedures and discover how we ensure accuracy and reliability, visit our dedicated page on how we test.

Risk Warning

The information provided in this article is for educational and informational purposes only and does not constitute financial or investment advice.

Some of the links on this website are affiliate links, meaning we may earn a commission if you click through and make a purchase or investment, at no extra cost to you. This helps support our website and allows us to continue providing quality content.

Updated 17/03/2025

Quick Answer:

eToro is ideal for crypto traders and social investing with CopyTrader, while Trading 212 is best for fee-conscious investors and beginners with its free ISA and £1 minimum investment. Both are FCA-regulated and beginner-friendly—your choice depends on your trading goals.

Featured Platform: eToro

- Copy Trading

- User Friendly Platform

- Regulated & Trusted

- 30 Million+ Users

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

Which is the Better Trading Platform?

When I first started trading a few years ago, I was overwhelmed by the number of platforms available. Two of the biggest names in the UK market—eToro and Trading 212—kept coming up in my research. But which one is best? The answer depends on what you are looking for.

If social trading and cryptocurrency investments appeal to you, eToro might be the better choice with its CopyTrader feature and crypto offerings. On the other hand, if you want commission-free share trading with a low minimum investment, Trading 212 is a fantastic alternative. Both platforms are FCA-regulated, beginner-friendly, and offer great features, so I’ll share my personal experiences to help you decide.

How Do eToro and Trading 212 Compare?

| Feature | eToro | Trading 212 |

|---|---|---|

| Minimum Investment | £10 (stocks/crypto) | £1 (stocks) |

| Cryptocurrency Trading | ✅ Supported | ❌ Not available |

| Copy Trading Feature | ✅ Available | ❌ Not available |

| Withdrawal Fees | £4 per withdrawal | ❌ No fees |

| ISA Availability | ✅ Through Moneyfarm | ✅ Supported |

Who Should Use eToro vs Trading 212?

Who should use eToro:

- Social Traders: If you enjoy the idea of mirroring successful investors, eToro’s CopyTrader tool is a game-changer. I found this feature particularly useful when starting out because it allowed me to learn from experienced traders while potentially making profits alongside them.

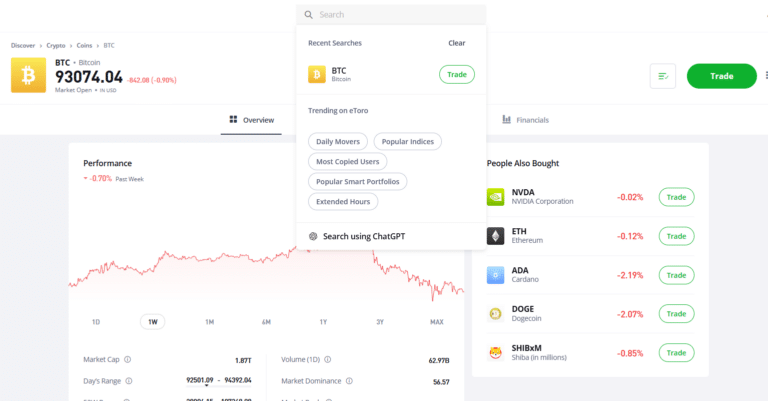

- Crypto Enthusiasts: eToro is one of the few regulated platforms in the UK that offers cryptocurrency trading. With over 100 cryptocurrencies available, it is an excellent choice for those looking to invest in digital assets. I use it to buy and hold cryptocurrencies like Bitcoin and Ethereum.

- Education Seekers: If you’re new to trading, eToro’s Academy provides a wealth of useful, educational resources. When I first joined eToro, I found the tutorials and webinars at eToro Academy incredibly helpful in understanding different trading strategies, staying up-to-date on industry trends and risk management techniques.

Who Should Use Trading 212:

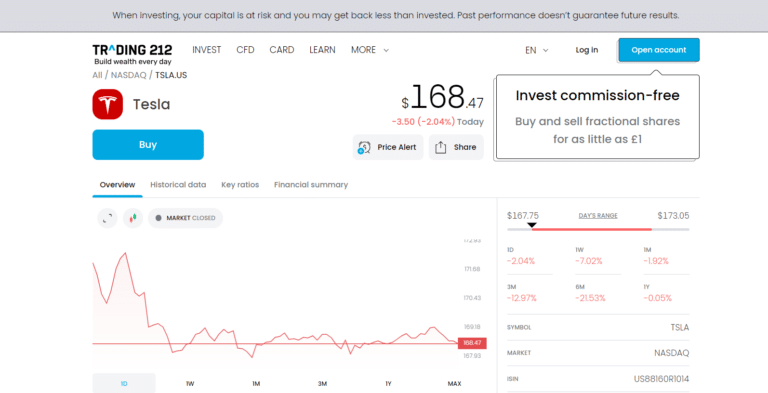

- Cost-Conscious Investors: Trading 212 stands out for its commission-free trading model and lack of withdrawal and inactivity fees. This is a significant advantage if you’re looking to keep initial trading costs low.

