Is the Trading 212 Cash ISA safe? - 2025

Thomas Drury

Co-Founder

Seasoned finance professional with 10+ years' experience. Chartered status holder. Proficient in CFDs, ISAs, and crypto investing. Passionate about helping others achieve financial goals.

Twitter ProfileAuthor Bio

Adam Woodhead

Co-Founder

Adam is a Co-Founder and content creator for The Investors Centre. His key areas of interest and expertise are cryptocurrency and blockchain technology.

Twitter ProfileAuthor Bio

Fact Checked

How we test

At The Investors Centre, we pride ourselves on our rigorous fact-checking process. To delve deeper into our meticulous testing procedures and discover how we ensure accuracy and reliability, visit our dedicated page on how we test.

Risk Warning

Please bear in mind that trading involves the risk of capital loss. 51% to 84% of retail investor accounts lose money when trading CFDs with the providers below. You should consider whether you can afford to take the high risk of losing your money.

Last Updated 28/04/2025

If you’re considering opening a Trading 212 Cash ISA, you’re probably wondering: will my money be safe? In this post, I’ll break down how it works, what protections are in place, and why I chose to use it myself.

Quick Answer: Is the Trading 212 Cash ISA safe?

Yes, the Trading 212 Cash ISA is safe. It’s FCA-regulated, protected by the FSCS up to £85,000, and your money is held in segregated UK bank accounts. This ensures your cash remains secure even if Trading 212 or its banking partner fails.

Featured Platform - Trading 212

- Advanced Trading Features

- No Withdrawal Fees

- Regulated & Trusted

Use code TIC to get a free share worth up to £100

Trading and investing involve risk. The value of your investments can go up or down, and you may lose all or part of your capital. These products may not be suitable for all investors. Please ensure you fully understand the risks involved.

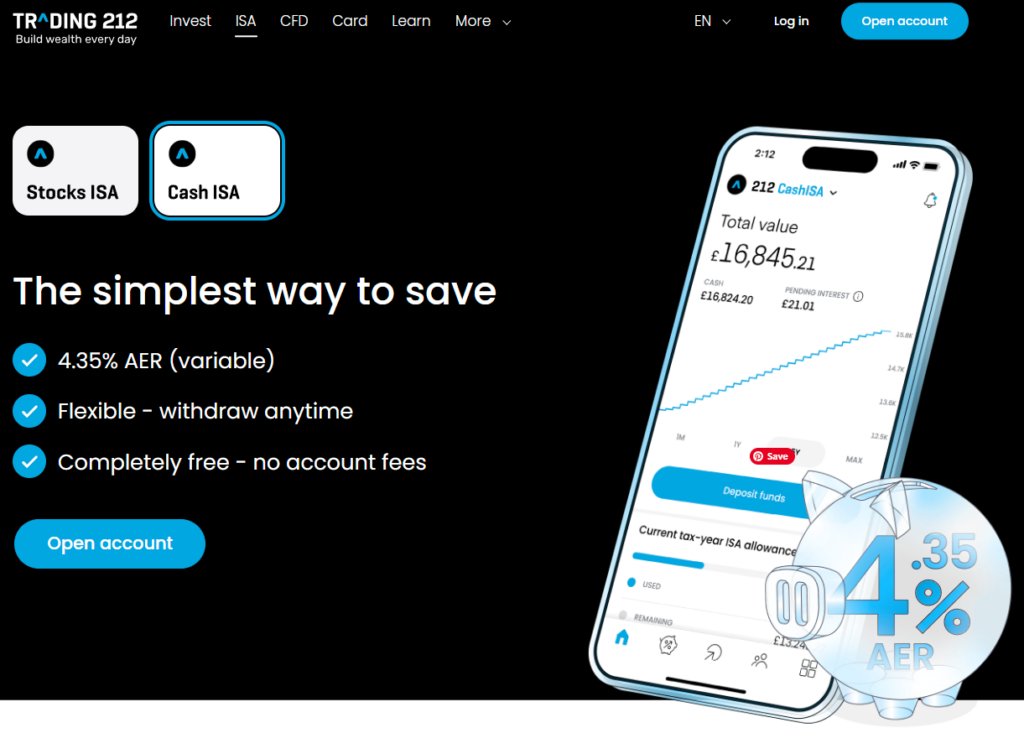

What is the Trading 212 Cash ISA?

