Hargreaves Lansdown Review [2025 Edition]

Adam Woodhead

Co-Founder

Adam is a Co-Founder and content creator for The Investors Centre. His key areas of interest and expertise are cryptocurrency and blockchain technology.

Twitter ProfileAuthor Bio

Thomas Drury

Co-Founder

Seasoned finance professional with 10+ years' experience. Chartered status holder. Proficient in CFDs, ISAs, and crypto investing. Passionate about helping others achieve financial goals.

Twitter ProfileAuthor Bio

Fact Checked

How we test

At The Investors Centre, we pride ourselves on our rigorous fact-checking process. To delve deeper into our meticulous testing procedures and discover how we ensure accuracy and reliability, visit our dedicated page on how we test.

Risk Warning

Please bear in mind that trading involves the risk of capital loss. 51% to 84% of retail investor accounts lose money when trading CFDs with the providers below. You should consider whether you can afford to take the high risk of losing your money.

Last Updated 28/04/2025

Thinking about investing with Hargreaves Lansdown? It’s one of the UK’s most established investment brokers, with over a million clients and a reputation for reliability..

Quick Answer: Is Hargreaves Lansdown Worth It in 2025?

Yes, Hargreaves Lansdown remains a strong choice for investors in 2025, offering expert research, responsive customer support, and a broad selection of investment options—all backed by a trusted, long-established platform designed for long-term financial planning and confident decision-making.

Featured Platform - Hargreaves Lansdown

- Access to 2,500+ investments

- Award-winning mobile trading app

- Expert insights & market analysis

- Secure, FCA-regulated platform

Trading and investing involve risk. The value of your investments can go up or down, and you may lose all or part of your capital. These products may not be suitable for all investors. Please ensure you fully understand the risks involved.

What is Hargreaves Lansdown?

Hargreaves Lansdown is a trusted UK investment platform ideal for long-term investors. While it charges higher fees than newer apps, it offers excellent research resources, strong support, and a wide range of investment options including ISAs, SIPPs, shares, funds, and more.

When I first signed up with Hargreaves Lansdown, I was seeking a platform that gave me confidence in my investment choices. HL ticked that box immediately—mainly because it’s not some fly-by-night trading app. It has been around since 1981, is listed on the London Stock Exchange. As of 2025, it is trusted by over 1.9 million clients. That kind of longevity really matters to me, especially when you’re investing your life savings or building a pension pot.

What does Hargreaves Lansdown offer?

You can invest in UK and international shares, funds, ETFs, bonds, and investment trusts. They also offer a solid range of tax-efficient accounts like ISAs, Junior ISAs, and SIPPs (Self-Invested Personal Pensions), which I’ve personally used for long-term savings. More recently, they’ve added Active Savings, which lets you access competitive interest rates from partner banks—without having to open multiple accounts.

Who Should Use Hargreaves Lansdown?

If you’re a long-term investor, someone planning for retirement, or you just prefer in-depth research and a bit more guidance before making decisions, then HL is a strong contender. It’s especially beneficial if you prefer to have all your investments, pensions, and savings under one roof.

On the flip side, if you’re a high-frequency trader who wants ultra-low fees or you prefer minimalist apps with no frills, HL probably isn’t the best match. The fees can add up if you’re making lots of trades or just dipping your toe in with a small amount of money. There are cheaper options available, but they often lack the same level of tools and support.

What Are the Pros and Cons of Using Hargreaves Lansdown?

Like any platform, Hargreaves Lansdown has its strengths and weaknesses. After using it for years, here’s how I’d break it down:

| Pros | Cons |

|---|---|

| Trusted and regulated | Higher costs than newer platforms |

| FCA-authorised and listed on the London Stock Exchange, which offers strong oversight and peace of mind. | Trading fees and platform charges can add up, especially for small portfolios. |

| Excellent research and tools | Limited appeal for active traders |

| Top-tier fund shortlists, expert analysis, and a wide range of educational content. | £11.95 per trade makes regular buying/selling costly. |

| Wide range of investment options | No fractional shares |

| Offers shares, funds, ETFs, bonds, ISAs, SIPPs, and even cash savings in one place. | Can’t invest small amounts in expensive stocks like Amazon or Tesla. |

Is My Money Safe with Hargreaves Lansdown?

Hargreaves Lansdown is regulated by the Financial Conduct Authority (FCA), which means they must adhere to strict standards designed to protect investors like me.

They also implement the use of segregated client accounts. Client funds are kept separate from the company’s own money, thereby reducing the risk of loss in the event of financial difficulties. Additionally, HL is a publicly listed company on the London Stock Exchange, which adds a layer of transparency and accountability.