- Newbies: With a minimum investment of £1, Trading 212 is ideal for traders and investors who want to start trading without committing large amounts of money. When I first tested the platform, I enjoyed how easy it was to buy fractional shares, allowing me to diversify even with a small budget.

- ISA Users: Trading 212 offers a free Stocks and Shares ISA, which can be a huge benefit for UK investors looking to grow their investments tax-free. I use Trading 212 for my ISA account as it allows me to invest without worrying about platform fees or additional costs.

What Account Types Are Available?

One of the first things I checked was what account options each platform provides. Here is how they stack up when compared side-by-side:

| Account Type | eToro | Trading 212 |

|---|---|---|

| Standard Account | ✅ Yes: Stocks, ETFs, crypto | ✅ Yes: Stocks, ETFs |

| ISA Account | ✅ Yes (via Moneyfarm) | ✅ Yes (no platform fee) |

| CFD Account | ✅ Yes | ✅ Yes |

| Demo Account | ✅ £100,000 virtual funds | ✅ Unlimited access |

| Pro/Advanced Account | ❌ Not available | ✅ Trading 212 Pro (CFD) |

My Takeaway:

The biggest difference here is in the ISA offering. eToro provides ISAs through Moneyfarm, but it comes with management fees ranging from 0.25% to 0.75%. Meanwhile, Trading 212 offers a free ISA with no platform charges, making it a budget-friendly choice.

What Markets and Products Are Available?

The products offered by each platform differ slightly; here’s how they compare:

| Product Type | eToro | Trading 212 |

|---|---|---|

| Stocks | ✅ Yes: Global stocks | ✅ Yes: Wide variety |

| ETFs | ✅ Yes | ✅ Yes |

| Cryptocurrencies | ✅ 100+ options | ❌ Not supported |

| CFDs | ✅ Yes | ✅ Yes |

| Commodities | ✅ Gold, oil, etc. | ✅ Gold, oil, etc. |

| Investment Trusts | ❌ Not available | ✅ Yes |

My Experience with Trading Markets

If you are interested in buying cryptocurrency, eToro has the clear advantage. I found their selection of over 100 coins impressive, especially since crypto adoption is growing in the UK. On the other hand, Trading 212 has a great selection of investment trusts, which can be valuable for those looking for more traditional portfolio diversification.

What Are the Fees Like?

Costs and Fees can make or break a trading experience, so I dug deep into both platforms for a side-by-side breakdown of their respective cost structures.

Breakdown of Fees and Costs (2025)

| Fee Type | eToro | Trading 212 |

|---|---|---|

| Share Trading Fees | ❌ No fees | ❌ No fees |

| Currency Conversion | 0.50% per transaction | 0.15% per transaction |

| Withdrawal Fees | £4 per withdrawal | ❌ No fees |

| Inactivity Fees | £8/month after 12 months | ❌ No fees |

| Crypto Trading Fees | 1% spread | ❌ Not available |

| ISA Platform Fee | 0.25%-0.75% (via Moneyfarm) | ❌ No fees |

| Leverage Costs (CFDs) | Variable, depending on position size | Variable, depending on position size |

| Overnight Fees (CFDs) | Charged for positions held overnight | Charged for positions held overnight |

My Takeaway on Costs

Trading 212 is the more budget-friendly choice, especially with no withdrawal or inactivity fees. However, if you’re into crypto, eToro’s fees are standard for the industry, and the additional costs are worth it if you value their social trading features.

Here at The Investors Centre, we’ve conducted an in-depth breakdown of eToro’s Fee structure, and if you want to learn more about Trading 212’s Fees

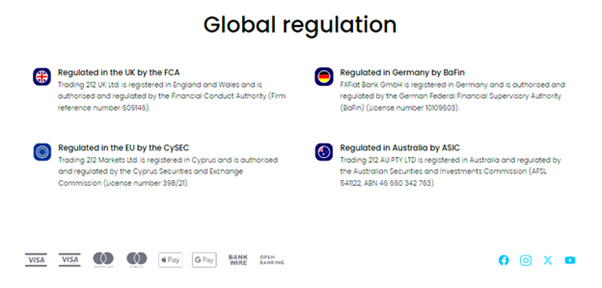

How Safe Are These Platforms?

Since I take security seriously, I checked out each platform’s safety measures.

| Safety Feature | eToro | Trading 212 |

|---|---|---|

| FCA Regulation | ✅ Yes | ✅ Yes |

| FSCS Protection | ✅ £85,000 coverage | ✅ £85,000 coverage |

| Two-Factor Authentication | ✅ Yes | ✅ Yes |

| Account Segregation | ✅ Yes | ✅ Yes |

My Takeaway on Security

Both platforms offer strong security features, which really is essential when choosing a platform to invest your funds. Both eToro and Trading 212 are compliant with FCA regulation and FSCS protection.

Want to learn more about Safety and Regulations on Trading 212? and for a look at eToro’s Safety and Regulations have a look at our full post.