It is a tax-free savings account that lets you earn interest on your money without investing it in the stock market.

They are seen as a simple, low-risk way to grow your savings—especially for those investors who want stability without market exposure. Having used Trading 212 for investing over the years, I was genuinely impressed when I discovered they had added this option to their platform. We have a detailed review of Trading 212’s Cash ISA, in this post, we’ll be looking at how your money is protected.

How is a Cash ISA different from other savings products?

Unlike a Stocks and Shares ISA, a Cash ISA doesn’t involve any exposure to the market. Your money isn’t invested in equities or funds – it just sits in cash, safely earning interest. And because it’s a regulated savings product, you’re also protected under UK government-backed schemes.

It’s a solid option if you’re not ready to invest or are looking for a safe, no-fuss place to park your money.

What is unique about Trading 212’s Cash ISA?

- App-based, so you manage everything from your phone

- Interest-bearing, meaning your cash earns a competitive rate

- And really, simple to use – no forms, no faff

I’ve been testing it out myself, and the setup was fast. Within minutes, I had an active ISA and could see my cash balance and interest rate clearly laid out in the app.

TLDR, Think of it like a digital savings account with a tax-free shield – but hosted inside a modern trading app.

How safe is Trading 212 as a provider?

When it comes to investing your money, even in a Cash ISA, you want to know that the company behind it is properly regulated and trustworthy.

FCA regulation isn’t just a nice-to-have. It means Trading 212 is legally required to follow strict rules that protect consumers. That includes how they handle your money, how transparent they are with their fees, and even how they deal with complaints.

What protections does regulation offer?

Being FCA-regulated means Trading 212 is:

- Subject to independent audits

- Required to keep enough capital on hand to stay financially healthy

- Obliged to segregate client funds

And if anything does go wrong, you’re also protected by the Financial Ombudsman Service (FOS). That provides a fair and independent way to resolve any disputes if you’re unhappy with how your issue was handled.

TLDR? Trading 212 has been around since 2004 — and yes, they’re FCA-regulated. That means strict rules, independent checks, and user protection.

| Feature | FCA-Authorised Provider (e.g. Trading 212) | Non-Authorised Provider |

|---|---|---|

| Regulated by FCA | Yes – Must follow strict rules set by the Financial Conduct Authority, including fair treatment of customers, clear communication, and operational transparency. | No – No regulatory oversight, which means no guaranteed consumer protections or minimum operating standards. |

| FSCS Protection Available | Yes – Eligible cash balances are protected up to £85,000 per person, per institution under the Financial Services Compensation Scheme. | No – If the provider fails, there is no statutory compensation scheme to recover your money. |

| Segregated Client Accounts | Yes – Legally required to hold client funds in ring-fenced accounts, separate from the company’s own operating funds. | Not guaranteed – Your money may be mixed with the firm’s operating funds and at risk in insolvency. |

| Audits & Capital Requirements | Yes – Subject to regular audits, capital adequacy testing, and compliance checks to ensure financial stability. | Rare – No enforced audits or capital controls, which increases risk of financial mismanagement. |

| Complaint Resolution (FOS) | Yes – You can escalate unresolved complaints to the Financial Ombudsman Service for free, impartial dispute resolution. | Not applicable – No obligation to follow UK complaint-handling rules or offer access to independent dispute services. |

| Transparency & Consumer Duty | Yes – Must comply with the FCA’s Consumer Duty, including clear terms, fair pricing, and avoiding harm to clients. | No – No legal requirement to treat customers fairly or disclose terms clearly. |

| Firm Trackability | Yes – Listed in the FCA Register with publicly accessible licensing details and complaint history. | No – No central registry or verified history; due diligence is more difficult. |

What is FSCS protection?

FSCS is a government-backed scheme that protects your money if a regulated financial firm goes bust. In the case of a Cash ISA, that means your deposits are covered up to £85,000 per person, per institution. I like to think of it as a financial seatbelt.

What does FSCS cover in a Trading 212 Cash ISA?

The money you deposit into a Trading 212 Cash ISA is not invested; it’s simply held in cash. Trading 212 partners with big-name UK banks (like Barclays or Lloyds), and that’s where your money actually sits.