Hargreaves Lansdown is also covered by the Financial Services Compensation Scheme (FSCS). If HL were to go out of business and couldn’t return my money, the FSCS could compensate me up to £85,000. This coverage also applies to cash held in HL’s Active Savings accounts, provided the partner bank fails.

Does Hargreaves Lansdown have a good reputation?

HL has been around since 1981 and, as such, has built a solid track record among its users and clients. While no company is perfect, and some users have expressed concerns about fees, the overall sentiment is quite positive. Many appreciate the comprehensive services and customer support HL offers.

From my experience, HL has been a reliable platform. Their customer service has been responsive, and I am confident knowing that my investments are managed within a well-regulated and established framework.

What Kind of security does Hargreaves Lansdown provide?

Hargreaves Lansdown prioritises the security of its clients’ accounts and investments through a comprehensive suite of protective measures. These include secure encryption protocols, two-factor authentication (2FA) with options for biometric login via its mobile app, and automatic logout after periods of inactivity.

They have a dedicated security centre where customers can learn about common investment scams and how to protect themselves against identity theft and phishing scams. If your account has been compromised or you suspect any suspicious or fraudulent activity, you can call their dedicated security line to talk to a representative.

What Can You Invest in with Hargreaves Lansdown?

Hargreaves Lansdown lets you invest in UK and international shares, funds, ETFs, investment trusts, bonds, and even cash savings—all in one place. That’s what initially drew me in, and why I’ve stuck with them over the years.

Personally, I’ve invested in both UK and US stocks through HL, and the real-time pricing has made the experience feel precise and responsive. They also offer access to over 2,500 funds, along with a wide range of ETFs and investment trusts.

For anyone who prefers a more hands-off approach, their ready-made portfolios and Wealth Shortlist— a curated list of quality funds —have saved me hours of research.

What really seals the deal for me is the ability to hold everything in tax-efficient accounts. I use both an ISA and a SIPP with HL to maximise tax benefits—and it’s all managed through one clean, integrated dashboard. And while it’s not technically investing, I’ve also used their Active Savings feature to get better rates on my cash, backed by FSCS protection.

| Asset/Product | Available? | Details |

|---|---|---|

| UK & US Shares | Yes | Direct access to most listed UK and US companies. Real-time pricing is available on the platform. |

| Funds (OEICs/Unit) | Yes | Over 2,500 actively managed and passive funds. HL provides a curated Wealth Shortlist. |

| ETFs | Yes | Broad selection across equities, bonds, and commodities. Can be bought/sold like individual stocks. |

| Investment Trusts | Yes | Listed on LSE; offers long-term growth/income strategies. Suitable for diversification. |

| Bonds & Gilts | Yes | Includes corporate bonds and government gilts. Limited range, but accessible via HL’s platform. |

| SIPP & ISA Accounts | Yes | Tax-efficient wrappers. Includes Stocks & Shares ISAs, Lifetime ISAs, Junior ISAs, and SIPPs. |

| Active Savings | Yes | Cash savings tool giving access to market-leading rates from multiple partner banks. FSCS-covered. |

How Much Does Hargreaves Lansdown Cost?

The core platform fee is 0.45% per year for holding funds, which is fairly standard for a full-service broker, though it does reduce if you’ve got a larger portfolio.

Now, the share dealing fees. Each trade costs £11.95 unless you’re a frequent trader—if you place more than 20 trades in a month, it drops to £5.95. You should be aware that this cost can add up quickly, especially if you are rebalancing regularly or investing in small increments.

Are there any hidden costs?

If you’re buying US stocks or anything not denominated in GBP, you need to be aware since HL applies up to a 1% currency conversion charge. I’ve paid this a few times when buying American shares, and while it’s not outrageous, it’s something to factor in when comparing platforms.

That said, there are no inactivity fees, and HL don’t charge anything to close or transfer your account, unlike some brokers. Maintenance fees for SIPPs and ISAs are rolled into the platform fee, so it’s fairly transparent.

Here’s a quick summary of the main costs:

| Fee Type | Cost | Details |

|---|---|---|

| Platform Fee (Funds) | 0.45% annually (tiered) | Charged on the value of funds held. Reduces to 0.25% above £250k and 0.1% above £1m. Shares and ETFs are exempt. |

| Share Dealing Fee | £11.95 per trade | Reduced to £8.95 for 10-19 trades/month and £5.95 for 20+ trades/month. |

| FX Fee | Up to 1.00% | Applied on foreign exchange when buying/selling international shares. Tiered down to 0.25% for large trades. |

| SIPP Annual Fee | From 0.45% | Same tiered structure as platform fee for funds. No charge for holding only shares. |

| ISA Account Fee | 0.45% annually | Applies only to funds. No charge for shares or ETFs in the ISA. |

| Exit/Closure Fee | £0 | No fee to close the account or transfer out investments. |

| Inactivity Fee | None | No charges for inactive accounts—ideal for long-term holders. |

What’s It Like to Use Hargreaves Lansdown Day to Day?