Which Platform Has the Best User Experience?

Since I trade on desktop and mobile, I compared usability across both.

| Feature | eToro | Trading 212 |

|---|---|---|

| Mobile App Usability | ✅ Intuitive with CopyTrader | ✅ Simple and fast |

| Desktop Platform | ✅ Comprehensive tools | ✅ Minimalistic interface |

| Charting Tools | ✅ 56 tools | ✅ 27 tools |

| Social Features | ✅ CopyTrader and community | ❌ Not available |

My Takeaway on User Experience

I found Trading 212’s app better for quick trades, while eToro’s CopyTrader and charting tools are excellent for traders wanting in-depth analysis.

Trading 212 vs eToro Scoring Comparison

| Review Factor | eToro Rating (Out of 5) | Trading 212 Rating (Out of 5) | Summary |

|---|---|---|---|

| Fees & Costs | ⭐⭐⭐⭐ | ⭐⭐⭐⭐ | eToro’s fees include withdrawal charges (£4) and inactivity fees, while Trading 212 has no such fees. |

| Account Types | ⭐⭐⭐⭐ | ⭐⭐⭐⭐⭐ | Both platforms offer multiple accounts, but Trading 212 shines with its free ISA and Pro accounts. |

| Available Markets | ⭐⭐⭐⭐⭐ | ⭐⭐⭐⭐ | eToro offers 100+ cryptocurrencies and social trading. Trading 212 supports investment trusts. |

| Platform (Mobile) | ⭐⭐⭐⭐ | ⭐⭐⭐⭐⭐ | eToro’s mobile app is feature-rich but more complex. Trading 212 is beginner-friendly and intuitive. |

| Platform (Desktop) | ⭐⭐⭐⭐ | ⭐⭐⭐⭐ | eToro offers advanced tools and charting. Trading 212’s simplicity suits quick trades. |

| Education & Tools | ⭐⭐⭐⭐ | ⭐⭐⭐⭐ | eToro provides CopyTrader and its Academy, while Trading 212 has video tutorials and community forums. |

| Customer Support | ⭐⭐⭐ | ⭐⭐⭐⭐ | Trading 212 offers quicker live chat. eToro prioritises premium users but lacks phone support. |

| Safety & Regulation | ⭐⭐⭐⭐⭐ | ⭐⭐⭐⭐⭐ | Both platforms are FCA-regulated and FSCS-protected, offering strong safety measures for UK users. |

| Overall Rating | ⭐⭐⭐⭐✨ (4.5/5) | ⭐⭐⭐⭐ (4.3/5) | eToro leads with broader market options and social trading, while Trading 212 excels in affordability and simplicity. |

Insights from the Table:

- eToro’s Overall Score: 34/40 (4.5/5) – Best for advanced traders, cryptocurrency enthusiasts, and those interested in social trading.

- Trading 212’s Overall Score: 32/40 (4.3/5) – Perfect for budget-conscious and beginner investors, with no-fee ISAs and a straightforward mobile experience.

What is My Final Verdict?

After using both platforms extensively, I’d say it comes down to what you personally would like to prioritise.

- If you want to trade cryptocurrencies and take advantage of social trading, eToro is a fantastic option.

- If you’re looking for a cost-effective, beginner-friendly experience, Trading 212 is the better choice.

Personally, I use Trading 212 for my ISA and long-term investing, while I rely on eToro for crypto trades and CopyTrader. I’d recommend trying both to see which suits you best!

Trade Smarter, not Harder

- Copy Trading

- Competetive Fee's

- Multi Asset Platforn

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

FAQs

Both platforms are beginner-friendly, but beginners often prefer Trading 212 due to its £1 minimum investment, free ISA, and straightforward interface. eToro, however, is excellent for those interested in social trading and cryptocurrency.

No, Trading 212 does not support cryptocurrency trading. If you want to trade crypto, eToro is the better option, as it offers over 100 different cryptocurrencies.

Yes, eToro charges a £4 withdrawal fee. In contrast, Trading 212 does not charge any withdrawal fees, making it a more cost-effective option for frequent withdrawals.

Both platforms are FCA-regulated and offer FSCS protection of up to £85,000. They also have two-factor authentication and account segregation for added security.

Trading 212 offers a free ISA with no platform fees, while eToro provides ISAs through Moneyfarm, which charges management fees between 0.25% and 0.75%. If an ISA is a priority, Trading 212 is the better option.

You May Also Like:

References:

- eToro Official Website – Stocks & beyond: Invest in 7000+ assets on eToro

- Financial Conduct Authority (FCA) – Financial Conduct Authority | FCA

- Statista – Statista – The Statistics Portal for Market Data, Market Research and …

- Trading 212 Official Website – Details on Trading 212’s commission-free model, ISAs, and account types.

- UK Cryptocurrency Regulation Report (Gov.uk) – Official UK government stance on cryptocurrency trading and taxation

Our #1 Recommended Platform in the UK

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.