Due to this structure, your cash is eligible for FSCS protection, just like it would be in a traditional bank savings account. FSCS doesn’t cover investment losses or protect you from low interest rates or inflation. It only applies if the firm holding your money fails and you lose access to your funds.

What happens if Trading 212 or its partner bank fails?

If either Trading 212 or the bank that holds your ISA cash were to collapse, FSCS would step in. You’d be able to claim back up to £85,000 of your money.

In most cases, FSCS aims to return funds within 7 working days, and the process is automatic for eligible claimants.

| Scenario | Protected? | Explanation |

|---|---|---|

| Trading 212 goes out of business | Yes | FSCS covers up to £85,000 if the platform fails. |

| Bank holding your ISA cash fails | Yes | FSCS covers the bank holding your cash. |

| You lose money due to poor interest rates | No | Not covered – interest changes and inflation are market risks. |

| You invest in shares (outside this ISA) | No | FSCS doesn't protect against investment losses. |

How does Trading 212 safeguard your money daily?

Trading 212 has some pretty robust systems in place to protect customer funds—and I think that’s one of the reasons they’ve become so popular.

Where is your money held?

When you deposit money into a Trading 212 Cash ISA, your funds don’t actually sit inside Trading 212 itself. Instead, the money is held in segregated accounts with major UK banks, like Barclays or Lloyds. It means your ISA cash is stored in a completely separate financial institution—not involved in Trading 212’s day-to-day business.

What does “segregated funds” mean?

“Segregated funds” means your money is ring-fenced—it’s kept apart from the company’s own funds. So even if Trading 212 were to go bust, administrators wouldn’t be able to touch your money to pay off the firm’s debts.

It is a legal requirement for FCA-regulated firms, and it’s one of the clearest signs that a platform takes client protection seriously.

What ongoing protections are in place?

Trading 212 doesn’t just set up these protections and forget about them—they actively maintain them. They conduct daily reconciliations to ensure your ISA balance is accurate and properly accounted for. They also conduct regular compliance checks and submit to external audits, which adds another layer of independent oversight.

Even if Trading 212 went under, your Cash ISA wouldn’t go with it — it’s kept entirely separate in a ring-fenced account.

To me, these aren’t just technical details—they’re the foundation of why I’m comfortable saving with them.

Are there any risks with using a Cash ISA through a trading platform?

I’ve been around the fintech space long enough to know that not everyone trusts app-based platforms when it comes to savings. It’s a fair concern. However, after examining how Trading 212 works, I’ve come to realise that most of the fears people have are more about perception than actual risk.

How do banks and apps differ when it comes to Cash ISAs?

Traditional banks definitely feel safer. They’ve got physical branches, long histories, and familiar logos—and there’s something comforting about that. However, feeling safe and being safe are not always the same thing.

Platforms like Trading 212 provide FSCS protection, is FCA-regulated, and uses segregated accounts. In many ways, they are just as safe—if not more convenient. Personally, I love being able to check my ISA balance and interest rate from my phone in seconds, without having to call a bank or log into a clunky desktop site.

What are the risks of using a fintech platform?

Like any digital service, fintech platforms are not immune to technical issues. You might run into:

- Delays in fund withdrawals (especially during peak demand)

- App downtime or maintenance periods

- Or, in rare cases, the platform shutting down

To be clear, I’ve never experienced any major issues with Trading 212, but I like to know what the “worst-case scenario” might look like. The key thing is that your money is still protected by FSCS, even if the app went dark.

Is your interest rate protected from inflation?

Like most Cash ISAs, the one offered by Trading 212 doesn’t always beat inflation. That’s not their fault—it’s just how savings products work right now.

So while your capital is safe, its buying power might erode over time if inflation runs high. That is why I treat my Cash ISA as a stable place to hold cash short-term, rather than a long-term growth tool.

What’s it like using the Trading 212 Cash ISA?

Honestly, one of the biggest reasons I’ve stuck with Trading 212 for my Cash ISA is the user experience inside the app. I’ve used plenty of banking apps over the years, and some of them make even simple tasks feel like a chore. With Trading 212, it’s the opposite.

How do you view, deposit, and manage the ISA?