One thing I’ve always appreciated about Hargreaves Lansdown is how smooth the entire experience is, from signing up to managing my investments on a day-to-day basis.

How quickly can I start investing?

The sign-up process took me only a few minutes, and after uploading my ID for verification, I was up and running in under 24 hours. Funding my account via bank transfer was quick too, and I was able to start investing almost immediately.

What is the platform like to use?

Once inside the platform, everything felt intuitive. The web interface is clean and beginner-friendly, with a logical layout that makes it easy to find what you’re looking for. I’ve set up a custom dashboard to track my ISA and SIPP balances at a glance, and I frequently use the “Portfolio X-Ray” tool to check my diversification across regions and sectors. Placing trades is simple—no jargon, just clear options and quick confirmations.

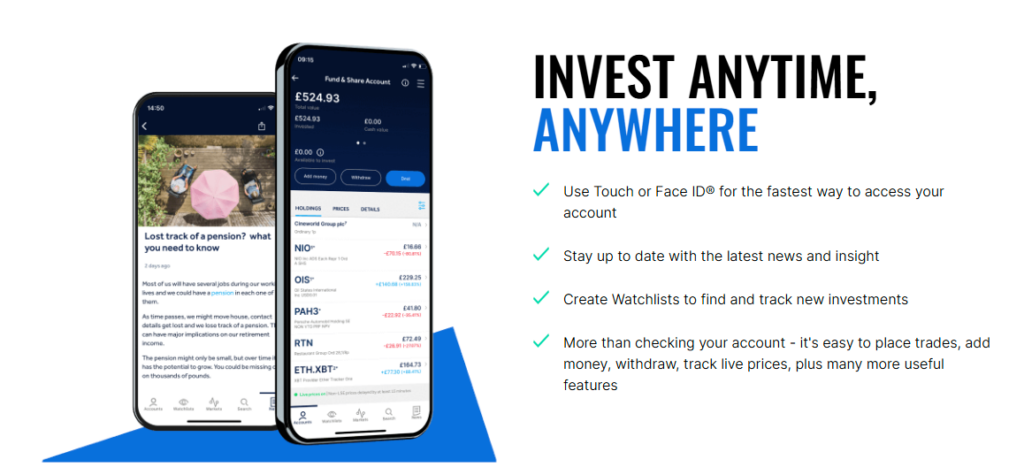

Is the mobile app any good?

The mobile app is another highlight for me. I use it just as much as the desktop version, especially for checking prices, monitoring my investments, and researching funds when I have a spare moment.

The app supports biometric authentication, making login secure and hassle-free. It also sends price alerts and news updates, which I’ve found really handy. You can also build watchlists and access research reports from the app, so it’s not just for monitoring; it’s genuinely useful for managing your portfolio on the go.

How is the customer support?

I’ve always had good experiences with HL’s customer support. They offer phone support during business hours, and I’ve never waited more than a few minutes to get through. Email replies are pretty prompt too, and their help centre is packed with useful guides. I’ve spoken to their SIPP team directly when I needed help with a pension transfer—and they handled it brilliantly.

All in all, the day-to-day experience feels like what you’d expect from a premium platform: smooth, secure, and reliable.

Is Hargreaves Lansdown Good for Learning About Investing?

Hargreaves Lansdown hosts its own research and education hub, which sets it apart from a lot of the newer, cheaper platforms. You can learn the basics of investing, personal finance and the first steps to building a portfolio.

What research tools and market analysis do they offer?

Their in-house team regularly publishes news and market updates, stock analyses, and sector outlooks, and I find their insights more practical than the generic summaries you see elsewhere. HL has its own editorial department so it can publish daily research reports on Shares, Funds, ETFs and Investment Trusts. They provide in-house reports on trending topics in the financial sector as well as live price updates and accompanying analysis.

The fund shortlists are particularly useful; they’ve helped me narrow down my options without spending hours trawling through performance charts and fee comparisons. I’ve used their Wealth Shortlist to pick out actively managed funds that match my long-term goals, and it’s saved me time and second-guessing.

Does HL offer any learning resources?

HL has a solid library of educational resources. If you’re just starting out, their beginner guides and explainer videos are a great way to get up to speed without feeling overwhelmed. They cover everything from “How to choose a fund” to “What’s the difference between a SIPP and an ISA?” in a way that’s simple but not patronising.

One feature I’ve found surprisingly good is HL Live—their online events and webinars. I tuned in to a couple last year during market volatility, and the commentary from their analysts helped put things into perspective. They don’t just explain what’s happening—they tell you why it matters and what you might consider doing about it.

Does HL offer any unique financial services?

Hargreaves Lansdown offers personalised financial advice tailored to individual goals, whether you’re planning for retirement, managing investments, or navigating complex financial decisions.

Their advice services encompass comprehensive financial planning and specific investment advice, provided by qualified financial advisers who assess your personal finance situation and risk tolerance to recommend suitable strategies.

The Initial consultations are free, allowing you to discuss your needs before committing. If you do choose to proceed, fees typically range from 1% to 2% of the assets advised on, with minimum charges applicable.

For long-term, ongoing support, an additional annual fee may apply. Meetings can be conducted via phone, video call, or in person, offering flexibility to suit your preferences.

TLDR, whether you’re a complete beginner or a more seasoned investor, there’s plenty of useful quality content to help you feel confident in your trading decisions.

How Does HL Compare to Other Investment Platforms in the UK?

Hargreaves Lansdown still holds its ground in a lot of key areas, even as new competitors flood the market.

What makes Haregreaves Lansdown stand out?

The quality of service. You can see it in the way the platform is built, the level of detail in their research, and how easily you can speak to a real person when you need help. Hargreaves Lansdown offers one of the most comprehensive ranges of products—everything from ISAs and SIPPs to bonds, ETFs, and even cash savings through Active Savings. For someone who likes to keep everything in one place, it’s incredibly convenient.

Where does it fall short?

Hargreaves Lansdown’s share-dealing costs and platform charges are higher than what you’ll find on other platforms. For someone who’s investing small amounts or trades frequently, those costs can chip away at your returns.

If you’re fee-conscious or just starting out, there are definitely alternatives worth looking at. It’s not about choosing one or the other—it’s about knowing what you want from a platform and matching it to your style and budget.

Final Verdict: Is Hargreaves Lansdown Right for You in 2025?

If you’re someone who values a polished experience, strong customer support, and robust research tools, then I think Hargreaves Lansdown is still one of the best platforms in the UK—especially in 2025 when the DIY investing world is bigger (and noisier) than ever.

Where HL really shines is in long-term investing. If you’re building a pension, managing a larger portfolio, or just want everything—from savings to stocks—in one place, the fees are well worth it. I personally use HL for my ISA and SIPP because I know the platform is stable, the service is reliable, and the research helps me make informed decisions.

But if you’re just starting out, only investing small amounts, or trading frequently, I’d suggest looking at something else. Hargreaves Lansdown isn’t trying to compete with the zero-commission crowd—and that’s okay.

For me, it’s about trust and simplicity. And Hargreaves Lansdown delivers both.

FAQs

Yes, it’s one of the most beginner-friendly full-service platforms in the UK. The interface is easy to use, and Hargreaves Lansdown offers excellent educational content and customer support.

Hargreaves Lansdown charges a 0.45% platform fee on funds, up to £11.95 per trade for shares, and up to 1% in FX fees. There are no inactivity or exit fees.

Absolutely. Hargreaves Lansdown offers Stocks and Shares ISAs, Lifetime ISAs, Junior ISAs, and Self-Invested Personal Pensions (SIPPs), all with competitive investment options.

No, Hargreaves Lansdown currently does not support fractional shares. You must buy whole shares, which may limit access to high-priced stocks for smaller investors.

The sign-up process is usually quick—many accounts are approved within 24 hours, especially if all ID checks are completed online.

Yes, Hargreaves Lansdown has a robust mobile app for iOS and Android that lets you trade, manage investments, view research, and receive alerts.

Yes. Hargreaves Lansdown is FCA-regulated and client funds are protected up to £85,000 by the Financial Services Compensation Scheme (FSCS).

References:

- Hargreaves Lansdown – Charges and Fees Overview

- Security and FSCS Protection – How safe is your investment?

- Hargreaves Lansdown – Expert outlook for 2025 and investment ideas

- Hargreaves Lansdown – Stocks And Shares ISA

- Hargreaves Lansdown Learning Hub – learn how to invest for Beginners

- FCA Registration Confirmation – Hargreaves Lansdown Savings Limited – FCA Register

- FSCS Protection Details – What we cover | Check your money is protected | FSCS

Featured Blogs

Trading and investing involve risk. The value of your investments can go up or down, and you may lose all or part of your capital. These products may not be suitable for all investors. Please ensure you fully understand the risks involved.

- Access to 2,500+ investments

- Award-winning mobile trading app

- Expert insights & market analysis

- Tax-efficient ISAs & SIPPs

- Secure, FCA-regulated platform