Everything is super intuitive. Setting up the ISA took me less than five minutes,

I found it to be a clean, straightforward experience. Once it’s active, you can:

- Deposit funds straight from your linked bank account

- Track your interest earnings in real time

- And view your balance, interest rate, and ISA allowance all in one place

What do users say about using Trading 212?

Most users highlight how simple and fast the setup is, and they like having everything in one app—from investing to saving.

That said, a few users have mentioned occasional bugs or delays in support response, especially during busy periods.

Still, if you’re looking for a hassle-free way to manage a Cash ISA from your phone, it’s genuinely one of the easiest setups I’ve come across.

How does Trading 212’s Cash ISA compare to other providers?

When I was deciding where to open my Cash ISA, I didn’t just jump in with Trading 212. I looked around—traditional banks, newer fintech apps, the whole lot. And while each option has its pros and cons, Trading 212 definitely held its own.

| Feature | Traditional Banks (e.g. Barclays, HSBC) | App-Based Rivals (e.g. Moneybox, Plum) | Trading 212 |

|---|---|---|---|

| FCA-Regulated & FSCS Protected | Yes | Yes | Yes |

| Interest Rates | Often low | Varies – some offer competitive rates | Competitive, especially during promos |

| Monthly Fees | None | Some charge fees for access or features | No fees |

| User Experience | Often outdated apps, clunky processes | Modern but can feel cluttered | Clean, fast, easy to use |

| Ease of Setup & Management | Can require in-branch setup or ID checks | App-based with helpful tools | Fully app-based, seamless process |

| Focus Area | General banking | Often investing-focused with savings features | Pure Cash ISA with savings focus |

| Extras & Tools | Limited | Budgeting, round-ups, auto-investing | Part of all-in-one investing & saving platform |

Final Thoughts – Is the Trading 212 Cash ISA a safe to use?

Yes, the Trading 212 Cash ISA is safe for the vast majority of savers. It is regulated by the FCA, and your money is protected up to £85,000 under FSCS. Funds are held in segregated accounts with UK banks and the company has a solid, 15+ year track record.

That said, if you are chasing high returns or trying to beat inflation this is not the right option. The Trading 212 Cash ISA is designed to be a safe place to hold cash tax-free.

I think it’s perfect for:

- Beginners who want a secure start without the complexity of investing

- Savers who value simplicity, transparency, and having everything in one place

For me, it’s earned a spot as my go-to Cash ISA—and I’d recommend it to anyone looking for a modern, trustworthy alternative to the banks.

We’re excited to share that we’ve teamed up with Trading 212 to bring an amazing opportunity straight to our readers. If you’re ready to kickstart your investment journey, our partnership could be your gateway.

Would you like a Free Share with Trading 212 worth £100? Click here

FAQs

Yes, your funds are protected by the Financial Services Compensation Scheme (FSCS) up to £85,000 per person if Trading 212 or its partner bank fails.

Yes, Trading 212 is authorised and regulated by the Financial Conduct Authority (FCA), ensuring compliance with UK financial rules and consumer protection standards.

Your ISA cash is held in segregated accounts with established UK banks, such as Barclays or Lloyds, separate from Trading 212’s own company funds.

If Trading 212 goes out of business, FSCS protection applies. You could recover up to £85,000 of your ISA funds through the compensation scheme.

You won’t lose money due to market fluctuations, but your cash may lose real value if interest rates are lower than inflation. FSCS does not cover inflation risk.

It depends on your needs. Trading 212 offers app-based convenience and zero fees, while traditional banks may offer more personal support but lower interest and outdated tech.

References:

- Financial Conduct Authority (FCA) – Financial Services Register | FCA

- Financial Services Compensation Scheme (FSCS) – Financial Services Compensation Scheme | FSCS

- Trading 212 – Terms & Conditions and ISA FAQs

- MoneySavingExpert – ISA Safety and FSCS

- Trustpilot – Trading 212 Reviews

- Gov.uk – ISA Allowance and Eligibility Rules

Featured Blogs

Trading and investing involve risk. The value of your investments can go up or down, and you may lose all or part of your capital. These products may not be suitable for all investors. Please ensure you fully understand the risks involved.

- Invest in stocks, ETFs, and CFDs

- Sleek and simple Trading 212 app

- Fractional shares with zero commission

- Smart alerts & in-depth market data

- Practice trading with a free demo